Virtual Desktop Market Size:

Virtual Desktop Market size is estimated to reach over USD 52,791.91 Million by 2032 from a value of USD 17,671.57 Million in 2024 and is projected to grow by USD 19,947.34 Million in 2025, growing at a CAGR of 14.70% from 2025 to 2032.

Virtual Desktop Market Scope & Overview:

Virtual Desktop refers to an interface that allows users to access their application, workspace, and desktop which has internet and compatibility, regardless of its hardware specifications and operating system. Any end-point device including a laptop, smartphone, or tablet, can be used to access a virtual desktop. Moreover, these desktop offers a range of benefits including remote access, seamless management, cost efficiency, data backup, and others. The above benefits are primary determinants for driving the market.

Virtual Desktop Market Insights:

Virtual Desktop Market Dynamics - (DRO) :

Key Drivers:

Advancements in Cloud Computing are Proliferating the Market Expansion

Cloud computing is the on-demand availability of computing resources including storage and infrastructure, as a service over the internet. Cloud-hosted virtual desktops, known as Desktop-as-Service (DaaS), decrease the requirement for on-site infrastructure, enabling smaller businesses lacking the capacity to handle a complicated IT setup to more easily adopt desktop virtualization. Moreover, cloud computing offers scalable, flexible, and cost-effective solutions that have made desktop virtualization more accessible to a wide range of organizations.

- In March 2021, according to the, IBM and Dizzion introduced Dizzion Managed Desktop as a Service (DaaS) on IBM Cloud, providing efficient end-user computing environments from 43 IBM Cloud data centers. This cloud desktop offering simplifies the process for organizations to purchase, utilize, and manage.

Therefore, the features of cloud computing collectively enable businesses to leverage virtualization solutions more effectively boosting the virtual desktop market growth.

Key Restraints :

Performance and High Latency Issues are Obstructing Market Expansion

Virtual desktops are hosted on servers and accessed over a network, network latency and bandwidth limitations can affect the responsiveness of applications and overall user experience. Insufficient network bandwidth and unreliable internet connections lead to high latency and poor performance, particularly for IT users. Additionally, overloaded servers slow down the performance of these desktops, without proper scalability and load balancing, user experience can degrade during peak usage times. Therefore, performance and latency issues are significant obstacles to the virtual desktop market expansion.

Future Opportunities :

Incorporation of Artificial Intelligence (AI) and Machine Learning (ML) Promotes New Opportunities

Integration of AI and machine learning enhances the functionality, efficiency, and user experience. AI and machine learning algorithms are being employed to intelligently allocate computing resources in virtual environments. By analyzing user behavior patterns, these algorithms can dynamically allocate CPU, memory, and network resources based on individual user needs. This ensures that each user receives optimal performance and responsiveness, leading to a smoother and more satisfying user experience. Factors include security enhancements, customized models, performance optimization, enhanced user interactivity, and efficient IT operations.

- In August 2023, VMware Inc. and NVIDIA collaborated to integrate generative AI on VMware's cloud infrastructure. VMware Private AI Foundation with NVIDIA will enable enterprises to customize models and run generative AI applications, including intelligent chatbots, assistants, search, and summarization. The platform will be a fully integrated solution featuring generative AI software and accelerated computing from NVIDIA, built on VMware Cloud Foundation and optimized for AI.

Therefore, rising innovations of desktop virtualization integrated with AI are anticipated to present transformative virtual desktop market opportunities during the forecast period.

Virtual Desktop Market Segmental Analysis :

By Component:

Based on the component, the market is bifurcated into software and services.

Trends in the Components:

- Software component enables seamless management of virtual desktops across multiple cloud environments, and provides flexibility and resilience, to optimize cost and performance through utilizing diverse cloud services.

The software segment accounted for the largest revenue share in the year 2024.

- Software provides and manages virtual desktops hosted on-premises or in the cloud. These desktops run on virtual machines located on servers in a data center instead of the actual desktop hardware.

- This software includes hypervisors, virtual desktop infrastructure (VDI) solutions, operating systems, management tools, and security software.

- Businesses use the software to leverage existing computer resources without increasing costs, update enterprise software tools, and allow employees to access desktop images using their own or company devices while maintaining data security.

- In August 2022, Dell Technologies and VMware introduced virtual desktop infrastructure solutions co-engineered to enhance automation and performance for organizations adopting multi-cloud and edge strategies. As data and applications continue to grow in multi-cloud environments, these solutions aim to simplify management and deliver value from data.

- Therefore, the market analysis concludes that the software segment is collectively driving the virtual desktop market share.

The service segment is anticipated to register the fastest CAGR growth during the forecast period.

- Services refers to support and management activities provided to implement, automate, maintain, and optimize virtual environments.

- These services include Platform as a Service (PaaS), Software as a Service (SaaS), Infrastructure as a Service (IaaS), Desktop as a Service (DaaS), managed services, and others.

- Businesses use these services to handle IT infrastructure with desktop virtualization, as they support remote and hybrid work environments including remote monitoring, management, and support services, essential to ensure productivity and connectivity.

- In October 2022, Deloitte launched Oracle MyCloud ERP offering to help fast-growing and private clients accelerate business transformation using Oracle's integrated SaaS Cloud platform. This offering includes access to Oracle Cloud products and Deloitte's implementation and support services for a consistent monthly fee, addressing talent constraints and high upfront costs.

By Type:

Based on type the market is bifurcated into Persistent and Non-Persistent.

Trends in the type:

- Persistent virtual desktop supports Bring Your Own Device (BYOD) Policies offering flexibility across various industries.

The non-persistent segment accounted for the largest revenue share in the year 2024.

- Non-persistent virtual desktops enable multiple users to utilize the desktops.

- These desktops are easy to manage and maintain as they revert to a default state after each use, reducing the need for extensive IT support and maintenance.

- Additionally, desktops are created from a master image, allowing system administrators to quickly update, back up, and deploy organization-wide applications.

- Determinants including lower cost, reduced storage, simplified management, and enhanced security, drive the market.

- In June 2024, AWS introduced Amazon WorkSpaces Pool, a cost-effective non-persistent virtual desktops. This WorkSpace Pool guarantees that all users receive identical applications and experiences. Moreover, users have the capability to handle a collection of non-persistent desktops through a single GUI, command line, or a series of AI-driven tools.

- Thus, as per the analysis simplified management of non-persistent virtual desktops is driving the virtual desktop market demand.

The persistent segment is anticipated to register the fastest CAGR growth during the forecast period.

- Persistent virtual desktops are replicas of traditional PCs assigned to individual users enabling personal desktops to store files and add their preferences.

- These desktops are quick and easy to set up, customizable, flexible to remote access, and help organizations comply with industry regulations.

- In November of 2023, VMware and Amazon Workspace joined forces to declare that AppVolumes will now offer support for Persistent Desktops, including Horizon. App Volumes change the way applications are distributed and controlled on Horizon VDI and Apps, Citrix Virtual Apps and Desktops, Azure Virtual Desktop, and Amazon Web Services. The same functionality will also be integrated into Amazon WorkSpaces Core.

- Hence, rising innovations in persistent virtual desktops are anticipated to boost the virtual desktop market trends.

By Deployment:

Based on deployment the market is bifurcated into on-premises and cloud-based.

Trends in the deployment:

- Cloud-based deployment includes disaster recovery and business continuity features, ensuring minimal downtime and data loss for resilience and reliability in cloud platforms.

The cloud-based segment accounted for the largest revenue share in the year 2024 and is anticipated to register the fastest CAGR growth during the forecast period.

- Cloud-based deployment enables organizations to easily scale their desktop virtualization environments up or down based on demand, without significant upfront investment in infrastructure.

- Additionally, these desktops offer a pay-as-you-go pricing structure where users are charged based on their consumption of resources and cloud services.

- In September 2022, AWS announced Amazon WorkSpace core, which is a cloud-based desktop virtualization solution that is fully managed by Desktop as a Service (DaaS). WorkSpaces Core comprises specialized VDI infrastructure that enables efficient spending with predictable, fixed rate, pay-as-you-go pricing, and with no upfront costs.

- Therefore, the market analysis concludes that the cloud-based deployment segment is driving the virtual desktop industry.

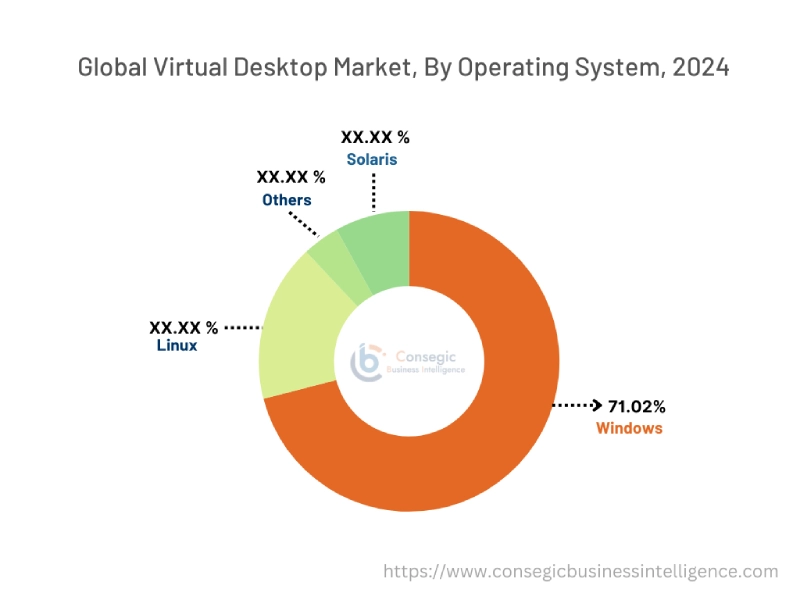

By Operating System:

Based on operating system the market is segmented into Linux, Windows, Solaris, and Others.

Trends in Operating Systems:

- Virtual desktops are focusing on improving cross-platform compatibility to allow seamless integration and operation across various operating system environments, enhancing user experience and enabling organizations to run diverse applications without compatibility issues.

The Windows segment accounted for the largest revenue share of 71.02% in the year 2024 and is anticipated to register the fastest CAGR growth during the forecast period.

- Windows OS has a large user base, most users are familiar with Windows OS making it a preferred choice for many organizations.

- Virtual desktops integrated with Windows OS allow users to stream all the applications, tools, data, and settings from the cloud across any device.

- Additionally, it secures the virtual environments by leveraging the power of the cloud and principles of Zero Trust, a security framework for authentication.

- In July 2021, Microsoft Corp. revealed Windows 365 a cloud-based service that offers a new way for businesses to use Windows 10 or Windows 11. Windows 365 brings the operating system to the Microsoft cloud by streaming the complete Windows experience, including apps, data, and settings, to personal or corporate devices.

- Thus, the Windows OS segment is propelling and is expected to expand the virtual desktop market demand.

By End-User:

Based on end-users the market is segmented into IT and Telecommunications, BFSI, Healthcare, Education, Retail, and others.

Trends in the End-Users:

- Desktop virtualization allows for a personalized learning experience, enabling educators to customize lesson plans and assignments catered to individual needs.

- The BFSI sector is increasingly adopting virtual desktops to comply with regulatory requirements by ensuring secure and controlled access to sensitive financial data, enhancing data protection and audit capabilities.

IT and Telecommunications segment accounted for the largest revenue share in the year 2024.

- IT and Telecommunications widely adopt desktop virtualization for remote work policies, enabling IT professionals to access work environments securely from any location.

- They offer scalability, allowing IT organizations to rapidly allocate and remove desktops based on project needs. This flexibility supports dynamic team and project-based work.

- Additionally, the incorporation of technological advancement including artificial intelligence (AI) and machine learning (ML) in the cloud-based workspace is a significant factor driving the market.

- In May 2023, Google launched Duet AI integrated with Google Workspace products, leveraging advanced NLP and machine learning to assist users in coding, generating content, drafting emails, and creating documents.

- Thus, IT and Telecommunications widely adopt cloud-based workspaces due to scalability and flexibility, driving the global virtual desktop market trend.

The healthcare segment is anticipated to register the fastest CAGR growth during the forecast period.

- Virtual desktops offer enhanced data security measures to protect patient privacy as Healthcare organizations work with sensitive and confidential patient information regularly.

- These desktops streamline the software and system update procedure. IT personnel can save time and decrease patient care disruptions by centrally implementing updates, instead of updating software on each physical desktop separately.

- Moreover, a collaboration of key players of cloud providers with healthcare organizations further boosts the market.

- In July 2024, GE HealthCare collaborated with Amazon Web Services, Inc. (AWS), to develop purpose-built foundation models and generative artificial intelligence (AI) applications designed to help clinicians improve medical diagnostic and patient care.

- Therefore, the analysis concludes that the healthcare segment is anticipated to boost the market during the forecast period.

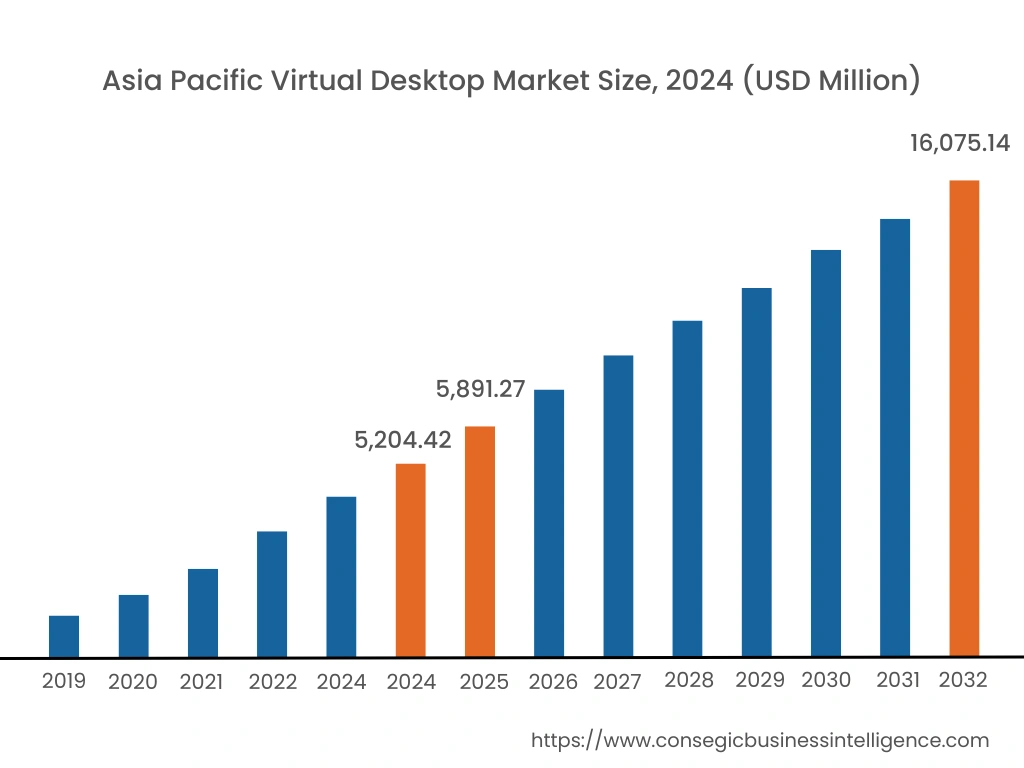

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

North America is estimated to reach over USD 17,109.86 Million by 2032 from a value of USD 5,861.81 Million in 2024. Determinants including high adoption of advanced technologies, widespread implementation of remote work policies, and strong presence of key players are fueling the virtual desktop market.

- In July 2023, Citrix (Florida, US) joined forces with Twilio, a global leader in customer engagement software, to provide integrated high-performance solutions for Citrix Desktop as a Service (DaaS) and Twilio Flex environments.

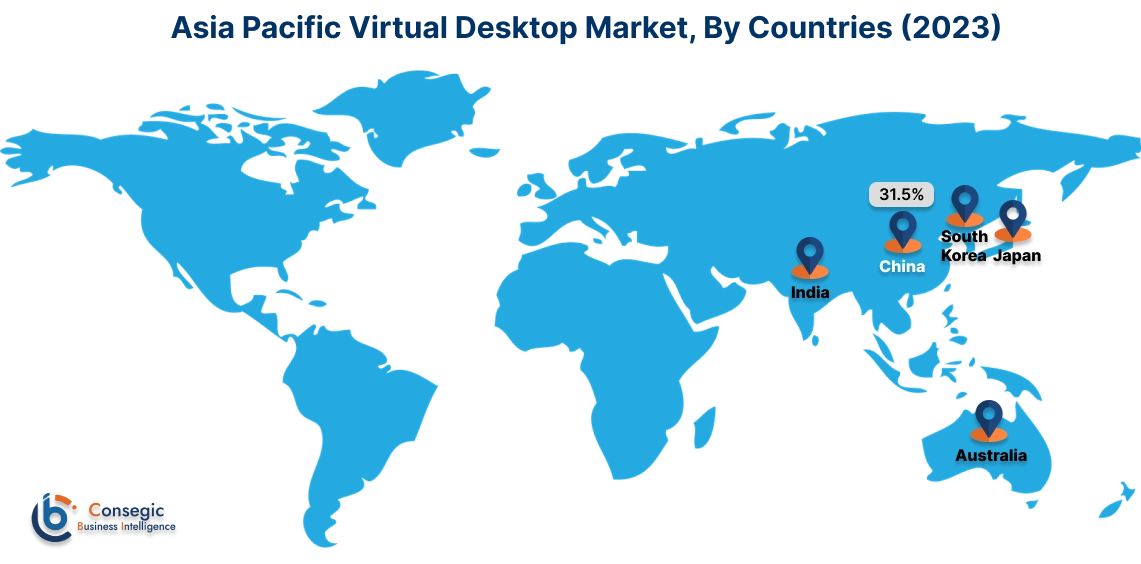

Asia-Pacific region was valued at USD 5,204.42 Million in 2024. Moreover, it is projected to grow by USD 5,891.27 Million in 2025 and reach over USD 16,075.14 Million by 2032. Out of this, China accounted for the maximum revenue share of 31.5%.

- For instance, according to the analysis of the International Journal of Interdisciplinary Research and Innovations the rapid growth of India's IT industry, driven by advancements in digital processing and communication, the demand for desktop virtualization is rising. This technology offers cost savings, enhanced security, and improved productivity, aligning with the IT sector's focus on innovation. The adoption of desktop virtualization is set to create new chances, reduce brain drain, and position India as a global leader in technology.

The Asia-Pacific region's growing surge in cloud infrastructure development and adoption, rising trend of remote workforces, and government-led initiatives to promote digital transformation are anticipated to show substantial growth in the virtual desktop market.

As per virtual desktop market analysis, Europe is anticipated to witness substantial growth that is backed by the cloud computing sector. Companies invest in innovative virtualization technologies to cater to the surging demand for cloud-based workspaces across the region.

The Middle East, Africa, and Latin America are expected to experience significant development in desktop virtualization adoption. The expansion of data centers and cloud services is facilitating the deployment of desktop virtualization across IT, education, healthcare, and others.

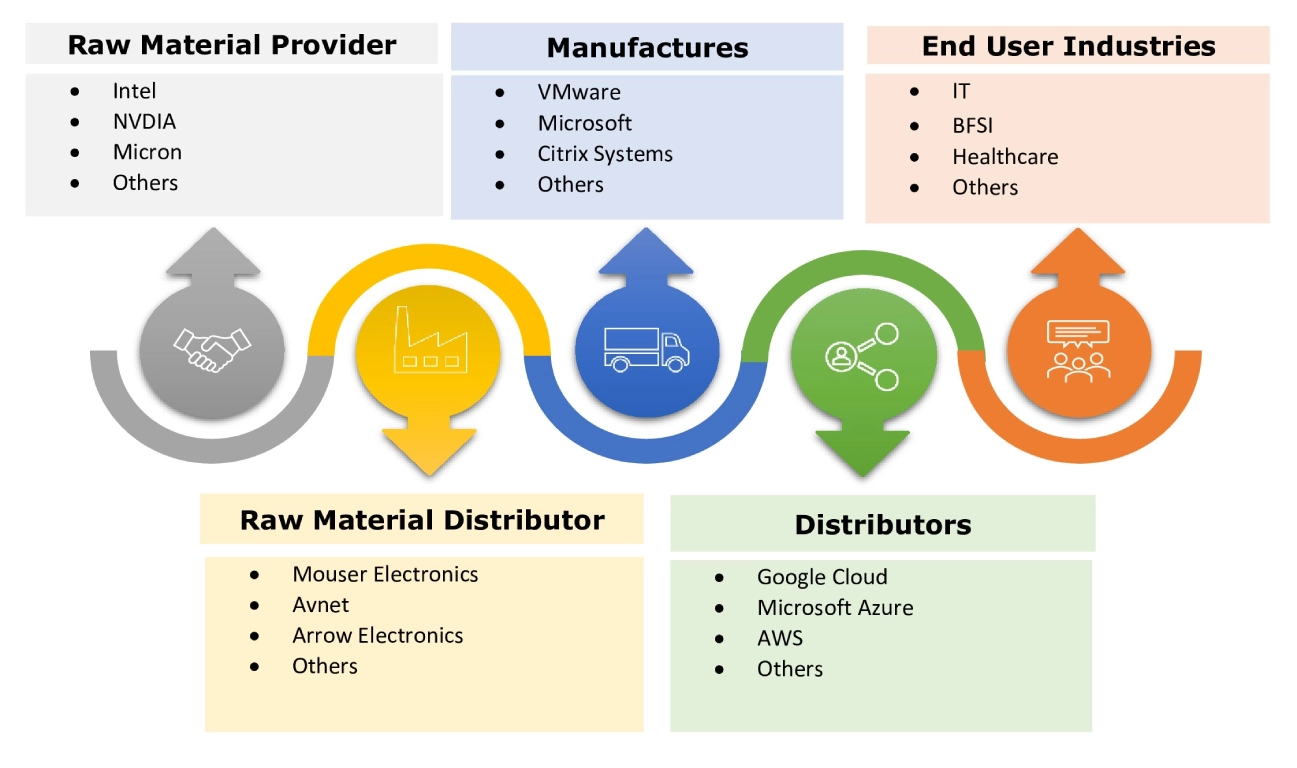

Top Key Players & Market Share Insights:

The virtual desktop market is highly competitive with major players providing enhanced user experience, realism, and immersion to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the virtual desktop market. Key players in the virtual desktop industry include-

- VMware(US)

- Citrix Systems (US)

- IBM Corporation (US)

- Huawei Technologies

- Fujitsu Ltd.

- IGEL Technology (Germany)

- Microsoft (US)

- Amazon Web Services, Inc. (US)

- Oracle (US)

- CISCO Systems (US)

- Red Hat Software

- Dell Technologies Inc.

Recent Industry Developments :

Product Launches:

- In March 2024, Citrixlaunched incentive programs designed for customers and partners seeking to transition their existing non-Citrix use cases to the newly introduced Citrix platform.

- In August 2023, Dizzion released Digital Workspace for financial services on the IBM cloud, which includes IBM's security features. This allows third-party partners, institutions, and vendors to safeguard sensitive information and systems, as well as empowering the modern workforce to work flexibly with different teams.

Collaboration:

- In July 2024, Deloitte collaborated with Amazon Web Services (AWS) to assist global clients in expanding their Generative Artificial Intelligence, data and analytics, and quantum computing capabilities through the utilization of AWS offerings like Amazon SageMaker, Amazon Bedrock, Amazon Q, and Amazon Bracket.

- In June 2024, Dizzion and IBM joined forces to provide remarkable digital workspace experiences. This involves providing not just a DaaS platform for businesses but also a customizable solution to address organizations' specific resource and skill requirements. Customers have the option to select either self-service or Dizzion-managed administration, deploy on their IBM Cloud account, or have it hosted by Dizzion, and add compliance services for GDPR, HIPAA, PCI, and SOC.

Announcements:

- In Feb 2024, Citrix announced a public tech preview of Citrix DaaS on Amazon WorkSpaces Core in February 2024. This preview allows customers to test new features and capabilities in a non-production or limited-production setting and give feedback. By integrating this, companies can expand their Citrix desktop virtualization setups to AWS infrastructure that is both scalable and inexpensive, all while still utilizing their current Citrix management software and Citrix HDX technology.

Virtual Desktop Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 52,791.91 Million |

| CAGR (2025-2032) | 14.7% |

| By Component |

|

| By Type |

|

| By Deployment Mode |

|

| By Operating System |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Virtual Desktop market? +

Virtual Desktop Market size is estimated to reach over USD 52,791.91 Million by 2032 from a value of USD 17,671.57 Million in 2024 and is projected to grow by USD 19,947.34 Million in 2025, growing at a CAGR of 14.70% from 2025 to 2032.

Who are the major players in the virtual desktop market? +

The key players in the virtual desktop market include VMware (US), Citrix Systems (US), Microsoft (US), IBM Corporation (US), Amazon Web Services (US), Oracle (US), CISCO Systems (US), Red Hat Software(US), Dell Technologies Inc (US), Huawei Technologies (China), Fujitsu Ltd, IGEL Technology (Germany) and others.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2025-2032? +

Asia-Pacific is anticipated to register the fastest CAGR growth during the forecast period due to a growing surge in cloud infrastructure development and adoption, a rising trend of remote workforces, and government-led initiatives to promote digital transformation, is anticipated to show substantial growth in the virtual desktop market opportunity.

What is the key market trend? +

Virtual desktops are focusing on improving cross-platform compatibility to allow seamless integration and operation across various operating system environments, enhancing user experience and enabling organizations to run diverse applications without compatibility issues.