Cloud Application Security Market Size:

Cloud Application Security Market size is estimated to reach over USD 41.24 Billion by 2032 from a value of USD 11.48 Billion in 2024 and is projected to grow by USD 13.23 Billion in 2025, growing at a CAGR of 15.3% from 2025 to 2032.

Cloud Application Security Market Scope & Overview:

Cloud application security involves protecting cloud-based apps and their data from threats such as unauthorized access and data breaches. It mostly involves a combination of processes, tools, and technologies, including user authentication, access control, data encryption, and continuous monitoring, for protecting applications and data in cloud environments. Moreover, cloud application security solutions offer several benefits including prevention of data breaches and theft, improved regulatory compliance, increased reliability, and others, which are key aspects for increasing its adoption in business enterprises operating across IT & telecommunication, BFSI, government & defense, healthcare, retail & e-commerce, manufacturing, and other sectors.

How is AI Transforming the Cloud Application Security Market?

The incorporation of AI is significantly transforming the cloud application security market. AI incorporation helps in automating threat detection, improving vulnerability management, along with facilitating real-time incident response. Moreover, AI-powered solutions are capable of analyzing cloud environments and application behavior for identifying vulnerabilities, predicting potential exploits, reducing false positives, as well as providing security teams with AI-assisted code scanning and AI-generated fixes.

In addition, AI solutions can evaluate large volumes of data for detecting unusual patterns and behaviors that signal a potential cyberattack, in turn facilitating earlier threat detection. Hence, the above factors are expected to positively impact the market growth in the upcoming years.

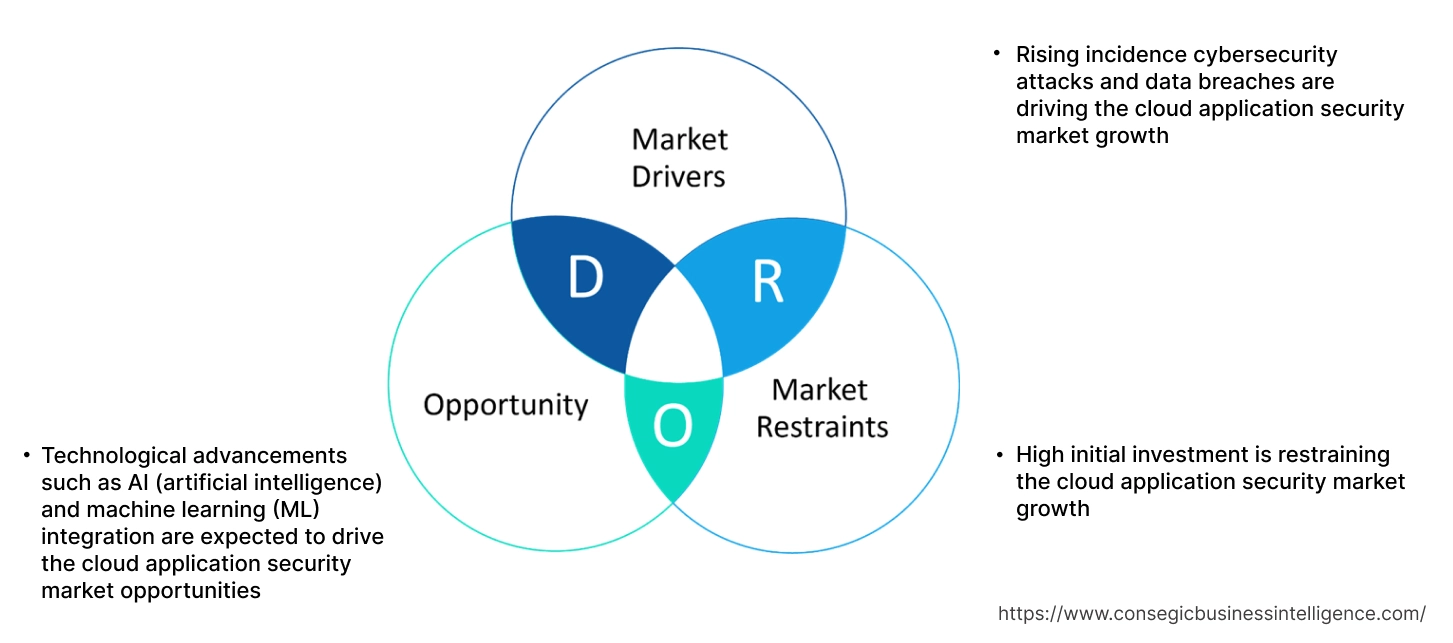

Cloud Application Security Market Dynamics - (DRO) :

Key Drivers:

Rising incidence cybersecurity attacks and data breaches are driving the cloud application security market growth

The current business landscape is witnessing a considerable increase in volume of cybersecurity threats and data breaches from cyber criminals. Also, business enterprises are increasingly exposed to data loss as well as security breaches, where sensitive information is stolen or compromised. Moreover, data breaches can be very costly for business enterprises, in terms of both financial and brand reputation. As a result, companies are investing in advanced security measures for actively detecting as well as addressing threats associated with cloud environments before they can cause substantial damage, in turn contributing to increased adoption of cloud app security solutions.

- For instance, according to the Identity Theft Resource Center (ITRC), the overall number of data breaches in the United States reached 3,205 breaches in 2023, which is a considerable increase of 78% as compared to 1,801 data breaches in 2022.

Hence, the increasing number of data breaches and cybersecurity attacks is increasing the demand for cloud app security solutions, in turn driving the cloud application security market size.

Key Restraints :

High initial investment is restraining the cloud application security market growth.

The high initial investment is among the primary factors limiting the market growth. Moreover, cloud application security solutions usually require considerable upfront costs for advanced technologies as well as skilled personnel, which may cause financial barriers, mainly for small and medium businesses operating with limited budgets. Also, implementing and maintaining advanced security solutions also requires specialized skills as well as a dedicated team of cybersecurity professionals.

In addition, the ongoing maintenance costs, complexity of modern cloud application environments, along with growing need for continuous investments in evolving threats may increase additional expenses, thereby restricting its widespread adoption. Thus, the aforementioned factors are hindering the cloud application security market expansion.

Future Opportunities :

Technological advancements such as AI (artificial intelligence) and machine learning (ML) integration are expected to drive the cloud application security market opportunities.

The integration of AI and ML helps in improving the security systems' ability to detect, predict, as well as respond to vulnerabilities more efficiently and accurately by evaluating vast amounts of data in real-time. Also, AI is capable of analyzing vast amounts of security data for identifying unusual patterns and behaviors in cloud environments, which may indicate a security breach. Moreover, the utilization of AI and ML technologies assists in offering proactive, adaptive, as well as automated approaches to threat detection and response, which in turn reduces human intervention and operational costs. Further, AI-powered cloud app security solutions offer several benefits including continuous monitoring, automated responses, improved accuracy, and streamlined workflows, among others.

- For instance, in October 2025, Palo Alto announced the launch of new versions of its Cortex Cloud, cloud security platform, along with AI application security platform Prisma AIRS. The app security platform offers AI-powered security solutions, as clients seek to secure their business operations from increasing cyberattacks and hacking incidents.

Consequently, the above factors are projected to boost the cloud application security market opportunities during the forecast period.

Cloud Application Security Market Segmental Analysis :

By Offering:

Based on offering, the market is segmented into solution and services.

Trends in the offering:

- Rising adoption of cloud app security solutions in business enterprises for protecting cloud-based applications and data from cyberthreats as well as vulnerabilities is driving the market.

- Increasing adoption of cloud app security services for helping organizations comply with data protection standards and regulations, such as GDPR and HIPAA, is boosting the market.

The solution segment accounted for the largest revenue in the cloud application security market share in 2024, and it is anticipated to register a significant CAGR during the forecast period.

- Cloud app security solutions include a combination of tools, processes, and practices which are used for protecting applications and data in cloud environments from several threats and vulnerabilitiesthroughout their entire lifecycle.

- It involves the integration of security measures into cloud environments for preventing data theft, unauthorized access, and other malicious activities, which in turn ensures the cloud application's confidentiality, integrity, as well as availability.

- Moreover, cloud app security solutions offer various benefits including protection of sensitive data, lower risk and minimized attack surface, improved regulatory compliance, and others.

- For instance, in August 2025, Palo Alto Networksintroduced its Cortex Cloud Application Security Posture Management, which is a prevention-first application security module that is capable of intelligently blocking security issues from reaching production. This solution merged the company's cloud native application protection platform with its cloud detection & response capabilities for facilitating real-time cloud security.

- According to the cloud application security market analysis, the increasing advancements related to cloud app security solutions are driving the cloud application security market size.

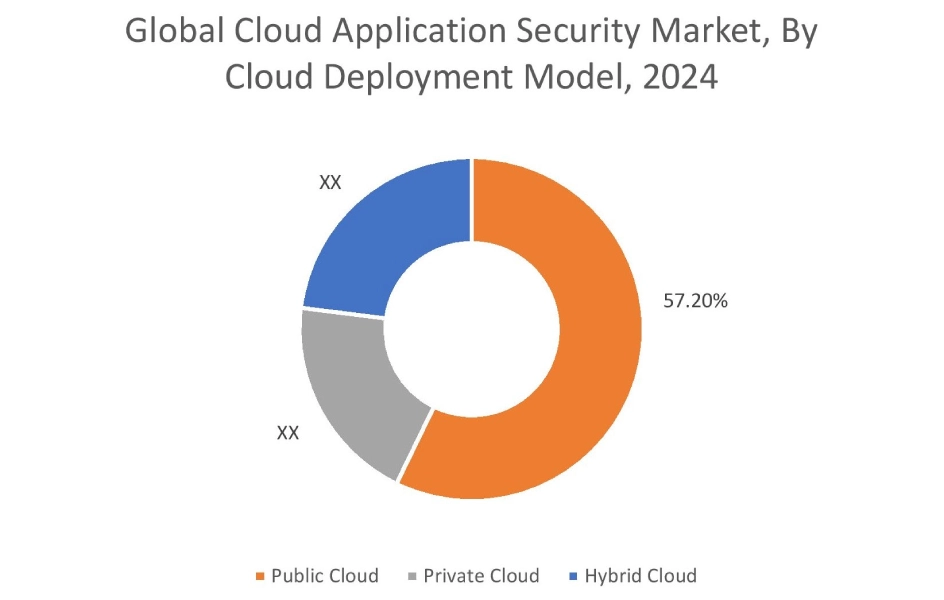

By Cloud Deployment Model:

Based on cloud deployment model, the market is segmented into public cloud, private cloud, and hybrid cloud.

Trends in the cloud deployment model:

- Factors including the rapid pace of digital transformationand increasing consumer preference for flexible, scalable, reliable, and cost-effective cloud platform are primary determinants for driving the public cloud segment.

- Factors including ease of integration, flexibility, higher security, and more control over sensitive assets of an organization are key aspects driving the private cloud deployment segment.

The public cloud segment accounted for the largest revenue share of 57.20% in the overall cloud application security market share in 2024, and it is anticipated to register a significant CAGR during the forecast period.

- Cloud app security in a public cloud deployment model involves using processes and tools for protecting applications and data based on public cloud environment from threats.

- Key practices for cloud app security in public cloud environment include implementing strong identity and access management (IAM), data encryption, secure configurations, along with continuous monitoring for managing risks such as unauthorized access, data breaches, and cyberattacks, among others.

- Moreover, public cloud deployment offers several benefits including higher accessibility, no maintenance requirement, increased scalability, and relatively lower costs in comparison to other types of cloud deployment.

- Consequently, the above benefits of public cloud deployment are further driving its adoption among enterprises, which in turn increases the demand for cloud app security solutions, thereby driving the cloud application security market trends.

By Enterprise Type:

Based on enterprise type, the market is segmented into large enterprises and small and medium enterprises (SMEs).

Trends in the enterprise type:

- Increasing trend in deployment of cloud app security solutions in large enterprises for facilitating improved protection of cloud-based apps and data from cyberattacksis driving the market.

- Factors including growing investments in development of small & medium enterprises and rising deployment of public cloud models in SMEs are key aspects driving the small and medium enterprise segment.

The large enterprises segment accounted for the largest revenue share in the cloud application security market in 2024.

- Large enterprises mostly use a combination of on-premises, public, and private clouds, along with multiple cloud providers. Cloud app security solutions help large enterprises in managing the complexity and security concerns that arise from this multi-cloud strategy.

- Moreover, it also helps in protecting vast amounts of sensitive data, intellectual property, and critical assets of large enterprises from increasing cyberattacks.

- Similarly, by preventing data breaches and other cyberattacks, cloud app security helps large enterprises in avoiding financial losses, reputational damage, as well as legal liabilities.

- The use of cloud app security solutions in large enterprises also offers several benefits such as advanced threat detection and response, enhanced data protection, improved regulatory compliance, centralized security management, and others.

- Therefore, the above benefits of cloud app security solutions are further increasing its adoption in large enterprises, in turn driving the market growth.

The small and medium enterprises (SMEs) segment is anticipated to register the fastest CAGR growth during the forecast period.

- Small and medium enterprises are companies that typically maintain workforce, revenues, and assets below a certain threshold.

- Moreover, SMEs usually account for the majority of the businesses that are operating across the world.

- Additionally, cloud app security plays an essential role in small and medium enterprises (SMEs) for protecting their cloud-based data and applications, maintaining customer trust, and ensuring business continuity in a cost-effective manner.

- For instance, according to the U.S. Chamber of Commerce, the number of small businesses in the United States reached 33.2 million in 2022, representing nearly 99.9% of total businesses in the U.S.

- According to the analysis, the rising number of small and medium enterprises is expected to boost the adoption of cloud app security solutions, thereby boosting the market during the forecast period.

By End-User:

Based on the end user, the market is segmented into IT & telecommunication, BFSI, government & defense, healthcare, retail & e-commerce, manufacturing, and others.

Trends in the end user:

- There is an increasing trend in adoption of cloud app security solutions in IT & telecommunication sector for protecting cloud-based applications and their data from threats and vulnerabilitiesto prevent unauthorized access and data breaches.

- There is a rising trend towards the utilization of cloud app security solutions in BFSI industry for facilitating advanced threat protection, improved protection of financial transaction, and compliance with regulatory standards, among others.

The IT & telecommunication segment accounted for the largest revenue share in the market in 2024.

- In IT & telecommunication sector, cloud app security plays an essential role in securing diverse cloud and digital services, internal operations, along with cloud-based application platforms, particularly with the increasing use of APIs and cloud services.

- Moreover, the use of cloud app security in IT & telecommunication sector helps in ensuring confidentiality, integrity, as well as availability of IT services and sensitive data.

- For instance, according to the National Association of Software and Service Companies (NASSCOM), the revenue of IT industry in India reached USD 245 billion in FY23, representing an increase of nearly 8% from USD 227 billion in FY22.

- Hence, the growing IT & telecom sector is driving the adoption of cloud app security solutions, in turn propelling the market growth.

The BFSI segment is anticipated to register a substantial CAGR during the forecast period.

- BFSI (banking, financial services, and insurance)firms are primary targets for cyberattacks, mainly due to the sensitive nature of their transactions and data.

- The use of cloud app security solutions in BFSI sector helps in protecting sensitive customer financial data, ensuring regulatory compliance, as well as maintaining user trust by preventing data theft, fraud, and unauthorized access in digital banking platform.

- Moreover, the use of app security solutions in BFSI sector offers numerous benefits such as advanced threat protection, improved protection of financial transactions, compliance with regulatory standards, and others.

- For instance, according to the Federal Reserve Board, there are approximately 2,134 large commercial banks in the United States as of September 2025. These banks have consolidated assets of USD 300 million or more, with several branches in the U.S as well as other countries.

- Thus, according to the analysis, the growing BFSI sector is projected to increase the utilization of cloud app security solutions, in turn driving the market during the forecast period.

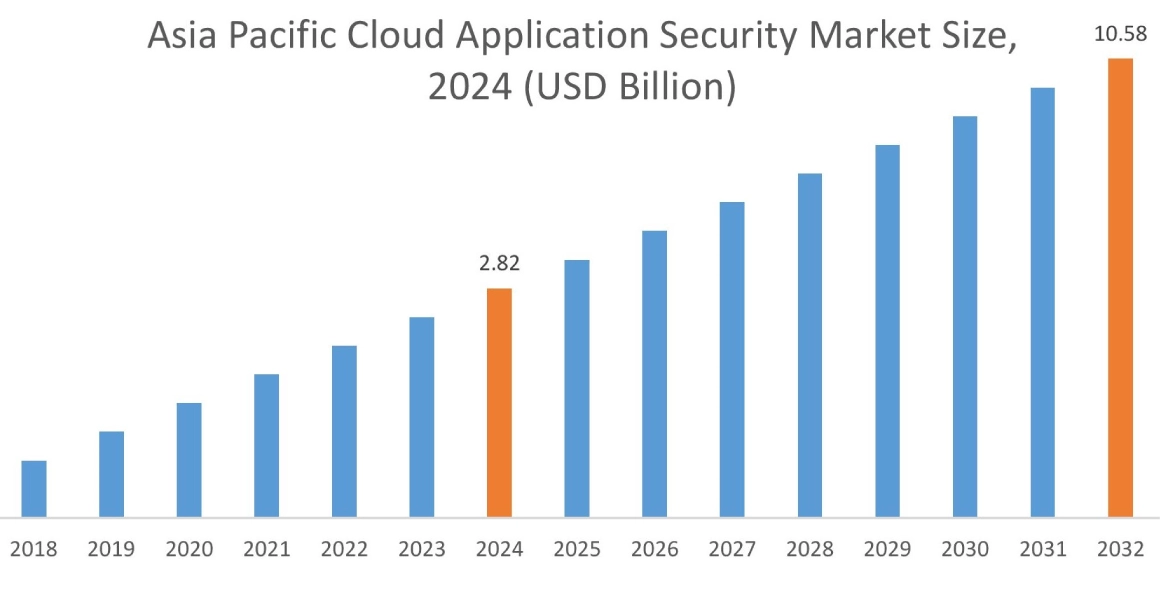

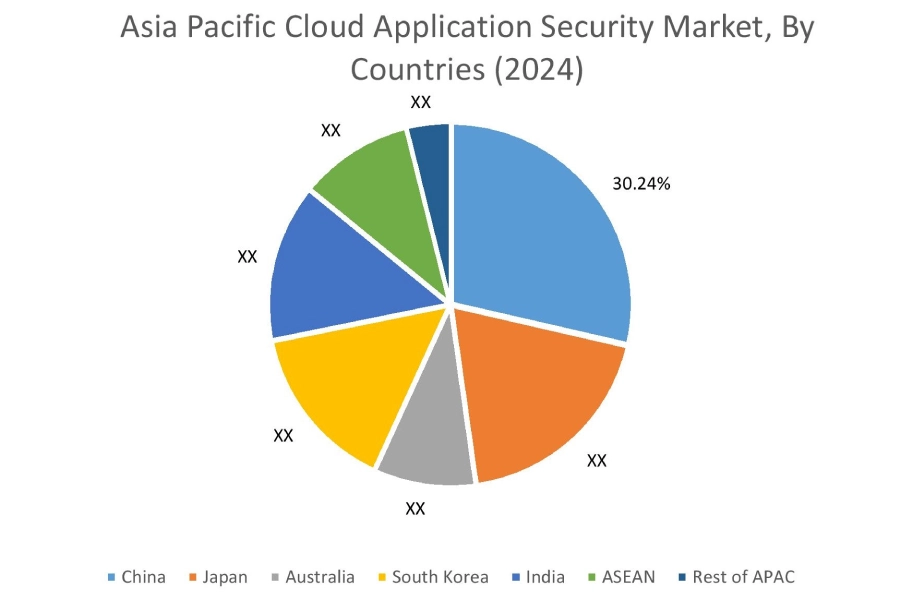

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 2.82 Billion in 2024. Moreover, it is projected to grow by USD 3.27 Billion in 2025 and reach over USD 10.58 Billion by 2032. Out of this, China accounted for the maximum revenue share of 30.24%. As per the cloud application security market analysis, the adoption of cloud app security solutions in the Asia-Pacific region is primarily driven by the growing IT & telecommunication, retail, and government sectors, among others. Additionally, the rising number of data breaches in government & public sector and increasing need for reliable cloud security solutions are further accelerating the cloud application security market expansion.

- For instance, in July 2022, Shanghai Municipal Police, a government organization based in China, witnessed a data breach that leaked the personal information of approximately one billion Chinese residents from the Shanghai police database stored in the cloud.The above factors are driving the market in the Asia-Pacific region.

North America is estimated to reach over USD 15.88 Billion by 2032 from a value of USD 4.44 Billion in 2024 and is projected to grow by USD 5.11 Billion in 2025. In North America, the growth of the cloud application security industry is driven by growing investments in BFSI, healthcare, retail, and other sectors. Moreover, the increasing adoption of cloud app security solutions in BFSI sector for facilitating advanced threat protection of digital banking platform and improved protection of financial transactions is further contributing to the cloud application security market demand in the region.

- For instance, in July 2022, Citi Bank launched its new Citi Commercial Bank in Canada, as a part of the company’s global extension plan. Citi Commercial Bank offers a wide range of institutional solutions and products to meet the evolving needs of corporates. The above factors are expected to drive the cloud application security market trends in North America during the forecast period.

Meanwhile, according to the regional analysis, factors including growing healthcare, IT & telecom, and retail & e-commerce sectors along with increasing demand for cloud security solutions among business enterprises are driving the cloud application security market demand in Europe. Furthermore, according to the market analysis, the market demand in Latin America, Middle East, and African regions is expected to grow at a considerable rate due to factors such as increasing investments in BFSI sector, expansion of IT firms, and rising need for robust cloud security solutions in government sector, among others.

Top Key Players & Market Share Insights:

The global cloud application security market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the cloud application security market. Key players in the cloud application security industry include-

- IBM Corporation(USA)

- Palo Alto Networks(USA)

- Fortinet(USA)

- Amazon Web Services Inc. (USA)

- Checkmarx Ltd (USA)

- Microsoft (USA)

- Oracle Corporation (USA)

- Veracode (USA)

- Akamai Technologies Inc. (USA)

- Apiiro (Isreal)

- Rapid7 Inc. (USA)

Recent Industry Developments :

Product Launches:

- In June 2025, Fortinet announced the launch of its new updates to Lacework FortiCNAPP, which will make it easier for customers to secure applications as well as workloads across multi-cloud and hybrid environments.

Partnerships & Collaborations:

- In October 2025, Akamai Technologies Inc. partnered with Apiiro, with the aim of integrating Akamai's app security platform and Apiiro's agentic app security posture management platform for assisting business enterprises in securing applications throughout the entire software development lifecycle, ranging from code, cloud, to runtime.

- In June 2024, Checkmarx Ltd announced a collaboration with DXC Technology, with the aim of providing robust and completely scalable app security programs and services across the world. The partnership enables DXC Technology to sell as well as support the Checkmarx One app security platform at its customer sites for facilitating enterprise-grade, complete protection across the software development life cycle, ranging from code to cloud.

Cloud Application Security Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 41.24 Billion |

| CAGR (2025-2032) | 15.3% |

| By Offering |

|

| By Cloud Deployment Model |

|

| By Enterprise Type |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the cloud application security market? +

The cloud application security market was valued at USD 11.48 Billion in 2024 and is projected to grow to USD 41.24 Billion by 2032.

Which is the fastest-growing region in the cloud application security market? +

Asia-Pacific is the region experiencing the most rapid growth in the cloud application security market.

What specific segmentation details are covered in the cloud application security report? +

The cloud application security report includes specific segmentation details for offering, cloud deployment model, enterprise type, end user, and region.

Who are the major players in the cloud application security market? +

The key participants in the cloud application security market are IBM Corporation (USA), Palo Alto Networks (USA), Fortinet (USA), Amazon Web Services Inc. (USA), Checkmarx Ltd (USA), Microsoft (USA), Oracle Corporation (USA), Veracode (USA), Akamai Technologies Inc. (USA), Apiiro (Isreal), Rapid7 Inc. (USA), and others.