Polyurea Coatings Market Size :

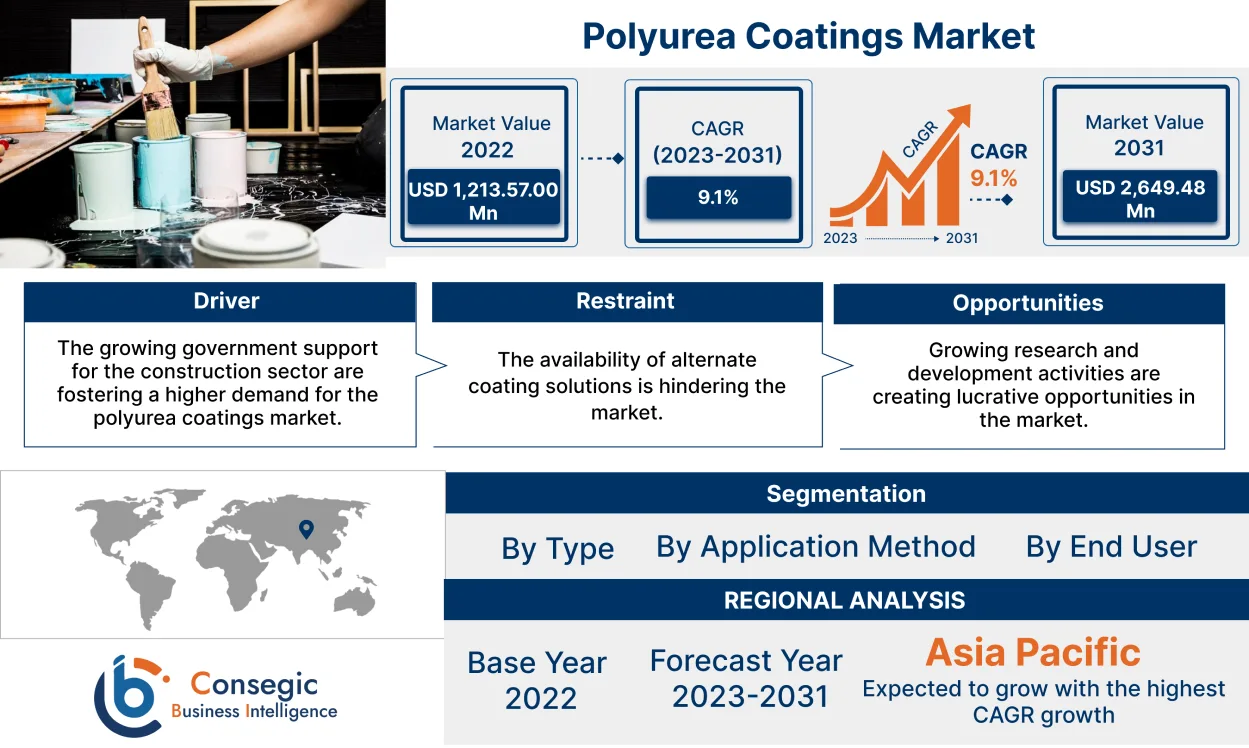

Consegic Business Intelligence analyzes that the polyurea coatings market size is growing with a CAGR of 9.1% during the forecast period (2023-2031). The market accounted for USD 1,213.57 million in 2022 and USD 1,318.35 million in 2023, and the market is projected to be valued at USD 2,649.48 Million by 2031.

Polyurea Coatings Market Scope & Overview:

Polyurea Coatings is a protective coatings produced by a reaction between isocyanates and amines which results in a high cross-linked polymer structure that offers superior resistance to abrasions, chemicals, corrosions, and weathering. These coatings are renowned for properties such as durability, rapid curing properties, and versatility. These properties make them suitable for various applications including waterproofing, coatings in military and defense equipment, and corrosion protection among others. Additionally, as per the analysis, they are utilized in various industries including construction, automotive, and manufacturing among others. Moreover, the utilization of these coatings for the protection of surfaces and infrastructure along with the technological advancements in the composition of these coatings is further propelling the polyurea coatings market trends.

How is AI Impacting the Polyurea Coatings Market?

AI is making a substantial impact on the polyurea coatings market by enhancing efficiency and innovation. In the research and development phase, AI algorithms are used to predict material properties and simulate the performance of new formulations, significantly reducing the time and cost associated with traditional experimentation. During production, AI-powered systems optimize manufacturing processes in real-time, improving quality control, detecting defects, and ensuring consistent product quality. Furthermore, AI is being integrated into robotic application systems to ensure precise and uniform coating, particularly in complex or hazardous environments, which improves safety and the final finish. This integration of AI is driving greater value, pushing the development of more durable and specialized polyurea coatings.

Global Polyurea Coatings Market Insights :

Polyurea Coatings Market Dynamics - (DRO) :

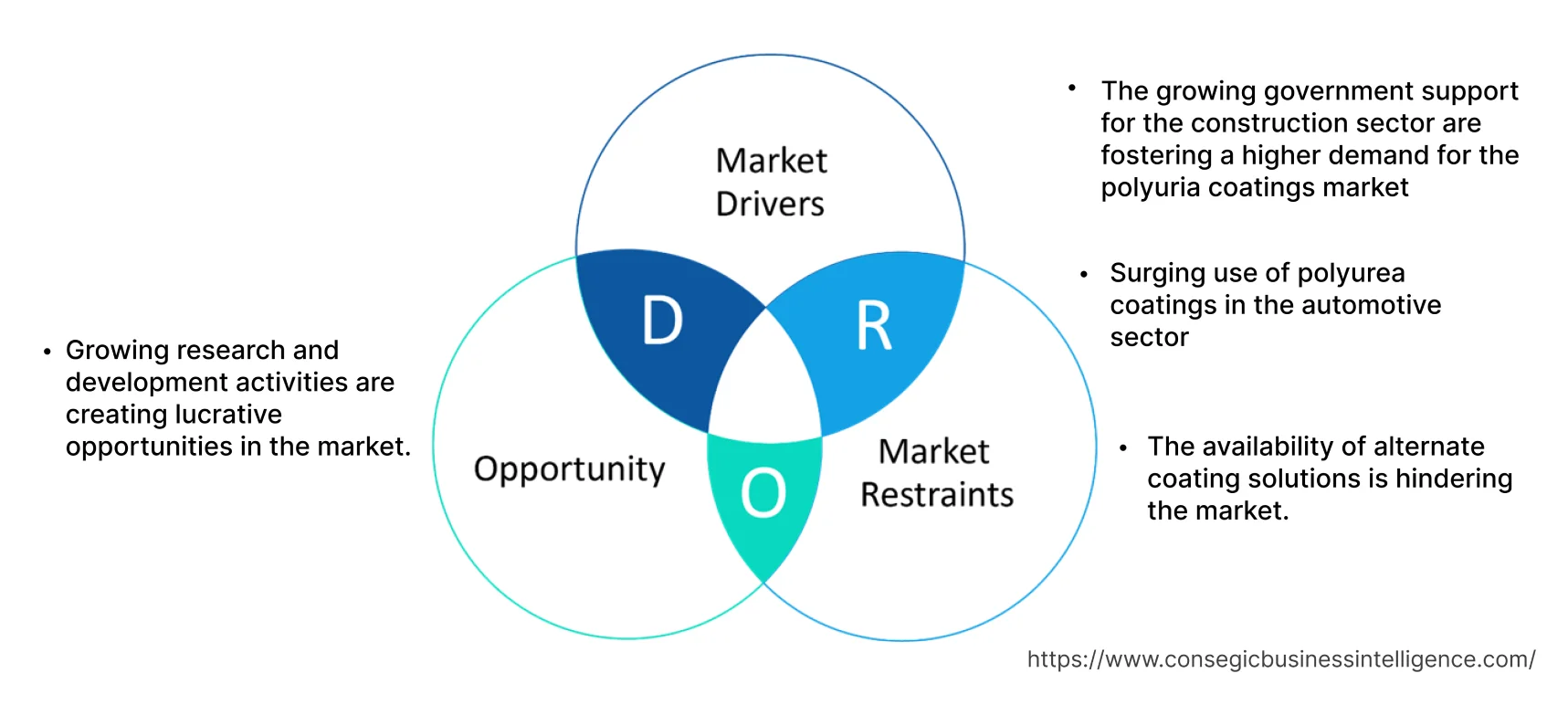

Key Drivers :

The growing government support for the construction sector are fostering a higher demand for the Polyurea coatings market

The coating material is utilized in the construction procedure to protect surfaces and infrastructures from wear and tear and enables shorter construction schedules. These coatings are ideal for roofing coats, basements, and water containment systems that produce exceptional waterproofing barriers. The growing government support for the construction sector and the utilization of Polyurea in the construction procedures are propelling the market.

Furthermore, their exceptional properties allow them to endure extreme temperature fluctuations, making them perfect for extreme temperature regions. These coatings are applied to surfaces to create a seamless and uniform finish. Hence, based on the analysis, the utilization of these coatings in the construction sector is attracting various government organizations to take various measures for the development of the construction sector.

For instance,

According to the data provided by India Brand Equity Foundation, the Dubai government and India signed a contract in October 2021 to build infrastructure in Jammu and Kashmir, including industrial parks, IT towers, multipurpose towers, logistics centers, medical colleges, and specialized hospitals. Consequently, government support for the construction sector and the rising construction sector is driving market growth and trends.

Surging use of polyurea coatings in the automotive sector

Polyurea coatings play a crucial role in the automotive sector, contributing to various aspects of vehicle performance, functionality, and aesthetics. They are primarily used in truck bed liners and provide protection against scratches, heavy impact, and corrosion, further extending the lifespan of the vehicle. These coatings provide certain characteristic advantages such as flexibility, increased strength and durability, and reduced friction and wear, among others further enhancing the overall performance and efficiency of the automotive parts and vehicles. Additionally, this coating is applied to numerous automotive parts and accessories, such as bumpers, fenders, and the interior of the vehicle to offer sturdiness. Owing to this, commendable efforts are being made by the leading players to expand their portfolio.

For instance,

In May 2022, LANXESS, a polyurea coating manufacturer, and Advent announced a joint acquisition of a materials business from DSM for a purchase price of around USD 4.02 billion. Under this agreement, LANXESS is contributing its High-Performance Materials (HPM) business unit to the joint venture. HPM is one of the leading suppliers of high-performance polymers, which are used primarily in the automotive sector. This joint venture and acquisition is expanding the automobile high-performance polymer portfolio of LANXESS.

For instance,

Moreover, these factors lead to the use of polyurea coatings in the automotive sector which is driving the automotive market which includes electric vehicles, and passenger cars.

According to the data published by the International Energy Agency in July 2023, electronic vehicleelectronic vehicle sales jumped from around 1 million to more than 10 million from 2017 to 2022. Additionally, of total sales of electric cars tripled from around 4% in 2020 to 14% in 2022.

Further, as per the date provided by the Germany Trade and Invest in September 2022, German passenger car and light commercial vehicle OEM generated foreign market revenue of almost USD 274 billion in 2021, a 10 % increase over 2020. Thus, the use of polyurea coatings in the automotive sector is propelling the trends of the market.

Key Restraints :

The availability of alternate coating solutions is hindering the market

The availability of alternate coating solutions is restraining the growth of the market. Coatings such as epoxy coatings, polyurethane coatings, acrylic coatings, vinyl ester coatings, and traditional paints are a few common alternatives utilized in place of polyurea coatings. These coatings are highly preferred over polyurea because of their various properties such as UV resistance, improved durability, adherence, exceptional resistance, and high performance. Furthermore, various coatings including traditional paints and epoxy coatings are preferred because of factors including low cost, and wider availability. Additionally, the aesthetic appeal of coatings such as acrylic coatings offers a wide range of color options and improves the look of the surface. Thus, the aforementioned factors are restraining the growth of the market.

Future Opportunities :

Growing research and development activities are creating lucrative opportunities in the market.

Research and development activities are creating lucrative polyurea coatings market opportunities and trends in the upcoming years. These activities are aimed at enhancing the formulations, application techniques, and performance characteristics. Scientists are continuously enhancing the polyurea formulations to optimize properties such as flexibility, adhesion, and chemical resistance among others, while reducing the curing time. Various research and development activities directed toward improving the functional qualities of these coatings are being implemented.

Furthermore, the expanding FMCG industry is expected to fuel the need for packaging solutions, further boosting the market.

For instance,

- According to the research article published in progress in the Organic Coating Journal, in September 2023, reported that synthesizing polyurea coatings with higher thermal stability, excellent corrosion resistance, and strong bactericidal properties is possible with the utilization of cardinal.

- Additionally, the report published in the Journal of Cleaner Production, in April 2023, stated that cardinol can be employed as a precursor for the development of green volatile organic compound-free anti-corrosive polyurea coatings.

Thus, the growing research and development activities for the development of novel formulations with enhanced features are creating lucrative opportunities in the upcoming years.

Polyurea Coatings Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2031 |

| Market Size in 2031 (USD Million) | USD 2,649.48 Million |

| CAGR (2023-2031) | 9.1% |

| By Type | Pure Polyurea, Hybrid Polyurea, Aliphatic Polyurea, Aromatic Polyurea, and Polyurea Topcoats |

| By Application methods | Spraying (High pressure hot spray, Warm spray coating, Low pressure cold spray), Pouring, Injections, Brushing, and Others |

| By End Use Industry | Construction, Automotive, Oil and Gas, Marine, and Others |

| By Region | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Players | BASF SE, Teknos Group, Huntsman International LLC, CITADEL FLOORS, Specialty Products Inc., Armorthane, Elastothane, SATYEN POLYMERS PVT. LTD, 3M |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Polyurea Coatings Market Segmental Analysis :

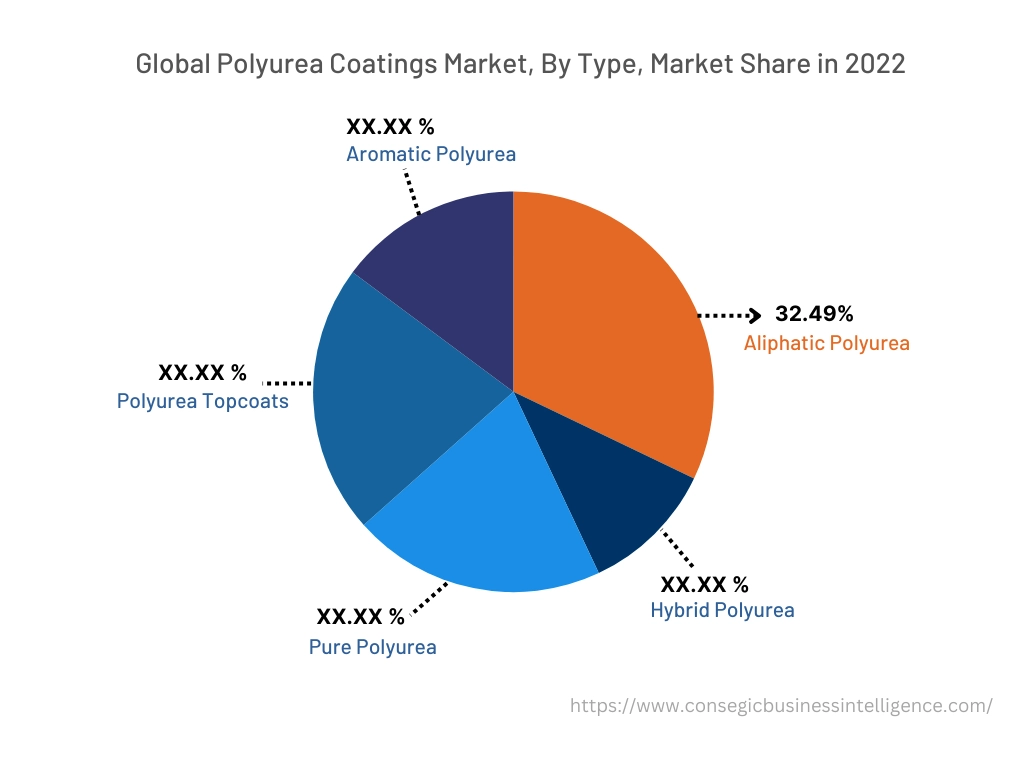

By Type :

The type is categorized into pure polyurea, hybrid polyurea, aliphatic polyurea, aromatic polyurea, and polyurea topcoats. In 2022, the aliphatic polyurea segment accounted for the highest polyurea coatings market share of 32.49% in the polyurea coatings market. Aliphatic coatings are polyurea formulations renowned for their properties such as UV stability, and color retention. As per the analysis, these coatings usually maintain their clarity and color over time making them ideal for outdoor applications where aesthetics and looks are important. These coatings provide durable protection against weathering and abrasions chemicals, and corrosions and are used in a wide range of applications in various industries including the construction, marine sector.

Moreover, the hybrid polyurea segment is expected to hold the highest CAGR over the forecast period. These coatings are generally developed by combining polyurea with other components to enhance properties such as flexibility, UV resistance, or chemical resistance. As per the analysis, various novel products are launched to enhance the above-mentioned factors. For instance, Tremco, in August 2021, launched a novel Micorea S5 a 100% solids, flexible, two-component spray-applied hybrid polyurea system designed for waterproofing and coating application for concrete, metal, and other substrates. Thus, the aforementioned factors are propelling the segment's growth.

Based on the Application Method :

The application method is categorized into spraying, pouring, injection, brushes, and others. The spraying segment is further bifurcated into high-pressure hot spray, warm spray coating, and low-pressure cold spray. In 2022, the spraying segment accounted for the highest market share in the market and it is also expected to grow at the fastest CAGR over the forecast period. Spraying is a method that involves spraying the polyurea evenly on the surface. The combination of this coating includes isocyanates and amines which offer durable and flexible coating application. They generally require equipment including spray guns and reactors. The method offers efficient and even coverage of the coating over surfaces, including concrete, steel, and wood. As per the analysis, they ensure protection against corrosion, abrasion, and weathering. Moreover, various products have been launched which offer this coating solution in spray form. For instance, in April 2023, ADCOS NV launched a novel specialty polyurea hot spray which is designed specifically for waterproofing concrete, steel, and other materials. Thus, the aforementioned factors are propelling the segment's growth and trends.

By End-Use Industry :

The end-user industry segment is categorized into construction, automotive, oil and gas, marine, and others. In 2022, the construction segment accounted for the highest market share in the overall Polyurea coatings market. The coating is highly utilized in the construction sector because of its properties including durability, flexibility, corrosion protection, and chemical resistance among others. It is primarily used as a waterproofing material for surfaces and is extensively used in industrial and commercial settings. Additionally, they are used to enhance the building structure further propelling the segment. For instance, according to the data provided by the National Bureau of Statistics, in February 2023, the value-added output of the construction sector in China accounted for USD 1,172.92 billion in 2022, which increased by 5.5% over 2021. Similarly, according to the data published by the U.S. Department of The Treasury in June 2023, non-residential construction spending in the US increased by 15% from November 2021 to April 2023. Thus, the aforementioned factors are driving the segment trend.

Moreover, the marine segment is expected to hold the fastest CAGR over the forecast period. This coating is utilized in the marine sector because of its properties such as durability, corrosion resistance, and waterproofing properties. They usually protect themselves from harsh conditions caused because of the marine environment such as boat hulls, decks, and offshore structures. These coatings form a protective layer protecting against UV exposure and chemical exposures. Thus, the aforementioned factors are propelling the trends of the market.

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

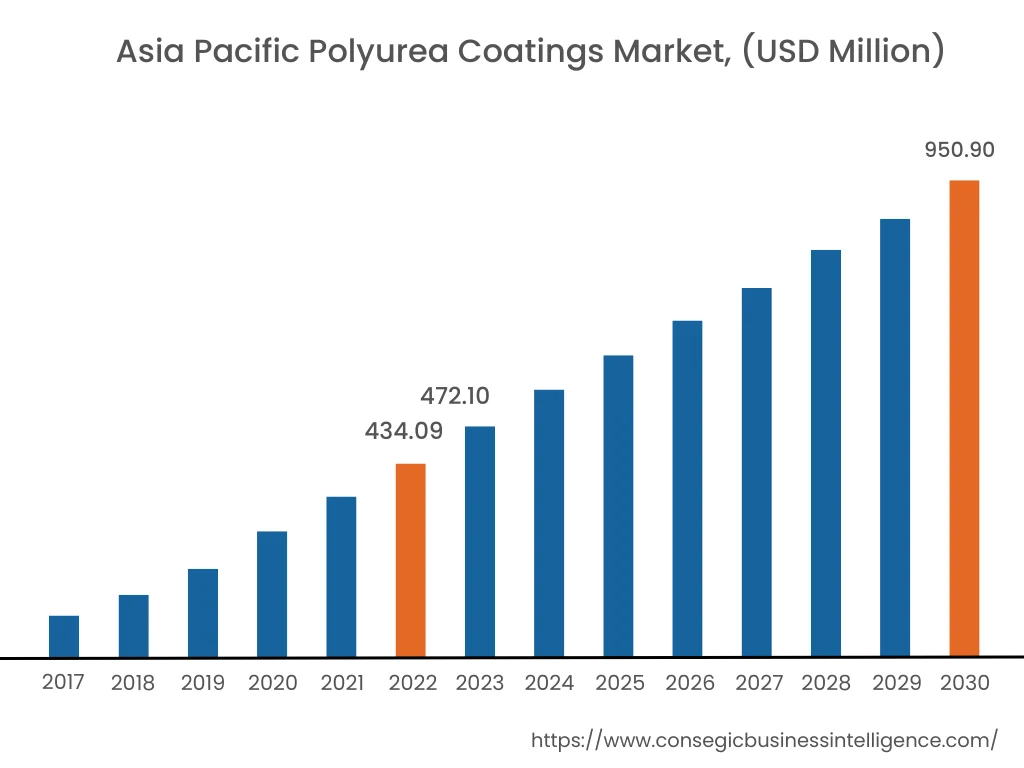

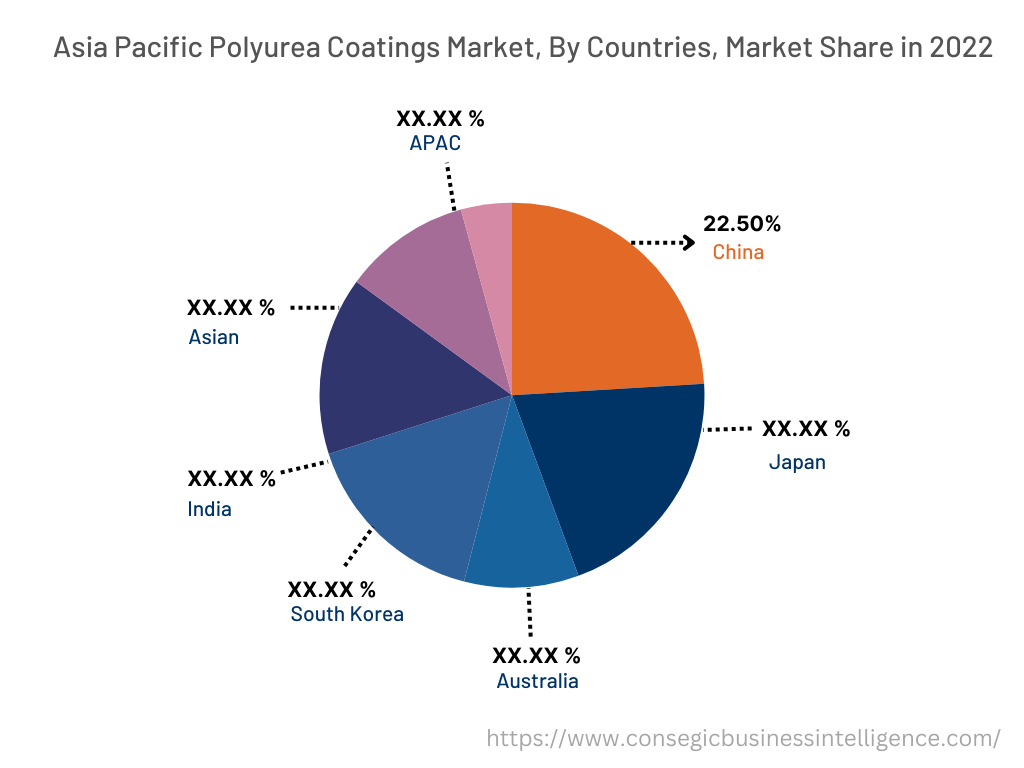

In 2022, Asia Pacific accounted for the highest market share at 35.77% valued at USD 434.09 Million in 2022 and USD 472.10 Million in 2023, it is expected to reach USD 950.90 Million in 2031 and it is also anticipated to hold the fastest CAGR over the forecast period. In Asia Pacific, China accounted for a major market share of 22.50% in the year 2022. The significant growth of the Polyurea coatings market trends across the Asia Pacific region is attributed to factors such as rising urbanization, and growing population leading to the demand for advanced infrastructure. They are generally utilized as protection coatings for surfaces. These factors are leading to a higher demand for polyurea coatings from industries such as transportation, marine, oil and gas, and construction because of their various properties including resistance, flexibility, and durability.

Additionally, based on the polyurea coatings market analysis, the rising population in the region is propelling the output of these industries, further fueling the demand for polyurea coatings. Furthermore, the investment by the governments of countries in this region for infrastructure development is expected to contribute to polyurea coatings market growth. For instance, according to the data provided by the India Brand Equity Foundation in August 2023, in Budget 2023-24, capital investment outlay for infrastructure is being increased by 33% to USD 122 billion, which would be 3.3 percent of GDP. Additionally, India plans to spend USD 1.4 trillion on infrastructure through the ‘National Infrastructure Pipeline' in the next five years. All these above-mentioned factors are collectively driving the polyurea coatings market demand in the Asia Pacific region and creating lucrative opportunities for the polyurea coatings market in the Asia Pacific region.

Top Key Players & Market Share Insights :

The global polyurea coatings market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The polyurea coatings industry is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market size through mergers, acquisitions, and partnerships. The key players in the market include-

- BASF SE

- Teknos Group

- CITADEL FLOORS

- Specialty Products Inc.

- Armorthane

- Huntsman International LLC

- Elastothane

- SATYEN POLYMERS PVT. LTD.

- 3M

Recent Industry Developments :

- In October 2023, Everest Systems EverMax Polyurea, a long-lasting and flexible coating for commercial roofing applications. This polyurea coating is formulated to have low shrinkage, extreme flexibility, and exceptional resistance to mechanical damage.

Key Questions Answered in the Report

What was the market size of the polyurea coatings market in 2022? +

In 2022, the market size of polyurea coatings was USD 1,213.57 million.

What will be the potential market valuation for the polyurea coatings industry by 2031? +

In 2031, the market size of polyurea coatings will be expected to reach USD 2,649.48 million.

What are the key factors driving the growth of the polyurea coatings market? +

The growing government support for the construction sector are fostering a higher demand for polyurea coatings.

What is the dominant segment in the polyurea coatings market for the type? +

In 2022, the aliphatic polyurea segment accounted for the highest market share of 32.49% in the overall polyurea coatings market.

Based on current market trends and future predictions, which geographical region is the dominating region in the Polyurea coatings market? +

Asia Pacific accounted for the highest market share in the overall market.