Home > > Materials And Chemicals > > Toluene Market Size, Share, Growth, Trends and Analysis Report - 2031

Toluene Market - Size, Industry Share, Growth Trends and Forecasts (2024 - 2031)

ID : CBI_1503 | Updated on : | Author : Pavan C | Category : Materials And Chemicals

Toluene Market Size:

Toluene Market size is estimated to reach over USD 59.00 Billion by 2031 from a value of USD 35.79 Billion in 2023 and is projected to grow by USD 37.46 Billion in 2024, growing at a CAGR of 6.4% from 2024 to 2031.

Toluene Market Scope & Overview:

Toluene, a colorless and volatile aromatic hydrocarbon with the chemical formula C7H8, possesses a distinctive odor bringing to mind paint thinners or solvents. This starting material, widely applied in industrial and commercial settings, is extensively utilized as a solvent for its ability to efficiently dissolve various compounds. It serves as the precursor in producing important derivatives such as benzene, xylene, and others—the latter employed in crafting polyurethanes. While its application in paints, coatings, and adhesives fully exploits its solvent properties, the compound also finds use as a building block in diverse pharmaceutical syntheses. They are used in industries like automotive, chemical, pharmaceutical, painting and coatings, agriculture, and packaging.

Toluene Market Insights:

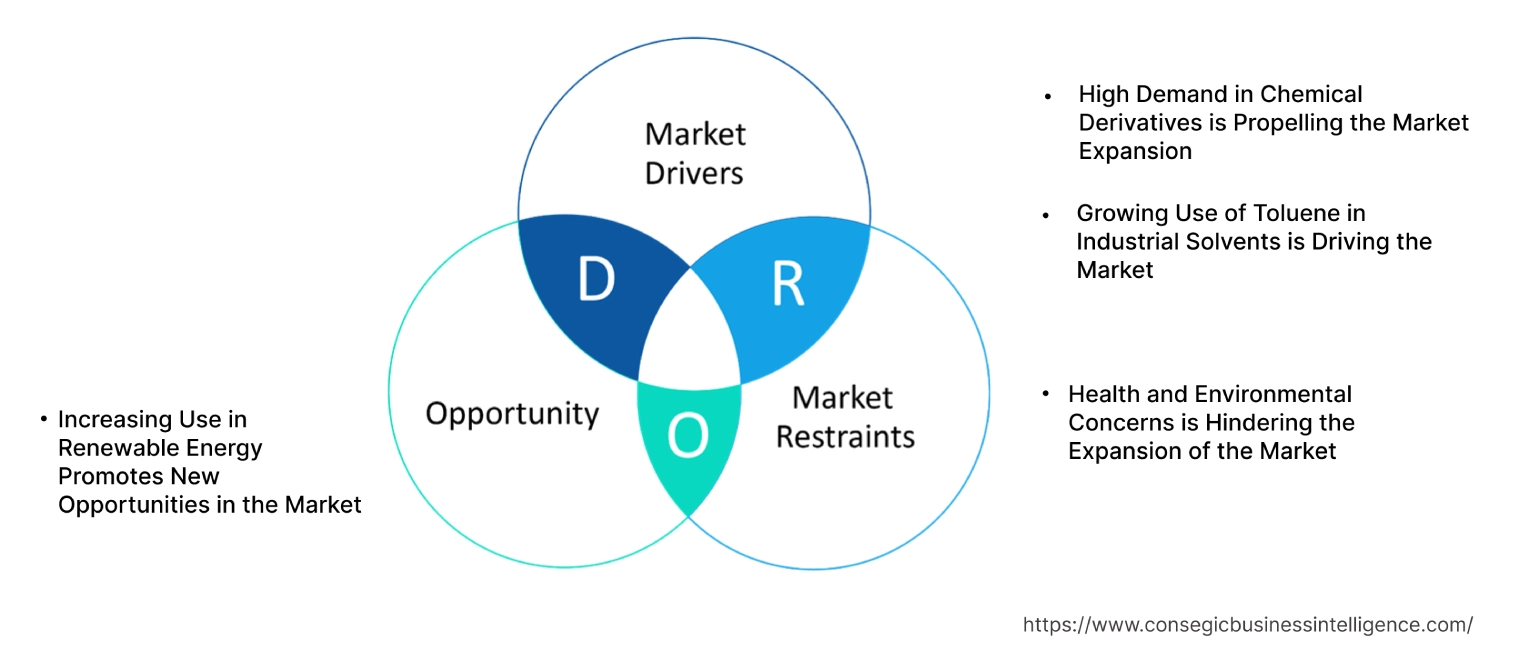

Toluene Market Dynamics - (DRO) :

Key Drivers:

High Demand in Chemical Derivatives is Propelling the Market Expansion

Toluene serves as a valuable precursor in producing numerous pivotal petrochemicals. Chief among them is benzene, a fundamental building block utilized extensively in manufacturing plastics, synthetic fibers, and resins. Additionally, the trio of ortho-xylene, meta-xylene, and para-xylene, collectively known as xylenes, also rely on this compound in their production. Xylenes themselves are indispensable in the synthesis of polyethylene terephthalate resins, moreover functioning as solvents and in the formulation of dyes. The escalating needs for sophisticated materials including advanced polymers and surface coatings have intensified the necessity for custom petrochemicals derived through refining this compound.

- For instance, Vizag Chemical uses benzene as it works as an effective solvent for various substances such as oils, resins, waxes, paints, and varnishes.

Therefore, as industries continue to seek advanced materials and chemicals, the role of the compound in producing these derivatives becomes increasingly crucial, driving the toluene market growth.

Growing Use of Toluene in Industrial Solvents is Driving the Market

Toluene is a powerful solvent that effectively dissolves a wide range of substances, including resins, polymers, and dyes, making it highly valuable in industrial applications. Its relatively high volatility means it evaporates quickly, which is advantageous in applications like coatings and paints where rapid drying is desired. It is a component in adhesives and sealants, helping to dissolve the adhesive agents and improve bonding strength and application ease. They are commonly used in paints, varnishes, and coatings to dissolve pigments and resins, ensuring smooth application and high-quality finishes.

- In 2024, Adheseal uses toluene because it is a strong and adaptable solvent that is used in a wide range of construction and trade applications. It effectively cleans metal parts and tools, removing grease, oil, and other contaminants.

Therefore, the market analysis shows that the compound's effectiveness as a solvent in paints, coatings, adhesives, and other applications drives the toluene market demand.

Key Restraints :

Health and Environmental Concerns is Hindering the Expansion of the Market

Toluene exposure endangers human wellness through multiple pathways. Repeated inhalation or dermal contact often leads to headaches, dizziness, and impaired cognition as neurological side effects. Prolonged intake will seriously jeopardize health, potentially damaging liver and kidney functioning while also impacting fertility. As a volatile organic compound, it contributes substantially to air pollution by facilitating tropospheric ozone formation. This degrades air quality and undermines public health. Heightened social mindfulness of environmental and wellness issues influences customer and corporate preferences.

- For instance, the Agency states that the central nervous system is the primary target organ for toluene toxicity in both humans and animals for acute and chronic exposures.

Therefore, as regulations become stricter and awareness of environmental and health issues grows, the market faces challenges related to compliance, costs, and shifting consumer preferences. Thus, the factors restrain the toluene market growth.

Future Opportunities :

Increasing Use in Renewable Energy Promotes New Opportunities in the Market

As the world transitions towards cleaner energy sources, the role of toluene in various renewable energy applications is expanding, creating new avenues for growth. It serves as a solvent in the fabrication of solar cells, including thin-film and high-efficiency solar panels, promoting a surge in solar energy applications. It is involved in the production of advanced battery components, such as electrolytes and separators. Innovations in battery technology, including those used in electric vehicles and grid storage, will create opportunities for suppliers.

- In August 2023, according to Acumen research, the adoption of eco-friendly techniques is essential for expansion. Meeting industry and regulatory standards requires developing and implementing sustainable production processes and limiting the environmental impact of this compound.

Therefore, the market trends analysis depicts that as renewable energy technologies continue to evolve and expand, the need for the compound and its derivatives in applications like solar energy, energy storage, and biofuels will increase. This in turn boosts the toluene market opportunities.

Toluene Market Segmental Analysis :

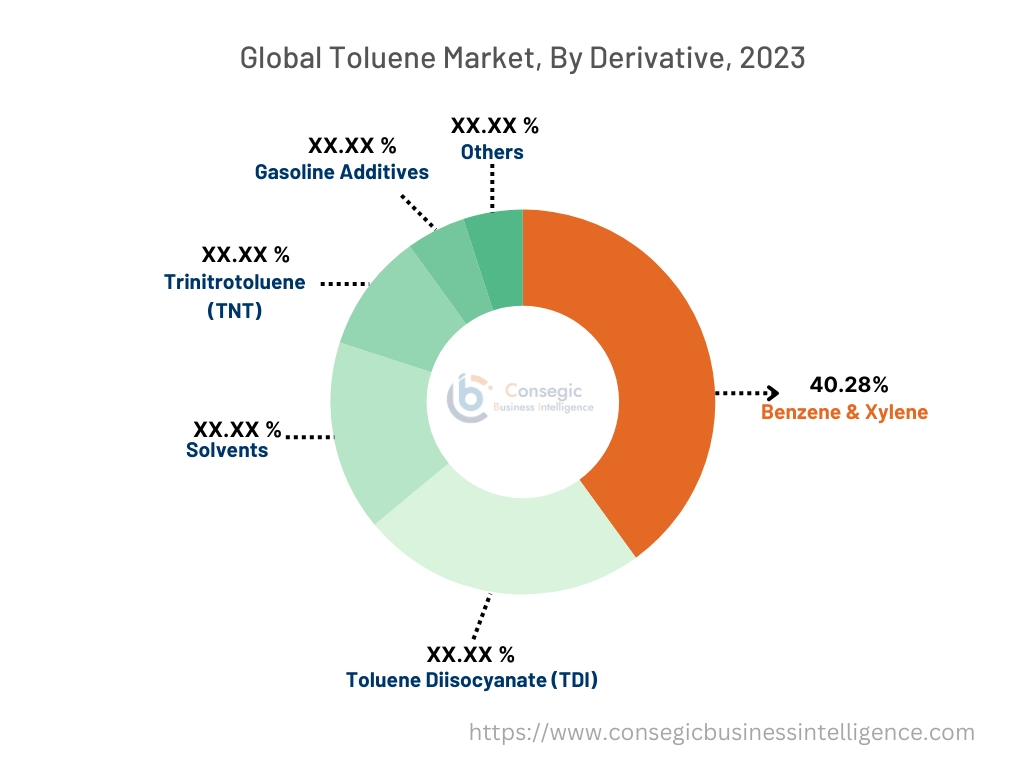

By Derivative:

Based on derivatives, the market is segmented into Benzene & Xylene, Toluene Diisocyanate (TDI), Solvents, Gasoline Additives, Trinitrotoluene (TNT), and others.

Trends in the Derivative:

- Toluene is important in conventional gasoline, there is a growing trend towards alternative fuels and electrification of vehicles. This shift impacts the long-term usage of toluene as a gasoline additive.

- The rise in usage of TDI-based products is expected to continue growing due to its wide range of applications and the expanding use of polyurethanes across various industries.

The benzene & xylene components accounted for the largest revenue share of 40.28% in 2023.

- Benzene and xylene are integral to various industrial processes, including the production of plastics, synthetic fibers, and other chemicals.

- Xylenes are crucial for producing terephthalic acid and dimethyl terephthalate, which are essential in making polyethylene terephthalate used in packaging, textiles, and containers.

- Advances in production technologies for benzene and xylene enhance efficiency and cost-effectiveness, supporting higher revenue streams.

- For instance, according to Tradeasia, approximately more than 70 million Metric Ton of PET resin were consumed in 2023 globally, with large usage mainly for water or carbonated soda drink bottles, film packaging, and fibers which are made from xylene isomers which are particularly important for PET production.

- Thus, the benzene and xylene components accounted for the largest revenue share due to their critical role in industrial applications, including petrochemicals, plastics, and solvents.

The toluene diisocyanate (TDI) component segment is anticipated to register the fastest CAGR during the forecast period.

- TDI is an organic compound with the formula C9H6N2O2. It is a key isocyanate used primarily in the production of polyurethanes.

- TDI is predominantly used in the manufacture of flexible polyurethanes, which are essential for making foams, coatings, adhesives, and elastomers.

- TDI-based foams are valued for their comfort, durability, and cushioning properties.

- The emphasis on energy efficiency and thermal insulation in buildings is driving demand for polyurethane insulation materials, which use TDI as a key raw material.

- For instance, Prakash Chemicals International is amongst the top global suppliers of Toluene Diisocyanate and produces flexible polyurethane foam for use in cushions, mattresses, garments, pads gloves, and packaging materials.

- Thus, the segmental analysis shows that the TDI component segment is anticipated to register the fastest due to its growing applications in flexible foams, automotive, construction, and other industries.

By Application:

Based on application the market is segmented into Industrial Feedstock, Paints, Coatings, Thinners, Adhesives, Pharmaceuticals, Dyes & Inks, and others.

Trends in the Application:

- There is a growing trend towards more sustainable and eco-friendly inks and dyes. This includes the development of low-VOC or water-based inks, which may impact the usage of traditional solvent-based inks that use toluene.

- Innovations in adhesive technologies, such as the development of high-performance and specialty adhesives, influence the formulation of adhesives.

The industrial feedstock component accounted for the largest revenue of the total toluene market share in 2023.

- Industrial feedstocks are raw materials used in the production of chemicals and products. They serve as the starting point for various chemical processes and manufacturing operations.

- They are used to produce a wide array of chemicals, including solvents, polymers, and specialty chemicals.

- They are essential in many sectors, including chemicals, plastics, textiles, and automotive.

- For instance, as per the International Energy Agency , energy costs constitute a considerable percentage of the total expenses incurred by chemical manufacturers. Policies that provide subsidies for select applications of fossil fuels warp the market, inevitably resulting in efficient energy utilization and transitions towards feedstocks that emit fewer carbon emissions.

- Thus, the wide applications across multiple industries, supported by technological advancements and economic growth, drive the toluene market demand.

The pharmaceutical component segment is anticipated to register the fastest CAGR during the forecast period.

- Hydrothermal synthesis allows for precise control over the dimension, shape, and morphology of

- Toluene is used as a solvent in the synthesis and formulation of various pharmaceutical compounds. Its ability to dissolve a wide range of substances makes it valuable in drug development and manufacturing.

- This high-quality solvent is in high demand due to the development of biopharmaceuticals and complicated medications that require sophisticated synthesis methods.

- The growing need for pharmaceuticals, driven by factors such as aging populations, increasing prevalence of chronic diseases, and heightened healthcare awareness, is boosting the need for the compound in drug production.

- For instance, SPI Pharma's findings indicate that exposure to toluene can induce both transient and permanent alterations to the central nervous system. Several experiments were conducted to examine the impacts of toluene inhalation on select enzyme levels as well as glutamate and GABA receptor affinity in precise regions of the rat brain across multiple exposure paradigms.

- Thus, the segmental analysis depicts that the role of the compound as a solvent and intermediate in pharmaceutical synthesis drives the toluene market trends.

By End-User Industry:

Based on the end-use industry the market is segmented into the Chemical, Oil & Gas, Automotive, Building & Construction, Pharmaceutical, and others.

Trends in the End-User Industry:

- Innovations in construction materials, including improved adhesives, paints, and coatings, influence the use of toluene. Advances in formulation technology may lead to the development of products with enhanced performance and reduced reliance on traditional solvents.

The chemical sector component accounted for the largest revenue share in the year 2023.

- The chemical sector is a significant consumer of various chemical components, including solvents like toluene. It uses these chemicals in the production of a wide range of products such as polymers, resins, dyes, adhesives, and more.

- Growth in the chemical sector, driven by industrial expansion, technological advancements, and increased production capacities, contributes to higher revenue generation from chemical components.

- Thus, the chemical sector due to its extensive use of the compound as a solvent and raw material in various chemical processes drives the toluene market expansion.

The pharmaceutical sector component segment is anticipated to register the fastest CAGR during the forecast period.

- Toluene acts as a reagent in various chemical reactions, including those used to produce active pharmaceutical ingredients (APIs) and intermediates.

- The expansion of pharmaceutical manufacturing facilities globally is increasing the demand for the compound as a key component in drug production processes.

- It is used in the production of APIs and other pharmaceutical intermediates. It helps in the synthesis and purification processes necessary for creating high-quality pharmaceutical products.

- For instance, the pharmaceuticals sector of the toluene market is the largest end-user, accounting for about 40-45% of total consumption.

- Thus, the pharmaceutical sector due to the need for pharmaceuticals, advancements in drug formulation technology, and expansion in pharmaceutical manufacturing is expected to drive the toluene market trends.

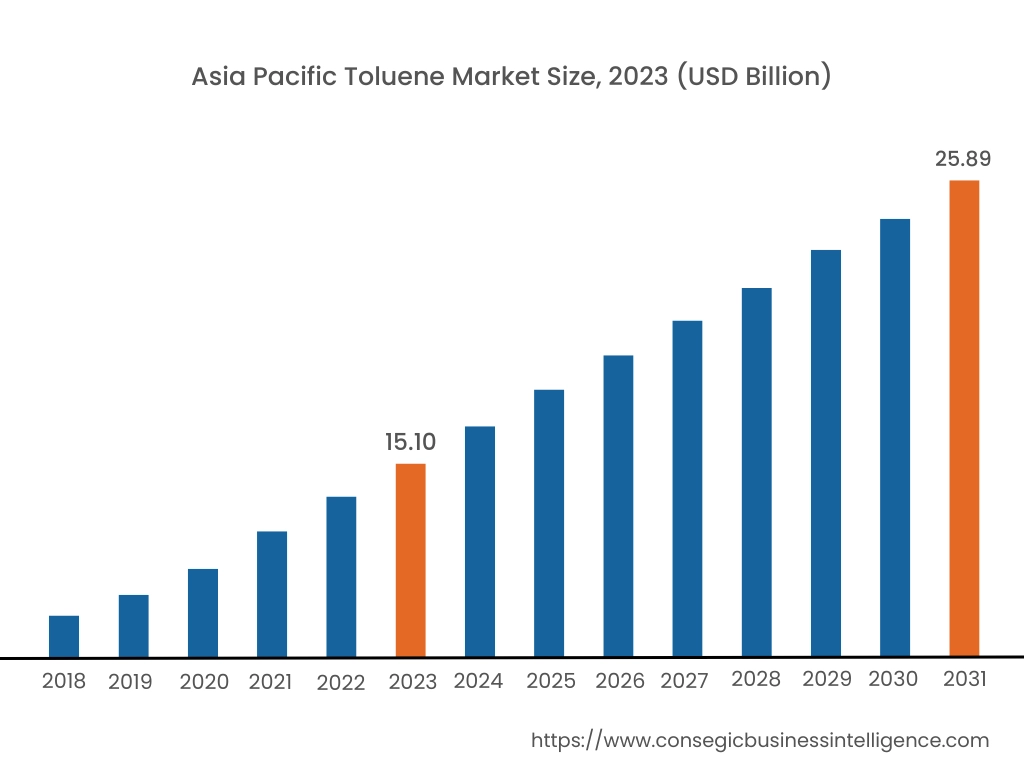

Regional Analysis:

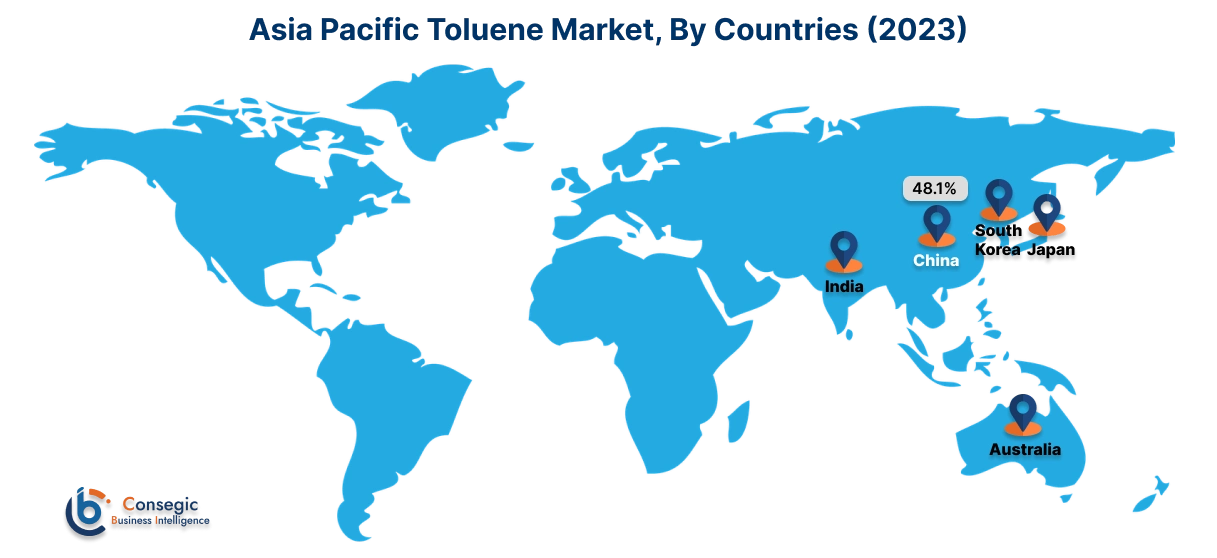

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 15.10 Billion in 2023. Moreover, it is projected to grow by USD 15.86 Billion in 2024 and reach over USD 25.89 Billion by 2031. Out of this, China accounted for the maximum revenue share of 48.1%. Asia Pacific held the largest toluene market share primarily due to the rapid industrialization and economic growth witnessed in China, India, and South Korea. The region's expanding manufacturing sector, particularly in the automotive, construction, and electronics industries, has been a significant driver of the market.

- In March 2023, currently producing and marketing TDI, Mitsui Chemicals will soon optimize its production capacity. As part of this restructuring, high-value products such as high-performance polyols like polypropylene glycol and methylene diphenyl diisocyanate will be developed.

North America is estimated to reach over USD 13.38 Billion by 2031 from a value of USD 7.91 Billion in 2023 and is projected to grow by USD 8.30 Billion in 2024. As per the toluene market analysis, North America, with its well-established chemical sector, is a major user of the compound for a variety of chemical synthesis and uses. The sector's continual expansion and innovation fuel consistent demand. Furthermore, North America's automotive, construction, and paints and coatings industries are all expanding, leading to rising usage.

As per the regional analysis in Europe, the market is fueled by the presence of a well-established chemical manufacturing sector, particularly in Germany and France. One of the major applications is the production of benzene and xylenes, which are essential building blocks for various chemical products.

In the Middle East, the market is primarily driven by the expansion of the petrochemical sector. Saudi Arabia and the UAE are investing in petrochemical plants. In Africa, the industrial growth in countries such as South Africa is contributing to the rising product usage as these economies develop their manufacturing bases.

In Latin America, particularly in Brazil and Mexico, the chemical and pharmaceutical sectors are expanding, requiring substantial amounts of the product for various applications.

Top Key Players & Market Share Insights:

The toluene market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global toluene market. Key players in the toluene industry include-

- Chevron Phillips Chemicals LLC (US)

- Mitsubishi Chemicals Corporation (Japan)

- INEOS Capital Limited (UK)

- BASF SE (Germany)

- SABIC (Saudi Arabia)

- China Petroleum and Chemical Corporation (China)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- Covestro AG (Germany)

- Royal Dutch Shell Pl (Netherlands)

- Exxon Mobil Corporation (US)

Recent Industry Developments :

Product Enhancement:

- In March 2023, Mitsui Chemicals announced that it would be expanding the capacity of its Toluene Diisocyanate (TDI) unit at Omuta Works by July 2025. TDI is an essential component used in the production of polyurethane.

Business Expansion:

- In September 2023, ExxonMobil recently announced the official opening of two new chemical production units at its Baytown, Texas manufacturing facility. ExxonMobil's $2 billion expansion is part of the company's long-term growth strategy to supply higher-value products from its refining and chemical operations on the United States Gulf Coast.

Toluene Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 59.00 Billion |

| CAGR (2024-2031) | 6.4% |

| By Derivative |

|

| By Application |

|

| By End-User Industry |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Toluene Market? +

Toluene Market size is estimated to reach over USD 59.00 Billion by 2031 from a value of USD 35.79 Billion in 2023 and is projected to grow by USD 37.46 Billion in 2024, growing at a CAGR of 6.4% from 2024 to 2031.

What specific segmentation details are covered in the toluene market report? +

Specific segments that are covered in the toluene market report derivatives, applications, and end-use industries.

Who are the major players in the toluene market? +

The major players in the toluene market are Chevron Phillips Chemicals LLC (US), Mitsubishi Chemicals Corporation (Japan), China Petroleum and Chemical Corporation (China), INEOS Capital Limited (UK), BASF SE (Germany), SABIC (Saudi Arabia), LyondellBasell Industries Holdings B.V. (Netherlands), Covestro AG (Germany), Royal Dutch Shell Pl (Netherlands), and Exxon Mobil Corporation (US)

Which region will lead the global toluene market? +

North America will lead the global toluene market.