Next Generation Memory Market Size:

Next Generation Memory Market size is estimated to reach over USD 43.36 Billion by 2032 from a value of USD 9.26 Billion in 2024 and is projected to grow by USD 11.07 Billion in 2025, growing at a CAGR of 16.38% from 2025 to 2032

Next Generation Memory Market Scope & Overview:

The next generation memory refers to advanced storage technologies which include volatile memory and non-volatile memory and is designed to overcome limitations of current storage technologies. Also, the key advantages including higher speed, increased storage capacity, non-volatility, and lower power consumption are driving the next generation memory market growth. Additionally, the aforementioned benefits drive adoption in applications such as AI and data analytics and improve system efficiency across various applications, from consumer electronics to data centers. Moreover, the high speed and low latency of these new memories enable data to be processed directly within the memory itself is driving the next generation memory market demand.

How is AI Impacting the Next Generation Memory Market?

Artificial Intelligence (AI) models, especially generative AI, require memory that can efficiently process vast amounts of data with high-speed, high-capacity memory is driving the demand for next generation memory. Additionally, AI significantly impacts the next generation memory industry due to the ability to handle massive datasets for AI model training and inference. Further, AI workloads necessitate high-bandwidth, low-latency memory for real-time processing and advanced nonvolatile memories for their speed and improved endurance is driving the AI impact on storage technologies. Furthermore, AI systems generate and process vast amounts of data, requiring memory and storage solutions along with innovations in memory interface chips and technologies are driving the market growth.

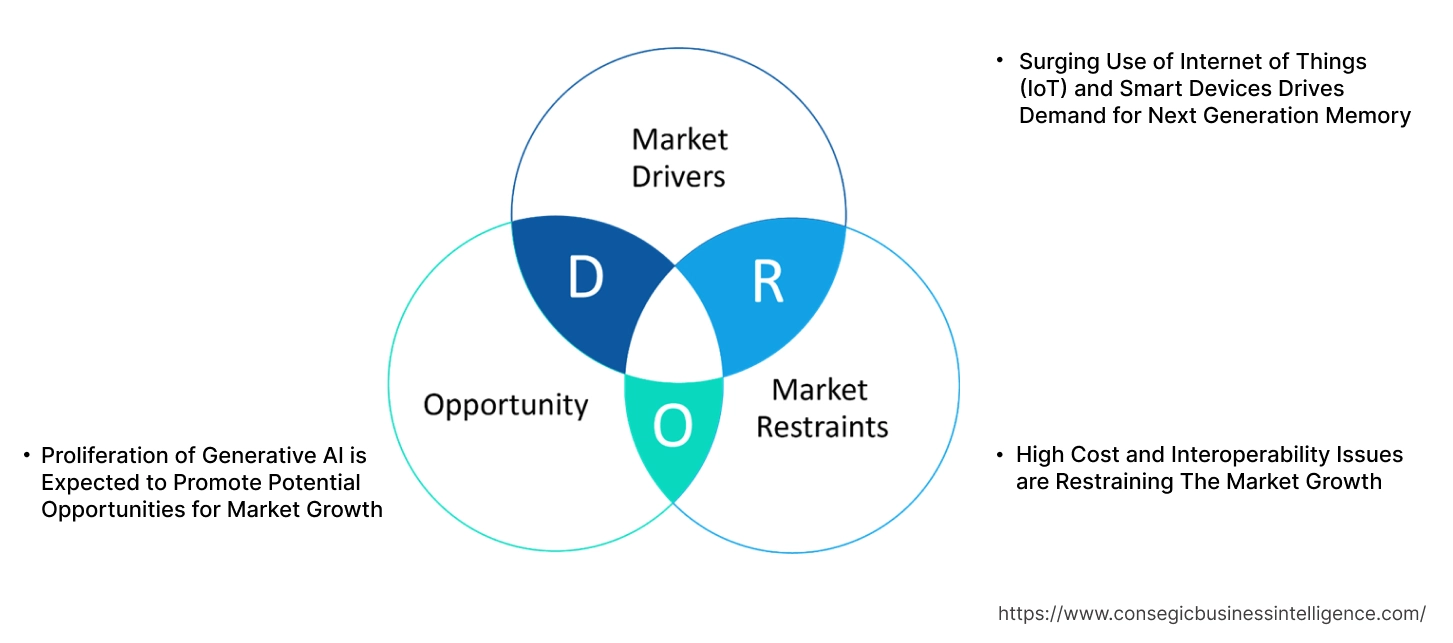

Next Generation Memory MarketDynamics - (DRO) :

Key Drivers:

Surging Use of Internet of Things (IoT) and Smart Devices Drives Demand for Next Generation Memory

The IoT devices which are used in a smart home or an industrial setting collect and share massive amounts of data in real-time which in turn drives the next generation memory market demand. Additionally, the advanced IoT systems are increasingly incorporating AI and machine learning capabilities which in turn drives the need for advanced memory technologies for storing and processing data. Further, the ability to perform real-time data analysis is crucial for optimizing processes, improving efficiency, and enabling predictive maintenance in smart factories drives adoption of advanced memory technology to handle the data flow is driving the next generation memory market growth.

- For instance, according toIoT Analytics GmbH, there were 16.6 billion connected IoT devices in 2023, 18.8 billion in 2024 and is expected to grow at a CAGR of 15% globally.

Thus, the rising adoption of IoT and smart devices is driving the need for next generation memory, in turn, proliferating the growth of the market.

Key Restraints :

High Cost and Interoperability Issues are Restraining The Market Growth

Next-generation memories require more complex and precise fabrication processes, specialized equipment, and advanced materials which in turn incur huge manufacturing costs, hindering the next generation memory market expansion. Moreover, the implementation of advanced memory technology necessitates costly and complex system redesigns which include changes in data paths, firmware and others. Moreover, the lack of universal standards and protocols for memory technologies leads to compatibility issues along with the integration of new memory technologies into existing systems requires significant customization. Further, the high costs and integration complexities hampers cost-sensitive consumer electronics and industrial end users.

Therefore, the high costs and compatibility issues of memory technologies utilized in consumer electronics and other applications are restraining the next generation memory market expansion.

Future Opportunities :

Proliferation of Generative AI is Expected to Promote Potential Opportunities for Market Growth

The increasing use of generative AI drives need for memory technologies, due to GenAI's significant memory and bandwidth requirements for training and inference. Also, the rapid evolution of GenAI applications expanding across industries is paving the way for next generation memory market opportunities. Further, the increasing use of GenAI in real-time applications, such as in healthcare for advanced imaging and diagnostics, drives the demand for advanced semiconductor and memory technology. Furthermore, the synergy between GenAI and advanced memory technologies is expected to fuel significant growth in the next-generation memory market.

- For instance, in August 2025, Teradyne launched Magnum 7H, which is a next-generation memory tester designed to meet the rigorous need of generative AI servers and test high-bandwidth memory (HBM) devices.

Hence, the rising adoption of generative AI is anticipated to increase the utilization of advanced memory technologies, in turn promoting prospects for next generation memory market opportunities during the forecast period.

Next Generation Memory Market Segmental Analysis :

By Technology:

Based on the technology, the market is bifurcated into non-volatile memory and volatile memory.

Trends in Technology:

- The rising need for data storage in smartphones, gaming devices, and other consumer gadgets is driving the need for non-volatile memory, which in turn is boosting the next generationmemory market trends.

- The rise of data center industry fuels the need for more advanced and efficient data storage solutions, is boosting the next generationmemory market trends.

The non-volatile memory accounted for the largest revenue share in the year 2024.

- The non-volatile memory encompasses ReRAM, MRAM, PCRAM, 3D XPoint and offers high speed and endurance.

- The next-generation non-volatile memory (NVM) refers to advanced storage technologies that retain data when power is off and provide improved features like higher performance, lower power consumption, and higher endurance.

- Additionally, the key advantages of next-generation non-volatile memory include faster speeds, higher capacities, better endurance, and lower power consumption than traditional memory is driving the next generationmemory market share.

- Further, the rising adoption of next-generation non-volatile memory in sectors such as healthcare and aerospace which require reliable and high-capacity storage solutions, is fueling the next generationmemory market share.

- For instance, in March 2022, Fujitsu Semiconductor Memory Solution Limited launched 12Mbit ReRAM with features of a small package size and a small read current. Also, the solution is ideal for use in wearable devices such as hearing aids and smart watches.

- Thus, as per the next generationmemory market analysis, the ability to eliminate the gap between next-generation non-volatile memory and traditional storage solutions is driving the market progress.

The volatile memory is anticipated to register the fastest CAGR during the forecast period.

- The next-generation volatile memory encompasses DRAM, SRAM and others, offering high-speed data access for AI and edge computing.

- The increasing need for faster, more energy-efficient, and higher-capacity memory for applications in artificial intelligence, machine learning, and edge computing is driving the need for next-generation volatile memory.

- Additionally, the need to overcome the performance and scaling limitations of traditional memory is driving the need for next-generation volatile memory which in turn is fueling the next generationmemory market size.

- Further, the proliferation of LPDDR5 and DDR6, which offer improved performance and energy efficiency, is driving the market development.

- Therefore, as per the market analysis, the rising adoption of AI and edge computing applications is anticipated to boost the market during the forecast period.

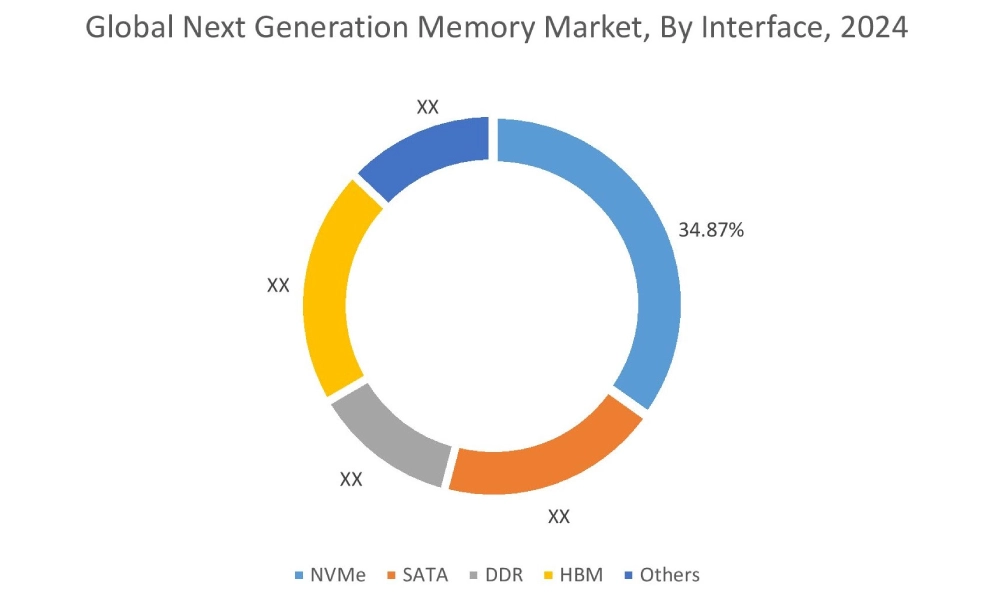

By Interface:

Based on the interface, the market is segmented into NVMe, SATA, DDR, HBM, and Others.

Trends in the Interface:

- The trend towards rising need for higher bandwidth and lower operating voltages with high-bandwidth connections is driving the adoption of the DDR interface.

- The next-gen memory solutions are increasingly integrating NVMe for creating lower-latency systems and faster data retrieval, which in turn is boosting the market trend.

NVMe accounted for the largest revenue share of 34.87% in the year 2024.

- NVMe (Non-Volatile Memory Express) is a high-speed communication protocol designed to enable faster data transfer, lower latency, and increased parallel processing for next-generation memory.

- Also, the NVMe interface significantly enhances system responsiveness for applications such as AI, gaming, and enterprise workloads which in turn is next generationmemory market size.

- Further, applications such as high-end gaming, video editing, and professional content creation leverage the advantages of the NVMe interface such as quick load times and fast file transfers.

- For instance, in July 2025, Kioxia Corporation LC9 Series enterprise SSD lineup with NVMe interface. The model is designed to deliver performance, and efficiency demands of generative AI environments.

- Thus, as per the next generationmemory market analysis, the rising need for quick load times and fast file transfers in the aforementioned applications is driving the market progress.

HBM is anticipated to register the fastest CAGR during the forecast period.

- The High Bandwidth Memory (HBM) interface is a 3D stacked DRAM technology designed for delivering high bandwidth and low power in data-intensive applications like AI and graphics.

- Additionally, HBM is ideal for data-intensive applications such as artificial intelligence, graphics processing, and high-performance computing, where massive amounts of data are processed.

- Moreover, the key advantages of the HBM interface include high memory bandwidth, improved power efficiency, reduced form factors and low latency, among others.

- Further, the advancement in semiconductor packaging, such as 3D stacking, is paving the way for market development.

- Therefore, as per the market analysis, the aforementioned factors are anticipated to boost the market during the forecast period.

By End-User Industry:

Based on the end user, the market is segmented into IT & telecom, healthcare, automotive, aerospace & defense, consumer electronics, and others.

Trends in the End User:

- The trend towards the need for enhanced data security and energy efficiency to process vast amounts of real-time sensor data in vehicles is driving the market progress.

- The digitalization & digital twins are transforming the aerospace & defense industry, creating enormous amounts of data that require advanced memory and storage solutions is boosting the market trend.

The IT & telecom sector accounted for the largest revenue share in the year 2024.

- Next-generation memory is crucial for the IT and telecom sectors to handle increasing data volumes and enable applications such as edge computing.

- Additionally, modern telecom networks, cloud services, and data centers generate and process huge amounts of data, driving need for memory solutions offering high speed and bandwidth.

- Further, the deployment of 5G requires networks which can handle data traffic, is driving the adoption of next-generation memory.

- Furthermore, technologies such as MRAM and ReRAM offer fast writing speeds, high durability, and low power requirements, making them suitable for adoption in the IT & telecom sector.

- Thus, as per the market analysis, the deployment of 5G and the anticipation of 6G are driving the market adoption in the IT and telecom sectors.

The automotive sector is anticipated to register the fastest CAGR during the forecast period.

- The advanced memory technology is crucial for the automotive sector to support advanced features such as autonomous driving and others.

- The memory technology provides high bandwidth, real-time data processing, and others for complex algorithms and AI, is driving the adoption in the automotive sector.

- Further, the key advantages include ultra-high-speed data access, enhanced AI processing, improved AI inferencing for autonomous driving and infotainment, reduced latency and others.

- Moreover, the rise of in-car infotainment, telematics, and vehicle-to-everything communication is driving the market adoption due to fast, reliable memory for smooth operation.

- Furthermore, the increasing adoption of EVs creates a need for memory solutions that withstand the higher operating temperatures and other harsh conditions is driving the market progress.

- Therefore, as per the market analysis, the increasing adoption of EVs is anticipated to boost the market during the forecast period.

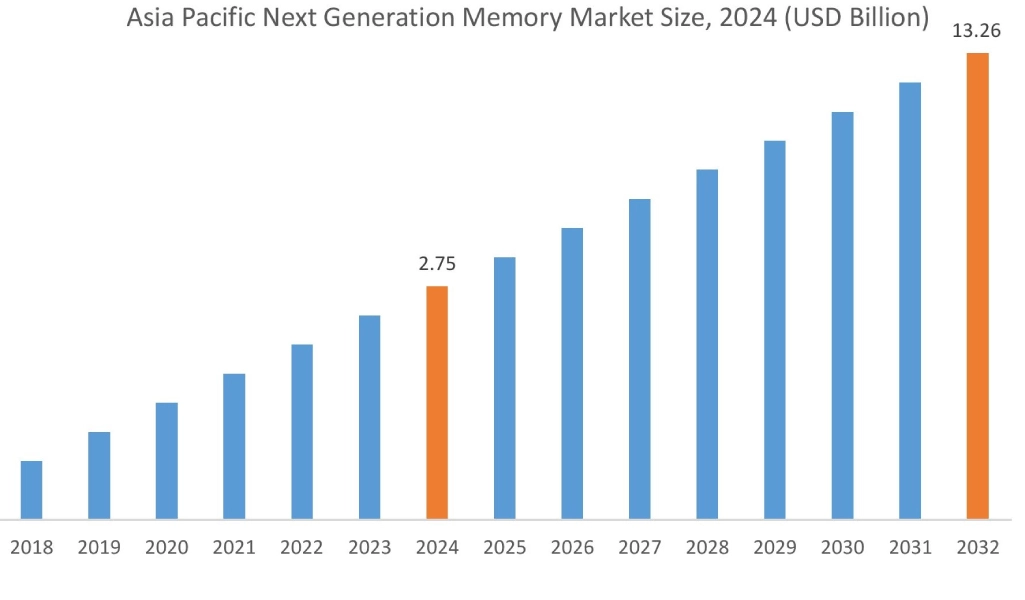

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

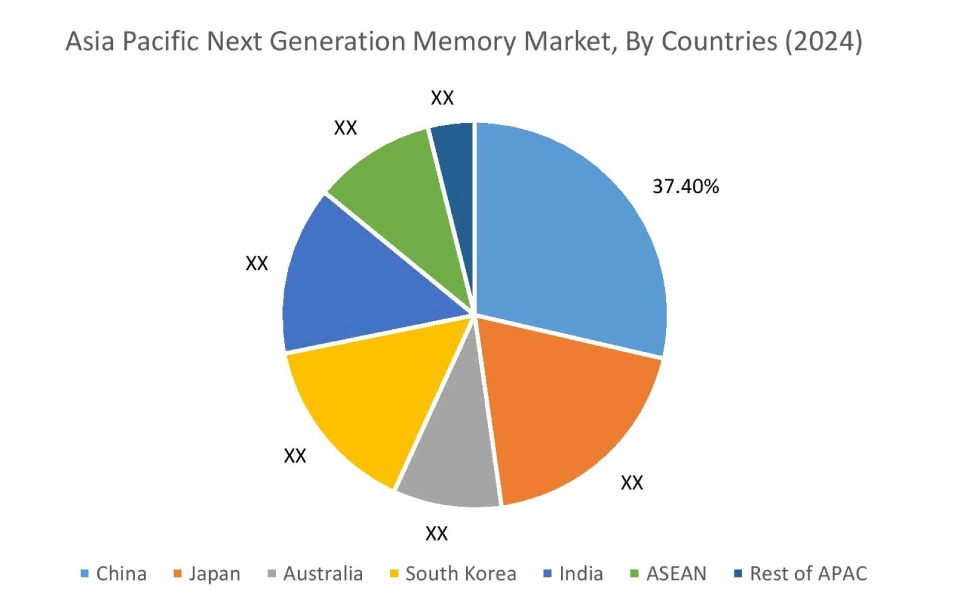

Asia Pacific region was valued at USD 2.75 Billion in 2024. Moreover, it is projected to grow by USD 3.30 Billion in 2025 and reach over USD 13.26 Billion by 2032. Out of this, China accounted for the maximum revenue share of 37.40%. The market progress is mainly driven by rising need for consumer electronics. Furthermore, factors including the proliferation of IoT devices, the development of cloud computing, and big data applications are projected to drive the market progress in Asia Pacific region during the forecast period.

- For instance, in October 2022, Samsung Electronics launched innovative memory technology to accelerate next-generation AI with the aim of improving performance and energy efficiency.

North America is estimated to reach over USD 14.26 Billion by 2032 from a value of USD 3.00 Billion in 2024 and is projected to grow by USD 3.59 Billion in 2025. The North American region's widespread adoption of IoT devices and increasing global focus on energy consumption and sustainability offer lucrative growth prospects for the market. Additionally, the proliferation of AI, machine learning, and big data analytics is driving the market progress.

- For instance, in October 2024, Micron launched the DDR5 Memory Portfolio, which delivers higher bandwidth and faster memory speeds which drive adoption in artificial intelligence and data-intensive applications.

The regional analysis depicts that the increasing need from the automotive sector for autonomous and electric vehicles is driving the market in Europe. Additionally, the key factor driving the market is the government push for smart cities and digital infrastructure, and the proliferation of AI and cloud computing is propelling the market adoption in the Middle East and African region. Further, the digital transformation initiatives, expansion of IT and telecommunications infrastructure, and increased adoption of cloud computing and smart devices are paving the way for the progress of the market in Latin America region.

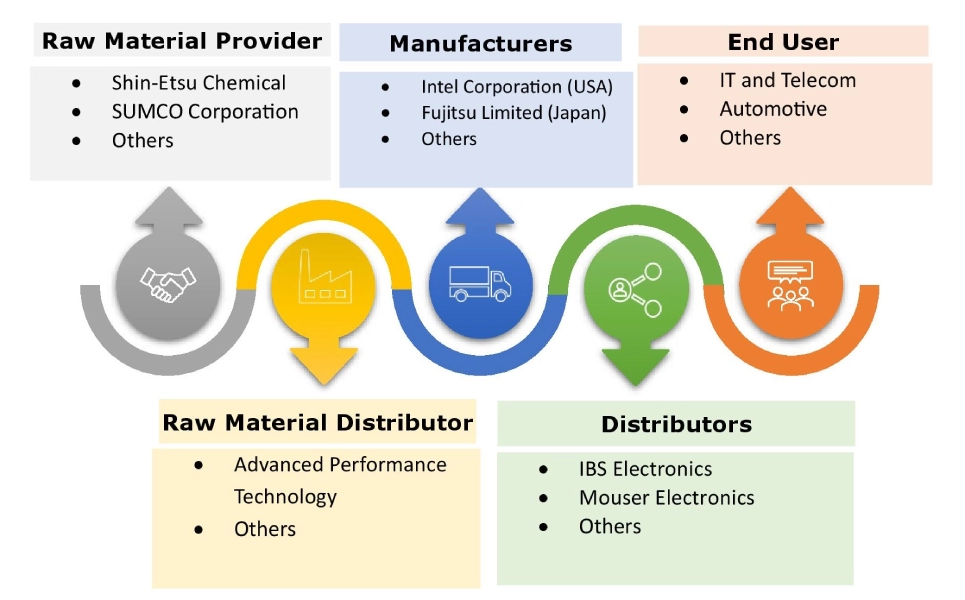

Top Key Players & Market Share Insights:

The global next generation memory market is highly competitive with major players providing next generation memory to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end user launches to hold a strong position in the next generation memory industry. Key players in the next generation memory market include-

- Samsung Electronics Co., Ltd. (South Korea)

- Micron Technology, Inc. (USA)

- Seagate Technology Holdings PLC (USA)

- Toshiba Corporation (Japan)

- NVIDIA Corporation (USA)

- SK hynix Inc. (South Korea)

- Intel Corporation (USA)

- Fujitsu Limited (Japan)

- Kioxia Holdings Corporation (Japan)

- Western Digital Corporation (USA)

Recent Industry Developments :

Product launches

- In June 2025, Pure Storage launched next-generation storage products designed for demanding, high-performance workloads. The aim is to provide performance, reliability, and flexibility in a unified storage experience.

Next Generation Memory Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 43.36 Billion |

| CAGR (2025-2032) | 16.38% |

| By Technology |

|

| By Interface |

|

| By End-User Industry |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the next generation memory market? +

The next generation memory market size is estimated to reach over USD 43.36 Billion by 2032 from a value of USD 9.26 Billion in 2024 and is projected to grow by USD 11.07 Billion in 2025, growing at a CAGR of 16.38% from 2025 to 2032.

Which segmentation details are covered in the next generation memory report? +

The next generation memory report includes specific segmentation details for technology, interface, end user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the next generation memory market, the volatile memory is the fastest-growing segment during the forecast period due to rising adoption in AI and edge computing applications.

Who are the major players in the next generation memory market? +

The key participants in the next generation memory market are Samsung Electronics Co., Ltd. (South Korea), Micron Technology, Inc. (USA), SK hynix Inc. (South Korea), Intel Corporation (USA), Fujitsu Limited (Japan), Kioxia Holdings Corporation (Japan), Western Digital Corporation (USA), Seagate Technology Holdings PLC (USA), Toshiba Corporation (Japan), NVIDIA Corporation (USA) and others.

What are the key trends in the next generation memory market? +

The next generation memory market is being shaped by several key trends including rising demand for data storage in smartphones, gaming devices, and other consumer gadgets, along with growth in data centers are the key trends driving the market.