Hyperimmune Globulins Market Size :

Consegic Business Intelligence analyzes that the Global Hyperimmune Globulins Market size is growing with a CAGR of 6.8% during the forecast period (2023-2031). The market accounted for USD 1,767.02 million in 2022 and USD 1,877.26 million in 2023, and the market is projected to be valued at USD 3,166.71 million by 2031.

Hyperimmune Globulins Market Scope & Overview:

Hyperimmune globulins are a type of polyclonal antibody product that is derived from the plasma of vaccinated donors. They contain high titers of antibodies that target specific antigens, providing passive immunity against certain diseases. They are commonly used for postexposure prophylaxis against diseases such as hepatitis B, rabies, tetanus, botulism, and varicella. Due to their polyclonal nature, these products contain a diverse range of antibodies in varying quantities.

Their use is particularly important in cases where patients are unable to synthesize their antibodies or when they have contracted a disease and require immediate intervention to mitigate the effects of associated toxins. Additionally, they are valuable for patients who have been exposed to a disease but are unable to mount an adequate immune response, which could potentially lead to complications. Without access to them, many individuals who contract serious diseases would be at a much greater risk of mortality.

Hyperimmune Globulins Market Insights :

Key Drivers :

Rising incidences of infectious bacterial, viral, and chronic diseases

The demand for hyperimmune globulins is increasing globally due to the growing cases of lethal infectious diseases like rabies, hepatitis, varicella-zoster, and tetanus. Antibody preparations, derived from immunized human donors, are used for the prevention and treatment of rabies, hepatitis A and B viruses, varicella-zoster virus, pneumonia caused by respiratory syncytial virus, Clostridium tetani, and Clostridium botulinum. Additionally, the market is also being potentially propelled by the rise in disease outbreaks such as SARS, MERS, and COVID-19 globally. Moreover, these globulins are the primary choice for treating emerging viral infections like Ebola and Zika virus, where there is still no treatment or vaccine available. They are also used as a treatment for people suffering from chronic disorders like AIDS/HIV, and hepatocellular carcinoma (liver cancer), and for pre-exposure prophylaxis, such as cytomegalovirus in solid organ transplantation.

Analysis of market trends concludes that the increasing prevalence of viral hepatitis across the globe is driving the demand for the market across the world. For instance, according to the report by the World Health Organization in July 2023, an estimated 58 million people have chronic hepatitis C virus infection, with about 1.5 million new infections occurring per year globally. There are an estimated 3.2 million adolescents and children with chronic hepatitis C infection. Thus, the growing incidences of viral and infectious diseases across the globe are driving the hyperimmune globulins market demand.

Growing adoption of immunoglobulin therapies

Hyperimmune globulins are immunoglobulin preparations that contain specific antibodies to protect against diseases. Administering hyperimmune globulin provides a patient with passive immunity to the targeted disease agents, which has an immediate but short-term protective effect. This contrasts with the active immunity offered by IVIGs, which is preferable when the patient is exposed to a live pathogen or injected with a substance containing antigen, such as the rabies vaccine. Additionally, vaccines take much longer to achieve their intended purpose, while hyperimmune globulin provides instant but short-lived passive immunity. Moreover, rising awareness about plasma donations for plasma-derived immunotherapies is substantially driving the hyperimmune globulins market. For instance, according to the data published by the Federal Deposit Insurance Corporation on February 7, 2022, between 2012 and 2021, the number of plasma centers in the United States increased from 400 to over 1000, and plasma collected in the U.S. is more than doubled. Plasma centers in the United States collect around two-thirds of the global plasma supply. Analysis of market trends concludes that the increasing use of immunoglobulin therapies is driving the growth of the hyperimmune globulins market.

Key Restraints :

High cost of hyperimmune globulin product development leading to price sensitivity

Hyperimmune globulins are specialized immune globulin preparations that contain high levels of antibodies. These preparations are derived from the plasma of vaccinated donors, and animals and are used to treat a variety of medical conditions. However, the production of these preparations is complex and expensive involving the purification of immunoglobulins from blood plasma, followed by the synthesis of the globulins. This process requires significant investment in terms of both time and cost. Additionally, the final product must undergo a rigorous process of clinical trials and regulatory approvals before it reaches the market. Furthermore, each regulatory agency has its own set of regulations, which can add further complexity to the process. As a result, these factors are hampering the growth of the hyperimmune globulins market.

Future Opportunities :

Increase in research and development activities across the healthcare and pharmaceutical sectors

The prevalence of outbreaks of infectious diseases is rising globally. There is a significant growth observed in the pharmaceutical and healthcare sectors post-COVID-19 pandemic. Analysis of market trends concludes that advancements in technologies to produce the globulins is expected to boost the hyperimmune globulins market. For instance, on April 15, 2021, GigaGen Inc., a biotechnology company advancing transformative antibody drugs for infectious diseases, transplant rejection, and checkpoint-resistant cancers, and a subsidiary of Grifols, announced the publication of research, titled, "Generation of recombinant hyperimmune globulins from diverse B cell repertoires," in the peer-reviewed journal Nature Biotechnology. According to the data published in this research paper, GigaGen's proprietary technology to produce a new class of antibody-drug is "recombinant hyperimmune globulins," which include its novel COVID-19 therapy, GIGA-2050. Additionally, this program recently received an Investigational New Drug (IND) approval by the U.S. Food and Drug Administration (FDA) for the initiation of a Phase 1 clinical trial. Moreover, an increase in awareness about the importance of immunoglobulin therapies in the healthcare sector is expected to drive the market potentially soon. For instance, on September 07, 2022, Grifols, a global leader in plasma medicines, announced its long-term agreement of 15 years with Canadian Blood Services, Canada's national blood authority, to greatly increase the country's self-sufficiency in immunoglobulin (Ig) medicines, essential plasma-protein therapies used to treat a wide range of immunodeficiencies and other medical conditions. Therefore, increase in research and development activities across the healthcare and pharmaceutical sectors is emerging as one of many hyperimmune globulins market opportunities that will drive market expansion.

Hyperimmune Globulins Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2031 |

| Market Size in 2031 | USD 3,166.71 Million |

| CAGR (2023-2031) | 6.8% |

| By Product Type | Immunoglobulins for Hepatitis B, Immunoglobulins for Botulism, Immunoglobulins for Rabies, Immunoglobulins for Tetanus, Rho (D) Immunoglobulins, and Others |

| By Dosage Form | Liquid Form and Powder Form |

| By Application | Infections, Immunodeficiency, and Autoimmune disorders |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Grifols, S.A., ADMA Biologics, Inc., Octapharma AG, Kedrion, Shanghai RAAS Blood Products Co., Ltd., EMERGENT, Biotest AG., CSL Behring, Kamada Pharmaceuticals., GigaGen and Saol Therapeutics |

Hyperimmune Globulins Market Segmental Analysis :

By Dosage Form :

By dosage form the hyperimmune globulins market is categorized into powder form and liquid form. In 2022, the liquid form segment accounted for the highest market share in the overall hyperimmune globulins market, and it is expected to hold the highest CAGR over the forecast period. Analysis of market trends concludes that the increasing prevalence of chronic bacterial and viral infections, along with the growing availability of immunotherapy options, is driving the demand for liquid dosage forms of the globulins. Liquid medications are not only cost-effective but also easy to administer to the body. Unlike powdered drugs that require further dilution, hyperimmune globulin drugs are available as ready-to-inject liquid solutions. Moreover, new product launches and government approvals are expected to drive the segment globally. Instance, On May 3, 2023, Kamada Ltd. a vertically integrated global biopharmaceutical company, focused on specialty plasma-derived therapeutics, announced the U.S. Food and Drug Administration (FDA) approval for the manufacturing of CYTOGAM® (Cytomegalovirus Immune Globulin Intravenous [Human]) (CMV-IGIV) at the Company's facility in Beit Kama, Israel. CYTOGAM is a sterile liquid antibody solution indicated for the prophylaxis of cytomegalovirus disease (CMV) associated with the transplantation of the kidney, lung, liver, pancreas, and heart, and is the sole FDA-approved immunoglobulin (IgG) product for this indication.

By Product Type :

The product type is categorized into immunoglobulins for hepatitis B, immunoglobulins for botulism, immunoglobulins for rabies, immunoglobulins for tetanus, Rho (D) immunoglobulins, and others. In 2022, the Rho (D) immunoglobulins segment accounted for the highest hyperimmune globulins market share. Rho(D) immune globulin (RhIG) is a medication used to manage and treat Rh-negative pregnancies and immune thrombocytopenic purpura (ITP), which is a blood disorder characterized by a low number of platelets that are essential for blood clotting. Rho(D) immune globulin is also used to prevent the formation of antibodies after a person with Rh-negative blood receives a transfusion with Rh-positive blood. ABO / Rh D type and antibody screen is performed early in pregnancy.

Moreover, the immunoglobulins for the hepatitis B segment are expected to hold the highest CAGR over the forecast period. The demand for hepatitis B segment is increasing due to the rising incidences and concerns about viral diseases. For instance, according to the report by the World Health Organization in July 2023, an estimated 58 million people have chronic hepatitis C virus infection, with about 1.5 million new infections occurring per year globally. Analysis of market trends concludes that new product launches in the hyperimmune globulins market are expected to boost the market in the future. For instance, on June 1, 2021 – Grifols, a leading global producer of plasma-derived medicines and provider of a variety of postexposure prophylaxis and IgG products for patients, launched HyperHEP B, a new formulation of hepatitis B immune globulin [human] for hepatitis B postexposure prophylaxis. Thus, the growing prevalence of viral disease is expected to provide lucrative opportunities for segment growth across the globe.

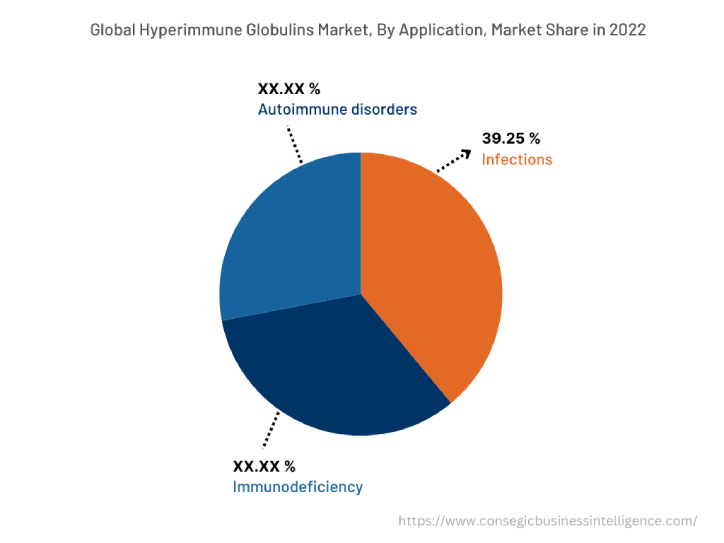

By Application :

The application segment of the hyperimmune globulins market is categorized into infections, immunodeficiency, and autoimmune disorders. In 2022, the infections segment accounted for the highest market share of 39.25% in the hyperimmune globulins market and it is expected to hold the highest CAGR over the forecast period. Despite the introduction of antibiotics and vaccines, plasma hyperimmunoglobulin therapy from whole blood donation plays a major role. Hyperimmune globulin treatment involves the transfer of high-titer antibodies from immunized human donors to provide immediate protection against specific diseases. This treatment either reduces the risk or severity of the infection. Antibody preparations derived from immunized human donors are commonly used to prevent and treat diseases such as rabies, hepatitis A and B viruses, varicella-zoster virus, pneumonia caused by respiratory syncytial virus, Clostridium tetani, cytomegalovirus infection during solid organ transplantation and Clostridium botulinum infection. Additionally, increasing incidences and prevalence of bacterial and viral infections worldwide are driving the segment across the globe. Examination of market trends concludes that the rise in the prevalence of outbreaks of infectious diseases is expected to drive the segment globally. For instance, according to the report published by WHO in February 2022, in 2020, 15 (29.4%) of the countries and territories in the Region of the Americas had at least one Zika virus surveillance report available.

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

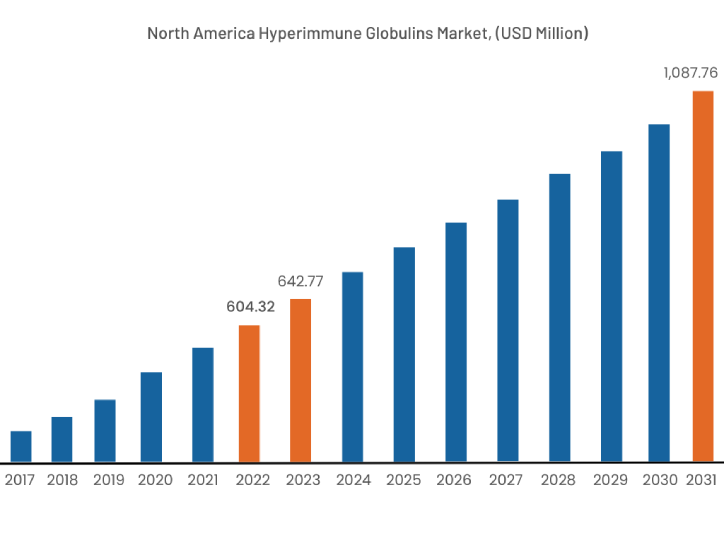

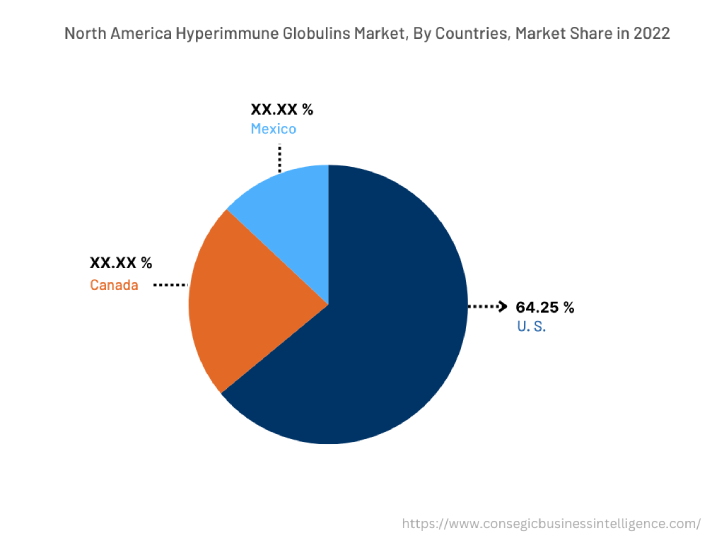

In 2022, North America accounted for the highest market share at 34.20% valued at USD 604.32 million in 2022 and USD 642.77 million in 2023, it is expected to reach USD 1,087.76 million in 2031. In North America, the U.S. accounted for a major market share of 64.25% in the year 2022. The market in North America is experiencing profilation due to the presence of major industry players in the region, advanced healthcare facilities and services, increased awareness about plasma donations, and the establishment of more plasma collection centers throughout the region. According to the data published by the Federal Deposit Insurance Corporation on February 7, 2022, between 2012 and 2021, the number of plasma centers in the United States increased from 400 to over 1000, and plasma collected in the U.S. more than doubled. Plasma centers in the United States collect around two-thirds of the global plasma supply. Examination of market trends concludes that the growing pharmaceutical research and development is substantially driving the hyperimmune globulins market growth. For instance, according to the report by the National Center for Science and Engineering Statistics in September 2023, in financial year (FY) 2022, the 42 federally funded research and development centers (FFRDCs) in the United States spent USD 26.5 billion on research and development (R&D). This was a 6.4% increase from the previous year. The hyperimmune globulins market analysis concluded that the rise in plasma collection centers and the rising pharmaceutical research and development spending across the region are propelling the market in North America.

Furthermore, the Asia Pacific region is expected to witness significant growth over the forecast period, growing at a CAGR of 7.3% during 2023-2031. The large patient population, significant expansion of the pharmaceutical sector and healthcare sector across the region is expected to increase the demand for hyperimmune globulins across the region. Analysis of hyperimmune globulins market trends concludes that the growth in the pharmaceutical industry post-COVID-19 in the Asia Pacific region is also expected to propel the hyperimmune globulins market. For instance, according to the report by the Indian Brand Equity Foundation in August 2023, the market size of the Indian pharmaceuticals industry is expected to reach USD 65 billion by 2024, and USD 130 billion by 2030, and the largest number of FDA-approved plants outside the US is in India. All these above-mentioned facors are collectively driving the demand for the market in the Asia Pacific region and creating lucrative growth opportunities for the hyperimmune globulins market in the Asia Pacific region.

Top Key Players & Market Share Insights:

The hyperimmune globulins market is highly competitive, with several large players and numerous small and medium-sized enterprises. The major companies operating in the hyperimmune globulins industry have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- Grifols, S.A.

- ADMA Biologics, Inc.

- CSL

- Kamada Pharmaceuticals.

- GigaGen

- Saol Therapeutics

- Octapharma AG

- Kedrion

- Shanghai RAAS Blood Products Co., Ltd.

- EMERGENT

- Biotest AG.

Recent Industry Developments :

- On May 3, 2023, Kamada Ltd., a vertically integrated global biopharmaceutical company, focused on specialty plasma-derived therapeutics, announced the U.S. Food and Drug Administration (FDA) approval for the manufacturing of CYTOGAM® (Cytomegalovirus Immune Globulin Intravenous [Human]) (CMV-IGIV) at the Company's facility in Beit Kama, Israel.

- On June 1, 2021 – Grifols, a leading global producer of plasma-derived medicines and provider of a variety of post-exposure prophylaxis and IgG products for patients, launched HyperHEP B, a new formulation of hepatitis B immune globulin [human] for hepatitis B post-exposure prophylaxis. The new formulation uses a unique caprylate chromatography process, which significantly reduces procoagulant activity and IgG aggregates.

Key Questions Answered in the Report

What was the market size of the hyperimmune globulins market in 2022? +

In 2022, the market size of hyperimmune globulins was USD 1,767.02 million.

What will be the potential market valuation for the hyperimmune globulins industry by 2031? +

In 2031, the market size of hyperimmune globulins will be expected to reach USD 3,166.71 million.

What are the key factors driving the growth of the hyperimmune globulins market? +

Rising incidences of infectious bacterial, viral, and chronic diseases are fueling market growth at the global level.

What is the dominant segment in the hyperimmune globulins market for the application? +

In 2022, the infections segment accounted for the highest market share of 39.25% in the overall Hyperimmune Globulins market.

Based on current market trends and future predictions, which geographical region is the dominating region in the Hyperimmune Globulins market? +

North America accounted for the highest market share in the overall market.