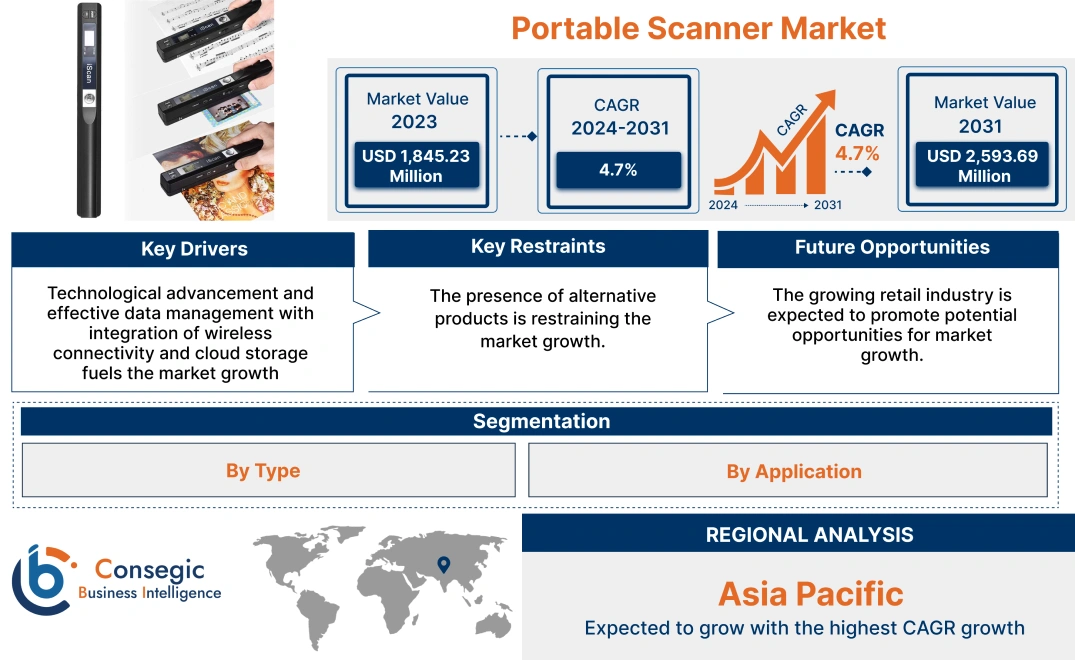

Portable Scanner Market Size:

Portable Scanner Market size is estimated to reach over USD 2,748.40 Million by 2032 from a value of USD 1,845.23 Million in 2024 and is projected to grow by USD 1,901.51 Million in 2025, growing at a CAGR of 4.7% from 2025 to 2032.

Portable Scanner Market Scope & Overview:

Portable scanners, also known as handheld or mobile scanners, refer to electronic devices designed for scanning physical documents into digital formats. Portable scanners are capable of scanning a physical document and converting it electronically to be displayed on computers or other devices. Moreover, these scanners offer several benefits including lightweight and compact design, ease of scanning, high image quality, higher efficiency, and reliability among others. The above benefits of handheld scanners are key determinants for driving their utilization in transportation & logistics, retail & e-commerce, healthcare, education, manufacturing, and other sectors.

Portable Scanner Market Insights:

Portable Scanner Market Dynamics - (DRO) :

Key Drivers:

Growing retail & e-commerce sector is propelling the portable scanner market growth

Handheld scanners are primarily used in the retail & e-commerce sector, particularly in retail stores, warehouses, and e-commerce operations for performing a range of functions including price checking, stock checking, locating items, inventory management, proof of delivery, and other related functionalities. Moreover, the benefits of handheld scanners including increased accuracy, high speed, improved convenience, and cost-efficiency are primary determinants for increasing their utilization in the retail & e-commerce sector.

- For instance, according to the U.S. Census Bureau (Department of Commerce), retail e-commerce sales in the United States were valued at USD 300.35 billion during the fourth quarter of 2024, representing a significant increase of 8.5% in comparison to the third quarter of 2023.

Hence, the growing retail & e-commerce sector is driving the utilization of handheld scanners for application in retail stores, warehouses, and e-commerce operations to improve operational efficiency, thereby proliferating the portable scanner market size.

Key Restraints :

Availability of substitute is restraining the portable scanner market growth

The primary substitute for portable scanners includes fixed/stationary scanners among others. Comparatively, the substitutes offer similar performance and applications, with respect to portable scanners, which is a primary factor restricting the market growth.

For instance, stationary scanners act as an ideal alternative to handheld scanners in a range of applications involving retail, manufacturing, logistics, and other industries. Moreover, fixed/stationary scanners offer a range of benefits including high speed, accuracy, and the ability to scan large volumes of items quickly, making it ideal for applications requiring precision and speed. Additionally, fixed/stationary scanners provide higher-resolution images in comparison to handheld scanners. Therefore, the aforementioned factors are hindering the portable scanner market expansion.

Future Opportunities :

Rising application in healthcare sector is expected to drive the portable scanner market opportunities

Portable scanners are often used in healthcare facilities during patient admittance for electronic tracking of patients by utilizing barcodes to increase the efficiency of treatments and eliminate errors. Barcodes are often attached to patient wristbands and healthcare records for identification starting from the patient admission process to the discharge process. Handheld scanners are also used in the healthcare sector for scanning clinical lab samples, healthcare inventory management, and other related applications. Moreover, the utilization of handheld scanners in healthcare facilities helps in delivering efficient and secure data by eradicating errors in data entry with patient files, tracking, and follow-up. Additionally, the deployment of healthcare scanners in healthcare facilities offers several benefits including accurate and improved care quality, accurate and faster diagnosis, enhanced patient safety, and others.

- For instance, according to the American Hospital Association, the overall number of hospitals in the United States reached 6,093 as of 2023. Additionally, the total number of patient admissions in overall U.S. hospitals reached 34,426,650 admissions in 2023.

Hence, as per the analysis, the rising prevalence of healthcare facilities and increasing number of in-patient admissions in hospitals is increasing the utilization of handheld scanners during patient admittance for electronic tracking of patient’s records and progress. The above factors are projected to boost the portable scanner market opportunities during the forecast period.

Portable Scanner Market Segmental Analysis :

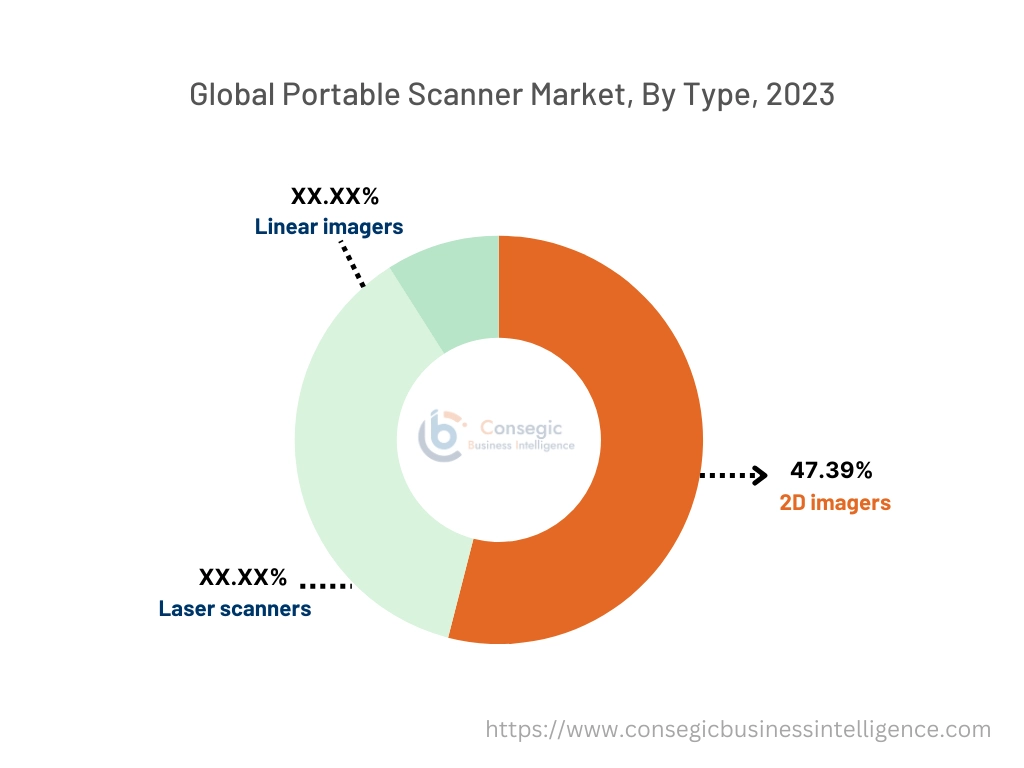

By Type:

Based on type, the market is segmented into 2D scanner (2D imager), laser scanner, and linear imager.

Trends in the type:

- Increasing trend in the adoption of 2D scanners across retail, logistics, healthcare, manufacturing, and other sectors is driving the portable scanner market size.

- There is a rising trend towards the utilization of laser scanners in advanced applications, due to their several benefits including rapid data capture, high accuracy, highly realistic visualizations, and others.

The 2D scanner (2D imager) segment accounted for the largest revenue share of 54.40% of the total portable scanner market share in 2024.

- Portable 2D scanners, also known as 2D imagers, are handheld devices that capture high-resolution images of QR codes, barcodes, and other two-dimensional codes.

- Moreover, 2D scanners offer several benefits including high readability, fast and efficient data capture, improved versatility, and others.

- Additionally, 2D scanners are primarily used in retail, logistics, healthcare, manufacturing, and other sectors.

- For instance, Honeywell offers Voyager 1350g model of handheld 2D scanner in its product offerings. The 2D scanner can be used in several industries including healthcare, government, education, hospitality, and other sectors.

- According to the portable scanner market analysis, the rising advancements associated with portable 2D scanners are driving the portable scanner market trends.

The laser scanner segment is anticipated to register the fastest CAGR growth during the forecast period.

- Portable laser scanners refer to handheld devices that utilize laser beams to capture detailed three-dimensional (3D) images of objects and environments.

- Moreover, laser scanners work by projecting laser beams onto the surface of an object and measuring reflected light to determine the dimension and shape of the objects. The collected data forms a detailed point cloud, which is then processed into 3D models for analysis and further utilization in several applications.

- Additionally, laser scanners offer a wide range of benefits including high accuracy, rapid data capture, highly realistic visualizations, comprehensive documentation, and others.

- For instance, Leica Geosystems AG offers BLK2GO model of handheld imaging laser scanner in its product portfolio. The laser scanner features a compact and lightweight design, optimized for fast, agile, and seamless data capture.

- Thus, increasing advancements related to portable laser scanners are projected to boost the market during the forecast period.

By End-User:

Based on the end-user, the market is segmented into transportation & logistics, retail & e-commerce, healthcare, education, manufacturing, government & public sector, and others.

Trends in the end-user:

- Factors including significant development of transport hubs/terminals, rising trade activities, and increasing freight transport are among the key trends driving the growth of the logistics and transportation segment.

- Factors including the increasing healthcare expenditure, significant development of healthcare facilities, and rising number of in-patient admissions are among the key aspects driving the demand for handheld scanners in the healthcare sector.

Transportation & logistics segment accounted for the largest revenue share in the overall portable scanner market share in 2024.

- Handheld scanners are primarily used in the transportation industry for several applications involving tracking assets, boarding passes, luggage, and cargo among others.

- Meanwhile, handheld scanners are used in logistics to facilitate the storage and tracking of goods during transit.

- Additionally, handheld scanners are mainly used in transportation & logistics applications involving inventory management, package tracking, order fulfillment, fleet management, and others.

- For instance, in April 2023, the administration at Felipe Angeles International Airport in Mexico announced the construction of a second terminal, which is scheduled to be operational in 2028.

- According to the analysis, the growing transportation & logistics sector is further propelling the portable scanner market trends.

The healthcare segment is anticipated to register the fastest CAGR growth during the forecast period.

- Handheld scanners are used in healthcare facilities during patient admittance for electronic tracking of patients by utilizing barcodes to increase the efficiency of treatments and eliminate errors.

- Moreover, handheld scanners are also used in the healthcare sector for scanning clinical lab samples, healthcare inventory management, and other related applications.

- For instance, Honeywell International offers a range of handheld scanners, including Xenon Ultra 1962h, Xenon Ultra 1960h, Xenon XP 1952h, and others in its product portfolio that are designed for healthcare applications. These scanners are used in vital tasks, including patient identification, specimen collection, and medication delivery among others.

- Therefore, the rising development of handheld scanners for utilization in healthcare applications is projected to drive market trends during the forecast period.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

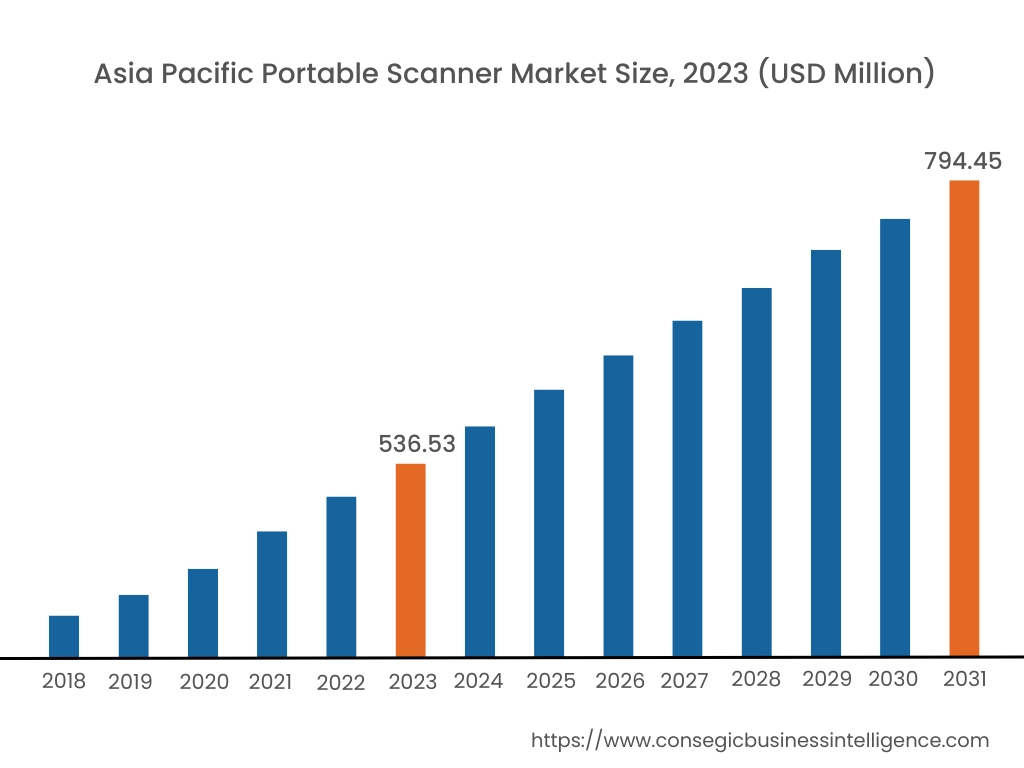

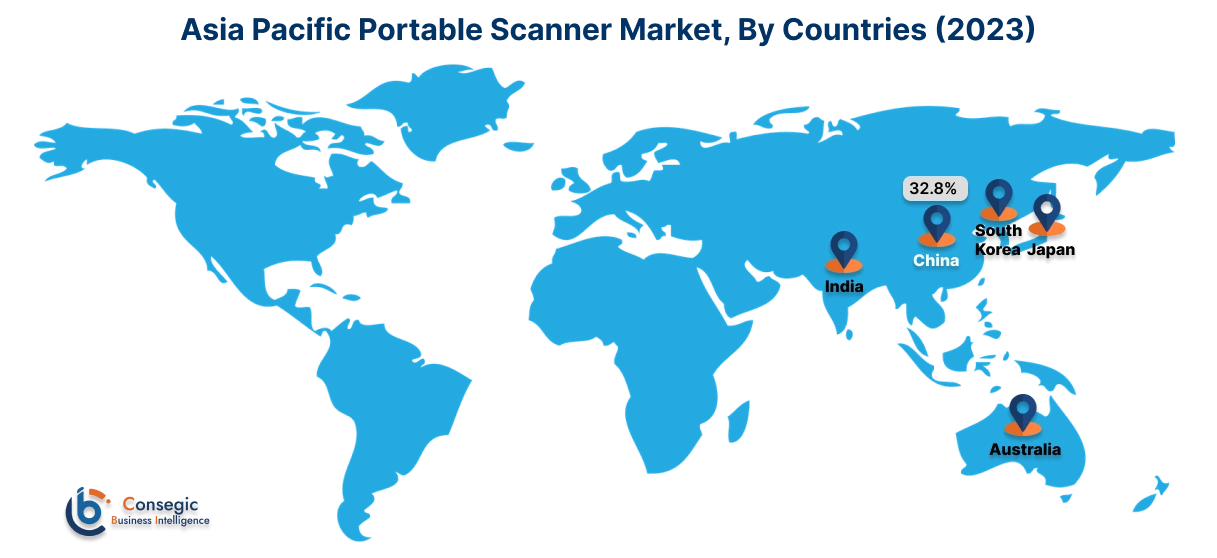

Asia Pacific region was valued at USD 558.14 Million in 2024. Moreover, it is projected to grow by USD 577.15 Million in 2025 and reach over USD 865.75 Million by 2032. Out of this, China accounted for the maximum revenue share of 33.72%. As per the portable scanner market analysis, the adoption of handheld scanners in the Asia-Pacific region is primarily driven by growing manufacturing, healthcare, and logistics sectors among others. Additionally, the growing retail & e-commerce sector is further accelerating the portable scanner market expansion.

- For instance, according to the India Brand Equity Foundation, the retail sector in India was valued at USD 1,200 billion in 2023, and it is projected to grow up to USD 2,500 billion by 2035. The above factors are further driving the adoption of handheld scanners in the retail sector, thereby propelling the market demand in the Asia-Pacific region.

North America is estimated to reach over USD 945.18 Million by 2032 from a value of USD 637.52 Million in 2024 and is projected to grow by USD 656.71 Million in 2025. In North America, the growth of the portable scanner industry is mostly driven by its utilization in retail & e-commerce, transportation & logistics, healthcare, manufacturing, and other sectors. Moreover, the growing retail & e-commerce sector and increasing utilization of handheld scanners in retail stores and warehouses for price checking, stock checking, and inventory management are further contributing to the portable scanner market demand in North America.

In addition, the regional analysis depicts that the growing manufacturing and transportation & logistics sectors along with increasing adoption of handheld scanners for facilitating inventory optimization, order fulfillment, and operational efficiency are driving the portable scanner market demand in Europe. Further, according to the market analysis, the market demand in Latin America, Middle East, and African regions is anticipated to grow at a substantial rate due to factors including increasing development of retail & e-commerce business, expansion of healthcare facilities, and rising manufacturing sector among others.

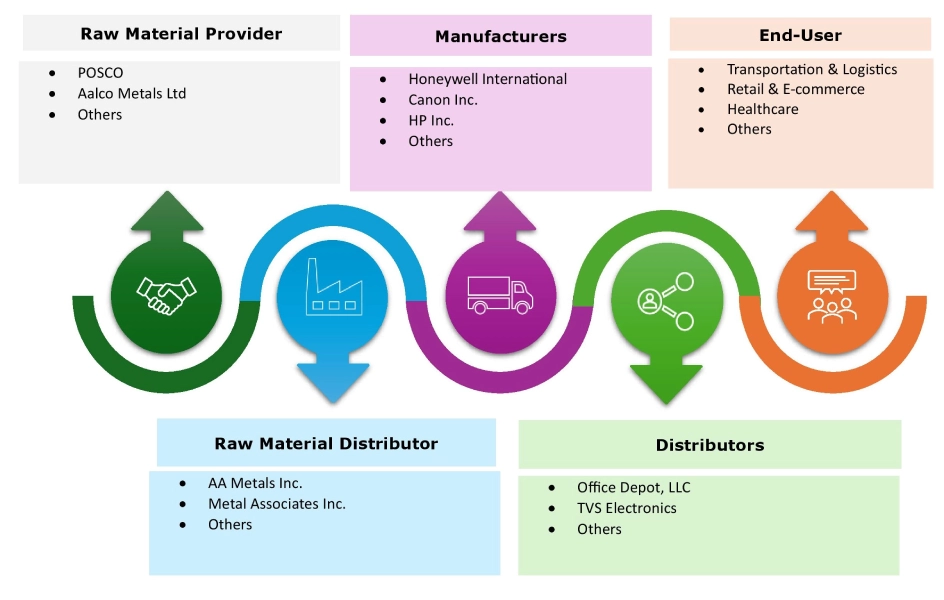

Top Key Players & Market Share Insights:

The global portable scanner market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the portable scanner market. Key players in the portable scanner industry include-

- Honeywell International Inc. (United States)

- Canon Inc. (Japan)

- Brother Industries, Ltd. (Japan)

- Toshiba Corporation (Japan)

- Zebra Technologies Corporation (United States)

- HP Inc. (United States)

- Fujitsu Limited (Japan)

- Seiko Epson Corporation (Japan)

- Eastman Kodak Company (United States)

- Panasonic Corporation (Japan)

Recent Industry Developments :

Product Launches:

- In February 2025, SCANTECH launched its new 3DeVOK MT model of handheld 3D scanner. The handled scanner offers several benefits such as fast and stable scanning, exceptional resolution, high precision, versatility, and superior performance.

- In September 2024, SHINING 3D launched its FreeScan UE Pro2 model of wireless laser handheld 3D scanner. The scanner features an integrated wireless module, offering exceptional mobility and flexibility.

Portable Scanner Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 2,748.40 Million |

| CAGR (2025-2032) | 4.7% |

| By Type |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the portable scanner market? +

The portable scanner market was valued at USD 1,845.23 Million in 2024 and is projected to grow to USD 2,748.40 Million by 2032.

Which is the fastest-growing region in the portable scanner market? +

Asia-Pacific is the region experiencing the most rapid growth in the portable scanner market.

What specific segmentation details are covered in the portable scanner report? +

The portable scanner report includes specific segmentation details for type, end-user, and region.

Who are the major players in the portable scanner market? +

The key participants in the portable scanner market are Honeywell International Inc. (United States), Canon Inc. (Japan), HP Inc. (United States), Fujitsu Limited (Japan), Seiko Epson Corporation (Japan), Eastman Kodak Company (United States), Panasonic Corporation (Japan), Brother Industries, Ltd. (Japan), Toshiba Corporation (Japan), Zebra Technologies Corporation (United States), and others.