Smart Personal Safety and Security Device Market Size :

Smart Personal Safety and Security Device Market size is estimated to reach over USD 12,904.13 Million by 2032 from a value of USD 5,575.41 Million in 2024 and is projected to grow by USD 6,092.70 Million in 2025, growing at a CAGR of 11.10 % from 2025 to 2032.

Smart Personal Safety and Security Device Market Definition & Overview :

Smart personal safety and security devices refer to electronic devices that are designed for enhancing personal safety while providing improved security to individuals. More over they offer a range of benefits including compact size, portability, ease of utilization, increased convenience, enhanced safety and security, ease of personalization, and others. and others. As per the analysis, the aforementioned benefits of these devices are major determinants for increasing its deployment in healthcare, military & defense, manufacturing, construction, law enforcement, and other related applications.

Smart Personal Safety and Security Device Market Insights :

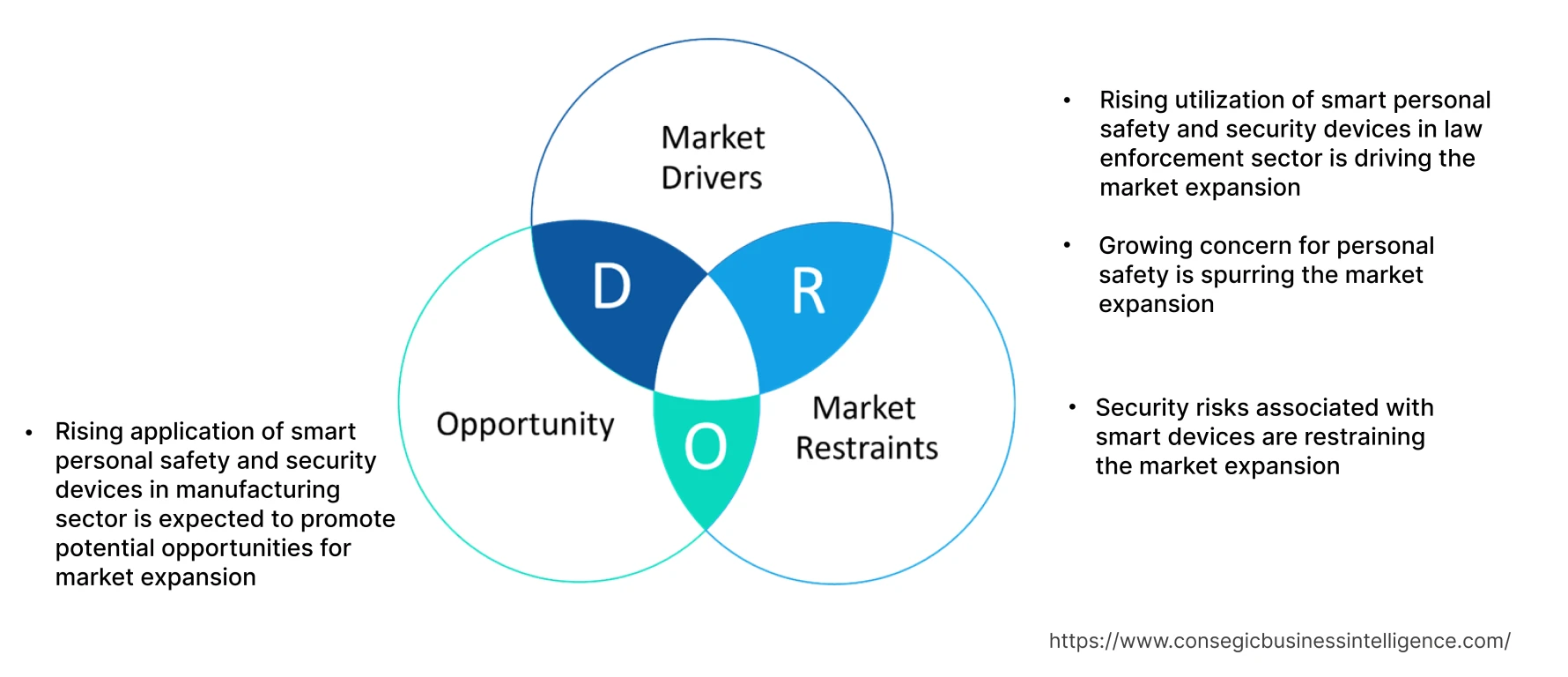

Key Drivers :

Rising utilization of smart personal safety and security devices in law enforcement sector is driving the market expansion

Smart personal safety and security devices such as smart helmets, and other wearable devices are primarily utilized by law enforcement personnel and first responders for operations in the field. Smart helmets are often integrated with facial recognition capabilities, temperature reading mode, plate number recognition, QR code reader, and other advanced features, which enables law enforcement personnel to gain quicker information access and stay more aware about their surroundings.

Based on the analysis, factors including increasing investments in law enforcement sector, rising prevalence of active law enforcement personnel, growing number of critical missions, and rising demand for personnel safety devices are among the major prospects driving the adoption of smart personal safety and security device market.

For instance, in 2020, police personnel in China, Italy, and Dubai used smart helmets for monitoring and identifying people with high temperatures during the combat against COVID-19 pandemic. The smart helmets utilized thermal imaging for recording people's temperatures at a distance of approximately two meters. Thus, the rise in adoption of smart safety devices including smart helmets, and other wearable devices by law enforcement personnel is driving the trends of the market.

Growing concern for personal safety is spurring the market expansion

The rising crime rates and security threats are primary determinants for increasing the demand for smart personal safety and security device market. As per the analysis, factors including increasing incidence of crimes including theft or robberies, assaults, and others has generated a sense of insecurity among individuals, in turn driving the smart personal safety and security device market.

For instance, according to Forbes, over one million home burglaries occur on average in the United States every year. Similarly, according to the Federal Bureau of Investigation of United States, the total cases of assaults in the United States reached 22,446 cases in 2022.

Additionally, according to the National Crime Records Bureau of India, the total reported cases of theft and burglaries against property reached 5,86,649 cases and 97,792 cases respectively in India in 2021.

Therefore, the rising crime rates is driving the adoption of smart safety and security device for providing enhanced individual safety and security, particularly in cases of emergency, thereby, proliferating the trends of the market.

Key Restraints :

Security risks associated with smart devices are restraining the market expansion

Smart devices are integrated with several technologies including Bluetooth, Wi-Fi, IoT (Internet of Things), and others. However, the deployment of smart devices is often associated with certain security risks, which is a key factor constraining the market trends.

For instance, smart devices are prone to security risks including increased attack surfaces, unsecured hardware, unencrypted data transmissions, and domain name system (DNS) threats among others.

Additionally, smart devices are also vulnerable to IoT ransomware attacks, firmware exploitation, and malicious node injections. Hence, the aforementioned security risks associated with the implementation of smart devices are limiting the expansion of the market.

Future Opportunities :

Rising application of smart personal safety and security devices in manufacturing sector is expected to promote potential opportunities for market expansion

The rising application of smart safety and security device in manufacturing sector is expected to present potential trends and smart personal safety and security device market opportunities. Smart safety and security devices are used in manufacturing sector to keep industrial workers safe from several physical threats in work environment. As per the analysis, the deployment of smart safety and security devices in manufacturing sector offers various benefits including provision of SOS signal from any worker stuck in a dangerous situation, continuous monitoring of worker's body vitals, improved safety, reduced cases of accidents, and increased quick response time among others.

Factors including the rising pace of industrialization, increasing investments in expansion of industrial manufacturing facilities, and rising trend of automation fueled by Industry 4.0 are crucial determinants for driving the trends of the manufacturing sector.

For instance, according to the Federal Ministry for Economic Affairs and Climate Action of Germany, annual investments by the German manufacturing industry in Industry 4.0 applications reached up to USD 49 billion by 2020. Hence, the growth of manufacturing sector is driving the application of smart safety and security device to keep industrial workers safe from several physical threats in work environment, in turn promoting opportunities and smart personal safety and security device market trends during the forecast period.

Smart Personal Safety and Security Device Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 12,904.13 Million |

| CAGR (2025-2032) | 11.1% |

| By Type | Wearable Devices, Smart Helmets, Smart Knee Guard, Personal Alarm, Panic Button, Fall Detection Device, and Others |

| By Technology | Bluetooth, GPS, and Others |

| By Application | Healthcare, Military & Defense, Manufacturing, Construction, Law Enforcement, and Others |

| By Region | Asia-Pacific, Europe, North America, Latin America, Middle East & Africa |

| Key Players | ADT Inc., Safelet B.V., UnaliWear Inc., Honeywell International Inc., Intelligent Cranium Helmets LLC, Sena Technologies Inc., Jarvish Inc., Revolar, Climax Technology Co. Ltd., Forcite Helmet Systems Pty Ltd. |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Smart Personal Safety and Security Device Market Segmental Analysis :

Based on the Type :

Based on the type, the market is bifurcated into wearable devices, smart helmets, smart knee guard, personal alarm, panic button, fall detection device, and others. The smart helmets segment accounted for a significant revenue share in the year 2024. Smart helmets are integrated with built-in technologies such as sensors, tracking tools, and augmented reality. As per the analysis, smart helmets are capable of warning individuals of dangerous conditions and send alerts in need of assistance. Moreover, smart helmets offer a range of features including integrated communication systems, enhanced visibility, ignition control system, emergency switch in case of critical situations, improved safety, and others. The above benefits of smart helmets are key determinants for increasing its deployment in defense, law enforcement, construction, and manufacturing applications among others.

For instance, Sena Technologies Inc. is a manufacturer of smart safety and security devices that offers a range of smart helmets for improved road safety in its product portfolio. The company's smart helmets are integrated with premium speakers and microphones to provide improved user experience. Thus, rising innovation associated with smart helmets for enhancing personal safety is among the prime factors driving the smart personal safety and security device market growth.

The personal alarm segment is anticipated to register fastest CAGR during the forecast period. A personal alarm refers to a compact device that enables users to monitor and communicate with an individual who may require attention in times of need. As per the analysis, personal alarms are optimized to send an emergency alert to a 24-hour monitoring service or pre-set mobile phone numbers in case it is triggered.

For instance, in June 2023, Pick Protection launched its new personal safety alarm that utilizes the phone's GPS to pinpoint exact individual location to disperse emergency services for further aid. The personal alarm is integrated with Bluetooth trigger and 12-month battery life. Therefore, rising advancements associated with personal alarms are anticipated to boost the demand of the market during the forecast period.

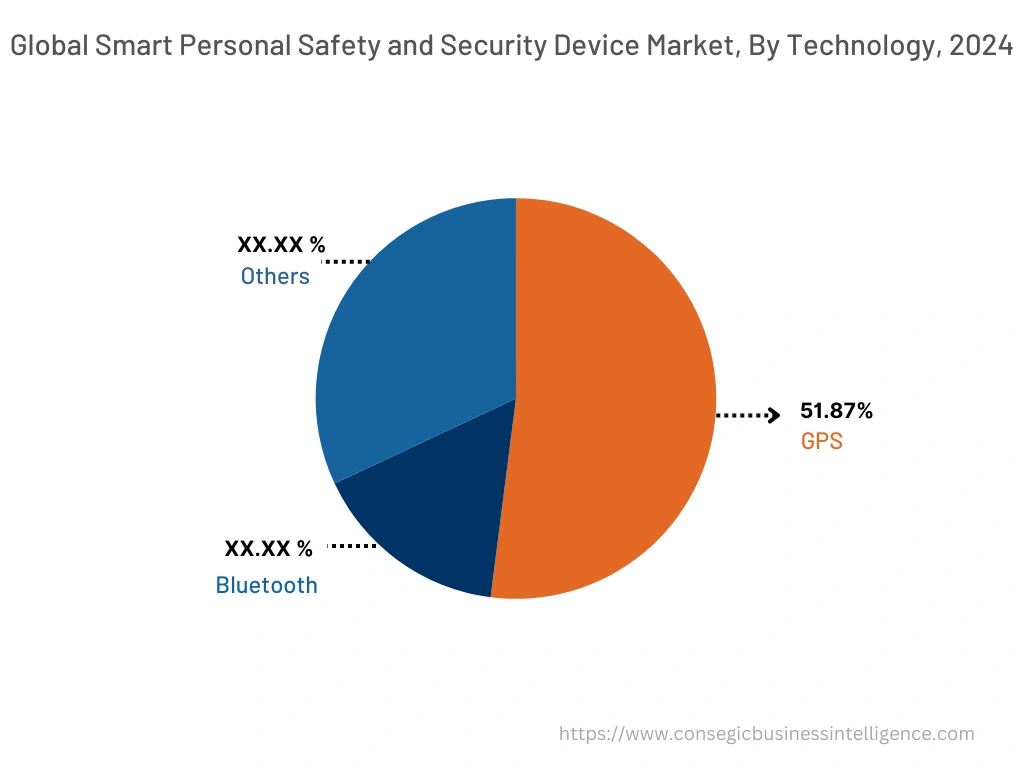

Based on the Technology :

Based on the technology, the market is bifurcated into Bluetooth, GPS, and others. The Bluetooth segment accounted for the largest revenue share of 51.87% in the year 2024. Bluetooth employs a short range wireless communication technology for exchanging data by utilizing short-wavelength UHF radio waves. Smart safety and security devices integrated with Bluetooth connectivity works by using radio waves for connecting smart security devices with smartphone or computer. Moreover, the integration of Bluetooth connectivity in smart safety and security devices offers several benefits including wireless communication, minimal interference, automatic connection within a specified range, and lower costs among others.

For instance, Forcite Helmet Systems Pty Ltd. offers MK1S model of smart helmet integrated with Bluetooth connectivity in its product portfolio. The smart helmet features a seamless Bluetooth connectivity to ensure improved user safety and minimal fuss. Therefore, the rising integration of Bluetooth connectivity in smart safety and security devices is a prime factor proliferating the expansion of the segment.

The GPS segment is anticipated to register fastest CAGR during the forecast period. GPS technology is often integrated in personal safety and security devices to enable individual's location tracking for enhanced safety and monitoring along with retrieval of precise locations for sending aid in case of emergency situations.

For instance, Caresafe Alarm offers SOS personal alarms integrated with GPS trackers for providing individual location in real-time. Thus, the increasing integration of GPS technology in smart safety and security devices for precise location monitoring and tracking is a key factor projected to drive the demand of the segment during the forecast period.

Based on the Application :

Based on the application, the market is segregated into healthcare, military & defense, manufacturing, construction, law enforcement, and others. The law enforcement segment accounted for the largest revenue share in the year 2024. Factors including increasing investments in law enforcement sector, rising prevalence of active law enforcement personnel, growing number of critical missions, and rising crime rates are driving the demand of the law enforcement segment.

For instance, Intelligent Cranium Helmets LLC is among the manufacturers of smart personal safety and security devices that offers IC-LE edition of smart helmets for application in law enforcement sector. Therefore, the rising development of smart safety and security devices particularly designed for law enforcement applications is driving the growth of the market.

Manufacturing segment is expected to witness fastest CAGR during the forecast period. The expansion of manufacturing segment is primarily driven by multiple factors including rising pace of industrialization, increasing investments in expansion of industrial manufacturing facilities, and prevalence of safety standards for industrial workers among others.

For instance, the government of Germany launched the "Industry 4.0" initiative with the aim of promoting the development of digital technologies in manufacturing sector. The initiative also aims at supporting automation in manufacturing along with enhancing Germany's competitiveness in the manufacturing sector. Smart safety and security devices are used in manufacturing sector to keep industrial workers safe from several physical threats in work environment. Thus, the rising initiatives to facilitate the integration of digital technologies in manufacturing sector is a key factor anticipated to drive the market expansion during the forecast period.

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

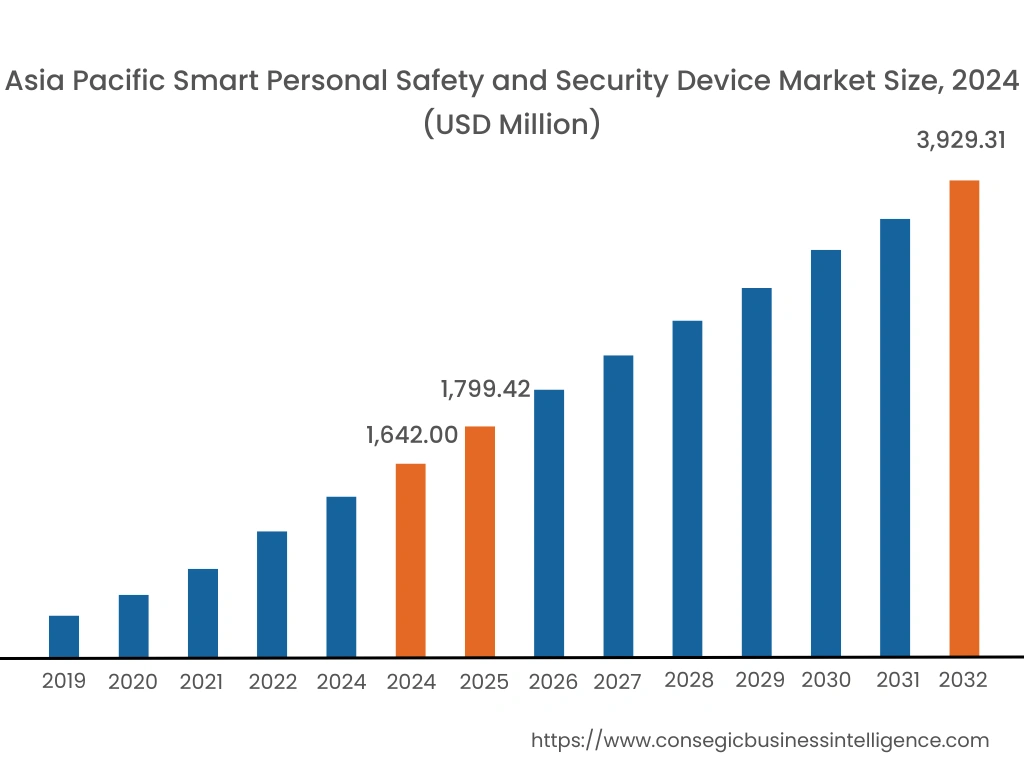

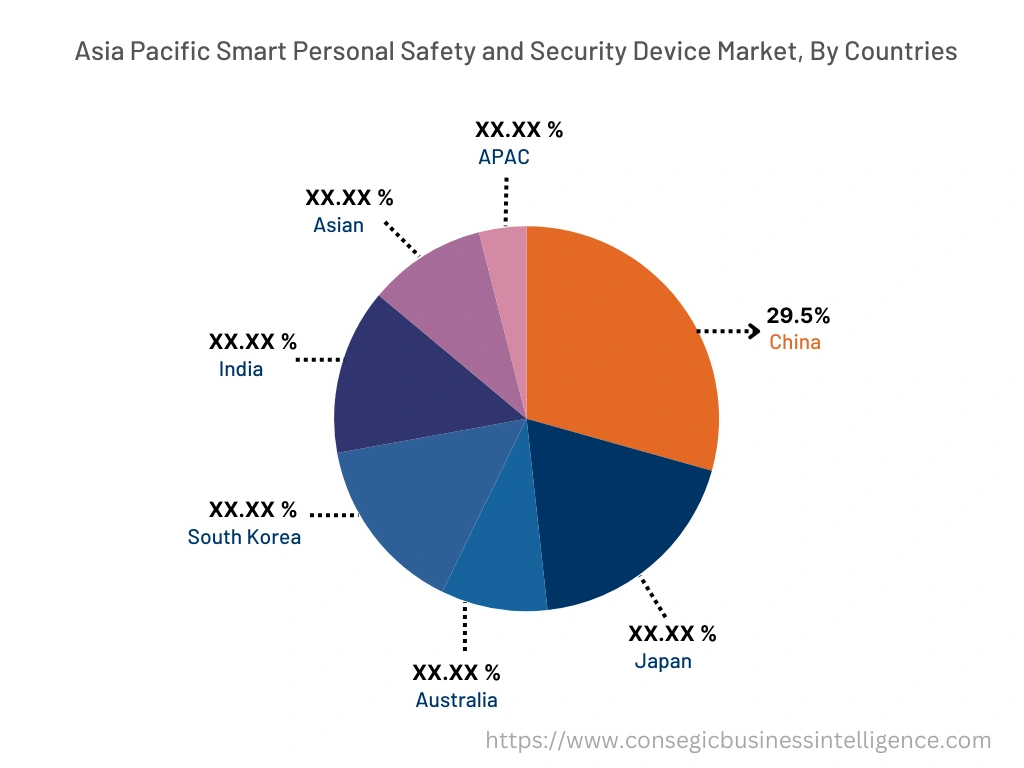

Asia Pacific accounted for the smart personal safety and security device market share of USD 1,642.00 Million in 2024 and is expected to reach USD 3,929.31 Million by 2032, registering the highest CAGR of 11.6% during the forecast period. In addition, in the region, the China accounted for the maximum revenue share of 29.5% in the same year.

Based on the smart personal safety and security device market analysis, the growing pace of industrialization and development is providing lucrative expansion prospects for the market in the region. In addition, factors including rising expansion of industrial manufacturing facilities, increasing construction activities, and others are driving smart personal safety and security device market demand in the Asia-Pacific region.

For instance, according to the Japan Statistical Yearbook 2022, the total value of construction order in Japan was valued at approximately USD 144.12 billion in 2020, depicting an increase from USD 118.04 billion in 2015. Additionally, the total value of construction order of private & government offices, hotels, and warehouse & distribution facilities witnessed a growth of 11.6%, 24.2%, and 61.4% respectively in 2020 in comparison to 2015. Smart safety and security devices such as smart helmets, panic buttons, and others are often used as a vital safety tool for empowering construction workers and enhancing their security in potentially hazardous environments. Thus, the rising construction activities is expected to boost market growth in the region during the forecast period.

North America is expected to register CAGR of 11.2% during the forecast period. The market growth for smart safety and security device in the North American region is primarily driven by its deployment in military & defense, law enforcement, manufacturing, and other sectors. Additionally, the rising crime incidences including theft, burglaries, and others along with growing need for safety and security solutions are among the significant factors driving the market growth in the region.

For instance, according to the 2021 Bank Crime Statistics Report, around 1,724 cases of robberies and 234 cases of burglaries in financial institutions such as commercial banks, mutual saving banks, credit unions, and others were recorded in the U.S. in 2021. The above factors are driving the adoption of smart safety and security devices for providing enhanced individual safety and security, particularly in cases of emergency, in turn driving the market growth in North America. Furthermore, factors including the increasing investment in law enforcement and defense sectors is anticipated to foster opportunities for market growth in North America during the forecast period.

Top Key Players & Market Share Insights :

The global smart personal safety and security device market is highly competitive with major players providing the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and application launches to hold a strong position in smart personal safety and security device market. Key players in the smart personal safety and security device industry include-

- ADT Inc.

- Safelet B.V.

- Honeywell International Inc.

- Intelligent Cranium Helmets LLC

- Sena Technologies Inc.

- UnaliWear Inc.

- Jarvish Inc.

- Revolar

- Climax Technology Co. Ltd.

- Forcite Helmet Systems Pty Ltd.

Recent Industry Developments :

- In March 2023, ADT Inc. introduced its new ADT self-setup smart home security system, which is an integrated offering from Google and ADT. ADT smart home security system is integrated with Google Nest smart home products with ADT SMART monitoring and ADT security capabilities.

Key Questions Answered in the Report

What is smart personal safety and security device? +

Smart personal safety and security devices refer to electronic devices that are designed for enhancing personal safety while providing improved security to individuals.

What specific segmentation details are covered in the smart personal safety and security device report, and how is the dominating segment impacting the market growth? +

For instance, by type segment has witnessed smart helmets as the dominating segment in the year 2024, owing to the increasing adoption of smart helmets in defense, law enforcement, construction, and manufacturing applications among others.

What specific segmentation details are covered in the smart personal safety and security device market report, and how is the fastest segment anticipated to impact the market growth? +

For instance, by application segment has witnessed manufacturing as the fastest-growing segment during the forecast period due to rising adoption of smart personal safety and security devices in industrial manufacturing facilities to enhance worker’s safety and security.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2025-2032? +

Asia-Pacific is anticipated to register fastest CAGR growth during the forecast period due to rapid pace of industrialization, expansion of industrial manufacturing facilities, increasing construction activities, and other related factors.