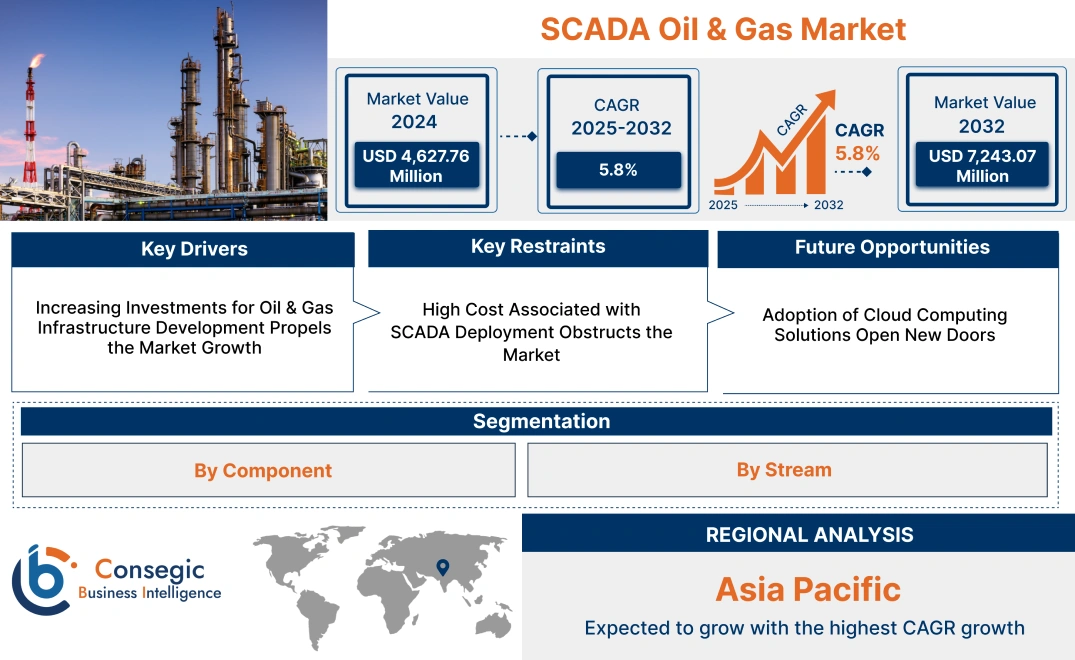

SCADA Oil & Gas Market Size:

SCADA Oil & Gas Market size is estimated to reach over USD 7,243.07 Million by 2032 from a value of USD 4,627.76 Million in 2024 and is projected to grow by USD 4,811.86 Million in 2025, growing at a CAGR of 5.80% from 2025 to 2032.

SCADA Oil & Gas Market Scope & Overview:

SCADA (Supervisory Control and Data Acquisition) is a system of hardware and software that allows industrial organizations to remotely monitor, control, and acquire data from industrial processes and critical infrastructure. In the oil and gas industry, SCADA is used to enable remote monitoring, control, and data acquisition from geographically dispersed assets like wells, pipelines, and refineries to enhance operational efficiency, safety, and reliability. Further benefits including enhanced operational efficiency, improved safety, better decision-making, and regulatory compliance are driving the market. Furthermore key trends driving the market include increasing digitalization and automation, growing adoption of cloud-based solutions and the Industrial Internet of Things (IIoT), integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive maintenance and optimized operations, and focus on robust cybersecurity measures to protect critical infrastructure.

SCADA Oil & Gas Market Dynamics - (DRO) :

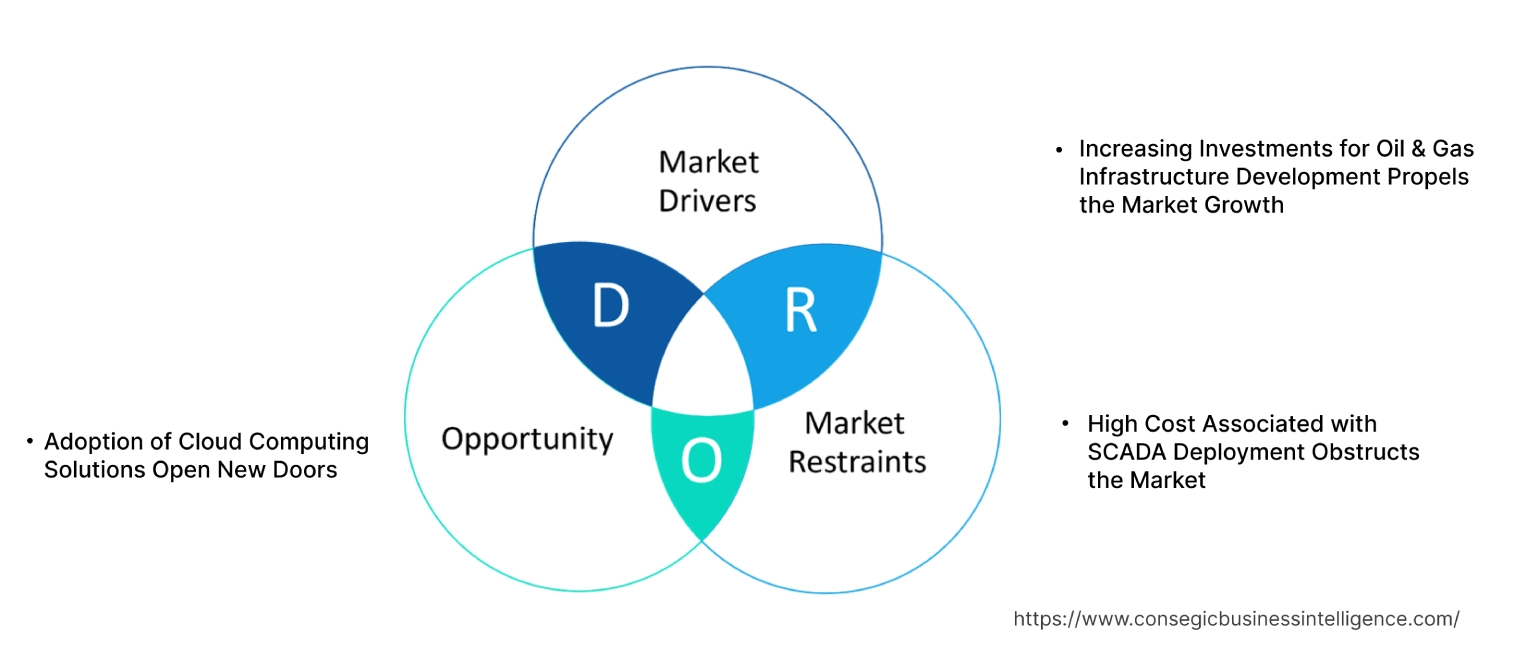

Key Drivers:

Increasing investments in oil & gas infrastructure development propels market growth

Increasing investments in oil and gas infrastructure, such as new pipelines, refineries, and exploration projects, are a primary driver for SCADA market growth. As these complex and geographically dispersed assets are developed, there's an escalating need for real-time monitoring, remote control, and data acquisition to ensure operational efficiency, safety, and regulatory compliance. SCADA systems provide the critical backbone for managing these vast networks, enabling optimized production, predictive maintenance, and rapid response to incidents, thereby driving their widespread adoption in new oil and gas developments globally.

- For instance, in April 2025, GTA Phase 1 project, a major LNG development on the Mauritania and Senegal maritime border, recently shipped its first LNG cargo. This deepwater project is one of BP's largest and is set to produce around 2.4 million tonnes of LNG annually and approximately 70,000 barrels of oil equivalent per day.

Thus, the analysis shows that the rising investments and collaboration for oil & gas infrastructure development are driving the SCADA oil & gas market growth.

Key Restraints :

High Cost Associated with SCADA Deployment Obstructs the Market

The high cost associated with SCADA deployment is a significant obstacle for restraining the SCADA oil & gas market demand. This encompasses substantial upfront investments in specialized hardware (RTUs, PLCs, sensors) and software licenses, which can range from thousands to millions of dollars depending on system complexity. Beyond initial expenditure, ongoing costs for maintenance, regular software updates, cybersecurity enhancements, and the need for highly skilled personnel to operate and troubleshoot these sophisticated systems further add to the financial burden. Therefore, high costs associated with the implementation and expansion of SCADA systems are restraining the growth of SCADA oil & gas market.

Future Opportunities :

Adoption of Cloud Computing Solutions Drives SCADA oil & gas market opportunities.

Cloud computing is transforming SCADA technology by offering flexible, scalable, and cost-effective alternatives to traditional on-site server solutions. With cloud-based SCADA systems, organizations can now store and process massive amounts of data without needing extensive hardware infrastructure. This not only reduces capital expenditure but also simplifies IT management and maintenance.

Further, a key advantage is remote access, empowering operators to monitor and control industrial processes from anywhere with an internet connection. This is especially beneficial for industries with widespread operations, like oil and gas, allowing for more efficient management of remote assets and reduced need for on-site personnel. Moreover, the integration of analytics and machine learning into these cloud systems significantly enhances their capabilities, enabling predictive maintenance, optimized resource allocation, and proactive problem-solving, thereby creating exciting new market opportunities and driving operational excellence.

- For instance, in August 2024, PaKEnergy LLC, a digital business automation supplier in the energy industry acquired Plow Technologies, a provider of cloud and SCADA software.

Thus, the growing adoption of cloud based solutions in the SCADA system drives the SCADA oil & gas market opportunities.

SCADA Oil & Gas Market Segmental Analysis :

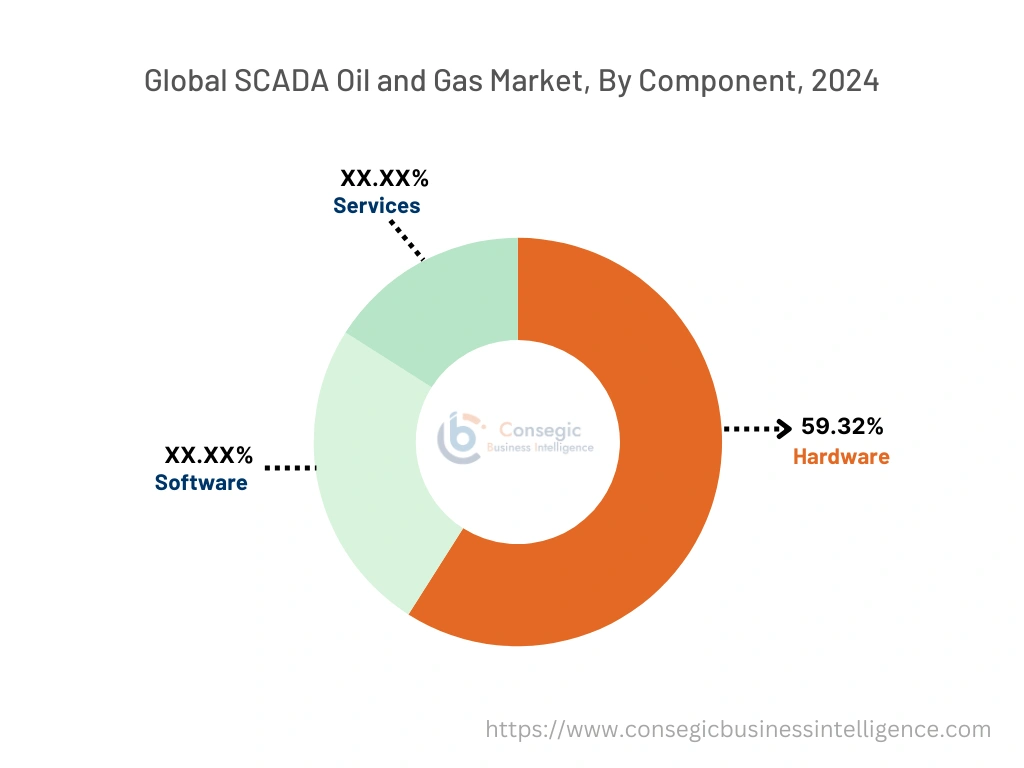

By Component:

Trends in the Component:

- Increasing demand for integration of AI and machine learning to optimize predictive maintenance and improve operational efficiency, drives SCADA oil & gas market size.

- Rising trend towards remote monitoring and controlling various equipment is boosting the need for SCADA oil & gas software solution.

Hardware segment accounted for the largest revenue share of 59.32% in 2024.

- There's a growing trend towards deploying more intelligent field devices, including advanced sensors, Remote Terminal Units (RTUs), and Programmable Logic Controllers (PLCs) which in turn drives SCADA oil & gas market share.

- There’s a drive towards miniaturization for easier installation and deployment in confined spaces or remote locations.

- The shift from wired to wireless communication for SCADA hardware is gaining momentum, driving the SCADA oil & gas market size.

- In September 2023, Siemens launched Simcenter SCADAS RS, with added features including IP 66 and 67 ratings, higher operating temperature range, and others.

- Thus, based on SCADA oil & gas market analysis, increased adoption of smart sensors, miniaturization, and wireless communication technologies are driving SCADA oil & gas market share.

Services is anticipated to register the fastest CAGR during the forecast period.

- Oil and gas companies are increasingly outsourcing the management and maintenance of their SCADA systems to third-party service providers to ensure continuous and efficient operation.

- The complexity of integrating new SCADA technologies with existing legacy systems, as well as integrating SCADA with other enterprise systems (e.g., ERP, EAM), is driving demand for specialized system integration and consulting services.

- Services are essential for oil and gas companies in areas like pipeline integrity management, remote monitoring and controlling, and ensuring compliance with safety and regulatory standards.

- For instance, Emerson, a SCADA service provider, acquired Zedi's software and automation business for cloud based remote control and monitoring.

- Thus, based on analysis, managed SCADA services, system integration and consulting services, and compliance is expected to boost the SCADA oil & gas market trends.

By Stream:

Based on stream, the market is segmented into upstream, midstream, and downstream.

Trends in the Stream:

- The downstream oil and gas system is used for refining/receiving crude oil at different plants for turning oil into many products such as LPG, gasoline, LNG, and others.

- In the midstream sector, SCADA systems enable real-time monitoring and automation of pipeline networks for improving leak detection and enhancing regulatory compliance which in turn drives SCADA oil & gas market trends.

Upstream sector accounted for the largest revenue share in the overall market in 2024.

- In upstream oil and gas, SCADA systems are used for monitoring and controlling extraction processes, including wellheads, drilling rigs, and field equipment.

- Further, increasing demand for exploration in remote and harsh environments requires SCADA systems that are increasingly critical for reliable, real-time monitoring and control of wellheads, subsea systems, and drilling rigs which in turn drives SCADA oil & gas market expansion.

- Upstream operators are leveraging SCADA data, combined with digital twin technology and AI/ML algorithms, for enhanced reservoir management, predictive maintenance of drilling equipment, and optimized production flow from individual wells.

- According to India Brand Equity Foundation (IBEF), government approved 100% FDI (Foreign Direct Investment) in upstream and refining projects in private sector.

- According to the analysis, remote and offshore operations optimization and integration with digital twins is set to boost the SCADA oil and gas market trends.

Midstream sector is anticipated to register the fastest CAGR during the forecast period.

- In midstream, SCADA system is used to manage movements of petroleum products through pipelines, ensuring efficient and reliable transportation and distribution.

- Further, the system improve the safety, efficiency, and reliability of midstream operations by enabling real-time monitoring, leak detection, and remote control of pipeline networks in turn driving SCADA oil & gas industry.

- Furthermore, SCADA oil & gas is used in midstream sector for pipeline monitoring, flow control, leak detection, and inventory management across terminals.

- For instance, in May 2021, EOT launched AI Edge Controller SCADA system, integrated with machine learning models to obtain real time predictions which is implemented in closed loop.

- Therefore, the rising advancements in SCADA system drives the SCADA oil & gas market growth.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

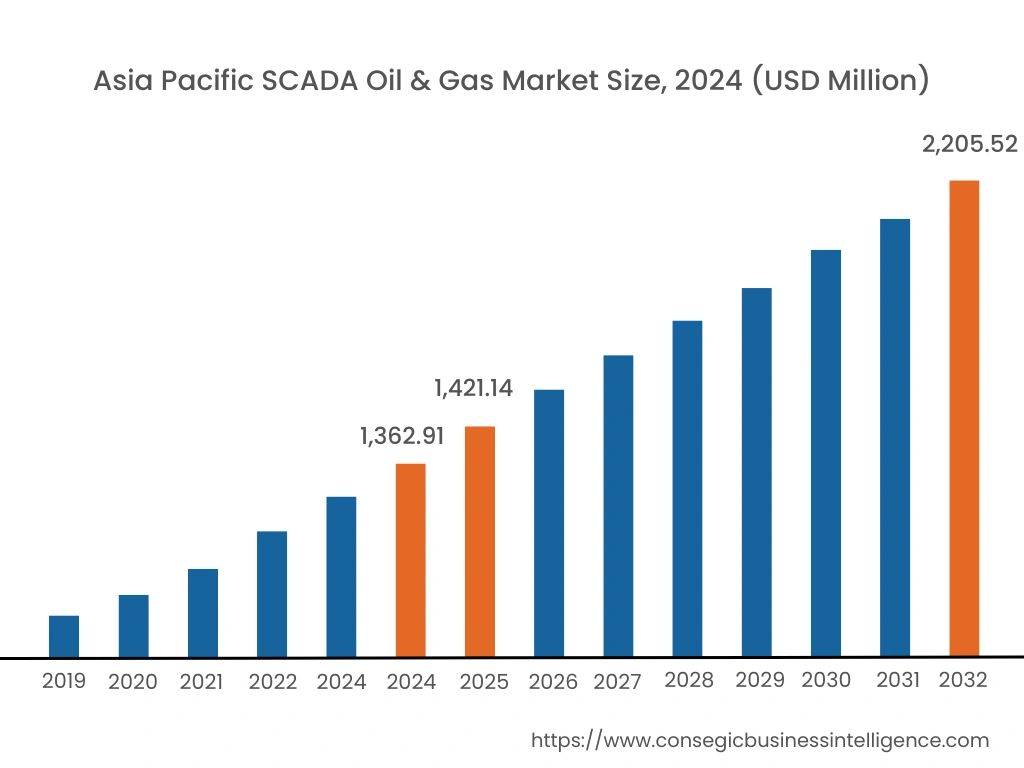

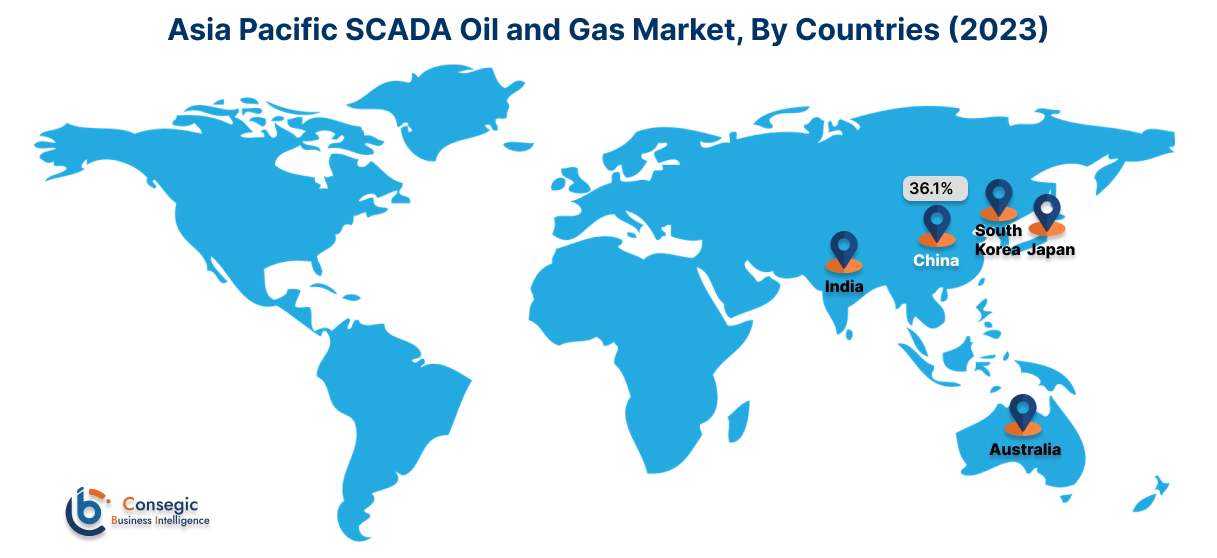

Asia Pacific region was valued at USD 1,362.91 Million in 2024. Moreover, it is projected to grow by USD 1,421.14 Million in 2025 and reach over USD 2,205.52 Million by 2032. Out of this, China accounted for the maximum revenue share of 36.1%. According to the SCADA oil & gas market analysis, increasing investments in pipeline networks, a growing demand for remote management of oil & gas infrastructure, and a strong push for process optimization through automation and digitalization, particularly in emerging economies like China and India drives the SCADA oil & gas market expansion.

- For instance, in April 2024, Wing Wah, a Chinese oil company, signed an amended production sharing contract with Chinese government, the oilfield aims to reach 80,000 barrels per day from 45,000 barrels per day.

North America is estimated to reach over USD 2,347.48 Million by 2032 from a value of USD 1,535.07 Million in 2024 and is projected to grow by USD 1,593.08 Million in 2025. The growth is driven by the increasing adoption of advanced technologies such as cloud computing and machine learning, which require scalability and flexibility of the oil plants. Hence, the remote monitoring and controlling feature, contribute to the SCADA oil & gas market.

- In May 2024, Honeywell, based out in US, collaborated with Weatherford's Cygnet SCADA platform to monitor and report by providing insights to reduce greenhouse gas emissions.

The regional trends analysis depicts that the strict carbon emission laws of Europe increase the adoption of sustainable SCADA solutions, in turn driving the SCADA oil & gas market demand. Further, as per the market analysis, the primary factor driving the adoption of SCADA oil & gas in the Middle East and African region include increasing investment and technological advancement to reduce the production cost related to oilfields. The rising investment in refining project is accelerating the market growth in the Latin America region.

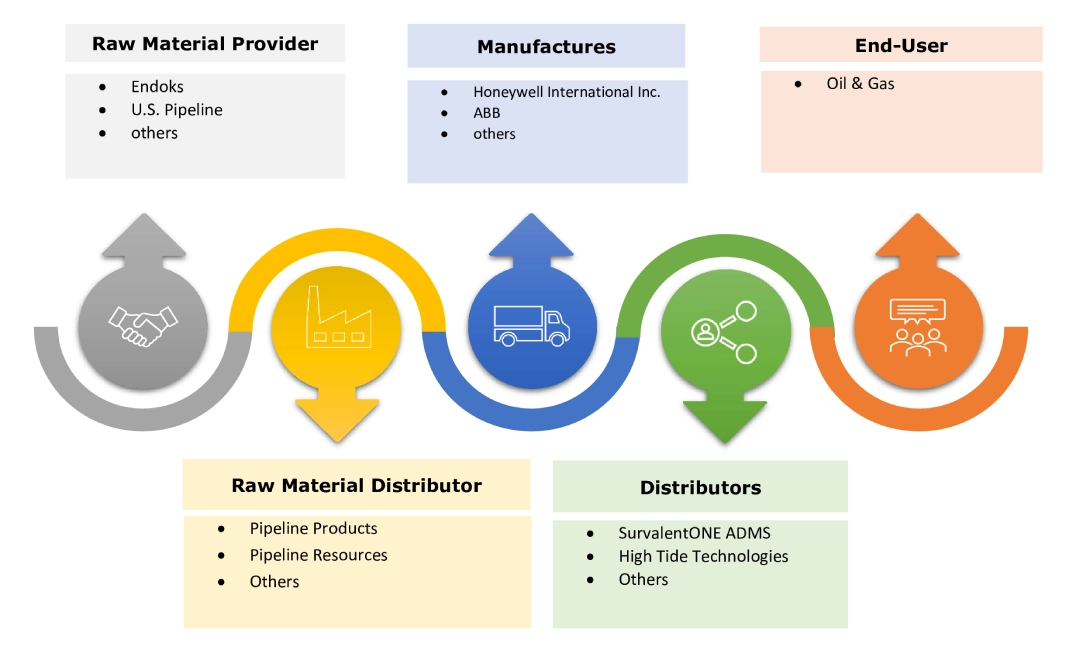

Top Key Players & Market Share Insights:

The global SCADA oil & gas market is highly competitive with major players providing services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global SCADA oil & gas market. Key players in the SCADA oil & gas industry include -

- General Electric (United States)

- ABB (Switzerland)

- Yokogawa Electric Corporation (Japan)

- Emerson Electric Co. (United States)

- Honeywell International Inc. (United States)

- Rockwell Automation, Inc. (United States)

- Siemens (Germany)

- Mitsubishi Electric Corporation (Japan)

- Schneider Electric SE (France)

- Larsen & Toubro Limited (India)

Recent Industry Developments:

Partnerships:

- ABB India has equipped IndianOil's extensive 20,000 km pipeline network, crucial for India's energy supply, with integrated automation and digital solutions. These solutions, centered around the ABB Ability SCADAvantage digital platform, enable real-time monitoring, enhance system availability, and secure vital data for improved decision-making.

SCADA Oil & Gas Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 7,243.07 Million |

| CAGR (2025-2032) | 5.8% |

| By Type |

|

| By Stream |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the SCADA oil & gas market? +

SCADA Oil & Gas Market size is estimated to reach over USD 7,243.07 Million by 2032 from a value of USD 4,627.76 Million in 2024 and is projected to grow by USD 4,811.86 Million in 2025, growing at a CAGR of 5.80% from 2025 to 2032.

What specific segmentation details are covered in the SCADA oil & gas market report? +

The SCADA oil & gas market report includes specific segmentation details for type, stream and region.

Which is the fastest segment anticipated to impact the growth? +

In the type segment, the service sector is the fastest-growing segment during the forecast period due to the requirement of system integration, maintenance, and support.

Who are the major players in the SCADA oil & gas market? +

The key participants in the SCADA oil & gas market are General Electric (United States), ABB (Switzerland), Schneider Electric SE (France), Rockwell Automation, Inc. (United States), Siemens (Germany), Mitsubishi Electric Corporation (Japan), Larsen & Toubro Limited (India), Yokogawa Electric Corporation (Japan), Emerson Electric Co. (United States), Honeywell International Inc. (United States)