Membrane Separation Materials Market Scope & Overview:

Membrane Separation Materials Market size is estimated to reach over USD 76,333.72 Million by 2032 from a value of USD 27,319.35 Million in 2024 and is projected to grow by USD 30,588.21 Million in 2025, growing at a CAGR of 10.70% from 2025 to 2032.

Membrane Separation Materials Market Size :

Membrane separation is a process that utilizes membranes to separate components of a fluid based on size and other factors. The material is mainly used for applications including water purification, wastewater treatment, and chemical processing, among others. Additionally, the materials offer several advantages, including cost-effectiveness, ease of operation, high selectivity, and energy efficiency, which in turn is boosting the membrane separation materials market growth. Moreover, the rising adoption of bio-based membranes is boosting the membrane separation materials market demand.

How is AI Impacting the Membrane Separation Materials Market?

AI is significantly impacting the membrane separation materials market by enhancing performance, sustainability, and cost-effectiveness. Also, AI algorithms analyze vast datasets of material properties and performance data to design more efficient and durable membranes for specific applications. Additionally, AI can optimize wastewater treatment processes, leading to more efficient removal of pollutants and better water quality. Further, AI improve the efficiency of various industrial separation processes, such as gas separation, chemical purification, and food processing. Furthermore, AI is accelerating the discovery and development of new membrane materials with enhanced properties is boosting the market progress.

Membrane Separation Materials Market Insights :

Membrane Separation Materials Market Dynamics - (DRO) :

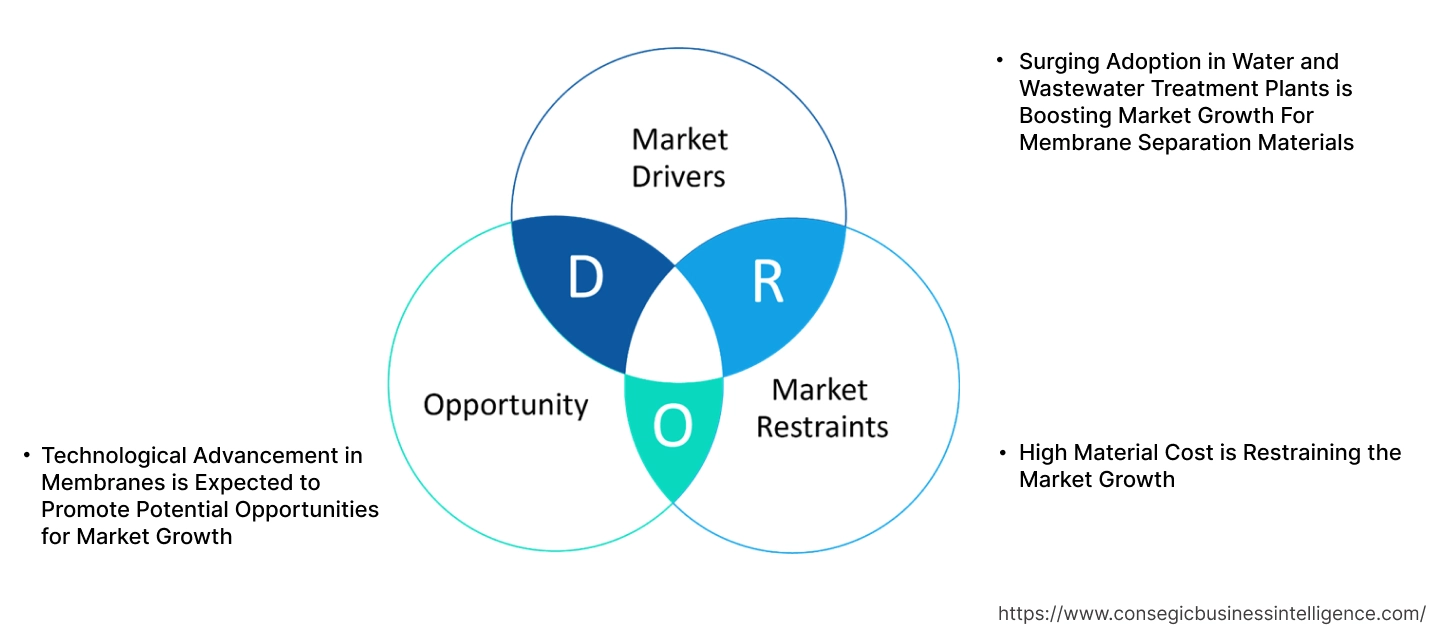

Key Drivers :

Surging Adoption in Water and Wastewater Treatment Plants is Boosting Market Growth For Membrane Separation Materials

The rising population and industrialization are creating a higher demand for clean water, which is driving the need for advanced treatment solutions in turn driving the membrane separation materials market demand. Additionally, the stricter environmental regulations on water pollution and industrial wastewater discharge due to the need for environmentally friendly treatment methods are driving the membrane separation materials market growth. Further, the rising number of wastewater treatment plants is driving the membrane separation materials industry.

- For instance, according to the Ministry of Statistics & Programme Implementation, the number of industrial wastewater treatment plants in India is 218 units, which in turn is boosting the market demand.

Therefore, the rising population and industrialization are driving the need for membrane material, in turn, proliferating the growth of the market.

Key Restraints :

High Material Cost is Restraining the Market Growth

The initial capital investment for setting up membrane systems and the ongoing operational expenses are hindering the membrane separation materials market expansion. Additionally, the initial investment in membrane systems, including membrane modules, pumps, instrumentation, and infrastructure, which incur huge costs, is restraining the market progress. Further, the fluctuations in raw material prices significantly hamper the costs for manufacturers, leading to price increases for membrane products. Furthermore, the high cost of membrane systems can slow down adoption rates, especially in industries where cost-effectiveness is a major concern which is restraining the market development.

Therefore, the high costs of raw materials utilized in the manufacturing are restraining the membrane separation materials market expansion.

Future Opportunities :

Technological Advancement in Membranes is Expected to Promote Potential Opportunities for Market Growth

The increasing adoption of membrane separation in diverse industrial processes, including chemical, pharmaceutical, food, and beverage production, is driving the adoption of advanced membrane technology is propelling the membrane separation materials market opportunities. Further, the development of smart membranes with tunable separation capabilities, as well as ongoing research, is crucial for water purification, wastewater treatment, and desalination is paving the way for market development.

- For instance, in July 2025, Argonne partnered with University of Chicago researchers for the development of advanced membrane technology that extracts lithium from water. The advanced membrane technology is designed for applications in electric vehicles, cellphones, laptops, and military technologies, among others.

Hence, the ongoing research and advancement in membrane technology are anticipated to increase the utilization, in turn promoting prospects for the membrane separation materials market opportunities during the forecast period.

Membrane Separation Materials Market Segmental Analysis :

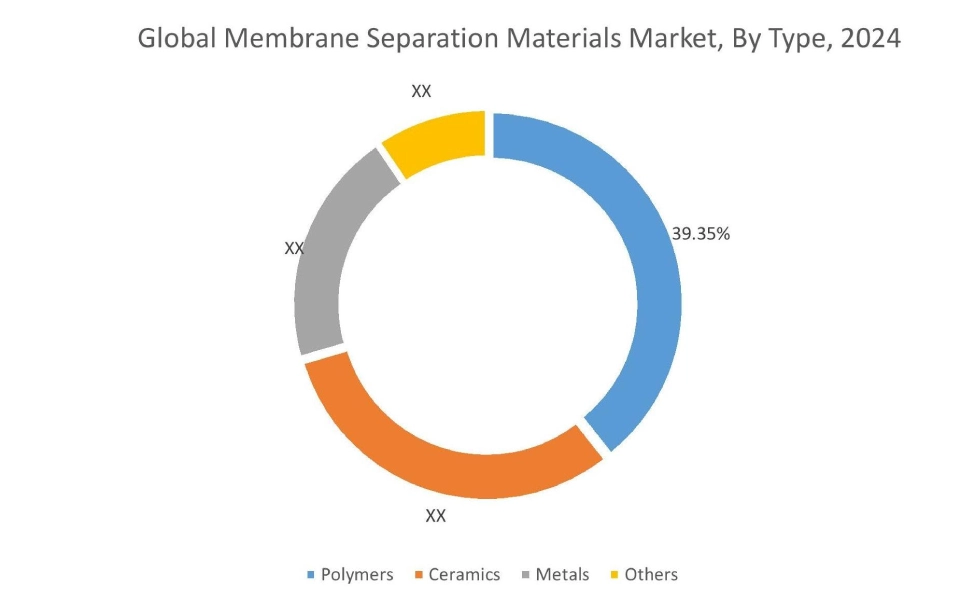

By Type:

Based on the type, the market is segmented into polymers, ceramics, metals, and others.

Trends in the Type:

- The rising adoption of polymer membranes for the development of advanced drug delivery systems is driving the membrane separation materials market trends.

- The increased popularity of metal-based membranes, particularly nanocomposites, due to their tunable properties and ability to address challenges faced by traditional polymeric membranes, is driving the membrane separation materials market trends.

Polymers accounted for the largest revenue share of 39.35% in the year 2024.

- Polymeric membranes, with their tunable properties, act as barriers, allowing some components to pass through while retaining others.

- Additionally, a wide variety of polymers is used, including cellulose acetate, polysulfone, polyimide, and others, due to selectivity, permeability, and mechanical strength is driving the membrane separation materials market share.

- Further, the analysis depicts that the rising focus on developing polymers membranes with properties such as rigid structures, and tunable pore sizes to enhance gas separation is boosting the membrane separation materials market share.

- For instance, in November 2023, Researchers from the University of Oklahoma are focusing on developing advanced polymer membranes aiming to advance molecular separation and related materials science.

- Thus, as per the membrane separation materials market analysis, the ongoing research in advancing polymer membranes is driving the market trends.

Ceramics is anticipated to register the fastest CAGR during the forecast period.

- Ceramic membranes are widely used in water treatment systems for removing impurities and pollutants.

- Additionally, the key advantages of ceramic membranes include stability, durability, longevity, and reduced maintenance is fueling the membrane separation materials market size.

- Further, the rising focus on sustainability and eco-friendliness is driving the adoption of ceramic membranes, which in turn is fueling the membrane separation materials market size.

- Therefore, as per the market analysis, the rising focus on sustainability and eco-friendliness is anticipated to boost the market during the forecast period.

By End-User:

Based on the end user, the market is segmented into water and wastewater, food and beverage, pharmaceuticals, and others.

Trends in the End User:

- The trend towards rising adoption of ceramic membranes due to high temperature and chemical resistance, making them suitable for harsh processing conditions, is driving the adoption in the food and beverage sector.

- The membrane separation helps remove bacteria, microorganisms, and other contaminants, ensuring the safety and purity of food and beverage products is boosting the market trends.

Water and Wastewater accounted for the largest revenue share in the year 2024.

- The rising development of advanced membrane materials, such as nanocomposites and ceramic membranes, is driving the adoption in water and wastewater.

- Additionally, rising need for improving membrane performance and promoting sustainability in the water and wastewater industry is driving the market trends.

- Further, stringent rules and regulations related to water and wastewater management are driving the demand for the membrane separation materials.

- For instance, according to the Ministry of Statistics & Programme Implementation, Gujarat has the highest capacity of industrial wastewater treatment plants with the capacity of 916 MLD, which in turn is driving the demand for membrane materials.

- Thus, as per the membrane separation materials market analysis, the government regulations and advancement in membrane technology are driving the market trends.

Pharmaceuticals are anticipated to register the fastest CAGR during the forecast period.

- The membrane separation is increasingly vital in drug purification, sterile filtration, and biopharmaceutical production.

- Additionally, the growing focus on sustainable practices is boosting the adoption of membrane technology.

- Further, the development of advanced polymeric membranes, such as Nanotechnology, is enhancing separation efficiency and cost-effectiveness in the pharmaceutical sector.

- Therefore, as per the market analysis, the growing focus on sustainable practices is anticipated to boost the market during the forecast period.

By Region :

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

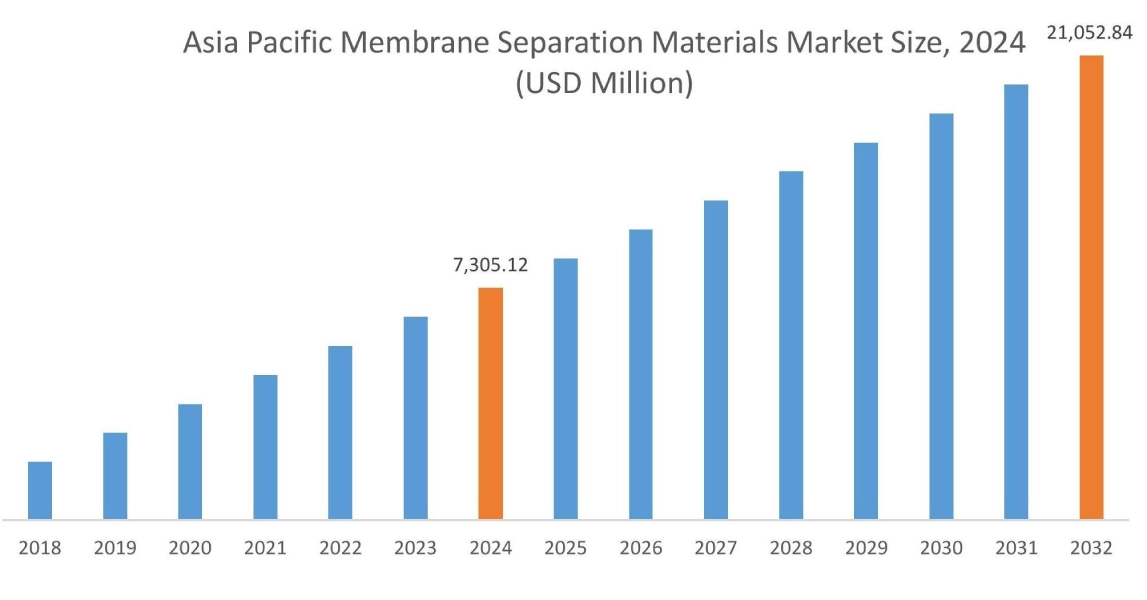

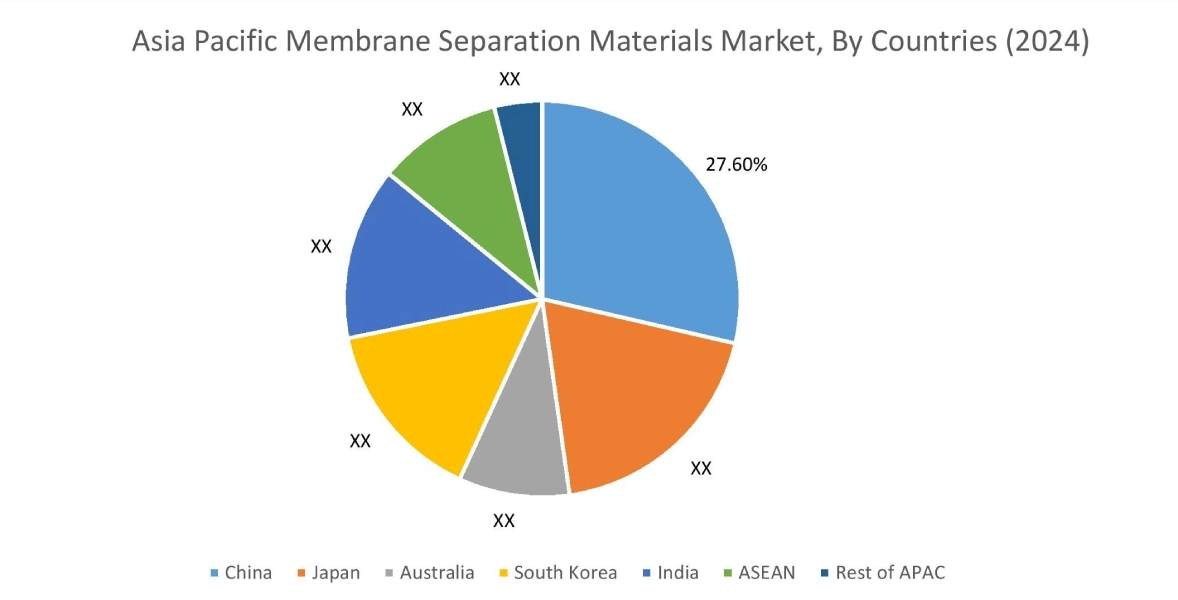

The Asia Pacific region was valued at USD 7,305.12 Million in 2024. Moreover, it is projected to grow by USD 8,200.62 Million in 2025 and reach over USD 21,052.84 Million by 2032. Out of this, China accounted for the maximum revenue share of 27.60%. The market progress is mainly driven by rising government initiatives promoting water quality. Furthermore, factors including the rising water scarcity and pollution concerns, as well as drug purification and separation in the pharmaceutical and biotechnology industries, are projected to drive the market growth in the Asia Pacific region during the forecast period.

- For instance, in July 2025, Metso received an order fromJindal Steel’s iron ore pellet plant in India to provide efficient and sustainable concentrate filtration technology featuring advanced membrane technology.

North America is estimated to reach over USD 24,854.26 Million by 2032 from a value of USD 8,824.02 Million in 2024 and is projected to grow by USD 9,886.48 Million in 2025. The North American region's growing focus on clean water and wastewater treatment offers lucrative growth prospects for the market. Additionally, the rising water scarcity and pollution concerns are driving the market progress.

- For instance, in March 2025, Rice University, based out in Texas, USA, established a center for membrane excellence to advance separation technologies for energy and sustainability.

The regional analysis depicts that the technological advancements in membrane materials are driving the market in Europe. Additionally, the key factor driving the market is the significant investments in water infrastructure, particularly for wastewater treatment, as well as the growing industrial sector, particularly in oil & gas, pharmaceuticals, and food industries is propelling the market adoption in the Middle East and African region. Further, the growing populations, urbanization, and industrialization are paving the way for the progress of the market in the Latin American region.

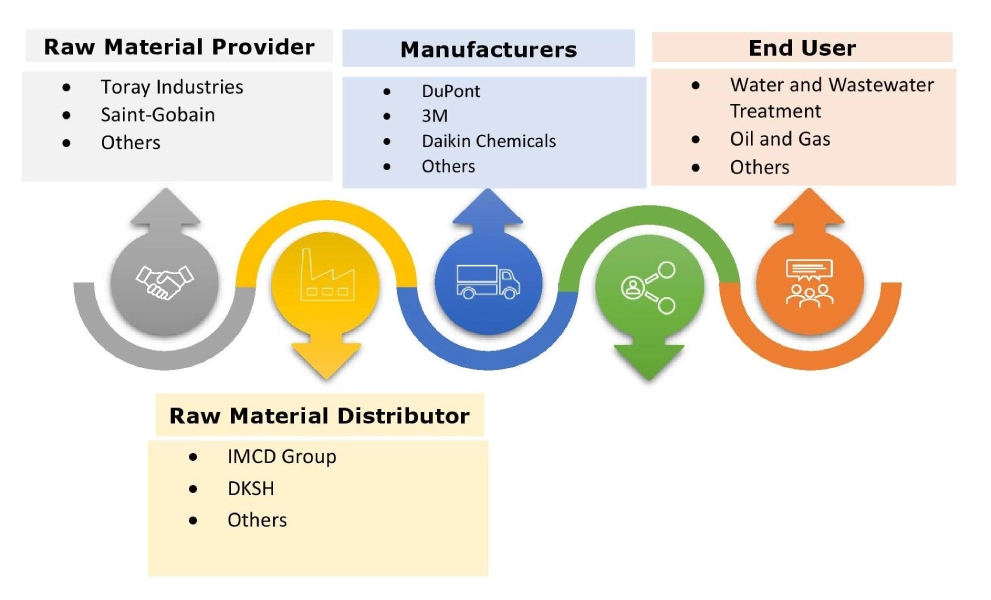

Top Key Players & Market Share Insights :

The global membrane separation materials market is highly competitive with major players providing membrane separation materials to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end user launches to hold a strong position in the membrane separation materials industry. Key players in the membrane separation materials market include-

- BASF SE(Germany)

- Solvay S.A.(Belgium)

- Gujarat Fluorochemicals Ltd (India)

- Hyflux Ltd. (Singapore)

- Corning Incorporated (USA)

- Arkema AG(France)

- DuPont (USA)

- 3M (USA)

- Daikin Chemicals (Japan)

- Chemours Company (USA)

Recent Industry Developments :

Partnerships & Collaborations:

- In January 2025, Arkema partnered with OOYOO LTD. to develop gas separation membranes by leveraging its expertise in high-performance polymers for carbon capture.

Membrane Separation Materials Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 76,333.72 Million |

| CAGR (2023-2030) | 10.70% |

| By Type |

|

| By End-user |

|

| By Region |

|

| Key Players |

|

Key Questions Answered in the Report

How big is the membrane separation materials market? +

The membrane separation materials market size is estimated to reach over USD 76,333.72 Million by 2032 from a value of USD 27,319.35 Million in 2024 and is projected to grow by USD 30,588.21 Million in 2025, growing at a CAGR of 10.70% from 2025 to 2032.

Which segmentation details are covered in the membrane separation materials report? +

The membrane separation materials report includes specific segmentation details for type, end user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the membrane separation materials market, ceramic is the fastest-growing segment during the forecast period due to rising focus on sustainability and eco-friendliness.

Who are the major players in the membrane separation materials market? +

The key participants in the membrane separation materials market are BASF SE (Germany), Solvay S.A. (Belgium), Arkema AG (France), DuPont (USA), 3M (USA), Daikin Chemicals (Japan), Chemours Company (USA), Gujarat Fluorochemicals Ltd (India), Hyflux Ltd. (Singapore), Corning Incorporated (USA) and others.

What are the key trends in the membrane separation materials market? +

The membrane separation materials market is being shaped by several key trends including rising adoption of polymer membranes for the development of advanced drug delivery systems, as well as rising adoption of ceramic membranes due to high temperature and chemical resistance, and others.