Smart Medical Devices Market Size:

Smart Medical Devices Market size is estimated to reach over USD 121.18 Billion by 2031 from a value of USD 42.40 Billion in 2023, growing at a CAGR of 16.2% from 2024 to 2031.

Smart Medical Devices Market Scope & Overview:

Smart medical devices are state-of-the-art instruments for the healthcare industry that use modern technology such as software, sensors, connections, etc., to monitor, diagnose, or treat patients. Typically, their designs aim to offer real-time data, boost patient care, increase treatment precision, and facilitate customized medical services. With the ability to link to the internet or other networks, these devices may be used for remote assessment, therapy, and continuous monitoring. One of the features of these medical devices includes their data collection and analytics capabilities by leveraging the built-in sensors to obtain real-time data. They also have automation, portability, and user-friendly interfaces that allow intuitive control for patients and healthcare professionals to manage the device. They are cost-effective and are used in the healthcare sector, homecare settings, rehabilitation centers, etc.

How is AI Transforming the Smart Medical Devices Market?

AI transforms the smart medical devices market by enhancing diagnostics, enabling personalized treatments, and improving predictive analytics through advanced data processing and machine learning. AI-enabled devices facilitate real-time tracking of patient health metrics from a distance, allowing healthcare providers to monitor patients remotely and intervene when necessary. Additionally, it leads to more accurate and intuitive devices, assists with remote monitoring and skill development, and streamlines device development and manufacturing by automating processes and improving quality control. Hence, AI helps in achieving better patient outcomes, reducing costs, and increasing accessibility to healthcare.

Smart Medical Devices Market Dynamics - (DRO) :

Key Drivers:

Increased Emphasis on Remote Monitoring and Telehealth Propels the Market

Telehealth allows patients to receive medical care and frequent consultations remotely reducing the dependence on in-person visits. Smart medical devices such as blood pressure monitors, wearable heart rate sensors, glucose meters, etc., allow patients to measure their health statistics from their homes. They then can transmit real-time data collected through these devices to healthcare professionals, facilitating remote diagnosis and preventive care. It is beneficial, particularly for patients suffering from chronic diseases. The integration of the Internet of Things (IoT) enhances the functionality of smart devices to track health data with critical insights. This allows for patient-centric data-driven treatment to obtain more efficient and precise outcomes.

- The U.S. Department of Veterans Affairs (VA) has embraced remote monitoring and telehealth, deploying smart medical devices for veteran care. The VA's use of devices like smart blood pressure monitors and activity trackers has significantly improved health outcomes for veterans, allowing clinicians to monitor their conditions remotely and adjust treatments based on real-time data. This initiative is helping to reduce hospitalizations and improve the quality of care for veterans.

Therefore, remote monitoring and telehealth offer cost-effective treatments to patients and enhance the overall efficiency of medical care, propelling the smart medical devices market demand.

Key Restraints :

Data Privacy and Security Concerns Hinder Market Growth

Smart medical devices collect huge amounts of sensitive information like patient vitals, their medical histories, etc. This information is then often transmitted over the internet and stored in cloud-based systems, making the data vulnerable to cybercrimes like hacking or data breaches. Such risks could result in patient identity theft or unauthorized use of medical data leading to legal and ethical implications. It creates concerns over how health data is handled, stored, and shared can reduce patient trust in these devices. Patients want to avoid the vulnerablilty of exploitation leading to their reluctance to adopt smart devices.

- For instance, Philips Respironics reported a hacking incident affecting 1,125 individuals, potentially compromising personal health data, linked to a vulnerability in MOVEit Transfer software.

Thus, the lack of robust security frameworks and insufficient protection measures hinder both hospitals and patients from integrating these devices into their systems, restraining the smart medical devices market growth.

Future Opportunities :

Development of Connected Health Ecosystems Offers New Avenues to the Market

A connected health ecosystem combines various smart medical devices, healthcare platforms, and electronic health records (EHRs) into a cohesive system. This allows the effective flow of patient data between different healthcare experts creating a framework for efficient and comprehensive patient care. Smart medical devices such as wearable sensors, at-home monitoring tools, and in-clinic devices, etc., data can be continuously updated and analyzed in real-time, offering a complete picture of a patient's health. This facilitates better diagnosis, personalized treatments, and faster response to medical emergencies. It also results in better patient engagement as patients can view their health data in real-time as well as track progress or set further goals for maintaining their health. They also tend to have patient engagement tools like reminders for medication, fitness tracking, etc., to help increase adherence to treatment plans and improve health outcomes.

- In October 2023, a novel connected health platform -ZAIDYN was launched by ZS, a consulting and technology company. ZAIDYN Connected Health is AI-powered and offers better engagement with patients by meeting unmet needs and enhancing health outcomes.

Therefore, the growth in connected health ecosystems leads to smart medical devices market expansion, fostering better compliance and a more proactive attitude toward health management.

Smart Medical Devices Market Segmental Analysis :

By Product:

The market is bifurcated based on products into Diagnostics and Monitoring (Blood Glucose Monitors, Heart Rate Monitors, Pulse Oximeters, and Blood Pressure Monitors) and Therapeutics Devices (Portable Oxygen Concentrators and Ventilators, Insulin Pumps, and Hearing Aids).

Trends in the Product:

- Smart rings are gaining traction in wearable medical devices as they provide sleep tracking, heartbeat, and stress level monitoring, etc.

- Smart fertility and pregnancy trackers like Ava or Tempdrop allow users to track menstrual cycles, fertility windows, etc.

Diagnostics and Monitoring accounted for the largest revenue in the smart medical devices market share in 2023.

- Chronic conditions such as diabetes, cardiovascular issues, respiratory disorders, etc., are rising in prevalence. Smart medical devices such as blood pressure monitors, wearable ECG monitors, glucose monitors, etc. offer continuous monitoring that helps in early diagnosis.

- These devices facilitate remote patient monitoring which allows healthcare providers to monitor patients in real-time without the need for inpatient care.

- Advancements made in the devices such as integration with AI or more innovative sensors have led to the development of precise, user-friendly, and portable smart devices for better monitoring and diagnosis.

- They are cost-effective in the long run as they minimize the need for frequent hospital visits and streamline preventive care.

- For instance, researchers from Stanford University and POSTECH have developed a smart contact lens to continuously monitor blood sugar levels. It offers a non-invasive way to monitor hypoglycemia and hyperglycemia by correlating glucose levels in tears. It also helps in alerting healthcare professionals in case of fluctuations in blood sugar levels.

- Thus, as per the smart medical devices market analysis, this segment contributes to the larger revenue generation as consumer awareness and demand for wellness tracking rises.

Therapeutics Devices are expected to have the fastest CAGR during the forecasted period.

- Smart therapeutic devices are imperative for the personalization of medicine that allows treatments to be tailored to individual patients. Devices such as closed-loop insulin pumps provide targeted insulin delivery based on real-time glucose monitoring.

- Innovative technologies such as AI, machine learning, Internet of Things (IoT), etc., transform therapeutic devices, making them more precise, easily adjustable, automatic, and facilitate real-time data collection.

- The global shift towards homecare settings and remote treatment through smart therapeutic devices such as portable neurostimulators enables patients to get essential treatment without any hassle.

- The aging demographic is more prone to chronic conditions that require therapeutic interventions to offer non-invasive treatment.

- For instance, spinal cord stimulation uses an implantable device to stimulate nerve fibers, reducing pain signals. It treats conditions like failed back surgery syndrome, complex regional pain syndrome, and peripheral neuropathy.

- Therefore, as smart therapeutic devices offer a user-friendly experience and mobile integration, they will boost the smart medical devices market trends.

By Modality:

The market is bifurcated based on modality into Wearable and Non-Wearable.

Trends in the Modality:

- Recently, wearable patch sensors for monitoring vitals such as blood pressure, respiratory health, etc., in a comfortable skin-adhesive form are becoming popular.

- Miniaturized smart diagnostics devices that provide quick and accurate blood tests that enable point-of-care testing for infections, kidney function, etc., are widely used nowadays.

Wearable accounted for the largest revenue in the overall smart medical devices market share in 2023.

- Wearable devices, especially fitness trackers and smartwatches are often equipped with heart rate monitoring, blood oxygen level as well as sleep tracking.

- Modern wearables have evolved beyond fitness trackers and now include electrocardiogram (ECG) monitoring, glucose levels monitoring, etc. This provides users with real-time health data and early warning for probable medical conditions.

- The growth in telemedicine drives the demand for more wearable devices as they enable healthcare providers to monitor and diagnose patients remotely, especially those with heart issues or hypertension.

- Wearable devices are integrated within a digitally connected healthcare ecosystem for better data management, sharing, and analysis by healthcare professionals, making them an important tool in preventive care.

- They are accessible and affordable to the larger population as major technological companies such as Xiaomi, Apple, Fitbit, etc., are manufacturing smart watches and fitness bands with scalable ease.

- The Samsung Galaxy Watch series features health-centric tools like ECG monitoring, blood pressure tracking, and body composition analysis. These smartwatches provide continuous health monitoring and are integrated with Samsung Health to help users track their fitness goals and overall health. The accessibility of these devices across a broad consumer base has made them one of the major contributors to the revenue in the smart wearable devices sector.

- Thus, as the popularity of fitness and preventive care is rising, this segment promotes the smart medical devices market demand.

Non-wearable devices are expected to have the fastest CAGR during the forecasted period.

- Remote monitoring through non-wearable devices such as blood pressure monitors, smart glucometers, oxygen concentrators, etc helps patients manage their chronic health diseases with relative efficiency.

- Non-wearable devices such as continuous glucose monitors (CGM) systems, smart nebulizers, etc., offer critical monitoring and targeted drug delivery to patients suffering from heart issues, respiratory disorders, etc.

- The integration of big data analytics into non-wearable devices enables them to provide more precise diagnostics and personalized treatment options.

- Non-wearable smart devices, such as advanced imaging systems, robotic surgery tools, smart infusion systems, etc., are increasingly being adopted into the hospital and clinical settings. They help in the precision of treatments, and real-time decision making which enhances patient outcomes.

- Smart insulin pens, such as Novo Nordisk's NovoPen 6 and NovoPen Echo Plus, offer precise insulin dosing and record-keeping, which can be synced with a smartphone app. These devices help users manage diabetes more effectively by providing data on insulin usage, dosage history, and reminders. The increasing prevalence of diabetes globally has driven the adoption of these non-wearable smart devices.

- Therefore, as regulatory bodies recognize the benefits of non-wearable smart devices in streamlining healthcare operational accuracy, this segment will boost the smart medical devices market trends.

By Application:

The market is segmented based on application into Chronic Disease Management (Diabetes Management, Cardiovascular Health, and Respiratory Conditions), Home Healthcare (Remote Patient Monitoring and Daily Health Tracking), Personal Fitness (Fitness and Activity Tracking and Health and Wellness Monitoring), and Diagnostic and Therapeutic Applications (Disease Diagnosis and Treatment Monitoring).

Trends in the Application:

- Recently, smart medical devices like fitness apps and nutrition tracking apps provide excellent personal fitness by analyzing real-time insights like caloric intake, metabolic health, etc.

- Smart devices and apps are recently being integrated into wearables to look for better cognitive health and mental well-being.

Chronic Disease Management accounted for the largest revenue share in 2023.

- The global rise in chronic conditions such as diabetes, cardiovascular ailments, and respiratory disorders requires continuous monitoring and management. Smart medical devices like blood pressure monitors, smart inhalers, etc, help patients with chronic conditions manage their health effectively.

- Advances in smart technology such as integration of AI, IoT, etc, have made it easier to monitor and manage chronic diseases by providing real-time data, predictive analysis, personalized care, etc.

- The aging demographic is prone to chronic diseases and it increases the need for smart devices to track health metrics at home and provide precise data to healthcare operators.

- There has been a shift from reactive care to preventive healthcare where patients are more focused on early diagnosis and continuous monitoring to prevent chronic disease progression. These medical devices provide timely insights which improves patient outcomes for chronic conditions.

- Devices such as the Dexcom G6 have revolutionized diabetes management by providing continuous glucose monitoring. The CGM system allows users to track glucose levels in real time, helping them maintain better control over their condition without frequent finger pricks.

- Therefore, as both patients and healthcare providers depend on medical devices for chronic disease management, it contributes to the largest revenue generation.

Home Healthcare is expected to have the fastest CAGR during the forecasted period.

- Smart medical devices offer vital health tracking from home, reducing the need for frequent hospital or clinical visits.

- With the prevalence of heart diseases, home healthcare through wearable sensors, smart glucose monitors, etc has become essential for patients to manage their health in real-time.

- Smart devices are tailored for the aging population with provisions like fall detection systems, independent living, etc., for providing critical data.

- The shift to telehealth, virtual care, and at-home monitoring facilitates remote consultations and continuous health checkups.

- Home healthcare is cost-effective compared to inpatient care as medical devices reduce expenses by minimizing the need for hospital admissions and diagnostics.

- They offer greater convenience to the patient, especially for the ones with mobility issues, and make it easier for post-surgery recovery.

- Home healthcare is a decentralizing solution that helps hospitals with resource and staff constraints manage patient loads and offer more efficient medical care.

- Companies like TytoCare have developed portable, all-in-one diagnostic devices that allow patients to conduct medical exams at home and share the data with healthcare providers remotely. TytoCare's device Home Smart Clinic can monitor heart rate, and temperature, and even perform throat and ear exams, enabling comprehensive telehealth consultations. This has become particularly useful for managing chronic conditions without frequent hospital visits, driving the adoption of smart devices for home healthcare.

- Thus, as patients are becoming more conscious about proactive care, the use of non-invasive smart medical devices for home healthcare will have fast growth in the future.

By Technology:

The market is segmented based on technology into Bluetooth, Wi-Fi, Near Field Communication (NFC), and Cellular Connectivity.

Trends in the Technology:

- The recent focus on predictive analysis through edge computing is gaining traction within this market as it processes data closer to the source.

- 5G cellular connectivity is now crucial in applications like robotic surgery where real-time feedback is essential for precision and safety.

Bluetooth accounted for the largest revenue share in the smart medical devices market in 2023.

- Bluetooth integration into smart medical devices allows seamless connectivity between devices and smartphones, tablets, computers, etc. This makes using medical devices easier without the need to employ additional equipment.

- They are designed to consume minimal power, making them ideal for wearable medical devices that need long battery life.

- Devices such as smartwatches, glucose monitors, fitness trackers, etc., use Bluetooth low energy (BLE) to continuously transmit data without draining much battery.

- Bluetooth technology is cost-effective to implement compared to other wireless communication technologies like Wi-Fi, leading to its widespread adoption across a range of medical devices.

- They have enhanced range and connection stability, especially, Bluetooth 5.0 which is known to transmit data faster and to 400 meters in range, improving the performance of medical devices.

- Bluetooth technology is secure and convenient to use even for elderly or non-tech savvy users. This has boosted its adoption as patients prefer easy-to-operate devices for health management.

- They can also be easily integrated with popular health apps like Apple Health, Google Fit, etc., so that patients can sync medical devices to monitor, set health goals, share data, etc.

- Devices like the Contour Next One by Ascensia Diabetes Care use Bluetooth technology to sync glucose readings with a smartphone app, allowing users to track their blood glucose levels easily. The app provides insights, trends, and the ability to share data with healthcare providers. This convenience has made Bluetooth-connected glucose meters a popular choice among diabetes patients.

- Thus, Bluetooth technology's widespread compatibility boosts the smart medical devices market.

Cellular Connectivity is expected to have the fastest CAGR during the forecasted period.

- Cellular connectivity makes smart devices much more suitable for patients who are on the move, live in remote areas, or have limited access to Wi-Fi infrastructure.

- Cellular signals such as LTE, 5G, etc., allow real-time monitoring and data transmission even when patients are far away from home or any healthcare facilities.

- They offer faster data transfer speeds, and have low latency and improved exchange capacity, making cellular connectivity ideal for advanced healthcare applications.

- They provide high-quality video consultations and transmission of large data sets like imaging or biometric data to healthcare professionals.

- Cellular-connected smart medical devices enable healthcare providers to remotely track patient vitals, symptoms, and overall health status which is beneficial for post-operative care as well as elderly care.

- Unlike, Bluetooth or Wi-Fi, cellular connectivity does not rely on local networks which tend to be non-dependable. Smart devices operating on cellular networks transmit critical health data directly to cloud-based systems, ensuring a smooth flow of information.

- These medical devices run on cellular networks such as smart cardiac monitors or defibrillators alert medical professionals or emergency services in real-time, no matter where the patient is located.

- Eversense E3 by Senseonics is a continuous glucose monitoring (CGM) system that uses cellular connectivity to transmit glucose readings to a smartphone app. It allows users and healthcare providers to receive alerts and monitor glucose levels in real-time, even if the user is not near a Wi-Fi network. This feature is crucial for patients who need constant monitoring while on the move, making cellular connectivity an attractive option for CGM devices.

- Therefore, as cellular connectivity offers a plug-and-play experience to their users, they are expected to promote the smart medical devices market expansion.

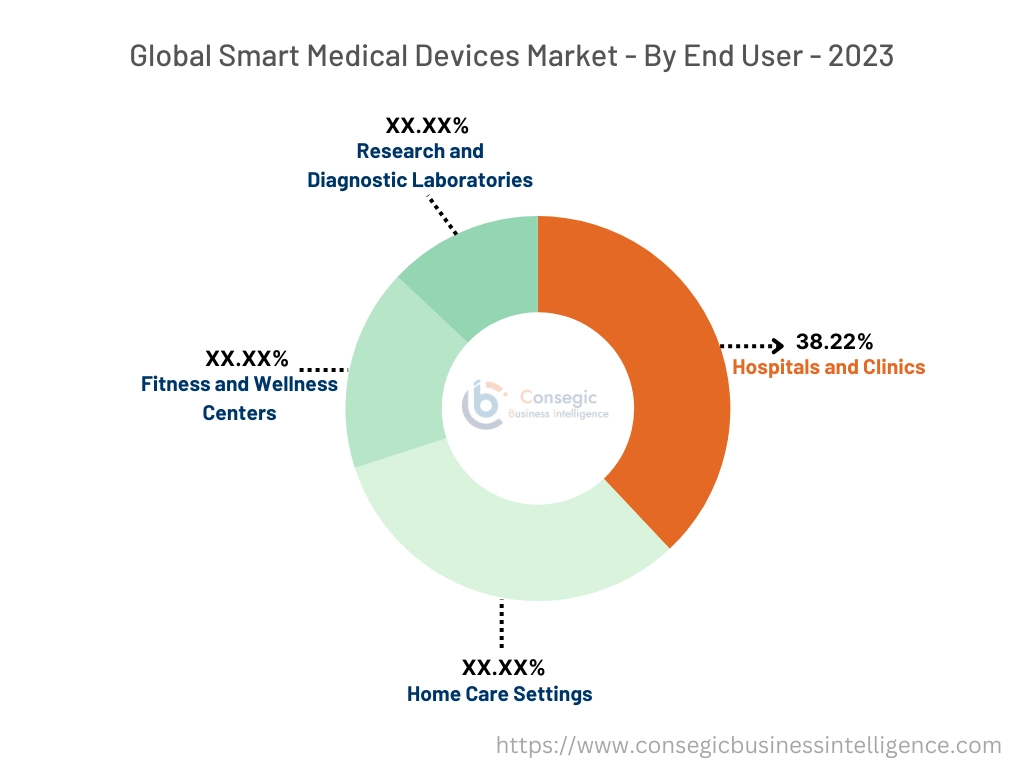

By End-User:

The market is segmented based on end-users into Hospitals and Clinics, Home Care Settings, Fitness and Wellness Centers, and Research and Diagnostic Laboratories.

Trends in the End-User:

- Hospitals and clinics are recently adopting AI-powered diagnostic devices such as AI-enabled radiology systems for detecting abnormalities in imaging scams.

- Smart pill dispensers are increasingly being adopted for home-setting healthcare as they ensure that elderly patients take their medications on time.

Hospitals and Clinics accounted for the largest revenue share of 38.22% in 2023.

- Hospitals and clinics are the primary settings where advanced diagnostic and monitoring medical devices such as connected ECG machines, smart infusion pumps, etc., are extensively used for patient care.

- Hospitals and clinics benefit from the continuous monitoring these devices offer, especially for critical care units, post-operative care, and long-term patient management.

- They have the resources to invest in high-cost and advanced smart medical devices such as devices integrated with AI, IoT, etc., for data collection and analysis.

- They handle large volumes of patients daily which creates a high demand for medical devices to streamline diagnostics, treatment, and patient monitoring processes.

- Hospitals and clinics have integrated their medical devices with their electronic health records (EHR) systems to enable seamless transfer of real-time patient data to patient health records. This facilitates better care coordination and decision-making and reduces manual errors.

- Hospitals and clinics are responsible for managing patients with more complex or severe health conditions and these medical devices play a critical role in intensive care units (ICUs), operating rooms, etc.

- Hospitals have widely adopted smart infusion pumps, such as the B. Braun Infusiomat Space, to enhance the precision and safety of intravenous drug administration. These devices help healthcare professionals program accurate dosages and monitor infusion rates in real-time, reducing the risk of medication errors.

- Thus, as hospitals and clinics use medical devices to identify potential risk patterns in patients, they contribute to smart medical devices market opportunities.

Home Care Settings are expected to have the fastest CAGR during the forecasted period.

- Patients with chronic conditions prefer using smart medical devices at home to continuously monitor their vitals. Devices like smart blood pressure cuffs, wearable heart rate monitors, etc., allow patients to track and send data directly to healthcare providers without the need for inpatient care.

- Home care settings are efficient, safe, and cost-effective way, especially for patients suffering from chronic diseases. Home-based devices such as portable ECG devices for heart conditions allow continuous monitoring and better management.

- Home healthcare settings are ideal for the aging demographic as they provide elderly people with a familiar environment for convalescence.

- Devices like the Freestyle Libre by Abbott have become popular in home care settings for managing diabetes. These CGMs allow patients to monitor their glucose levels continuously without the need for frequent finger pricks. The data is transmitted to a smartphone app via Bluetooth, enabling users to track trends and share information with healthcare providers remotely.

- Therefore, patients opt for the convenience of home healthcare settings boosting the smart medical devices market growth.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

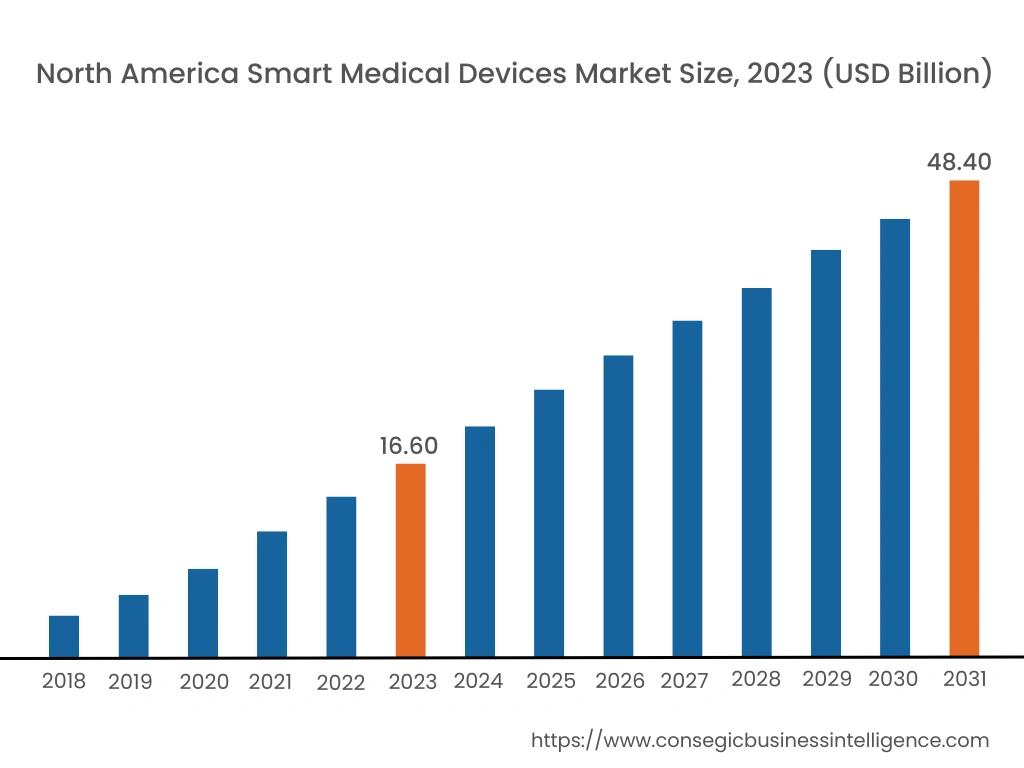

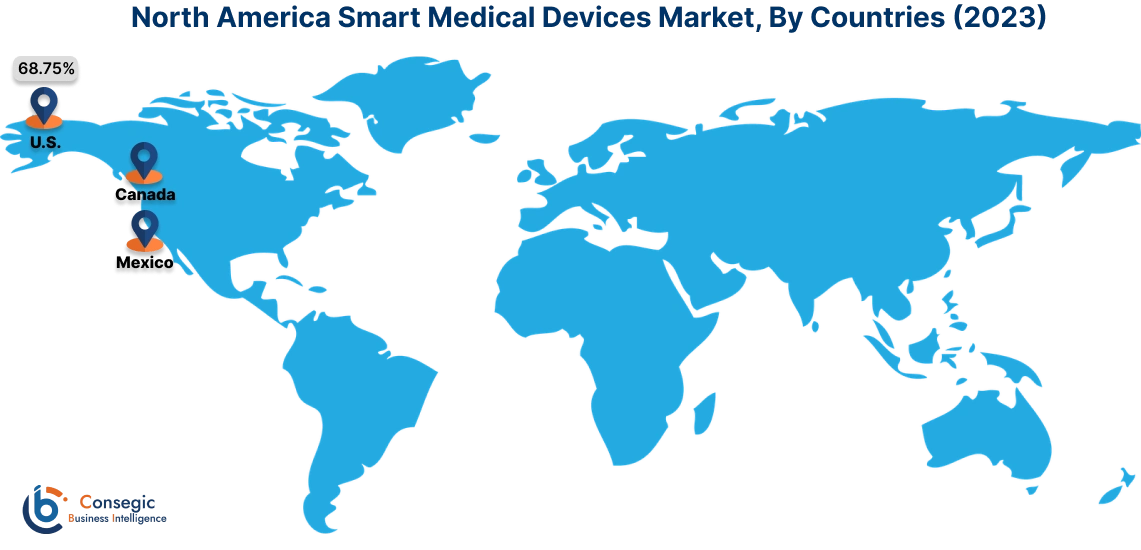

In 2023, North America accounted for the highest market share at 39.15% and was valued at USD 16.60 Billion, and is expected to reach USD 48.40 Billion in 2031. In North America, the U.S. accounted for the highest market share of 68.75% during the base year of 2023. As per the smart medical devices market analysis, North America, especially the USA, is home to advanced technology companies, research institutions, and healthcare startups. They facilitate continuous innovation in medical technology has driven the development and adoption of these medical devices.

- Apple Inc. has been at the forefront of integrating advanced health monitoring features into its devices. The Apple Watch series includes ECG monitoring, blood oxygen level tracking, and heart rate alerts. These features are developed in collaboration with research institutions like Stanford University, which conducted a study called Apple Heart Study using Apple Watch to detect atrial fibrillation. This partnership between a tech giant and a leading research institution demonstrates how innovation in smart medical devices is thriving in the USA.

Asia Pacific is expected to witness the fastest CAGR over the forecast period of 16.9% during 2024-2031. The Asia-Pacific region, particularly in countries like Japan, China, South Korea, etc., has a large concentration of rapidly aging population. The aging demographic experiences chronic diseases, and that has led to a growth in demand for more efficient healthcare solutions to monitor health.

- Japan's aging population has driven the adoption of smart medical devices, such as the HOSPI-Rimo by Panasonic, a robotic device designed to help monitor the health of elderly patients. It assists in measuring vital signs, medication reminders, and remote consultations. Due to the increasing number of elderly people requiring healthcare, such innovations have become essential in Japan's healthcare infrastructure.

European nations, especially the UK, Germany, France, etc., have governments that are actively promoting digital healthcare through various initiatives and programs. This helps in the greater integration of digital health technologies into public health systems and has increased the adoption of smart medical devices for diagnosis and treatment. In the Middle East and Africa (MEA) region, especially in the Gulf countries like UAE, Qatar, Saudi Arabia, etc., there is a rapid trend of urbanization. The population has an increasing amount of disposable income which is contributed to advancing medical technologies. This has led to a higher consumer demand for at-home smart medical devices. Latin America focuses on cost-effective healthcare solutions, given the economic challenges some parts of this region face. These medical devices reduce the expenditure of hospital visits and enable remote monitoring and improvement of long-term health outcomes.

Top Key Players & Market Share Insights:

The Smart Medical Devices Market is highly competitive with major players providing products and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global smart medical devices market. Key players in the smart medical devices industry include:

- Medtronic (USA)

- Koninklijke Philips N.V. (Netherlands)

- Abbott (USA)

- GE HealthCare (USA)

- Siemens Healthineers AG (Germany)

- Johnson & Johnson Services, Inc. (USA)

- Boston Scientific Corporation (USA)

- Honeywell International Inc. (USA)

- Dexcom, Inc. (USA)

- F. Hoffmann-La Roche Ltd. (Switzerland)

Recent Industry Developments :

Product Launches:

- In In June 2023, Teltonika Networks, announced the launch of smart medical wristbands to help patients with cardiovascular issues. This new product – Teltoheart is expertly engineered to detect fluctuations and inconsistencies in atrial fibrillation. The wristband monitors arrhythmia or a patient's pulse shows signs of abnormal fall or rise. Then it helps in recording a six-derivative electrocardiogram that enables healthcare professionals to offer early diagnosis and preventive care.

- In June 2024, Sky Lab, a biotech firm, announced the launch of a new ring blood pressure monitoring device —CART BP. This new wearable smart medical device allows wearers to continuously monitor and quantify blood pressure for 24 hours. The ring recognizes the rise and fall of blood pressure and helps the user modify medication dosages based on it. It can also track blood pressure t all through the day, even during sleep cycles or exercise routines.

Mergers and Acquisitions:

- In January 2024, GE HealthCare announced its intention to acquire MIM Software. While MIM is a tech firm that offers patient care by enabling customer-centered innovative imaging solutions, GE is a Meditech innovator that offers pharmaceutical diagnostics and digital solutions. Through this acquisition, GE HealthCare aims to combine MIM Software solutions into its innovative visualization offerings. It would help in AI-based segmentation and contouring as well as dosimetry analysis for patients.

Partnerships and Collaborations:

- In August 2024, Medtronic announced their partnership with Abbott after gaining approval for their continuous glucose monitor (CGM) – Simplera. The product's design is engineered to simplify insertion and improve patient experience.

Smart Medical Devices Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 121.18 Billion |

| CAGR (2024-2031) | 16.2% |

| By Product |

|

| By Modality |

|

| By Application |

|

| By Technology |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

Who are the major players in the smart medical devices market? +

The major players in the market include Medtronic (USA), Koninklijke Philips N.V., (Netherlands), Johnson & Johnson Services, Inc. (USA), Abbott (USA), Boston Scientific Corporation (USA), Siemens Healthineers AG (Germany), GE HealthCare (USA), Honeywell International Inc. (USA), Dexcom, Inc. (USA), and F. Hoffmann-La Roche Ltd. (Switzerland).

Which region will lead the smart medical devices market? +

North America will lead the global smart medical devices market in the future.

What specific segmentation details are covered in the smart medical devices market report? +

The smart medical devices market is segmented into product, modality, application, technology, and end-user industry.

Which is the fastest-growing region in the smart medical devices market? +

Asia Pacific is the fastest-growing region in the smart medical devices market.