InGaAs Image Sensor Market Introduction :

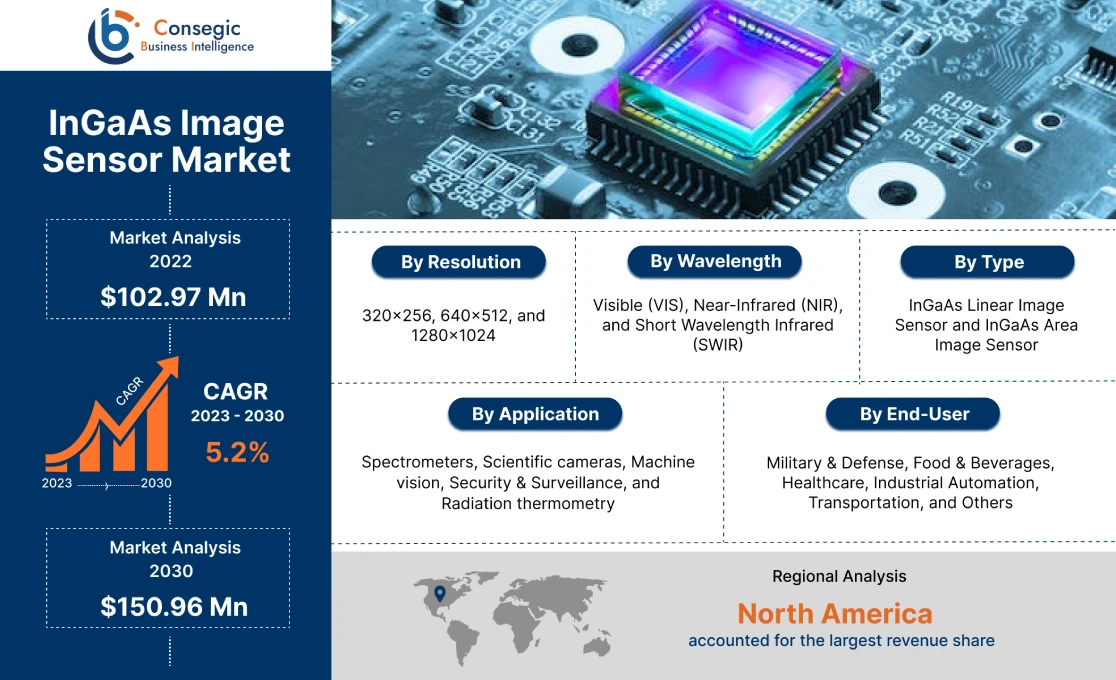

InGaAs Image Sensors Market size is estimated to reach over USD 150.86 Million by 2030 from a value of USD 102.76 Million in 2022, growing at a CAGR of 5.20% from 2023 to 2030.

InGaAs Image Sensor Market Definition & Overview :

InGaAs image sensors is a type of sensor that is composed of an alloy of indium arsenide and gallium arsenide and utilizes the near infrared region of the spectrum to generate images of an object. Moreover, based on the analysis, these sensors offer a range of benefits including exceptional sensitivity in the near-infrared (NIR) range, high quantum efficiency, low dark current, wide bandgap for precise detection, and versatility in photonic applications among others. As per the analysis, The aforementioned benefits of these systems are key determinants for increasing its deployment in military & defense, automotive, healthcare, food & beverage, electronics & semiconductors, and other industries.

InGaAs Image Sensor Market Insights :

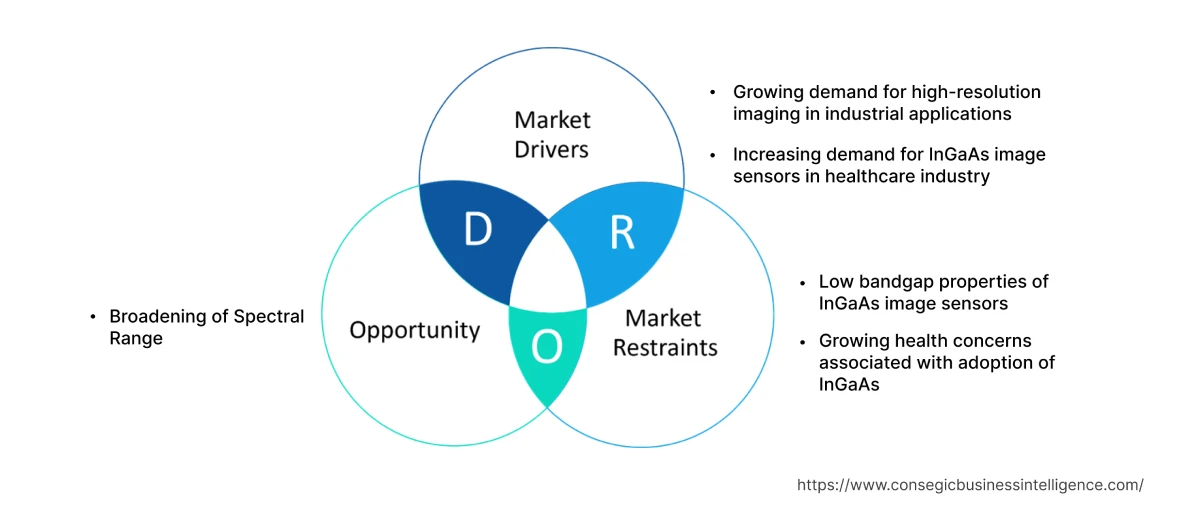

Key Drivers :

Growing military & defense sector is spurring the market growth

InGaAs image sensor is deployed in the military & defense sector for various applications including surveillance, patrolling, security, and night vision imaging among others. Moreover, the integration of these sensor in air defense systems has significantly mitigated the risks of flying in night or low-light conditions. Additionally, they are commonly used in military aviation for identification, location, and targeting the enemy forces. The ability of these systems to provide accurate navigation for the operation of military vehicles at night or in demanding situations of fog, smoke, and dust is further increasing its utilization in the military & defense sector.

Factors including the increasing investments in military & defense equipment and vehicles along with rising production of air defense systems are primary determinants for driving the growth of the military & defense sector.

For instance, in December 2022, Dassault Aviation, a France-based manufacturer of military aircraft and business jets, launched its new Rafale fighter aircraft for its application in the French military procurement agency called the Directorate General of Armaments. Further, in December 2022, the Department of Defence of the United States invested around USD 50 million for the automation of future army ground vehicles that is led by the Army's Robotic Combat Vehicle program. The investment aims at supporting military vehicles designed for surveillance, reconnaissance, and high-risk missions. Thus, as per the analysis, the rising investments in the military & defense sector and increasing production of military aircraft are driving the adoption of InGaAs image sensors market trend for application in intelligence, surveillance, and reconnaissance operations. The above factors are further proliferating the growth of the market trend.

Rising utilization of InGaAs image sensors in food & beverage sector is driving the market growth

InGaAs image sensors are used in the food & beverage sector, particularly for applications including routine inspection and quality assurance of food & beverage products. They are deployed for online food inspection through conveyor belt. Moreover, these sensors are capable of efficiently capturing images in visible and near infrared spectrum for sorting and inspection steps such as assessing signs of decay, detection and removal of foreign objects, screening for moisture content, and others. The aforementioned features of these sensors are prime determinants for increasing its utilization in the food & beverage sector. Factors including significant investments in food & beverage sector, increasing consumer demand for packaged and processed food products, along with rising hygiene standards in the food sector are major trends driving the growth of the food & beverage sector.

For instance, according to Food Drink Europe, a European Union confederation for the food sector, the European Union food and beverage industry was valued at EUR 1,121 billion (USD 1,292.0 billion) in 2022, representing an increase of 2.6% in comparison to EUR 1,093 billion (USD 1,177.8 billion) in 2021. Hence, the growing food & beverage sector is increasing the adoption of InGaAs image sensors trend for applications including routine inspection and quality assurance of food & beverage products, in turn proliferating the market growth.

Key Restraint :

Limitations and operational challenges associated with InGaAs image sensors are restraining the market

The utilization of these image sensors is usually associated with few limitations and operational challenges, which is a key factor limiting the market.

For instance, the primary limitation of these sensors includes its noise level. The lower bandgap of the material generates higher dark current, which in turn requires InGaAs sensors to be deeply cooled for increasing signal to noise ratio by reducing dark noise. Moreover, the implementation of InGaAS sensors is often associated with pixel defects. The complexity of fabrication of this sensor is a prime factor resulting in defective pixels, which further hampers the sensor's performance.

Additionally, InGaAs sensors are prone to be affected by fixed pattern noise, which is mainly caused by gain or response variations. Therefore, the above limitations and operational challenges associated with these sensors are constraining the market.

Future Opportunities :

Rising application of InGaAs image sensors in healthcare sector is expected to promote potential opportunities for market

The rising application of these sensors in healthcare sector is expected to present potential InGaAs image sensors market opportunities for the evolvement of the InGaAs image sensors market. These sensors are often used in healthcare sector, particularly in medical imaging for preventive and therapeutic applications. Moreover, they are utilized in spectroscopy technique for biomedical applications, attributing to its ability to generate detailed cross-sectional images of human tissues in medical imaging.

Factors including the increasing trend in healthcare expenditure, rising incidence of chronic diseases, and growing investments in efficient medical imaging solutions for early detection of diseases are primary aspects driving the healthcare sector.

According to American Medical Association, the total healthcare spending in the United States reached up to USD 4.3 trillion in 2021, witnessing a rise in comparison to 2020. Healthcare expenditure in the United States accounted for 18.3% of the total GDP in 2021. Additionally, the European Commission invested around USD 6 billion budget during the 2021-27 period to support the healthcare sector in Europe.

Therefore, the rising investments in the healthcare industry are projected to increase the integration of InGaAs sensors for application in medical imaging, in turn fostering opportunities for market expansion during the forecast period.

InGaAs Image Sensor Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 150.96 Million |

| CAGR (2023-2030) | 5.2% |

| Based on the Type | InGaAs Linear Image Sensor and InGaAs Area Image Sensor |

| Based on the Resolution | 320x256, 640x512, and 1280x1024 |

| Based on the Wavelength | Visible (VIS), Near-Infrared (NIR), and Short Wavelength Infrared (SWIR) |

| Based on the Application | Spectrometers, Scientific cameras, Machine vision, Security & Surveillance, and Radiation thermometry |

| Based on the End-User | Military & Defense, Food & Beverages, Healthcare, Industrial Automation, Transportation, and Others |

| Based on the Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Chunghwa Leading Photonics Tech, First Sensor AG, Hamamatsu Photonics K.K., Jenoptik, Luna, New Imaging Technologies, SemiConductor Devices, Sofradir Group, Teledyne FLIR LLC, United Technologies Corporation, Xenics |

InGaAs Image Sensor Market Segmental Analysis

Based on the Type :

Based on the type, the market is bifurcated into linear image sensors and area image sensor. The area image sensor segment accounted for the largest revenue share in the year 2022. InGaAs area image sensors refer to two-dimensional image sensors comprising of a hybrid structure including back-illuminated InGaAs photodiodes and CMOS readout circuit for near infrared and short wavelength infrared regions. Moreover, these sensors offer several benefits including high resolution, extremely low dark current, high speed, and low noise for high signal-to-noise ratio among others. The aforementioned benefits of these area image sensors are key aspects for driving its adoption in military & defense, automotive, food & beverage, medical imaging, and other related applications.

According to ACEA (European Automobile Manufacturers Association), passenger car production in the Europe Union reached up to 10.9 million in 2022, witnessing an increase of 8.3% as compared to 2021. Therefore, the rising automotive production is among the key factors driving the adoption of InGaAs area image sensors for application in advanced driver assistance system to offer enhanced night vision, which increases safety and reduces the risk of accidents, in turn contributing to the evolvement of the market.

The linear image sensor segment is anticipated to register fastest CAGR during the forecast period. InGaAs linear image sensors refers to one-dimensional image sensors that are particularly designed for the visible, near infrared, and short wavelength infrared regions. Moreover these sensors offer a range of benefits including high dynamic range, low dark current, high line scan rate, low readout noise, higher sensitivity, high speed, and others. The above benefits of these linear image sensor are increasing its application in food & beverage, electronics & semiconductors, and healthcare sectors among others.

For instance, according to the Brazilian Electrical and Electronics Industry Association, the Brazilian electronics sector was valued at USD 42.2 billion in 2022, depicting an increase of approximately 8% as compared to USD 39.2 billion in 2021. These linear image sensors is utilized in the electronics & semiconductor sector for inspecting defective parts in the production line or conducting failure analysis of electrical circuits and semiconductor wafers. Hence, the development of electronics sector is anticipated to drive the market during the forecast period.

Based on the End-User :

Based on the end-user, the market is segregated into automotive, military & defense, healthcare, food & beverage, electronics & semiconductors, and others. The military & defense segment accounted for the largest revenue share of 25.40% in the year 2022. As per the analysis, factors including the increasing investments in military & defense equipment and vehicles along with rising production of air defense systems are key determinants for driving the development of the military & defense segment.

For instance, in April 2022, Huntington Ingalls Industries introduced its new Block IV Virginia-class attack submarine that is primarily developed for the U.S. navy. The submarine is optimized to perform various coastal and open-water missions. The submarine is equipped with the latest technologies and offers improved maneuverability, stealth, and firepower capabilities. Hence, the rising development of military & defense vehicles and equipment is driving the adoption of these InGaAs mage sensors for surveillance, security, and accurate navigation applications for operation of military vehicles at night or in demanding situations of smoke, fog, and dust, in turn proliferating the market.

Food & beverage segment is expected to witness fastest CAGR during the forecast period. According to the analysis, the development of food & beverage segment is attributed to several factors including growing investments in expansion of food & beverage manufacturing facilities, increasing consumer demand for packaged and processed food products, and rising hygiene standards in the food sector.

For instance, in March 2022, Kerry Group, a food and beverage company, launched its new food manufacturing facility worth USD 137 million in Georgia, United States. Therefore, the rise of food & beverage sector is projected to drive the adoption of these image sensors for applications including inline food inspection and quality assurance of food & beverage products, in turn driving the market during the forecast period.

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

North America accounted for the largest InGaAs image sensors market share of USD 40.49 Million in 2022 and is expected to reach a share of USD 59.44 Million by 2030, registering a CAGR of 5.2% during the forecast period. In addition, in the region, the U.S. accounted for the maximum revenue share of 65.60% in the same year. The adoption of these sensors in the North American region is primarily driven by its usage in automotive, military & defense, food & beverage, healthcare, and other sectors. Additionally, North America has been a primary hub for companies associated with autonomous vehicle manufacturing. The advent of autonomous driving and the rising adoption of these sensors in modern automobiles for offering enhanced imaging solutions for driving assistance even in low light or night conditions has been significant factors for market expansion in the region.

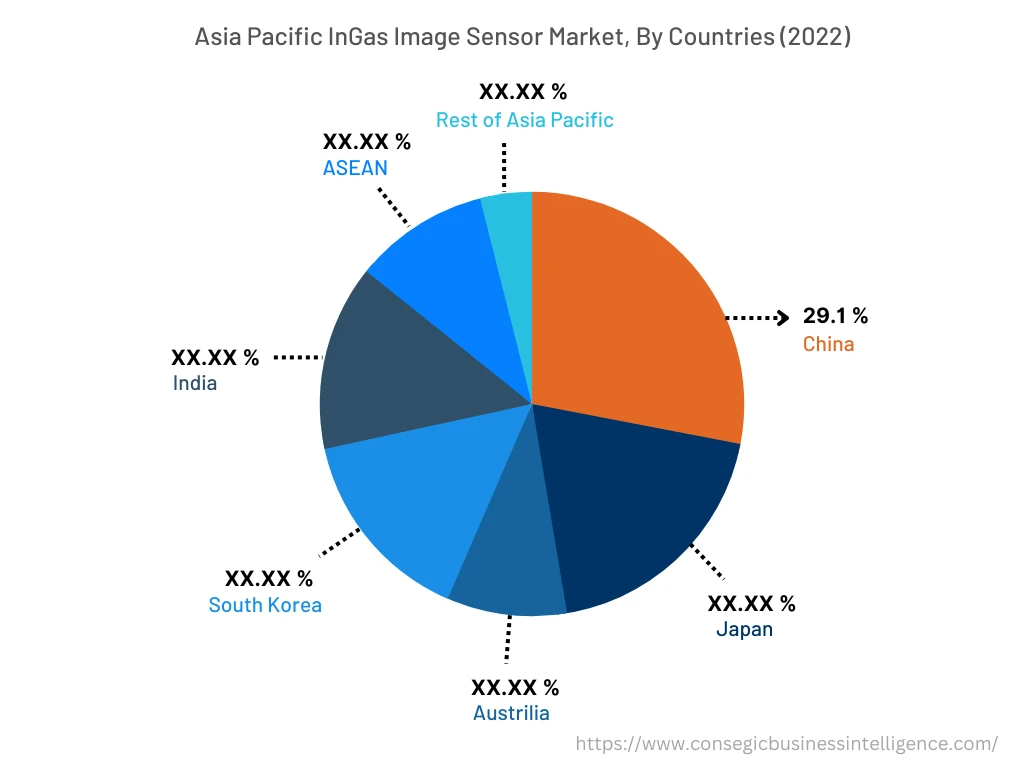

Asia-Pacific is expected to register fastest CAGR of 5.4% during the forecast period. The growing pace of industrialization and development is creating lucrative expansion prospects for the market in the region. Additionally, factors including the development of multiple industries such as automotive, military & defense, electronics, and others are fostering the market trend for these sensors in the Asia-Pacific region.

For instance, according to the China Association of Automobile Manufacturers, the total production of passenger cars in China reached up to 14.8 million units in January-August 2022, depicting a YoY rise of 14.7%. Hence, the growing automotive sector is anticipated to drive the utilization of InGaAs image sensors for application in advanced driver assistance system to offer enhanced night vision imaging for increasing safety and reducing the risk of accidents, thereby, fueling the InGaAs image sensors market growth and trend in the Asia-Pacific region during the forecast period.

Further, the increasing investments in the military and defense sector is a vital factor fostering the InGaAs image sensors market demand in the region. For instance, in March 2021, the U.S. Government allocated approximately USD 752.9 billion budget for national defence for FY 2022, among which USD 715 billion was allotted for the Department of Defence of the United States. The FY 2022 Defence Budget submission aims at enhancing capabilities of the U.S. military and national security and renewing the country's network of partnerships and alliances. Thus, based on the InGaAs image sensors market analysis, rising investments in military and defense sector is projected to drive the application of these sensors in military vehicles, aircraft, and equipment for surveillance, security, night vision imaging, and other related applications. The above factors are expected to drive the market trend in North America during the forecast period.

Top Key Players & Market Share Insights :

The InGaAs image sensors market is highly competitive with major players providing InGaAs image sensors to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and application launches to hold a strong position in InGaAs image sensors industry. Key players in the these sensors market include-

- Chunghwa Leading Photonics Tech

- First Sensor AG

- Sofradir Group

- Teledyne FLIR LLC

- United Technologies Corporation

- Xenics

- Hamamatsu Photonics K.K.

- Jenoptik

- Luna

- New Imaging Technologies

- SemiConductor Devices

Recent Industry Developments :

- In April 2022, Synergy Optosystems Co. Ltd. launched its new high resolution InGaAs NIR Detector, integrated with InGaAs image sensor and wide spectral sensitivity. The product is ideal for laser beam profiler and several optical beam measurement applications in visible to 1700 nm spectral range.

Key Questions Answered in the Report

What is InGaAs Image Sensor? +

InGaAs image sensors are room-temperature semiconductors that detects light and converts the photons into electron-hole pair. Image Sensors are widely used in health, manufacturing, food safety and quality, and security and surveillance due to its high sensitive, low noise and spectral responses from 0.6 to 2.4 micrometres.

What specific segmentation details are covered in the InGaAs Image Sensor market report, and how is the dominating segment impacting the market growth? +

The report consists of segments including Type, Resolution, Wavelength, Application and End-User. Each segment has key dominating sub-segment being driven by the industry trends and market dynamics. For instance, by Type has witnessed linear image sensor as the dominating segment in the year 2022, due to its ability to capture images in near-infrared region.

What specific segmentation details are covered in the InGaAs Image Sensor market report, and how is the fastest segment anticipated to impact the market growth? +

The report consists of segments including Type, Resolution, Wavelength, Application and End-User. Each segment is projected to have the fastest growing sub-segment being fueled by industry trends and drivers. For instance, by wavelength segment has witnessed short wavelength infrared (SWIR) region as the fastest-growing segment due to its ability to capture images for monitoring & inspection purposes.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2023-2030? +

The Asia-Pacific region is anticipated to witness fastest CAGR growth during the forecast period due to the increasing demand for cameras for security & surveillance purposes. Moreover, the growing adoption of consumer electronics such as cameras is further accelerating the growth of the market.