Set-Top Box Market Size:

Set-Top Box Market size is estimated to reach over USD 29,412.86 Million by 2031 from a value of USD 23,116.11 Million in 2023 and is projected to grow by USD 23,411.07 Million in 2024, growing at a CAGR of 3.1% from 2024 to 2031.

Set-Top Box Market Scope & Overview:

A set-top box (STB) is a device that enables televisions to receive and display digital content from various sources, such as cable, satellite, or internet-based streaming services. It decodes or decrypts the signals into a format that can be displayed on the TV screen, enabling users to access a variety of content. Additionally, it provides a user-friendly interface including an on-screen menu and, an electronic program guide to help users navigate channels or apps. Moreover, modern STBs come with additional features including recording capabilities (DVR), internet connectivity for streaming apps, and support for ultra-high-definition content. The aforementioned features are major determinants for increasing their deployment in residential, education, hospitality, entertainment, and other industries.

Set-Top Box Market Insights:

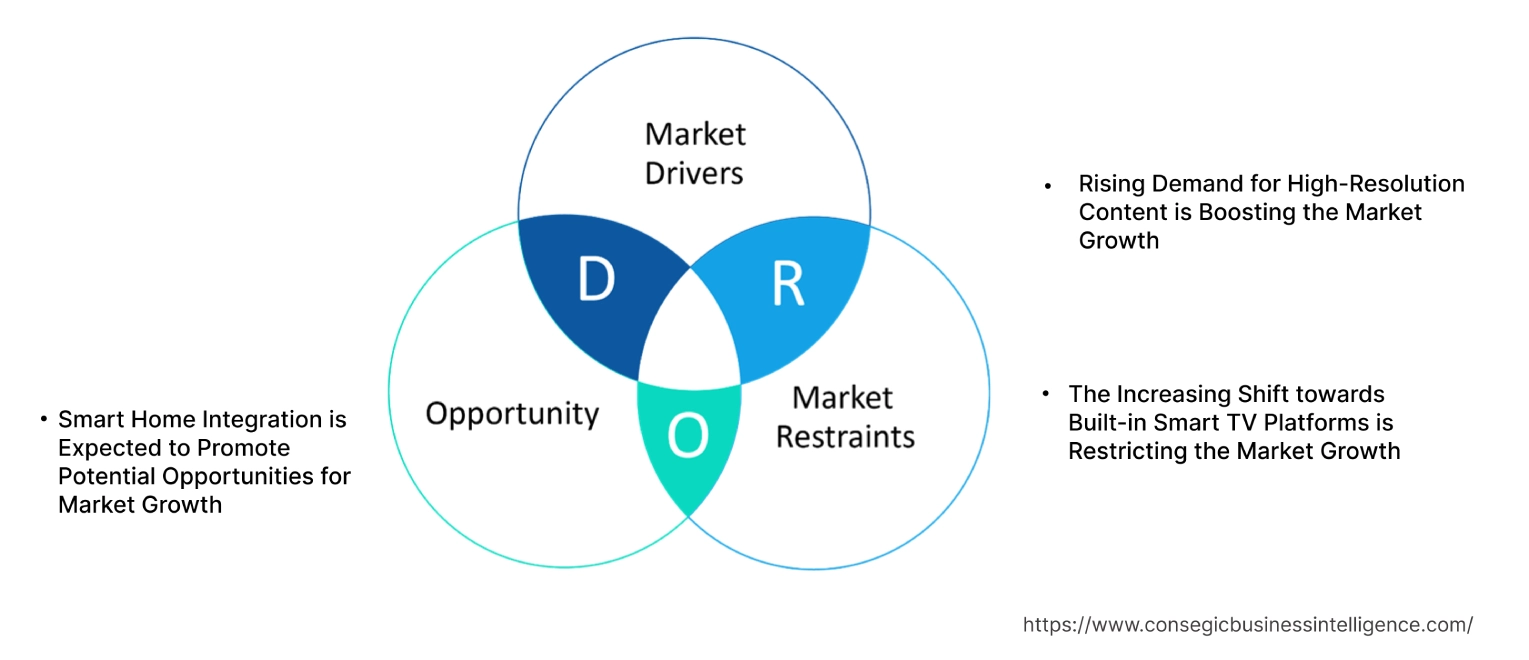

Set-Top Box Market Dynamics - (DRO) :

Key Drivers:

Rising Demand for High-Resolution Content is Boosting the Market Growth

High-resolution content includes high-definition, 4K, and 8K formats, which offer an immersive and detailed viewing experience. Set-top boxes that support high-resolution content are essential for delivering clearer and more detailed images, which enhances the overall quality of television programming and streaming content. Additionally, streaming platforms including Netflix, Amazon Prime Video, Disney+, YouTube, and others are offering a growing library of high-resolution content. This trend is further fueling their need that handle ultra-high definition, 4K, or 8K content without quality loss.

- In July 2021, Sagemcom introduced the P/DVB-T2 Ultra HD STB with embedded Wi-Fi 6. It supports AV1 decoding which offers entertainment service of TIM. It also enables users to stream OTT platforms including Netflix, Amazon Prime Video, Disney+, YouTube, and Others.

Therefore, according to the analysis, the need for high-resolution content is propelling the set-top box market growth.

Key Restraints :

The Increasing Shift towards Built-in Smart TV Platforms is Restricting the Market Growth

As smart TVs with integrated streaming capabilities become more prevalent, consumers are less inclined to purchase separate set-top boxes. Modern smart TVs come equipped with pre-installed streaming apps and services, such as Netflix, Hulu, Amazon Prime Video, and others. These integrated features eliminate the need for a separate STB to access these platforms. Additionally, the rapid advancement of smart TV technology means that these devices are continually improving in terms of performance, content access, and smart features without needing stand-alone STBs.

- For instance, Samsung's latest Neo QLED TVs come with built-in access to popular streaming services including Netflix, Hulu, and Amazon Prime Video. These models also feature Samsung's Tizen OS, which offers a comprehensive smart TV experience without the need for a separate set-top box.

Hence, the increasing adoption of smart TVs with integrated streaming capabilities is a major restraint for the set-top box market demand.

Future Opportunities :

Smart Home Integration is Expected to Promote Potential Opportunities for Market Growth

The integration of set-top boxes with smart home ecosystems represents a significant opportunity to enhance their functionality beyond traditional media consumption. As smart home technology continues to advance, STBs can serve as a pivotal component in creating a unified, interconnected environment. This integration allows STBs to interact with various smart home devices. Additionally, it adds value beyond traditional media functions by incorporating features including voice control and automated home management.

- In September 2022, Amazon launched a third-generation Fire TV Cube integrated with Amazon Alexa to control smart home devices through voice commands. This supports 4K ultra HD, Dolby Vision, and Dolby Atmos audio. It offers features including an HDMI input port, Wi-Fi 6E support, and super-resolution upscaling.

Consequently, smart home integration presents a valuable for the set-top box market opportunities to enhance its functionality.

Set-Top Box Market Segmental Analysis :

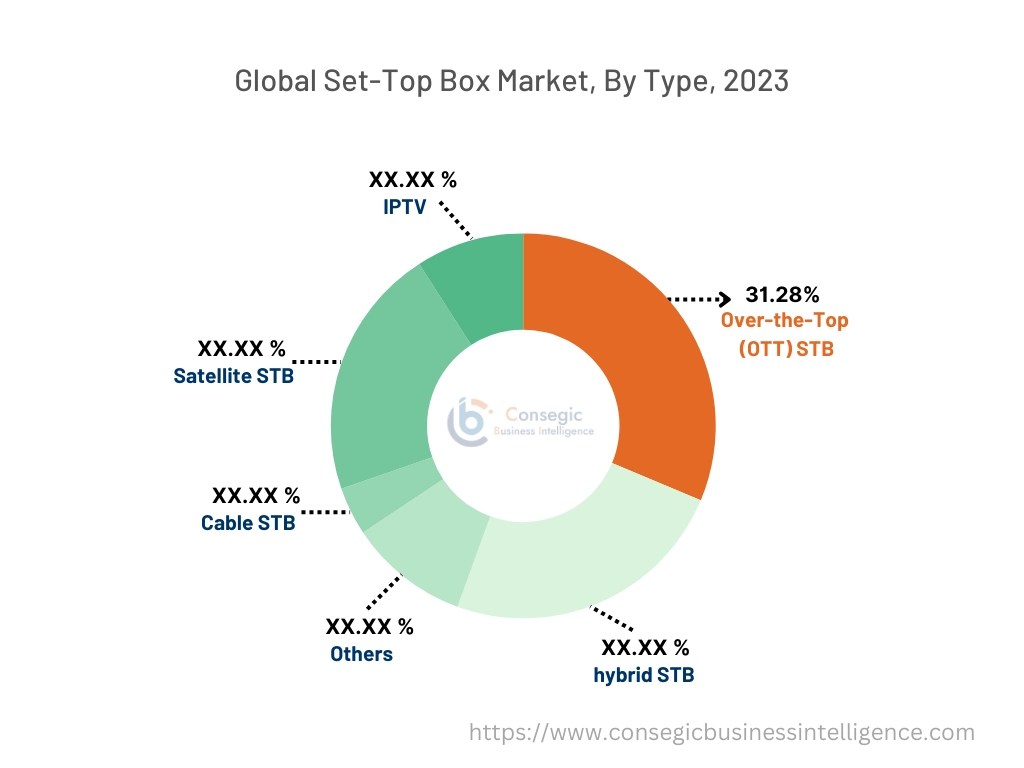

By Type:

Based on the type, the market is segmented into cable STB, satellite STB, IPTV, over-the-top (OTT) STB, hybrid STB, and others.

Trends in the Type:

- Cable STBs are now integrating streaming services like Netflix, Hulu, and Amazon Prime Video. This reflects the growing need for a unified entertainment experience, combining traditional cable channels with on-demand streaming options.

- IPTV STBs are increasingly supporting advanced features such as interactive TV, video-on-demand (VoD), and time-shifted viewing, providing a more dynamic and engaging viewing experience.

The over-the-top (OTT) STB accounted for the largest revenue share of 31.28% in 2023.

- Over-the-top (OTT) STBs are designed to stream content directly from internet-based services like Netflix, Hulu, Amazon Prime Video and others.

- These devices bypass traditional broadcast and cable methods, focusing on internet-based content delivery.

- Additionally, it offers the convenience of accessing a wide range of on-demand content from multiple streaming platforms through a single device.

- In June 2024, ZTE Corporation partnered with PTCL to launch B866V2F, a 4K OTT STB. It is designed to enhance the viewing experience with improved entertainment content. The device boasts 200 live TV channels, 60 of which are in HD, and offers 15,000 hours of on-demand content.

- In summary, the rise of streaming platforms and the appealing features of OTT STBs are fueling the set-top box market demand.

The hybrid STB is anticipated to register the fastest CAGR during the forecast period.

- The hybrid set-top box is a device that provides a combination of capabilities of traditional broadcast television services and internet-based content streaming.

- It enables users to access both live TV channels and on-demand content from streaming services through a single device.

- This dual functionality gives consumers more flexibility in choosing content, providing a seamless experience between traditional and digital media.

- In November 2022, SDMC collaborated with NAGRA and Amlogic to launch a 4K resolution Hybrid STB powered by Android TV. This collaboration is aimed at featuring Amlogic S905C2 SoC and runs on Android TV, with the integrated NAGRA Connect security client.

- Therefore, as per the analysis the combination of traditional and internet-based content offered by the hybrid device, is expected to fuel the growth of the set-top box market trends.

By Resolution:

Based on the resolution, the market is segmented into the standard definition (SD), high-definition (HD), full HD, 4K, 8K, and others.

Trends in the Resolution:

- Standard set-top boxes are experiencing a decline in popularity as consumers increasingly seek higher-resolution content. There is a drift towards HDs, which offer better picture quality.

- The high-resolution set-top boxes incorporate smart features including built-in apps and cloud DVR services to enhance functionality and provide beyond basic HD resolution.

The 4K STB accounted for the largest revenue share in the year 2023.

- 4K STBs are specifically designed to support high resolution (3840x2160 pixels), which provides a higher level of detail and clarity.

- It offers superior picture quality with four times the resolution of full HD, resulting in sharper images and an enhanced viewing experience.

- Additionally, it provides advanced features including high dynamic range (HDR) support, Dolby Vision, and improved audio options.

- In October 2022, Apple released Apple TV 4K to deliver high performance and enhanced cinematic quality. It provides ultra-high resolution with support for Dolby Vision and Dolby Atmos. It offers a high-quality streaming experience and integrates seamlessly with Apple's ecosystem, including access to various streaming services.

- Overall, the aforementioned factors of 4k resolution collectively boost the set-top box market growth.

The 8K resolution is anticipated to register the fastest CAGR during the forecast period.

- 8K resolution refers to a display resolution of approximately 7680x4320 pixels, providing four times the detail of 4K resolution.

- It delivers an incredibly sharp and immersive audiovisual experience, particularly on large screens.

- In September 2022, ZTE Corporation collaborated with Amlogic to launch 8K STB. This is powered by AI computing capabilities, enabling 3D digital AI/XR space services. It is featured with immersive 4K and enhanced ultra HD video quality, by providing the audiovisual experience.

- Hence, as per the analysis, 8K technology is poised to boost the set-top box market opportunities.

By Connectivity:

Based on connectivity, the STB market is segmented into wired and wireless.

Trends in the Connectivity:

- Wired STBs are favored for their stable and reliable connection, particularly for high-definition and 4K content streaming where uninterrupted performance is crucial.

- Wireless STBs offer greater flexibility and ease of installation, as they do not require cables running between devices. This trend is particularly appealing for setups in modern homes where cable management is a concern.

The wired connectivity accounted for the largest revenue in the year 2023.

- Wired connectivity in set-top boxes refers to connections that require physical cables to transmit data between the STB and other devices.

- It includes ethernet which offers high bandwidth and stable data transmission rates, crucial for streaming high-definition, 4K, and 8K content without interruptions.

- Additionally, it features high performance, and reliability, enhances stability, network security, and low latency.

- For instance, the TiVo Bolt VOX offers wired Ethernet connectivity for stable and high-speed access to streaming services and DVR functions. This is designed for users seeking reliable performance for their entertainment needs.

- Thus, wired connectivity due to its reliability and stability in performance is the preferred choice among consumers, propelling the set-top box market share.

The wireless connectivity is anticipated to register the fastest CAGR during the forecast period.

- Wireless connectivity is becoming increasingly important as consumer preferences shift toward convenience and mobility.

- These STBs utilize Wi-Fi, Bluetooth, or other wireless technologies to connect to the internet, allowing users to stream content efficiently.

- This flexibility enables easy installation and placement, making it simpler for users to integrate into a home entertainment system.

- For instance, NVIDIA's SHIELD TV Pro provides a wireless connection with Wi-Fi and Bluetooth 5.0 support. It is easily integrated with Google Home and Amazon Echo and enables control over these systems through the voice assistants of Google and Alexa.

- Hence, as per the set-top box market analysis, wireless connectivity offers convenience and flexibility in streaming content is proliferating the STB market.

By Sales Channel:

Based on sales channels, the market is segmented into online and offline.

Trends in the Sales Channel:

- Online platforms offer bundled set-top boxes with subscription services, enhancing the appeal of purchasing online.

- Retailers offer promotions, discounts, and options that are available in-store, attracting customers who seek immediate purchase and support.

The offline sales channel accounted for the largest revenue share in the year 2023.

- The offline sales channel for STBs includes physical retail environments where consumers can purchase these devices in person.

- It provides the advantage of a tangible shopping experience which enables customers to physically inspect and test the STBs.

- Additionally, in-store staff offer personalized recommendations, answer queries, and provide troubleshooting assistance, enhancing the overall purchasing experience.

- For instance, Walmart's physical stores offer a range of STBs, including cable, satellite, and streaming devices. Customers can purchase these devices while shopping for other items, often benefiting from in-store promotions.

- Therefore, as per the analysis offline stores offer immediate purchase and assistance, which is driving the STB market.

The online sales channel is anticipated to register the fastest CAGR during the forecast period.

- Online platforms offer convenience and flexibility in purchasing coupled with the ability to compare products, read reviews, and enable price analysis for consumers.

- The rise of e-commerce platforms is attracting consumers to rely on online shopping, wider selection, and digital transactions.

- For instance, Amazon's online store is a leading platform for purchasing STBs, featuring a wide range of models from various brands like Roku, Amazon Fire TV, and Apple TV. The convenience of online shopping, combined with competitive pricing and exclusive deals, makes Amazon a dominant player in the online STB market.

- Consequently, as per the set-top box market analysis, the online segment is poised to dominate the market.

By End-User:

Based on end-users, the market is segmented into telecom, media and entertainment, residential, hospitality, educational institutes, and others.

Trends in the End-User:

- The hospitality industry is increasingly integrating set-top boxes with guest management systems and offering personalized entertainment options to enhance the guest experience.

- There is a growing drift to bundle set-top boxes with broadband and telecommunication services, providing consumers with a comprehensive package that includes TV, internet, and phone services.

The residential segment accounted for the largest revenue share in the year 2023 and is anticipated to register the fastest CAGR during the forecast period.

- Residential consumers are seeking set-top boxes that provide seamless access to content with high resolution for enhanced video quality.

- With the increasing popularity of streaming platforms including Netflix, Amazon Prime Video, Disney+, and others are attracting consumers for widespread adoption.

- Additionally, set-top boxes featuring smart capabilities including voice control and integration with other smart home devices are catering to the growing trend of smart home technology.

- For instance, Xiaomi Mi Box S is a set-top box that supports 4K HDR streaming and offers access to a wide range of content through Google Play and other streaming services. It features a lot of content, smart control, enhanced performance, and seamless connectivity.

- Overall, as per the analysis aforementioned features are propelling the set-top box market trends.

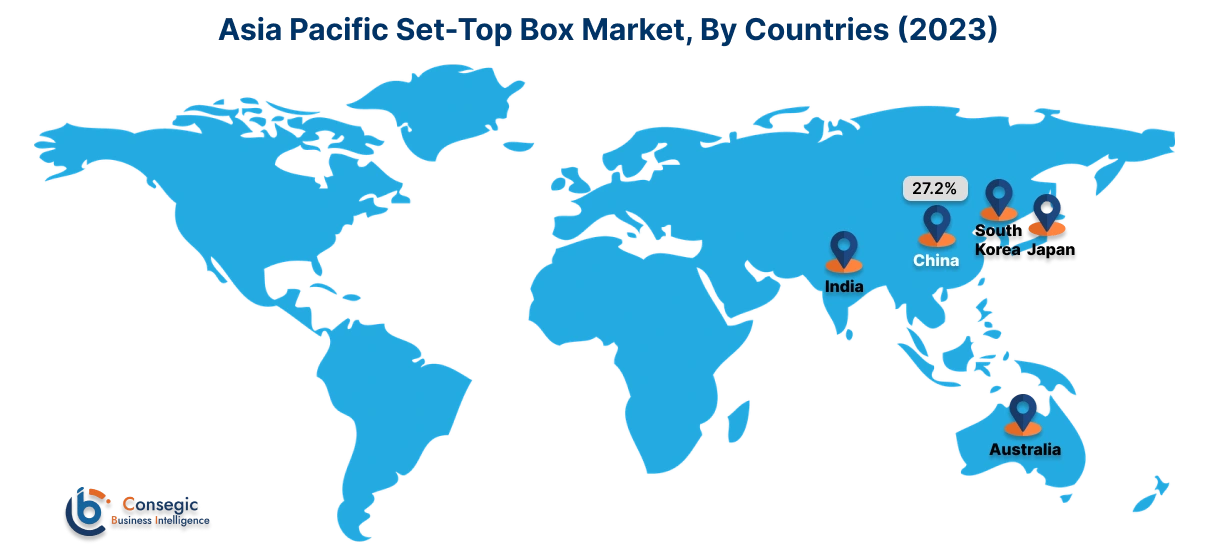

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 5,881.70 Million in 2023. Moreover, it is projected to grow by USD 5,970.52 Million in 2024 and reach over USD 7,691.46 Million by 2031. Out of this, China accounted for the maximum revenue share of 27.2%. The Asia-Pacific region is experiencing rapid expansion in broadband and telecommunications infrastructure, supporting the widespread adoption of advanced STBs. Additionally, the region is witnessing technological advancements in STB technology, including the integration of 4K and 8K resolution support, smart features, and enhanced connectivity options.

- In August 2021, Sumitomo Electric's BS4K set-top box powered by Android TV enables video service at home. The device ensures a high-resolution display, seamless connectivity, security, and reliable remote monitoring. The product hit a milestone of one million units in Japan and the company has supplied around 4 million set-top boxes to domestic video service providers.

North America is estimated to reach over USD 10,403.33 Million by 2031 from a value of USD 8,135.91 Million in 2023 and is projected to grow by USD 8,243.12 Million in 2024. North America, particularly the United States and Canada is the dominant region in the market. The region has a well-established telecommunications industry and broadcasting infrastructure, supporting the deployment and adoption of high-definition, 4K, and smart STBs. Additionally, the strong market presence of streaming services such as Netflix, Hulu, Amazon Prime Video, and Disney+ drives the need for STBs that support these platforms, further enhancing set-top box market expansion.

Europe has a diverse market with varying preferences across countries. The market is influenced by high internet penetration rates and a growing need for high-definition and interactive content. The rise of OTT platforms and IPTV services is reshaping the European STB market, with an increasing need for STBs that can handle multiple streaming and on-demand services.

Latin America is a growing market for STBs, driven by increased internet access, improvements in cable and satellite infrastructure, and growth in consumer need for digital content. There is a growing tendency towards expanding digital TV services with increasing investments in STBs that support high-definition content on OTT platforms.

The market in the Middle East and Africa is characterized by a mix of traditional and emerging technologies, with varying levels of market maturity across different countries. There is a growing need for premium and high-definition content, leading to increased adoption of advanced STBs, and boosting the set-top box market expansion.

Top Key Players & Market Share Insights:

The set-top box market is highly competitive with major players providing a content display on television to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global set-top box market. Key players in the set-top box industry include-

- Apple Inc. (USA)

- Humax Co., Ltd. (South Korea)

- Shenzhen Skyworth Digital Technology Co., Ltd. (China)

- EchoStar Corporation (USA)

- Kaonmedia Co., Ltd. (South Korea)

- Roku, Inc. (USA)

- Netgear, Inc. (USA)

- Cisco Systems, Inc. (USA)

- ZTE Corporation(China)

- Comcast Corporation (USA)

- Sagemcom Broadband SAS (France)

- ARRIS International Limited (USA)

- Broadcom Inc. (USA)

- Nokia Corporation (Finland)

Recent Industry Developments :

Product Launches:

- In February 2024, ZTE launched B810T2-A10, a 4K Zapper STB designed to provide ultra-high definition display. It provides users with smooth and clear TV images along with digital video broadcasting services. The device is incorporated with a System on Chip (SoC) based on the chip Cortex-A35 and has a large memory.

- In April 2024, Vereinigte Stadtwerke launched its own IPTV service, VS Media IPTV, in partnership with Zattoo. The service offered over 130 TV channels, including foreign language options, and could be accessed via various platforms including STBs and mobile devices.

Collaboration:

- In January 2024, CommScope collaborated with Du to introduce the VIP7802 Ultra-HD Set Top Box in Du TV. The device features with Vulkan 3D-capable GPU, and dual-band Wi-Fi 6 connectivity. It provides users with a high-quality viewing experience with 4K UltraHD resolution and High Dynamic Range (HDR).

- In March 2024, 3 Screen Solutions (3SS) partnered with Telus to launch a 4K Ultra HD Jade set-top box. It features a powerful quad-core processor and Bluetooth 5.0 technology with an Android TV operating system that supports streaming video and music services, online gaming applications, and Wi-Fi 6 capabilities.

Set-Top Box Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 29,412.86 Million |

| CAGR (2024-2031) | 3.1% |

| By Type |

|

| By Connectivity |

|

| By Resolution |

|

| By Sales Channel |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

What is a set-top box? +

A set-top box (STB) is a device that enables televisions to receive and display digital content from various sources, such as cable, satellite, or internet-based streaming services. It decodes or decrypts the signals into a format that can be displayed on the TV screen, enabling users to access a variety of content.

How big is the set-top box market? +

Set-Top Box Market size is estimated to reach over USD 29,412.86 Million by 2031 from a value of USD 23,116.11 Million in 2023 and is projected to grow by USD 23,411.07 Million in 2024, growing at a CAGR of 3.1% from 2024 to 2031.

What is the key trend? +

IPTV STBs are increasingly supporting advanced features such as interactive TV, video-on-demand (VoD), and time-shifted viewing, providing a more dynamic and engaging viewing experience.

Who are the major key players in the set-top box market? +

The major key players in set-top box market are Apple Inc. (USA), Humax Co., Ltd. (South Korea), Cisco Systems, Inc. (USA), ZTE Corporation (China), Shenzhen Skyworth Digital Technology Co., Ltd. (China), Comcast Corporation (USA), Sagemcom Broadband SAS (France), ARRIS International Limited (USA), EchoStar Corporation (USA), Kaonmedia Co., Ltd. (South Korea), Roku, Inc. (USA), Broadcom Inc. (USA), Nokia Corporation (Finland), Netgear, Inc. (USA), and others