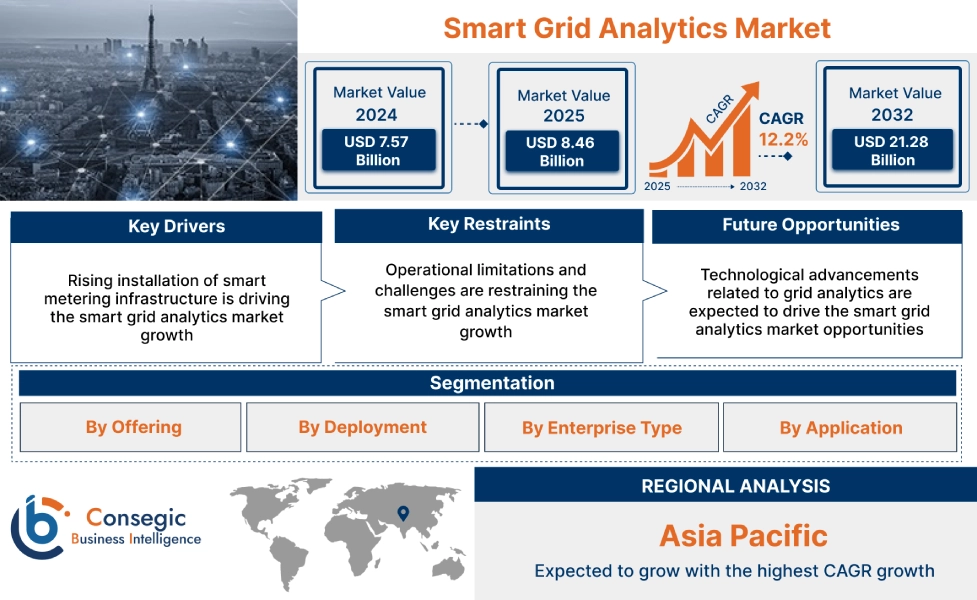

Smart Grid Analytics Market Size:

Smart Grid Analytics Market size is estimated to reach over USD 21.28 Billion by 2032 from a value of USD 7.57 Billion in 2024 and is projected to grow by USD 8.46 Billion in 2025, growing at a CAGR of 12.2% from 2025 to 2032.

Smart Grid Analytics Market Scope & Overview:

Smart grid analytics includes technologies and tools that are used to analyze vast datasets from smart electrical grids, aiming to improve performance, reliability, and grid efficiency. It involves using tools such as big data, AI (artificial intelligence), and machine learning to transform grid data into actionable insights, which helps utilities in optimizing operations, forecasting demand, preventing outages, managing renewable energy integration, and enhancing customer service. Moreover, grid analytics uses data to improve energy distribution, offering benefits such as enhanced reliability, reduced energy costs, improved demand management, and greater integration of renewable energy sources. It also offers real-time insights into grid operations and enables predictive maintenance, optimized resource use, and improved grid resilience.

How is AI Impacting the Smart Grid Analytics Market?

AI is significantly influencing the smart grid analytics market, driving its growth and evolution. Grid analytics leverage artificial intelligence to enable real-time monitoring, advanced demand forecasting, automated fault detection, and improved grid resilience through machine learning and data analytics. Moreover, by processing vast datasets from smart meters and sensors, AI models can balance supply and demand, predict and prevent outages, optimize energy distribution, and seamlessly integrate renewable energy sources. This leads to more efficient, sustainable, and responsive energy systems, which play a vital role in meeting modern energy demand. Consequently, the above factors are expected to drive the market growth in the upcoming years.

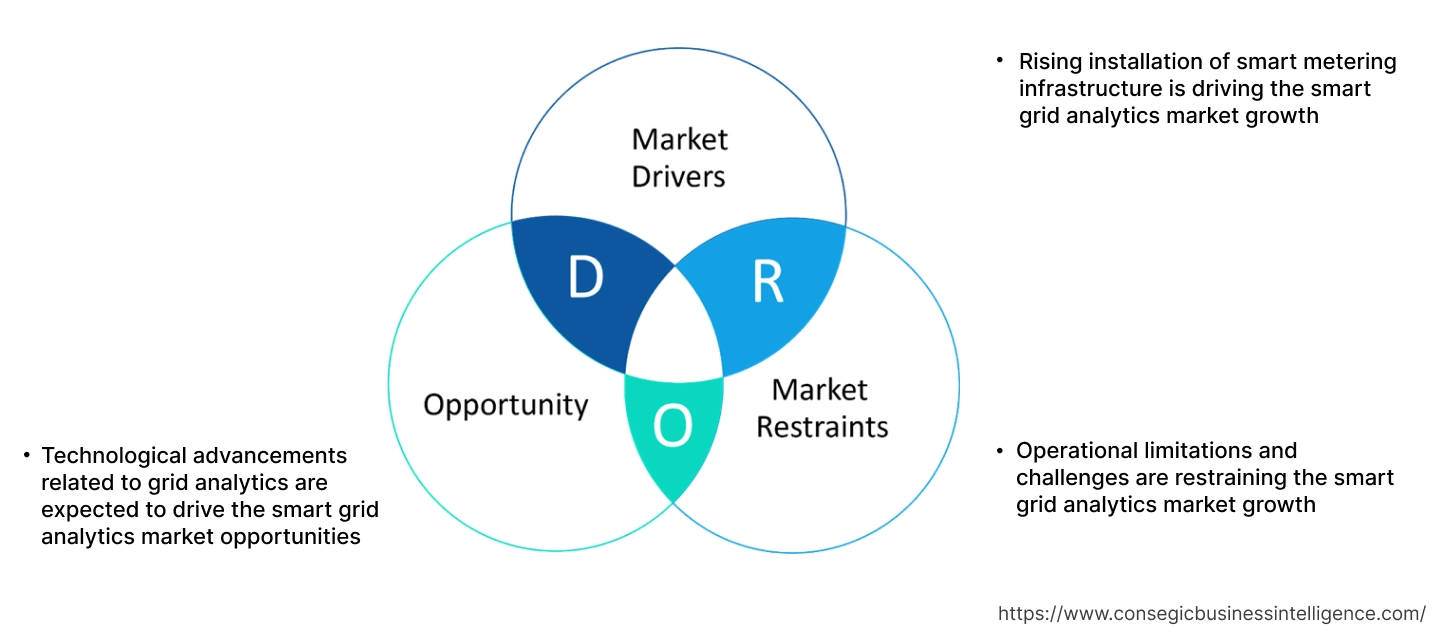

Smart Grid Analytics Market Dynamics - (DRO) :

Key Drivers:

Rising installation of smart metering infrastructure is driving the smart grid analytics market growth

Smart meters, particularly advanced metering infrastructure (AMI) systems, collect real-time data on energy consumption and grid performance. Moreover, AMI can generate vast amounts of data that require advanced analytics to optimize grid operations, manage load, reduce outages, improve billing accuracy, and integrate renewable energy sources. Grid analytics solutions help utilities understand load patterns, predict demand, and manage fluctuations caused by renewable energy sources, which leads to more efficient grid operations. Additionally, the governments' support for energy efficiency, grid modernization, and smart city initiatives further fuels the demand for grid analytics as utilities leverage data to create more reliable, sustainable, and resilient power grids.

- For instance, according to the S. Energy Information Administration, the electric utilities in the United States had approximately 119 million advanced (smart) metering infrastructure (AMI) installations in 2022, accounting for around 72% of total electric meter installations.

Thus, the rising installation of smart metering infrastructure is driving the smart grid analytics market size.

Key Restraints :

Operational limitations and challenges are restraining the smart grid analytics market growth

The implementation of grid analytics is often associated with certain operational limitations and challenges, which are among the primary factors restraining the market. The key limitations related to the deployment of grid analytics solutions include high initial infrastructure investment costs, significant data privacy and cybersecurity concerns, integration complexities related to diverse legacy systems, and others.

The implementation of smart grids and analytics platforms requires significant upfront capital investment in advanced meters, sensors, communication networks, and specialized software, which may limit their adoption among organizations, particularly smaller utilities with budget constraints. Additionally, the collection and analysis of vast amounts of sensitive consumer data raises significant concerns regarding potential breaches and the need for robust security measures. Further, integrating new smart grid technologies with existing, legacy infrastructure poses a significant challenge, adding to the complexity and cost of deployment. Thus, the above operational limitations and challenges associated with the deployment of grid analytics solutions are hindering the smart grid analytics market expansion.

Future Opportunities :

Technological advancements related to grid analytics are expected to drive the smart grid analytics market opportunities

Grid analytics solution providers are frequently investing in the development of new technologies associated with smart grid analytics to ensure its safe and effective utilization in several applications, such as advanced metering infrastructure analytics, demand response analytics, grid optimization, and others. Technological advancements, including the integration of artificial intelligence (AI) and internet of things (IoT), are significantly expanding the smart grid analytics market. These technologies enable enhanced predictive capabilities, real-time monitoring, improved operational efficiency, and facilitate seamless integration of renewable energy sources.

- For instance, in March 2025, Schneider Electric announced the launch of its One Digital Grid Platform, which is an integrated and AI-powered platform that is designed to improve grid reliability, resiliency, and efficiency.The platform enables predictive analytics, real-time insights, and automation to drive resiliency and efficiency across the grid.

Hence, according to the analysis, the rising technological advancements associated with grid analytics solutions are projected to boost the smart grid analytics market opportunities during the forecast period.

Smart Grid Analytics Market Segmental Analysis :

By Offering:

Based on offering, the market is segmented into solution and services.

Trends in the offering:

- Increasing technological advancements associated with grid analytics solutions, such as AI, IoT, and cloud computing for enhancing grid efficiency, reliability, and the ability to integrate renewable energy, are driving the market.

- Rising utilization of grid analytics solutions to enable improved data management from smart meters and sensors while facilitating predictive maintenance, real-time monitoring, and optimized operations is driving the market growth.

The solution segment accounted for the largest revenue share in the smart grid analytics market share in 2024, and it is anticipated to register a significant CAGR during the forecast period.

- Smart grid analytics solution analyzes data from electric power grids to improve their efficiency, reliability, and sustainability by using advanced technologies to predict equipment failures, optimize grid operations, manage renewable energy sources, and facilitate two-way communication between utilities and consumers.

- Grid analytics solutions enable utilities to gain deeper insights into grid performance and consumer behavior, which enables more proactive and automated decision-making to meet the demands of modern energy systems.

- For instance, Itron Inc. offers Active Smart Grid Analytics (ASA) solution in its solution offerings, which is developed for delivering the value of data intelligence for the smart grid. The solution offers utilities with an innovative approach for deriving value from smart meter data and optimizing their smart grid infrastructure.

- According to the smart grid analytics market analysis, the increasing advancements associated with grid analytics solutions are further driving the market.

By Deployment:

Based on deployment, the market is segmented into on-premise and cloud.

Trends in the deployment:

- The adoption of on-premise deployment is primarily driven by higher security and privacy, lower network bandwidth costs, and more control over server hardware.

- Factors including the ease of integration, rapid deployment, and increasing consumer preference for flexible, scalable, reliable, and cost-effective grid analytics solutions are driving the cloud deployment segment.

The on-premise segment accounted for a significant revenue in the overall smart grid analytics market share in 2024.

- On-premise deployment involves installing grid analytics software on a utility's own hardware and within its private networks, offering greater control over data, enhanced security, and easier integration with legacy systems.

- Moreover, on-premise deployment enables enterprises to manage and have complete control over its integrations, and maintain tighter control over the system’s security aspects as compared to cloud-based deployment.This reduces the risk of data breaches and unauthorized access.

- Further, factors including higher security and privacy, lower network bandwidth costs, and more control over server hardware are vital aspects driving the on-premise deployment segment.

- Therefore, increasing advancements associated with on-premise grid analytics solutions are driving the smart grid analytics market trends.

The cloud segment is anticipated to register the fastest CAGR during the forecast period.

- Cloud-based smart grid analytics solutions offer improved scalability, cost-effectiveness, and ease of access in processing large datasets for grid optimization and demand forecasting.

- Cloud-based model offers utilities on-demand computing, continuous updates, and remote monitoring capabilities. Additionally, cloud deployment also supports various models such as public, private, and hybrid clouds, which enable flexible and secure data management.

- Additionally, cloud-based deployment offers multiple benefits, including minimal capital expense, rapid implementation, ease of utilization and integration, higher scalability, and faster processing, among others.

- For instance, Oracle offers Oracle Utilities Analytics Insights in its solution offerings, which is an Oracle Cloud offering that is capable of unlocking smart grid data and turning it into actionable insights for gas, electric, and water utilities.

- According to the market analysis, the above benefits of cloud-based grid analytics solutions are projected to drive its adoption among business enterprises, thereby driving the market during the forecast period.

By Enterprise Type:

Based on enterprise type, the market is segmented into large enterprise and small and medium enterprise (SME).

Trends in the enterprise type:

- Increasing trend in adoption of grid analytics solutions in large enterprises for enhanced grid monitoring, resource optimization, compliance with regulatory pressures, and meeting sustainability goals.

- Rising adoption of cloud-based grid analytics solutions in SMEs for optimizing their energy consumption, integrating renewable sources, managing energy storage, and ensuring grid stability is driving the market.

Large enterprise segment accounted for the largest revenue in the overall market in 2024.

- Large enterprises use grid analytics solutions for several applications, such as managing complex, high-energy demands, reducing costs by analyzing consumption patterns, managing peak loads, and improving energy efficiency through predictive maintenance and renewable energy integration.

- Moreover, large enterprises leverage grid analytics for enhanced grid monitoring, resource optimization, compliance with regulatory pressures, and meeting sustainability goals, further driving overall operational improvement and innovation in energy management.

- For instance, GE Vernova offers grid analytics solutions for large enterprises in its solution offerings. The solution enables businesses to lower costs, avoiding up to 40% in inertia management costs for large grids with high renewables penetration.

- Therefore, the increasing adoption of grid analytics in large enterprises is driving the smart grid analytics market size.

Small and medium enterprise (SME) segment is anticipated to register the fastest CAGR during the forecast period.

- Small and medium enterprises refer to companies that maintain revenues, workforce, and assets below a certain threshold.

- SMEs often account for the majority of the businesses that are operating across the world.

- Moreover, small and medium enterprises are increasingly using grid analytics solutions to improve energy efficiency, reduce costs, and enhance competitiveness by adopting scalable, cost-effective, and accessible cloud-based solutions for energy usage insights, demand forecasting, and improved resource allocation.

- Additionally, grid analytics solutions can help SMEs in optimizing their energy consumption, integrating renewable sources, managing energy storage, and ensuring grid stability.

- Thus, the above factors are expected to drive the adoption of grid analytics solutions in small and medium enterprises, in turn propelling the market during the forecast period.

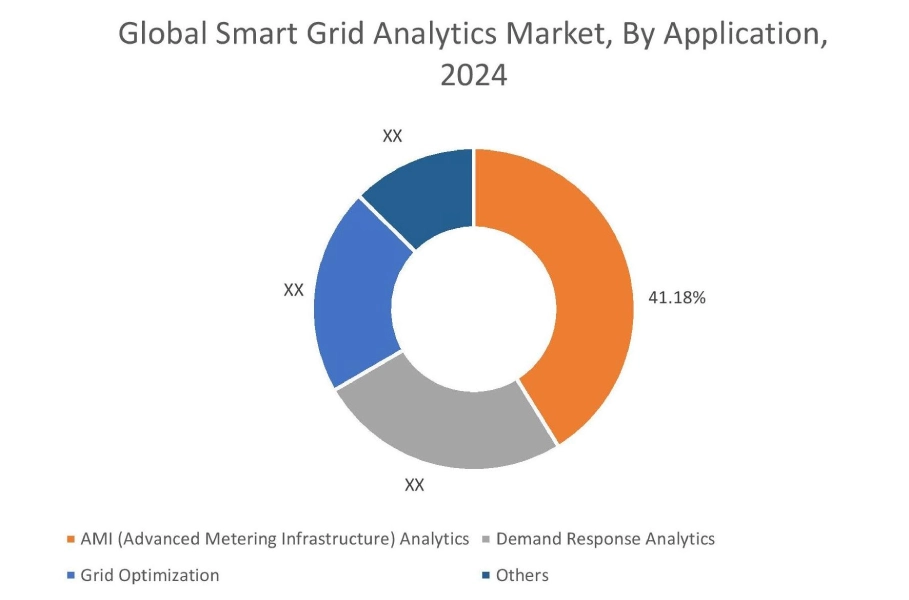

By Application:

Based on the application, the market is segmented into AMI (advanced metering infrastructure) analytics, demand response analytics, grid optimization, and others.

Trends in the application:

- Rising adoption of analytics solutions to optimize grid operations, improve energy efficiency, and facilitate real-time monitoring, demand response, fault detection, load forecasting, and personalized energy insights is driving the market.

- There is a rising trend towards the adoption of grid analytics solutions among utilities for predicting peak demand and implementing strategies such as time-of-use pricing to encourage consumption during off-peak hours, in turn reducing strain on the grid.

The AMI (advanced metering infrastructure) analytics segment accounted for the largest revenue share of 41.18% in the market in 2024.

- Advanced metering infrastructure (AMI) provides real-time consumption and voltage data, which enables utilities to perform actions such as demand response, predictive maintenance, asset monitoring, revenue protection, and even facilitate renewable energy integration.

- Moreover, grid analytics leverage data from AMI to optimize grid operations and improve energy efficiency by facilitating real-time monitoring, demand response, fault detection, load forecasting, and personalized energy insights.

- For instance, according to the Indian Press Information Bureau, around 203 million smart meters have been sanctioned in 28 States across India under the Revamped Distribution Sector Scheme (RDSS), among which approximately 24 million smart meters have been installed as of July 2025.

- Hence, the growing installation of smart metering infrastructure and smart grids is increasing the adoption of grid analytics solutions, therebydriving the market growth.

The grid optimization segment is anticipated to register the fastest CAGR during the forecast period.

- Grid analytics solutions use big data, AI, and machine learning for analyzing real-time data from smart meters and sensors to optimize grid efficiency, reliability, and sustainability.

- Moreover, the primary roles of grid analytics solutions in grid optimization applications include predicting and managing demand, facilitating dynamic pricing, detecting and responding to faults, integrating renewable energy, and preventing equipment failures, which helps in reducing costs and improving energy management for utilities and consumers.

- Additionally, grid analytics solutions help utilities in predicting peak demand and implementing strategies such as time-of-use pricing to encourage consumption during off-peak hours, thereby reducing strain on the grid.

- Further, real-time monitoring and grid analytics can assist utilities in detecting faults, reducing grid downtime, and improving response times.

- Consequently, the above factors areexpected to drive the market growth during the forecast period.

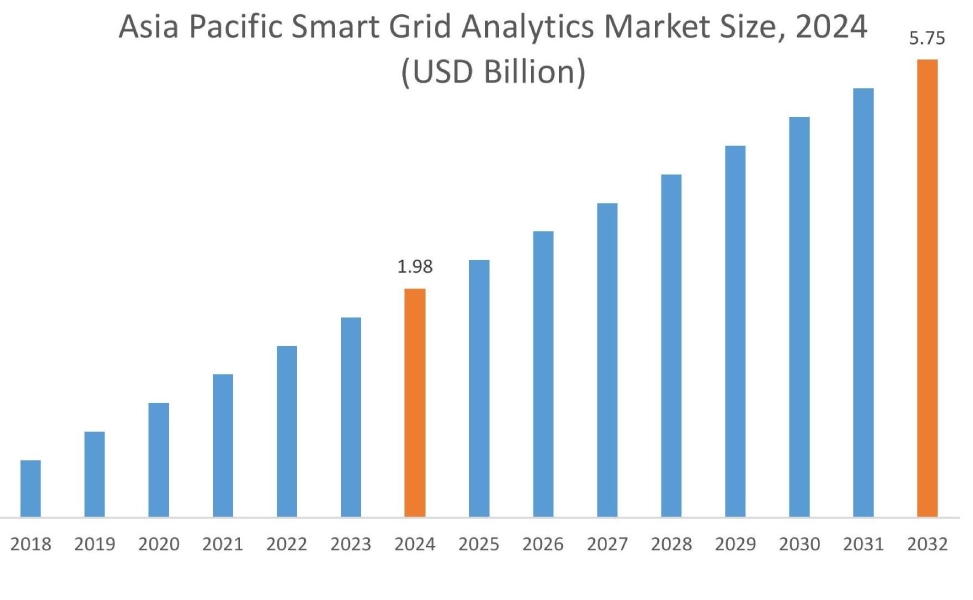

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

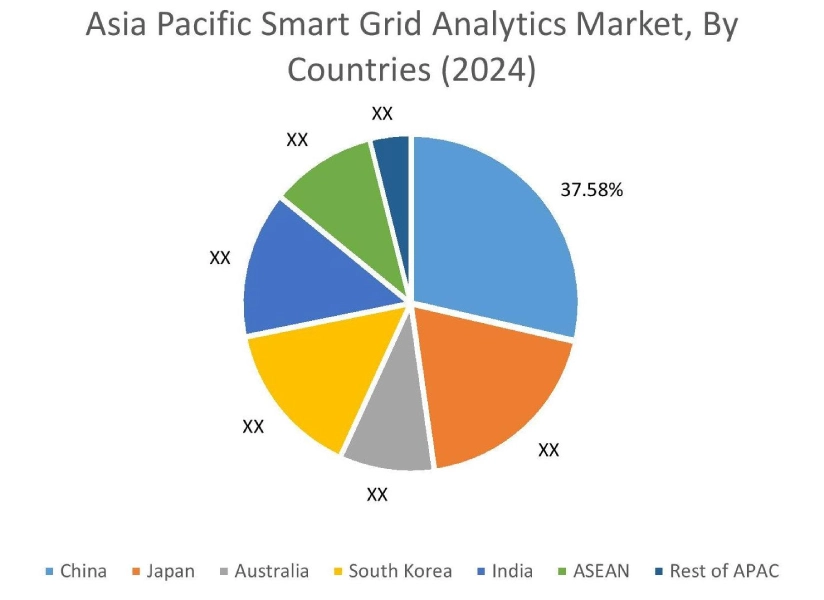

Asia Pacific region was valued at USD 1.98 Billion in 2024. Moreover, it is projected to grow by USD 2.22 Billion in 2025 and reach over USD 5.75 Billion by 2032. Out of this, China accounted for the maximum revenue share of 37.58%. As per the smart grid analytics market analysis, the adoption of grid analytics in the Asia-Pacific region is primarily driven by the strong government investment in smart grid technology and government measures for the development of smart cities, among others. Similarly, the rising installation of smart metering infrastructure is further accelerating the smart grid analytics market expansion.

- For instance, according to the Indian Press Information Bureau, around 16.7 million smart meters have been sanctioned in the Gujarat state of India under the Revamped Distribution Sector Scheme (RDSS), among which approximately 2.09 million smart meters have been installed as of July 2025. The above factors are driving the industry in the Asia-Pacific region.

North America is estimated to reach over USD 7.66 Billion by 2032 from a value of USD 2.74 Billion in 2024 and is projected to grow by USD 3.06 Billion in 2025. In North America, the growth of the smart grid analytics industry is driven by a strong focus on energy efficiency and reliable power management, including the integration of renewable energy sources such as solar and wind. Moreover, there is a growing adoption of smart meters and grid automation, along with supportive regulatory frameworks for smart grid development, which are further contributing to the smart grid analytics market demand in the region.

- For instance, according to the U.S. Energy Information Administration, the total number of advanced metering installations in the industrial sector in the United States reached up to 574,726 installations in 2022. The above factors are expected to propel the smart grid analytics market trends in North America during the forecast period.

Meanwhile, according to the regional analysis, factors including favorable government measures for facilitating the development of smart electricity grids and integration of renewable energy sources in smart grids are driving the smart grid analytics market demand in Europe. Furthermore, according to the market analysis, the market in Latin America, Middle East, and African regions is expected to grow at a considerable rate due to factors such as the rising pace of urbanization, significant investments in smart grid infrastructure, and other similar factors.

Top Key Players & Market Share Insights:

The global smart grid analytics market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the smart grid analytics market. Key players in the smart grid analytics industry include-

- Schneider Electric (France)

- Oracle (U.S)

- ABB (Switzerland)

- Wipro (India)

- Itron Inc. (U.S)

- GE Vernova (U.S)

- Siemens (Germany)

- IBM (U.S)

- Honeywell International Inc. (U.S)

- SAP (Germany)

Recent Industry Developments :

Product Launch:

- In October 2024, Schneider Electric launched new smart grid solutions, including grid analytics solutions, for strengthening grid resiliency, flexibility, and managing net-zero demands.

Smart Grid Analytics Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 21.28 Billion |

| CAGR (2025-2032) | 12.2% |

| By Offering |

|

| By Deployment |

|

| By Enterprise Type |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the smart grid analytics market? +

The smart grid analytics market was valued at USD 7.57 Billion in 2024 and is projected to grow to USD 21.28 Billion by 2032.

Which is the fastest-growing region in the smart grid analytics market? +

Asia-Pacific is the region experiencing the most rapid growth in the smart grid analytics market.

What specific segmentation details are covered in the smart grid analytics report? +

The smart grid analytics report includes specific segmentation details for offering, deployment, enterprise type, application, and region.

Who are the major players in the smart grid analytics market? +

The key participants in the smart grid analytics market are Schneider Electric (France), Oracle (U.S), GE Vernova (U.S), Siemens (Germany), IBM (U.S), Honeywell International Inc. (U.S), SAP (Germany), ABB (Switzerland), Wipro (India), Itron Inc. (U.S), and others.