Personal Loans Market Size :

Personal Loans Market size is estimated to reach over USD 1,032.94 Billion by 2031 from a value of USD 113.79 Billion in 2023 growing at a CAGR of 31.7% from 2024 to 2031.

Personal Loans Market Scope & Overview :

Personal loan refers to money borrowed from a bank or other financial institutions within a fixed repayment period and consistent monthly payments. The loans are versatile and can be used for emergencies, travel, or personal expenses. Moreover, as per the analysis, these loans offer a range of benefits including hassle-free loan processing, instant disbursal, easy documentation, flexible repayment options, and others. The above benefits of these loans are primary determinants for driving the personal loans market growth.

How is AI Transforming the Personal Loans Market?

AI is being increasingly used in the personal loans market. AI-powered solutions are being used for enhancing risk assessment, making faster and more accurate decisions, personalizing customer experiences with tailored offers, improving fraud detection, and automating processes such as onboarding and verification. Moreover, AI integration in personal loans helps in automating, accelerating, and improving various aspects of the loan process, ranging from application assessment and risk evaluation to fraud detection and customer service. Additionally, key benefits include faster loan approvals, more accurate risk assessment, and potential for increased financial inclusion by reaching new customer segments. Thus, the above factors are projected to drive the market growth during the forecast period.

Personal Loans Market Insights :

Personal Loans Market Dynamics - (DRO) :

Key Drivers :

Prevalence of significant number of banking institutions is driving the market

Banks are among the primary providers of these loans that offers multiple types of loans including education loan, home renovation loan, wedding loan, medical emergency loan, and others to its customers.

Factors including rising digitalization of banking sector, prevalence of substantial number of banking firms, and availability of a broad range of personal loan schemes are among the key prospects driving the market.

For instance, according to Federal Deposit Insurance Corporation (FDIC), United States comprised of approximately 4,136 commercial banks along with 69,905 total branches across the country as of 2022.

Additionally, according to the European Union, there are approximately 5,441 banks operating in EU region, among which Germany accounted for 28% of the total number of banks in EU, followed by Poland with 11%, Austria and Italy with 9% each, and the rest in other EU member states. Hence, as per the analysis, the prevalence of a significant number of banking firms offering a range of loans is proliferating the trends of the market.

Expansion of small and medium businesses is spurring the market

Small and medium businesses play a vital role in the economic development of a country. Small and medium business entrepreneurs usually take these loans for setting up a new business or expanding and modifying the current establishment. Moreover, these loans for business purpose are easy to attain, quicker, and requires maintenance of a good personal credit score while eliminating the need for collateral.

Factors including the rising pace of urbanization, increasing development of small & medium-sized businesses, and growing need for flexible loan options with lower interest rates for small businesses are key prospects driving the adoption of these loans.

According to the Organization for Economic Co-operation and Development (OECD), there were more than 140 million SMEs (Small and medium businesses) in China in 2020. Similarly, China registered around 2.52 million new corporate companies in 2020.

Additionally, according to SME Support Japan, there are approximately 3.58 million SMEs (small and medium businesses) accountable for 99.7% of the total number of enterprises in Japan. Thus, the growing number of small and medium businesses is increasing the market demand for these loans for setting up a new business or expanding and modifying the current establishment, in turn driving the expansion of the market.

Key Restraints :

Availability of alternatives is restraining the market

There are multiple alternatives to these loans including loan against public provident fund, loan against employee provident fund, loan against gold, loans against property, and others, which is a prime factor restricting the market.

For instance, taking a loan against employee provident fund is an alternate to these loans. Loan against employee provident fund enables users to apply for loan amount reaching up to 90% of the total amount deposited in the provident fund. Similarly, gold can be pledged as collateral and acts as an ideal alternative to thesel loans. As per the analysis, the loan amount approved primarily depends on the value of the gold pledged and is usually taken up to 75% as the loan amount.

Additionally, other alternative to these loans include taking a loan against property. The loan amount based on property can reach up to 80% of the value of the property. Therefore, the availability of several alternatives to personal loans is restraining the expansion of the market.

Future Opportunities :

Prevalence of government schemes for personal loans is expected to promote potential opportunities for market

The prevalence of government schemes for these loans is expected to present potential personal loans market opportunities and trends in the coming years. Government personal loan schemes refer to financial programs or initiatives set up by the state and central governments to provide loans to individuals for several purposes. The initiative includes multiple loan schemes for helping individuals start their own businesses, and improve financial well-being while reducing dependency on informal credit sources.

Moreover, personal loan schemes provided by the government offers several benefits including lower interest rates and more flexible repayment tenures, which are key determinants for providing lucrative trends aspects for the market.

For instance, the Government of India provides serval credit-linked government schemes for several types of these loans including education loans, agriculture loans, livelihood loans, and others. Therefore, the prevalence of government schemes for these loans is anticipated to promote opportunities and personal loans market trends during the forecast period.

Personal Loans Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 1,032.94 Billion |

| CAGR (2024-2031) | 31.7% |

| By Type | Education Loan, Home Renovation Loan, Wedding Loan, Medical Emergency Loan, and Others |

| By Distribution Channel | Banks, Credit Union, and Others |

| By End Use | Individuals, Small and Medium Businesses, and Others |

| By Region | Asia-Pacific, Europe, North America, Latin America, Middle East & Africa |

| Key Players | Truist Financial Corporation, Social Finance Inc., Citizens Bank, Achieve, OneMain Holdings Inc., Happy Money Inc., Avant LLC, DBS Bank India Limited, Standard Chartered Bank, American Express |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Personal Loans Market Segmental Analysis :

By Type :

Based on the type, the market is bifurcated into education loan, home renovation loan, wedding loan, medical emergency loan, and others. The education loan segment accounted for the largest revenue share in the year 2023. An education loan refers to the amount of money borrowed to finance school or college-related expenses while pursuing an academic degree. Moreover, education loans offer a range of benefits including lower interest rate, wide range of expense coverage, tax benefits, easy repayment terms, and pay after education option.

For instance, Standard Chartered Bank is a provider of personal loans that offer education loans in its loan portfolio. Additionally, Citizens Bank offer a range of loans including education loans in its portfolio. Thus, the prevalence of significant number of banking/financial institutions providing education loan is among the prime factors driving the expansion of the segment.

The home renovation loan segment is anticipated to register significant CAGR during the forecast period. A home renovation loan refers to a type of loan that enables users to carry out any renovation or repair work to their existing house. Moreover, as per the analysis, the primary benefits of home renovation loan includes faster processing, tax benefits, and flexible usage among others.

For instance, LIC Housing Finance Ltd. offers home renovation loans with several features including quick sanction, low EMI, simple documentation, low rate of interest, and others. Therefore, the increasing availability of several home renovation loan schemes by financial institutions is anticipated to boost the demand of the segment during the forecast period.

By Distribution Channel :

Based on the distribution channel, the market is segregated into banks, credit unions, and others. The banks segment accounted for the largest revenue share in the year 2023. Factors including rising digitalization of banking sector, prevalence of substantial number of banking firms, and availability of a broad range of personal loan schemes are key aspects driving the demand of the banks segment.

For instance, according to the Canadian Bankers Association, the banking sector in Canada consisted of 5,711 bank branches in 2021. Banks are among the primary providers of these loans that provides its customers with access to a broad range of these loans such as education loan, home renovation loan, wedding loan, medical emergency loan, and others. Therefore, the prevalence of significant number of banking firms is proliferating the personal loans market demand.

Credit union segment is expected to witness fastest CAGR during the forecast period. Credit unions offer a range of financial services that are similar to banks, including access to these loans. Moreover, these loans from credit unions provide multiple benefits including lower interest rates, more flexible terms, options for smaller loan amounts, and less stringent approval requirements.

For instance, NASA Federal Credit Union and Pentagon Federal Credit Union are few of the credit unions based in the United States that offers a range of financial services including these loans in its service offerings. Thus, the increasing availability of personal loans from credit unions is projected to drive the segment trendsduring the forecast period.

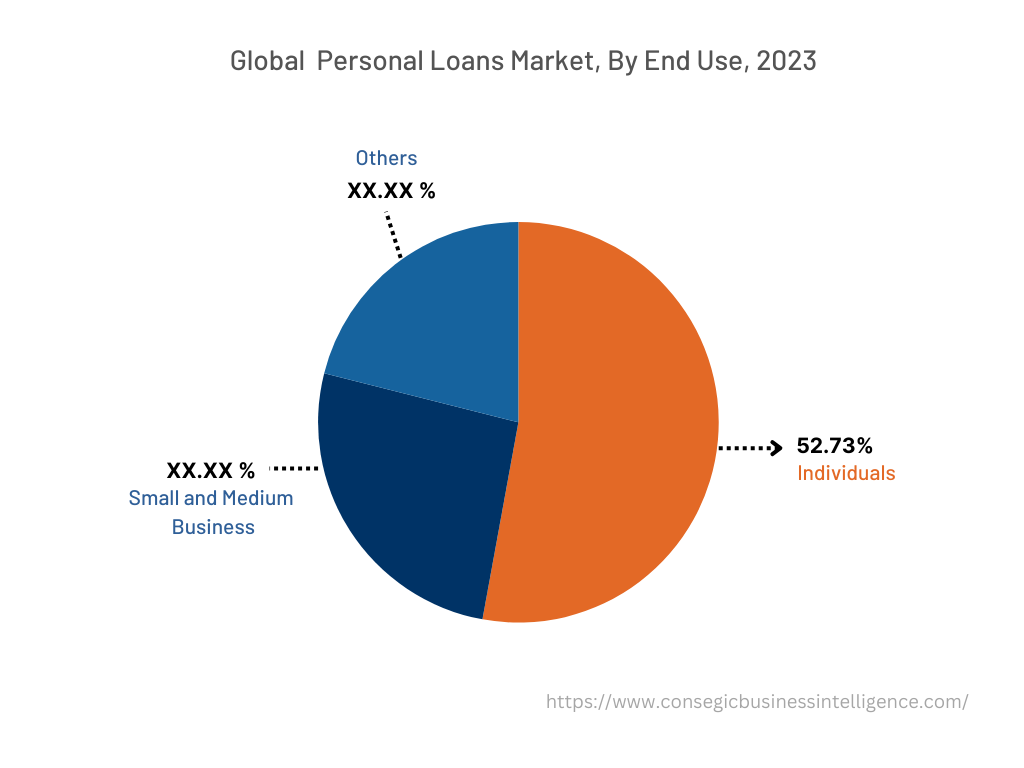

By End Use :

Based on the end use, the market is segregated into individuals, small and medium businesses, and others. The individuals segment accounted for the largest personal loan market share of 52.73% in the year 2023. Factors including rising pace of urbanization, prevalence of low and middle income individuals, and increasing loan application for personal usage are key aspects driving the demand of the individuals segment.

For instance, according to LendingTree LLC, American citizens owe approximately USD 241 billion in personal loan debt as of the third quarter of 2023, representing an increase of 14.8% in comparison to USD 210 billion in 2022. Therefore, the prevalence of number of personal loan applications from individuals for personal usage is proliferating the trends of the market.

Small and medium businesses segment is expected to witness significant CAGR during the forecast period. As per the analysis, the demand of small and medium businesses segment is attributed to several factors including growing pace of urbanization, increasing development of small & medium-sized businesses, and rising need for flexible loan options with lower interest rates for small businesses among others.

For instance, Standard Chartered Bank, Citi Bank, Axis Bank, and Kotak Mahindra Bank are among the primary providers of these loans that offers these loans for funding businesses within 1 to 5 years tenure. Thus, the increasing availability of loan schemes for funding small and medium businesses is projected to drive the market trends during the forecast period.

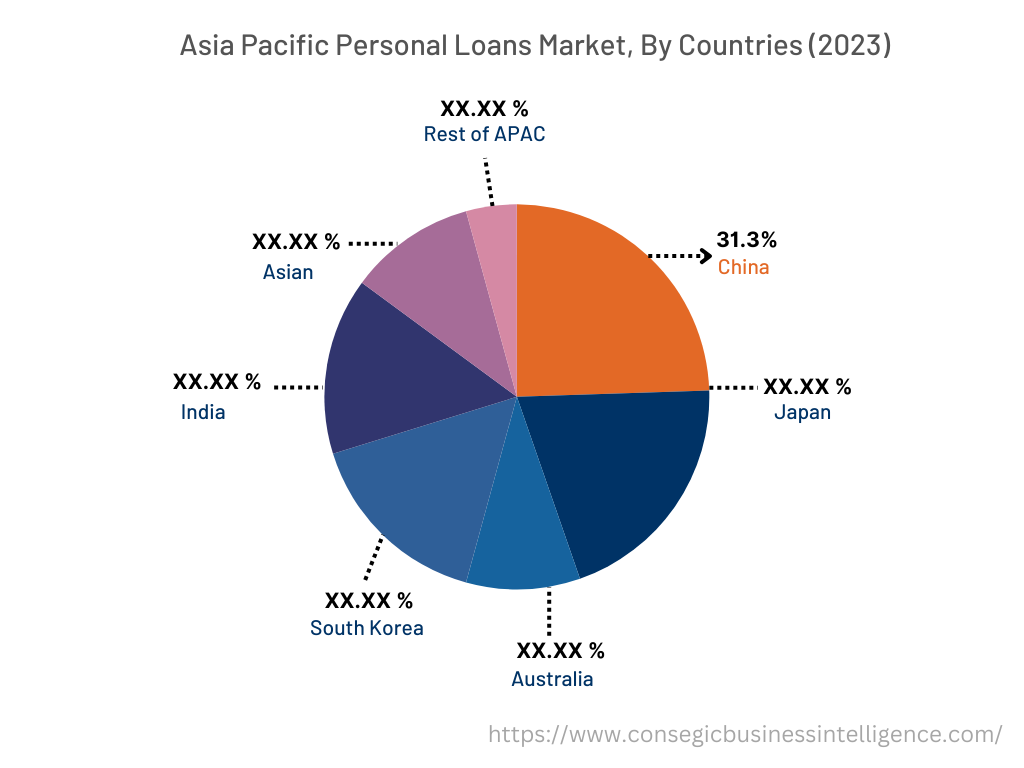

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

Asia Pacific accounted for the revenue share of USD 29.59 Billion in 2023 and is expected to reach USD 278.79 Billion by 2031, registering the highest CAGR of 32.4% during the forecast period. In addition, in the region, the China accounted for the maximum revenue share of 31.3% in the same year.

As per the personal loans market analysis, the growing pace of urbanization and development is providing lucrative growth prospects for the market in the region. In addition, factors including the presence of substantial number of banking/financial institutions, and rising prevalence of lower and middle income individuals are driving the market growth and trends for personal loans market in the Asia-Pacific region.

For instance, according to Invest India, there are approximately 123,000 bank branches across India as of March 2022. Banks are among the primary providers of these loans that offer various types of loans to its customers. Therefore, the growth of banking/financial institutions is projected to boost the market growth in the Asia-Pacific region during the forecast period.

North America is expected to register CAGR of 31.8% during the forecast period. The personal loans market growth in North America is primarily driven by the prevalence of significant number of banking/financial institutions that offer personal loans in the region including Truist Financial Corporation, Social Finance Inc., OneMain Holdings Inc., Avant LLC, American Express, and others. Moreover, as per the analysis, the increasing expansion of banking firms has been a prevalent factor for market growth in the region.

For instance, in July 2022, Citi Bank launched its Citi Commercial Bank in Canada, as a part of the company's global expansion plan. Citi Commercial Bank delivers a broad range of institutional products and services including personal loans in its portfolio. The above factors are proliferating the growth of the personal loans market in North America.

Top Key Players & Market Share Insights :

The global personal loans market is highly competitive with major players providing personal loans to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-use launches to hold a strong position in the personal loans market. Key players in the personal loans industry include-

- Truist Financial Corporation

- Social Finance Inc.

- Achieve

- OneMain Holdings Inc.

- American Express

- Citizens Bank

- Happy Money Inc.

- Avant LLC

- DBS Bank India Limited

- Standard Chartered Bank

Recent Industry Developments :

- In August 2021, Truist Financial Corporation announced the acquisition of Service Finance Company LLC, a North American national provider of point-of-sale (POS) financing solutions for the home improvement industry.

Key Questions Answered in the Report

What is personal loans? +

Personal loan refers to money borrowed from a bank or other financial institutions within a fixed repayment period and consistent monthly payments.

What specific segmentation details are covered in the personal loans report, and how is the dominating segment impacting the market growth? +

For instance, by type segment has witnessed education loan as the dominating segment in the year 2023, owing to its range of benefits including lower interest rate, wide range of expense coverage, tax benefits, easy repayment terms, and pay after education option among others.

What specific segmentation details are covered in the personal loans market report, and how is the fastest segment anticipated to impact the market growth? +

For instance, by distribution channel segment has witnessed credit unions as the fastest-growing segment during the forecast period due to increasing availability of various types of personal loan schemes from credit unions at lower interest rates, more flexible terms, and less stringent approval requirements.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2024-2031? +

Asia-Pacific is anticipated to register fastest CAGR growth during the forecast period due to rapid pace of urbanization, presence of substantial number of banking/financial institutions, and increasing prevalence of lower and middle income individuals.

What is personal loans? +

Personal loan refers to money borrowed from a bank or other financial institutions within a fixed repayment period and consistent monthly payments.

What specific segmentation details are covered in the personal loans report, and how is the dominating segment impacting the market growth? +

For instance, by type segment has witnessed education loan as the dominating segment in the year 2023, owing to its range of benefits including lower interest rate, wide range of expense coverage, tax benefits, easy repayment terms, and pay after education option among others.

What specific segmentation details are covered in the personal loans market report, and how is the fastest segment anticipated to impact the market growth? +

For instance, by distribution channel segment has witnessed credit unions as the fastest-growing segment during the forecast period due to increasing availability of various types of personal loan schemes from credit unions at lower interest rates, more flexible terms, and less stringent approval requirements.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2024-2031? +

Asia-Pacific is anticipated to register fastest CAGR growth during the forecast period due to rapid pace of urbanization, presence of substantial number of banking/financial institutions, and increasing prevalence of lower and middle income individuals.