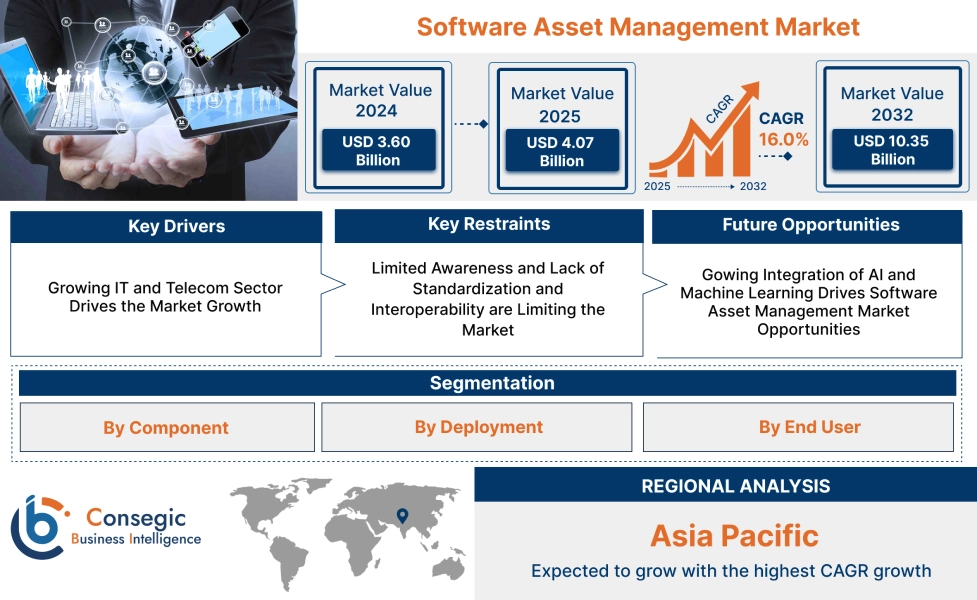

Software Asset Management Market Size:

Software Asset Management Market is estimated to reach over USD 10.35 Billion by 2032 from a value of USD 3.60 Billion in 2024 and is projected to grow by USD 4.07 Billion in 2025, growing at a CAGR of 16.0% from 2025 to 2032.

Software Asset Management Market Scope & Overview:

Software Asset Management (SAM) refers to the processes and tools that are used for managing and optimizing the purchase, deployment, maintenance, and usage of an organization's software assets. The benefits of the solution including reduced IT expenditure, mitigation of legal risks, and improved operational efficiency are driving the market. Further, the solution is used across wide range of sectors including IT & telecom, BFSI, healthcare & life sciences, manufacturing, and others. Furthermore, key trends including proliferation of hybrid and multi-cloud environments, increasing need for regulatory compliance, the integration of artificial intelligence and machine learning are driving the market.

How is AI Impacting the Software Asset Management Market?

AI is reshaping the software asset management sector by transitioning it from a reactive to a proactive function. AI-powered software solutions automate the tedious, manual tasks of software discovery and license reconciliation by intelligently analyzing vast datasets. Furthermore, AI's predictive analytics capabilities allow organizations to forecast future software needs, optimize license allocation in real-time to prevent overspending, and proactively identify compliance risks before an audit occurs. This shift enables companies to achieve significant cost savings, enhance operational efficiency, and make more strategic, data-driven decisions about their entire software portfolio.

Software Asset Management Market Dynamics - (DRO) :

Key Drivers:

Growing IT and Telecom Sector Drives the Market Growth

IT & Telecom sector is a key driver of the software asset management market due to its inherently complex and dynamic IT infrastructure. These companies manage vast and diverse software portfolios, including a mix of on-premises systems, cloud services, and custom applications. The sheer scale and complexity of these assets create significant challenges in license management, compliance, and cost control. Furthermore, the rapid adoption of new technologies like 5G, IoT, and AI-driven platforms within the sector continuously expands the software landscape. This necessitates robust software solutions to gain visibility, optimize spending, and mitigate the substantial financial and reputational risks associated with software audits and non-compliance.

- For instance, according to Telecom Regulatory Authority of India (TRAI), the Indian telecom sectorexperienced significant growth during the 2023-2024 financial year. The country's overall tele-density increased from 84.51% at the end of March 2023 to 85.69% at the end of March 2024, representing a yearly growth rate of 1.39%. This rise in telecom sector is boosting the overall asset management market.

Thus, vast and diverse software portfolios and rapid adoption of new technologies like 5G and IoT are driving the software asset management market size.

Key Restraints :

Limited Awareness and Lack of Standardization and Interoperability are Limiting the Market

Limited awareness about the strategic value of software asset management remains a significant restraint, as many organizations, particularly smaller ones, still perceive it as a low-priority IT function rather than a critical tool for cost savings and risk mitigation. Furthermore, the lack of standardization and interoperability between disparate vendor tools and data formats is a major challenge. Without common data models or APIs, SAM solutions struggle to seamlessly integrate with other enterprise systems like IT Service Management (ITSM) and procurement. This makes it difficult for businesses to get a single, accurate view of their software in turn hindering the market.

Future Opportunities :

Gowing Integration of AI and Machine Learning Drives Software Asset Management Market Opportunities

The integration of AI and machine learning is driving significant opportunities in the software asset management market by fundamentally changing how organizations manage software. AI-powered tools move beyond simple data collection to offer predictive analytics, allowing companies to forecast future needs, optimize spending, and avoid over-provisioning. Furthermore, AI automates the complex task of data reconciliation and normalization, reducing manual effort and human error. This enables a shift towards proactive risk mitigation, as AI can continuously monitor usage for non-compliance issues before they escalate into costly audits. By providing actionable insights and improving efficiency, AI and ML are transforming the software from a compliance-focused function into a strategic tool for driving business value.

- For instance, ServiceNowSAM solution is a single-platform application designed to help organizations control risk, reduce spending, and automate the software lifecycle. Running on the ServiceNow AI Platform, it provides a unified system to track and manage software licenses and usage across the entire enterprise.

Thus, increasing need for risk mitigation, predictive analytics, and system automation drives software asset management market opportunities.

Software Asset Management Market Segmental Analysis :

By Component:

Based on the component, the market is segmented into solutions and services.

Trends in the Component:

- Service providers are focusing on delivering tangible business outcomes, such as quantified cost savings, reduced audit risk, and improved operational efficiency which is expected to drive software asset management market size.

Solutions accounted for the largest revenue share in the year 2024.

- Increasing use of AI and machine learning to automate license reconciliation, predict future software needs, and identify cost-saving prospects with minimal human intervention is driving the software asset management market share.

- Further, there is an increasing focus on merging platforms with IT Asset Management (ITAM) to provide a single, holistic view of both software and hardware assets, enabling better cost control and efficiency.

- Furthermore, growing incorporation of cybersecurity platforms to identify and mitigate risks posed by outdated, unauthorized, or vulnerable software installations drives the software asset management market trends.

- Thus, as per analysis, convergence with ITAM, AI-driven automation, and enhanced security integration are driving the software asset management market trends.

Services is anticipated to register the fastest CAGR during the forecast period.

- Services are becoming more tailored to specific industries, such as healthcare or BFSI, to address unique and complex licensing and compliance requirements.

- Further, with the proliferation of on-premises and multi-cloud environments, organizations are turning to managed servicesfor expert-led management which propels the software asset management market expansion.

- Furthermore, services now cover the entire lifecycle of a software asset, from strategic procurement and deployment to ongoing monitoring, cost optimization, and ultimate retirement which in turn drive the market.

- Therefore, based on analysis, managed services for hybrid IT, specialized industry expertise, and asset lifecycle management are anticipated to boost the market during the forecast period.

By Deployment:

Based on the deployment, the market is segmented into on-premises and cloud.

Trends in the Deployment:

- On-premises solutions remain critical for sectors with strict data sovereignty and security regulations, such as government, BFSI, and healthcare which in turn drives the software asset management market demand.

- On-premises solutions are evolving to integrate more effectively with cloud-based solutions in turn driving the software asset management market share.

Cloud accounted for the largest revenue share in the year 2024 and is anticipated to register the fastest CAGR during the forecast period.

- Advantages including convenience, scalability, and lower upfront costs of the SaaS model are driving the software asset management market growth.

- Further, there is an increasing focus on multi-cloud and hybrid management which in turn drives the software asset management industry.

- Furthermore, there is an increasing use of AI and machine learning to analyze usage patterns and automate cost optimization which in turn drives the market growth.

- For instance, In February 2024, Softchoice, a launched a new portfolio of services called SAM+ to help organizations manage the increasing complexity of subscription-based software licensing. This new offering directly addresses the challenges and helps businesses reduce risk, optimize costs, and maximize the value of their software investments.

- Thus, as per software asset management market analysis, aforementioned factors are driving the market.

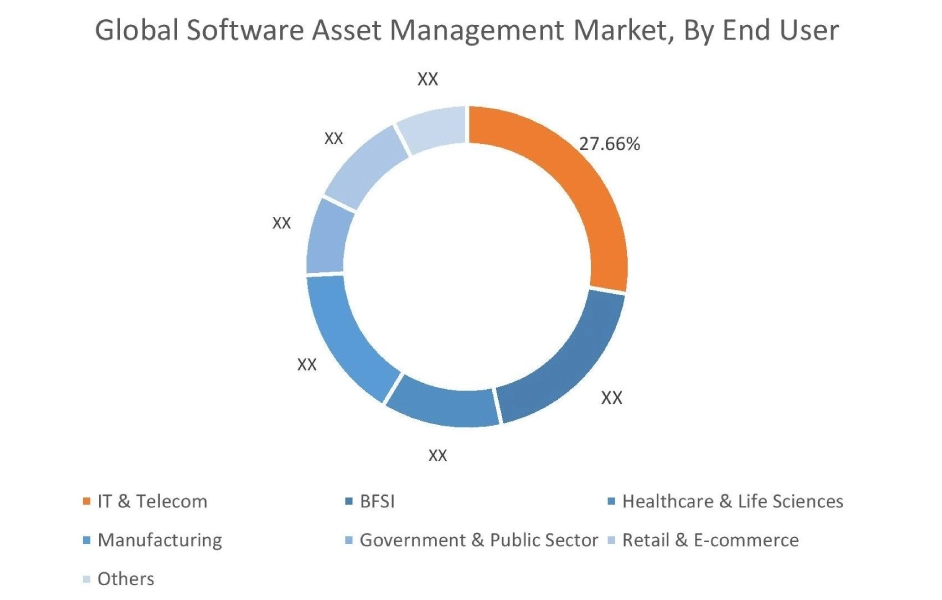

By End User:

Based on the end user, the market is segmented into IT & telecom, BFSI, healthcare & life sciences, manufacturing, government & public sector, retail & e-commerce, and others.

Trends in the End User:

- The adoption of "Industry 4.0" technologies, including smart factories, automation, and IoT devices drives the software asset management market.

- Complex licensing models and data security and privacy in government sector drive the software asset management market growth.

IT & Telecom accounted for the largest revenue share of 27.66% in the year 2024.

- Rising demand for multi cloud and SaaS license optimization drives the adoption of the software.

- Further, rising integration of the SAM with ITSM and FinOps tools drives software asset management market demand.

- Furthermore, there is an increasing shift towards automation & AI driven license usage tracking which in turn drives the market.

- Thus, as per software asset management market analysis, aforementioned trends are driving the market.

Healthcare & life sciences is anticipated to register the fastest CAGR during the forecast period.

- The primary driver in the healthcare sector is compliance with regulations like HIPAA, which require meticulous tracking and management of software assets which in turn drive the market.

- Further, the rise in demand of Internet of Things (IoT) and Internet of Medical Things (IoMT) devices, propels the software asset management market expansion.

- Furthermore, the shift to telemedicineand cloud-based patient management systems is accelerating the market growth.

- Therefore, based on analysis, regulatory compliance,IoT and IoMT management, and telemedicine are anticipated to boost the market during the forecast period.

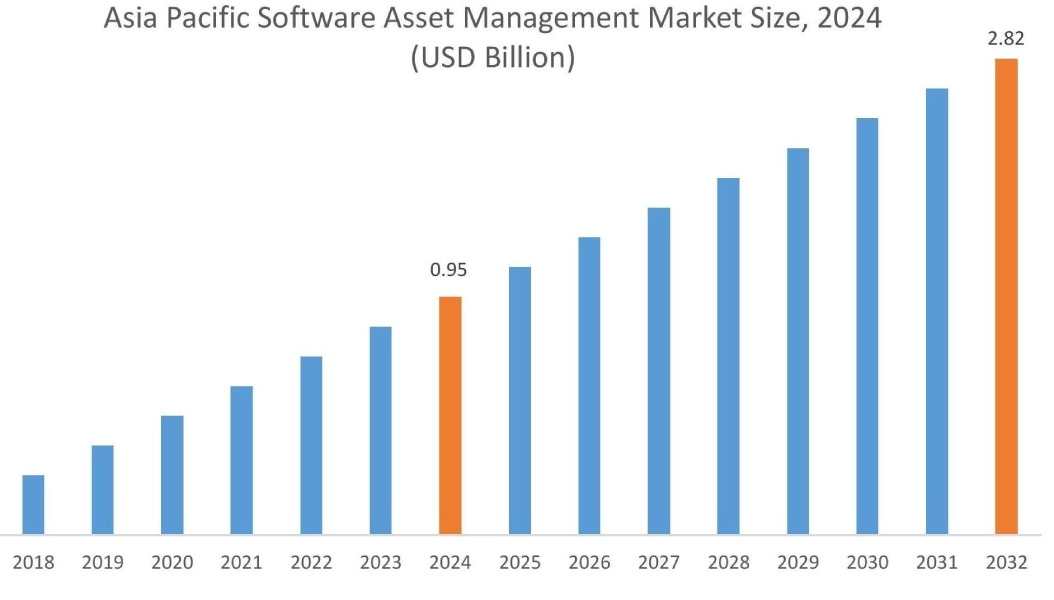

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

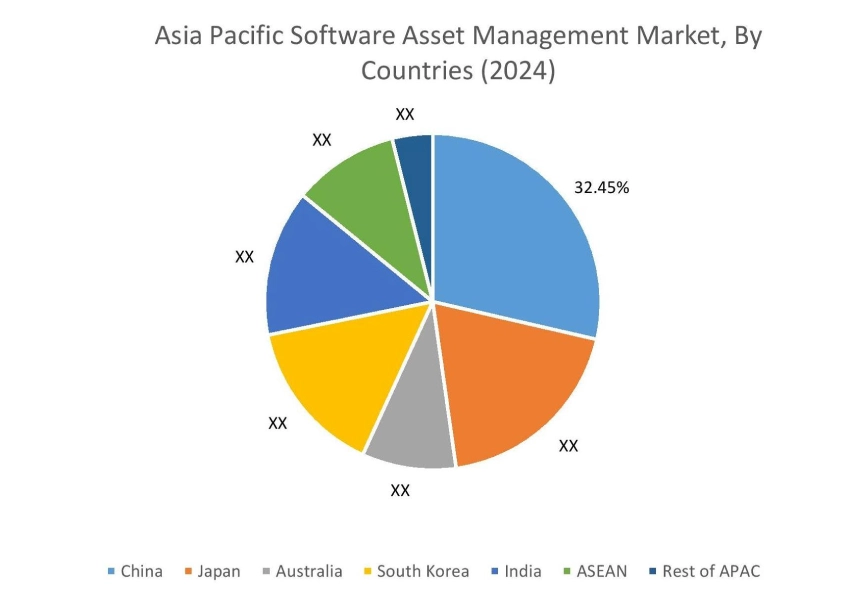

Asia Pacific region was valued at USD 0.95 Billion in 2024. Moreover, it is projected to grow by USD 1.07 Billion in 2025 and reach over USD 2.82 Billion by 2032. Out of this, China accounted for the maximum revenue share of 32.45%. The market for software asset management is mainly driven by rapid digital transformation and the increasing demand for regulatory compliance across various sectors. Additionally, growing IT infrastructure and a rising awareness among organizations of the benefits of cost optimization and efficient IT asset management are further driving the market.

- For instance, in January 2025, ServiceNow a major player in global market, updated its Software Asset Management application in its latest Yokohama release with several key enhancements. A major highlight is the introduction of Now Assist for SAM, which uses generative AIto create summaries of software deployments, license compliance, and optimization.

North America is estimated to reach over USD 3.67 Billion by 2032 from a value of USD 1.27 Billion in 2024 and is projected to grow by USD 1.44 Billion in 2025. The North American market is primarily driven by region's highly mature IT infrastructure, presence of numerous large enterprises, and early adoption of advanced technologies like cloud computing. Also, strong emphasis on stringent regulatory compliance and the need to mitigate the risks and financial penalties drives the market.

- For instance, in March 2021, Ivanti completed the acquisition of Cherwell Software, a prominent provider of enterprise service management solutions. The acquisition is intended to accelerate Ivanti’s innovation by converging its core offerings in unified endpoint management, zero trust security, and enterprise service management.

Regional analysis depicts that stringent regulatory frameworks and growing trend of digitalization in Europe are driving the market. Additionally, factors driving the market in the Middle East and African regions are rapid digital transformation initiatives, increasing IT investments, and the growing need to manage complex, multi-vendor IT environments. Further, growing adoption of cloud services by businesses, and the increasing demand for cost optimization is paving the way for the progress of market trends in Latin America region.

Top Key Players & Market Share Insights:

The global software asset management market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the software asset management industry. Key players in the global software asset management market include-

- Flexera(U.S.)

- ServiceNow (U.S.)

- USU Software AG (Germany)

- BMC Software (U.S.)

- Microsoft (U.S.)

- Belarc, Inc.(U.S.)

- Ivanti (U.S.)

- Certero (UK)

- Eracent (U.S.)

- IBM (U.S.)

Recent Industry Developments :

Acquisition

In February 2024, Flexera announced it has completed the acquisition of Snow Software, a move designed to enhance its technology value optimization portfolio. This acquisition combines the expertise and technology of both companies to provide customers with greater visibility into their hybrid IT environments.

Software Asset Management Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 10.35 Billion |

| CAGR (2025-2032) | 16.0% |

| By Component |

|

| By Deployment |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the software asset management market? +

The software asset management market is estimated to reach over USD 10.35 Billion by 2032 from a value of USD 3.60 Billion in 2024 and is projected to grow by USD 4.07 Billion in 2025, growing at a CAGR of 16.0% from 2025 to 2032.

What specific segmentation details are covered in the software asset management report? +

The software asset management report includes specific segmentation details for component, deployment, end user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the software asset management market, cloud is the fastest-growing segment during the forecast period.

Who are the major players in the software asset management market? +

The key participants in the software asset management market are Flexera (U.S.), Belarc, Inc. (U.S.), Ivanti (U.S.), Certero (UK), Eracent (U.S.), IBM (U.S.), ServiceNow (U.S.), USU Software AG (Germany), BMC Software (U.S.), Microsoft (U.S.) and others.

What are the key trends in the software asset management market? +

The software asset management market is being shaped by several key trends including proliferation of hybrid and multi-cloud environments, increasing need for regulatory compliance, the integration of artificial intelligence and machine learning are driving the market.