Wireless Fire Detection System Market Size:

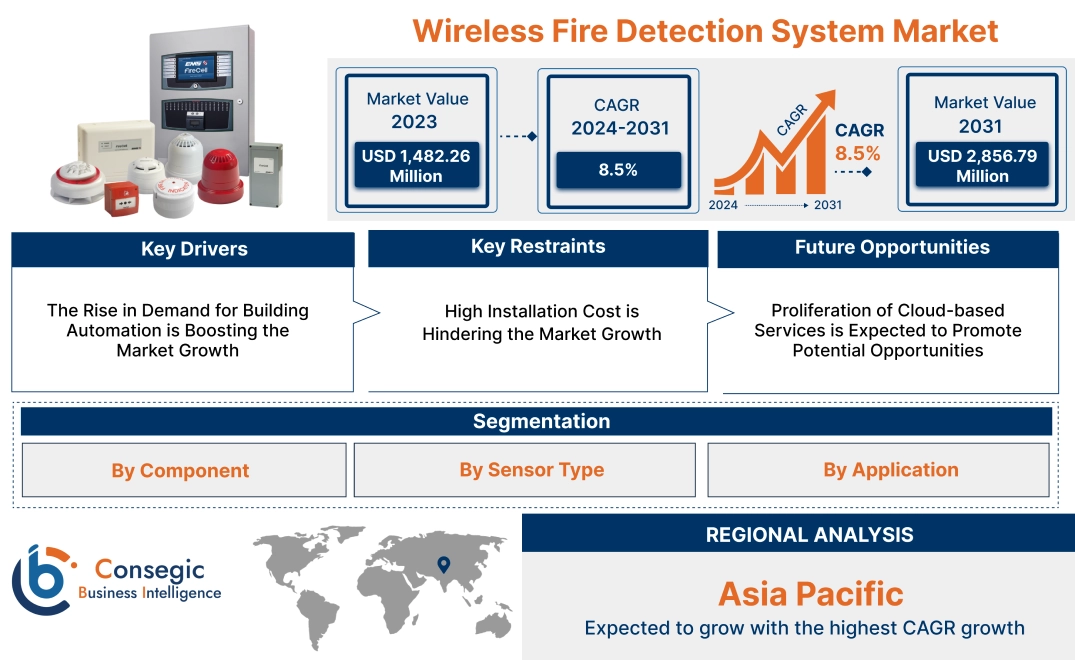

The Wireless Fire Detection System Market size is estimated to reach over USD 2,856.79 Million by 2031 from a value of USD 1,482.26 Million in 2023 and is projected to grow by USD 1,582.55 Million in 2024, growing at a CAGR of 8.5% from 2024 to 2031.

Wireless Fire Detection System Market Scope & Overview:

A wireless fire detection system refers to an alarm system that uses wireless technologies to detect and report fire-related events without the need for extensive cabling. These systems transmit signals through radio frequency (RF) communication. Additionally, the main components of this system include wireless smoke detectors, heat detectors, manual call points, control panels, and alarm sounders or visual indicators. This enables more flexible and less intrusive installation, particularly in environments including historical buildings, large industry facilities, or temporary structures. The aforementioned factors of wireless fire detection systems are major determinants for increasing their deployment in commercial residential, and other industries.

Wireless Fire Detection System Market Insights:

Wireless Fire Detection System Market Dynamics - (DRO) :

Key Drivers:

The Rise in Demand for Building Automation is Boosting the Market Growth

Building Automation includes an automatic fire alarm system that detects the fire and alerts the building occupants by alarm bells. As buildings become smarter and more integrated, the need for advanced fire detection systems that seamlessly connect with other building functions is increasing. These systems offer flexibility to be incorporated into broader building automation systems (BAS), which manage various functions including HVAC, lighting, and security. Additionally, this integration enhances the overall efficiency and safety of modern buildings, making wireless systems the preferred choice. Moreover, these systems provide enhanced remote monitoring and controlling capabilities, essential for the real-time management that building automation demands.

- In August 2022, Honeywell launched a Morley MAx fire detection and alarm system for enhancing building and occupant safety. This system is an advanced scalable fore detection solution equipped with intelligent detection and control capabilities, offering real-time monitoring.

Therefore, the increasing need for automated fire detectors in smart buildings is proliferating the wireless fire detection system market growth.

Key Restraints :

High Installation Cost is Hindering the Market Growth

The wireless fire detection system offers numerous benefits including flexibility, scalability, and ease of integration with the building automation systems, the upfront investment is significantly high. This includes the cost of advanced wireless sensors, control panels, and other related components along with the need for specialized installation expertise. Additionally, the ongoing maintenance costs and installation fees add to the overall expense, making it less accessible for small and medium enterprises.

- For instance, according to the wireless fire detection system market analysis, the installation cost approximately ranges from USD 10000 and USD 50000 depending on the magnitude and complexity of the building. In addition, the installation fee ranges from USD 200 to USD 2000 or more per device.

Hence, high installation costs are hindering the wireless fire detection system market demand.

Future Opportunities :

Proliferation of Cloud-based Services is Expected to Promote Potential Opportunities

As more businesses transition to cloud-based platforms, integrating detection systems with cloud services represents significant growth. Cloud-based solution enhanced data management and accessibility by allowing fire detection systems to store and process data in real time on remote server. Moreover, this approach facilitates advanced analytics, trend analysis, and remote monitoring, enabling building managers and safety personnel to access crucial information. This capability allows facility managers to receive instant alerts, access system data, and control fire detection systems through an internet connection.

- In September 2022, Siemens introduced digital services and a managed service portfolio for fire safety that connects the fire detection systems to the cloud. This portfolio enables real-time monitoring for hazard identification and prevention of fire detection through cloud-based platforms.

Therefore, cloud-based platforms offer real-time monitoring and risk analysis, which is driving the wireless fire detection system market trend.

Wireless Fire Detection System Market Segmental Analysis :

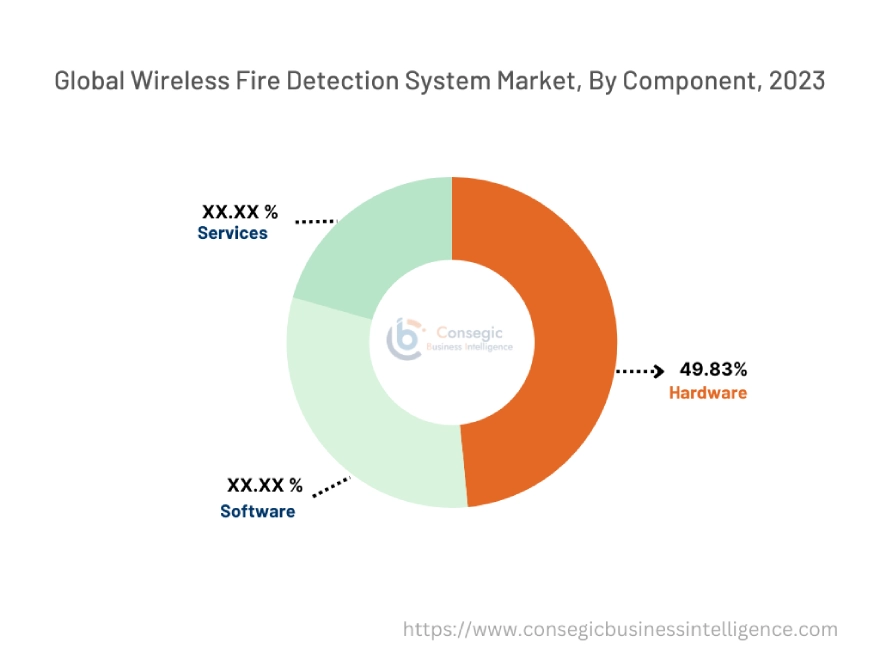

By Component:

Based on components the market is trifurcated into hardware, software, and services.

Trends in the Component:

- The incorporation of AI and machine learning into analytics and reporting software is becoming a prominent trend. These technologies enable more sophisticated data analysis, predictive maintenance, and anomaly detection, improving the system's ability to prevent false alarms and identify potential fire risks.

- There is a growing demand for tailored fire detection solutions and specialized consulting services, particularly for complex or high-risk environments including industrial facilities, hospitals, and large commercial buildings.

The hardware component accounted for the largest revenue share of 49.83% in 2023.

- Hardware component elements include sensors, detectors, control panels, fire alarms, and wireless modules.

- The sensors and detectors are essential for early detection of fire hazards while control panels and alarms are crucial for system management and emergency notification.

- Additionally, these advancements in detectors provide more accurate and faster detection of life hazards, reducing false alarms and improving overall system reliability.

- In September 2022, Honeywell introduced a Smoke detection and Indoor Air Quality Monitoring System built on the VESDA-E line. The solution is incorporated with an IAQ sensor to help enhance building safety by offering improved monitoring.

- Thus, sensors and detectors are influencing the hardware component by offering enhanced building safety to boost the global wireless fire detection system market trend.

The software is anticipated to register the fastest CAGR during the forecast period.

- Software components include the various software applications and platforms that support the operation, monitoring, and control of fire detection devices.

- There is a growing trend of increasing integration of advanced analytics, cloud-based management platforms, and AI-driven predictive maintenance solutions.

- Additionally, incorporating smart building technologies significantly boosts the need for advanced software.

- These advanced software solutions support enhanced scalability and functionality of fire detection systems.

- In July 2021, IDEMIA collaborated with Bosch Building Technologies to offer software solutions. This solution manages different Bosch security subsystems including access control, video surveillance, fire detection, public address, and intrusion systems for smart building security.

- Hence, advancements in software solutions offer improved advanced and predictive analytics is fueling the wireless fire detection system market opportunities.

By Sensor Type:

Based on sensor type the market is segmented into smoke detectors, heat detectors, gas detectors, multi-sensor detectors, flame detectors, and others.

Trends in the Sensor Type:

- Modern heat detectors are incorporating advanced algorithms to better analyze temperature changes and distinguish between fire-related heat increases and other environmental factors. This trend helps in reducing false alarms and improving response accuracy.

- Flame detectors are increasingly using advanced sensing technologies, including digital signal processing and sophisticated optics, to improve their ability to detect flames quickly and accurately.

The smoke detector accounted for the largest revenue share in 2023.

- Smoke detectors are highly effective at detecting the presence of smoke which is the primary indication of fire.

- It provides early warnings allowing for timely evacuation and response improving accuracy.

- These detectors are widely used in both residential and commercial settings, making them a staple in fire safety systems.

- In January 2023, Siemens introduced FDA261 and FDA262, smoke detectors particularly preferred for critical infrastructure and large protection buildings. It provides comprehensive smoke detection with improved accuracy preventing mishaps from happening.

- Therefore, as per the analysis, smoke detectors are boosting the wireless fire detection system market share

The multi-sensor detector is anticipated to register the fastest CAGR during the forecast period.

- Multi-sensor detectors combine smoke, heat, and gas detection capabilities into a single unit, providing a more comprehensive approach to fire detection.

- These detectors are increasingly incorporating advanced data processing technologies, including AI and machine learning to analyze multiple indicators of fire and improve accuracy.

- Additionally, these detectors are well suited to smart building systems and IoT devices enabling real-time monitoring, automated responses, and enhanced connectivity.

- For instance, Blazequel's multi-sensor smoke and heat detectors are designed to provide comprehensive fire safety by integrating both smoke and heat detection capabilities into a single device.

- Consequently, as per the analysis, the ability of multi-sensor detectors to detect smoke, heat, and gas is proliferating the global wireless fire detection system market growth.

By Application:

Based on application the market is segmented into industrial, commercial, residential, and others.

Trends in the Application:

- The industrial sector is increasingly adopting advanced fire detection technologies including multi-sensor detectors and IoT-enabled systems. These solutions offer enhanced accuracy and real-time monitoring, which are critical in high-risk environments including manufacturing plants, oil and gas facilities, and chemical industries.

- The residential segment is experiencing significant growth towards the adoption of smart home technologies, including smart smoke detectors. These devices are often integrated with home automation systems, allowing homeowners to monitor and control fire safety remotely through smartphones and connected devices.

The commercial segment accounted for the largest revenue share in the year 2023 and is anticipated to register the fastest CAGR during the forecast period.

- The commercial sector including offices, retail spaces, hotels, and other public facilities, is increasingly embracing smart building technologies.

- Fire detection systems in these settings are often integrated with comprehensive building management systems.

- It provides centralized control and monitoring capabilities that enhance safety, accuracy, and operation efficiency.

- In March 2021, Johnson Controls launched 700 Series Conventional Fire Detectors. It includes a range of smoke detectors designed to deliver reliable and precise fire detection in various environments. It offers a complete fire detection solution with improved accuracy of alerts which is ideal for commercial buildings.

- Hence, the demand for enhanced monitoring improved safety, and accuracy in the commercial sector is propelling the wireless fire detection system market.

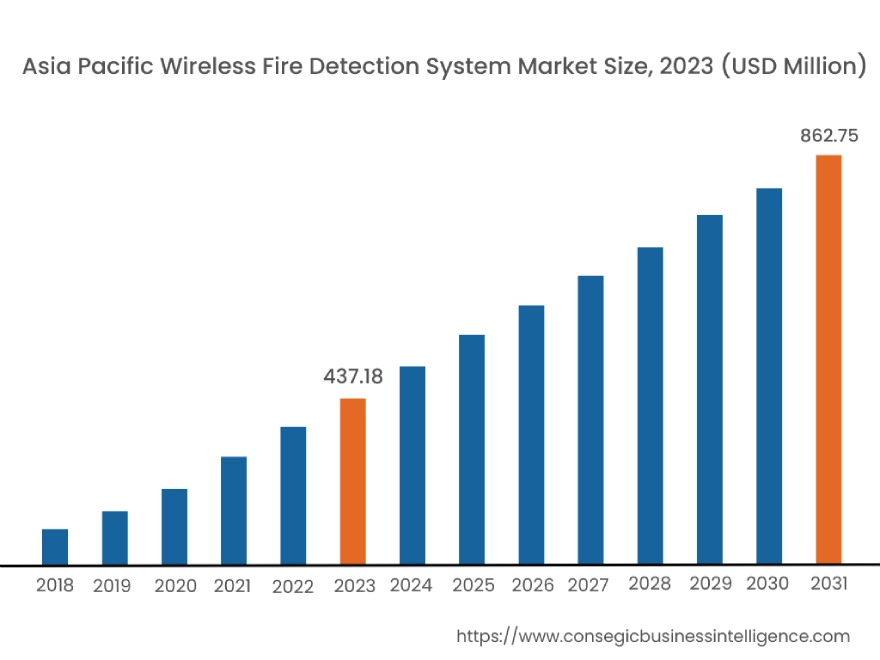

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 437.18 Million in 2023. Moreover, it is projected to grow by USD 467.69 Million in 2024 and reach over USD 862.75 Million by 2031. Out of this, China accounted for the maximum revenue share of 32.8%. Asia Pacific is poised for rapid growth in the wireless fire detection system market, fueled by rapid urbanization, infrastructure development, and increasing awareness of fire security. Countries including China, Japan, and India are experiencing a surge in demand for modern fire safety solutions as a part of their broader efforts to enhance building safety standards.

- For instance, Teledata Fire Systems (Asia) Pte Ltd is a manufacturer of wireless fire detection systems providing solutions including smoke detectors and heat detectors with easy installation.

North America is estimated to reach over USD 1,008.45 Million by 2031 from a value of USD 518.48 Million in 2023 and is projected to grow by USD 553.98 Million in 2024. According to the wireless fire detection system market analysis, the industry is driven by stringent fire safety regulations, high adoption of advanced technologies, and smart building infrastructure. The US and Canada are at the forefront with the increasing integration of wireless fire detection systems into building automation and smart city projects.

- In November 2023, Pye-Barker Fire & Safety, a fire protection, safety, and security services provider in the United States acquired three security systems and alarm companies from the Sonitrol Security Systems network.

Europe represents a significant wireless fire detection system market, particularly in countries including Germany, the UK, and France, where there is strong regulatory support for fire safety measures. The region's emphasis on sustainable building practices and smart city initiatives is driving the adoption of wireless fire detection systems.

Latin America, the Middle East, and Africa are emerging industries with growing potential Countries including Brazil, Mexico, and South Africa are increasingly adopting wireless fire detection systems as part of broader infrastructure.

Top Key Players & Market Share Insights:

The wireless fire detection system market is highly competitive with major players providing fire alarms to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the wireless fire detection system market. Key players in the wireless fire detection system industry include-

- Honeywell International, Inc (US)

- Siemens AG (Germany)

- Bosch Sicherheitssysteme GmbH (Germany)

- Hochiki Corporation (Japan)

- Fike Corporation (US)

- Johnson Controls (Ireland)

- United Technologies Corporation (US)

- SECOM Co, Ltd (Japan)

- Napco Security Technologies, Inc. (US)

- Halma plc (United Kingdom)

Recent Industry Developments :

Product Launches:

- In March 2024, Hochiki unveiled smoke detectors for UL268 7th edition compliance. The redesigned smoke chamber to optimize airflow and smoke intake. This introduced significant advancements in fire detection technology including detectors to identify smoke and flames to prevent the hazards.

- In July 2023, Johnson Controls launched Autocall Foundation Series fire detection systems for small to mid-size building protection. It features 4 fire alarm control units and a full range of notification appliances, sensors, and annunciators.

Business Expansion:

- In December 2023, Siemens expanded its fire safety offering with Building X which enables remote monitoring, real-time analysis, and predictive maintenance. This digital building platform supports digitalizing, managing, and optimizing building operations along with fire safety measures.

Wireless Fire Detection System Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 2,856.79 Million |

| CAGR (2024-2031) | 8.5% |

| By Component |

|

| By Sensor Type |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

What is the wireless fire detection system market? +

Wireless Fire Detection System refers to an alarm system that uses wireless technologies to detect and report fire-related events without the need for extensive cabling. These systems transmit signals through radio frequency (RF) communication.

How big is the wireless fire detection system market? +

The Wireless Fire Detection System Market size is estimated to reach over USD 2,856.79 Million by 2031 from a value of USD 1,482.26 Million in 2023 and is projected to grow by USD 1,582.55 Million in 2024, growing at a CAGR of 8.5% from 2024 to 2031.

What is the key market trend? +

The incorporation of AI and machine learning into analytics and reporting software is becoming a prominent trend. These technologies enable more sophisticated data analysis, predictive maintenance, and anomaly detection, improving the system’s ability to prevent false alarms and identify potential fire risks.

Who are the major key players in the wireless fire detection system market? +

The key players in the wireless fire detection system market are Honeywell International, Inc (US), Siemens AG (Germany), Johnson Controls (Ireland), Bosch Sicherheitssysteme GmbH (Germany), Hochiki Corporation (Japan), Fike Corporation (US), Halma plc (United Kingdom), United Technologies Corporation (US)SECOM Co, Ltd (Japan) and others.