PVB Film Market Size:

PVB Film Market size is growing with a CAGR of 4.1% during the forecast period (2025-2032), and the market is projected to be valued at USD 3.64 Billion by 2032 from USD 2.66 Billion in 2024. Additionally, the market value for the 2025 attributes to USD 2.76 Billion.

PVB Film Market Scope & Overview:

Polyvinyl Butyral (PVB) is a synthetic thermoplastic resin known for its strong binding capabilities, optical clarity, and excellent adhesion to various surfaces like glass and metals. While PVB exists as a resin, its primary application lies in the form of films. These films are created by extruding PVB resin with plasticizers. These films provide exceptional binding strength, optical clarity, adhesion to glass and other surfaces, and impact resistance, preventing glass from shattering and minimizing injury upon breakage. The films find their application in the preparation of automotive products, building materials, laminated glass, photovoltaic glass, security glazing, and others. The end use of these films consists of automotive, construction, solar energy, electronics, and others.

How is AI Impacting the Product Life Cycle Management Market?

AI is profoundly transforming the Product Lifecycle Management (PLM) market by infusing intelligence and automation into every stage. It enables faster new product development through generative design, where AI creates optimized designs based on specified parameters, significantly reducing ideation and prototyping time. AI-powered analytics enhance decision-making by analyzing vast datasets from design, manufacturing, and customer feedback to predict market trends, potential risks, and optimize product features. Automation of routine tasks like data entry, document management, and quality control frees up engineers for more strategic work. Furthermore, AI improves supply chain visibility and risk mitigation by predicting component failures and optimizing logistics, leading to more efficient and sustainable product lifecycles.

PVB Film Market Dynamics - (DRO) :

Key Drivers:

Growing Adoption of Electric Vehicles (EVs) to Propel the PVB Film Market Demand

Polyvinyl Butyral films enhance sound insulation, a crucial aspect in the quieter cabin environment of EVs where engine noise is absent, effectively reducing road and wind noise for a more comfortable ride. These films also offer solar control and UV protection, which is vital for managing cabin temperature and reducing the load on the EV's battery-powered climate control system. The rise in the adoption of EVs influences the use of these films.

For instance,

- The data by IEA states that electric car sales surged in 2023, rising by 3.5 million units compared to the previous year, representing a substantial 35% growth.

Thus, the rise in the adoption of electric vehicles is influencing the use of these films.

Growing Development of Privacy Film is Driving the PVB Film Market Growth.

Polyvinyl Butyral film serves as an essential component in laminated glass that incorporates dynamic privacy layers like LC or SPD films. Newer privacy films offer advancements in adhesive technology for increased impact resistance. This approach leverages PVB's inherent bonding capabilities with the enhanced strength provided by advanced privacy films, creating a multi-layered defense. Manufacturers are developing new security films that provide enhanced adhesion.

For instance,

- In 2021, Kuraray developed Trosifol Translucent White provides high adhesion, making it particularly suitable for use with heat-strengthened or fully tempered glass, reducing the risk of delamination. It is also well-suited as a privacy screen.

Thus, the development of new films for privacy applications is driving the market.

Key Restraints:

Commercialization of Alternative Films is Hampering the PVB Film Market Growth.

The PVB Film industry faces significant hurdles due to the availability of various substitute films such as Ethylene Vinyl Acetate (EVA) film, ionoplast film, and others. These alternative films offer comparable or even superior performance in specific applications, such as EVA's cost-effectiveness and adhesion in solar panels, and ionoplast's exceptional strength and rigidity in structural glazing. This competition necessitates continuous innovation from PVB manufacturers to enhance their product offerings, focusing on specialized properties like acoustic dampening, thermal insulation, and UV protection, which is generally time consuming and requires significant investment. Thus, as per the market analysis, the availability of alternative materials hinders the PVB film market expansion.

Future Opportunities :

Development of Sustainable Interlayer Solutions is Creating Lucrative PVB Film Market Opportunities.

Sustainable interlayers for laminated glass are being developed using recycled PVB from discarded automotive and architectural glass, reducing waste and the need for virgin materials. These sustainable interlayer solutions not only reduce the carbon footprint of laminated glass but also enhance the appeal of Polyvinyl Butyral films to environmentally conscious consumers and industries. Manufacturers are developing sustainable films that reduce carbon emissions.

For instance,

- In 2024, Kuraray developed Trosifol R3 that achieves up to 90% CO₂ emissions reduction compared to traditional PVB clear interlayers. This innovative solution emphasizes a significant advancement in sustainable glazing, offering a high-performance, eco-conscious alternative.

Thus, the growing development and adoption of sustainable films are creating lucrative PVB film market opportunities.

PVB Film Market Segmental Analysis :

By Application:

Based on the application, the market is categorized into automotive products, building materials, laminated glass, photovoltaic glass, security glazing, and others.

Trends in the Application:

- The growing trend for lightweight materials is influencing the use of these polyvinyl films.

- There's a trend towards integrating sensors and energy management systems with PV glass to optimize energy collection and potentially modulate transparency.

The automotive products segment accounted for the largest market share in 2024.

PVB films are essential in automotive products, serving primarily as the interlayer in laminated safety glass for windshields, side windows, backlights, sidelights, and sunroofs. This crucial application prevents glass from shattering into dangerous fragments upon impact, significantly enhancing occupant safety during collisions. The films also offer significant UV radiation blockage, protecting the vehicle's interior from fading and shielding occupants from harmful rays. Various manufacturers are introducing novel films for EV sidelights.

For instance,

- In 2024, Eastman introduced Saflex Evoca RSL, a rigid acoustic PVB for EV sidelights, which enhances design flexibility while advancing EV glazing solutions.

Thus, the rising use of these films in various automotive products is driving the PVB film market trends.

The photovoltaic glass is expected to grow at the fastest CAGR over the forecast period.

In photovoltaic (PV) glass for solar panels, PVB films serve as a crucial encapsulant layer. This encapsulation ensures long-term durability and maintains the performance efficiency of the solar modules over their lifespan. PVB's excellent light transmission properties allow maximum sunlight to reach the photovoltaic glass in solar cells, optimizing energy conversion and contributing to the overall effectiveness of solar energy projects. Thus, as per the PVB film market analysis, the adoption of these films for photovoltaic glass applications is driving the market trends in the coming years.

By End Use:

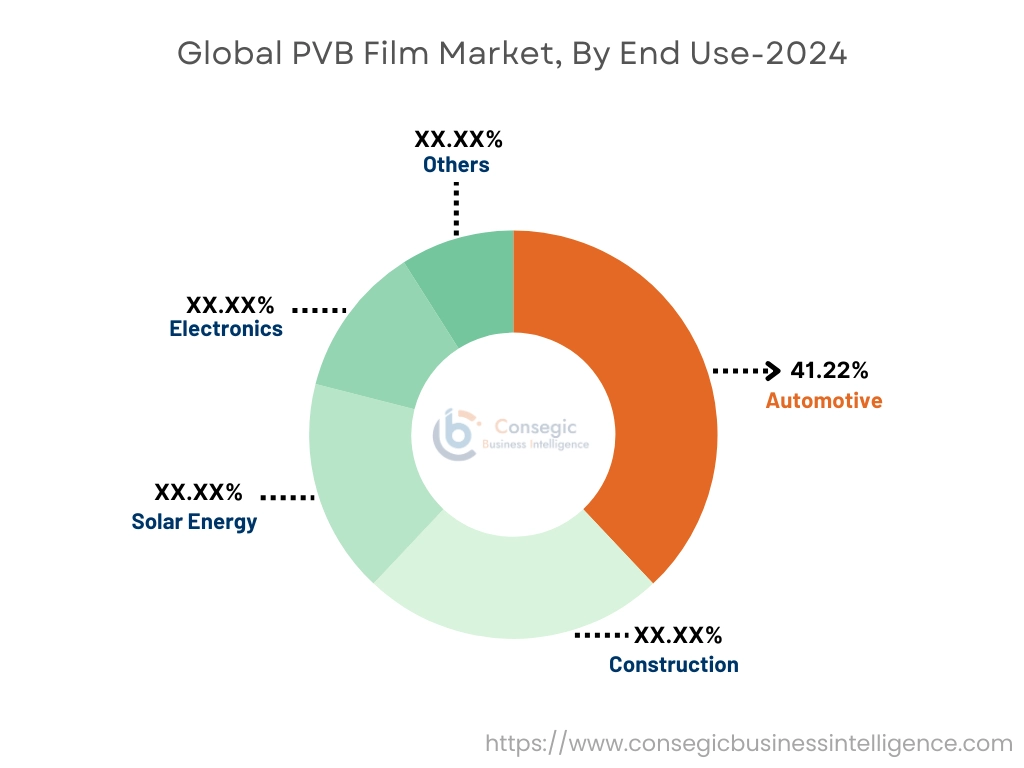

Based on the end use, the market is categorized into automotive, construction, solar energy, electronics, and others.

Trends in end use:

- There is a rising trend for top-trim and luxury vehicles with advanced features, including larger displays, sophisticated ADAS, and enhanced comfort.

- The overall efficiency of solar panels is constantly improving, driving higher demand for high-performance PV glass that maximizes light transmittance to the cells.

The automotive segment accounted for the largest PVB Film market share of 41.22% in the year 2024.

PVB films are necessary for the automotive sector, primarily serving as the interlayer in laminated safety glass for windshields, side windows, backlights, and automotive sunroofs among others. PVB interlayers contribute to a more comfortable driving experience by providing sound dampening and reducing road and windy noise within the cabin. Furthermore, they offer significant UV radiation blockage, protecting the vehicle's interior from fading and shielding occupants from harmful rays. Thus, as per the analysis, the utilization of these films in the automotive sector is influencing the PVB Film market expansion.

The solar energy segment is expected to grow at the fastest CAGR over the forecast period.

PVB films play a crucial role as an encapsulant within photovoltaic (PV) modules including fixed-tilt solar PV systems. Sandwiched between the glass front sheet and the back sheet, this film protects the solar cells from environmental factors like moisture, UV radiation, and physical impact, ensuring the long-term durability and performance of the solar panels. The number of solar power plant projects is growing because of supportive government policies and investments promoting renewable energy.

For instance,

- The data by IEA states that between 2024 and 2030, solar photovoltaic (PV) technology contributes approximately 80% of the renewable energy. This growth is fueled by the development of new large-scale solar power plants.

Thus, the expansion of solar projects is driving the segment growth in the coming years.

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

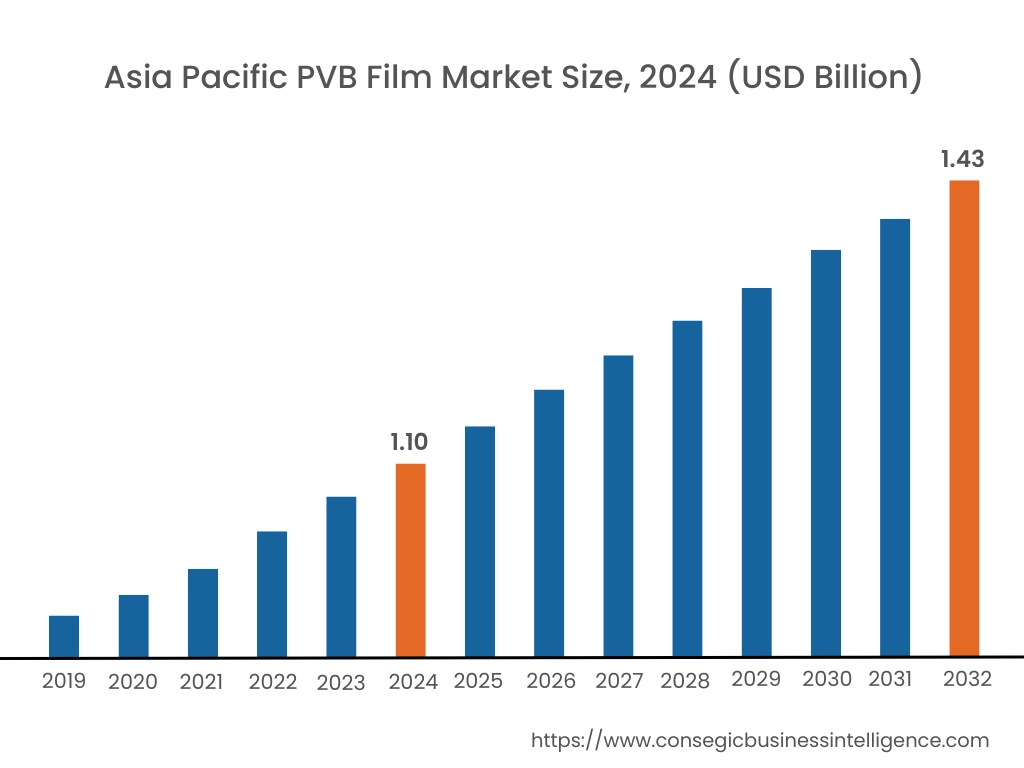

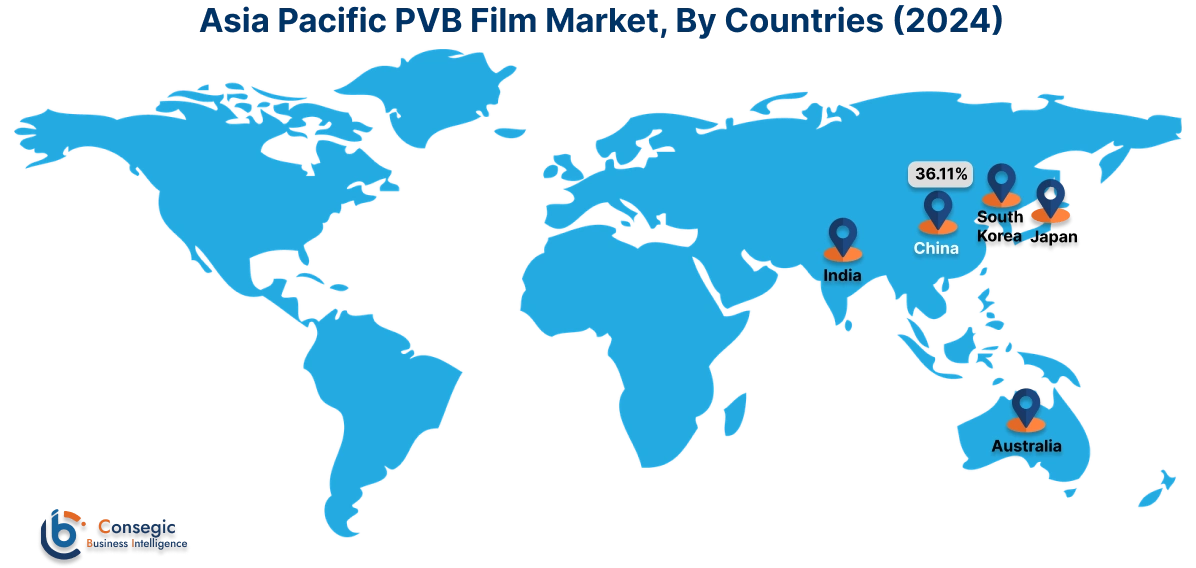

In 2024, Asia Pacific accounted for the highest PVB Film market share at 41.5% and was valued at USD 1.10 Billion and is expected to reach USD 1.43 Billion in 2032. In Asia Pacific, China accounted for the highest market share of 36.11% during the base year of 2024. The Asia Pacific’s automotive sector's requirement for Polyvinyl Butyral films is robust and evolving, driven by a strong consumer preference for comfort and energy efficiency, and the growing electric vehicle market. The need for lightweight and the integration of advanced technologies like ADAS further emphasizes the use of these films. The rise in adoption of Electric vehicles in this region is influencing the use of this solution.

For instance,

- According to the International Energy Agency, new electric car registrations in China reached 8.1 million in 2023, a 35% increase from 2022.

Thus, the rise in the automotive sector is influencing the PVB film market demand in this region.

Europe is experiencing the fastest growth with a CAGR of 5.5% over the forecast period. The European region, with its growing automotive and construction sectors, presents a significant market for sustainable and recyclable films. Increasing environmental awareness and stricter regulations are driving the requirement for eco-friendly materials. Manufacturers are responding by developing bio-based PVB options and enhancing recycling technologies for end-of-life laminated glass a type of advanced glass from vehicles and buildings across Europe. These efforts not only reduce waste and carbon emissions but also cater to the growing preference for sustainable solutions in both automotive glazing for electric vehicles and energy-efficient architectural applications. Thus, as per the PVB market analysis, the rise in the use of recycled products is influencing the PVB film industry in the Europe region.

The North America region is witnessing significant advancements in both safety and privacy film technologies, with PVB films playing a crucial role. For safety, PVB remains the dominant interlayer in laminated glass for automotive and architectural applications, providing essential impact resistance and preventing shattering. Simultaneously, the demand for privacy is driving innovation in films with varying translucency levels, colors, and embedded patterns, offering aesthetic versatility alongside inherent safety and UV protection. Thus, as per the PVB film market analysis, the rise in the requirement for safety and privacy films is driving the PVB film market demand.

In the Middle East and Africa region, PVB films are integral to laminated glass, driven by standards and a growing emphasis on energy efficiency and sustainability. PVB interlayers prevent shattering, enhance security, and provide crucial UV protection. Furthermore, acoustic films contribute to noise reduction in urban environments. The rise in infrastructure development and construction projects, including high-rise buildings, boosts the demand for laminated glass in windows, doors, and facades for safety and aesthetic purposes. Thus, as per the market analysis, growing use in the construction sector is influencing the PVB Film market trends.

In Latin America, the growing solar energy sector presents significant opportunities for Polyvinyl Butyral film. As countries in Latin America are increasingly investing in solar projects to meet rising energy requirements and sustainability goals, these films are crucial for encapsulating and protecting photovoltaic modules from the region's harsh environmental conditions, including high UV radiation and humidity. Its excellent light transmission properties also ensure optimal energy conversion efficiency. The growing scale of solar farms and rooftop installations across Latin America translates to a substantial and expanding market for these films, thus driving the growth in this region.

Top Key Players and Market Share Insights:

The global PVB Film market is highly competitive with major players providing precise products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global PVB Film market. Key players in the PVB Film industry include-

- Eastman Chemical Company (United States)

- Kuraray (Japan)

- Sichuan EM Technology Co., Ltd. (China)

- Tangshan Jichang New Material Co., Ltd. (China)

- Chang Chun Group (Taiwan)

- Everlam (Belgium)

- Genau Manufacturing Company LLP (India)

- 3M (United States)

- Perstorp (Sweden)

- Qingdao Jiahua Plastics Co., Ltd (China)

Recent Industry Developments :

Product Launch:

- In 2024, Eastman introduced Saflex Evoca RSL, a rigid acoustic PVB for EV sidelites, which enhances design flexibility while advancing EV glazing solutions.

PVB Film Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 3.64 Billion |

| CAGR (2025-2032) | 4.1% |

| By Application |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the PVB Film market? +

In 2024, the PVB Film market is USD 2.66 Billion.

Which is the fastest-growing region in the PVB Film market? +

Europe is the fastest-growing region in the PVB Film market.

What specific segmentation details are covered in the PVB Film market? +

Application and End use segmentation details are covered in the PVB Film market.

Who are the major players in the PVB Film market? +

Eastman Chemical Company (United States), Kuraray (Japan), and Everlam (Belgium) are some of the major players in the market.