Medium Voltage Switchgear Market Size :

Medium Voltage Switchgears Market size is estimated to reach over USD 86.34 Billion by 2030 from a value of USD 51.40 Billion in 2022, growing at a CAGR of 7.0% from 2023 to 2030.

Medium Voltage Switchgear Market Scope & Overview:

A medium voltage switchgear is a type of electrical equipment that is used to control, protect, and isolate electrical power systems operating at medium voltage levels between 1kV and 36kV. The system includes several transformers, switches, circuit breakers, and fuses. Based on the analysis, the system play a vital role in the distribution and transmission of electrical energy in industrial, commercial, and utility applications. In addition, electrical switchgears are responsible for lowering the current of the system in situations of short circuits or sudden current increases.

Medium Voltage Switchgear Market Insights :

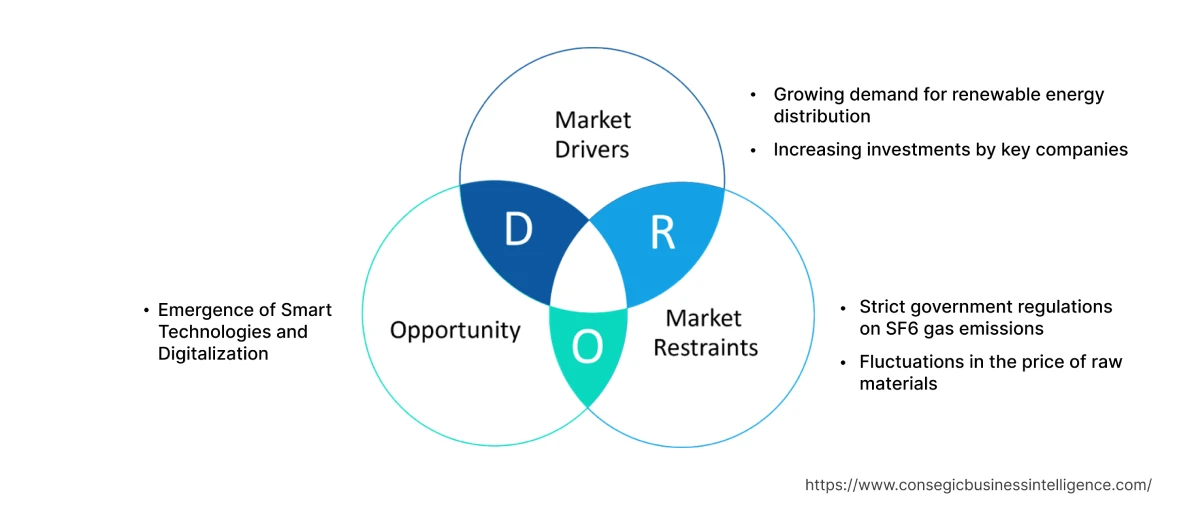

Medium Voltage Switchgear Market Dynamics - (DRO) :

Key Drivers :

Growing medium voltage switchgears market demand from power distribution industry

The medium voltage switchgear is designed to improve the operational reliability and performance of electric distribution utilities by monitoring precise current flow. The medium voltage switchgears are crucial in ensuring safe and efficient distribution of electricity. Additionally, the medium voltage switchgear allows for control, monitoring, and switching of the power flows, resulting in efficient utilization of energy and reducing power losses during transmission and distribution. As per the analysis, the growing requirement for electricity in various sectors including residential, commercial, and industrial is driving the market growth. For instance, according to the United Nations Statistics Division, the industrial sector accounted for highest electricity consumption in 2022 accounting to 121.9 Exajoules, followed by transport sector with consumption of 115.4 Exajoules.

Increasing investments by key companies

The increasing investments by key manufacturers to develop advanced medium voltage switchgears and sensors is one of the key factors driving the growth of the market. Major market players are spending heavily on research and development to produce advanced sensors that are present in these systems. For instance, in April 2022, ABB invested USD 1 Million for the development of advanced sensors for medium voltage switchgear. The sensors are designed to detect faults in numerous industrial applications and also to reduce emissions and cut energy costs thus contributing to promoting market growth. In addition, the rising demand for advanced MV switchgear from energy utilities for secondary distribution applications, namely fault detection, sub-station automation, and power quality management is also contributing significantly to accelerate the market growth. In conclusion, as per the analysis, the increasing investment by key players to build advanced voltage switchgears for the regulation of precise current flow in various applications is contributing significantly to bolstering the growth of the market.

Key Restraints :

Stringent government regulations on SF6 gas emissions

The major restraint for the growth of the medium voltage switchgears market is the stringent government regulations regarding the emission of SF6 gas. The gas is utilized as an insulator in switchgear and delivers better switching in comparison to conventional air-insulated switchgear. However, SF6 has a high global warming potential (GWP) and is classified as a greenhouse gas. Based on the analysis, many government agencies have implemented strict regulations regarding the emission of greenhouse gases including SF6, impeding the growth of the MV switchgears market. For instance, the European Climate Change Programme (ECCP) and United States Environmental Protection Agency (EPA) highlighted SF6 reduction as a crucial component in increasing global warming.

Future Opportunities :

Surge in initiatives to shift from hydrocarbons to renewable energy sources

The rising initiatives to shift from hydrocarbons to renewable energy are creating lucrative medium voltage switchgears market opportunities in the coming years. The medium voltage switchgears play a significant role in the integration and distribution of renewable energy sources including solar power and wind power. Increasing adoption of the medium voltage switchgears to enable safe switching of direct current is considered to be one of the key factors expected to positively impact the adoption of the switchgears in renewable energy sector. Further, based on the analysis, the rising concerns regarding climate change is anticipated to fuel the adoption of renewable energy in turn fuel the demand for medium voltage switchgears. For instance, IEA (International Energy Agency) predicts renewable power capacity to increase by 75 % by 2027. Also, IEA predicts solar power to be the biggest source of energy by 2027. Thus, these factors are creating lucrative opportunities in the forecast year.

Medium Voltage Switchgear Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 86.34 Billion |

| CAGR (2023-2030) | 7.0% |

| By Component | Circuit Breakers, Switches & Disconnector, Contactors, Fuses, and Others |

| By Insulation | Air Insulated Switchgears, Gas Insulated Switchgears, Oil Insulated Switchgears, and Vacuum Insulated Switchgears |

| By Installation | Indoor and Outdoor |

| By Voltage | 1kV-6kV, 6kV-12kV, 12kV-18kV, 18kV-24kV, 24kV-30kV, and More than 30kV |

| By End-User | Residential, Commercial, and Industrial |

| By Region | Asia-Pacific, Europe, North America, Latin America, Middle East & Africa |

| Key Players | Schneider Electric SE, NOJA Power Switchgear Pty Ltd, ABB, Siemens AG, Hitachi Group, Bharat Heavy Electricals Limited, Eaton Corporation Plc, General Electric, Mitsubishi Electric Corporation, Fuji Electric Co. |

Medium Voltage Switchgear Market Segmental Analysis :

By Component :

The component segment is divided into circuit breakers, switches & disconnectors, contactors, fuses, and others. Circuit breakers accounted for the largest market share in 2022 as the breakers serve as one of the primary components of the medium voltage switchgear system. Circuit breakers are responsible for sensing the irregularity and interrupting the power flow in several situations including an electrical fault. Moreover, circuit breakers are widely deployed in power generation stations and distribution sub-stations to lower the voltage in order to reduce the damage to the system. For instance, in November 2022, NOJA Power launched the EcoLink, a reclosing circuit breaker equipped with capability to self-power on minimum 0.15 Amperes of primary current.

Fuses are projected to witness the fastest CAGR during the forecast period owing to the increasing applications to provide overcurrent protection in industrial settings. In addition, fuses have the ability to open and close the circuit and interrupt the current flow by melting the electrical wire at a prescribed time and temperature. Moreover, fuses also protect the system from damage by mismatched loads and act as a barrier between the electric circuit and the human body. In conclusion, the above-mentioned factors, namely overcurrent protection and the ability to open and close the circuit are expected to drive the adoption of fuses in upcoming years.

By Insulation :

The insulation segment is categorized into air insulated switchgears, gas insulated switchgears, oil insulated switchgears, and vacuum insulated switchgears. Air insulated switchgears accounted for the largest market share in 2022 owing to the advancements in technology including the Internet of Things (IoT). The air insulated switchgears use air as the primary insulation medium. Technological advancements in the air insulated switchgears enable 24/7 condition monitoring of the system to detect any voltage load on the system. In addition, the integration of IoT reduces downtime and quickly identifies issues including poor environmental conditions and condensation. For instance, in August 2021, Schneider Electric introduced GenieEvo Connected, an air insulated switchgear. The product is equipped with advanced IoT sensors that improve the efficiency of fault detection and also reduce downtime by 25%.

Gas-insulated switchgears are anticipated to witness the fastest CAGR during the forecast in the medium voltage switchgear market. The expansion is attributed to the ability to widespread adoption of gas-insulated switchgear across various applications including data centers, power distribution, tunnels, smart cities, and other infrastructural developments. In addition, gas insulated switchgears offer better protection, and efficiency, and requires less maintenance in comparison to other switchgear. Moreover, many gas-insulated switchgear are equipped with advanced robotics to deliver real-time data thus enhancing efficiency and productivity. Consequently, the increasing adoption of gas-insulated switchgears across several industries is projected to fuel the demand for gas switchgears during the forecast period.

By Installation :

The installation segment is bifurcated into indoor and outdoor. Outdoor installation accounted for the largest market share in 2022 owing to the advancements in technology and the development of alternatives to SF6 gas. SF6 is a greenhouse gas and is harmful to the environment. However, the development of alternatives including CF3CHCl2 gas, and others that are less harmful to the environment promotes the installation of switchgear in outside settings. Consequently, the development of advanced alternatives to improve efficiency and reduce carbon footprints is promoting the installation of medium voltage switchgear in the outside environment. For instance, in June 2021, S&C Electric Company introduced Vista underground distribution switchgear as an alternative to SF6 to support sustainability goals. The product is designed to offer a 97% reduction in CO2e as compared to SF6 and is ideal for outdoor industrial applications.

Indoor installation is projected to witness the fastest CAGR during the forecast period owing to the increasing adoption of switchgears to monitor the current flow in buildings or other enclosures. The switchgears monitor the current flow, isolate the circuits, and convey the electricity from generating plants. In addition, indoor installation is widely employed in many commercial applications namely educational institutes and hospitals to monitor the flow of power. In conclusion, the ability of switchgear to detect voltage in many commercial applications is expected to drive the expansion of indoor installation in the upcoming years.

By Voltage :

The voltage segment is classified into 1kV-6kV, 6kV-12kV, 12kV-18kV, 18kV-24kV, 24kV-30kV, and more than 30kV. 12kV-18kV accounted for the largest market share in 2022 and is considered a standard range for the medium voltage switchgears market. The ability of 12kV-18kV switchgear to offer a high safety level including arc protection is considered to be one of the major factors driving the market trends. In addition, the voltage range is appropriate to work with metering systems and remote control including smart grid networks further, fueling the global medium voltage switchgears market growth.

1kV-6kV segment is anticipated to witness the fastest CAGR during the forecast period due to the improved stability and reliability offered at low voltages. In addition, low voltage is also applicable for converting the energy from photovoltaic cells to solar energy. The resulting renewable energy is then utilized in greenhouses and solar farms, hence, accelerating the expansion of the market. Consequently, the ability of 1kV-6kV switchgear to convert light energy into solar energy is predicted to drive market expansion in upcoming years. For instance, in January 2023, SPIE Deutschland & Zentraleuropa installed a medium voltage (6kV) substation for Bodensee-Wasserversorgung customers. The 6 kV medium voltage substation is expected to supply the facility with renewable energy from photovoltaic cells to ensure grid stability, thus propelling the market trends.

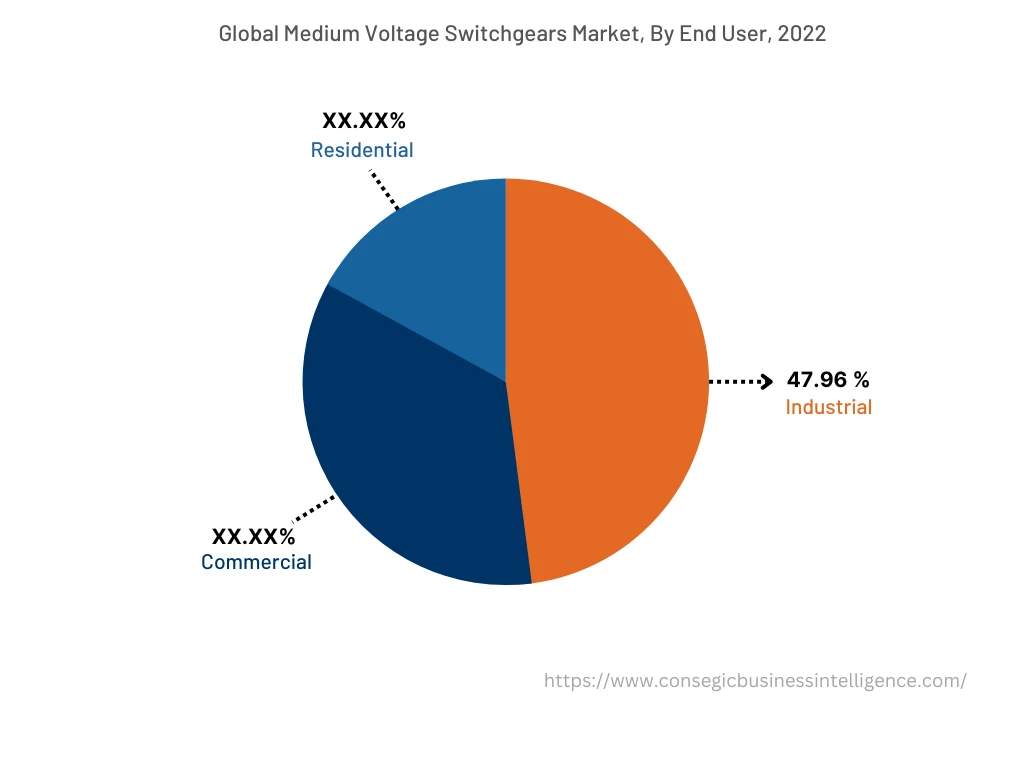

By End-User :

The end-user segment is trifurcated into residential, commercial, and industrial. The industrial sector accounted for the largest medium voltage switchgears market share of 47.96% in 2022 and is also projected to witness the fastest CAGR during the forecast period. The trend is attributed to the increased usage of switchgear in power plants, gas and petrochemical, and utility sectors. In addition, the development of alternatives to SF6 to reduce the global warming effects is also fueling the trends of the industrial sector. In conclusion, the increasing adoption of switchgear in industrial sectors to monitor the flow of current along with the development of SF6 alternatives are collectively contributing to drive the trends of the industrial segment.

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

North America accounted for the largest revenue share in the year 2022 valued at USD 16.49 Billion and is projected to grow at a CAGR of 7.2% during the forecast period. The trend is attributed to the expanding manufacturing and chemical industries that use switchgear to regulate and monitor the amount of current flowing. In addition, based on the medium voltage switchgears market analysis, the expansion is also attributed to the advancements in technology including IoT and advanced sensors that further propel the market trends. Moreover, the ability of switchgear to identify potential issues in real-time, reducing downtime and operational costs across various industrial applications is accelerating the medium voltage switchgears market trends in North America. For instance, in May 2022, Schneider Electric launched SureSeT MV switchgear to expand its portfolio in the North American market. The product is equipped with advanced sensors to deliver real-time insights for remote access, predictive maintenance, and operational efficiency. The aforementioned factors collectively contribute to promoting the expansion of the medium voltage switchgears market in North America.

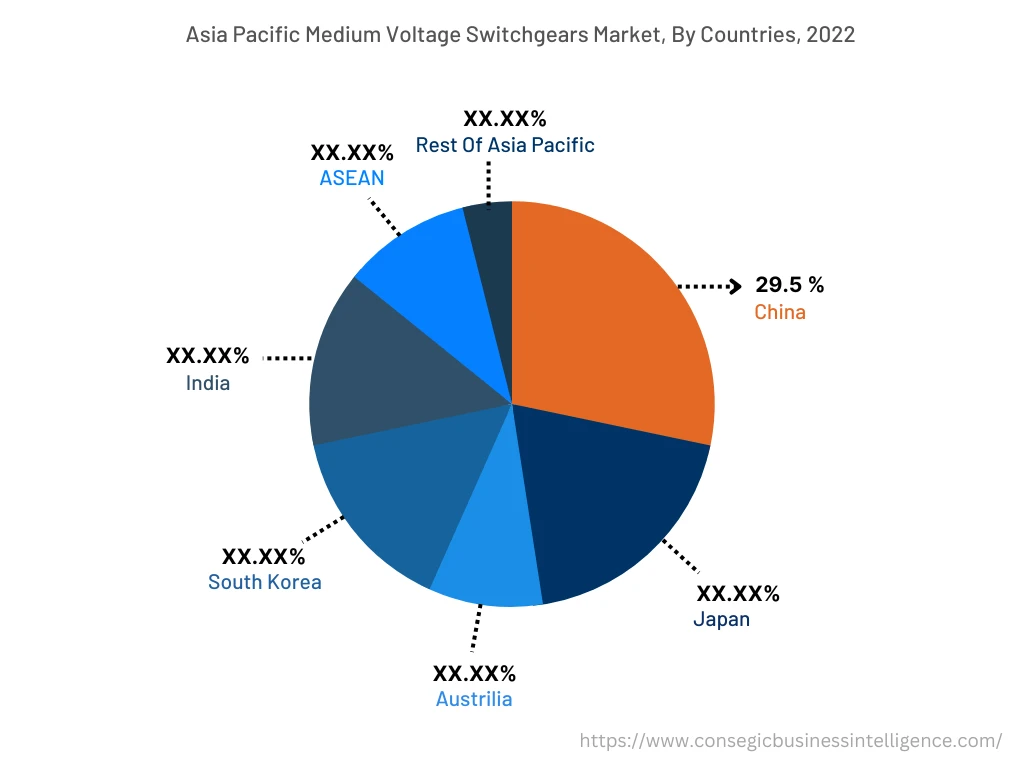

Asia Pacific accounted for USD 12.45 Billion in 2022 and is anticipated to witness the fastest CAGR of 7.4% in the medium voltage switchgears market during the forecast period. In addition, in the region, China accounted for the maximum revenue share of 29.5% in the year 2022. The medium voltage switchgears market demand is attributed to the increasing electricity demand and upgradation of the aging electrical grid infrastructure. Moreover, the growing demand for energy efficiency in power grid systems is also raising the demand for energy-efficient switchgear in Asia Pacific countries. Consequently, the increasing adoption of switchgear for the upgradation and construction of energy-efficient or renewable power grid systems is expected to drive market trends in the region. For instance, according to International Renewable Energy Agency (IRENA), as of April 2020, Japan, China, and India are the leading countries for installing renewable energy in 2020. China was the leader in renewable energy installations, with a capacity of around 136 gigawatts in the Asia Pacific region.

Top Key Players & Market Share Insights:

The competitive landscape of the global medium voltage switchgears market has been analyzed in the report, along with the detailed profiles of the major players operating in the industry. Further, the surge in Research and Development (R&D), product innovation, various business strategies, and application launches have accelerated the medium voltage switchgears market trends. Key players in the medium voltage switchgears industry include-

- Schneider Electric SE

- NOJA Power Switchgear Pty Ltd

- ABB

- Siemens AG

- Hitachi Group

- Bharat Heavy Electricals Limited

- Eaton Corporation Plc

- General Electric

- Mitsubishi Electric Corporation

- Fuji Electric Co.

Recent Industry Developments :

- In November 2022, Hitachi announced to deliver the sulfur hexafluoride (SF6) free 420 kV gas-insulated switchgear technology and advanced prefabricated grid connection solution in Germany, assisting the major European grid operator to meet the carbon neutrality goals.

- In April 2022, Siemens AG supplied EWE NETZ GmbH, with a new switchgear technology. In addition, EWE NETZ completed the installation of an advanced medium voltage switchgear in the Brake, featuring seven fluorine gas free NXPLUS C 24 circuit breaker panels from Siemen's green-blue GIS line.

Key Questions Answered in the Report

What is medium voltage switchgear? +

A medium voltage switchgear is defined as a set of electrical equipment responsible for monitoring and rectifying electrical current. Additionally, medium voltage switchgear offers improved control of the energy use and are responsible for reducing the current flow in case of a short circuit.

What specific segmentation details are covered in the medium voltage switchgears market report, and how is the dominating segment impacting the market growth? +

The report consists of segments including component, insulation, installation, voltage, and end-user. Each segment has a key dominating sub-segment being driven by industry trends and market dynamics. For instance, the component segment has witnessed circuit breakers as the dominating segment in the year 2022. The growth is attributed to the ability of circuit breakers to sense the anomaly and interrupt the power flow in several situations including an electrical fault.

What specific segmentation details are covered in the medium voltage switchgear market report, and how is the fastest segment anticipated to impact the market growth? +

The report consists of segments including component, insulation, installation, voltage, and end-user. Each segment is projected to have the fastest-growing sub-segment fuelled by industry trends and drivers. For instance, in the insulation segment, air insulated switchgear is anticipated to witness the fastest CAGR growth during the forecast period. The growth is attributed to the ability of gas insulated switchgear to offer better protection and efficiency in comparison to other switchgear.

What specific segmentation details are covered in the Medium Voltage Switchgears Market report, and how does each dominating segment is influencing the demand globally? +

As aforementioned, each dominating segment is influencing the demand globally due to growing industrial needs. Moreover, fluctuation in demand being witnessed from different sectors is responsible for driving the medium voltage switchgears market.