Water Analysis Instrumentation Market Size:

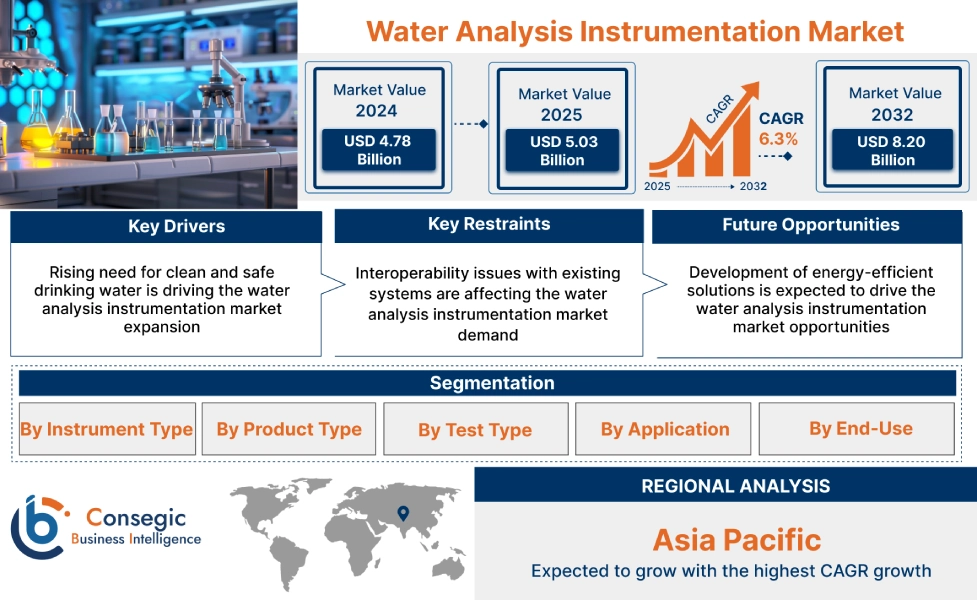

Water Analysis Instrumentation Market Size is estimated to reach over USD 8.20 Billion by 2032 from a value of USD 4.78 Billion in 2024 and is projected to grow by USD 5.03 Billion in 2025, growing at a CAGR of 6.3% from 2025 to 2032.

Water Analysis Instrumentation Market Scope & Overview:

Water analysis instrumentation encompasses the devices and techniques used to measure and analyze water quality parameters. These instruments are crucial for assessing the suitability of water for various applications, including drinking, industrial use, and environmental monitoring. They range from simple pH meters and turbidity meters to advanced spectrophotometers and mass spectrometers.

How is AI Transforming the Water Analysis Instrumentation Market?

AI is transforming the water analysis instrumentation market by improving accuracy, efficiency, and predictive capabilities. Traditional instruments often require manual calibration and frequent sampling, but AI-driven systems can process real-time data and automatically adjust measurements for variables such as temperature, pH, or turbidity. This enhances the reliability of water quality monitoring in industries like environmental management, pharmaceuticals, and wastewater treatment. AI also supports predictive maintenance by detecting sensor drift or performance issues before failures occur, reducing downtime and costs. Moreover, by analyzing large datasets, AI helps identify contamination patterns and optimize treatment processes. As water quality standards grow stricter, AI-enabled instrumentation is becoming a critical tool for sustainable water management globally.

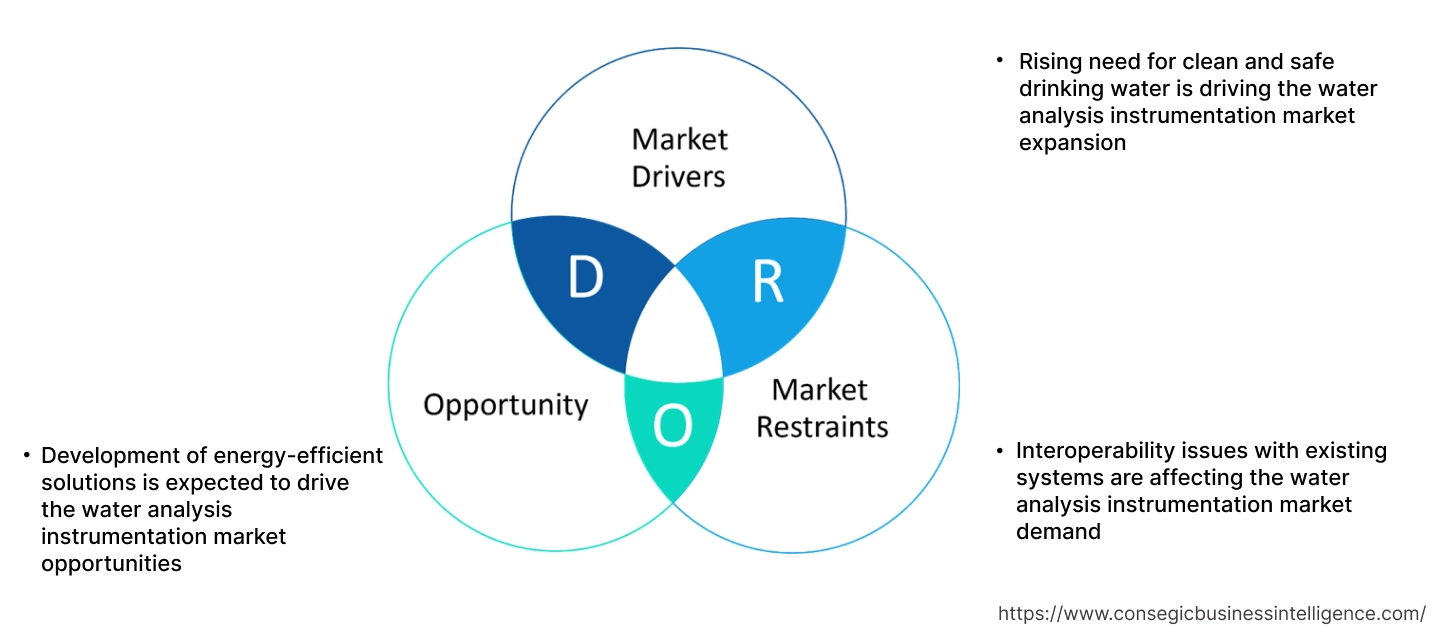

Water Analysis Instrumentation Market Dynamics - (DRO) :

Key Drivers:

Rising need for clean and safe drinking water is driving the water analysis instrumentation market expansion

The rising need for clean and safe drinking water is a critical factor driving the global market. As the population grows, urbanization increases, and climate change intensifies, access to clean water has become an urgent issue in many regions. Contaminants such as heavy metals, bacteria, and chemicals often compromise water quality, posing health risks. This has heightened the need for reliable water testing solutions to ensure that water sources meet safety standards and are free from harmful pollutants, particularly in developing nations where access to clean water is still a challenge.

As consumers become more health-conscious, there is a growing need for high-quality drinking water, both from municipal supplies and bottled water. This shift is driving the need for effective water analysis instrumentation to ensure water safety. Industries, particularly in food and beverage, healthcare, and pharmaceuticals, are increasingly adopting advanced water quality testing technologies to meet stringent regulatory standards and to reassure consumers about the safety of the products they consume. With the rising awareness of waterborne diseases and the need for preventive measures, the need for accurate and frequent water testing continues to grow across various sectors.

- For instance, in February 2021, Neogen Corporationlaunched a new wastewater test called Early Warning COVID-19 Testing. This test can detect the presence of the SARS-CoV-2 virus, which causes COVID-19, in wastewater sludge. By analyzing the sludge, Neogen can provide quick and accurate results that can help identify new outbreaks and give early warnings of potential increases in infections within specific facilities.

Thus, according to the water analysis instrumentation market analysis, the rising need for clean and safe drinking water is driving the water analysis instrumentation market size.

Key Restraints:

Interoperability issues with existing systems are affecting the water analysis instrumentation market demand

Many water management systems utilize a diverse range of technologies and equipment, often from different vendors, leading to compatibility issues. Integrating new water analysis instrumentation technologies with legacy systems can be complex and costly, as these older systems may not be designed to communicate effectively with modern solutions. This lack of seamless integration can hinder the efficiency and effectiveness of water management processes, creating barriers to the adoption of advanced technologies. Further, the challenge of interoperability also impacts data sharing and system coordination for water management systems. Thus, the above analysis depicts that the aforementioned factors would further impact the water analysis instrumentation market size.

Future Opportunities :

Development of energy-efficient solutions is expected to drive the water analysis instrumentation market opportunities

The development of energy-efficient solutions is expected to facilitate market growth. As water treatment and distribution processes are energy-intensive, there is a growing emphasis on adopting technologies that reduce energy consumption and operational costs. Energy-efficient solutions, such as advanced control systems and optimized pump technologies, help minimize energy usage while maintaining effective water management. These innovations not only contribute to cost savings but also align with global sustainability goals by reducing the carbon footprint of water operations.

Advancements in energy-efficient technologies are leading to the integration of smart sensors and automated control systems that optimize energy use based on real-time data. For example, variable frequency drives (VFDs) and energy-efficient motors adjust their operation to match the actual demand, resulting in significant energy savings. Additionally, technologies such as energy recovery systems capture and reuse energy from wastewater, further enhancing overall efficiency. These developments are crucial for improving the sustainability of water management systems and meeting regulatory requirements related to energy efficiency and environmental impact.

- For instance, in June 2023, ABBand China Telecom launched a joint lab for digitalization and industrial IoT. In the field of smart water networks, ABB recently collaborated with E Surfing IoT. Chinese water companies implemented IoT solutions as part of the collaboration, resulting in improved data quality and better operational efficiency, reducing costs and energy consumption by 20%.

Thus, based on the above water analysis instrumentation market analysis, the development of energy-efficient solutions is expected to drive water analysis instrumentation market opportunities.

Water Analysis Instrumentation Market Segmental Analysis :

By Instrument Type:

Based on instrument type, the market is segmented into total organic carbon (TOC) meter, pH meter, dissolved oxygen meter, conductivity meter, turbidity meter, spectrometer, chromatograph, and others.

Trends in the instrument type:

- Technological advancements in water testing and monitoring solutions are driving the market. Innovations such as IoT-enabled sensors, real-time data monitoring, and advanced analytics are enhancing the accuracy and efficiency of these systems.

- With the increasing need for clean and safe water for domestic, industrial, and agricultural purposes, there is a growing need for efficient water analysis and monitoring systems.

The spectrometer segment accounted for the largest revenue in the year 2024.

- Industries such as pharmaceuticals, food and beverage, and chemicals are increasingly adopting water assessment spectrometers to monitor and control the quality of water used in their processes.

- The need for maintaining high standards of water quality in these industries to ensure product safety and compliance with regulatory standards is further fuelling the need for water assessment spectrometers.

- The increasing awareness regarding water pollution and its adverse effects on human health and the environment are significant factors propelling the segment development.

- For instance, Horiba’s UV spectroscopy-based instruments are widely used for water monitoring. They can quickly capture new data that leads to rapid responses to water quality changes.

- Thus, the above factors are further driving the water analysis instrumentation market growth.

The total organic carbon (TOC) meter segment is anticipated to register the fastest CAGR during the forecast period.

- TOC meter is used to measure the amount of organic carbon in water. This analyser plays a crucial role in detecting organic contaminants in both potable and wastewater sources, making it essential in industries such as pharmaceuticals, food and beverage, and municipal water treatment.

- TOC meters help to monitor the cleanliness of water and identify potential sources of pollution, ensuring that water quality standards are met.

- The use of artificial intelligence is expected to boost the total organic carbon (TOC) meter segment. AI helps in predicting the performance of the analyzer, thereby reducing the chances of errors and ensuring accurate results.

- The integration of AI with TOC analyzers helps in real-time monitoring and assessment, providing quick and accurate results.

- Thus, based on the above analysis, these factors are expected to drive the water analysis instrumentation market share during the forecast period.

By Product Type:

Based on product type, the market is segmented into portable & handheld and benchtop.

Trends in the product type:

- The adoption of benchtop and portable equipment is driven by the need for accurate and reliable data in research and development activities, as well as in regulatory compliance testing.

- The integration of advanced monitoring systems within portable and benchtop segments allows real-time data collection and monitoring, enabling proactive management of water resources.

The benchtop segment accounted for the largest revenue in the year 2024.

- Benchtop devices are larger and more powerful instruments designed for laboratory or more permanent setups. These devices are typically used in environments that require high accuracy, detailed assessments, and the ability to process large sample volumes.

- Benchtop water testing equipment is commonly used in research laboratories, water treatment facilities, and industrial applications where precise data is required to ensure compliance with regulations or to carry out in-depth water quality testing and assessments.

- These instruments often offer more advanced features and higher levels of accuracy than portable and handheld devices, making them ideal for in-depth scientific analysis and regulatory testing.

- Despite being larger and less portable, benchtop devices play an essential role in providing reliable, high-quality results for more complex water testing applications.

- For instance, in 2022, YSI Inc., a Xylem Inc. company, launched the Turb 750 T, a new benchtop turbidimeter. This device provides affordable turbidity measurements up to 1100 FNU/NTU, includes analytical quality assurance features, and meets EPA 180.1 standards.

- Thus, based on the above analysis, these factors would further supplement the global market.

The portable & handheld segment is anticipated to register the fastest CAGR during the forecast period.

- Portable testers are commonly used for routine water quality checks in municipalities, agricultural applications, and environmental monitoring, enabling users to conduct tests without the need for specialized laboratory equipment.

- The portability of these devices provides the flexibility for real-time testing, allowing users to make prompt decisions in response to changes in water quality.

- Handheld devices are particularly valued for their ease of use, with simple interfaces that allow operators to perform tests and obtain results without needing specialized knowledge.

- Their versatility and affordability make them popular among a wide range of users for maintaining clean water in various settings.

- Hence, the aforementioned factors are anticipated to further drive the water analysis instrumentation market trends during the forecast period.

By Test Type:

Based on test type, the market is segmented into physical test, chemical test, and biological test.

Trends in the test type:

- There is a growing trend towards continuous monitoring and real-time data acquisition directly at the source or in pipelines, reducing the reliance on laborious manual sampling and laboratory assessments. This enables immediate detection of changes and faster responses.

- The increasing global population and industrial needs put immense pressure on freshwater resources. This drives the need for efficient water treatment, testing types, and sustainable water management practices.

- These factors are anticipated to further drive the water analysis instrumentation market trends during the forecast period.

The physical test segment accounted for the largest revenue in the year 2024, and it is expected to register the highest CAGR during the forecast period.

- Physical tests are crucial for assessing water quality. These tests measure characteristics like color, total solids, turbidity, suspended solids, dissolved solids, odor, and taste.

- Physical tests facilitate on-site testing in remote locations, quick diagnostic checks, and rapid response during emergencies or for compliance checks by field personnel. This reduces the time and cost associated with sending samples to a lab.

- The growing need for rapid and accurate physical parameter monitoring to ensure drinking water safety, detect contamination early, and provide public confidence. This includes monitoring for even subtle changes in taste, odor, or color.

- Thus, based on the above analysis, these factors are driving the water analysis instrumentation market growth.

By Application:

Based on application, the water analysis instrumentation market is segmented into environmental monitoring, water treatment, and research development.

Trends in the application:

- The increasing exploitation of groundwater resources for agriculture and domestic use is driving the demand for advanced water monitoring equipment.

- The growing emphasis on data-driven decision-making and predictive maintenance is further fueling the demand for water analysis and instrumentation solutions in several applications, such as water treatment and municipal water treatment, among others.

The water treatment segment accounted for the largest revenue in the year 2024.

- The growing awareness about waterborne diseases and the rising demand for safe drinking water are propelling the adoption of water quality monitoring equipment.

- The adoption of water treatment systems combining technologies such as reverse osmosis (RO) and ultraviolet (UV) purification has surged due to the emergence and integration of innovative treatment methods.

- The adoption of water recycling and reuse strategies within several industries to minimize operational costs and adhere to environmental standards is significantly contributing to market development.

- Furthermore, technological advancements in water treatment processes, such as the development of cost-effective and energy-efficient treatment methods, are enhancing the capabilities of water treatment systems, making them more appealing to industrial end-users.

- For instance, in October 2024, the U.S. government announced USD 35 million for water infrastructure in New Hampshire. This initiative will enable communities throughout the region to enhance their water infrastructure. This is crucial for safely managing wastewater, safeguarding local freshwater resources, and providing safe drinking water to residences, educational institutions, and businesses.

- Therefore, the above factors are further driving the global market.

The environmental monitoring segment is anticipated to register the fastest CAGR during the forecast period.

- The integration of internet of things(IoT) and artificial intelligence (AI) with environmental monitoring systems is enabling real-time data collection and reporting.

- These technological advancements are not only improving the precision of water monitoring but also reducing operational costs, making advanced systems more accessible to a broader range of end-users.

- Environmental protection agencies and conservation organizations are investing heavily in monitoring infrastructure to ensure sustainable water management. These investments are aimed at both mitigating pollution and managing water resources more effectively.

- Hence, the above factors are anticipated to further drive the water analysis instrumentation market expansion during the forecast period.

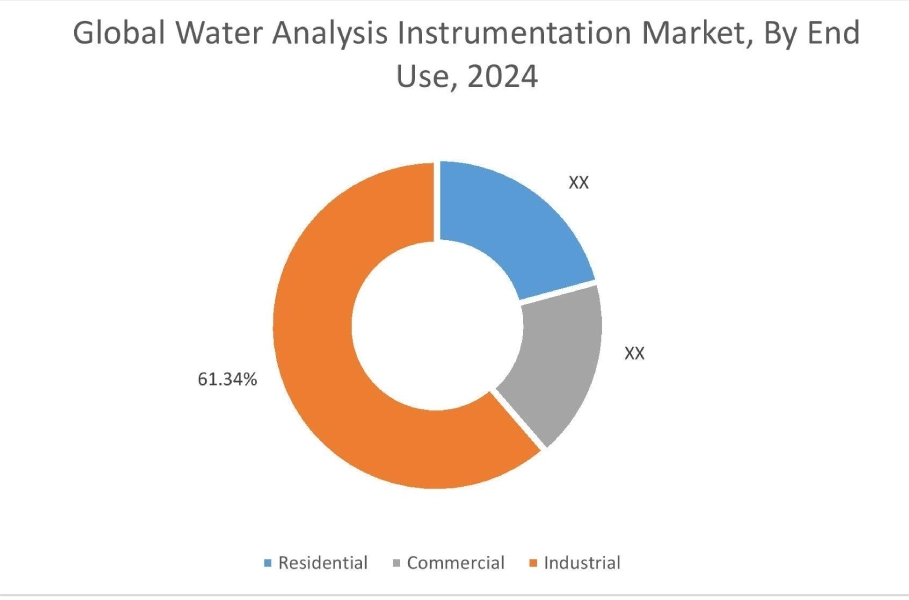

By End-Use:

Based on end use, the market is segmented into residential, commercial, and industrial.

Trends in the end use:

- The need for water analysis instruments is driven by the increasing prevalence of water pollution from industrial discharges, agricultural surpluses, and urbanization.

- Agricultural entities use water analysis instruments to ensure the quality of water used for irrigation and livestock, thereby enhancing agricultural productivity and sustainability. The diverse end-user base for water quality monitoring equipment highlights its importance in various sectors, driving the market development.

The industrial segment accounted for the largest revenue share of 61.34% in the year 2024.

- Industrial end-users, such as manufacturing plants, power generation facilities, and chemical industries, rely on water quality monitoring equipment to ensure compliance with environmental regulations and optimize their processes.

- Industrial processes often involve the use of water for cooling, cleaning, and production, generating wastewater that needs to be monitored and treated.

- The implementation of stringent discharge regulations and the increasing focus on sustainable industrial practices are driving the adoption of water analysis and monitoring equipment in the industrial sector.

- Therefore, the above factors are driving the water analysis instrumentation market demand.

The residential segment is anticipated to register the fastest CAGR during the forecast period.

- The residential sector is also witnessing an increasing need for water quality monitoring equipment. Homeowners are becoming more aware of the potential contaminants in their water supply and are investing in monitoring systems to ensure the safety and quality of their drinking water.

- The growing concern about the health effects of water pollution and the increasing availability of affordable and user-friendly monitoring devices are driving the adoption of water quality monitoring equipment in the residential sector.

- Thus, the above factors are anticipated to drive the market during the forecast period.

Regional Analysis:

The global market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa (MEA), and Latin America.

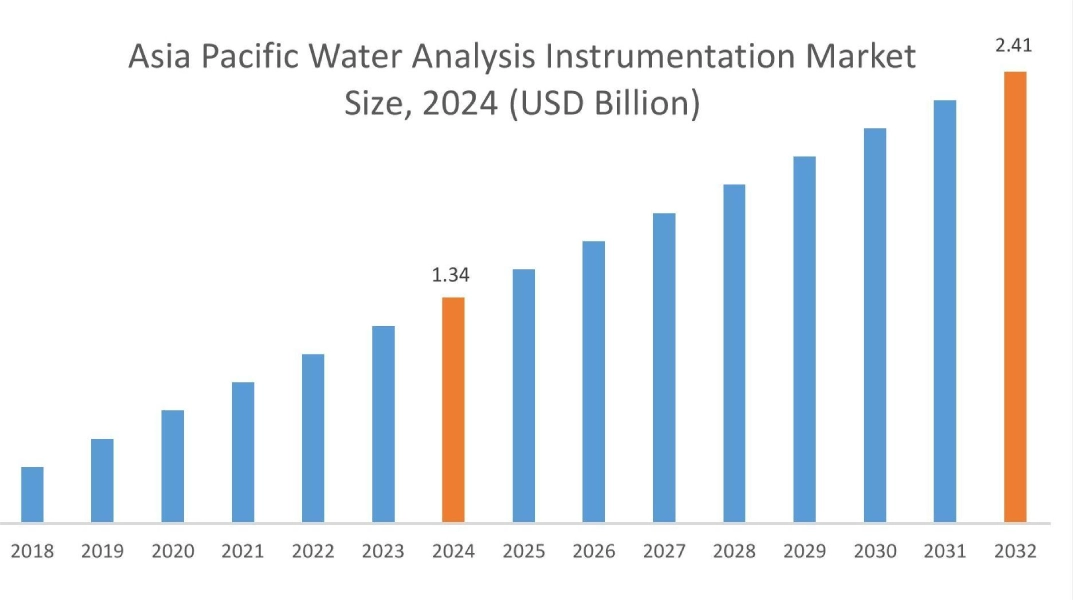

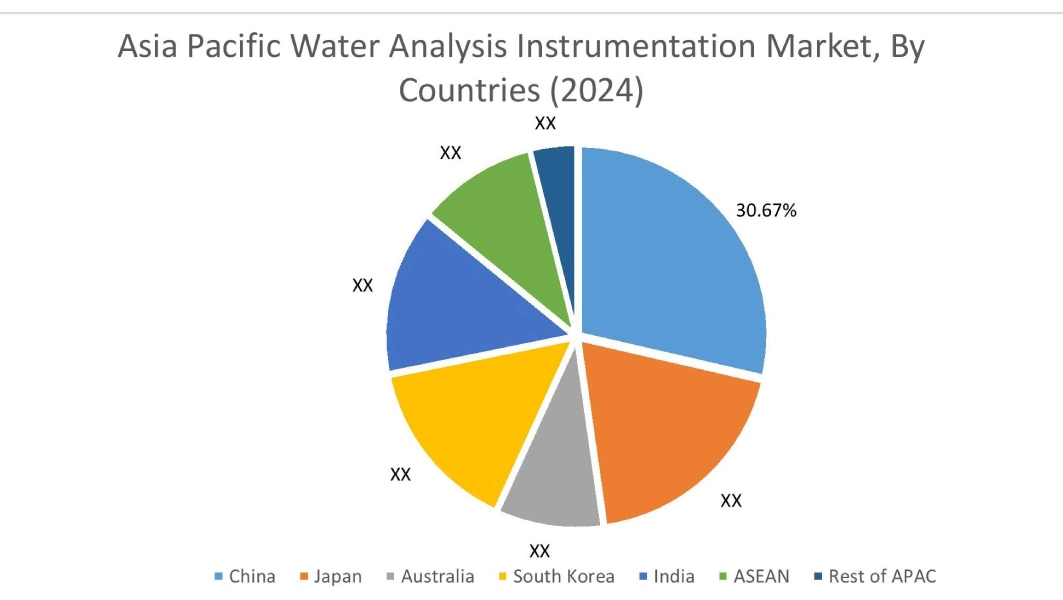

Asia Pacific mobility as a service market expansion is estimated to reach over USD 2.41 billion by 2032 from a value of USD 1.34 billion in 2024 and is projected to grow by USD 1.42 billion in 2025. Out of this, the China market accounted for the maximum revenue split of 30.67%. The Asia-Pacific region is experiencing rapid growth and holds a considerable share of the market, driven by increasing urbanization, industrialization, and the need for advanced water monitoring solutions. Countries in the region are investing heavily in modernizing their water infrastructure to address growing population demands and water scarcity issues. Further, the region's dynamic growth and expanding infrastructure projects create significant opportunities for automation and instrumentation technologies, contributing to its growing market share. These factors would further drive regional water analysis instrumentation market share during the forecast period.

- For instance, LABOAO’s water quality analyzers are designed to measure the content of various indicators in water quality, such as dissolved oxygen, pH, and total bacterial colonies. It is widely used in several applications across various sectors, including power generation, water treatment, beverage production, and environmental protection. It is also crucial for industrial water management, aquaculture, textile industry, winemaking, pharmaceutical manufacturing, epidemic prevention, and healthcare facilities.

North America market is estimated to reach over USD 2.81 billion by 2032 from a value of USD 1.64 billion in 2024 and is projected to grow by USD 1.73 billion in 2025. North America holds a dominant position in the water quality monitoring equipment market, driven by stringent environmental regulations and substantial investments in water infrastructure. The United States Environmental Protection Agency (EPA) plays a crucial role in setting and enforcing water quality standards, driving the adoption of advanced water analysis systems. The presence of leading market players and continuous technological advancements further contribute to the market growth in this region. Additionally, the increasing focus on sustainable water management practices and the implementation of smart water technologies are expected to drive market development in the region. These factors would further drive the regional market.

- For instance, in February 2023, Thermo Fisher Scientific introduced water analysis systems, Aqua Master, for industrial and agricultural testing. The new Thermo Scientific Gallery Plus Aqua Master and Thermo Scientific Gallery Aqua Master analyzers streamline high-volume, multi-parameter wet chemistry analysis. It utilizes custom software that automates workflows, ensuring tests meet EPA-approved methods and other international standards.

Additionally, according to the analysis, the water analysis instrumentation industry in Europe is expected to witness significant development during the forecast period. The European market benefits from extensive investments in water analysis technologies and instrumentation to enhance operational performance and meet regulatory compliance, strengthening its substantial share in the global market. Additionally, the increasing focus on sustainable water management practices and the implementation of smart water technologies are expected to drive market development in Latin America. Further, the increasing focus on reducing water pollution and ensuring safe drinking water is propelling market growth in the Middle East & Africa region.

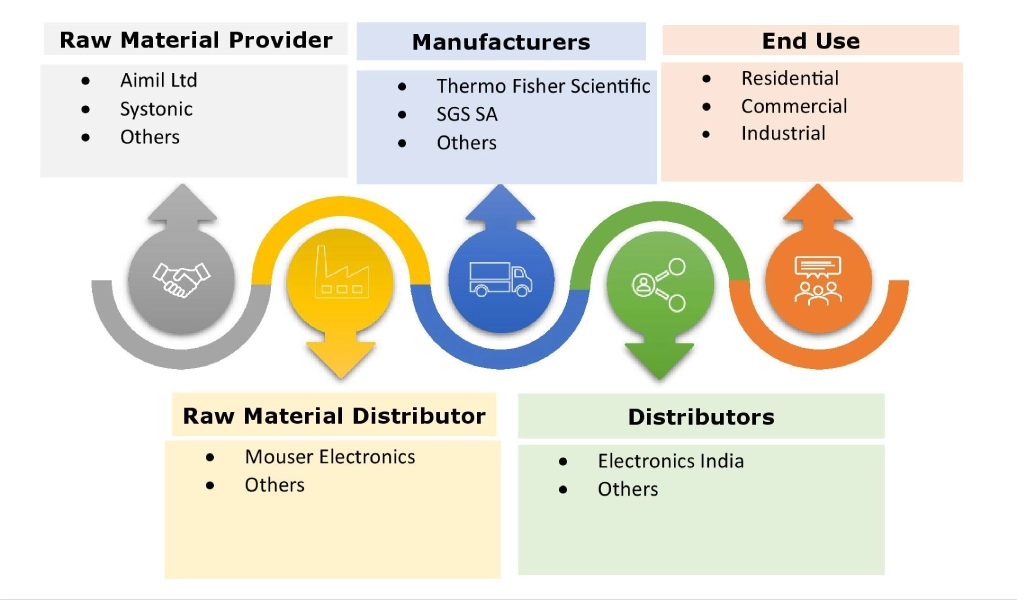

Top Key Players and Market Share Insights:

The global water analysis instrumentation market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the water analysis instrumentation industry include-

- Thermo Fisher Scientific (U.S.)

- SGS SA (Switzerland)

- Honeywell International, Inc. (U.S.)

- 3M (U.S.)

- Shimadzu Corporation (Japan)

- Xylem Inc. (U.S.)

- Agilent Technologies (U.S.)

- Horiba Ltd. (Japan)

- Emerson Electric Co. (U.S.)

- Danaher Corporation (U.S.)

Recent Industry Developments :

Product Launch:

- In March 2023, Hanna Instruments unveiled its new HI6421P advanced benchtop meter series, designed specifically for laboratory and research applications. This series excels at measuring pH, dissolved oxygen, and conductivity. The HI6421P is a streamlined benchtop meter that is equipped with Hanna's polarographic oxygen analysis and features a large touchscreen display for precise measurements in both saltwater and freshwater.

Water Analysis Instrumentation Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 8.20 Billion |

| CAGR (2025-2032) | 6.3% |

| By Instrument Type |

|

| By Product Type |

|

| By Test Type |

|

| By Application |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Water Analysis Instrumentation Market? +

Water Analysis Instrumentation Market Size is estimated to reach over USD 8.20 Billion by 2032 from a value of USD 4.78 Billion in 2024 and is projected to grow by USD 5.03 Billion in 2025, growing at a CAGR of 6.3% from 2025 to 2032.

Which is the fastest-growing region in the Water Analysis Instrumentation Market? +

Asia-Pacific is the region experiencing the most rapid growth in the market.

What specific segmentation details are covered in the Water Analysis Instrumentation report? +

The mobility as a service report includes specific segmentation details for instrument type, product type, test type, application, end use, and region.

Who are the major players in the Water Analysis Instrumentation Market? +

The key participants in the market are Thermo Fisher Scientific (U.S.), SGS SA (Switzerland), Xylem Inc. (U.S.), Agilent Technologies (U.S.), Horiba Ltd. (Japan), Emerson Electric Co. (U.S.), Danaher Corporation (U.S.), Honeywell International, Inc. (U.S.), 3M (U.S.), Shimadzu Corporation (Japan), and others.