Telecom Managed Services Market Size:

Telecom Managed Services Market size is estimated to reach over USD 73,450.53 Million by 2032 from a value of USD 31,082.16 Million in 2024 and is projected to grow by USD 34,153.08 Million in 2025, growing at a CAGR of 12.6% from 2025 to 2032.

Telecom Managed Services Market Scope & Overview:

Telecom managed services (TMS) refer to the process of delivering, controlling, and planning communications infrastructure and services. Telecom services consists of capacity management, network monitoring, service provisioning, network planning, and customer service management. Further, it provides various services including managed data center services, managed security services, managed network services, and others. Moreover, telecom managed service is a practice in which maintenance, monitoring, and control of various network functions and processes are performed. Additionally, TMS provides various benefits such as low cost, improved technical support, proactive monitoring, scalability, flexibility, reduced downtime, and others.

How is AI Transforming the Telecom Managed Services Market?

AI is significantly being used in the telecom managed services market, specifically for network optimization and predictive maintenance, customer service automation through chatbots, fraud detection and security, and personalizing customer experiences. Moreover, by automating tasks, predicting failures, and analyzing customer data, AI-powered solutions increase operational efficiency, reduce operational costs, improve service quality, and enhance customer satisfaction, which are key benefits for managed services providers. Additionally, AI algorithms can analyze network data to predict potential failures, which enables proactive maintenance and minimizes downtime. It can also optimize network performance to ensure greater speed and efficiency. Therefore, the aforementioned factors are expected to drive the market growth in upcoming years.

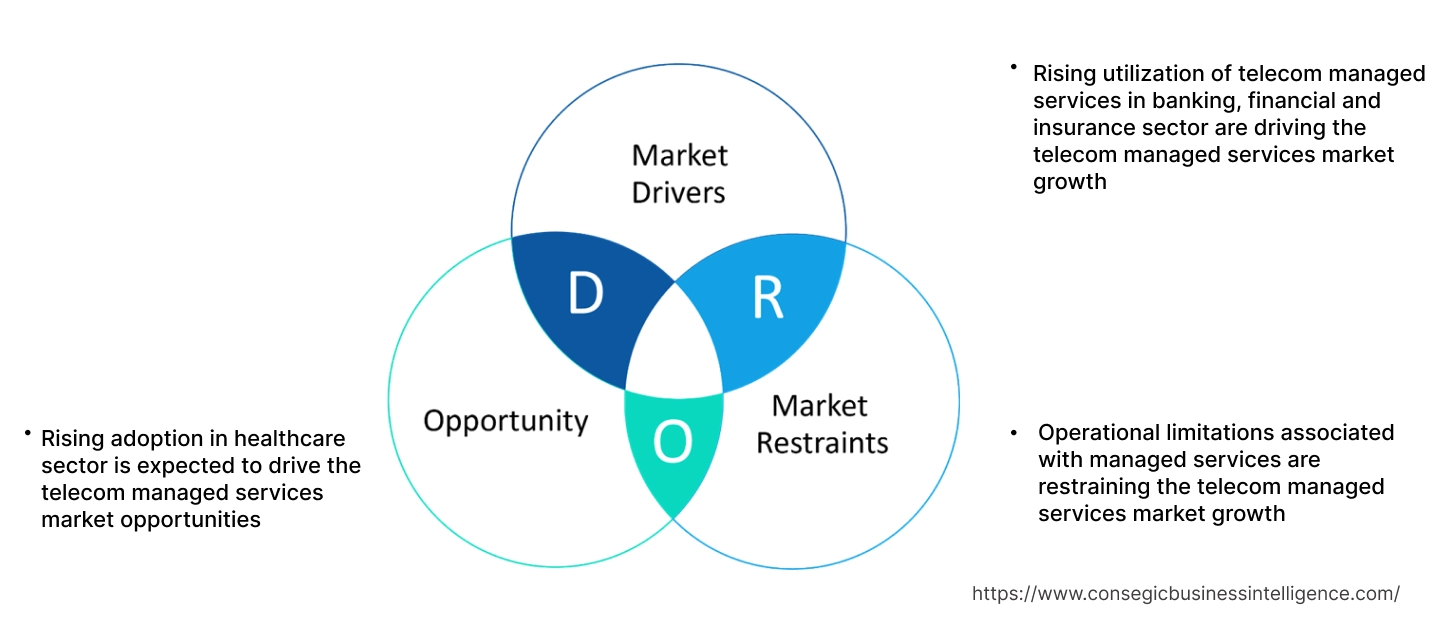

Telecom Managed Services Market Dynamics - (DRO) :

Key Drivers:

Rising utilization of telecom managed services in banking, financial and insurance sector are driving the telecom managed services market growth

In banking sector, managed services are widely getting adopted for digitalization and modernizing banking services. Financial institutions are adopting managed services for security, cloud management, network services, data storage, monitoring, management, and others. Further, managed service providers work closely with financial institutions for designing network infrastructure which align closely with their business objectives. Additionally, TMS offers IT management services and facilitates the adoption of open APIs for increasing efficiency in IT department.

- For instance, in July 2022, Citi Commercial Bank launched its new Citi Commercial Bank (CCB) branch in Canada as a part of expansion plan. This is further increasing the demand of telecom managed services for managing IT and telecom operations in the banking firm.

Thus, the rising adoption of managed services in banking sector for enabling advanced IT operations are driving the telecom managed services market size.

Key Restraints:

Operational limitations associated with managed services are restraining the telecom managed services market growth

Operational challenges are primarily associated with resource limitations in cloud migration, support delays, insufficient IT expertise, cybersecurity challenges, inconsistent maintenance, and others.

Further, small managed service provider lacks specialized expertise, resources, and infrastructure for handling complex issues and providing in depth services to large enterprises. Moreover, lack of on-site engineers delays in troubleshooting network issues, hardware defects, and repairs, which results in increased downtime. Additionally, as managed service providers operate remotely, it makes it difficult for the subscribers to verify and ensure on the agreed service levels, which in turn hindering the market growth.

Therefore, the operational limitations associated with inadequate support, scalability, and increased downtime are restraining the telecom managed services market size.

Future Opportunities :

Rising adoption in healthcare sector is expected to drive the telecom managed services market opportunities

In healthcare sector, managed services include healthcare & patient data backup and recovery, EMR (Electronic Medical Records) consulting & support, healthcare IT security, and network monitoring. Further, it allows monitoring patient care quality, real-time collaboration on multiple, secure devices, improved patient experience in online bookings and appointments, a custom on-premise IT infrastructure, and others. Additionally, it provides security-proof approach which guarantees full data recovery in the event of a breach by storing data on the backup servers.

- For instance, in September 2024, ZTE partnered with China Telecom's Suzhou branch for deployment of an innovative 5G IoT integrated network solution at hospital of Soochow University.

Thus, as per the telecom managed services market analysis, rising utilization of managed services in modern healthcare facilities are driving the global telecom managed services market opportunities.

Telecom Managed Services Market Segmental Analysis :

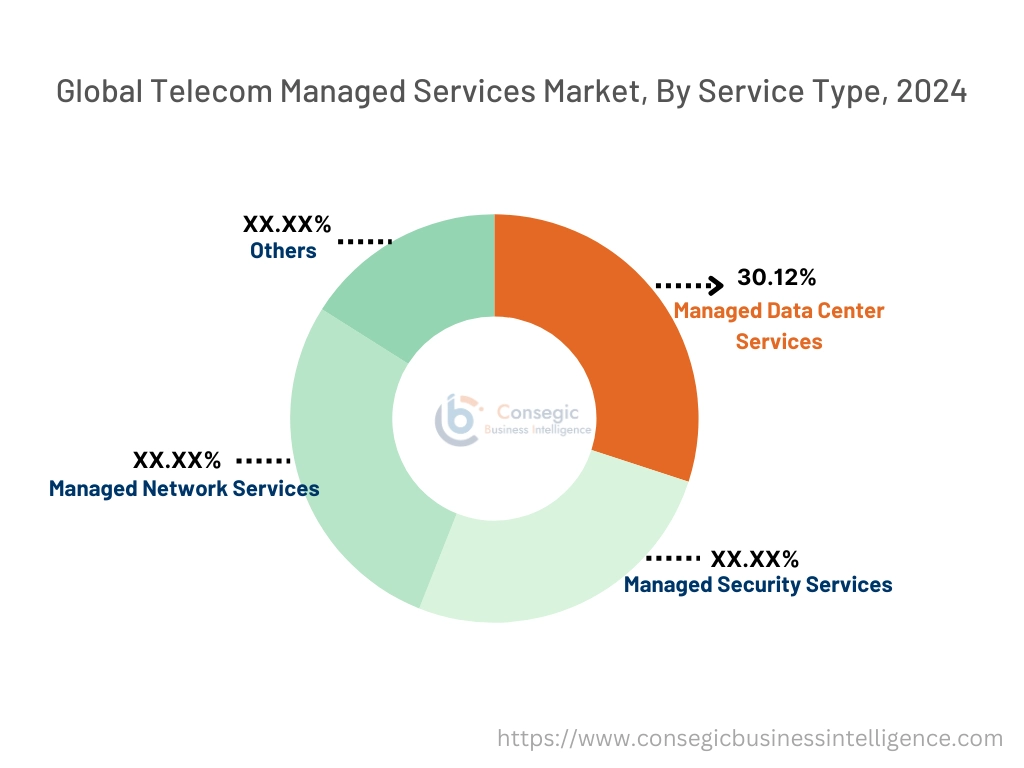

By Service Type:

Based on the service type, the market is segmented into managed data center services, managed security services, managed network services, and others.

Trends in the Service Type:

- There is an increasing trend towards adoption of managed data center services for data storage, data analysis, data security, and others.

- Increasing utilization of security services by large enterprises for managing cloud security, vulnerability, infrastructure security, and others.

Managed data center services segment accounted for the largest revenue share of 30.12% in the total telecom managed services market share in 2024.

- Managed data centre services refer to monitoring, deployment, and management by an external service provider.

- Further, service provider provides maintenance of all hardware and network services, patching, upgradation of OS, installation and other system-level software.

- Additionally, data center offers various benefits such as centralized data management, flexibility to scale, high level security, disaster recovery, and low operational cost.

- For instance, in September 2023, HCLTech launched Shared DCaaS (Shared Data Center as a Service), an advanced service to accelerated hybrid cloud transformation.

- Thus, the rising advancements associated with managed data center services are driving the telecom managed services market trend.

Managed network services are anticipated to register a significant CAGR during the forecast period.

- Managed network services comprise of the IT services by an external service provider for managing the technical support, infrastructure, and software of an organization’s network.

- Moreover, it includes several aspects ranging from managing and providing hardware such as switches, routers, and servers, to installing and managing software such as operating systems, firewalls, and applications while providing for network infrastructure.

- Additionally, managed network services provide security for network infrastructure and end-to-end visibility into network performance for ensuring optimal network availability and operation.

- For instance, in September 2022, Hughes Communications India Private Limited (HCI), a managed network service provider, launched High-Throughput Satellite (HTS) broadband service for delivering high speed broadband across India.

- Thus, the rising advancements associated with managed network services are driving the telecom managed services market demand.

By Enterprise:

Based on enterprise, the market is segmented into small and medium enterprises (SMES) and large enterprises.

Trends in the Enterprise:

- There is an increasing trend towards adoption of cloud services in large enterprises for computing and storing data-oriented tasks.

- Increasing utilization of network services by small and medium enterprises for streamlining IT operations, cost savings, network monitoring, and more.

Large enterprises accounted for the largest revenue in the total telecom managed services market share in 2024.

- Large enterprises such as multinational technology company heavily relies on experts for maintaining network security and efficient management of IT systems.

- Moreover, large enterprises utilize various managed services such as data, network, and security for monitoring and storing enterprise data on database.

- Additionally, in large enterprises, a unified service desk is implemented for all departments to manage and use different IT systems.

- For instance, Airtel provides telecom managed services in its product offerings for utilization in large enterprises among others. It offers various benefits such as flexibility in customizing solutions, end to end managed services, and others.

- Thus, the rising utilization of network management services in large enterprises are driving the telecom managed services market trends.

Small and medium enterprises (SMEs) are anticipated to register a significant CAGR during the forecast period.

- Small and medium businesses rely on information technology for service delivery, client communication, accounts management, and others.

- Further, small and medium enterprises use services such as cloud computing for remote accessibility and online solutions, cloud storage, and others for saving money, reducing downtime, compliance related issues, and others.

- For instance, in January 2024, T-Mobile collaborated with Cisco Meraki devices and launched connected workplace with 5G business internet and cloud managed networking platform.

- Thus, the rising collaboration of managed service provider and small and medium enterprises are driving the telecom managed services market expansion.

By End-User:

Based on end-user, the market is segmented into BFSI, healthcare, retail, government, and others.

Trends in the End-User:

- There is an increasing adoption of cloud services by government for storing and computing private and public data.

- Increasing utilization of network services by retail enterprises for digitizing IT operations, monitoring day to day tasks, and others.

BFSI accounted for the largest revenue in the total market share in 2024.

- In BFSI (banking, financial services, and insurance) sector, managed services are used for providing IT services, security, cloud management, network services, data storage, monitoring & management, and others.

- Further, telecom managed service providers enable collaboration within teams, tailored IT service architecture, cloud capabilities for enhancing data security, scalability, flexibility, and more.

- For instance, in July 2021, Tata Communications launched IZO Financial Cloud platform in India to enhance security and performance of banking and financial services.

- Thus, as per the analysis, the rising advancements in managed services for banking and financial sectors are driving the telecom managed services market trends.

Healthcare anticipated to register a significant CAGR during the forecast period.

- In healthcare facilities, IT operations and functions are outsourced to a telecom managed service provider for handling critical IT functions.

- Moreover, it is used for storing patient information on cloud storages for mitigating data losses for enhanced accessibility and minimizing downtime. Additionally, electronic medical records (EMR) are becoming critical in modern medical facilities.

- For instance, in April 2023, Nordic Consulting, a global health and technology, launched managed services offerings and collaborated with Bon Secours Mercy Health and Roper St. Francis Healthcare for building an end-to-end managed services organization.

- Thus, the rising utilization of managed services by healthcare facilities are driving the telecom managed services market expansion.

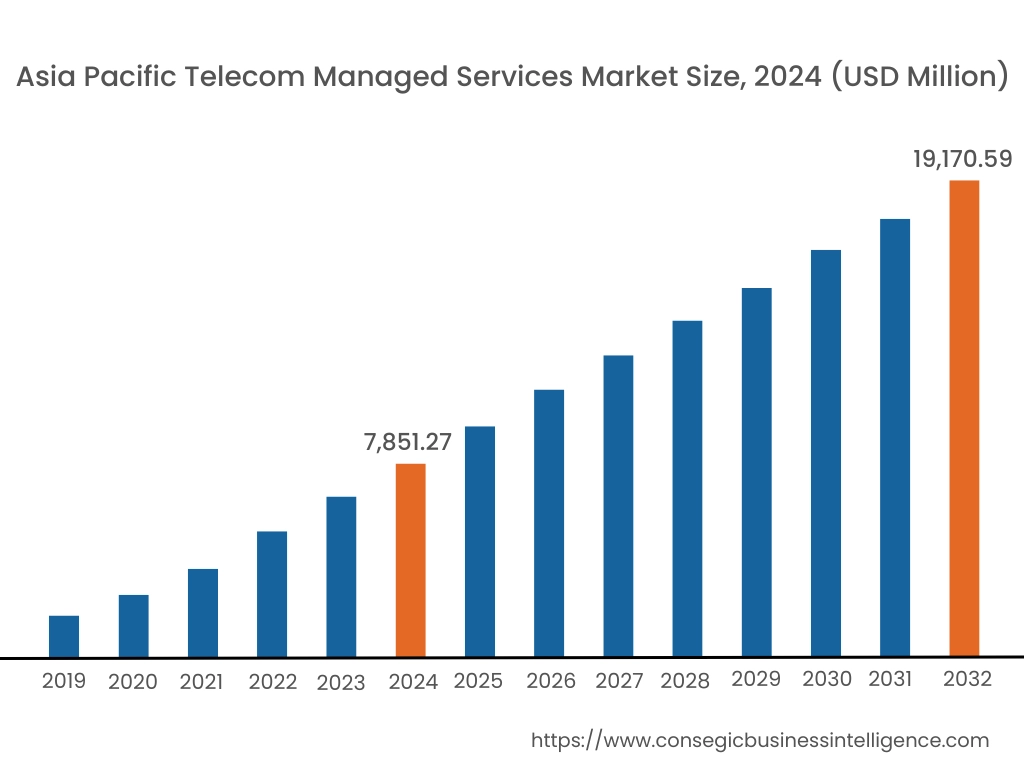

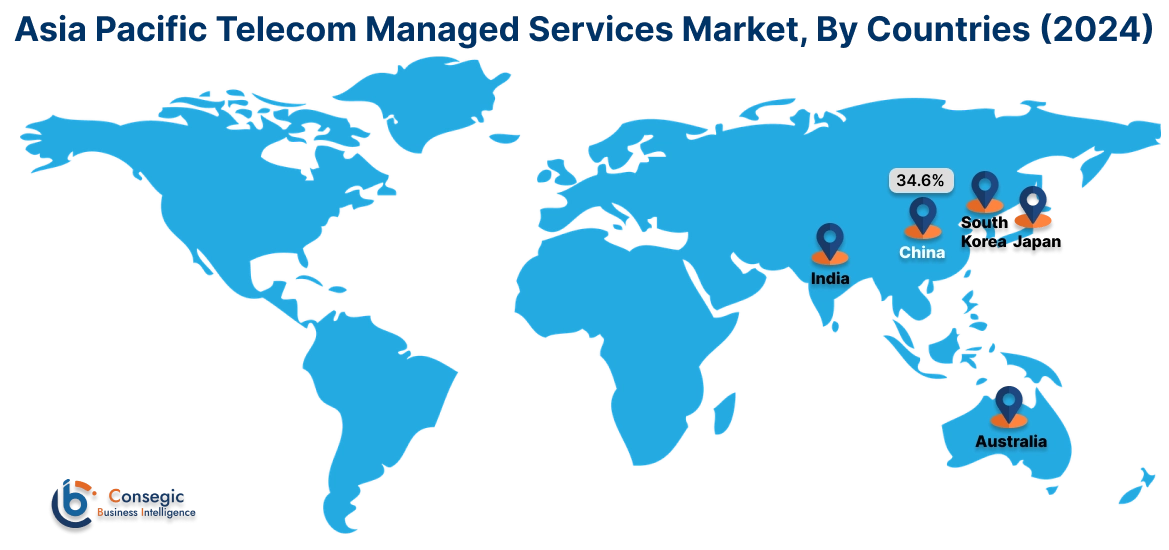

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 7,851.27 Million in 2024. Moreover, it is projected to grow by USD 8,650.89 Million in 2025 and reach over USD 19,170.59 Million by 2032. Out of this, China accounted for the maximum revenue share of 34.6%. As per the telecom managed services market analysis, there is an increasing adoption of telecom services, particularly in countries such as China, India, and Japan, for providing advanced and efficient data services. The rapid development and growing investments in telecom sector are accelerating the telecom managed services market.

- For instance, in February 2023, Huawei, a China-based telecom managed service provider, launched digital managed network solution for carriers to transform from ISPs to MSPs and provide carriers B2B services. This is further increasing the adoption of managed services, which in turn is driving the market in the Asia-Pacific region.

North America is estimated to reach over USD 25,964.76 Million by 2032 from a value of USD 11,008.44 Million in 2024 and is projected to grow by USD 12,094.16 Million in 2025. In North America, the growth of telecom managed services industry is driven by the rising adoption of telecom managed services such managed data center services, managed security services, managed network services, and others. Rising adoption of advanced data management services for monitoring, storing, and maintaining are also driving the market growth. Further, increasing investments in healthcare and BFSI industry for digitalization are massively contributing to the growth of telecom managed services market demand.

The regional analysis depicts that the rising investments in healthcare industry for modernizing and digitization are driving the market demand in Europe. Further, as per the market analysis, the primary factor driving the market growth in the Middle East and African region includes increasing investment in retail and healthcare sector. The rising demand for advanced network management solutions and increasing utilization of managed data services are driving the market demand in the Latin America region.

Top Key Players and Market Share Insights:

The telecom managed services market is highly competitive with major players providing services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global telecom managed services market. Key players in the telecom managed services industry include –

- IBM (US)

- Huawei Technologies Co., Ltd. (China)

- GTT Communications, Inc. (US)

- Cisco Systems, Inc. (US)

- NTT Data (Japan)

- AT&T (US)

- CenturyLink (US)

- Amdocs (US)

- Comarch S.A. (Poland)

- Ericsson AB (Sweden)

Recent Industry Developments :

Partnerships & Collaborations:

- In August 2023, HCLTech collaborated with Verizon Business for deployment of managed network services. The partnership aims at delivering large-scale wireline service delivery for enterprise customers.

- In August 2024, Hewlett Packard Enterprise partnered with Khazna Data Centers and launched its managed data center hosting service for artificial intelligence (AI) in the United Arab Emirates.

Telecom Managed Services Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 73,450.53 Million |

| CAGR (2025-2032) | 12.6% |

| By Service Type |

|

| By Enterprise |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the telecom managed services market? +

The telecom managed services market was valued at USD 31,082.16 Million in 2024 and is projected to grow to USD 73,450.53 Million by 2032.

Which is the fastest-growing region in the telecom managed services market? +

Asia-Pacific is the region experiencing the most rapid growth in the telecom managed services market.

What specific segmentation details are covered in the telecom managed services report? +

The telecom managed services report includes specific segmentation details for service type, enterprise, end-user, and region.

Who are the major players in the telecom managed services market? +

The key participants in the telecom managed services market are IBM (US), Huawei Technologies Co., Ltd. (China), AT&T (US), CenturyLink (US), Amdocs (US), Comarch S.A. (Poland), Ericsson AB (Sweden), GTT Communications, Inc. (US), Cisco Systems, Inc. (US), and NTT Data (Japan).