Cyber Security Consulting Market Size:

Cyber Security Consulting Market Size is estimated to reach over USD 26.34 Billion by 2032 from a value of USD 14.57 Billion in 2024 and is projected to grow by USD 15.43 Billion in 2025, growing at a CAGR of 8.4% from 2025 to 2032.

Cyber Security Consulting Market Scope & Overview:

Cyber security consulting involves expert services provided to organizations to assess, design, implement, and manage their cybersecurity strategies and defenses against cyber threats. These consultants analyze an organization's unique risks and vulnerabilities, recommend security solutions, develop security policies and procedures, and assist with incident response and compliance requirements.

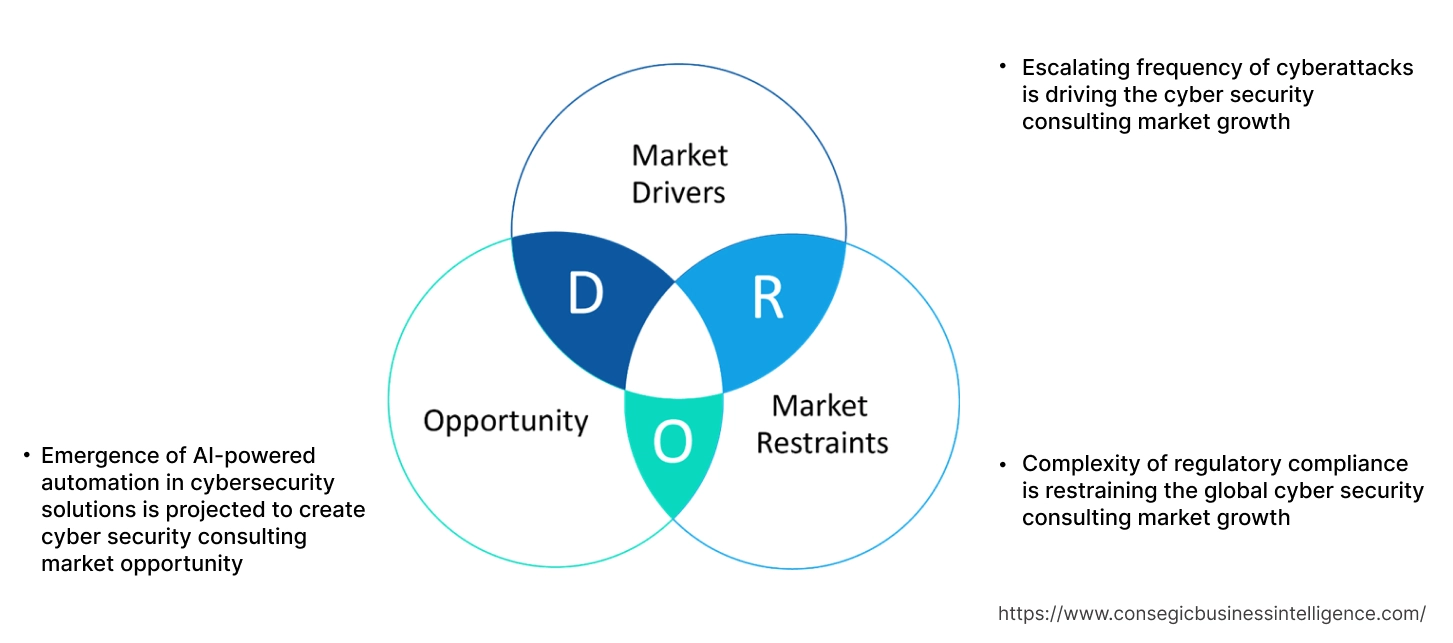

Cyber Security Consulting Market Dynamics - (DRO) :

Key Drivers:

Escalating frequency of cyberattacks is driving the cyber security consulting market growth

Increasing volume of cyberattacks is leading to an immediate need for incident response services. Organizations that have fallen victim to breaches require expert consultants to contain the damage, eliminate threats, recover data, and restore their systems. This surge in incidents translates to increased demand for consultants specializing in these reactive measures. Also, the constant real-world impact of frequent cyberattacks is raising awareness among businesses about their own vulnerabilities. This heightened awareness compels organizations to take proactive steps and seek cybersecurity consultants to conduct risk assessments and implement security measures, thereby driving the cyber security consulting market size.

- For instance, in 2021, the FBI's Internet Crime Complaint Center (IC3) reported a record 847,376 complaints from the US public, a 7% rise from 2020, with potential losses surpassing USD 6.9 billion. Key incidents included ransomware, business email compromise (BEC) which alone accounted for nearly USD 2.4 billion in losses across 19,954 complaints, and the criminal use of cryptocurrency.

Consequently, escalating frequency of cyberattacks is driving the cyber security consulting market expansion.

Key Restraints:

Complexity of regulatory compliance is restraining the global cyber security consulting market growth

Consultants must dedicate substantial time in understanding the details of various regulations including GDPR, CCPA, HIPAA, PCI DSS, ISO 27001. They need to continuously update their knowledge as regulations evolve which consume significant resources. Cybersecurity professionals spend an average of 24% of their time on compliance-related activities.

Additionally, consulting firms need to invest in training their staff on diverse and evolving regulatory frameworks. They need to hire specialized compliance experts or legal counsel to ensure they provide accurate advice. Developing and maintaining methodologies and tools that cater to different regulatory requirements also adds to their operational expenses. Therefore, as per the analysis, these combined factors are significantly hindering cyber security consulting market share.

Future Opportunities :

Emergence of AI-powered automation in cybersecurity solutions is projected to create cyber security consulting market opportunity

Organizations are increasingly adopting AI-driven solutions for threat detection, incident response, vulnerability management, and compliance. However, they often lack the in-house expertise to effectively implement, configure, and manage these complex systems. Cybersecurity consultants with specialized knowledge in AI and machine learning (ML) for security will be in high demand to guide organizations through the selection, deployment, and optimization of these tools. Additionally, integrating AI-powered security solutions with existing security infrastructure and workflows is difficult. Consultants will be needed to ensure seamless integration and maximize the effectiveness of these new technologies, hence boosting cyber security consulting market demand.

- For instance, in Apr 2025, Synechron launched Synechron CyberAI, its 14th accelerator program, featuring four AI-powered solutions designed to bolster enterprise security. The suite includes RiskControl.AI for automated IT risk management and compliance insights, AppSec.AI for unified vulnerability management and remediation prioritization, Resolve.AI for intelligent incident categorization and response, and Validate.AI to secure GenAI models against various threats like prompt injection and data leakage.

Hence, based on the analysis, emergence of AI-powered automation in cybersecurity solutions is expected to create cyber security consulting market opportunities.

Cyber Security Consulting Market Segmental Analysis :

By Service Type:

Based on the Service Type, the market is categorized into Data-protection-as-a-Service (DPaaS), Managed Security Services (MSS), Managed Detection & Response (MDR), Managed Security Incident and Event Management (SIEM), Vulnerability and Compliance Management, and Others.

Trends in the Service Type:

- Increasing trend towards the adoption of cloud-based DPaaS solutions to address the growing volume of data, coupled with the need for scalable and cost-effective data protection.

- Traditional SIEM is evolving into more sophisticated platforms that integrate with Security Orchestration, Automation and Response (SOAR) technologies and advanced threat intelligence feeds.

Managed Security Services (MSS) accounted for the largest revenue share in 2024.

- The steep volume of security alerts generated by various security tools is driving the need for MSS providers to filter, prioritize, and respond effectively.

- Additionally, securing cloud environments requires specialized skills and tools and MSS providers offer expertise in cloud security, helping organizations protect their data and applications in the cloud.

- Moreover, MSS providers offer proactive services like threat hunting and continuous monitoring to identify and mitigate threats, further boosting the cyber security consulting market size.

- For instance, in Aug 2023, Schneider Electric launched a new Managed Security Services (MSS) offering specifically designed to help customers in operational technology (OT) environments combat rising cyber risks linked to remote access and connectivity. Leveraging their global Cybersecurity Connected Service Hub (CCSH), Schneider Electric will provide flexible services to monitor OT cyber threats and proactively manage responses for their clients.

- Thus, as per the cyber security consulting market analysis, the aforementioned factors are driving the Managed Security Services (MSS) segment.

Managed Detection & Response (MDR) is predicted to register the fastest CAGR during the forecast period.

- Cyberattacks are utilizing techniques like ransomware, APTs, and zero-day exploits, creating need for MDR that can proactively hunt for and neutralize these complex threats.

- The growing expense for organizations to build and maintain in-house security operations center (SOC) is raising the need for MDR services to provide access to experienced security analysts.

- MDR providers offer solutions tailored for complex cloud and hybrid IT infrastructures, providing comprehensive visibility and threat detection across diverse platforms.

- For instance, in July 2024, ivision partnered with Expel to offer its clients Expel's 24/7 managed detection and response solutions. This collaboration aims to bolster ivision clients' security against evolving threats by providing rapid detection and response across diverse environments, including cloud, SaaS, endpoint, and more. Expel's AI and automation-driven MDR boasts impressive metrics, including a mean-time-to-detect of 1.7 minutes and an 87% reduction in mean-time-to-remediate with auto-remediation.

- Therefore, as per cyber security consulting market analysis, the above-mentioned factors are collectively responsible in driving the Managed Detection & Response (MDR) segment during the forecast period.

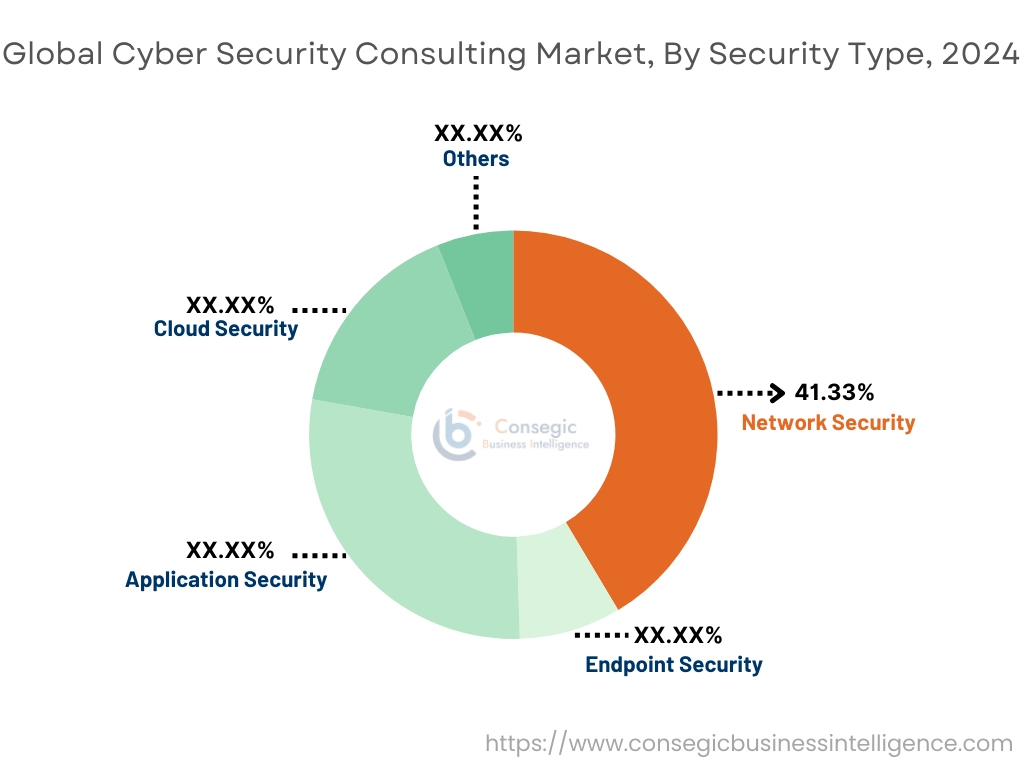

By Security Type:

Based on the Security Type, the market is classified into Network Security, Endpoint Security, Application Security, Cloud Security, and Others.

Trends in the Security Type:

- Increased trend towards the adoption of Extended Detection and Response (XDR), crucial for comprehensive endpoint protection by integrating data and providing broader visibility.

- Utilizing automated tools for static and dynamic application security testing (SAST/DAST) and interactive application security testing (IAST) to identify vulnerabilities efficiently.

Network Security accounted for the largest revenue share of 41.33% in 2024 and is also projected to register fastest CAGR.

- Utilizing artificial intelligence and machine learning to analyze network traffic, identify anomalies, and predict/prevent sophisticated attacks in real-time is driving the cyber security consulting market demand.

- Integrating network security data with endpoint, cloud, and other security layers for a holistic view of threats and faster, more effective response, thereby driving the market trend.

- Combining network security functions (firewalls and secure web gateways) with SD-WAN capabilities into a unified, cloud-delivered service to secure distributed workforces.

- For instance, in Nov 2024, Zyxel Networks introduced SecuPilot, an AI assistant integrated into its SecuReporter Cloud Analytics Service. This new feature utilizes generative AI to provide IT professionals with rapid access to actionable network insights, enabling quicker identification and response to security threats.

- Thus, as per the cyber security consulting market analysis, the aforementioned factors are driving network security segment.

By Enterprise Size:

Based on the Enterprise Size, the market is categorized into Small & Medium Enterprise and Large Enterprises.

Trends in the Enterprise Size:

- SMEs are becoming targets for cybercriminals due to the perception of weaker security postures compared to larger enterprises.

- Large enterprises face greater regulatory pressures and the potential for significant financial and reputational damage from breaches.

Large Enterprises accounted for the largest revenue share in the market in 2024.

- Large enterprises are investing in sophisticated solutions like Security Information and Event Management (SIEM), Security Orchestration, Automation and Response (SOAR), and advanced threat intelligence.

- Adoption of Zero Trust models is a key trend to enhance security beyond traditional perimeter defenses.

- Large enterprises are implementing AI-powered tools for threat detection, behavioural analysis, and security automation.

- For instance, in Feb 2022, Tata Consultancy Services (TCS) introduced its Cyber Defense Suite, a platform offering a range of modular and rapidly deployable cybersecurity services. The suite delivers comprehensive visibility and predictive intelligence from a unified platform, enabling proactive defense and response against the increasing and evolving landscape of cyber threats.

- In conclusion, the aforementioned factors are contributing to the growth of global cyber security consulting market expansion.

Small & Medium Enterprise is predicted to register the fastest CAGR during the forecast period.

- SMEs lack dedicated cybersecurity staff and struggle with budget constraints for robust security solutions and in-house expertise.

- There is a growing recognition among SMEs about the importance of cybersecurity to prevent financial losses and reputational damage.

- Due to limited internal resources, SMEs commonly rely on Managed Security Service Providers (MSSPs) for their cybersecurity needs.

- Investments are prioritized in areas like antivirus software, firewalls, VPNs, password management, and Endpoint Detection and Response (EDR), further contributing to the market size.

- Subsequently, the aforementioned factors are collectively responsible in accelerating the market during the forecast period.

By End User:

Based on the End User, the market is categorized into BFSI, IT & Telecom, Automotive, Retail, Government and Defense, Manufacturing, Healthcare, Energy & Utility, and Others.

Trends in the End User:

- Increasing trend of protecting in-vehicle systems, telematics, and communication networks from cyber threats.

- Securing connected devices like point-of-sale (POS) systems and smart shelves is driving the adoption in retail sector.

BFSI accounted for the largest revenue share in 2024.

- BFSI institutions handle vast amounts of highly sensitive financial and personal data, making them prime targets for cybercriminals seeking financial gain.

- BFSI sector is subjected to numerous regulations including GDPR, CCPA, PCI DSS, and region-specific financial regulations, mandating robust cybersecurity controls and compliance, hence driving the market trend.

- Cyberattacks lead to massive financial losses, including direct theft, fines for non-compliance, and significant reputational damage, eroding customer trust.

- Financial institutions are consistently among the most targeted by sophisticated cyberattacks, including ransomware, phishing, and advanced persistent threats (APTs).

- For instance, in May 2022, Mastercard launched Cyber Front, aimed at strengthening cybersecurity resilience for businesses and governments. This initiative, backed by a strategic investment in Picus Security, is part of Mastercard's expanding Cybersecurity & Risk consulting practice and responds to the critical need for innovative cybersecurity solutions as global cybercrime is projected to reach USD 10.5 trillion USD annually.

- In conclusion, the aforementioned factors are contributing to the growth of global cyber security consulting market expansion.

Healthcare is predicted to register the fastest CAGR during the forecast period.

- Healthcare organizations are prime targets for cybercriminals due to the sensitive and valuable nature of patient data. The rise in ransomware attacks targeting healthcare institutions disrupts operations, necessitating robust security measures.

- The increasing use of Electronic Health Records (EHRs), telemedicine, connected medical devices (IoMT-Internet of Medical Things), and cloud-based healthcare solutions expands the attack surface.

- Cyberattacks on medical devices and healthcare systems directly impact patient safety and well-being.

- For instance, in Sep 2024, The Centers for Medicare & Medicaid Services (CMS) and Wisconsin Physicians Service Insurance Corporation (WPS), a contractor managing Medicare Part A/B claims, are informing individuals that their protected health information or PII may have been compromised due to an incident related to WPS's administrative services for Medicare.

- Subsequently, as per the market analysis, the aforementioned factors are collectively responsible in accelerating the market during the forecast period.

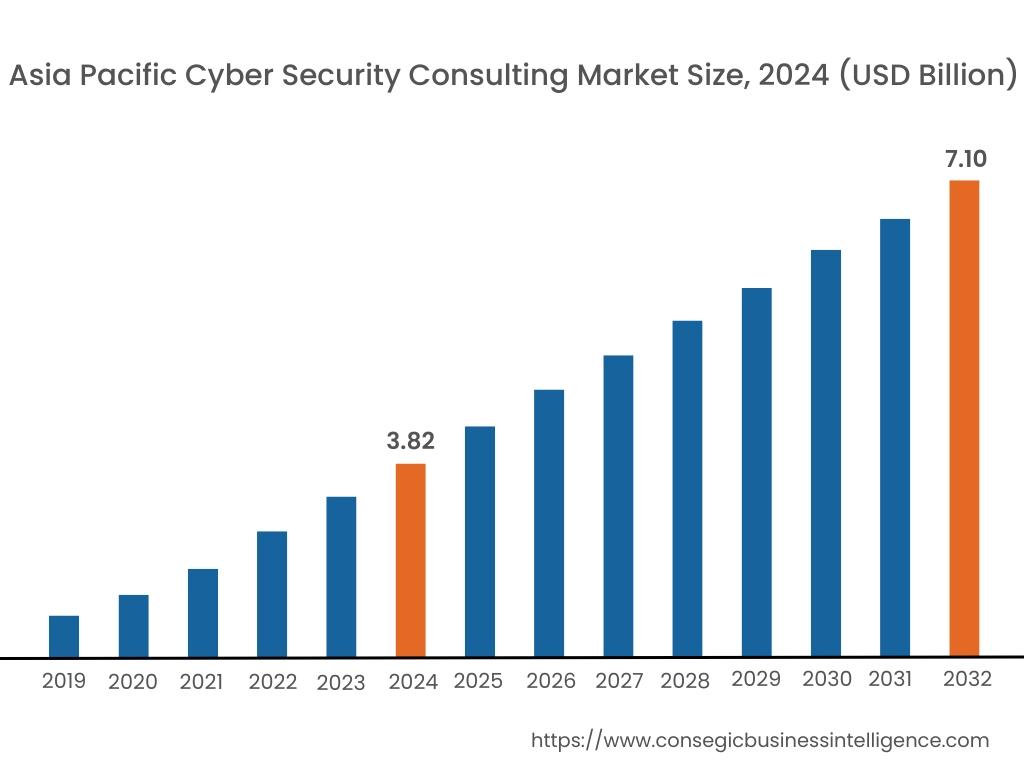

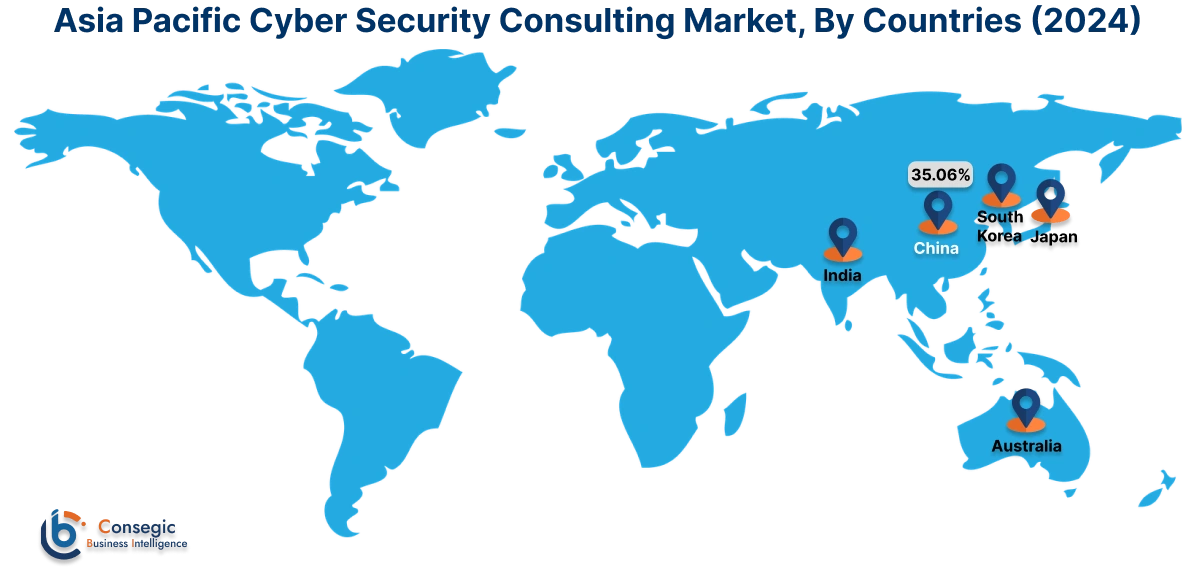

Regional Analysis:

The global cyber security consulting market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

Asia Pacific was valued at USD 3.82 Billion in 2024. Moreover, it is projected to grow by USD 4.06 Billion in 2025 and reach over USD 7.10 Billion by 2032. Out of these, China accounted for the largest revenue share of 35.06% in 2024. Asia Pacific is expected to witness a surge in cyber threats, including ransomware, data breaches, and AI-powered attacks, targeting various sectors from BFSI to manufacturing, which necessitates expert consultation to build resilient defenses. Additionally, the swift adoption of cloud computing, IoT, and AI technologies across Asia Pacific is expanding the attack surface, creating a demand for specialized security consulting. Moreover, the key players in the region are also implementing strategic initiatives to strengthen market growth in the region.

- For instance, in Mar 2025, TTC Global partnered Oneconsult to enhance its digital security testing services for customers in New Zealand. This collaboration will leverage Oneconsult's specialization in areas like penetration testing, incident response, and vulnerability management to provide more comprehensive and advanced security assurance, ultimately improving software quality and protecting New Zealand organizations from cyber threats.

North America region was valued at USD 4.71 Billion in 2024. Moreover, it is projected to grow by USD 4.99 Billion in 2025 and reach over USD 8.49 Billion by 2032. North American businesses are rapidly adopting cloud computing, IoT, and AI technologies to enhance efficiency and innovation. Securing these increasingly complex digital environments requires specialized cybersecurity expertise. Also, the region is characterized by strong and evolving data privacy and security regulations such as GDPR, CCPA/CPRA, HIPAA, and sector-specific guidelines. Navigating this complex legal framework drives significant demand for compliance-focused consulting, contributing to the market.

- For instance, in Apr 2025, Accenture Federal Services and Google Public Sector have partnered to launch a joint Managed Extended Detection and Response (MxDR) solution specifically for government agencies. This offering combines Google's Security Operations (SecOps) platform with Accenture Federal's cybersecurity expertise, leveraging security-focused generative AI to improve threat detection, incident response, and overall security for federal entities.

As per the cyber security consulting market analysis, Europe's cybersecurity consulting market is expanding due to stringent regulations like GDPR and the NIS Directive, coupled with a rise in sophisticated cyberattacks targeting diverse industries. Latin American market is experiencing rapid growth, driven by increasing cyber threats, digital transformation, and a growing awareness of data protection, with businesses investing more in cybersecurity to secure expanding digital operations. Middle East and Africa cybersecurity consulting market is driven by rapid digitalization, increased government initiatives, and rising cyber threats, with sectors like finance and energy heavily investing in security to protect critical infrastructure.

Top Key Players and Market Share Insights:

The market is highly competitive with major players providing cyber security consulting to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the cyber security consulting industry include-

- Deloitte (United Kingdom)

- Accenture (Ireland)

- EY (Ernst & Young) (United Kingdom)

- KPMG (Netherlands)

- PwC (United Kingdom)

- HCLTech (India)

- Atos (France)

- Rapid7 (United States)

- IBM Security (United States)

- Capgemini (France)

- Infosys Consulting (India)

- Tata Consultancy Services (TCS) (India)

- Cognizant (United States)

- Booz Allen Hamilton (United States)

- Wipro (India)

Recent Industry Developments :

Collaboration:

- In Sep 2024, TCS collaborated with Google Cloud to introduce two new cybersecurity offerings. Leveraging Google Security Operations, the TCS Managed Detection and Response (MDR) solution will help businesses accelerate threat detection and response times. This expanded partnership aims to enhance cyber resilience and provide industry-specific innovation by combining TCS's expertise with Google Cloud's advanced technologies.

Acquisitions:

- In Dec 2021, Capgemini finalized its acquisition of VariQ, a US-based provider of software development, cybersecurity, and cloud services for federal government entities. VariQ will be integrated into Capgemini Government Solutions LLC, enhancing Capgemini's presence and growth prospects within the U.S. federal market.

Strategic Alliance:

- In July 2021, Deloitte and Palo Alto Networks announced a strategic alliance to provide joint enterprise and government clients with comprehensive Zero Trust and multi-cloud cybersecurity solutions.

Cyber Security Consulting Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 26.34 Billion |

| CAGR (2025-2032) | 8.4% |

| By Service Type |

|

| By Security Type |

|

| By Enterprise Size |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the cyber security consulting market? +

The cyber security consulting market size is estimated to reach over USD 26.34 Billion by 2032 from a value of USD 14.57 Billion in 2024 and is projected to grow by USD 15.43 Billion in 2025, growing at a CAGR of 8.4% from 2025 to 2032.

What specific segmentation details are covered in the cyber security consulting report? +

The cyber security consulting report includes specific segmentation details for service type, security type, enterprise size, end user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the cyber security consulting market, healthcare is the fastest-growing segment during the forecast period.

Who are the major players in the cyber security consulting market? +

The key participants in the cyber security consulting market are Deloitte (United Kingdom), Accenture (Ireland), EY (Ernst & Young) (United Kingdom), KPMG (Netherlands), PwC (United Kingdom), IBM Security (United States), Capgemini (France), Infosys Consulting (India), Tata Consultancy Services (TCS) (India), Cognizant (United States), Booz Allen Hamilton (United States), Wipro (India), HCLTech (India), Atos (France), Rapid7 (United States), and Others.