Private Cloud Market Size:

Private Cloud Market is estimated to reach over USD 265.81 Billion by 2032 from a value of USD 130.40 Billion in 2024 and is projected to grow by USD 141.02 Billion in 2025, growing at a CAGR of 10.4% from 2025 to 2032.

Private Cloud Market Scope & Overview:

A private cloud is a cloud computing environment where all hardware and software resources are dedicated exclusively to a single organization. It offers enhanced control, security, and customization for that organization's specific needs, unlike public clouds where resources are shared among multiple tenants. Further, benefits including cost efficiency, enhanced control, security, customization, and improved performance drive the market growth. Also, increasing deployment in telecommunications, finance, healthcare, and government sector drives the market. Furthermore, key trends driving the market include increasing demand for enhanced data security and compliance, growing adoption of hybrid cloud architectures, and surge in AI-driven cloud automation.

How is AI Transforming the Private Cloud Market?

AI is transforming the private cloud market by enhancing automation, efficiency, and security. It helps optimize resource allocation, predict system failures, and automate routine IT tasks, reducing manual efforts and operational costs. AI-powered analytics offer deeper insights into workload performance, enabling smarter decision-making and improved scalability. In private cloud environments, AI also strengthens security by detecting anomalies, managing threats in real time, and ensuring compliance. Additionally, it supports intelligent data management by automating backup, recovery, and storage processes. As businesses demand more control and agility, AI is becoming essential in making private cloud systems more responsive, resilient, and cost-effective, driving their adoption across various industries.

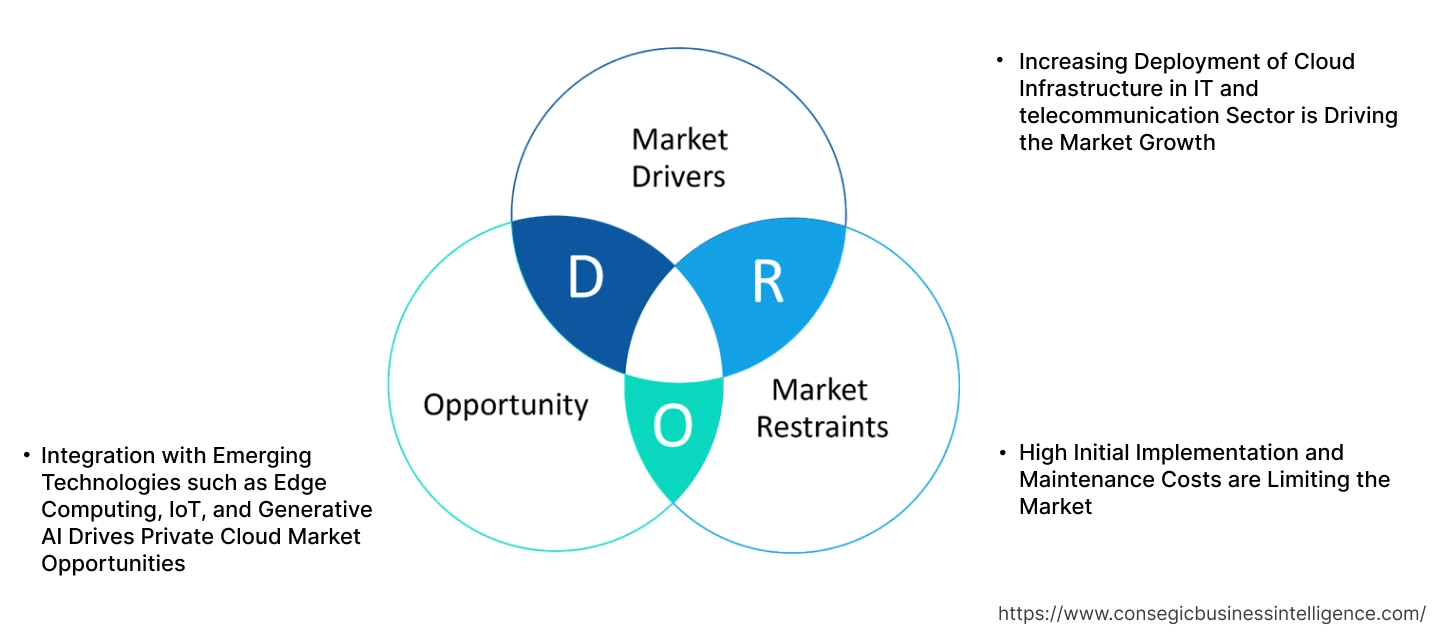

Private Cloud Market Dynamics - (DRO) :

Key Drivers:

Increasing Deployment of Cloud Infrastructure in IT and telecommunication Sector is Driving the Market Growth

IT and telecommunication sectors are rapidly adopting cloud infrastructure, significantly driving market growth. The widespread adoption is fueled by the cloud's inherent scalability and agility, allowing these industries to quickly expand network capacity and deploy innovative services like 5G and IoT. Further, by virtualizing network functions and shifting from rigid hardware to flexible software-defined solutions, companies are achieving substantial cost reductions and enhanced operational efficiency. Furthermore, cloud environments enable faster time-to-market for new offerings, foster seamless collaboration, and improve data analytics capabilities.

- For instance, in 2022, NTT Docomo Inc.a Japanese telecommunication company, migrated its on-premises data platform to Amazon Web Services (AWS) cloud platform. NTT Docomo’s shift to cloud-based environment enabled the company to adapt to the needs of individual organizations while establishing data catalogs for easier analytics.

Thus, increasing adoption of 5G and IoT is driving the deployment of cloud infrastructure in IT and telecommunication sector.

Key Restraints :

High Initial Implementation and Maintenance Costs are Limiting the Market

High initial implementation and ongoing maintenance costs pose a significant challenge to the market's expansion. Building a dedicated cloud environment necessitates substantial upfront capital expenditure for hardware, software licenses, data center space, power, and cooling. This heavy initial investment can be prohibitive for many organizations, especially small and medium-sized enterprises (SMEs) with limited budgets. Further, once deployed, internal clouds require continuous financial outlay for maintenance, regular upgrades, adding capacity, and retaining a specialized, skilled IT workforce. The recurring operational expenses, coupled with the complexity of managing such an intricate infrastructure limits broader market penetration for cloud solutions.

Future Opportunities :

Integration with Emerging Technologies such as Edge Computing, IoT, and Generative AI Drives Private Cloud Market Opportunities

The increasing integration of clouds with emerging technologies like edge computing, IoT, and generative AI is creating substantial market opportunities. Edge computing leverages dedicated cloud environment by processing data closer to its source, like IoT devices which in turn drastically reduce latency and enable real-time analytics for applications such as smart factories and autonomous vehicles. Further, local processing within a private environment also bolsters data sovereignty and security. Furthermore, internal clouds provide the secure, high-performance infrastructure necessary for training and deploying large generative AI models, allowing organizations to harness AI's power for tasks like content creation or advanced analytics while maintaining full control over sensitive data. This convergence transforms internal clouds from mere infrastructure into powerful platforms for advanced, data-intensive applications.

- For instance, in April 2025, Alibaba Cloudsignificantly bolstered its AI capabilities for international customers, announcing new AI models, tools, and infrastructure upgrades at its Spring Launch 2025 event.

Thus, edge computing, IoT, and generative AI transform clouds from mere infrastructure into powerful platforms for advanced, data-intensive applications which in turn drive private cloud market opportunities.

Private Cloud Market Segmental Analysis :

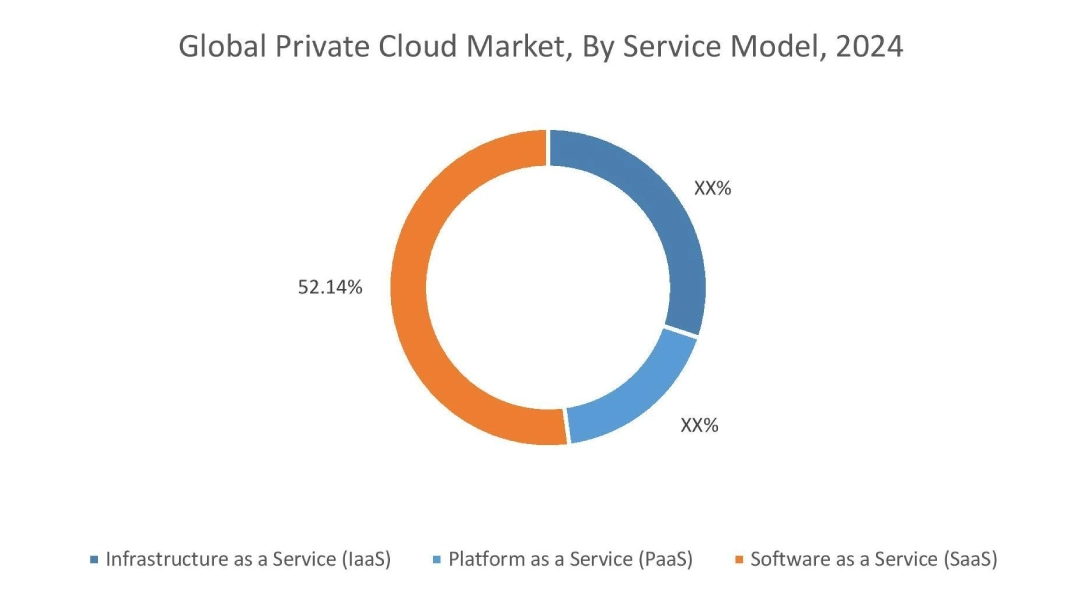

By Service Model:

Based on the service model, the market is segmented into Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS).

Trends in the Service Model:

- SaaS providers are embedding AI into their applications to offer enhanced features, such as predictive analytics, automated workflows, and personalized services which in turn drive the private cloud market trends.

- PaaS providers are implementing security-first models, including Zero Trust frameworks and AI-powered threat detection which is expected to drive private cloud market size.

Software as a Service accounted for the largest revenue share of 52.14% in the year 2024.

- There is a growing trend of specialized SaaS applications tailored to specific industries such as healthcare and finance, offering customized features which in turn drives the private cloud market share.

- Further, there is an increasing need for solutions that offer stringent data protection measures and meet specific regulatory requirements, such as GDPR and HIPAA.

- Furthermore, businesses are leveraging SaaS solutions that operate seamlessly across both private and public infrastructures which in turn drives private cloud market trends.

- Thus, as per analysis, industry-specific solutions, focus on enhanced data security, and adoption of hybrid SaaS models are driving the market.

Infrastructure as a Service (IaaS) is anticipated to register the fastest CAGR during the forecast period.

- IaaS providers are increasingly embedding AI capabilities to automate resource management, optimize performance, and reduce manual intervention.

- Further, IaaS providers are focusing on energy-efficient data centers propelling the private cloud market expansion.

- Furthermore, IaaS providers are offering serverless options, allowing organizations to run applications without managing underlying servers, which in turn drive the market.

- Therefore, based on analysis, serverless computing, focus on eco-friendly infrastructure, and AI-driven automation are anticipated to boost the market during the forecast period.

By Deployment Model:

Based on the deployment model, the market is segmented into on-premises, Virtual Private Cloud (VPC), managed/hosted private cloud, and hybrid cloud.

Trends in the Deployment Model:

- Organizations are deploying AI and ML workloads directly on-premises for real-time analytics and enhanced security in turn driving the private cloud market share.

On-premises accounted for the largest revenue share of 40.18% in the year 2024.

- Organizations are moving from public clouds to on-premises clouds to gain better cost control, performance, and data sovereignty.

- Further, on-premises clouds are increasingly leveraging open-source cloud technologies like OpenStack and Kubernetes which in turn drive the private cloud industry.

- Furthermore, stricter data protection regulations are driving companies to keep sensitive data within their own physical control.

- For instance, Microsoft offers Azure Stack/Azure Arc which allows customers to run Azure services and applications in their own data centers or other environments.

- Thus, as per private cloud market analysis, aforementioned factors are driving the market.

Managed/Hosted Private Cloud is anticipated to register the fastest CAGR during the forecast period.

- Businesses are increasingly turning to managed cloud providers to offload the day-to-day management, maintenance, and security operations.

- Further, managed/hosted solutions offer more predictable cost models and guaranteed performance which in turn propels the private cloud market expansion.

- Therefore, based on analysis, outsourcing operational complexity and focus on predictable costs and performance are anticipated to boost the market during the forecast period.

By Enterprise Size:

Based on the enterprise size, the market is small and medium-sized enterprises (SMEs) and large enterprises.

Trends in the Enterprise Size:

- SMEs are starting to adopt cloud solutions that incorporate AI capabilities for routine IT operations, such as automated resource management, backup, and disaster recovery which in turn drives the private cloud market.

Large enterprises accounted for the largest revenue share in the year 2024.

- Large enterprises are actively moving specific workloads back from public to internal clouds to gain better cost predictability, performance, and control.

- Further, ability to implement granular security controls, robust governance frameworks, and strict compliance measures drive the private cloud market growth.

- For instance, In April 2025, HPE announced significant developments to its HPE Aruba Networking and HPE GreenLake cloud portfolios, enhancing secure connectivity and hybrid cloud operations with multi-layered, zero-trust security. Additionally, HPE Private Cloud Enterprise now offers threat-adaptive security to support DORA compliance, enabling temporary disconnection from the public internet upon detecting network threats.

- Thus, based on analysis, aforementioned factors are expected to drive the market growth during forecast period.

Small and medium-sized enterprises (SMEs) is anticipated to register the fastest CAGR during the forecast period.

- SMEs are leaning towards managed or hosted cloud services to access enterprise-grade security and performance.

- Further, SMEs are attracted to the predictable budgeting offered by internal cloud which in turn drives the private cloud market demand.

- Furthermore, SMEs are becoming more aware of data privacy regulations and security risks in turn drive the market.

- Therefore, emphasis on data security, cost predictability, and increased adoption of managed services are anticipated to boost the market during the forecast period.

By End-Use:

Based on the end user, the market is segmented into BFSI, government and defense, healthcare and life sciences, IT and telecom, manufacturing, retail and e-commerce, energy and utilities, and others.

Trends in the End User:

- Telecom operators are heavily investing in cloud solutions to deploy their 5G core networks and integrate edge computing capabilities which in turn drive the market.

- Increasing trend of industry 4.0 and smart factory integration is driving the private cloud market demand.

BFSI accounted for the largest revenue share in the year 2024.

- Financial institutions are increasingly adopting cloud solutions to meet strict regulatory requirements like GDPR, PCI DSS, and local data residency laws.

- Further, greater agility, scalability, and rapid deployment is driving the private cloud market growth.

- Furthermore, there is an increasing adoption of AI/ML for fraud detection and risk management.

- For instance, In March 2025, Tata Communications unveiled Tata Communications Vayu, a cutting-edge cloud platform designed to revolutionize enterprise IT. Vayu offers AI-powered scalability with on-demand NVIDIA GPUs and automation, simplifies multi-cloud and DevOpswith vendor-agnostic tools, and ensures robust security and compliance with a zero-trust framework.

- Thus, as per private cloud market analysis, enhanced data sovereignty, and AI/ML integration are driving the market.

Healthcare and Life Sciences is anticipated to register the fastest CAGR during the forecast period.

- Healthcare organizations are deploying AI models on cloud for advanced diagnostics, predictive analytics for patient outcomes, and clinical decision support.

- Further, necessity to comply with strict regulations like HIPAA (for patient data) and GDPR (for privacy) is a major driver.

- Furthermore, with the rise of virtual care, cloud solution ensures the secure and high-performance delivery of telemedicineplatforms which in turn drive the market.

- Therefore, based on analysis, AI for diagnostics, data privacy, and secure telemedicine are driving the market.

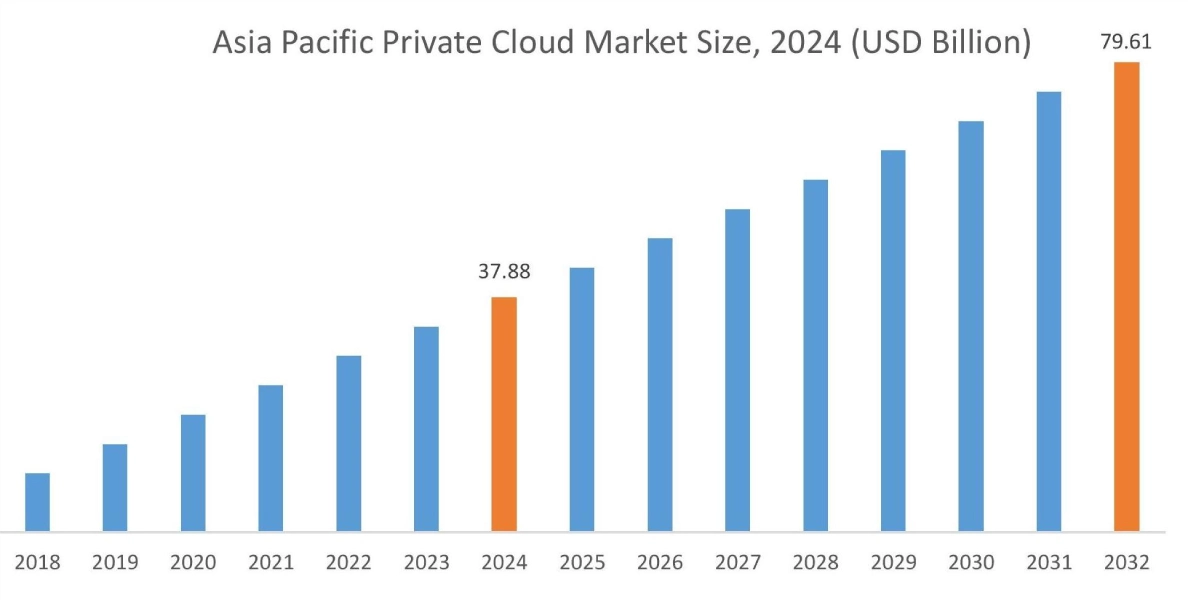

Regional Analysis:

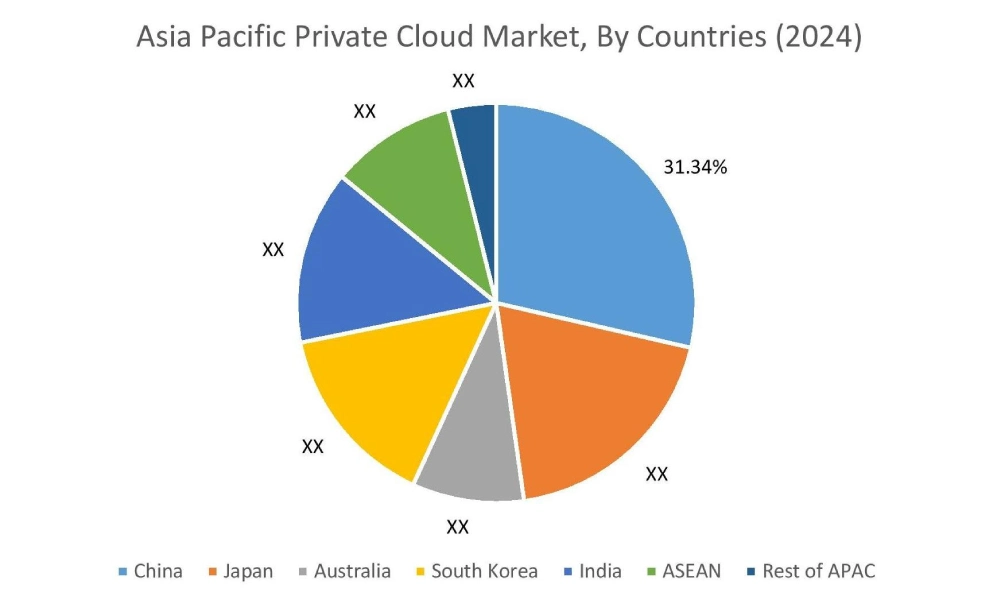

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 37.88 Billion in 2024. Moreover, it is projected to grow by USD 41.07 Billion in 2025 and reach over USD 79.61 Billion by 2032. Out of this, China accounted for the maximum revenue share of 31.34%. The market for dedicated cloud environment is mainly driven by raising adoption of hybrid and multi-cloud strategies, desire for greater control over IT infrastructure, and the ongoing initiatives. Additionally, growing e-commerce industry is further driving the market.

- For instance, according to International Trade Administration, India is projected to have the fastest retail e-commerce rise globally among major 20 countries between 2023 and 2027, boasting a CAGR of 14.1%. The rise in e-commerce is expected to boost the market growth.

North America is estimated to reach over USD 87.16 Billion by 2032 from a value of USD 42.64 Billion in 2024 and is projected to grow by USD 46.12 Billion in 2025. The North American market is primarily driven by growing digitalization of retail, BFSI, and healthcare sectors and strong emphasis on data security and regulatory compliance.

- For instance, in December 2024, AWS PrivateLink expanded its capabilities, allowing users to privately and securely access VPC resources like databases or clusters via VPC endpoints.

The regional analysis depicts that stringent data sovereignty, compliance requirements, and increasing demand for enhanced security in Europe is driving the market. Additionally, factors driving the market in the Middle East and African region are accelerated digital transformation initiatives and significant government and enterprise investments in smart city projects and AI-driven cloud solutions. Further, increasing focus on data security and regulatory compliance and increasing adoption of advanced technologies like AI and IoT is paving the way for the progress of market trends in Latin America region.

Top Key Players & Market Share Insights:

The global private cloud market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the private cloud industry. Key players in the global private cloud market include-

Recent Industry Developments :

Product Launch

In May 2025, Hewlett Packard Enterprise (HPE) announced significant advancements to its private cloud portfolio. The aim was to redefine enterprise hybrid IT with improved cost efficiency, performance, and simplicity. Further, a key introduction is HPE Private Cloud Business Edition, which is expected to cut VM license costs by up to 90% through multi-hypervisor support and self-service consumption.

Private Cloud Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 265.81 Billion |

| CAGR (2025-2032) | 10.4% |

| By Service Model |

|

| By Deployment Model |

|

| By Enterprise Size |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the private cloud market? +

The private cloud market is estimated to reach over USD 265.81 Billion by 2032 from a value of USD 130.40 Billion in 2024 and is projected to grow by USD 141.02 Billion in 2025, growing at a CAGR of 10.4% from 2025 to 2032.

What specific segmentation details are covered in the private cloud report? +

The private cloud report includes specific segmentation details for service model, deployment model, enterprise size, end user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the private cloud market, Infrastructure as a Service (IaaS) is the fastest-growing segment during the forecast period.

Who are the major players in the private cloud market? +

The key participants in the private cloud market are Microsoft (US), Amazon.com, Inc. (US), Cisco Systems, Inc. (US), Alphabet Inc. (US), Broadcom (US), IBM (US), Oracle (US), Hewlett Packard Enterprise Development LP (US), Dell Inc. (US), Cisco (US), Alibaba (China), Nutanix (US) and others.

What are the key trends in the private cloud market? +

The private cloud market is being shaped by several key trends including increasing need for enhanced data security, adoption of hybrid cloud architecture, and surge in AI driven automation.