Managed Print Services (MPS) Market Size:

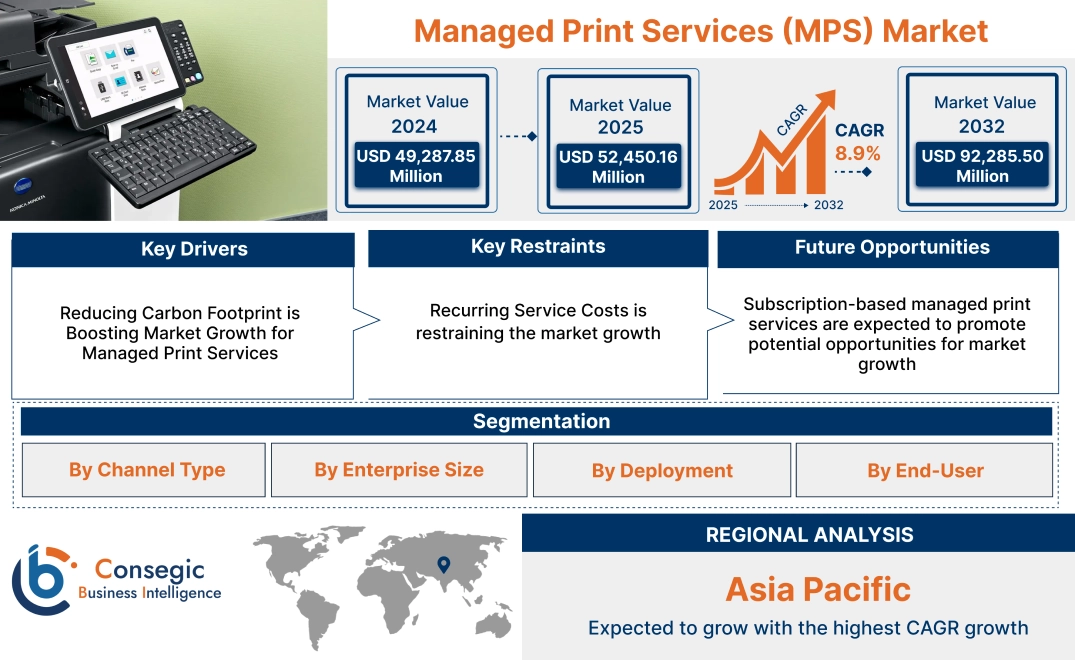

Managed Print Services (MPS) Market Size is estimated to reach over USD 101.63 Billion by 2032 from a value of USD 49.29 Billion in 2024 and is projected to grow by USD 53.31 Billion in 2025, growing at a CAGR of 8.4% from 2025 to 2032.

Managed Print Services (MPS) Market Scope & Overview:

Managed print services (MPS) are outsourcing solutions that help businesses manage and optimize their document output, including printing, scanning, and faxing. MPS aims to reduce costs, improve efficiency, and streamline document workflows. It involves assessing an organization's print environment, optimizing hardware and software, and providing ongoing support and management.

How is AI Transforming the Managed Print Services (MPS) Market?

AI is increasingly being integrated into managed print services (MPS) sector to enhance efficiency, security, and sustainability. AI-powered analytics and automation help in optimizing print workflows, reducing costs, and proactively addressing potential issues.

AI algorithms can analyze data from printers to predict potential hardware failures, which facilitates proactive maintenance and minimizes downtime. Further, AI integration in MPS offers several benefits, including predictive maintenance, cost optimization, automated reporting and analytics, enhanced print security, and others. Consequently, the above factors are projected to boost the market growth in upcoming years.

Managed Print Services (MPS) Market Dynamics - (DRO) :

Key Drivers:

Growing emphasis on environmental sustainability is driving the managed print services market

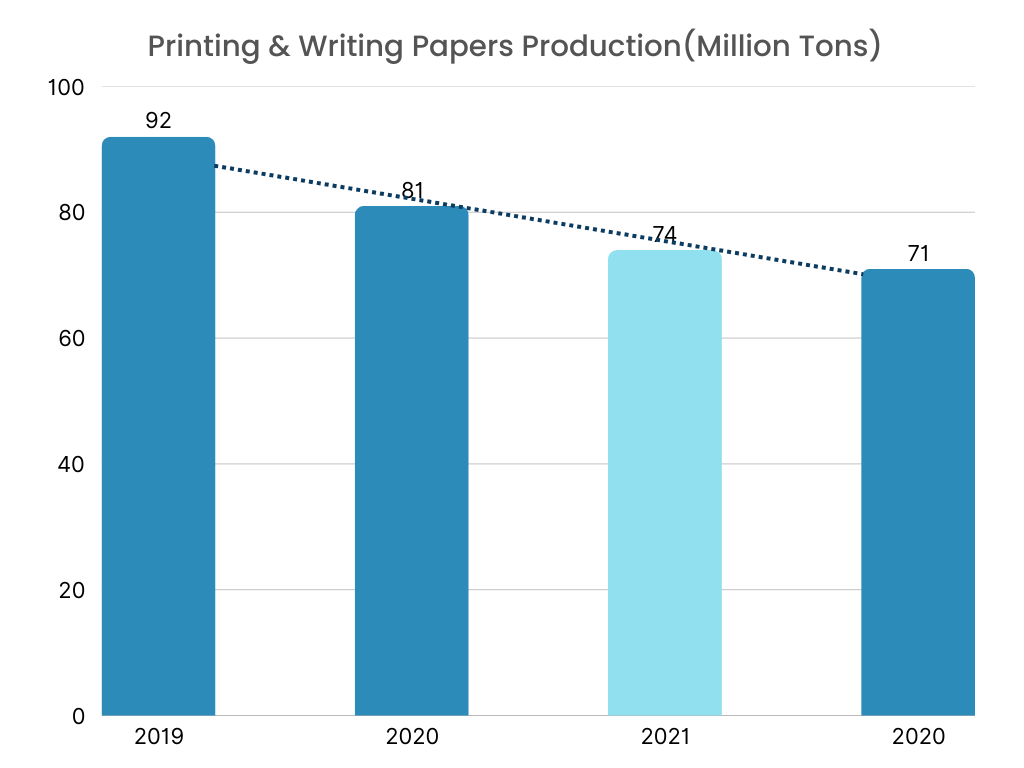

The growing emphasis on environmental sustainability and the need to comply with stringent regulatory requirements are driving the adoption of managed print services (MPS). Organizations are seeking ways to reduce their carbon footprint and achieve their sustainability goals and print service providers offers a sustainable solution by promoting paperless processes and reducing energy consumption. Additionally, compliance with data protection regulations, such as GDPR, has made secure document management a crucial concern for businesses, further boosting the demand for managed print services (MPS) that ensure secure and compliant printing solutions.

- For instance, according to Statista, the printing & writing papers production have reduced from 92 million tons in 2019 to 71 million tons in 2022, due to increased digitalization.

Thus, according to the managed print services market, the growing emphasis on environmental sustainability is driving the managed print services (MPS) market size and trends.

Key Restraints:

Data security concerns and privacy are affecting the managed print services (MPS) market demand

The concerns over data security and privacy can pose a significant challenge, particularly in industries dealing with sensitive and confidential information. Further, several multifunction printers (MFPs) have internal hard drives that can store scanned documents and print data. Moreover, some managed print services (MPS) involve cloud-based management or direct printing to cloud-connected devices. The security of the data transmitted to and stored in the cloud is vulnerable to cyberattacks. Thus, the analysis depicts that the aforementioned factors would further impact the managed print services (MPS) market size.

Future Opportunities :

Growing need for flexible and accessible printing solutions is expected to drive managed print services (MPS) market opportunities

The rise of remote work is encouraging businesses to find adaptable printing options. MPS is meeting this need with mobile printing features, enabling employees to print from their personal devices (phones, tablets, laptops) from any location. This boosts efficiency and keeps document handling consistent, irrespective of the individual’s location. The necessity to support remote and mobile teams is a key reason why organizations are embracing these solutions as the workplace evolves. To meet this growing need, companies are introducing new product lines.

- For instance, in August 2023, Fujifilm Business Innovation launched MPS Guardia, a secure managed print service designed with multiple levels of endpoint protection. It is available in two versions, Life Essentials and Enterprise Plus, which suits businesses of varying scales. The service includes features including encrypted print jobs, adaptable user verification, and security configurations that help organizations meet their security rules and industry standards.

Thus, based on the managed print services (MPS) market analysis, the growing need for flexible and accessible printing solutions is expected to drive managed print services (MPS) market opportunities.

Managed Print Services (MPS) Market Segmental Analysis :

By Channel Type:

Based on channel type, the managed print services (MPS) market is segmented into printer/copier manufacturers, system integrators/resellers, and independent software vendors (ISVs).

The market involves printer/copier manufacturers including HP and Canon, system integrators/resellers including Print Solution, and independent software vendors (ISVs). Printer/copier manufacturers provide hardware and offer comprehensive MPS solutions that integrate digital services and software. System integrators and resellers, like Print Solution, work with various brands and offer solutions tailored to specific needs, often providing hardware, software, and services. ISVs, like those in the Print Solution ecosystem, develop software and applications that enhance printer functionality and manage print fleets.

Trends in the channel type:

- System integrators are increasingly targeting smaller and mid-sized businesses by developing budget-friendly and adaptable managed print services (MPS) packages.

- System integrators are also prioritizing seamless integration of these MPS solutions with the client's existing IT systems.

The printer/copier manufacturers segment accounted for the largest revenue in the year 2024.

As data breaches and cyberattacks are a growing concern, there is a high demand for secure printing solutions. To meet this need, manufacturers are building advanced security into their devices, like secure print release, user verification, encryption, and secure boot. These features help safeguard confidential data, ensure adherence to data protection laws, and reduce the risk of unauthorized access.

- For instance, HCL Technologies offers managed print service, which helps organizations to implement cloud-based print infrastructure services to accelerate their digital transformation journey. This helps organizations work closely together and allow them to more effectively address clients' requirements.

Thus, based on the managed print services (MPS) market analysis, the above factors are further driving the managed print services (MPS) market growth.

The independent software vendors (ISVs) segment is anticipated to register the fastest CAGR during the forecast period.

The complexity of managing various processes and workflows intensifies when businesses undergo expansion and evolution. Efficient business process management is crucial to ensure smooth operations, reduce redundancies, and enhance productivity. ISVs provide specialized software solutions that help businesses streamline their processes, automate repetitive tasks, and manage workflows effectively. These solutions offer valuable insights into business operations, enabling decision-makers to identify bottlenecks and implement necessary improvements. Furthermore, they facilitate better resource allocation, improved communication, and increased transparency across the organization.

- For instance, Zebra's PartnerConnect program has an ISV track for companies creating apps that work with Zebra printers. This track simplifies app development, makes it faster, and improves how well the apps perform.

Thus, based on the above analysis, these factors are expected to drive the managed print services (MPS) market share and growth during the forecast period.

By Enterprise Size:

Based on enterprise size, the market is segmented into small and medium enterprise and large enterprise.

Managed Print Services offer benefits to both small/medium enterprises (SMEs) and large enterprises by streamlining print operations, reducing costs, and improving efficiency. While the specific needs and challenges vary, the core benefits of MPS, such as cost reduction, improved efficiency, and enhanced security, apply across the board. Large enterprises can significantly reduce their printing costs by consolidating print fleets, negotiating volume discounts, and optimizing print processes. Meanwhile, MPS help SMEs reduce printing costs by optimizing their print fleet, negotiating better pricing with vendors, and reducing waste through centralized monitoring and control.

Trends in the enterprise size:

- Enterprises are increasingly trying to reduce unnecessary printing and use less paper, which is driving the market.

- The inclination toward better printing efficiency and security is driving the adoption of managed print services across several enterprises.

The large enterprise segment accounted for the largest revenue in the year 2024.

Large enterprises often require extensive and complex printing solution, high-cost efficiencies, streamlined operations, and security enhancements, which are further driving the need for managed printing services in large enterprises. These organizations usually have the financial and IT resources to implement comprehensive printing services and solutions, while integrating them with their existing systems to maximize operational efficiency and data security. Further, these services provide a central point of control, enabling large organizations to set standard printing rules, track usage, and ensure everyone follows them, regardless of location. This central management leads to better oversight, more efficient use of resources, and consistent printing procedures. Thus, based on the above analysis, these factors would further supplement the global market share and growth.

The small and medium enterprise (SME) segment is anticipated to register the fastest CAGR during the forecast period.

Small and medium enterprises find print services appealing due to its ability to reduce operational costs and improve productivity without requiring significant upfront investment. SMEs often lack the dedicated IT personnel and resources to manage print infrastructure effectively. By outsourcing these functions to MPS providers, they can leverage advanced printing technologies and services that would otherwise be beyond their reach. Cloud-based MPS solutions are particularly beneficial for SMEs, providing them with scalable and flexible printing services that can grow with their business needs.

- For instance, in April 2024, ECI Software Solutions announced an advancement in e-automate and Printanista designed to empower small- and medium-sized office equipment dealers for remote monitoring of printer fleets.

The above developments are anticipated to further drive the managed print services (MPS) market trends during the forecast period.

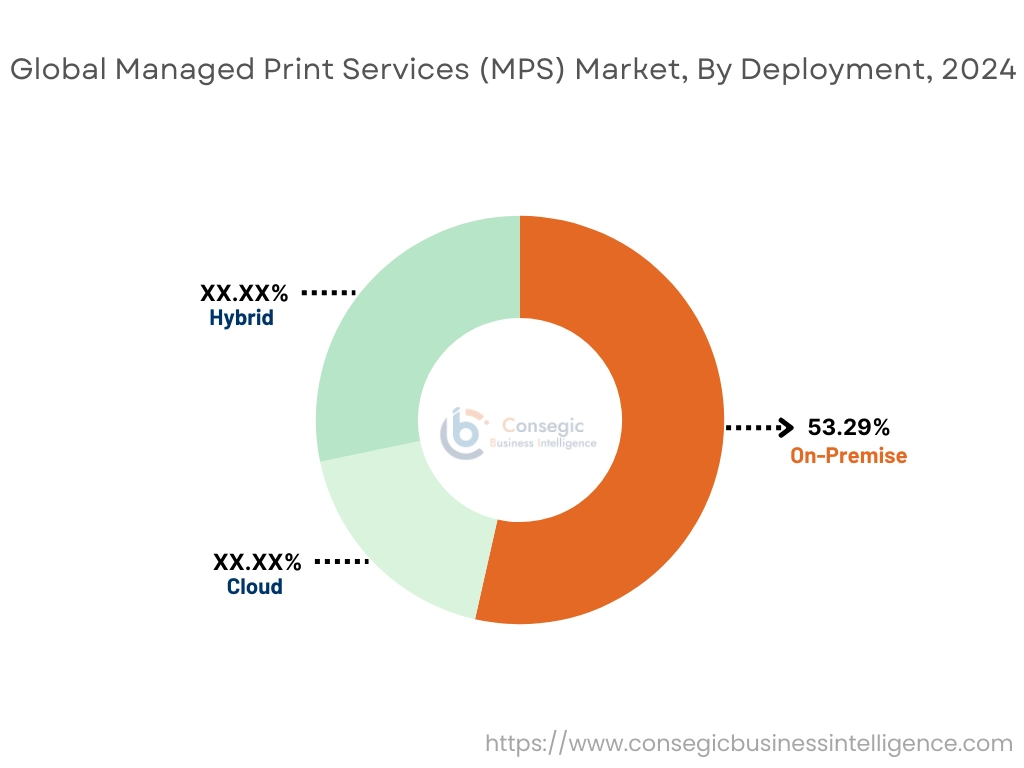

By Deployment:

Based on deployment, the market is segmented into cloud, on-premise, and hybrid.

Managed Print Services (MPS) can be deployed in cloud, on-premise, or hybrid models, each offering distinct benefits and challenges. Cloud-based MPS leverage remote servers for print management, while on-premise solutions host all print-related infrastructure on-site. Hybrid models combine elements of both, allowing for flexibility in managing print environments.

Trends in the deployment:

- The trend towards adoption of AI (artificial intelligence) into on-premise deployment is driving the market progress.

- The inclination towards integrating multi-cloud strategies into printing services is propelling the progress of cloud deployment. Thus, based on the above analysis, these factors are anticipated to further drive the managed print services (MPS) market trends during the forecast period.

The on-premise segment accounted for the largest revenue of 53.29% in the year 2024.

On-premises deployment involves the installation of print services software and infrastructure within the organization’s premises, offering greater control and customization. This mode is preferred by large enterprises and sectors with stringent data security requirements, such as BFSI and government among others. Moreover, on-premise solutions provide robust security features and allow organizations to integrate the MPS with their existing IT infrastructure seamlessly. Therefore, based on the above analysis, the aforementioned factors would further supplement the global market share.

The cloud segment is anticipated to register the fastest CAGR during the forecast period.

Cloud-based deployment is gaining significant traction due to its flexibility, scalability, and cost-effectiveness. With cloud-based printing services, businesses can access print services from any location, making it an ideal solution for the modern, distributed workforce. The cloud model reduces the need for upfront capital investment and allows businesses to pay for services based on usage, making it an appealing option for small and medium enterprises. Additionally, cloud-based solutions offer advanced features such as remote monitoring, automated updates, and enhanced collaboration capabilities. Moreover, cloud-based printing lets employees print from anywhere using their laptops, tablets, or phones. This ability to print remotely is crucial for companies that have employees working in different places or have several office buildings.

- For instance, in February 2023, Konica Minolta Business Solutions Inc. launched Dispatcher Paragon Cloud V2.0, which is a new version of their cloud-based software for MFPs (machines that can print, copy, and scan). The software allows users to handle, scan, and send documents directly to well-known cloud services such as Dropbox, Microsoft OneDrive, and SharePoint Online.

Therefore, based on the above analysis, these factors are driving the managed print services (MPS) market growth.

By End-User:

Based on end user, the managed print services (MPS) market is segmented into BFSI, education, government, healthcare, IT & telecom, manufacturing, retail, and others.

MPS are gaining popularity across various industries, including BFSI, healthcare, education, government, manufacturing, IT & telecom, and retail, due to their ability to optimize printing workflows, reduce costs, and enhance security. The BFSI sector, for instance, benefits significantly from MPS due to its high volume of print activity and regulatory requirements, while other industries find MPS helpful in managing print equipment, reducing paper waste, and improving overall efficiency.

Trends in the end user:

- The growing e-commerce business is driving the adoption of services in the retail sector, which in turn is propelling the global market.

- The increasing focus on paperless documentation initiatives in BFSI and IT & telecom sectors is fueling the market growth.

- Therefore, the aforementioned factors are driving the managed print services (MPS) market demand.

The BFSI segment accounted for the largest revenue share in the year 2024.

The BFSI sector is significant adopter of managed printing services due to its high volume of sensitive and confidential documents requiring secure and efficient printing solutions. The print services providers offer robust security features, such as secure print release and user authentication, which are critical for maintaining compliance with stringent regulatory standards in the BFSI sector. Further, by turning paper documents into digital files and organizing them, MPS helps these organizations work more efficiently, require less physical storage space, and find important information more easily.

- For instance, Wepsol’s managed print services are designed to help banks, financial institutions, and insurance companies get a better handle on their printing. This can lead to cost savings, increased efficiency, and more secure management of sensitive information.

Hence, the above factors are further driving the global market trends and growth.

The healthcare segment is anticipated to register the fastest CAGR during the forecast period.

The healthcare sector represents a substantial market for printing services, driven by the need to handle vast amounts of patient records and medical documents securely. These services help healthcare organizations streamline their document workflows, reduce printing costs, and enhance data security, which are fundamental in complying with healthcare regulations.

- For instance, Connected Office Technologies’ provide managed printing services to healthcare sector by ensuring regulatory compliance, reducing costs, enhancing security features, and supporting eco-friendly operations. The company’s services help automate workflows, which leads to fewer mistakes, increased productivity, and a better experience for individuals using the printing services in the healthcare sector.

The above factors and trends are anticipated to further drive the managed print services (MPS) market expansion during the forecast period.

Regional Analysis:

The global market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

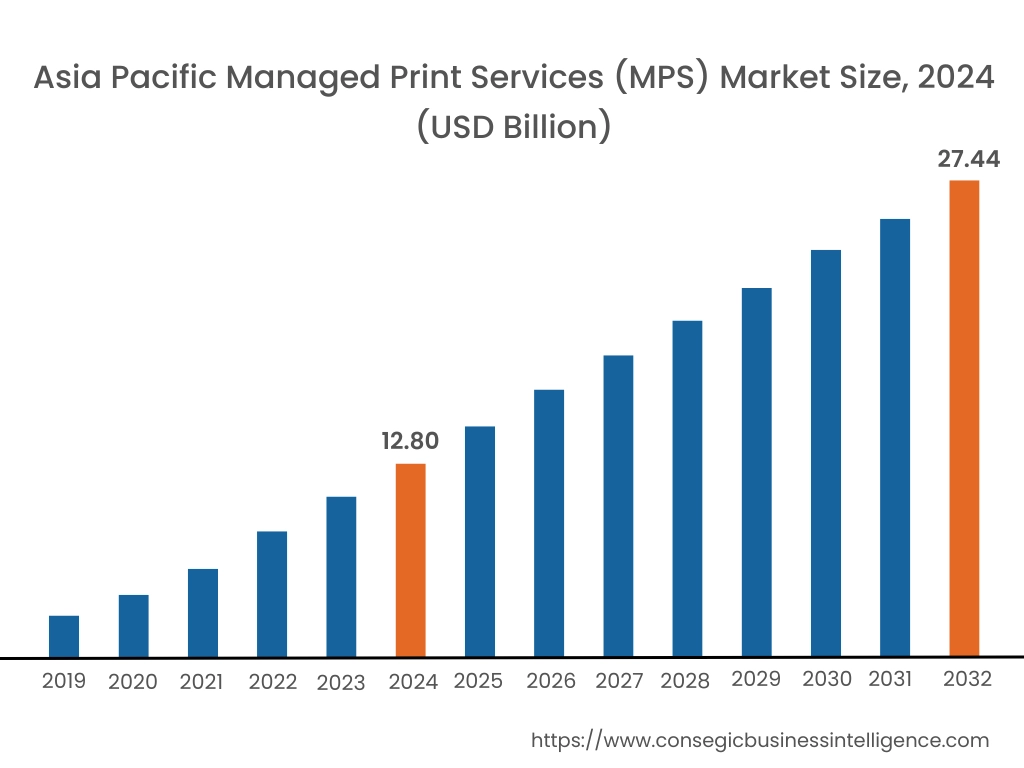

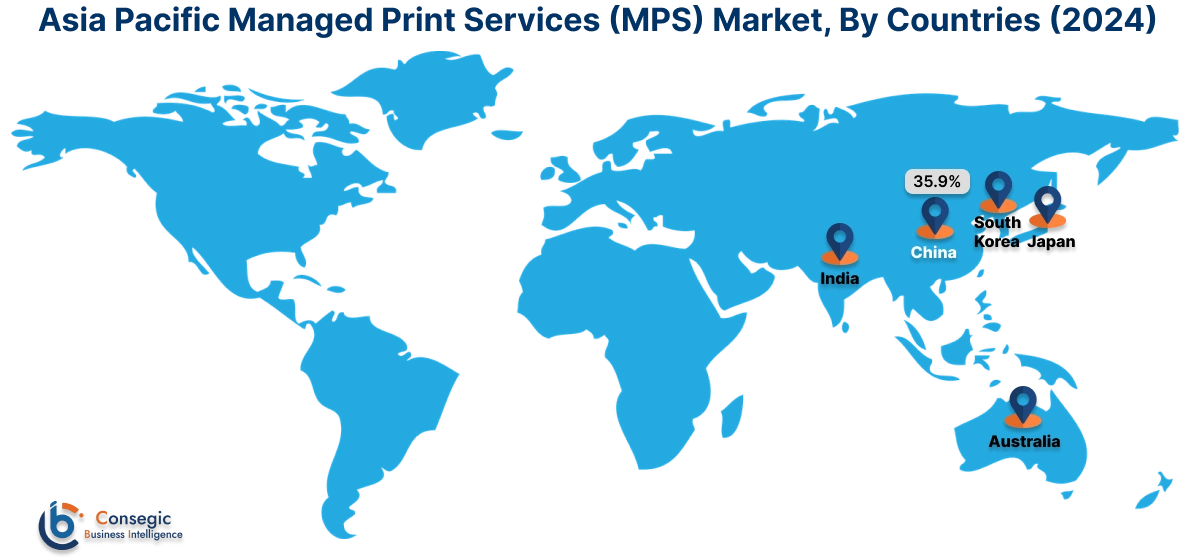

Asia Pacific managed print services (MPS) market expansion is estimated to reach over USD 27.44 billion by 2032 from a value of USD 12.80 billion in 2024 and is projected to grow by USD 13.89 billion in 2025. Out of this, the China market accounted for the maximum revenue split of 35.67%. The region’s fast economic growth is increasing the demand for managed printing solutions and services. Further, the rising number of small and medium-sized businesses in the region is also driving the need for printing services. These factors would further drive regional managed print services (MPS) market share during the forecast period.

- For instance, according to Indian Brand Equity Foundation (IBEF), the government of India allocated the union budget of USD 11.50 billion for fiscal year 2025-26, in order to support digital infrastructure development in healthcare sector, which is propelling the managed print service (MPS) market.

North America market is estimated to reach over USD 37.20 billion by 2032 from a value of USD 18.12 billion in 2024 and is projected to grow by USD 19.59 billion in 2025. In North America, organizations are using modern printing technology and cloud services to provide print management that is more efficient, secure, and can easily grow with a business. By connecting printers to the internet of things (IoT), they can monitor them in real-time and fix problems before they cause downtime, which makes things run more smoothly. Also, using cloud-based printing solutions makes it easier to manage printing from different locations and improves who can access the system. This helps organizations control their printing setup even if they have offices in many places.

- For instance, in January 2022, Novatech acquired ManagedPrint, which is a managed print service provider. The acquisition aims to expand the services offered in South Carolina and across the U.S.

Additionally, according to the managed print services (MPS) industry, the managed print services (MPS) industry in Europe is expected to witness significant development during the forecast period. European businesses are increasingly seeking ways to reduce their carbon footprint and achieve sustainability goals, and managed printing solutions offers a viable solution by promoting paperless processes and reducing energy consumption.

Additionally, the development of modern IT infrastructure is boosting the market in Latin America region. Further, businesses in the Middle East & Africa are increasingly looking to outsource non-core functions such as print management. This allows them to concentrate their time and resources on activities that directly contribute to their key goals and revenue.

Top Key Players & Market Share Insights:

The global managed print services (MPS) market is highly competitive with major players providing services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global managed print services (MPS) market. Key players in the managed print services industry include-

- HP Development Company, L.P. (USA)

- ARC Document Solutions, Inc. (USA)

- Ingram Micro Inc. (USA)

- Konica Minolta, Inc. (Japan)

- Kyocera Corporation (Japan)

- Canon UK Limited (UK)

- Acrodex Inc. (Canada)

- Canon, Inc. (Japan)

- Lexmark International, Inc. (USA)

- HCL Technologies (India)

Recent Industry Developments :

Partnership:

- In March 2022, the University of Massachusetts collaborated with Toshiba America Business Solutions for the deployment of cloud-based managed print services to achieve sustainability goals by reducing paper waste. The university leverages Toshiba's Encompas managed print-as-a-service (MPaaS) to improve printing across its six campuses. This cloud-based system manages nearly 900 Toshiba e-STUDIO multifunction printers, making printing more secure, environmentally friendly, cost-effective, and efficient.

Managed Print Services (MPS) Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 101.63 Billion |

| CAGR (2025-2032) | 8.4% |

| By Channel Type |

|

| By Enterprise Size |

|

| By Deployment |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Managed Print Services (MPS) Market? +

Managed Print Services Market (MPS) Size is estimated to reach over USD 101.63 Billion by 2032 from a value of USD 49.29 Billion in 2024 and is projected to grow by USD 53.31 Billion in 2025, growing at a CAGR of 8.4% from 2025 to 2032.

Which is the fastest-growing region in the Managed Print Services (MPS) Market? +

Asia-Pacific is the region experiencing the most rapid growth in the market.

What specific segmentation details are covered in the Managed Print Services (MPS) report? +

The managed print services report includes specific segmentation details for channel type, enterprise size, deployment, end user, and region.

Who are the major players in the Managed Print Services (MPS) Market? +

The key participants in the market are HP Development Company, L.P. (USA), ARC Document Solutions, Inc. (USA), Canon UK Limited (UK), Acrodex Inc. (Canada), Canon, Inc. (Japan), Lexmark International, Inc. (USA), HCL Technologies (India), Ingram Micro Inc. (USA), Konica Minolta, Inc. (Japan), Kyocera Corporation (Japan), and others.

What are the key trends in the managed print services (MPS) market? +

The managed print services (MPS) market is being shaped by several key trends including the trend towards integrating multi-cloud strategies into managed print services as well as increasing focus towards minimizing unnecessary printing and optimizing paper usage in large enterprises and others are the key trends driving the market.