Open Radio Access Network (Open RAN) Market Size:

Open Radio Access Network (Open RAN) Market size is estimated to reach over USD 46.73 Billion by 2032 from a value of USD 3.25 Billion in 2024 and is projected to grow by USD 4.47 Billion in 2025, growing at a CAGR of 34.1% from 2025 to 2032.

Open Radio Access Network (Open RAN) Market Scope & Overview:

Open radio access network (open RAN) refers to a mobile network architecture that promotes interoperability and flexibility in radio access networks by using open interfaces and disaggregating hardware and software components from different vendors. It aims to shift from the traditional, closed, and proprietary RAN models towards a more open and programmable ecosystem. Moreover, open radio access network (open RAN) offers several benefits, including reduced vendor lock-in, interoperability, increased flexibility and scalability, cost savings, enhanced security, and others.

Impact of AI on Open Radio Access Network (Open RAN) Market

AI is significantly transforming the Open Radio Access Network (Open RAN) market by enabling enhanced automation, real-time network optimization, and intelligent resource allocation. It helps telecom operators automate tasks like monitoring performance, detecting faults, and managing network traffic in real time. AI also improves how different vendors equipment works together, which is important in Open RAN systems. By analyzing large amounts of network data, AI can predict issues before they happen and adjust network settings for better efficiency. This leads to faster, more reliable, and energy-efficient networks. As the demand for 5G and cloud-based networks grows, AI is becoming essential for managing the complexity and performance of Open RAN deployments.

Open Radio Access Network (Open RAN) Market Dynamics - (DRO) :

Key Drivers:

Increasing deployment of 5G networks is propelling the open radio access network (open RAN) market growth.

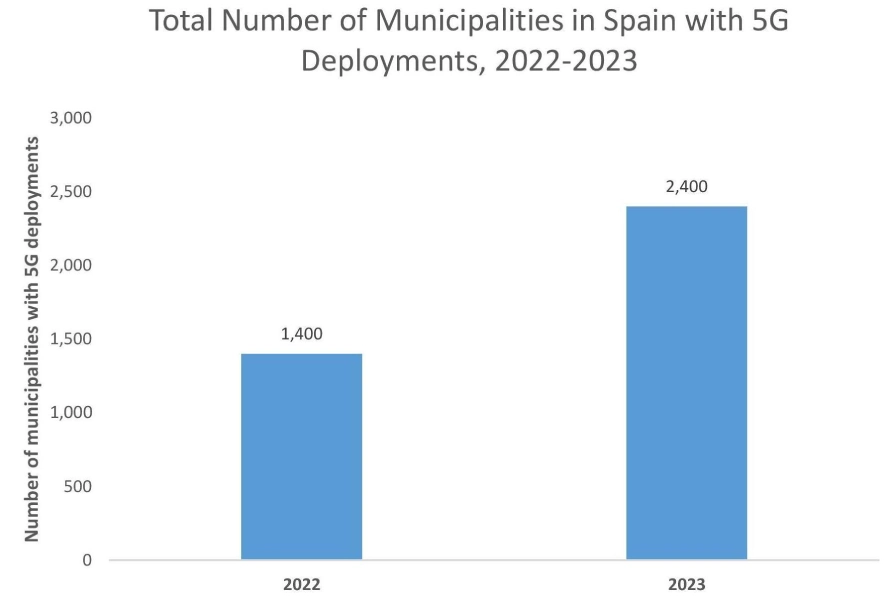

Open radio access network (open RAN) promotes open interfaces and virtualization in the radio access network. Moreover, it is being increasingly adopted by network operators to meet the demands of 5G's enhanced mobile broadband, ultra-low latency, and rising IoT (internet of things) connectivity. Additionally, open RAN enables mobile network operators to build 5G networks by combining components from different vendors, rather than being tied to a single vendor's proprietary solution. As a result, the rising deployment of 5G networks, driven by the growing demand for flexible, scalable, and cost-effective network solutions, is boosting the market growth.

- For instance, Telefonica, a Spanish multinational telecommunications company, deployed its 5G services to approximately 1,400 municipalities in Spain in 2022 and 2,400 municipalities by 2023. Additionally, Telefonica installed 700MHz 5G base stations for serving 700 towns and cities throughout Spain as of February 2022.

Therefore, the increasing deployment of 5G networks is propelling the open radio access network (open RAN) market size.

Key Restraints:

High initial investment is limiting the open radio access network (open RAN) market growth.

High initial investment associated with open RAN infrastructure is among the primary factors limiting the market growth. The upfront costs associated with open RAN infrastructure, including costs of equipment, hardware, software, and others along with integrating them into existing systems can be significantly high, which often leads to financial barriers, specifically for smaller businesses or businesses operating on tighter budgets.

Additionally, integrating components from different vendors and ensuring seamless interoperability can be complex and time-consuming, which often requires specialized expertise, potentially leading to increased integration costs. Thus, the aforementioned factors are hindering the open radio access network (open RAN) market expansion.

Future Opportunities :

Rising advancements associated with open RAN solutions are expected to drive the open radio access network (open RAN) market opportunities

Open RAN providers are frequently investing in the development of new technologies associated with open radio access networks to ensure safe and effective utilization across various applications. As a result, open RAN providers are deploying open radio access networks with updated features and capabilities, which are further expected to provide lucrative aspects for market development.

- For instance, in November 2024, Viettel launched its open RAN (O-RAN) 5G network, which utilizes Qualcomm's 5G RAN platforms. Viettel further announced its open RAN 5G deployments in more than 300 sites across various provinces in Vietnam in early 2025, along with the potential for additional deployments, as part of its expansion plans in 2025 and beyond.

Hence, as per the analysis, the rising advancements associated with open RAN solutions are projected to boost the open radio access network (open RAN) market opportunities during the forecast period.

Open Radio Access Network (Open RAN) Market Segmental Analysis :

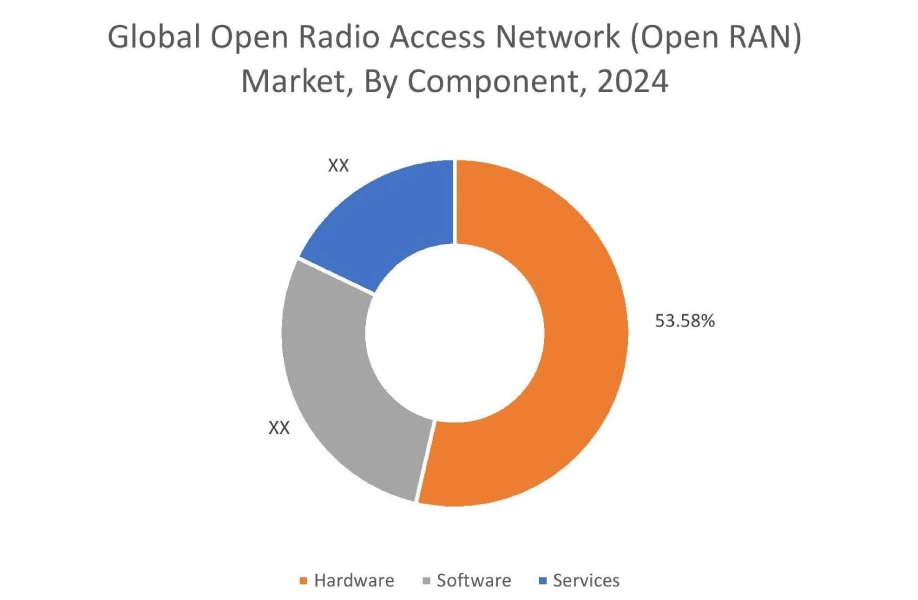

By Component:

Based on component, the market is segmented into hardware, software, and services.

Trends in the component:

- Rising technological advancements associated with open RAN hardware components, such as radio units, distributed units, centralized units, and others, are driving the market.

- Increasing trend in adoption of open RAN software to enable improved optimization, automation, agility, and faster network deployment is boosting the market.

The hardware segment accounted for the largest revenue share of 53.58% in the overall market in 2024.

- The primary hardware components used in open radio access networks include radio units, distributed units, centralized units, and others.

- Radio units are responsible for radio frequency (RF) transmission, reception, amplification, and digitization. It is usually located near or integrated with the antenna.

- Meanwhile, distributed units handle the lower-layer baseband processing functions, and they are often located at the cell site or aggregated in a central location.

- Moreover, centralized units are used for higher-layer protocol processing and are often located closer to the core network.

- These hardware components are connected through open front-haul, mid-haul, and back-haul interfaces, which enable greater flexibility and cost-effectiveness in network deployments.

- For instance, NEC Corporation offers open RAN radio units in its product offerings, which are designed to facilitate large-scale commercial deployments while allowing network-wide open RAN deployment.

- Thus, according to the analysis, the rising advancements related to open RAN hardware components are driving the market growth.

The software segment is anticipated to register the fastest CAGR during the forecast period.

- Open RAN software is designed to support open radio access network architecture and specifications.

- Software is used for combining and accelerating the evolution and deployment of the open radio access network architecture.

- Moreover, open RAN software enables operators to gain maximum benefits from their network assets and harness the cloud to modernize their networks while making them automated, interoperable, and easy to deploy and maintain the network.

- For instance, Parallel Wireless offers open RAN network software in its solution offerings. The software enables improved optimization, automation, agility, and faster deployment to the network. It supports new technologies such as 4G and 5G, along with legacy 2G and 3G networks.

- Therefore, according to the market analysis, the rising advancements related to open RAN software are projected to boost the market during the forecast period.

By Deployment phase:

Based on deployment phase, the market is segmented into brownfield and greenfield.

Trends in the deployment phase:

- Factors including increased flexibility, potential cost savings, and vendor diversification are among the primary determinants for driving the brownfield segment.

- Factors including enhanced scalability, cost reduction, and extension of 5G networks are key aspects expected to drive the greenfield segment development.

The brownfield segment accounted for the largest revenue share in the overall open radio access network (open RAN) market share in 2024, and it is anticipated to register significant CAGR during the forecast period.

- Open RAN (radio access network) is being increasingly deployed in brownfield environments, wherein it is integrated into existing, legacy telecom networks.

- This approach enables operators to modernize their infrastructure incrementally, while reducing costs and complexity as compared to a full-scale replacement.

- Moreover, brownfield deployment offers a range of benefits, including increased flexibility, potential cost savings, and vendor diversification, among others.

- Consequently, the above benefits related to brownfield deployments are further driving its adoption, in turn propelling open radio access network (open RAN) market trends.

By Network Type:

Based on network type, the market is segmented into 2G/3G, 4G/LTE, and 5G.

Trends in the network type:

- Factors including growing need for faster mobile internet speeds and increased capacity to support bandwidth-intensive applications are key trends driving the 4G/LTE segment.

- Increasing trend in the deployment of 5G networks, due to factors such as rising advancements in IoT, increasing need for enhanced mobile broadband, and prevalence of government initiatives promoting 5G deployment, among others.

4G/LTE segment accounted for the largest revenue share in the open radio access network (open RAN) market share in 2024.

- Open RAN technology can be applied to 4G/LTE networks, which enables a more flexible and open approach to building and managing these networks.

- It enables 4G network operators to deploy and manage 4G networks with greater flexibility and cost-efficiency.

- For instance, in February 2024, Samsung was selected by Vodafone Romania for deploying its completely virtualized RAN software and radio solutions for the open RAN rollout across Romania. Samsung’s triple-band radio combines multiple frequency bands into one compact radio that offers multi-spectrum coverage for 4G and other networks, in turn facilitating greater flexibility, increased network capacity, and a smaller footprint.

- Therefore, the above factors are driving the open radio access network (open RAN) market trends.

The 5G segment is anticipated to register the fastest CAGR growth during the forecast period.

- 5G (fifth-generation) network is developed to offer significantly faster data speeds, lower latency, and increased capacity as compared to its 4G network.

- Moreover, open RAN offers a new approach to building and managing mobile networks, particularly for 5G, which leverages open standards and interoperability.

- Open RAN enables 5G operators to use equipment from different vendors in their RAN, in turn increasing flexibility and potentially lowering costs.

- For instance, in February 2023, DISH Network Corporation launched its virtual open RAN 5G network with Samsung Electronics, marking the beginning of the company's role in the operator's nation-wide 5G rollout.

- Thus, the rising deployment of 5G networks is expected to drive the open radio access network (open RAN) market size during the forecast period.

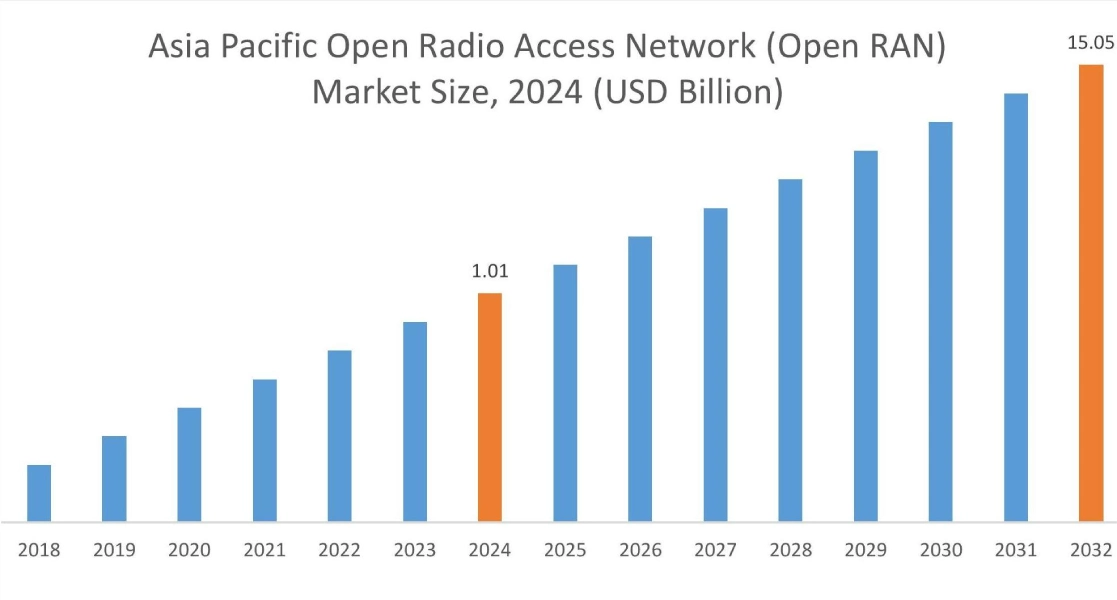

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

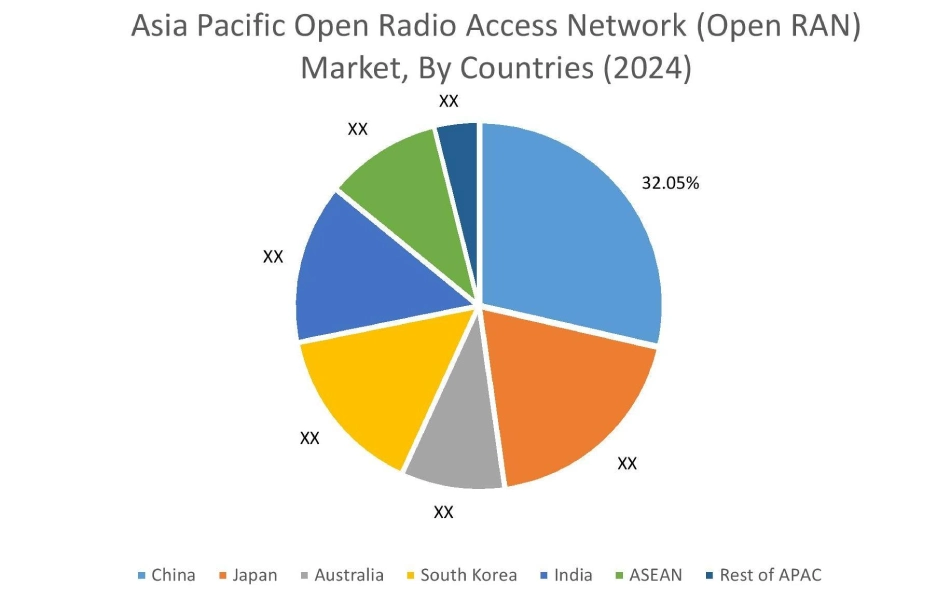

Asia Pacific region was valued at USD 1.01 Billion in 2024. Moreover, it is projected to grow by USD 1.39 Billion in 2025 and reach over USD 15.05 Billion by 2032. Out of this, China accounted for the maximum revenue share of 32.05%. As per the open radio access network (open RAN) market analysis, the adoption of open radio access network in the Asia-Pacific region is primarily driven by the growing telecommunication industry. Additionally, increasing investments in telecom base stations, specifically 5G base stations, are further accelerating the open radio access network (open RAN) market expansion in the region.

- For instance, according to the Department of Telecommunication of India, the overall deployment of 5G base stations across India reached up to 464,990 base stations as of December 2024, depicting an increase of 10.8% from 419,845 base stations in January 2024. The aforementioned factors are anticipated to drive market demand in the Asia-Pacific region during the forecast period.

North America is estimated to reach over USD 15.79 Billion by 2032 from a value of USD 1.12 Billion in 2024 and is projected to grow by USD 1.53 Billion in 2025. In North America, the growth of the open radio access network (open RAN) industry is driven by rising investments in telecom base stations and growing need for flexible, cost-effective, and scalable network infrastructure. Moreover, the rising deployment of 5G networks is contributing to the open radio access network (Open RAN) market demand in North America.

- For instance, according to 5G Americas, North America witnessed a substantial growth in 5G adoption, reaching up to 264 million 5G connections by the end of third quarter of 2024. The above factors are further driving the market in North America.

Additionally, as per the regional analysis, factors including the growing demand for high-speed connectivity and increasing need for cost-effective network solutions are driving the open radio access network (Open RAN) market demand in Europe. Further, according to the open radio access network (open RAN) market analysis, the market in Latin America, Middle East, and African regions is expected to grow at a substantial rate due to several factors such as increasing investments in telecommunication infrastructure, primarily driven by the increasing need for reliable internet and communication services, particularly in remote areas, among others.

Top Key Players and Market Share Insights:

The global open radio access network (open RAN) market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the open radio access network (open RAN) market. Key players in the open radio access network (open RAN) industry include-

- Mavenir (USA)

- Juniper Networks Inc. (USA)

- NEC Corporation (Japan)

- Ericsson (Sweden)

- Airspan Networks (USA)

- Fujitsu Limited (Japan)

- Nokia Corporation (Finland)

- Samsung (South Korea)

- Radisys Corporation (USA)

- Parallel Wireless (USA)

Recent Industry Developments :

Acquisition

- In March 2025, Airspan Networks announced the acquisition of the open RAN radio portfolio from Jabil and its associated intellectual property rights (IPR). The strategic acquisition aims at expanding Airspan’s capability while facilitating product innovation and evolution in a rapidly growing market.

Partnership & Collaboration:

- In September 2022, NEC Corporation and Mavenir deployed massive MIMO on Orange’s 5G standalone experimental network, in turn driving the open RAN forward. Mavenir’s cloud-native open RAN software has been deployed on the cloud infrastructure from Orange, along with massive MIMO active antenna unit from NEC, in order to deliver high capacity and improved coverage.

Open Radio Access Network (Open RAN) Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 46.73 Billion |

| CAGR (2025-2032) | 34.1% |

| By Component |

|

| By Deployment Phase |

|

| By Network Type |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the open radio access network (Open RAN) market? +

The open radio access network (open RAN) market was valued at USD 3.25 Billion in 2024 and is projected to grow to USD 46.73 Billion by 2032.

Which is the fastest-growing region in the open radio access network (Open RAN) market? +

Asia-Pacific is the region experiencing the most rapid growth in the open radio access network (open RAN) market.

What specific segmentation details are covered in the open radio access network (open RAN) report? +

The open radio access network (open RAN) report includes specific segmentation details for component, deployment phase, network type, and region.

Who are the major players in the open radio access network (open RAN) market? +

The key participants in the open radio access network (open RAN) market are Mavenir (USA), Juniper Networks Inc. (USA), Fujitsu Limited (Japan), Nokia Corporation (Finland), Samsung (South Korea), Radisys Corporation (USA), Parallel Wireless (USA), NEC Corporation (Japan), Ericsson (Sweden), Airspan Networks (USA), and others.