Potassium Sulfate Market Size :

Potassium Sulfate Market size is estimated to reach over USD 7,894.79 Million by 2032 from a value of USD 5,239.07 Million in 2024 and is projected to grow by USD 5,421.29 Million in 2025, growing at a CAGR of 5.30% from 2025 to 2032.

Potassium Sulfate Industry Scope & Overview:

Potassium sulfate is an inorganic compound that contains sulfuric acid and has a low concentration of chloride. The chemical is highly known for producing nutrition-rich feed and high-quality crops. It is a white crystalline powder which is odorless and has a saline-like taste. The chemical is widely used as fertilizer for different crops which includes fruits and vegetables. Moreover, as per the analysis, it is also used for the production of lubricants and dyes and is useful in manufacturing ceramics, glass, and production of gypsum boards. Additionally, the chemical is useful for helping plant growth by resisting drought, frost and other insect growth, and enhancing the growth of fruits and vegetables.

Potassium Sulfate Market Insights :

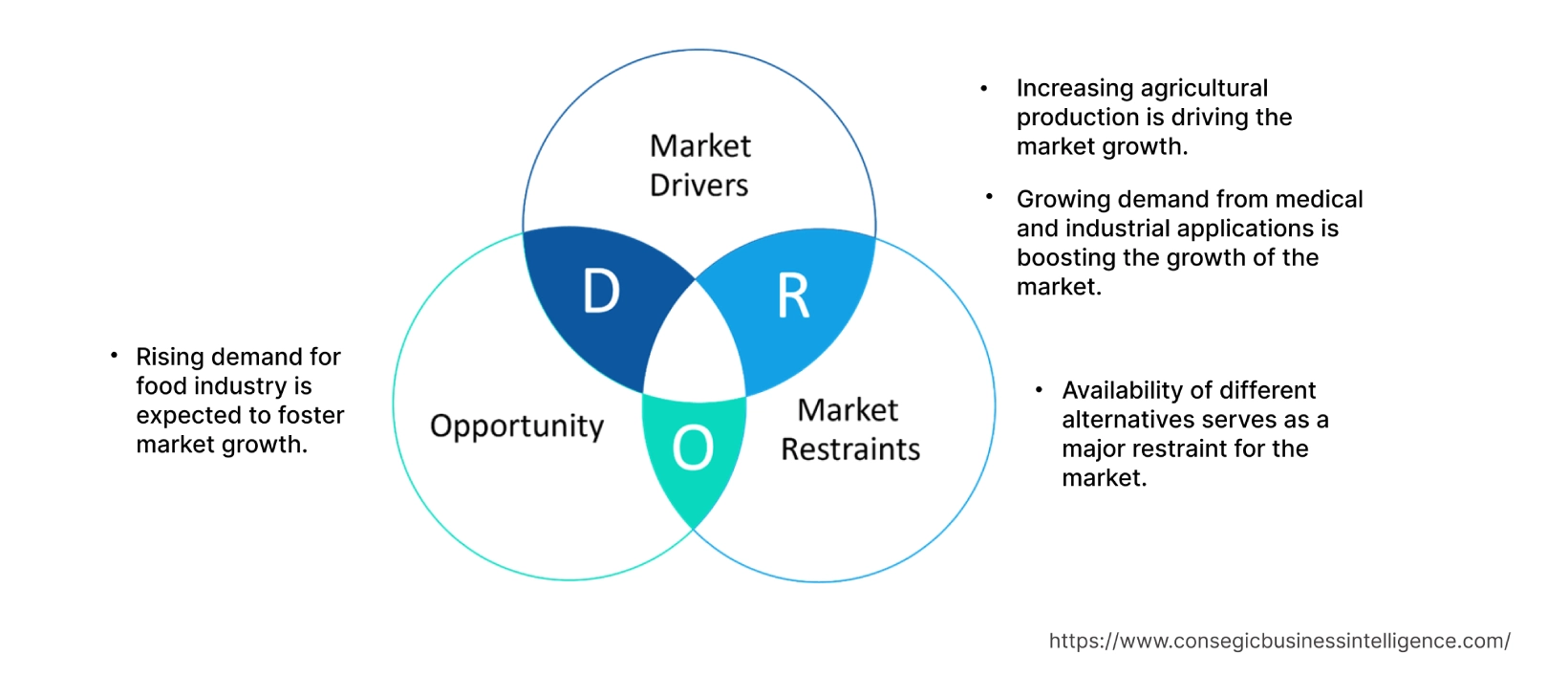

Potassium Sulfate Market Dynamics - (DRO) :

Key Drivers :

Increasing agricultural production is driving the market

Potassium sulfate is largely incorporated for producing high quality crops. The chemical has a low concentration of chloride and also has a low salt index, making it ideal for usage in the agricultural sector. It is utilized in the agricultural sector to help plants resist disease and increase the plant's ability to withstand drought. Also, the prevention of infection of plants from pests and other microbes acts as a major driving factors for the chemical. It is useful for plants to adapt to fluctuating and unfavorable weather conditions and favors the plant in absorbing minerals from the soil. Furthermore, as per the analysis, the chemical has wide applications in the agriculture sector for fertigation and drip irrigation, which enhances the conservation of freshwater resources. Also, rising agricultural production is boosting the potassium sulfate industry. For instance, according to a recent report by the Press Information Bureau of the government of India, in 2023, India's agriculture sector has been witnessing robust development with an average annual growth rate of 4.6 percent over the last six years. Hence, the growing agricultural sector is boosting the market expansion and trends.

Growing demand from medical and industrial applications is boosting the growth of the market

It is widely utilized as a medical treatment ingredient. The chemical has great medical advantages such as treating urinary issues and increasing perspiration. It is widely requireded in several industrial applications. Also it is used in the manufacturing of various chemicals for the dying sector and making high-quality inorganic compounds such as pure potassium sulfate potassium alum, potassium persulfate, potassium water glass, and others. Based on the analysis, the chemical is also used as an additive for manufacturing water-based, chloride-free drilling fluids, drawing lubricants, and others. The flourishing medical and chemical sector is leading to increased requirements of the product. For instance, according to a recent report by Invest India, in 2023, the market size of the chemicals & petrochemicals sector in India around USD 178 billion in 2022 and is expected to amount to around USD 300 billion by 2025. Hence, due to the increasing chemical sector globally, the market trend is increasing significantly.

Key Restraints :

Availability of different alternatives serves as a major restraint for the market

The wide availability of different alternatives such as polymer-based flocculants and advanced oxidation processes for different applications is hampering the requirement of the potassium sulfate market. Furthermore, high competition from alternative chemicals or technologies is posing a threat to the requirement for these products. Hence, the rising adoption of substitute products and technology due to the substitute such as polymer-based flocculants being a cheaper and economical option is likely to restrain this chemical market. Thus, due to the aforementioned factors, the availability of various alternatives in the market proves to be a restraint for the potassium sulfate market growth.

Future Opportunities :

Rising demand for the food sector is expected to foster market

The rising requirement for potassium sulfate in the food sector is creating lucrative potassium sulfate market opportunities and trends in the coming years. It is used in the food sector as a firming agent, thickening agent, and nutrient supplement, among others. It helps to firm up food by absorbing water and making the proteins in the food more tightly packed. As per the analysis, this is used in foods such as canned fruits and vegetables, pickles, and sausages. Increasing population globally is leading to increasing demand for food and beverages, propelling the expansion of the potassium sulfate market. For instance, according to a recent report by Invest India, in 2023, the total FDI received in the food processing sector from April 2000 to December 2022 has been around USD 11.79 billion. Also, the Indian food processing market is estimated to reach around USD 535 billion and is growing at a compound annual growth rate of 15.2%. Hence, due to the above-mentioned factors the rising demand for the food sector is expected to drive the trends of the market in the forecast period.

Potassium Sulfate Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 7,894.79 Million |

| CAGR (2025-2032) | 5.3% |

| By Form | Solid and Liquid |

| By End-use Industry | Agriculture, Pharmaceutical, Cosmetics, Food & Beverage, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | K+S Aktiengesellschaft, Van Iperen, SESODA CORPORATION, Sigma-Aldrich Co., Merck KGaA, HOLLAND COMPANY, Sunway Group, K+S Minerals, Tessenderlo Group, and Yara International ASA |

Potassium Sulfate Market Segmental Analysis :

By Form :

The form segment is categorized into solid and liquid. In 2024, the solid segment accounted for the highest market share and is expected to grow at the fastest CAGR over the forecast period in the potassium sulfate market. This is due to the high requirement for solid-based chemicals in the agricultural sector. Owing to the high requirement for the product in plant growth and crop production, the solid form of these chemicals such as powder, granules, and prills is widely demanded. Furthermore, the solid form provides an efficient and convenient way to supply potassium in the soil. The wide adoption rate of the chemical by farmers globally for increasing crop yield and agricultural productivity is driving the segment expansion of solid form in the potassium sulfate market. Hence, due to the aforesaid factors, the solid segment is witnessing significant development and trends.

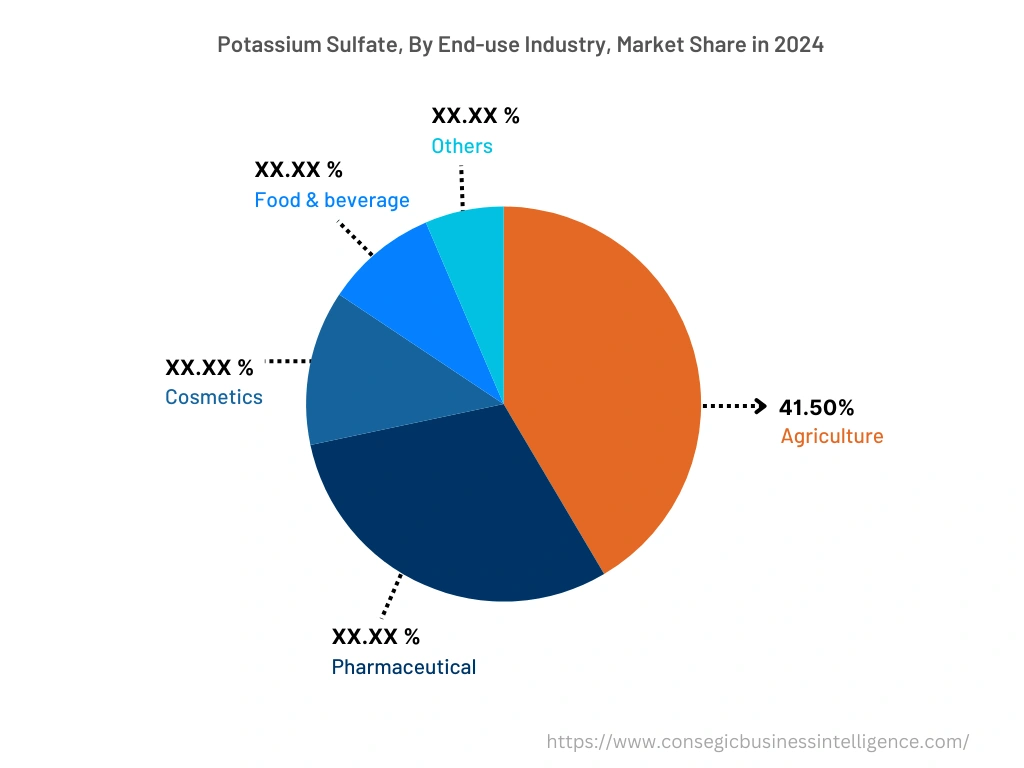

By End-Use-Industry :

The end-use industry segment is categorized into agriculture, pharmaceutical, cosmetics, food & beverage, and others. In 2024, the agriculture segment accounted for the highest potassium sulfate market share of 41.50% in the market. Rising requirement for food grains and cereals is increasing the requirement for this substance in crop yield and fertilizers. The chemical provides essential nutrients to the plant and helps in improving the production of food grains and vegetables. Furthermore, it provides an important source of sulfate which is essential for supporting the plants' need for enzymes and protein synthesis. Also, increasing the requirement for cereals and other high-quality crops is acting as a major driver of increased requirement for these compounds is influencing the segment trends.

However, the pharmaceutical segment is expected to grow at the fastest CAGR over the forecast period in the potassium sulfate market. This is due to the wide usage of the product in treating urinary issues and to increase perspiration. Moreover, the chemical is also used to regulate hypokalemia and is required for different therapies such as bowel preparation therapy and is used to cleanse the colon before a colonoscopy. Hence, due to the aforementioned factors, the pharmaceutical segment is witnessing significant potassium sulfate market demand.

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

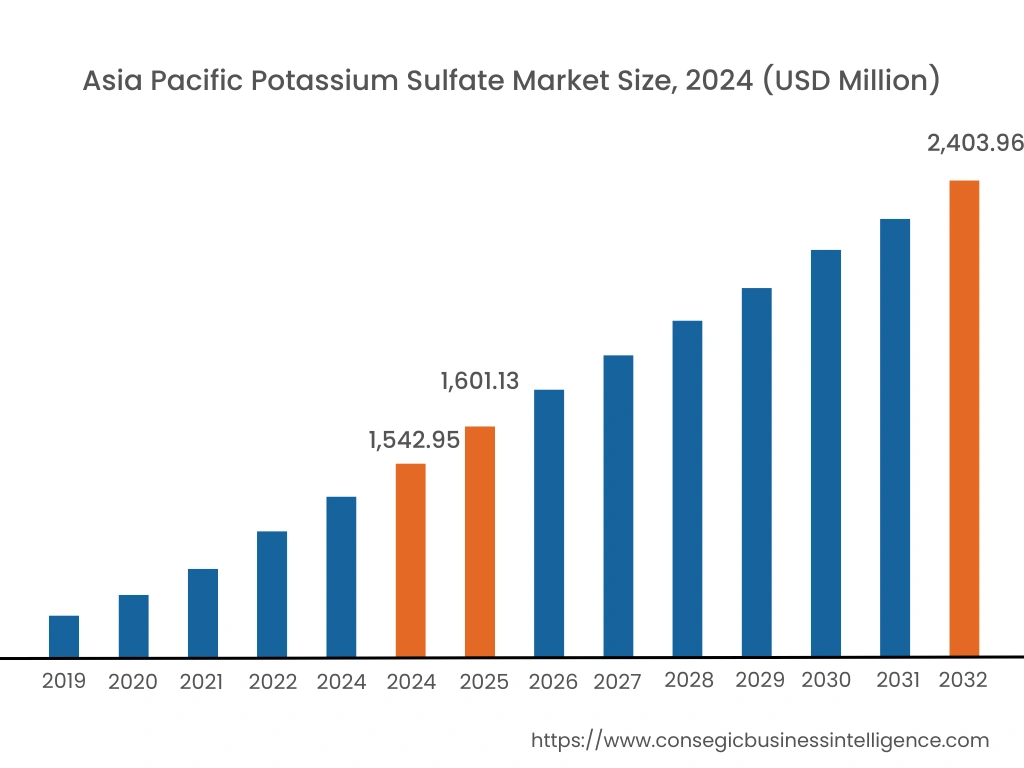

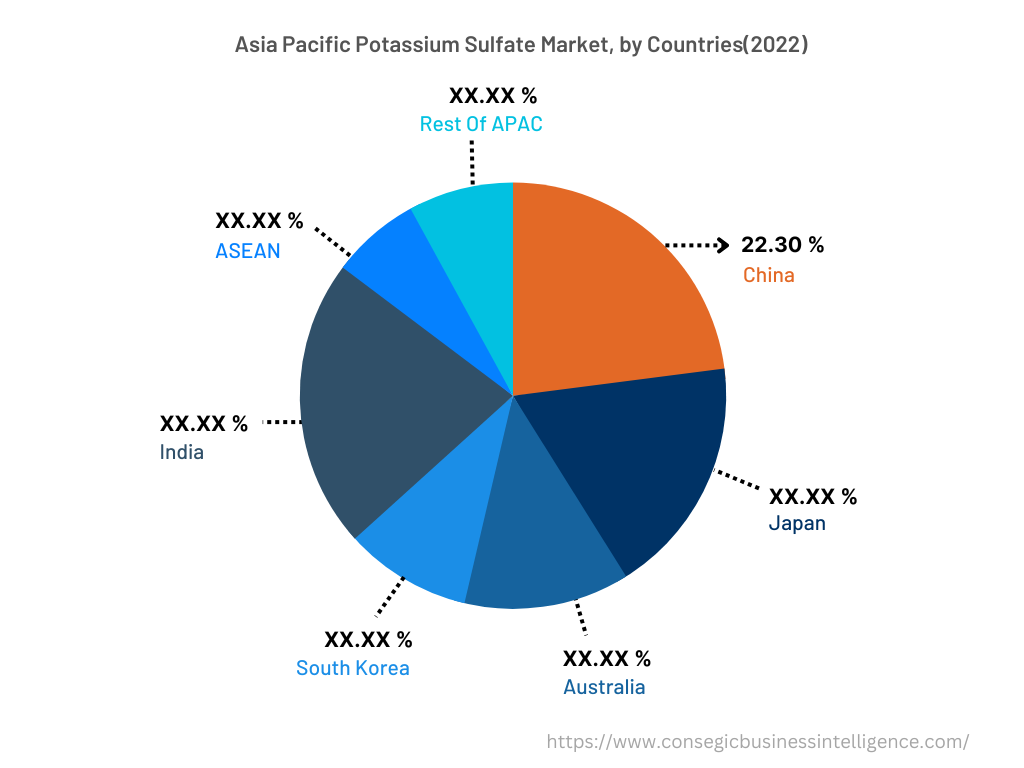

In 2024, Asia Pacific accounted for the highest market share at 39.11% valued at USD 1,542.95 million and projected to grow to USD 1,601.13 million in 2025, it is expected to reach USD 2,403.96 million in 2032. In Asia Pacific, China accounted for the highest market share of 22.30% during the base year of 2024. Based on the potassium sulfate market analysis, high investment opportunities coupled with easy trade flow is driving major requirements for the chemical in this region. Also, the high dependence of the economy of Asian countries on the agriculture sector is boosting the market. Also, the increasing population and growing demand for food grains act as a catalyst for the expansion of the potassium sulfate market. Furthermore, increasing specialty crop cultivation in the region such as cash crops, fruits, and vegetables is fostering the market. Hence, increasing agricultural production is boosting the expansion of the potassium sulfate market in the region. For instance, according to a recent report by India Brand Equity Foundation, in 2023, the Indian agricultural sector is expected to increase to around USD 24 billion by 2025, where India's agricultural and processed food products exports stood at USD 43.37 billion in the financial year 2023. Thus, the aforementioned factors are propelling the segment trends.

However, North America is expected to witness significant rise over the forecast period, growing at a CAGR of 5% during 2025-2032. This is due to the presence of major market players along with a wide industrial base across the region. As per the analysis, there has been a large production of tree nuts in this region such as cashews, almonds, and others in recent years. Hence, the increasing adoption of potassium sulfate-based fertilizers by farmers to generate effective crop yield is boosting the expansion of the potassium sulfate market trends in this region. Thus, due to the aforesaid factors, the market is expected to flourish in North America in the forecast years.

Top Key Players & Market Share Insights:

The global potassium sulfate market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- K+S Aktiengesellschaft

- Van Iperen

- K+S Minerals

- Tessenderlo Group

- Yara International ASA

- SESODA CORPORATION

- Sigma-Aldrich Co.

- Merck KGaA

- HOLLAND COMPANY

- Sunway Group

Recent Industry Developments :

- In June 2022, K+S signed a letter of intent with the Swedish company Cinis Fertilizer on future cooperation in the synthetic production of potassium sulfate. Under the planned agreement, K+S intends to supply Cinis Fertilizer with its entire potassium chloride requirements.

- In October 2021, Van Iperen partnered with Cinis Fertilizer, a Swedish cleantech startup, to produce a sustainable and circular potassium sulfate fertilizer. This partnership is expected to bring more innovation in the agricultural sector with new technologies and upcycling industrial processes.

Key Questions Answered in the Report

What was the market size of the potassium sulfate industry in 2024? +

In 2024, the market size of potassium sulfate was USD 5,239.07 million.

What will be the potential market valuation for the potassium sulfate industry by 2032? +

In 2032, the market size of potassium sulfate will be expected to reach USD 7,894.79 million.

What are the key factors driving the growth of the potassium sulfate market? +

Increasing agricultural production is fueling market growth at the global level.

What is the dominating segment in the potassium sulfate market by end-use industry? +

In 2024, the agriculture segment accounted for the highest market share of 41.50% in the overall potassium sulfate market.

Based on current market trends and future predictions, which geographical region is the dominating region in the potassium sulfate market? +

Asia Pacific accounted for the highest market share in the overall Potassium Sulfate market.