Temporary Bonding Adhesive Market Size:

Temporary Bonding Adhesive Market size is growing with a CAGR of 8.5% during the forecast period (2025-2032), and the market is projected to be valued at USD 477.74 Million by 2032 from USD 248.76 Million in 2024. Additionally, the market value for the 2025 attributes to USD 269.14 Million.

Temporary Bonding Adhesive Market Scope & Overview:

Temporary bonding adhesive is a specialized material. It is designed to provide a secure and robust bond between two substrates. It is a crucial step during the manufacturing process. This is completely debonded at a later and controlled stage. It does not damage substrates and does not leave residue. These adhesives are made from various polymeric materials. This includes thermoplastic polymers, UV-curable resins, and polyimides among others. They are designed to provide sufficient bond strength in harsh conditions. This includes high temperatures, chemical exposure, and mechanical stress.

How is AI Impacting the Temporary Bonding Adhesive Market?

AI is transforming the temporary bonding adhesive market by optimizing formulation development, production efficiency, and application performance. Through predictive modeling and machine learning, manufacturers can simulate adhesive behaviors under various conditions, reducing trial-and-error testing and accelerating product innovation. AI-driven quality control systems ensure consistency and minimize material defects in semiconductor and microelectronic applications. Furthermore, AI enhances supply chain management by forecasting demand and improving inventory planning. In R&D, AI algorithms analyze chemical compositions to design adhesives with superior thermal stability, reworkability, and adhesion strength. Overall, AI integration is streamlining manufacturing processes, improving material precision, and driving technological advancements in the temporary bonding adhesive market.

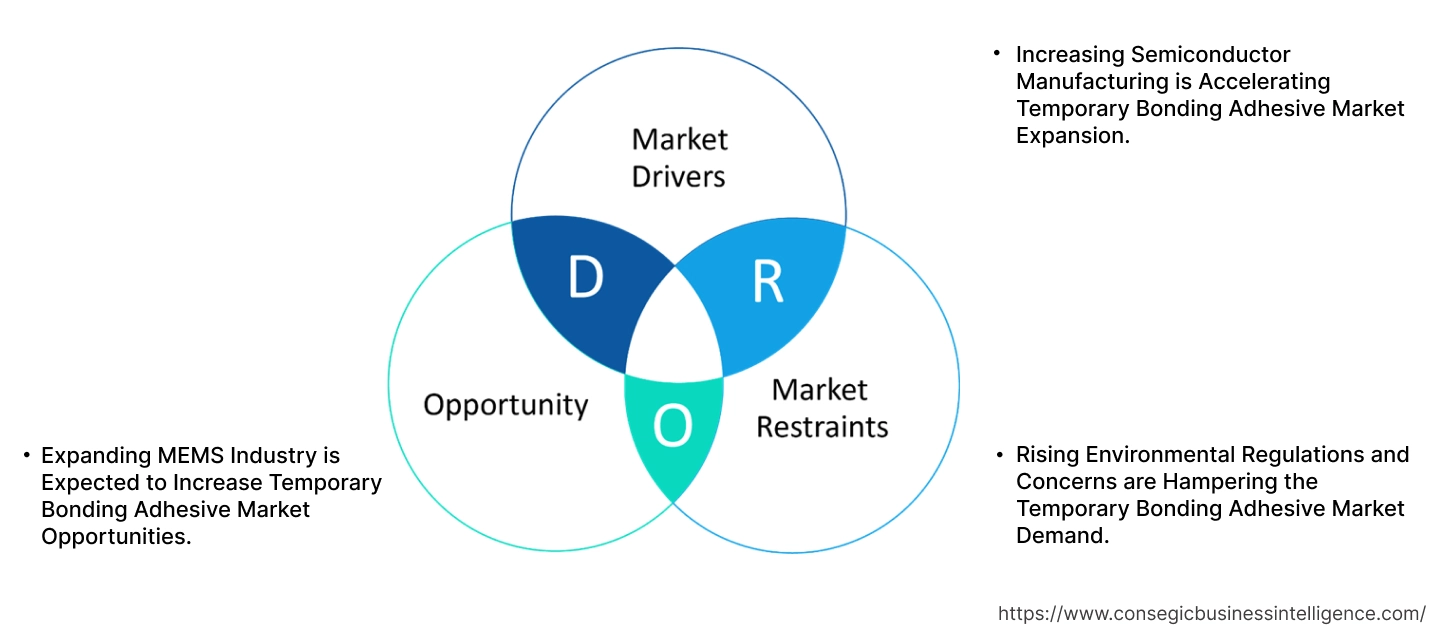

Temporary Bonding Adhesive Market Dynamics - (DRO) :

Key Drivers:

Increasing Semiconductor Manufacturing is Accelerating Temporary Bonding Adhesive Market Expansion.

Semiconductors are materials with electrical conductivity between that of a conductor and an insulator. They enable controlled flow of electric current. Adhesives used for temporary bonding in the semiconductor sector is beneficial in attaching a semiconductor wafer to a carrier substrate. It is crucial in processes such as wafer thinning, dicing, and surface protection among others. These adhesives also provide easier handling and processing. This is helpful in preventing damage to the delicate device layers. Moreover, they are excellent materials for advanced packaging techniques. This includes 3D IC integration, wafer-level packaging, and fan-out wafer-level packaging among others. Its controlled debonding also ensures a high yield of the finished semiconductor components. Increasing demand across various sectors such as AI and autonomous vehicles are driving semiconductor manufacturing, hence requiring these adhesives for multiple applications.

For instance,

- According to the United States International Trade Commission, Taiwan's semiconductor industry output between 2018 and 2022 grew at a CAGR of 17.04%, thus positively impacting temporary bonding adhesive market trends.

Overall, increasing semiconductor manufacturing is significantly boosting the temporary bonding adhesive market expansion.

Key Restraints :

Rising Environmental Regulations and Concerns are Hampering the Temporary Bonding Adhesive Market Demand.

The market is facing significant restraint from evolving environmental regulations and increasing sustainability concerns. Governments worldwide are implementing strict limits on the use of hazardous chemicals. This especially includes volatile organic compounds (VOCs), as they are common substances found in these adhesives. This requires manufacturers to invest more in research and development to innovate their products with materials that do not harm the environment. Moreover, another hurdle is the waste disposal of used adhesives and carrier substrates. The focus on circular economy requires adhesives that are biodegradable and recyclable. This further increases the operational costs for the manufacturers. Hence, the rising environmental regulations and concerns are hampering the temporary bonding adhesive market demand.

Future Opportunities :

Expanding MEMS Industry is Expected to Increase Temporary Bonding Adhesive Market Opportunities.

MEMS which stand for micro-electro-mechanical systems are miniature devices. They combine mechanical and electrical components at the micro-scale. The temporary bonding adhesive helps in attaching fragile MEMS wafers to carrier substrates. They serve crucial components in processes such as thinning, grinding, and dicing. They provide support during fabrication, and it is beneficial in transferring selective components. Moreover, it provides necessary mechanical stability to MEMS devices, which helps in preventing damage to highly sensitive microstructures. Additionally, in MEMS wafers, it provides precise alignment and fabrication. This ensures clean debonding without residue. This enhances MEMS devices’ overall performance. Increasing focus on device miniaturization is leading to an increase in demand for MEMS, hence requiring these adhesives.

For instance,

- According to Electronics Era, the global MEMS industry from 2023 to 2029 is expected to grow at a CAGR of 5%. This creates potential for the market.

Overall, the expanding MEMS sector is expected to increase the temporary bonding adhesive market opportunities.

Temporary Bonding Adhesive Market Segmental Analysis :

By Type:

Based on type, the market is categorized into thermal release adhesives, UV-curable adhesives, solvent-based adhesives, water-based adhesives, and others.

Trends in Type:

- There is a growing trend of using thermal release adhesives in high-volume semiconductor manufacturing. This is due to their reliability and efficient debonding.

- UV-curable adhesives usage due to their fast-curing times and precise control over bonding strength is also a rising trend.

The thermal release adhesives segment accounted for the largest market share in 2024.

- Thermal release adhesives are designed to provide strong adhesion at room temperatures. Later, they cleanly lose their adhesion once they are heated.

- They are advantageous in providing robust and stable bonding. Moreover, they are capable of handling multiple production steps such as thinning and chemical etching among others.

- When a defined debonding temperature is reached, the adhesive softens and melts its adhesion. This allows the bonded substrates to be easily separated.

- Their simplicity, reliability, and tunable debonding temperature make them highly efficient in applications such as MEMS manufacturing and other precision electronics assembly.

- Overall, as per the market analysis, thermal adhesives providing secure and heat-releasable properties in microelectronics are driving a segment in the temporary bonding adhesive market growth.

The UV-curable adhesives segment is expected to grow at the fastest CAGR over the forecast period.

- UV-curable adhesives rapidly cure and harden when they are exposed to ultraviolet (UV) light of different wavelengths.

- They provide advantages such as fast curing times and low-temperature processing. They also provide excellent control over bond formation.

- Owing to these properties they are increasingly used in the manufacturing of sensors and integrated circuits among others. Increasing production of these devices is driving the segment.

- For instance, in the Observatory of Economic Complexity, U.S. exports of Integrated Circuits saw a 25.7% year-on-year increase in 2025.

- According to the temporary bonding adhesive market analysis, the aforementioned factors will drive the segmental share for the upcoming years.

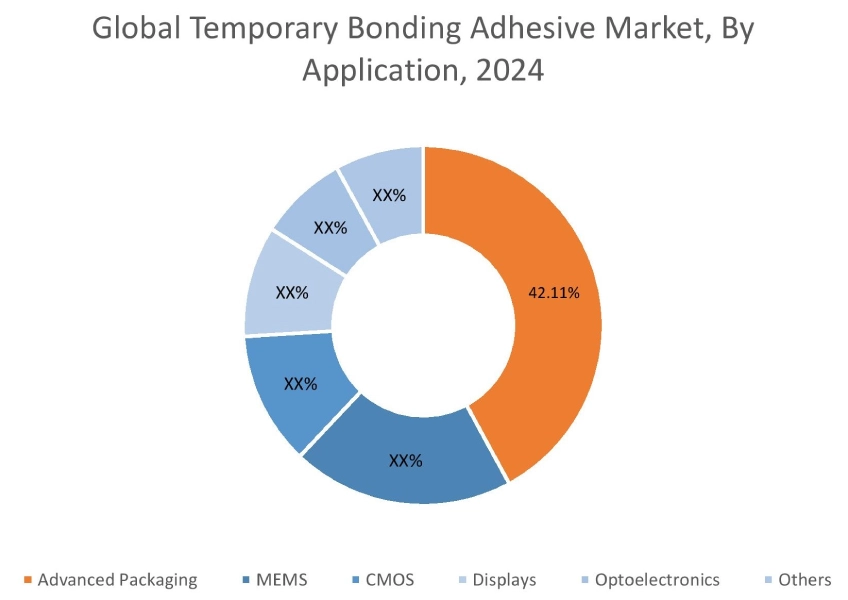

By Application:

Based on application, the market is categorized into advanced packaging, MEMS, CMOS, displays, optoelectronics, and others.

Trends in the Application

- As per temporary bonding adhesive market trends, manufacturing smaller, thinner, and more powerful electronic devices drives the demand for temporary bonding.

- The increasing adoption of MEMS in automotive and healthcare applications necessitates temporary bonding for their delicate fabrication.

The advanced packaging segment accounted for the largest market share of 42.11% in 2024.

- Advanced Packaging refers to semiconductor manufacturing techniques, which go beyond traditional methods of encasing a single chip.

- Key advanced packaging methods include 3D IC integration fan-out wafer-level packaging, and system-in-package.

- Adhesives used for temporary bonding enable secure bonding of components with ultra-thin and fragile wafers.

- These adhesives facilitate these delicate operations without damaging the device layers.

- Advanced packaging is increasing. It is due to the limitations of shrinking transistors, hence requiring these adhesives to provide a secure attachment.

- Overall, as per the market analysis, the aforementioned factors are driving the segment in the temporary bonding adhesive industry.

The displays segment is expected to grow at the fastest CAGR over the forecast period.

- Displays include liquid crystal displays, organic light-emitting diodes, and flexible displays.

- These displays need to be temporarily bonded to a rigid carrier during processing steps such as sputtering.

- The adhesive used for temporary bonding ensures the precise positioning and stability of these display layers throughout the manufacturing line. Manufacturers increasing their display production capacity is driving the segment.

- For instance, Samsung Display plans to increase its AMOLED panel production by 10% in 2025,focusing on high-value products such as tablets and foldable displays.

- Thus, according to market analysis, growing display productions will drive segment in the temporary bonding adhesive market growth.

By End Use:

Based on end-use, the market is categorized into electronics, automotive, aerospace & defense, medical devices, and others.

Trends in the End-Use

- Manufacturing advanced avionics systems relies on temporary adhesives for precise bonding and assembly.

- The production of diagnostic equipment and surgical implants requires temporary bonding for delicate component handling.

The electronics segment accounted for the largest market share in 2024.

- The electronics segment refers to the widespread application of temporary bonding adhesive throughout the entire electronics supply chain,

- This includes electronics such as smartphones, tablets, wearables, and computing devices among others.

- These adhesives hold components in place during soldering and encapsulation. They provide masking in sensitive areas during surface treatment.

- Moreover, they enable easy assembly of complex modules in electronic devices.

- Additionally, they support flexible circuits and thin PCBs during their fabrication and handling. All these benefits have contributed to its increased demand in the sector.

- Overall, as per the market analysis, the aforementioned factors are driving the segment in the market.

The medical device segment is expected to grow at the fastest CAGR over the forecast period.

- This segment includes a wide array of medical devices, such as catheters, syringes, surgical instruments, and diagnostic equipment among others.

- Adhesives used for temporary bonding hold components of these devices together during manufacturing and assembly.

- Rising chronic disease rates and the increasing adoption of new technologies have led to sector growth, thus a driving need for these adhesives.

- For instance, according to the MedTech Europe report, the medical device market of Europe has grown at a CAGR of 5.7% in the last ten years and is expected to grow more than that in the coming years.

- Thus, according to market analysis, expanding the medical device sector will drive segmental growth for the forecasted years.

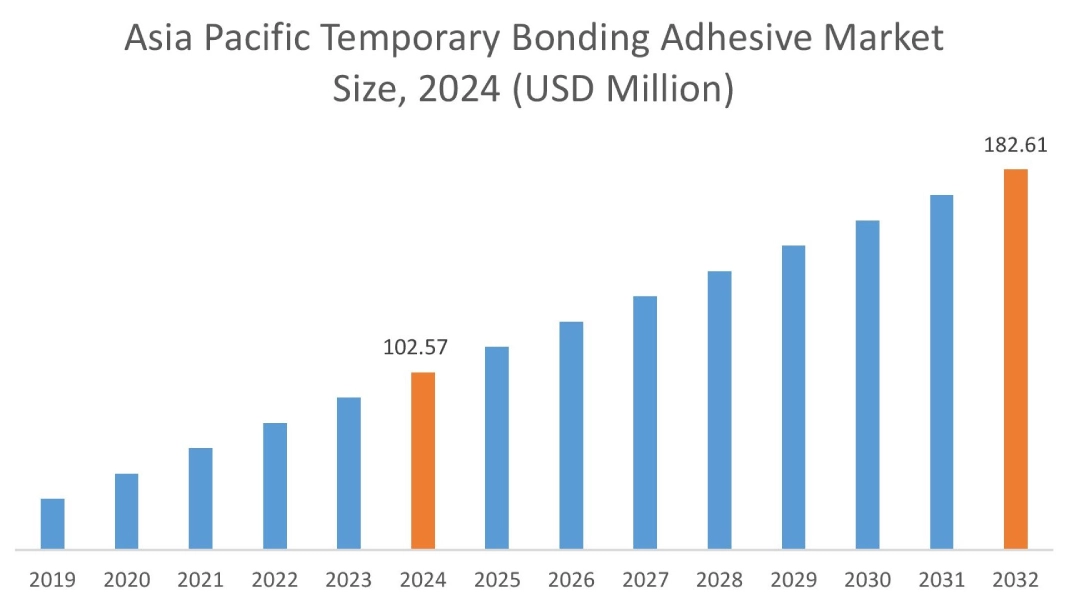

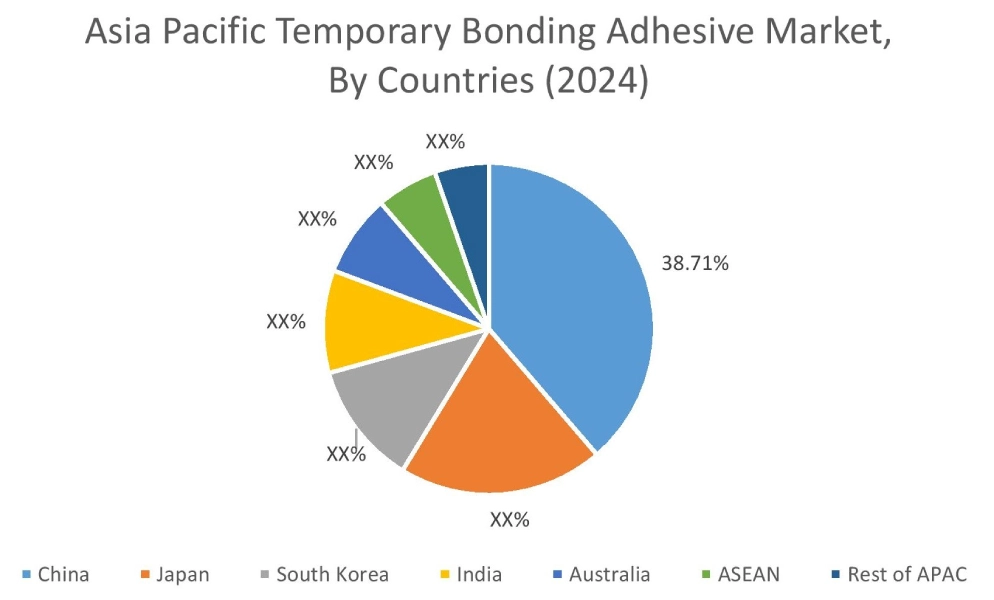

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2024, Asia Pacific accounted for the highest temporary bonding adhesive market share at 41.23% and was valued at USD 102.57 Million and is expected to reach USD 182.61 Million in 2032. In Asia Pacific, the China accounted for the temporary bonding adhesive market share of 38.71% during the base year of 2024. The region is a hub for semiconductor manufacturing. They host major foundries and advanced packaging facilities. Countries such as Taiwan, South Korea, Japan, and China lead the market.

For instance,

- According to the Semiconductor Association, China's expanded wafer capacity represented 26% of the global increase.

Temporary bonding adhesives provide crucial mechanical support in processes such as wafer thinning. It also provides higher yields and protects fragile wafers from further damage. As there will be an increased focus on 3D ICs and fan-out wafer-level packaging, it will require more of these adhesives. Overall, the growing semiconductor manufacturing is driving the market in the region.

In Europe, the temporary bonding adhesive market is experiencing the fastest growth with a CAGR of 10.3% over the forecast period. There is rising adoption of sustainable adhesives in the region. This is driven by the European Union implementing stringent environmental regulations, such as the Ecodesign for Sustainable Products Regulation (ESPR) and REACH. Countries such as Germany, UK, and France lead the market. Moreover, there is a strong societal push towards a circular economy. This has pushed manufacturers to develop bio-based versions of this temporary bonding adhesive. They minimize hazardous substances and are easier to recycle.

North America’s temporary bonding adhesive market analysis indicates that several key trends are contributing to its growth in the region. There is robust growth in the optoelectronics sector. This is fueled by increasing the demand for high-speed data transmission in data centers and advancements in LiDAR for autonomous vehicles. Adhesives for temporary bonding is crucial in manufacturing these optoelectronic components. They provide support during the fabrication of delicate optical elements and integrated photonic circuits. Their ability to ensure residue-free debonding is vital for maintaining optical integrity. This also enables next-generation optoelectronic products across North America.

Middle East and Africa (MEA) market analysis indicates that Countries such as UAE and Saudi Arabia are utilizing advanced manufacturing capabilities. They are focusing on increasing their industrial bases, which have also benefitted this market. There are advancements in debonding technologies for temporary bonding adhesive. This includes newer debonding’s such as laser debonding, thermal slide-off, and improved mechanical debonding. They offer superior control, higher precision, and reduced risk of wafer damage compared to older techniques. The availability of these efficient debonding solutions encourages wider adoption.

Latin America's region creates potential for the market. The region is experiencing a growing need for advanced sensors and MEMS. This surge is fueled by increasing industrial automation and a growing automotive sector. Countries such as Brazil, Chile, and Argentina lead the market. Adhesive for temporary bonding is critical here. They provide essential temporary support in MEMS fabrication. Their ability to ensure clean debonding is vital for the functional integrity of these advanced sensors. This enables Latin American manufacturers to produce high-quality components.

Top Key Players & Market Share Insights:

The Temporary Bonding Adhesive market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global Temporary Bonding Adhesive market. Key players in The Temporary Bonding Adhesive industry include-

- AI Technology, Inc. (United States)

- Micro Materials Inc. (United States)

- YINCAE Advanced Materials, LLC (China)

- EV Group (Austria)

- HD MicroSystems, Ltd. (United States)

- Master Bond, Inc. (United States)

- 3M (United States)

- Brewer Science, Inc. (United States)

- Daxin Materials Corp. (China)

- Promerus, LLC (United States)

Temporary Bonding Adhesive Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 477.74 Million |

| CAGR (2025-2032) | 8.5% |

| By Type |

|

| By Application |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Temporary Bonding Adhesive market? +

In 2024, the Temporary Bonding Adhesive market is USD 248.76 Million.

Which is the fastest-growing region in the Temporary Bonding Adhesive market? +

Europe is the fastest-growing region in the Temporary Bonding Adhesive market.

What specific segmentation details are covered in the Temporary Bonding Adhesive market? +

Type, Application, and End-Use segmentation details are covered in the Temporary Bonding Adhesive market.

Who are the major players in the Temporary Bonding Adhesive market? +

AI Technology, Inc. (United States), Master Bond, Inc. (United States), 3M (United States), Brewer Science, Inc. (United States), Daxin Materials Corp. (China), and Promerus, LLC (United States) are some major players in the market.