Truck Bedliners Market Size:

Truck Bedliners Market size is estimated to reach over USD 814.17 Million by 2032 from a value of USD 600.64 Million in 2024 and is projected to grow by USD 613.47 Million in 2025, growing at a CAGR of 4.1% from 2025 to 2032.

Truck Bedliners Market Scope & Overview:

Truck bedliners refer to a type of protector that is applied or installed onto a truck's cargo space to protect it from scratches and dents. The bed liners are either spray-on or 1drop and offer a layer of protection in the truck beds when goods are kept in the beds. Further, bed liners protect the space from unwanted sliding of cargo by providing a rough surface. Moreover, the rising adoption of bed liners for light-duty trucks owing to the ample amount of cargo space in the trucks and the need to protect the cargo space is driving the market.

How is AI Transforming the Truck Bedliners Market?

AI is transforming the truck bedliners market by improving material innovation, production efficiency, and customization. Through AI-driven simulations, manufacturers can design bedliners with enhanced durability, chemical resistance, and impact strength, optimizing formulations for different truck models and usage conditions. Machine learning also streamlines manufacturing by predicting equipment performance, reducing defects, and minimizing material waste. AI-powered analytics help companies forecast demand trends and tailor products to consumer preferences, such as texture, coating type, or finish. Additionally, AI supports automated quality inspections, ensuring consistent product standards. As the automotive industry shifts toward smarter and more sustainable solutions, AI is driving advancements that make truck bedliners more reliable, efficient, and aligned with evolving customer needs globally.

Truck Bedliners Market Dynamics - (DRO) :

Key Drivers:

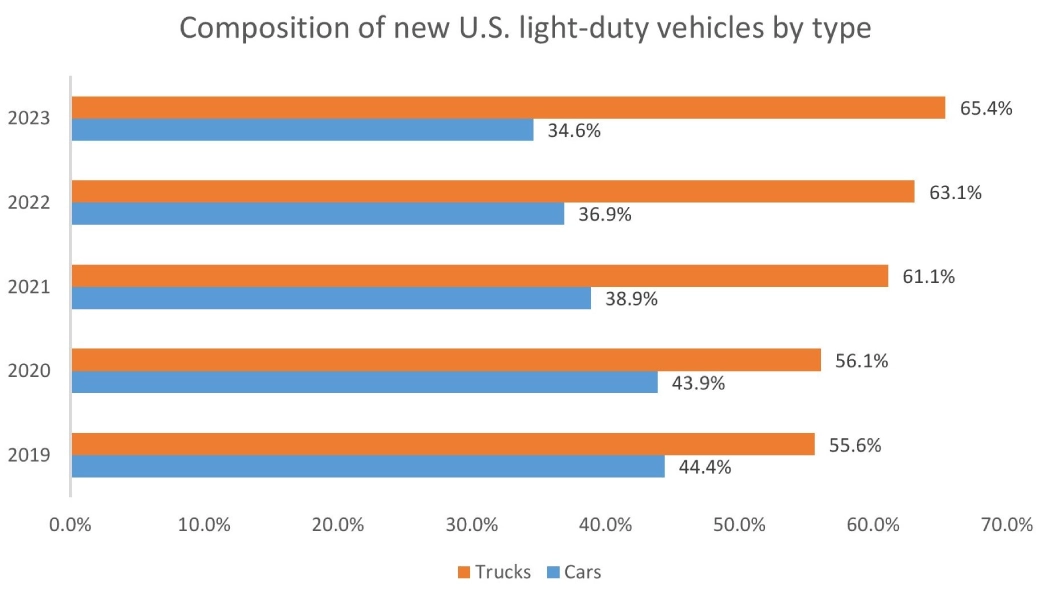

Rising Ownership of Pickup Trucks is Propelling the Truck Bedliners Market Growth

Pickup trucks offer various benefits including increased cargo space and towing capabilities. Moreover, the trucks are known for their durability and off-road capability making them suitable for both on-road and off-road tasks. Additionally, the rising number of pickup truck launches by major vehicle producers with various features including increased towing and payload is driving the overall market as bedliners are often utilized in pickup trucks to protect the cargo space.

- For instance,according to a report by the S. Environmental Protection Agency , in the year 2023, trucks accounted for approximately 65.4% of the new light-duty vehicles in the U.S. The truck category includes pickup trucks, minivans, vans, and SUVs that are greater than 6000 pounds.

Hence, the rising ownership of pickup trucks due to increased cargo space and payload and the growing need for bedliners to improve truck bed durability is driving the truck bedliners market size.

Key Restraints:

Quality and Wear Issues are Restraining the Truck Bedliners Market Growth

Low-priced bedliners typically use low-quality plastic which is vulnerable to cracking and warping resulting in fitment problems. Additionally, the surface material of certain drop-in bedliners is slippery which can cause the cargo to slide around the truck space. Moreover, bedliners require professional fitting from garages to ensure proper coating and adhesion which can be expensive for consumers, especially consumers who prefer DIY fitting.

Thus, low-quality raw materials, slippery surfaces, and costs of professional fitting act as a restraint to the truck bedliners market expansion.

Future Opportunities :

Rising Adoption of Bed Liners in Hybrid Trucks is Expected to Drive the Truck Bedliners Market Opportunities

Hybrid trucks have experienced a growing adoption due to their improved fuel economy and reduced emissions. Further, many governments have started offering tax incentives to end consumers to incentivize them to purchase hybrid and electric vehicles including trucks which has increased the sales of the trucks. Moreover, the increasing number of bed liner offerings by companies for hybrid trucks is driving the market.

- For instance,Ford offers a bedliner with a ribbed floor for its F-150 2024-2025 model. The F-150 features a 3.5L PowerBoost Hybrid V6 engine for optimized power and capability.

Thus, the rising adoption of bedliners in hybrid trucks is projected to drive the truck bedliners market opportunities during the forecast period.

Truck Bedliners Market Segmental Analysis :

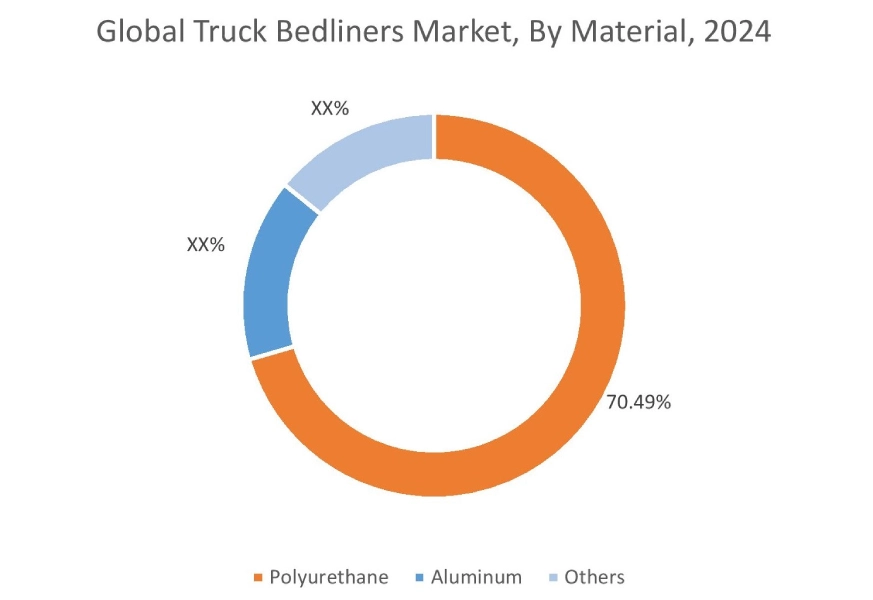

By Material:

Based on the material, the market is segmented into polyurethane, aluminium, and others.

Trends in the Material:

- Increasing adoption of polyurethane due to its protection against rust is driving the truck bedliners market share.

- Rising utilization of aluminum for moving various items including wood and soil is driving the truck bedliners market trends.

Polyurethane accounted for the largest revenue share of 70.49% in the year 2024 and is anticipated to register the fastest CAGR during the forecast period.

- Polyurethane is known for its durability and resistance to abrasion which has increased the adoption of the material in bedliners.

- Additionally, there has been a rising adoption of polyurethane coatings to provide UV radiation protection, which is driving the market.

- Moreover, manufacturers have started polyurethane bed liner kits that can be applied to different surfaces including plastic and metal.

- For instance,Herculiner offers a bed liner kit that allows the user to cover the truck bed surface with a textured polyurethane coating that provides a skit-resistant coating when cured.

- According to the market analysis, the rising advancements related to polyurethane due to better durability and abrasion resistance are driving the truck bedliners market trends.

By Product Type:

Based on the product type, the market is segmented into drop-in and spray-on.

Trends in the product type:

- Rising trend towards the adoption of spray-on due to better quality and the enhanced visual appeal is driving the global truck bedliners market.

- Increasing utilization of drop-in due to ease of replicability when the bedliner gets damaged has resulted in the growth of the market.

Spray-on accounted for the largest revenue share in the year 2024.

- Spray-on bedliner is a type of bedliner that involves spraying the surface of the truck to create a durable layer.

- Additionally, spray-on bedliners have experienced a rising adoption due to the fact that they keep the truck beds in excellent condition which can increase the resell value of the trucks in the long term.

- Moreover, manufacturers have started offering spray-on bedliners that offer impact and gouge resistance for protection in extreme cases.

- For instance,LINE-X offers spray-on bedliners that offer high-impact resistance and a variety of colors to complement the color of the truck.

- According to the analysis, increasing utilization of spray-on due to high impact resistance and increased resale value of the truck is driving the truck bedliners market expansion.

Drop-in is anticipated to register the fastest CAGR during the forecast period.

- Drop-in bedliner is a prefabricated liner that is budget friendly and can be installed by placing it onto the truck bed.

- Moreover, manufacturers have started offering drop-in bedliners that integrate molded-in board holders and tailgate cup holders which is driving the market, as per the market trends.

- For instance,Penda offers DuraLiner drop-in bedliners that offer 7 times more protection than spray-on bedliners that integrate molded-in board holders for better cargo organization.

- According to the market analysis, the increasing adoption of drop-in due to cheaper prices and integration molded-in board holders is anticipated to boost the truck bedliners market demand during the forecast period.

By Vehicle:

Based on the vehicle, the market is segmented into light-duty trucks and heavy-duty trucks.

Trends in the vehicle:

- Increasing adoption of truck bedliners in light-duty trucks especially pick-up trucks to improve the functionality of the truck bed is driving the market.

- Rising adoption of truck bedliners in heavy-duty trucks for hassle-free sweeping of stuck materials in the trucks during the unloading of goods is driving the market growth.

Light-duty trucks accounted for the largest revenue share in the year 2024 and it is anticipated to register the fastest CAGR during the forecast period.

- Light-duty trucks offer improved fuel efficiency and maneuverability which has driven the segment.

- Further, the increasing utilization of light-duty truck bedliners in last-mile delivery to minimize the damage to delicate and fragile goods is driving the market.

- Moreover, there has been a rising adoption of light-duty trucks in developing countries due to their low prices and utilization in supply chains which is driving the truck bedliners market demand.

- For instance,Tata Motors reported intermediate and light commercial vehicle sales of 68,606 for FY 2022-23, witnessing an increase of 5.3% compared to the previous year.

- Therefore, the increasing demand for bedliners for light-duty trucks to deliver fragile goods in last-mile delivery is driving the truck bedliners market size.

By Sales Channel:

Based on the sales channel, the market is segmented into original equipment manufacturers (OEMs) and aftermarket.

Trends in the Sales Channel:

- There has been a rising adoption of aftermarket bedliners due to lower costs and wider offerings which are driving the market.

- Increasing utilization of OEM bedliners due to superior quality of materials and intricate fitting on the truck beds is driving the market.

Aftermarket accounted for the largest revenue share in the year 2024 and it is anticipated to register the fastest CAGR during the forecast period.

- Aftermarket has experienced growing adoption due to the increasing need for spray-on bedliners that can retain the surface grip even in harsh weather conditions.

- Moreover, the increasing consumer spending on vehicle maintenance and repairs to protect the vehicle from damages and increase its longevity is driving the overall market as bedliners are also a form of maintenance to protect the vehicle from paint destruction.

- For instance, according to FRED, vehicle maintenance and repairs for all consumer units stood at USD 975, witnessing a growing trend over the last ten years.

- Thus, increasing adoption of aftermarket bedliners due to utilization in harsh weather conditions and rising vehicle maintenance spending is driving the overall market.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

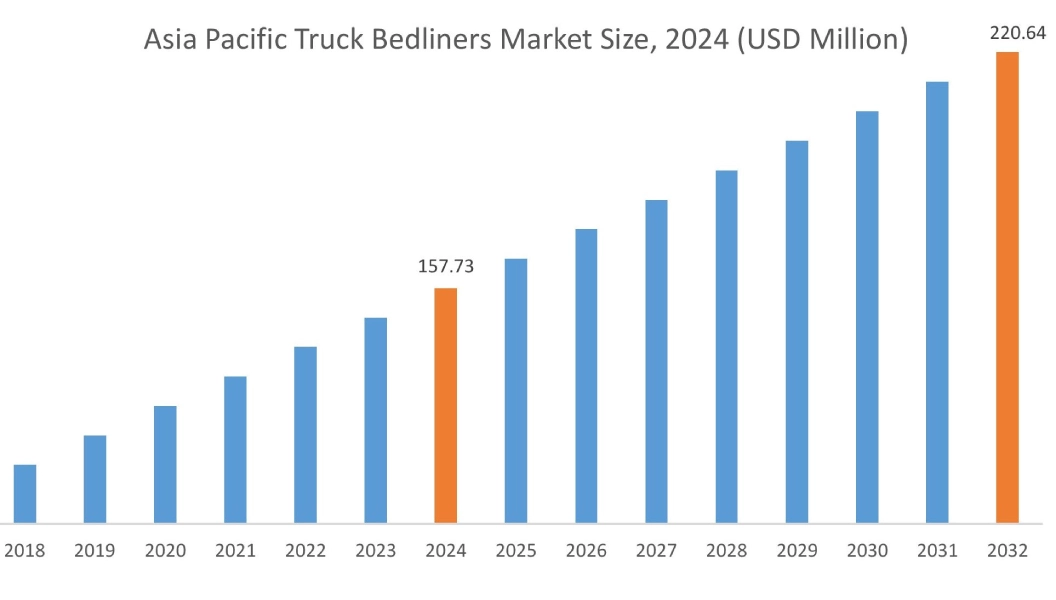

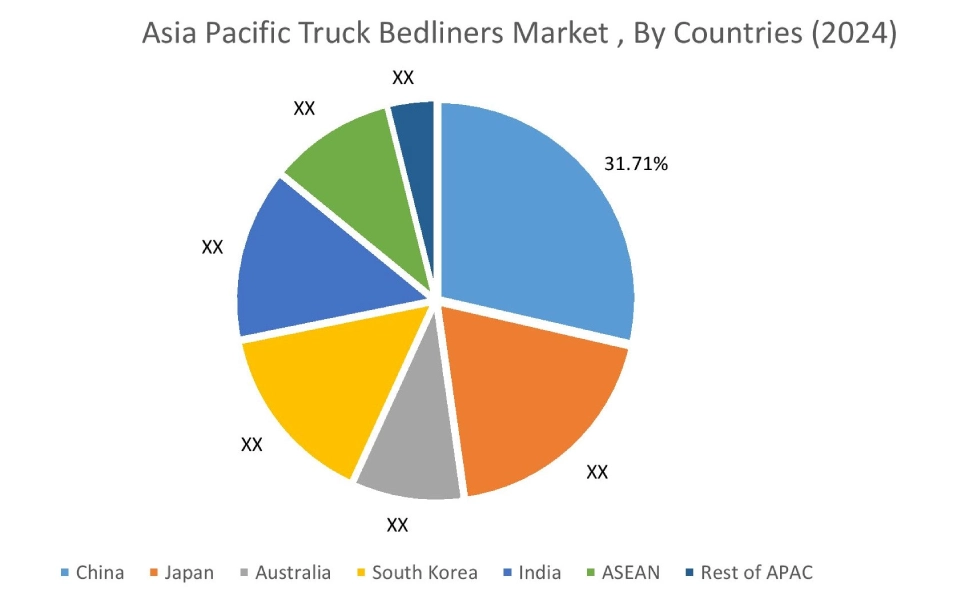

Asia Pacific region was valued at 157.73 Million in 2024. Moreover, it is projected to grow by 161.52 Million in 2025 and reach over 220.64 Million by 2032. Out of this, China accounted for the maximum revenue share of 31.71%. As per the truck bedliners market analysis, the growth in the Asia-Pacific region is primarily driven by the rising utilization of polyurethane bedliners and increasing demand for aftermarket auto components.

- For instance, according to ACMA, the Indian auto component aftermarket grew by about 10% in FY-24. The increasing reliance on aftermarkets by Indian consumers is also expected to boost the bedliners market as more consumers turn to affordable options for truck bedliners.

North America is estimated to reach over USD 284.63 Million by 2032 from a value of USD 209.23 Million in 2024 and is projected to grow by USD 213.76 Million in 2025. In North America, the growth of truck bedliners industry is driven by the growing e-commerce sector due to the increasing adoption of online platforms for purchasing the bedliners. Moreover, the increasing sales of light vehicles has resulted in the rise of truck bedliners market share.

- For instance,according to the Alliance for Automotive Innovation, U.S. light vehicle sales stood at 15.5 million in the year 2023. The increase in sales is expected to boost the market as bedliners are a popular add-on accessory for light vehicles.

Additionally, the regional analysis depicts that the growing investments in the production of polyurethane are driving the market demand in Europe. Furthermore, as per the market analysis, the market demand in Latin America is expected to grow at a considerable rate due to rising income levels. Middle East and African regions are expected to grow at a considerable rate due to factors such as rising ownership of heavy-duty trucks and growing investments in the production of aluminum among others.

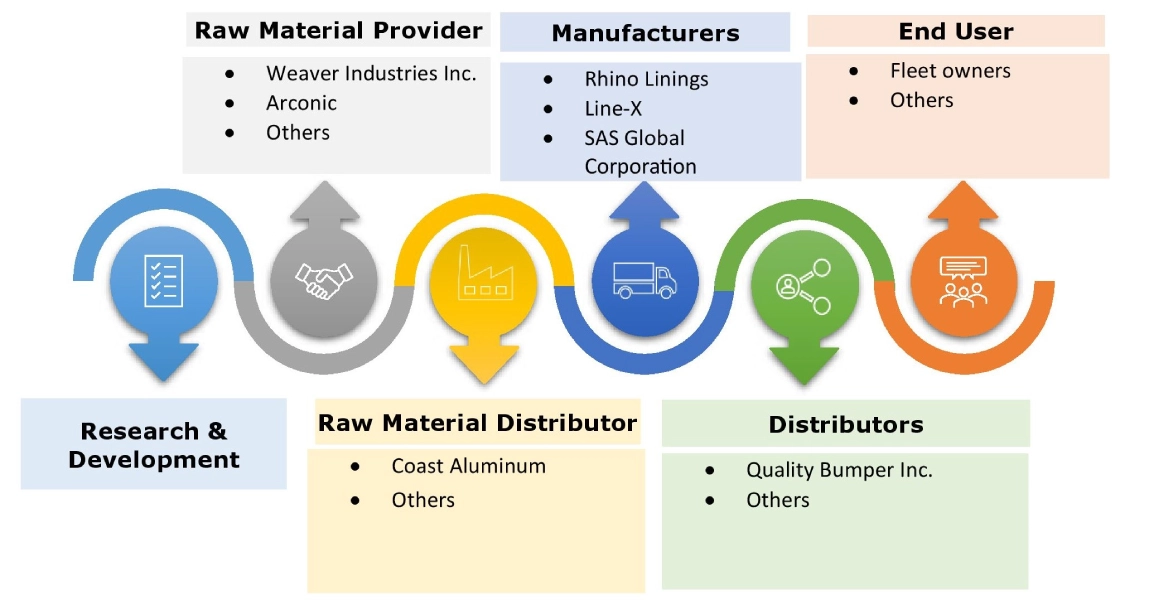

Top Key Players and Market Share Insights:

The global truck bedliners market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the truck bedliners market. Key players in the truck bedliners industry include-

- Ultimate Linings (U.S.)

- S. Chemicals & Plastics (U.S.)

- J-B Weld (U.S.)

- SAS Global Corporation (U.S.)

- Langeman Manufacturing Ltd. (U.S.)

- DualLiner Truck Bed Liners (U.S.)

- Ford Motor Company (U.S.)

- Line-X (U.S.)

- Rhino Linings (U.S.)

- Metso (Finland)

Recent Industry Developments :

Agreements:

- In April 2025,Metso, a manufacturer of haul truck bed liners announced that the company had signed a EUR 700 million sustainability-linked revolving credit facility (RCF) agreement to refinance the company’s existing facility. The mechanism used for pricing of the agreement is tied to the sustainability targets of Metso.

Acquisitions:

- In April 2025, RealTruck, a manufacturer of automotive accessories including bed liners announced the acquisition of Husky Liners, a company that produces automotive aftermarket accessories. The acquisition is RealTruck’s tenth acquisition since the formation of the company in 2027 and is part of the company’s growth strategy to acquire other companies in the vehicle accessory market.

Truck Bedliners Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 814.17 Million |

| CAGR (2025-2032) | 4.1% |

| By Material |

|

| By Product Type |

|

| By Vehicle |

|

| By Sales Channel |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the truck bedliners market? +

The truck bedliners market is estimated to reach over USD 814.17 Million by 2032 from a value of USD 600.64 Million in 2024 and is projected to grow by USD 613.47 Million in 2025, growing at a CAGR of 4.1% from 2025 to 2032.

Which is the fastest-growing region in the truck bedliners market? +

Asia-Pacific region is experiencing the most rapid growth in the truck bedliners market.

What specific segmentation details are covered in the truck bedliners market report? +

The truck bedliners market report includes material, product type, vehicle, sales channel, and region.

Who are the major players in the truck bedliners market? +

The key participants in the truck bedliners market are Ultimate Linings (U.S.), U.S. Chemicals & Plastics (U.S.), DualLiner Truck Bed Liners (U.S.), Ford Motor Company (U.S.), Line-X (U.S.), Rhino Linings (U.S.), Metso (Finland), J-B Weld (U.S.), SAS Global Corporation (U.S.), Langeman Manufacturing Ltd. (U.S.), and Others.