Security Scanning Equipment Market Size:

Security Scanning Equipment Market size is valued at USD 11,011.84 Million in 2024. It is projected to reach USD 12,227.58 Million by 2025 and USD 20,467.08 Million by 2032, growing at a CAGR of 8.1%.

Security Scanning Equipment Market Scope & Overview:

Security scanning equipment is used to identify vulnerabilities, potential threats, and weaknesses in various systems, networks, and web applications. It encompasses a range of technologies and tools, including network scanners, vulnerability scanners, and web application scanners, all aimed at enhancing security measures and protecting against malicious attacks. The scanning equipment identifies vulnerabilities before they can be exploited and reduces the chances of security breaches and data leaks. The scanning equipment also reduces the risk of terrorist attacks and other security incidents.

How is AI Transforming the Security Scanning Equipment Market?

AI transforms security scanning by enabling faster, more accurate, and efficient threat detection through pattern recognition and real-time analysis of vast data sets. Also, it enhances physical security with features like automated anomaly detection and facial recognition, while in cybersecurity, AI identifies and blocks cyberattacks, detects suspicious network behavior, and automates responses to threats. Additionally, AI can predict potential failures in hardware or identify emerging cybersecurity risks, allowing for proactive maintenance and defense. This leads to improved safety, reduced manual oversight, greater adaptability to new threats, and lower long-term operational costs.

Security Scanning Equipment Market Dynamics - (DRO) :

Key Drivers:

Rising adoption of security scanning equipment in commercial and public spaces is boosting the market growth

Security scanning equipment in commercial and public spaces encompasses a range of technologies used to detect threats, vulnerabilities, and unwanted activities. These include x-ray scanners, metal detectors, and various software-based scanning tools for detecting security weaknesses. X-ray scanners are used for detecting hidden objects in luggage, baggage, and even full-body scanners in some contexts. Moreover, metal detectors are used to detect metallic objects by individuals, commonly found in airports, malls, and other public spaces. Airports use x-ray scanners for luggage and baggage, as well as full-body scanners for passenger screening. Shopping malls employ metal detectors and security personnel to prevent theft and ensure a safe environment. In public transportation, metal detectors and security cameras are used to maintain order and prevent potential threats. In office buildings, access control systems and alarm systems are used to manage entry and protect against security breaches.

- For instance, in September 2024, Smiths Detection launched SDX 6040. It is suitable for high-traffic urban environments, including government and corporate buildings, transport networks, cruise ships, visitor attractions, prisons, sports arenas/venues, and others.

Thus, the wide applications of scanning equipment in commercial and public spaces are driving the security scanning equipment market growth.

Key Restraints :

Prevalence of false positives is hindering the market growth

False positives in security scanning occur when a tool incorrectly flags a non-existent vulnerability or identifies legitimate activity as malicious. This can lead to wasted time and resources, as security teams investigate alerts that turn out to be false. Common causes include misconfigured tools, incomplete testing, and a lack of contextual awareness.

Moreover, false positives can be a major source of frustration and inefficiency for security teams. They waste time and resources by requiring investigation and potentially causing unnecessary disruptions. Additionally, they can also lead to a feeling of burnout among security professionals as they constantly deal with false alerts. Thus, the aforementioned factors are hindering the security scanning equipment market demand.

Future Opportunities :

Integration of advanced technologies with security scanning equipment opens new market opportunities

Security scanning equipment is advancing rapidly, with key innovations including AI-powered scanners, millimeter wave imaging, and the integration of biometrics and advanced imaging technologies. These advancements aim to improve accuracy, speed up screening processes, and minimize inconvenience for passengers. AI-integrated X-ray scanners feature intelligent threat detection and real-time video monitoring. Integration of AI algorithms improves the image resolution and automatically detects threats within baggage. Millimeter wave scanners use non-harmful radio waves to detect concealed objects on the human body, including non-metallic items.

- For instance, in February 2025, Rohde & Schwarz launched AI-powered millimeter-wave (mmWave) security scanners. These systems identify concealed items with speed and accuracy, which enhances operational efficiency and safety.

Thus, the integration of advanced technologies with scanning equipment is creating new security scanning equipment market opportunities.

Security Scanning Equipment Market Segmental Analysis :

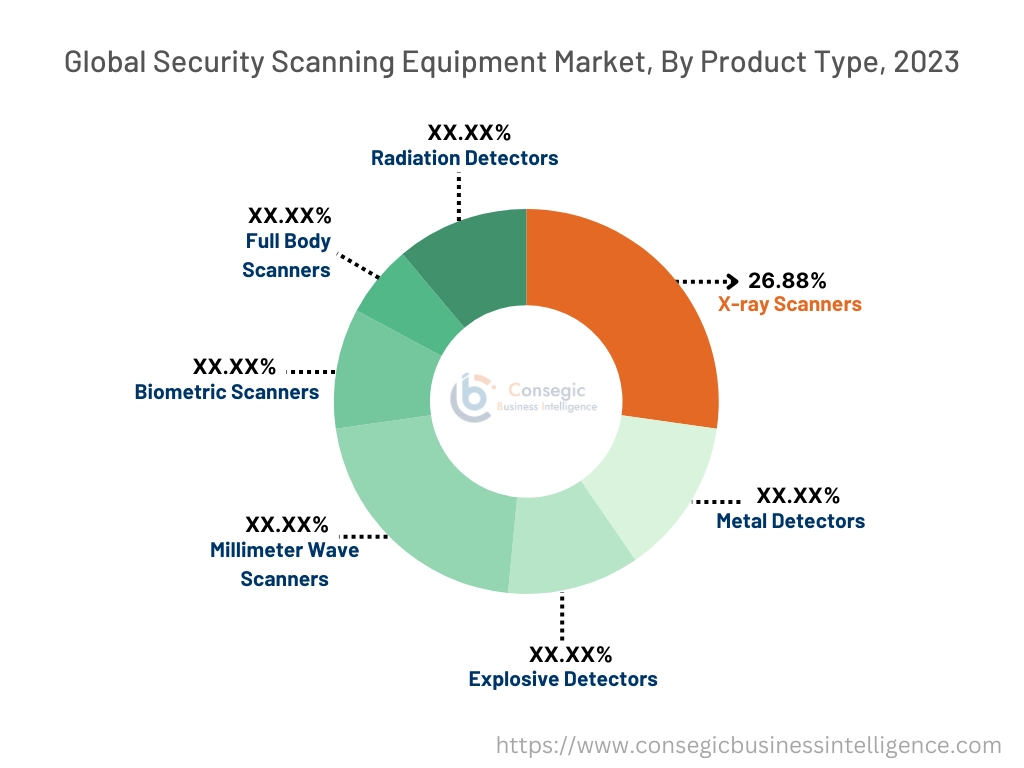

By Product Type:

Based on product type, the market is segmented into X-ray Scanners, Metal Detectors, Explosive Detectors, Millimeter Wave Scanners, Biometric Scanners, Full Body Scanners, and Radiation Detectors.

Trends in the Product Type:

- The rapid growth of e-commerce is propelling the need for faster, more efficient cargo screening solutions, which is driving the security scanning equipment market trends.

- Rising trend in adoption of biometric scanners in office premises to prevent intrusion and threat attacks.

X-ray scanners accounted for the largest revenue share in the year 2024.

- Airports around the world continue to rely heavily on X-ray scanners for screening both passengers and luggage.

- Additionally, the need to secure critical infrastructure, including power plants, transportation hubs, and financial institutions, is propelling the adoption of X-ray scanners.

- Further, increasing focus on reducing smuggling, human trafficking, and border security is fueling the adoption of x-ray scanners, in turn boosting the security scanning equipment market size.

- For instance, Point Security Inc. offers various products related to security X-ray equipment, which are mainly utilized for detecting metallic and non-metallic materials by using low-dose penetrating radiation.

- Thus, according to the security scanning equipment market analysis, the rising adoption of X-ray scanners in airports, transportation, government, and defense sectors is driving the X-ray scanner segment development.

Millimeter wave scanners are anticipated to register the fastest CAGR during the forecast period.

- Millimeter wave scanners are widely favored for their non-invasive nature, as they do not expose individuals to harmful ionizing radiation, making them a safer option for frequent use.

- Further, the rising focus on the integration of artificial intelligence and machine learning in millimeter wave scanners to automate the process is fueling the security scanning equipment market share.

- Therefore, according to the security scanning equipment market analysis, technological advancement and increasing focus on deploying safety solutions into public places are anticipated to boost the market during the forecast period.

By Technology:

Based on technology, the market is bifurcated into active and passive.

Trends in Technology:

- The rising adoption of 3D imaging active scanning technologies, as well as dual-energy x-ray systems for enhancing threat detection capabilities, is fueling the security scanning equipment market trends.

- Increasing adoption of passive scanning technologies to prevent false positives is boosting the market.

Active scanning technology accounted for the largest revenue share in the year 2024.

- Active scanning technologies are mainly utilized to produce detailed images that enable the precise identification of threats.

- Additionally, the increasing adoption of millimeter-wave and terahertz scanners due to their ability to provide detailed images of concealed items while maintaining privacy is boosting the security scanning equipment market size.

- Further, the rise in air travel and heightened security concerns are propelling the adoption of quick, non-invasive scans that identify threats with a high level of precision, in turn fueling the security scanning equipment market share.

- Thus, as per the market analysis, widespread use in critical security environments is driving the security scanning equipment market growth.

Passive scanning technology is anticipated to register the fastest CAGR during the forecast period.

- Passive scanning systems detect naturally emitted radiation or other signals from objects and individuals.

- Further, governments and public venues are increasingly adopting passive scanning technologies for security screening is fueling the market progress.

- Furthermore, the key benefits of passive scanning technology including non-disruptive, threat detection, and reduced risk of false positives are driving the market progress.

- Therefore, as per the market analysis, the non-invasive nature, safety advantages, and efficiency in threat detection are anticipated to boost the security scanning equipment market expansion during the forecast period.

By End-User Industry:

Based on the end-user industry, the market is segmented into government & defense, transportation & logistics, healthcare, retail, banking, financial services & insurance (BFSI), commercial and public spaces, and others.

Trends in the End-User Industry:

- The rising trend towards adoption of fingerprint, facial recognition, and iris scanning systems into healthcare security infrastructures to prevent unauthorized access to patient data is driving the market.

- Increasing adoption of scanning equipment in government and defense to control illegal activities across borders.

Government & defense accounted for the largest revenue share of 32.55% in the year 2024.

- The increasing movement of goods and people across international borders has significantly impacted the need for advanced scanning equipment.

- The role of scanning equipment is to detect contraband, weapons, explosives, and other security threats.

- Additionally, the government and defense sector are investing heavily in security systems to enhance border security and control illegal activities.

- Further, the rising cross-border tension is propelling the adoption of security scanning equipment by the government and defense sector.

- For instance, in April 2025, Rohde & Schwarz received approval of detection capability from the European Civil Aviation Conference (ECAC) for QPS Walk2000, which is being installed in airports and is based on millimeter wave security.

- Thus, as per the market analysis, increasing global security challenges and growing investments in defense and homeland security are driving the market trends.

Healthcare is anticipated to register the fastest CAGR during the forecast period.

- Healthcare facilities are increasingly vulnerable to security threats, which in turn is propelling the adoption of equipment such as metal detectors, X-ray machines, and others.

- Further, the increasing investment in modern scanning and authentication systems is driving the need for advanced fingerprint access control systems, encryption technologies, and secure data access controls.

- Furthermore, the healthcare security scanning system combines physical and digital security measures to protect patients, staff, and sensitive data within healthcare facilities

- Therefore, as per the market analysis, the rising demand for both physical and digital healthcare security systems is anticipated to boost the security scanning equipment market opportunities during the forecast period.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 4,218.91 Million in 2024. Moreover, it is projected to grow by USD 4,465.76 Million in 2025 and reach over USD 7,634.22 Million by 2032. Out of this, China accounted for the maximum revenue share of 34.30%. The market growth is mainly driven by its deployment in defense, airports, and other industries. Furthermore, factors including a rising focus on ensuring passenger safety and compliance with international security regulations are projected to drive the market growth in the Asia Pacific region during the forecast period.

- For instance, in April 2025, Delhi International Airport Limited announced that it is focusing on leveraging advanced full-body scanners at Indira Gandhi International Airport (IGIA). Additionally, the scanners utilize millimeter-wave technology, making them safe for all travelers.

North America is estimated to reach over USD 4,938.71 Million by 2032 from a value of USD 2,790.89 Million in 2024 and is projected to grow by USD 2,948.63 Million in 2025. The North American region's growing adoption of AI and ML in security systems offers lucrative growth prospects for the market. Additionally, the system is widely used in various applications, including airports and other public spaces, which in turn is driving the market progress.

- For instance, in April 2024, the United States Environmental Protection Agency built cabinet X-ray systems for screening luggage and carry-on items. The strong walls of the enclosed cabinet and lead drapes at the cabinet's entry and departure ports prevent radiation from escaping.

The regional evaluation depicts that the rising terrorist attacks in countries such as France, Germany, and the UK are driving the market in Europe. Additionally, the key factor driving the market is geopolitical instability and security threats as well as increased investment in security measures is propelling the market adoption in the Middle East and African region. Further, the increasing security concerns and technological advancements are paving the way for the progress of the market in the Latin American region.

Top Key Players & Market Share Insights:

The global security scanning equipment market is highly competitive, with major players providing products and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global security scanning equipment market. Key players in the security scanning equipment industry include-

- Smiths Detection Group Ltd. (UK)

- Rapiscan Systems (USA)

- Nuctech Company Limited (China)

- Leidos Holdings, Inc. (USA)

- OSI Systems, Inc. (USA)

- Safran Group (France)

- Hitachi, Ltd. (Japan)

- ADANI Systems, Inc. (Belarus)

- Thales Group (France)

- L3Harris Technologies, Inc. (USA)

Recent Industry Developments :

Product Launches:

- In April 2024, Lumana announced the launch of its next-generation video security technology, which incorporates artificial intelligence (AI) and distributed hybrid cloud architecture. Lumina stated that its technology enables enterprises to improve security and safety measures, increase operational efficiency, and speed incident response.

Security Scanning Equipment Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 20,467.08 Million |

| CAGR (2024-2031) | 8.1% |

| By Product Type |

|

| By Technology |

|

| By End-User Industry |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Security Scanning Equipment Market? +

Security Scanning Equipment Market size is valued at USD 11,574.10 Million in 2024. It is projected to reach USD 12,227.58 Million by 2025 and 20,467.08 Million by 2032, growing at a CAGR of 8.1%.

What specific segmentation details are covered in the security scanning equipment market report? +

The specific segmentation details that are covered in the security scanning equipment market are product type, technology, end-user industry, and region.

What is the key market trend? +

The key market trend is that biometric systems such as fingerprint, facial recognition, and iris scanning are being integrated into healthcare security infrastructures to prevent unauthorized access to patient data.

Which region will lead the global security scanning equipment market? +

North America will lead the global security scanning equipment market.