Explosive Detector Market Size :

Explosive Detector Market is estimated to reach over USD 14,207.53 Million by 2030 from a value of USD 7,370.88 Million in 2022, growing at a CAGR of 8.8% from 2023 to 2030.

Explosive Detector Market Scope & Overview:

Explosive detectors are devices or systems designed to detect the presence of explosive materials in airports, government buildings, and public events, to enhance safety and prevent potential threats. Explosive detectors play a crucial role in enhancing security protocols by alerting authorities to the potential presence of explosives, allowing for further investigation or implementation of preventive measures. In addition, explosives detectors are also used by public safety organizations to screen vehicles, luggage, packages, and other items.

Explosive Detector Market Insights :

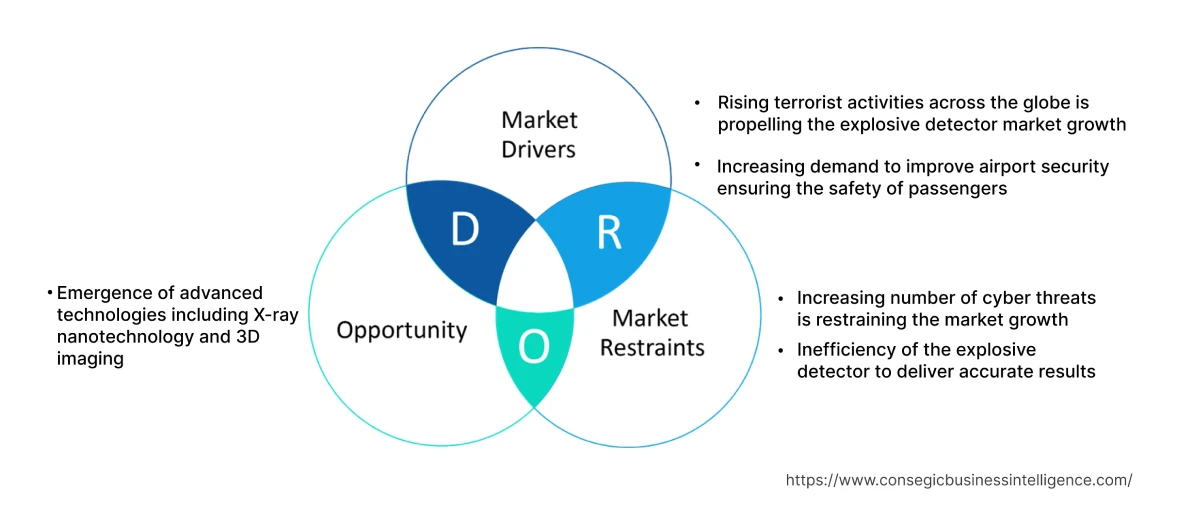

Explosive Detector Market Dynamics - (DRO) :

Key Drivers :

Rising terrorist activities across the globe is propelling the explosive detector market growth

Terrorist activities including bombings and attacks, raise the demand to enhance security measures and compels the government to invest in advanced technologies, including explosive detectors, to detect and prevent potential threats. In addition, the evolving maneuvers of terrorists and the use of improvised explosive devices (IEDs) require proactive measures to detect explosives among moving pedestrians, remotely and in real-time. For instance, in May 2022, North Atlantic Treaty Organization (NATO) demonstrated an advanced technology developed through DEXTER that allows the identification of explosives and firearms bearers among moving pedestrians, remotely and in real-time. Consequently, the increasing number of terrorist activities is raising the demand for advanced explosive detectors to protect the infrastructure from potential threats.

Increasing demand to improve airport security ensuring the safety of passengers

Airports are among key transportation mode that are primarily key targets for terrorist activities which raises the demand for advanced explosive detection systems including trace detectors and X-ray scanners to effectively detect explosives. In addition, government associated regulatory bodies have framed stringent security measures and standards for airports to ensure passenger safety. Consequently, the implementation of security measures at airports by the government to protect the infrastructure and improve passenger safety is promoting the growth of the explosive detectors market. For instance, in April 2022, the German Government implemented a Thermo Detection brand EGIS III system for the detection of explosives in German airports. The advanced explosive detector has key features including showcasing of low false-positive rate, improved sensitivity, and the ability to detect ICAO taggants, thus contributing to the market growth.

Key Restraints :

Increasing number of cyber threats is restraining the market growth

Explosive detectors are connected to a set of network devices that are linked directly to the security system present on a premises. The security system analyses the obtained data remotely from the point of suspicious activity in real-time and shares information with the security system. Moreover, such security systems are prime targets for cyberattacks resulting in hacking of mainstream system. In addition, security systems are subjected to hacking that reduces the integrity of explosive detection systems, thus leading to potential failures or unauthorized access for attackers.

Inefficiency of the explosive detector to deliver accurate results

The inefficiency of the explosive detection system to deliver accurate results in terms of false positives or false negatives is hampering the growth of the market. The system generates false positive results by incorrectly identifying an ordinary object as an explosive, causing inconvenience to passengers and disruption of operations. False positives decrease the efficiency and throughput of security checkpoints, restraining the growth of the market. In contrast, false negatives are generated by the system owing to the inability of the detector to detect explosives resulting in potential terrorist attacks. In conclusion, the incompetence of explosive detectors to deliver precise results leading to false positives and false negatives is impeding the growth of the market.

Future Opportunities :

Emergence of advanced technologies including X-ray nanotechnology and 3D imaging

The advent of advanced technologies including X-ray nanotechnology and 3D imaging is anticipated to create potential opportunities for the growth of the explosive detectors market. Nanotechnology allows the development of extremely sensitive sensors for explosive detection enabling more precise identification at lower concentrations. Furthermore, 3D imaging finely detects explosives, knives, and weapons offering improved security and safety to users. In conclusion, the emergence of X-ray nanotechnology and 3D imaging is projected to drive the market growth in upcoming years. For instance, in June 2022, Thales launched HELIXVIEW, an explosive detection system that prevents passengers not to remove items from luggage at airport. The system combines X-ray nanotechnology-based electronic scanning and 3D imaging to offer higher security at airports, thus mitigating the risk of potential attacks.

Explosive Detector Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 14,207.53 Million |

| CAGR (2023-2030) | 8.4% |

| By Product Type | Handheld, Vehicle-Mounted, Robotics, Biosensors, and Others |

| By Technology | Trace Detector and Bulk Detector |

| By End-User | Cargo & Transport, Military & Defense, Aviation, Public Places, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | American Science & Engineering, Inc., Analogic Corporation, Chemring group PLC, Flir Systems, Inc., Implant Sciences Corporation, L-3 Communications Holdings, MS Technologies Inc., NOVO DR Ltd., Smiths Detection Group Ltd., Westminster International Ltd. |

Explosive Detector Market Segmental Analysis :

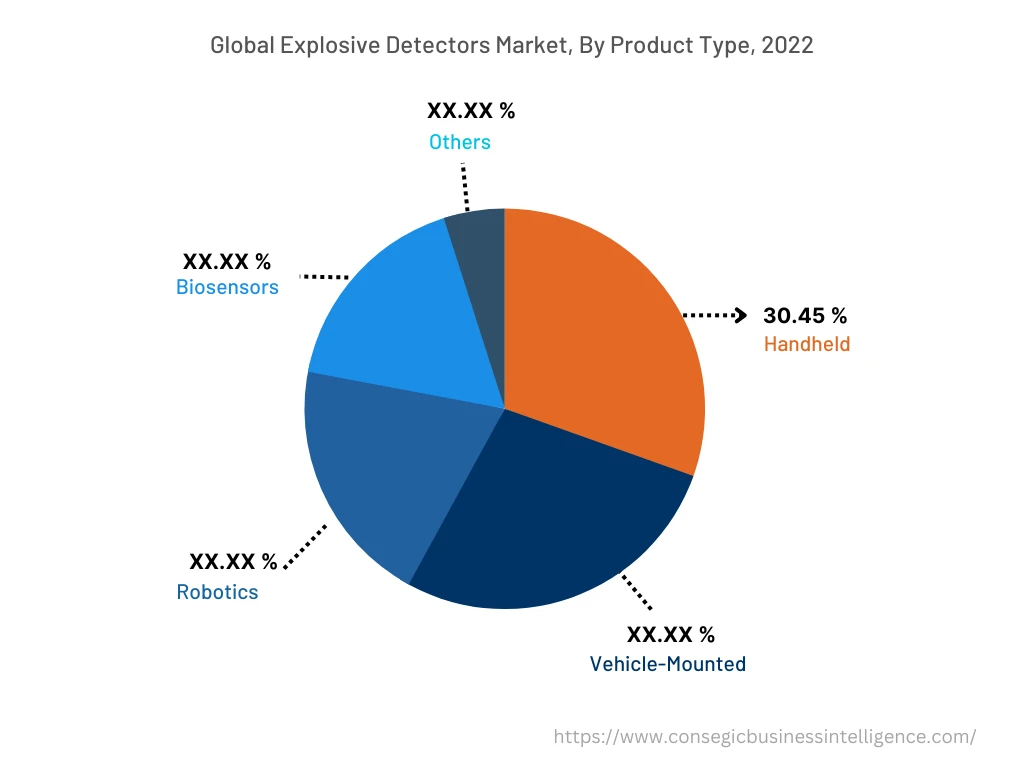

By Product Type :

The product type segment is classified into handheld, vehicle-mounted, robotics, biosensors, and others. Handheld explosive detectors accounted for the largest market share of 30.45% in 2022 as handheld detectors offer portability, mobility, and are light weight. In addition, handheld explosive detector enables real-time detection and trace vapour detection for screening buildings, people, and terrorist hotspots. Moreover, the detectors have a low warm-up time and minimum false positive rates to achieve improved sensitivity for the detection of RDX, TNT, SEMTEX, PETN & other plastic explosives used in military explosives and IED (Improvised Explosive Device). For instance, in April 2021, Researchers at IIT Bombay developed Beaglez, a handheld explosive detector in collaboration with Bigtec Labs. The detector has a low warm up time of approximately 30 seconds for the real-time detection of RDX, SEMTEX, and PTN, hence contributing significantly in accelerating the growth of explosive detector market.

Biosensors are anticipated to register the fastest CAGR in the explosive detector market during the forecast period. Biosensors deploy biomimetic recognition elements namely enzymes or antibodies that exhibit high affinity and specificity towards target analytes, resulting in exceptional sensitivity. In addition, biosensors also detect explosives at extremely low concentrations, including trace amounts further driving the growth of the market. Subsequently, the ability of biosensors to detect explosives at low concentrations with high precision is predicted to drive the growth of the explosive detector market in upcoming years.

By Technology :

The technology segment is bifurcated into trace detectors and bulk detectors. Bulk detectors accounted for the largest share in 2022 owing to the ability to identify bulk quantities of explosives, including large, concealed devices and explosive substances with a high level of accuracy. In addition, bulk detectors identify various explosives including traditional explosives such as TNT, as well as improvised explosive devices (IEDs). Moreover, the detectors offer relatively fast screening times and have the capability to detect explosives in pure form as well as with contaminants. Consequently, the aforementioned factors including improved accuracy, faster screening times, and the ability to detect explosives in pure and contaminated form are propelling the growth of the market. For instance, in March 2020, the Defence Research & Development Organisation (DRDO) and the Indian Institute of Science (IISc) developed RaIDer-X to detect explosives in bulk quantities. The detection device identifies the explosives in pure and contaminant forms, thus contributing notably in boosting the market growth.

Trace detectors are expected to register the fastest CAGR in the explosive detector market by providing non-invasive screening capabilities. Trace detectors allow the detection of drugs and explosives in seconds, thus contributing notably in driving the market growth. In addition, the detectors enable real-time identification of the explosives along with offering improved safety. Moreover, the detector signals visual and audio alarm indications upon identification of an explosive substance allowing the user to access spectrogram display and diagnostic tools. Consequently, the capability of trace detectors to signal alarms in real-time upon identification of an explosive substance is expected to drive the growth of the explosive detector market during the forecast period.

By End-User :

The end-user segment is divided into cargo & transport, military & defense, aviation, public places, and others. Military and defense accounted for the largest market share in 2022 owing to the increasing demand for detectors in counterterrorism operations to detect and neutralize explosive devices. In addition, explosive detectors are also employed in areas of insurgency and counterinsurgency operations to identify and disarm improvised explosive devices (IEDs). Furthermore, the ongoing strategic military action against Ukraine by Russia is also raising the demand for advanced explosive detectors to defend Ukraine against Russian strikes on its cities and infrastructure. For instance, in December 2022, the UK military supported Ukraine by delivering more than 100 bomb de-arming kits and 1000 VALLON metal detectors. Consequently, the increasing demand for advanced explosive detectors from military and defense is contributing significantly in propelling the market growth.

Aviation industry is predicted to witness the fastest CAGR as explosive detectors are deployed at airports to screen passengers including checked baggage for identifying potential threats. In addition, cargo and freight transported by air are subject to rigorous security measures to prevent the shipment of explosives or dangerous substances. Explosive detectors are utilized to screen cargo and freight to identify explosives, thus ensuring the safety of the aircraft, crew, and passengers. In conclusion, the increasing adoption of explosive detectors to improve the safety and security of passengers at airports is expected to accelerate the market growth in upcoming years.

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

North America accounted for the largest revenue share in the year 2022 owing to the robust research and development infrastructure, facilitating the development of advanced explosive detection technologies. In addition, the region is witnessing an increase in security threats and incidents, including acts of terrorism, smuggling, and illegal activities. Governments and security agencies are investing in advanced security technologies to address such issues, thereby driving the growth of the market. Moreover, the presence of key players in the region including American Science & Engineering, Inc., Analogic Corporation, and Flir Systems, Inc. constantly applies strategic decisions to gain a competitive edge and also to strengthen the market position. Consequently, the development of advanced research infrastructure, expanding aviation industry, and the presence of key players are collectively responsible for propelling the growth of the explosive detector market in the region.

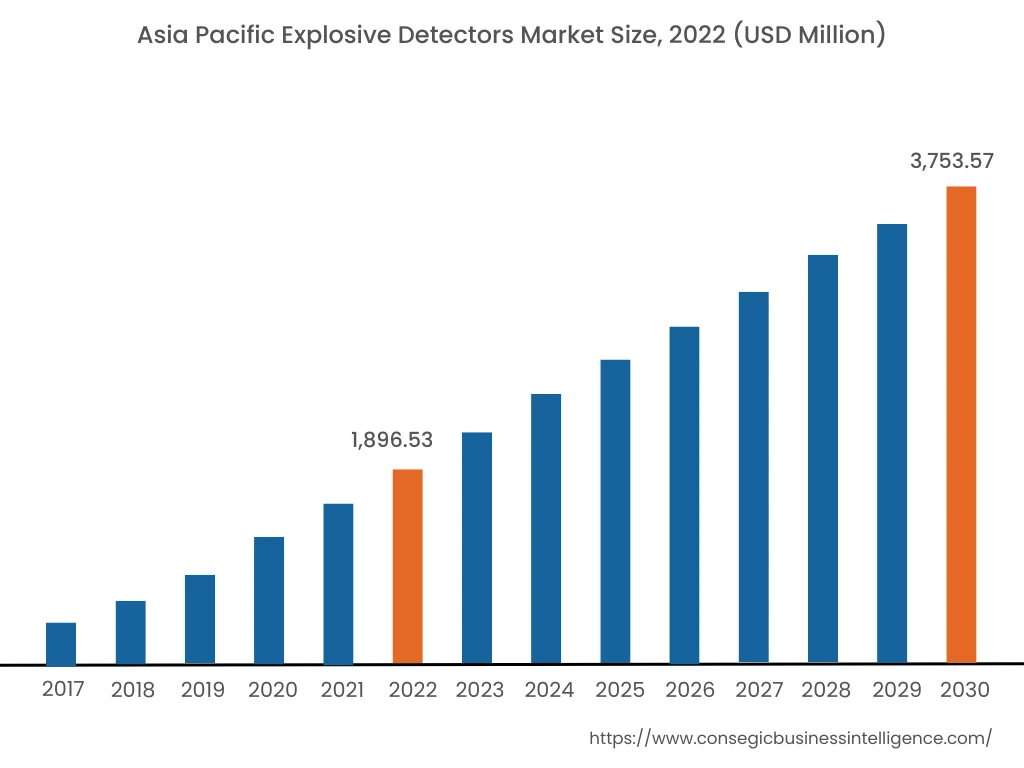

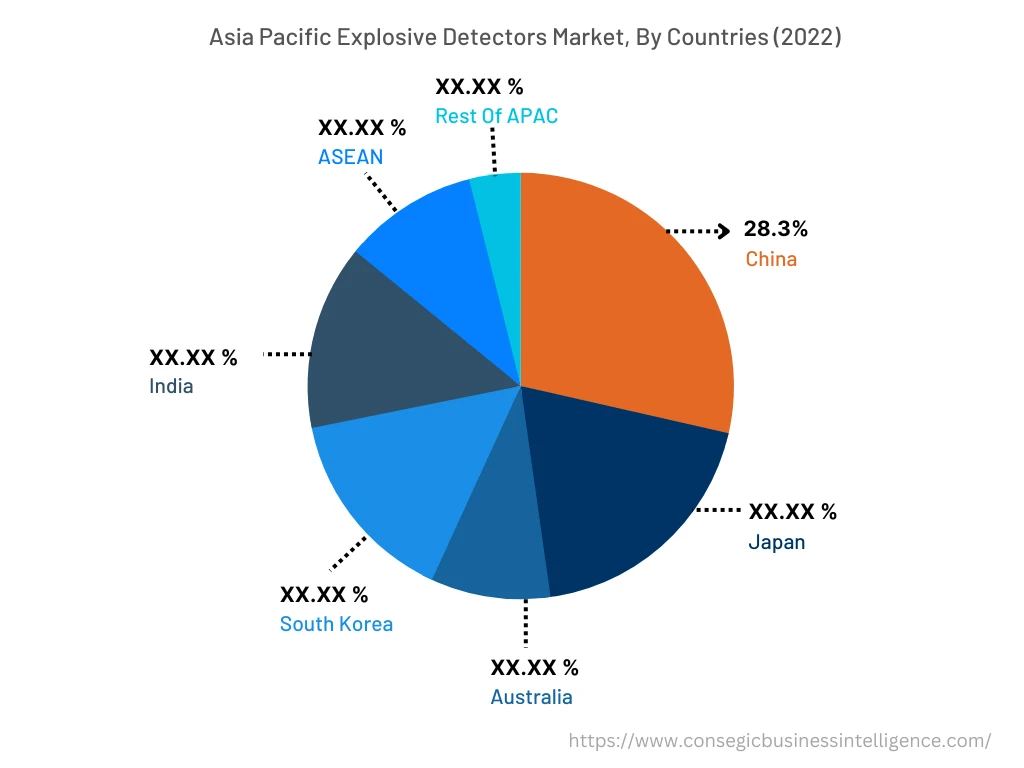

Asia Pacific accounted for a revenue share of USD 1,896.53 Million in 2022 and is anticipated to reach USD 3763.57 Million by 2030, registering a CAGR of 9.2% during the forecast period in the explosive detectors market. In addition, in the region, China accounted for the maximum revenue share of 28.3% in the year 2022. The growth of the market is attributed to the expanding aviation industry that increases the demand for comprehensive security measures to improve passenger safety. The increasing need for security measures raises the demand for advanced explosive detectors which in turn promotes the growth of the market. For instance, in February 2023, according to Airports of Thailand, commercial aircraft movements increased by approximately 120% in 2021, indicating an exponential increase from the previous year. Consequently, the growth in the aviation industry increases the demand for advanced explosive detectors to mitigate potential threats at airports.

Top Key Players & Market Share Insights:

The landscape of the explosive detectors market is highly competitive and has been examined in the report, along with complete profiles of the key players operating in the industry. In addition, the surge in innovations, acquisitions, mergers, and partnerships has further accelerated the growth of the transit card market. Major players in the market include -

- American Science & Engineering, Inc.

- Analogic Corporation

- Chemring group PLC

- Flir Systems, Inc.

- Implant Sciences Corporation

- L-3 Communications Holdings

- MS Technologies Inc.

- NOVO DR Ltd.

- Smiths Detection Group Ltd.

- Westminster International Ltd.

Recent Industry Developments :

- In March 2023, Smiths Detection introduced a Lightweight Chemical Detector (LCD) 4 for the detection of street narcotics, explosives, pharmaceuticals, and super toxic chemical threats.

- In October 2021, MS Tech launched MULTISCAN GEN3, 3rd generation of non-radioactive explosive and narcotics trace detector for law enforcement, EOD units, police, and air cargo screening.

Key Questions Answered in the Report

What are Explosive Detectors? +

Explosive detectors are devices or systems designed to detect the presence of explosive materials in various security settings, including airports, government buildings, and public events, to enhance safety and prevent potential threats.

What specific segmentation details are covered in the Explosive Detectors Market report, and how is the dominating segment impacting the market growth? +

The report consists of segments including product type, technology, end-user, and region. Each segment has a key dominating sub-segment being driven by industry trends and market dynamics. For instance, the product type segment has witnessed handheld explosive detectors as the dominating segment in the year 2022, driven by the ability of handheld detectors to offer portability and mobility. In addition, handheld explosive detector enables real-time detection and trace vapour detection for screening buildings, people, and terrorist hotspots.

What specific segmentation details are covered in the explosive detectors market report, and how is the fastest segment anticipated to impact the market growth? +

The report consists of segments including product type, technology, end-user, and region. Each segment is projected to have the fastest-growing sub-segment driven by industry trends and drivers. For instance, in the end-user, the aviation sub-segment is anticipated to witness the fastest CAGR growth during the forecast period. The growth is attributed to the ability of explosive detectors to screen passengers including checked baggage for identifying potential threats.

Which region is anticipated to witness the highest CAGR during the forecast period, 2023-2030? +

Asia Pacific is anticipated to witness the fastest CAGR during the forecast period owing to the expanding aviation industry that increases the demand for comprehensive security measures to improve passenger safety.