Zero Trust Security Market Size:

Zero Trust Security Market is estimated to reach over USD 109.44 Billion by 2032 from a value of USD 36.76 Billion in 2024 and is projected to grow by USD 41.70 Billion in 2025, growing at a CAGR of 16.6% from 2025 to 2032.

Zero Trust Security Market Scope & Overview:

Zero trust security is a modern cybersecurity framework based on the principle of "never trust, always verify," meaning no user, device, or application is implicitly trusted, even if they are inside the network perimeter. Also, every access request is rigorously authenticated, authorized, and continuously validated. The benefits offered by the framework include reduced attack surface, enhanced data protection, improved threat detection, better regulatory compliance, and secure access for hybrid and remote workforces. Additionally, key trends driving the market include escalating volume and sophistication of cyberattacks, the widespread adoption of cloud computing and hybrid work models, and increasingly stringent global regulatory compliance mandates.

Key Drivers:

Accelerated Cloud Adoption and Digital Transformation Drives the Market Growth

Fast-tracked cloud adoption and ongoing digital transformation are key catalysts for the market. As organizations increasingly migrate their data, applications, and infrastructure to various cloud environments and embrace digital tools for enhanced efficiency, the traditional network perimeter dissolves. Further, this distributed and dynamic IT landscape necessitates a fundamental shift to a model of "never trust, always verify" for every user, device, and workload, regardless of its location. Furthermore, this continuous authentication and authorization approach, becomes crucial to effectively secure the vastly expanded attack surface created by cloud services and interconnected digital operations.

- For instance, in May 2024, Palo Alto Networks launched Prisma SASE 3.0, an innovative update to its Secure Access Service Edge platform, designed to deliver comprehensive Zero Trust security for modern workforces. Key enhancements include the industry's first natively integrated enterprise browser for securing unmanaged devices and AI-powered data security for highly accurate data classification.

Thus, improved efficiency and productivity driven by cloud adoption and digital transformation contribute significantly to the zero trust security market size.

Key Restraints:

Complexity and High Upfront Implementation Costs are Limiting the Market

The intricate nature of implementing zero trust security, coupled with the substantial upfront investment acts as a significant limiting factor for market growth. This framework necessitates a complete re-evaluation of an organization's entire security posture, involving comprehensive mapping of data flows, reconfiguring access policies, and integrating diverse security technologies. Many enterprises, especially those with extensive legacy systems, face considerable hurdles in transitioning their existing infrastructure to align with zero trust principles, often requiring costly upgrades or complex middleware solutions. Thus, technical complexity, combined with the need for specialized cybersecurity expertise hinders the market's full potential.

Future Opportunities :

Growing E-Commerce Sector Drives Zero Trust Security Market Opportunities

The escalating progress of the e-commerce sector presents substantial opportunities for the zero trust security market. As online retail platforms expand globally, they process a massive volume of sensitive customer data, including personal information and payment details, making them highly attractive targets for cybercriminals. This heightened risk exposure compels e-commerce businesses to adopt more robust and proactive security measures. Zero trust principles, by continuously verifying every user, device, and transaction enables secure online shopping experiences while building customer trust and ensuring compliance with data protection regulations.

- For instance, according to International Trade Administration, Global B2C e-commerce revenue is projected to reach USD 5.5 trillion by 2027, exhibiting a consistent 14.4% annual growth rate.

Thus, growing e-commerce sector requires secure online shopping experiences which in turn drives zero trust security market opportunities.

Zero Trust Security Market Segmental Analysis :

By Offering:

Based on the offering, the market is segmented into solutions and services.

Trends in the Offering:

- Increasing focus on protecting sensitive data at rest and in transit drives the zero trust security market trends.

- Organizations are heavily relying on expert consulting services for strategy formulation and policy design which is expected to drive zero trust security market size.

Solutions accounted for the largest revenue share in the year 2024.

- Increasing demand for zero trust platforms that combine multiple security functions into a unified suite in turn driving the zero trust security market share.

- Further, there is an increasing demand of embedding AI and machine learning for enhanced threat detection, anomaly behavior analysis, and automated policy adjustments.

- Furthermore, emphasis on protecting data itself with advanced encryption, data loss prevention (DLP), and continuous data access monitoring, driving the zero trust security market trends.

- For instance, in January 2024, Zscaler launched Zscaler Zero Trust SASE, a unified solution built with Zero Trust AI that integrates Zero Trust SD-WAN and a new line of plug-and-play appliances. The offering aims to help organizations reduce costs and complexity by replacing traditional firewalls and VPNs with a secure, policy-driven connectivity model.

- Thus, as per analysis, AI & ML augmentation, data-centric focus, and platform consolidation are driving the market.

Services segment is anticipated to register the fastest CAGR during the forecast period.

- Services for training internal IT and security teams on zero trust principles, tools, and best practices are gaining significant traction.

- Further, more organizations are outsourcing the ongoing management, monitoring, and optimization of their zero trust architectures which in turn propels the zero trust security market expansion.

- Therefore, based on analysis, skill development & training and need for managed services are anticipated to boost the market during the forecast period.

By Authentication Type:

Based on the authentication type, the market is segmented into single-factor authentication and multi-factor authentication.

Trends in the Authentication Type:

- Single-factor authentication is increasingly deemed insufficient for accessing sensitive data and critical systems.

- The integration of advanced biometrics and behavioral biometrics is enhancing both security and user experience for multi-factor authentication.

Multi-factor authentication accounted for the largest revenue share in the year 2024 and is anticipated to register the fastest CAGR during the forecast period.

- Multi-factor authentication (MFA) is evolving to be dynamic, adjusting authentication requirements based on real-time risk assessments which in turn drives the zero trust security market demand.

- Further, there's a growing demand for MFA methods that are inherently resistant to phishing which in turn drives the zero trust security industry.

- Furthermore, MFA is moving beyond a one-time login event to include continuous background verification throughout a user's session.

- Thus, as per zero trust security market analysis, aforementioned factors are driving the market.

By Enterprise Size:

Based on enterprise size, the market is bifurcated into SMEs and large enterprises.

Trends in the Enterprise Size:

- SMEs are increasingly adopting the technology via cloud-native and SaaS-based solutions which in turn drives the zero trust security market growth.

- Increased awareness of ransomware, data breaches, and other cyberattacks subsequently propels the zero trust security market demand.

Large enterprises accounted for the largest revenue share in the year 2024 and is anticipated to register the fastest CAGR during the forecast period.

- Large enterprises are increasingly integrating zero trust principles across their entire IT infrastructure, including on-premises, cloud, and hybrid environments.

- Further, large enterprises are leveraging AI and ML for real-time threat detection, automated policy enforcement, and continuous risk assessment which in turn drives the zero trust security market expansion.

- Furthermore, growing adoption of technology to secure interactions with vendors, partners, and broader supply chain drives zero trust security market growth.

- For instance, according to IBEF, India's retail market is projected to expand significantly, reaching USD 1.6 trillion by 2026 with a robust annual growth rate of 10%. The growing retail sector will drive the need for enhanced data security in turn driving the market.

- Thus, based on analysis, focus on supply chain, comprehensive architectural overhaul, and integration of AI and ML is driving the market.

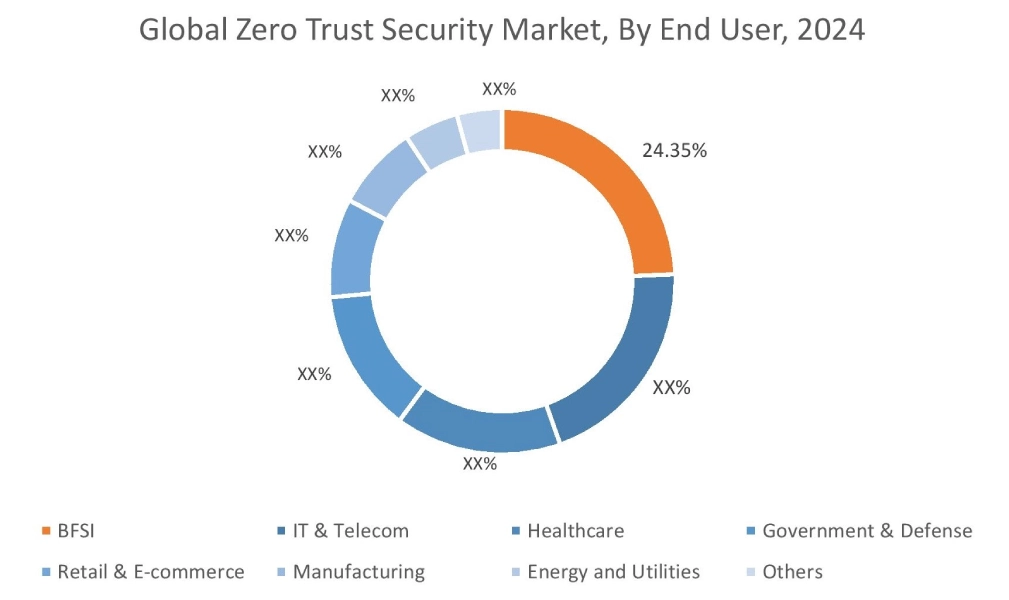

By End User:

Based on the end user, the market is segmented into BFSI, IT & telecom, healthcare, government & defense, retail & E-commerce, manufacturing, energy and utilities, and others.

Trends in the End User:

- Government & defense sector is investing in zero trust to protect national security, critical infrastructure, and highly classified information which in turn drives the zero trust security market share.

- In retail sector, immense volume of online transactions and sensitive customer data drives the market.

BFSI accounted for the largest revenue share of 24.35% in the year 2024.

- Financial institutions handle highly sensitive financial and personal data, making them prime targets for sophisticated cyberattacks in turn driving the market.

- Further, BFSI sector is heavily regulated which mandates robust cybersecurity measures that align well with zero trust principles.

- Furthermore, rapid adoption of online banking, mobile payments, and digital financial services is driving the market.

- For instance, in December 2024, Cognizant and Zscaler deepened their alliance by offering businesses a more robust and streamlined security approach. This collaboration empowers enterprises across various sectors to accelerate their cybersecurity modernization.

- Thus, as per zero trust security market analysis, high-value data, strict regulatory compliance, and digital transformation are driving the market.

Healthcare is anticipated to register the fastest CAGR during the forecast period.

- Patient health records (PHRs) are frequent targets for data breaches and ransomware attacks, driving the market.

- Further, healthcare sector faces an increasing volume and sophistication of cyberattacks, including ransomware, phishing, and insider threats, which can severely disrupt patient care and operations.

- Furthermore, widespread adoption of Electronic Health Records (EHRs), telehealth, remote patient monitoring, and Internet of Medical Things (IoMT) devices drive the market.

- Therefore, based on analysis, escalating cyber threats and digitalization is anticipated to boost the market during the forecast period.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

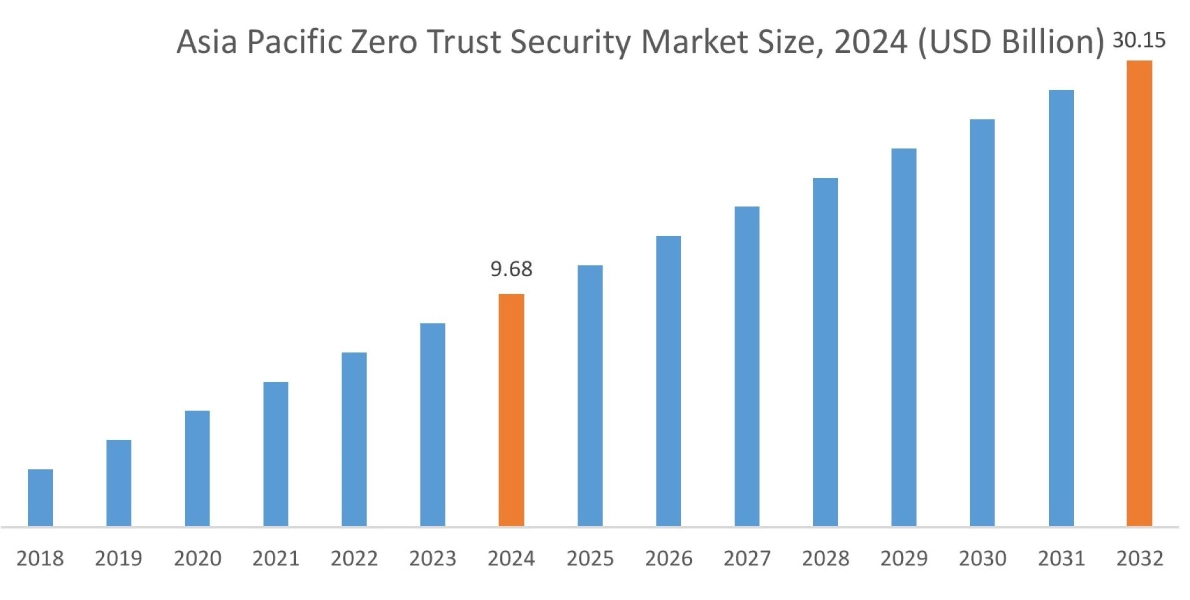

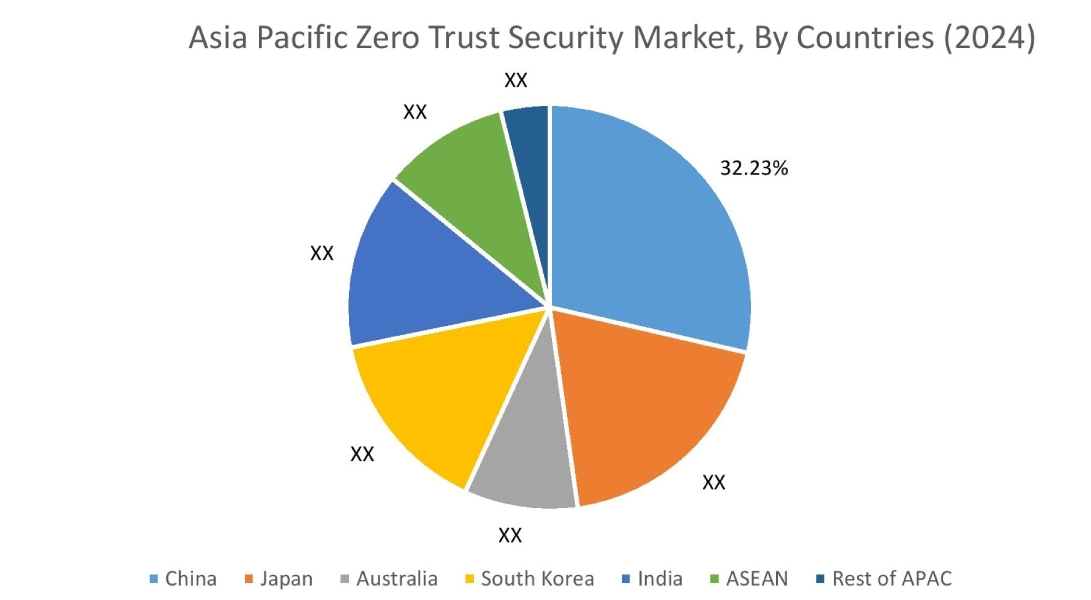

Asia Pacific region was valued at USD 9.68 Billion in 2024. Moreover, it is projected to grow by USD 11.02 Billion in 2025 and reach over USD 30.15 Billion by 2032. Out of this, China accounted for the maximum revenue share of 32.23%. The market for zero trust security is mainly driven by rapid industrialization and rapid pace of digital transformation. Additionally, growing e-commerce and retail industry is further driving the market.

- For instance, according to International Trade Administration, India is projected to have the fastest retail e-commerce rise between 2023 and 2027, boasting a CAGR of 14.1%. The rise in e-commerce is expected to drive the market growth.

North America is estimated to reach over USD 37.01 Billion by 2032 from a value of USD 12.38 Billion in 2024 and is projected to grow by USD 14.05 Billion in 2025. The North American market is primarily driven by high prevalence and increasing sophistication of cyberattacks, including data breaches and ransomware.

- For instance, in August 2023, National Cybersecurity Center of Excellence, a division of NIST, released a guide titled "Implementing a Zero Trust Architecture". This comprehensive publication provides practical, real-world examples and best practices for organizations to adopt Zero Trust.

The regional analysis depicts that stringent and evolving cybersecurity regulations and significant rise in sophisticated cyberattacks in Europe are driving the market. Additionally, factor driving the market in the Middle East and African region is state-sponsored threats and data breaches and a growing emphasis on data sovereignty. Further, acceleration of digital transformation initiatives and growing adoption of cloud services are paving the way for the progress of market trends in Latin America region.

Top Key Players and Market Share Insights:

The global zero trust security market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the zero trust security industry. Key players in the global zero trust security market include-

- Palo Alto Networks, Inc. (US)

- Check Point Software Technology Ltd. (Israel)

- CrowdStrike, Inc. (US)

- VMware Inc. (US)

- Symantec (US)

- Cisco Systems, Inc. (US)

- IBM Corporation (US)

- Microsoft (US)

- Fortinet, Inc. (US)

- Cloudflare, Inc. (US)

Recent Industry Developments :

Product Launch

- In March 2025, VMware announced rolling out of significant updates to vDefend, to boost enterprise progress towards a Zero Trust model. These advancements introduce capabilities like detailed micro-segmentation planning, air-gapped Network Detection and Response for high-security settings, and a more scalable Security Services Platform 5.0,

- In October 2024, Alkira, announced the launch of Alkira Zero Trust Network Access (ZTNA). This cloud-based service aims to transform secure access for modern enterprises by integrating zero trust principles with Alkira's network infrastructure expertise.

Zero Trust Security Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 109.44 Billion |

| CAGR (2025-2032) | 16.6% |

| By Offering |

|

| By Authentication Type |

|

| By Enterprise Size |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the zero trust security market? +

The zero trust security market is estimated to reach over USD 109.44 Billion by 2032 from a value of USD 36.76 Billion in 2024 and is projected to grow by USD 41.70 Billion in 2025, growing at a CAGR of 16.6% from 2025 to 2032.

What specific segmentation details are covered in the Zero Trust Security report? +

The zero trust security report includes specific segmentation details for offering, authentication type, enterprise size, end user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the zero trust security market, healthcare is the fastest growing segment during the forecast period.

Who are the major players in the zero trust security market? +

The key participants in the zero trust security market are Palo Alto Networks, Inc. (US), Cisco Systems, Inc. (US), IBM Corporation (US), Microsoft (US), Fortinet, Inc. (US), Cloudflare, Inc. (US), Check Point Software Technology Ltd. (Israel), CrowdStrike, Inc. (US), VMware Inc. (US), Symantec (US) and others.

What are the key trends in the Zero Trust Security market? +

The zero trust security market is being shaped by several key trends including escalation of cyber threats, widespread cloud adoption and digital transformation, and rise of growth of remote and hybrid work models.