Sales Force Automation Software Market Size:

Sales Force Automation Software Market size is estimated to reach over USD 21.83 Billion by 2032 from a value of USD 11.38 Billion in 2024 and is projected to grow by USD 12.15 Billion in 2025, growing at a CAGR of 9.4% from 2025 to 2032.

Sales Force Automation Software Market Scope & Overview:

Sales force automation software refers to an automation technology utilized to automate and streamline various tasks within a sales workflow, which include tasks such as lead management, sales forecasting, order & invoices management, and others. Additionally, the advantages include increased productivity, enhanced efficiency, and promoting sales progress, which in turn is fueling the sales force automation software market growth. Further, increasing focus on strategic activities such as closing deals and building customer relationships are propelling the sales force automation software market demand. Furthermore, increasing focus on customization in the dashboard is driving the sales force automation software industry.

How is AI Impacting the Sales Force Automation Software Market?

AI is transforming the sales force automation (SFA) software market by making sales processes more intelligent, personalized, and efficient. AI-powered tools analyze customer data, buying behaviors, and market trends to help sales teams prioritize leads and improve conversion rates. AI also automates repetitive tasks such as data entry, scheduling, and follow-ups, freeing sales professionals to focus on relationship building and strategy. Overall, AI is turning SFA software into a strategic driver of revenue growth and customer engagement worldwide.

Sales Force Automation Software Market Dynamics - (DRO) :

Key Drivers:

Integration of Generative AI with CRM is Boosting the Market Growth for Sales Force Automation Software

Generative AI helps to personalize customer interactions, automate tasks, and improve sales processes, which in turn is boosting the sales force automation software market demand. Further, the rising need to increase employee productivity as well as transform customer experiences is driving the integration of generative AI with software, which in turn is fueling the sales force automation software market growth.

- For instance, in May 2023, Salesforce collaborated with Accenture to leverage the power of generative AI into CRM aiming to increase employee productivity and transform customer experiences as well as harness generative AI effectively.

Therefore, the rising need to increase employee productivity as well as transform customer experiences is driving the adoption of generative AI capabilities, in turn proliferating the growth of the market.

Key Restraints :

High Implementation Cost is Restraining the Market Growth

The software requires significant upfront investment and ongoing subscription fees, which is hindering the sales force automation software market expansion. Further, the implementation of software in small and medium-sized enterprises requires training and skilled labor incorporating huge costs, which in turn is restraining the market adoption. Furthermore, ongoing maintenance and support costs also contribute to the overall financial burden restricting the market evolution.

Therefore, the high costs of implementation of software are hindering the sales force automation software market expansion.

Future Opportunities :

Surging Adoption of AI Agents is Expected to Promote Potential Opportunities for Market Growth

Businesses are leveraging AI agents to automate sales, service, and marketing tasks, which in turn handle complex workflows independently, boosting efficiency and productivity. Further, AI-powered agents are available 24/7 for customer service by resolving issues swiftly is fueling the market evolution. Furthermore, AI agents provide key benefits such as better decision-making, data-driven insights, and enhanced customer experience among others are driving sales force automation software market opportunities.

- For instance, in September 2024, Salesforce collaborated with IBM to launch AI and Autonomous Agents to help businesses improve productivity, maintain security, and adhere to regulations.

Hence, the rising adoption of AI agents is anticipated to increase the utilization of in turn promoting prospects for sales force automation software market opportunities during the forecast period.

Sales Force Automation Software Market Segmental Analysis :

By Deployment:

Based on the deployment, the market is bifurcated into cloud and on-premise.

Trends in the Deployment:

- The rising adoption of intelligent virtual assistants and chatbots to automate tasks is fueling the adoption of cloud deployment, which in turn is boosting the sales force automation software market trend.

Cloud accounted for the largest revenue share in the year 2024 and is anticipated to register the fastest CAGR during the forecast period.

- Cloud deployment offers advanced security measures for businesses and provides easy access to sales teams with stable internet connections.

- Additionally, the advantages of adopting cloud deployment including scalability, accessibility, security, and cost-effectiveness are driving the sales force automation software market share.

- Further, the integration of AI and machine learning to automate tasks, and predict customer behavior, and insights among others is propelling the adoption of cloud deployment, which in turn fuels the sales force automation software market size.

- Thus, as per the market analysis, the integration of AI and machine learning is driving the adoption of cloud deployment.

By Enterprise Size:

Based on the enterprise size, the market is bifurcated into large enterprises and SMEs.

Trends in the Enterprise Size:

- The trend towards growing retail and IT & telecom industry is paving the way for adoption by large enterprises.

- The increased focus on AI-powered insights is driving the adoption by large enterprises, which in turn is fueling the sales force automation software market trend.

Large Enterprises accounted for the largest revenue share in the year 2024.

- Large enterprises are dependent on data analytics to understand their sales performance and identify factors for improvement.

- Further, large enterprises are leveraging cloud-based automation software due to scalability, flexibility, and ability to handle complex data, which in turn fuels the sales force automation software market share.

- For instance, in April 2022, Salesforce announced the innovations in Salesforce Flow for empowering people, simplifying processes, and integrating systems. Additionally, Salesforce achieved a milestone by running 1.3 trillion automation on the Salesforce Platform, which in turn saved billions of work hours for enterprises.

- Thus, according to the sales force automation software market analysis, factors such as scalability, flexibility, and ability to handle complex data are driving the market adoption by large enterprises.

SMEs are anticipated to register the fastest CAGR during the forecast period.

- The SMEs leverage software to automate routine tasks, providing sales teams with data analysis to focus on building customer relationships for driving sales.

- Additionally, the expanding digital infrastructure is paving the way for market adoption by SMEs.

- Further, the emergence of startup culture is propelling the adoption of automation software, which in turn fuels the sales force automation software market size.

- Therefore, according to the sales force automation software market analysis, the expanding digital infrastructure as well as the emergence of startup culture are anticipated to boost the market during the forecast period.

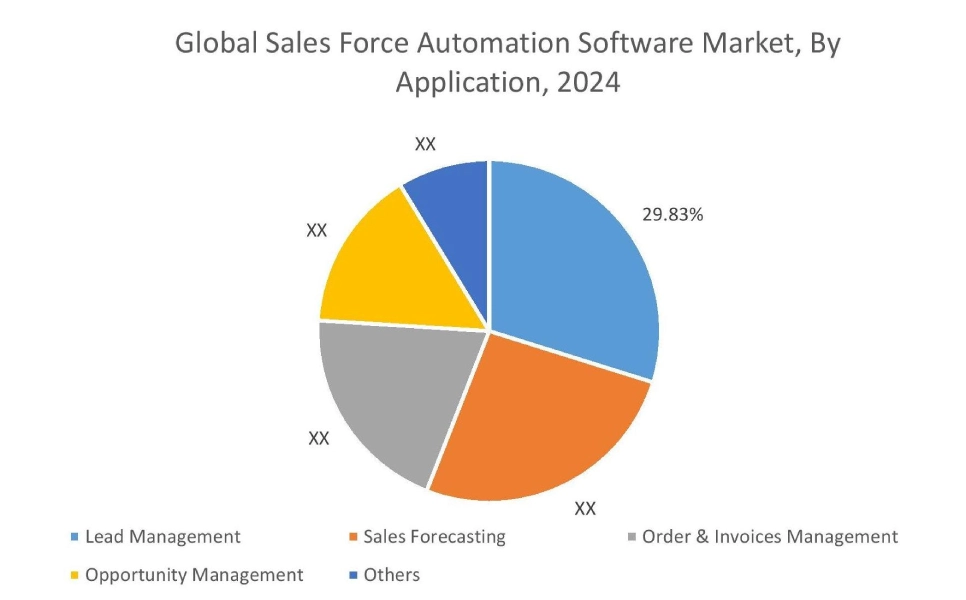

By Application:

Based on the application, the market is segmented into lead management, sales forecasting, order & invoices management, opportunity management, and others.

Trends in the Application:

- The trend towards rising demand for virtual customer engagement is driving the adoption of software for opportunity management.

- The trend towards adoption of order & invoice management to automate order process, reducing manual errors and ensuring faster and more accurate fulfillment.

Lead Management accounted for the largest revenue share of 29.83% in the year 2024.

- Lead management helps to improve sales processes by automating tasks and managing leads effectively.

- Additionally, the lead management software helps sales teams manage leads, track activities, and close deals.

- Further, businesses are increasingly leveraging AI and virtual assistants to streamline sales by generating real-time lead data, which in turn is driving the market progress.

- For instance, in September 2024, Nimble CRM launched lead engagement automation to fuel growth across the organization. The launch aims to manage the full customer journey.

- Thus, the rising adoption of AI and virtual assistants is driving the lead management segment.

Sales Forecasting is anticipated to register the fastest CAGR during the forecast period.

- Sales forecasting analyzes historical data and current sales performance to predict future sales with the help of software.

- Additionally, the growing retail and e-commerce business is paving the way for sales forecasting adoption.

- Further, the rising adoption of automation software for sales forecasting to predict future sales trends and improve forecasting accuracy.

- Therefore, as per the market analysis, the growing retail and e-commerce businesses are anticipated to boost the market during the forecast period.

By End User:

Based on the end user, the market is segmented into BFSI, retail, healthcare, telecom, manufacturing, automotive, media & entertainment, and others.

Trends in the End User:

- The rising adoption of IoT and connected devices is revolutionizing inventory management by providing real-time updates on stock levels in the retail sector is driving the market progress.

- The increasing demand for real-time product prediction analysis in the healthcare sector is driving market progress.

BFSI accounted for the largest revenue share in the market in 2024.

- The BFSI sector leverages software for cross-selling and upselling financial products across the globe.

- Further, the rising demand for real-time financial consulting and loan processing tracking is driving the market adoption by the BFSI sector.

- For instance, in March 2025, Bandhan Bank Collaborated with Salesforce to revolutionize its loan origination systems. The collaboration aims to deliver a seamless, digital-first experience for customers across 35 states and union territories in India.

- Thus, as per the market analysis, rising demand for real-time financial consulting and loan processing tracking is driving the market adoption by the BFSI sector.

Retail is anticipated to register the fastest CAGR during the forecast period.

- The key advantages of adopting software in the retail sector include increased productivity, improved customer experience, enhanced sales performance, and others.

- Further, the growing e-commerce sector is propelling the retail sector to leverage automation software to streamline sales operations and improve customer engagement, and others.

- Therefore, as per the market analysis, the growing e-commerce sector is anticipated to boost the market during the forecast period.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

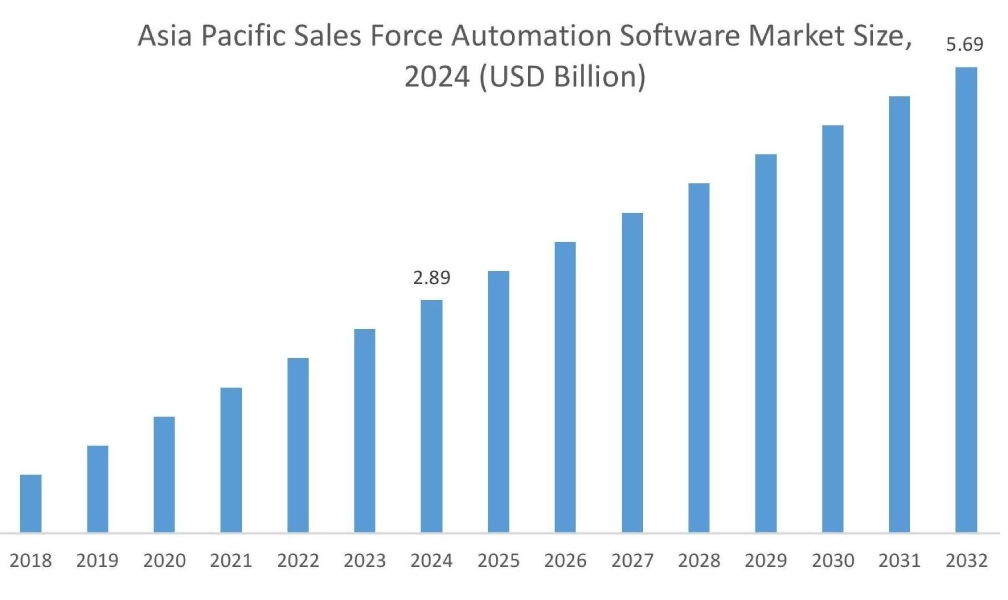

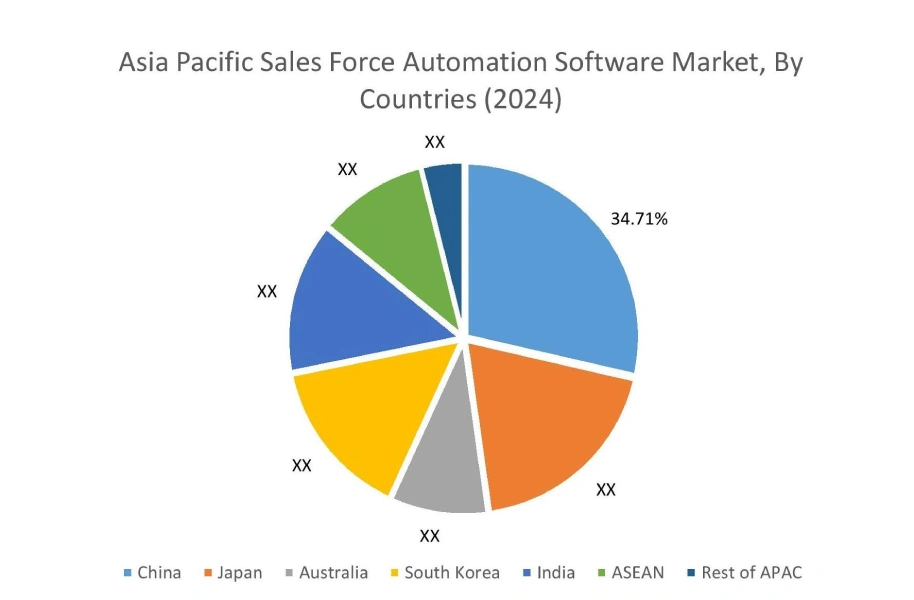

Asia Pacific region was valued at USD 2.89 Billion in 2024. Moreover, it is projected to grow by USD 3.09 Billion in 2025 and reach over USD 5.69 Billion by 2032. Out of this, China accounted for the maximum revenue share of 34.71%. The market is mainly driven by the rising adoption of AI agents into the software to autonomously execute tasks across business functions. Furthermore, factors including increasing focus on customer experience are projected to drive the market progress in the Asia Pacific region during the forecast period.

- For instance, in February 2025, Salesforce collaborated with Tata Play to drive AI-powered customer experience as well as enhance targeting, optimize campaigns, and deliver seamless, personalized experiences across platforms.

North America is estimated to reach over USD 7.62 Billion by 2032 from a value of USD 4.01 Billion in 2024 and is projected to grow by USD 4.28 Billion in 2025. The North American region's increasing focus on digital transformation to automate tasks, improve efficiency, and leverage data for better decision-making offers lucrative growth prospects for the market. Additionally, the increasing focus on building and maintaining strong customer relationships is driving the market evolution.

- For instance, in January 2024, Apex Systems collaborated with Salesforce to leverage Einstein, which is Salesforce’s AI technology. The collaboration aims to revolutionize the apex business by leveraging the generative AI capabilities of Einsteinto create customizable, predictive, and generative AI experiences to cater to business needs.

The regional evaluation depicts that the rising adoption of cloud-based deployments is driving the market in Europe. Additionally, the key factor driving the market is increasing technology adoption for enhancing customer experience is propelling the market adoption in the Middle East and African region. Further, key factors such as increased sales efficiency, reduced costs, and improved customer satisfaction are paving the way for the adoption of the market in the Latin America region.

Top Key Players & Market Share Insights:

The global sales force automation software market is highly competitive with major players providing sales force automation software to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end user launches to hold a strong position in the sales force automation software industry. Key players in the sales force automation software market include-

- Microsoft Corporation (USA)

- Infor Inc. (Koch Industries Inc)(USA)

- Consensus Sales Inc.(Georgia)

- Aptean Inc.(USA)

- SugarCRM Inc (USA)

- SAP SE (Germany)

- com Inc.(USA)

- Pegasystems Inc(USA)

- Zoho Technologies Private Limited(USA)

- Oracle Corporation(USA)

Recent Industry Developments :

Product launches

- In March 2025, Salesforce launched AgentExchange designed for partners, developers, and Agentblazers. The platform aims to quickly deploy AI agents to improve productivity, efficiency, and innovation in any profession or industry.

Partnerships & Collaborations

- In February 2025, Salesforce collaborated with Google to integrate Gemini models into Agentforce. The collaboration aims to provide crucial flexibility, which in turn empowers customers to develop tailored AI solutions that meet their specific needs.

Sales Force Automation Software Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 21.83 Billion |

| CAGR (2025-2032) | 9.4% |

| By Deployment |

|

| By Enterprise Size |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the sales force automation software market? +

The sales force automation software market size is estimated to reach over USD 21.83 billion by 2032 from a value of USD 11.38 billion in 2024 and is projected to grow by USD 12.15 billion in 2025, growing at a CAGR of 9.4% from 2025 to 2032.

Which segmentation details are covered in the sales force automation software report? +

The sales force automation software report includes specific segmentation details for deployment, enterprise size, application, end user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the sales force automation software market, sales forecasting is the fastest-growing segment during the forecast period due to the growing retail and e-commerce business.

Who are the major players in the sales force automation software market? +

The key participants in the sales force automation software market are Microsoft Corporation (USA), Infor Inc. (Koch Industries Inc.) (USA), Consensus Sales Inc. (Georgia), Aptean Inc. (USA), Zoho Technologies Private Limited (USA), SugarCRM Inc (USA), SAP SE (Germany), Salesforce.com Inc. (USA), Pegasystems Inc (USA), Oracle Corporation (USA) and others.

What are the key trends in the sales force automation software market? +

The sales force automation software market is being shaped by several key trends including the rising adoption of voice assistants and chatbots to automate tasks as well as the rising adoption of IoT and connected devices and other are the key trends driving the market.