Open Gear Lubricants Market Size:

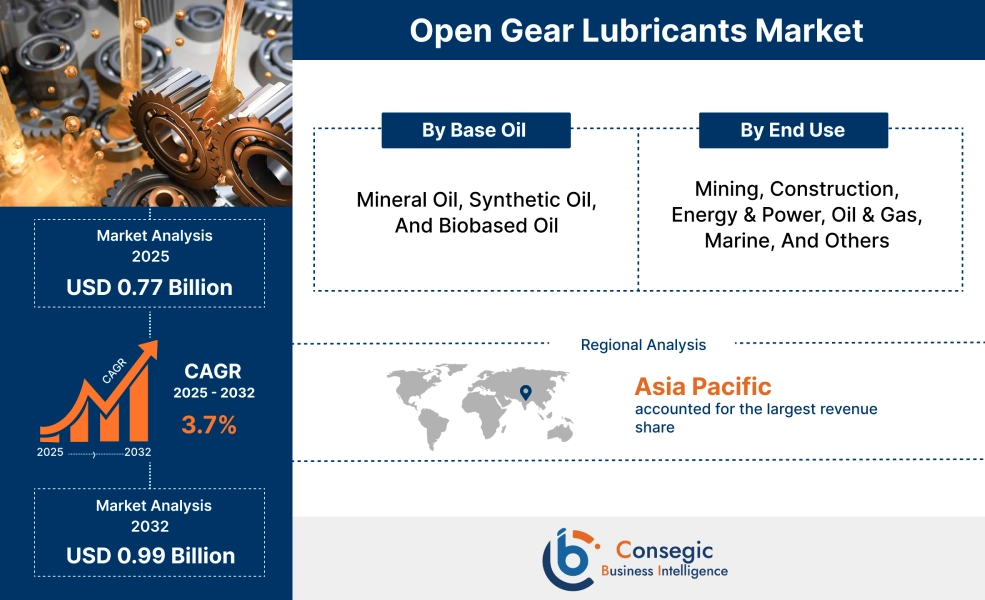

The Open Gear Lubricants Market size is growing with a CAGR of 3.7% during the forecast period (2025-2032), and the market is projected to be valued at USD 0.99 Billion by 2032 from USD 0.75 Billion in 2024. Additionally, the market value for 2025 is attributed to USD 0.77 Billion.

Open Gear Lubricants Market Scope & Overview:

Open gear lubricants are specialized formulations engineered to protect and extend the operational life of large, exposed gear systems, which operate without a sealed housing. These gears are found in heavy industrial machinery and function under severe conditions, including immense loads, slow speeds, and constant exposure to environmental contaminants such as dust, moisture, and extreme temperatures. To counter these challenges, lubricants are characterized by exceptional extreme pressure and anti-wear properties, high adhesion to resist fling-off, superior water resistance, and robust film strength. They are crucial for sectors such as mining and construction among others, where ensuring the reliability and longevity of critical heavy machinery is key requirement for continuous operation.

Open Gear Lubricants Market Dynamics - (DRO) :

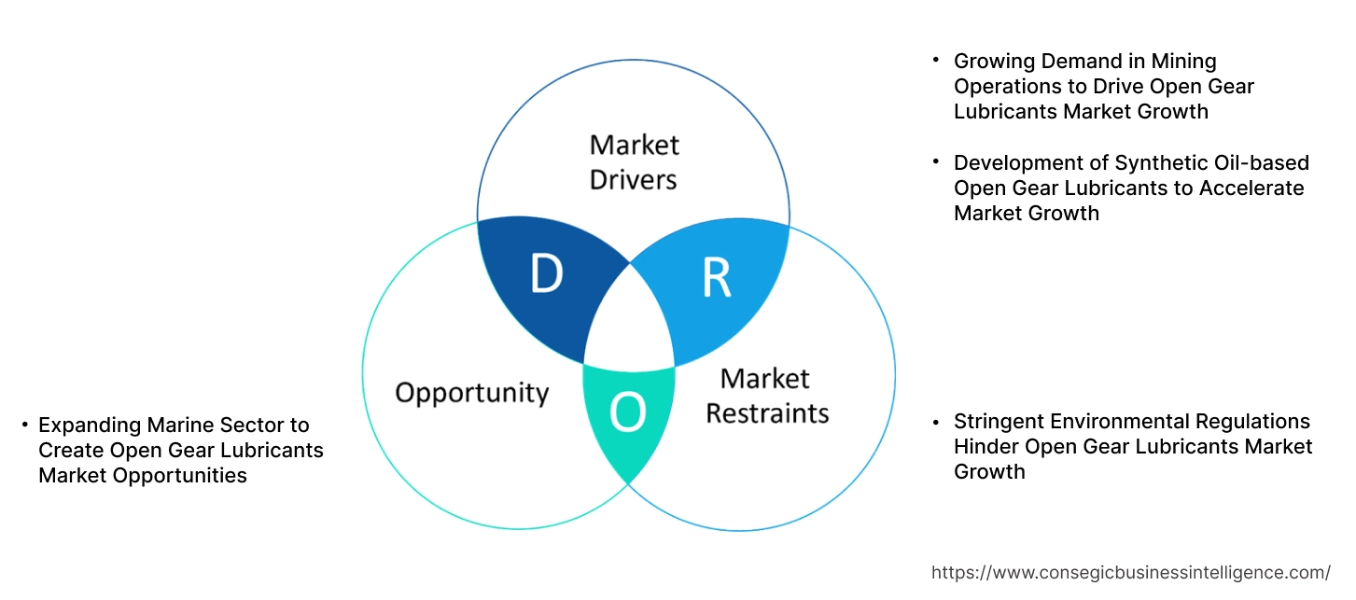

Key Drivers:

Growing Demand in Mining Operations to Drive Open Gear Lubricants Market Growth.

The operations in mining sector rely heavily on high-value equipment, such as draglines, shovels, excavators, and various types of mills. This equipment features large-scale gear systems which operate under severe conditions such as immense loads and constant exposure to moisture and contaminants among others. This harsh environment necessitates specialized lubricants distinguished by superior extreme pressure protection, strong adhesion to prevent sling-off, robust film strength, and excellent wear resistance to ensure continuous operation and extend equipment lifespan. As the global demand for minerals and metals continues to accelerate, the industry's requirement for these lubricants surges, thereby impacting market demand.

- For instance, the Public Information Bureau of India stated that in fiscal year 2023-24, India's iron ore production reached 274 million metric tons (MMT). Production increased from 252 MMT during the April-February period of FY 2023-24 to 263 MMT during the corresponding period in FY 2024-25, representing a growth rate of 4.4%.

Thus, as per the analysis, the market for these lubricants in mining is witnessing significant growth.

Development of Synthetic Oil-based Open Gear Lubricants to Accelerate Market Growth.

Synthetic oils formulated with polyalphaolefins, or esters are distinguished by superior performance characteristics compared to traditional mineral oil-based alternatives. These benefits include exceptional thermal stability and enhanced load-carrying capacity. In addition, synthetic formulations provide extended service life which results in longer lubrication intervals, reduced lubricant consumption, and ultimately, lower maintenance costs and less downtime for equipment operators. are driving their rising adoption, making them a key factor in market revenue.

- For instance, TotalEnergies has developed GEARLOG range, which is a new fully synthetic, high-viscosity lubricant for open gears that offers superior anti-wear and extreme pressure performance across various lubrication systems.

Thus, the long-term operational efficiencies and improved equipment protection offered by synthetic oils is impacting positively on the open gear lubricants market demand.

Key Restraints:

Stringent Environmental Regulations Hinder Open Gear Lubricants Market Growth

Stringent environmental regulations serve as significant impediment to the open gear lubricants market demand. Governments worldwide are increasingly imposing stricter rules concerning the composition, emissions, and disposal of industrial lubricants to mitigate their environmental impact. This pressure necessitates that manufacturers invest heavily in research and development to formulate products that are more biodegradable, less toxic, and have lower volatile organic compound emissions. Such innovations often lead to higher production costs and complexity in developing new formulations. Furthermore, the shift away from traditional lubricants presents issues in terms of balancing performance, cost, and widespread adoption across diverse and demanding industrial applications, thereby limiting the open gear lubricants market expansion.

Future Opportunities :

Expanding Marine Sector to Create Open Gear Lubricants Market Opportunities.

Increasing global trade and strategic fleet renewal initiatives are projected to expand the marine market worldwide. This surge directly translates to a need for robust lubrication solutions for the various open gear systems found on ships and offshore platforms such as deck machinery, cranes, among others. These systems operate under highly challenging conditions such as constant exposure to saltwater. As shipbuilding activities increase globally, and as maritime operators increasingly focus on extending equipment life and ensuring operational reliability in corrosive marine environments, the demand for high-performance lubricants is set to rise, making the marine sector a key area for the market.

- For instance, in 2025, the Brazilian government sanctioned its most significant single investment to date, approving USD 3.9 billion for 26 projects. These funds are designated for the construction of new vessels, repairs, vessel retrofits, shipyard expansion, and the development of new port infrastructure.

Henceforth, the growing investments across the marine sector are creating lucrative open gear lubricants market opportunities over the forecast period.

Open Gear Lubricants Market Segmental Analysis :

By Base Oil:

Based on Base Oil, the market is categorized into mineral oil, synthetic oil, and biobased oil.

Trends in the Base Oil:

- There is growing trend for the adoption of synthetic lubricants in applications requiring superior thermal stability, extended service life, and enhanced load-carrying capacity.

- Increasingly stringent environmental policies and corporate sustainability initiatives accelerating the use of biodegradable and less toxic bio-based lubricants is a key trend.

The mineral oil segment accounted for the largest open gear lubricants market share in 2024.

- Mineral oil serves as the most traditional and widely used base oil for open gear lubricants. These oils are derived from crude oil refining and are blended with asphaltic or bituminous additives to enhance their tackiness and adhesion to gear surfaces.

- In addition, these base oils offer a good balance of lubricity, thermal stability, and anti-wear properties at a relatively lower cost.

- Mineral oil segment holds the largest share due to their affordability and broad applicability across various heavy-duty sectors such as mining and construction among others. The high adoption rate across these sectors coupled with growing end use sectors contribute to the segment revenue.

- For instance, the National Bureau of Statistics of China stated that cement output was 2.02 billion tonnes in the year 2023. The China Cement Association (CCA) estimated that the capacity utilization rate was 59% in 2023.

- Hence, owing to the well-established use of these base oils, the mineral oil segment is dominating the overall market revenue.

Bio-based oil segment is expected to grow at the fastest GAGR over the forecast period.

- Bio-based base oils are derived from renewable resources, including vegetable oils and other bio-synthesized hydrocarbons.

- The primary advantage of these base oils includes superior biodegradability, lower toxicity, and reduced carbon footprints. These benefits make them an environmentally preferable choice.

- The segment revenue is influenced by increasingly stringent environmental regulations, growing corporate sustainability initiatives, and the requirement for eco-friendly and biodegradable lubrication solutions.

- Consequently, as per the analysis, owing to the growing need for ecofriendly lubricant formulation, the biobased oil is expected to witness fastest growth rate in the open gear lubricants market trends.

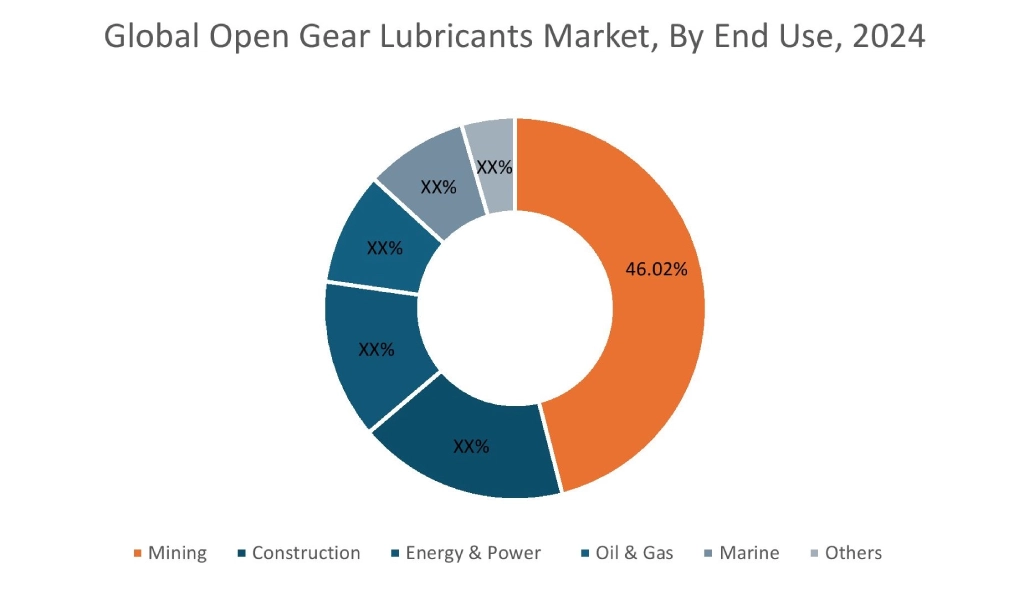

By End Use:

Based on the end use, the market is categorized into mining, construction, energy & power, oil & gas, marine, and others.

Trends in the End Use:

- Growing adoption of automated lubrication systems to ensure consistent application and reduce human exposure in hazardous environments is a trend positively impacting the market.

- Increasing adoption of environmentally acceptable lubricants to comply with stricter marine environmental regulations is a key trend.

The mining segment accounted for the open gear lubricants market share of 46.02% in 2024.

- Mining is the major consumer of open gear lubricants in heavy-duty mining equipment such as massive draglines, shovels, and excavators.

- In addition to this, these lubricants are also used for various types of mills such as ball mills, SAG mills, rod mills used for ore processing.

- The extreme operating conditions of mining that include heavy loads, abrasive dust, moisture, and shock loads necessitate highly robust and adhesive lubricants.

- The increasing global demand for minerals and metals, coupled with ongoing investments in mining infrastructure, fuels the rise in this end use segment.

- For instance, according to the Eurostat, mining and quarrying sector within the European Union experienced a substantial increase in its net turnover in 2022, rising by approximately 70% compared to the previous year.

- Thus, as per the open gear lubricants market analysis, the mining segment holds dominating contribution in the market.

The marine segment is expected to grow at the fastest CAGR over the forecast period.

- Marine segment encompasses the use of open gear lubricants on ships and offshore vessels for deck machinery, cranes, winches, rudder systems, and other exposed gear mechanisms that operate in saline and often corrosive marine environments.

- Expanding global trade volumes are significantly increasing the sector turnover. This in turn supports the rise in shipbuilding activities.

- Such operations create the need for durable lubricants that are to perform under exposure to saltwater, humidity, and heavy loads in maritime operations.

- Overall, aforementioned factors are expected to fuel segment turnover in the forecast period.

Regional Analysis:

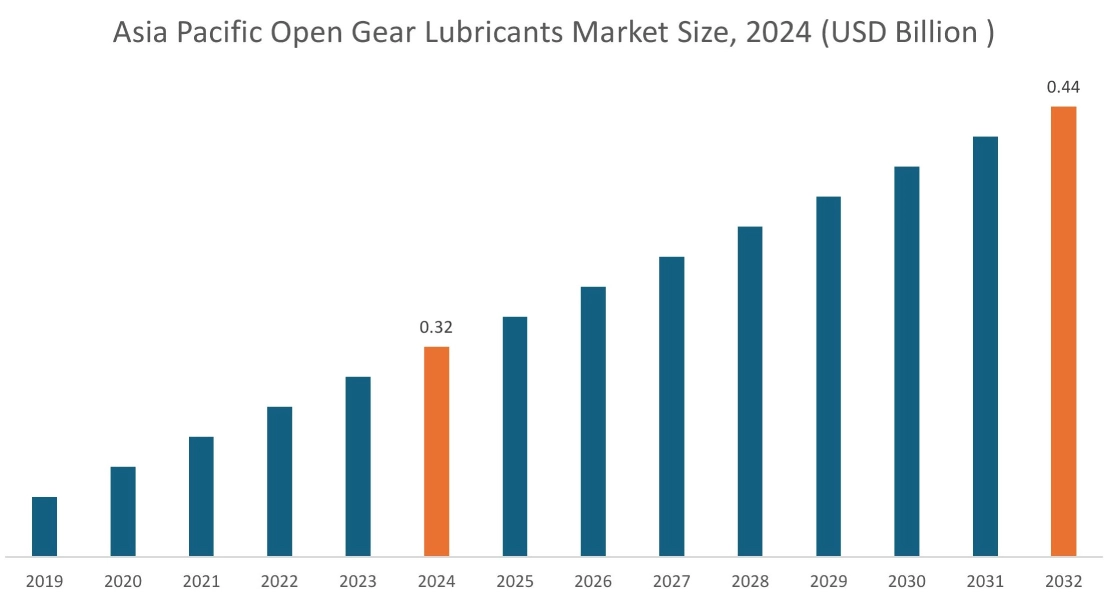

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

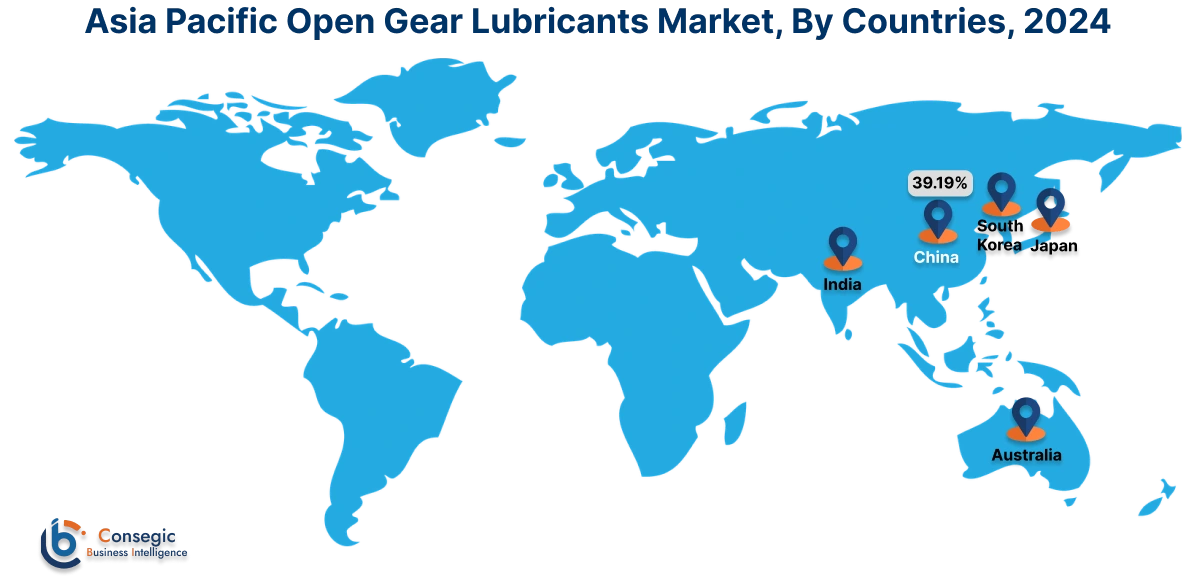

In 2024, Asia Pacific accounted for the highest market share at 42.11% and was valued at USD 0.32 Billion and is expected to reach USD 0.44 Billion in 2032. In Asia Pacific, China accounted for a market share of 39.19% during the base year of 2024. The upwards trajectory of regional share is primarily driven by the region's extensive and growing heavy duty sectors such as mining, cement, and construction. Countries such as China, India, and Australia are experiencing substantial growth in mining activities, which heavily rely on large, open-geared machinery. Furthermore, substantial government investments in infrastructure development along with the growing production of building materials such as cement across the APAC region are consistently fueling the requirement for these specialized lubricants.

- For instance, according to IBEF, the capital investment outlay for infrastructure in the Union Budget 2025-26 of India has been increased to USD 128.64 billion, representing 3.1% of the nation's GDP.

Thus, as per analysis. these factors collectively position Asia-Pacific as a critical region for the market, demanding efficient and robust solutions for its rapidly expanding industrial base.

In Europe, the open gear lubricants industry is experiencing the fastest growth with a CAGR of 5.4% over the forecast period. Shift towards sustainable lubricant formulations serves a primary part in upward market trajectory in Europe. European consumers are increasingly conscious of environmental and health impacts. European countries present some of the strictest regulations across the globe. The region's robust construction sector also contributes, with a surge fueled by infrastructure modernization, renovations, and sustainable development. Furthermore, Europe's strong emphasis on environmental compliance and industrial efficiency plays a crucial role, influencing the need for high-quality, long-lasting, and increasingly eco-friendly lubricant formulations. Hence, as per analysis, these factors collectively present a positive impact on the European market.

The North American market benefits from a robust mining sector, particularly in the United States and Canada, which necessitates high-performance lubricants for large-scale operations. Furthermore, significant activity in the construction and energy sectors, coupled with ongoing investments in infrastructure and a strong emphasis on maintaining operational efficiency, further fuels regional contribution. The market in North America is also characterized by a strong adoption of advanced synthetic and bio-based lubricant formulations, reflecting a regional focus on technological innovation and adherence to stringent safety and environmental regulations. Collectively these factors fuel North America open gear lubricants market analysis.

The open gear lubricants market expansion is largely fueled by increasing investments in the region's prominent mining sector, particularly in countries like Chile and Brazil, which are major global producers of key minerals. The requirement for robust lubrication is critical for the heavy machinery used in these operations which operate under extreme conditions. Furthermore, growing construction activities and substantial infrastructure development projects across various Latin American nations are driving the need for durable lubricants in heavy equipment. As industrialization advances and economic development continues, the region is expected to witness upward open gear lubricants market trend.

The market in Middle East and Africa is characterized by substantial investments in infrastructure development and rapid industrialization across the region. Countries within the MEA are witnessing significant increase in their mining sectors. Concurrently, major oil and gas projects, especially in the Gulf Cooperation Council countries are propelling the requirement for high-performance lubricants to support heavy-duty industrial equipment. Furthermore, escalating construction activity, fueled by mega-infrastructure initiatives critically supports the adoption of these lubricants in cement manufacturing and earth-moving equipment.

Top Key Players and Market Share Insights:

The Global Open Gear Lubricants Market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global Open Gear Lubricants market. Key players in the Open Gear Lubricants industry include

- Shell plc (United Kingdom)

- Kluber Lubrication (Germany)

- Carl Bechem GmbH (Germany)

- Petron Corporation (Philippines)

- Specialty Lubricants Corporation (U.S.)

- Exxon Mobil Corporation (U.S.)

- Chevron Corporation ( U.S.)

- Castrol Limited (United Kingdom)

- TotalEnergies (France)

- FUCHS (Germany)

Recent Industry Developments :

Product Launch:

- In 2024, PT Semen Indonesia (SIG) successfully collaborated with PT Pertamina Lubricants to develop the Indonesia’s first domestically produced open gear lubricant. This achievement represents a strategic move towards reducing reliance on imported lubricants and enhancing the domestic component level (TKDN) within SIG's operational framework.

Open Gear Lubricants Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 0.99 Billion |

| CAGR (2025-2032) | 3.7% |

| By Base Oil |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Open Gear Lubricants market? +

In 2024, the Open Gear Lubricants market is USD 0.75 Billion.

Which is the fastest-growing region in the Open Gear Lubricants market? +

Europe is the fastest-growing region in the Open Gear Lubricants market.

What specific segmentation details are covered in the Open Gear Lubricants market? +

By Base Oil and End Use segmentation details are covered in the Open Gear Lubricants market.

Who are the major players in the Open Gear Lubricants market? +

Shell plc (United Kingdom), Exxon Mobil Corporation (U.S.), Chevron Corporation U.S.), Castrol Limited (United Kingdom), TotalEnergies (France) are some of the major players in the market.