4D Printing in Healthcare Market Size:

4D Printing in Healthcare Market size is estimated to reach over USD 11.72 Billion by 2031 from a value of USD 2.45 Billion in 2023 and is projected to grow by USD 2.94 Billion in 2024, growing at a CAGR of 21.6% from 2024 to 2031.

4D Printing in Healthcare Market Scope & Overview:

4D printing in healthcare refers to the application of smart materials that can change shape or properties over time in response to external stimuli such as heat, light, or moisture. This technology enhances traditional 3D printing by enabling the production of dynamic medical devices and implants that adapt to changing physiological conditions. Key applications of 4D printing include self-adjusting stents, responsive drug delivery systems, and adaptive prosthetics, all of which contribute to personalized treatments and improved patient care. End-use sectors such as hospitals, research institutions, and medical device manufacturers are leading the development and application of 4D printing technologies. As these innovations gain traction, the market is poised for strong growth, driven by the potential for improved clinical outcomes and the creation of dynamic, responsive medical solutions.

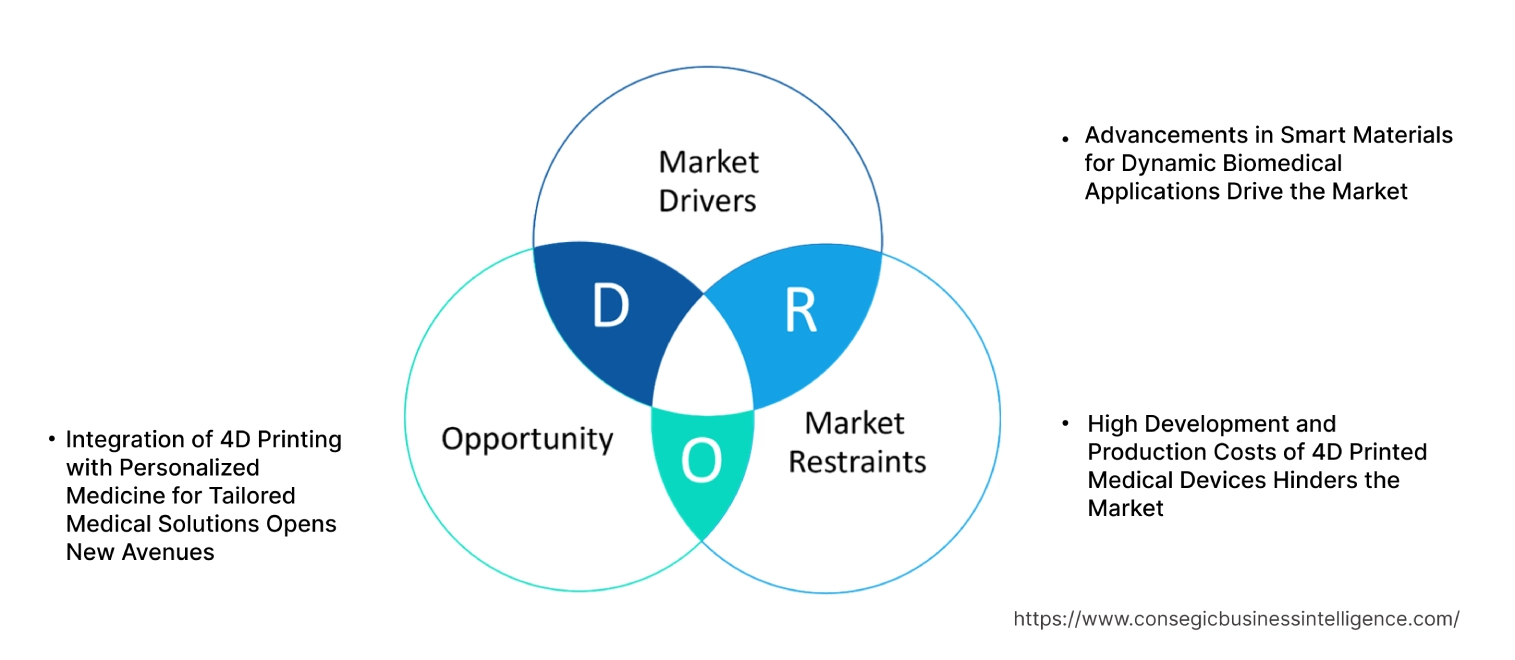

4D Printing in Healthcare Market Dynamics - (DRO) :

Key Drivers:

Advancements in Smart Materials for Dynamic Biomedical Applications Drive the Market

One of the key drivers in the 4D printing in healthcare market growth is the rapid advancement of smart materials that can change shape, structure, or function in response to environmental stimuli such as heat, moisture, or chemical exposure. These materials, including shape-memory polymers, hydrogels, and stimuli-responsive composites, are revolutionizing the design of medical devices and implants. For example, shape-memory polymers are used to create self-expanding stents that can be deployed with minimal surgical intervention and automatically adjust to the patient's body temperature. This technology significantly improves outcomes in minimally invasive procedures by reducing trauma and recovery time. Additionally, these smart materials are enabling the development of adaptive wound dressings that respond to changes in pH levels or temperature, releasing medication or changing their form to promote faster healing. The ongoing research into more robust, biocompatible materials will continue to drive the application of 4D printing in healthcare, allowing for the production of dynamic, patient-specific medical devices that enhance precision and functionality.

Key Restraints :

High Development and Production Costs of 4D Printed Medical Devices Hinders the Market

Despite its transformative potential, the adoption of 4D printing technologies in healthcare is currently constrained by the high development and production costs associated with creating responsive materials and manufacturing complex, adaptable medical devices. The design and production of smart materials require highly specialized equipment, sophisticated software, and advanced material science knowledge, all of which contribute to elevated costs. Moreover, the production processes must undergo rigorous testing to meet the stringent regulatory standards required for medical devices, particularly in regions with complex regulatory environments like the U.S. and Europe. This involves extensive validation, clinical trials, and post-market surveillance, which significantly increases time-to-market and costs. The lack of scalable, cost-effective manufacturing solutions for 4D printing further limits its widespread adoption, especially among smaller healthcare providers and in markets with constrained healthcare budgets. These financial and logistical barriers must be addressed to accelerate the adoption of 4D printing technologies in mainstream healthcare applications.

Future Opportunities :

Integration of 4D Printing with Personalized Medicine for Tailored Medical Solutions Opens New Avenues

The intersection of 4D printing and personalized medicine offers a highly promising 4D printing in healthcare market opportunity, as the ability to create patient-specific devices and implants aligns with the broader healthcare trend toward individualized treatment plans. Using data from imaging technologies like MRI and CT scans, 4D printing can produce customized implants, prosthetics, and tissue scaffolds that adapt to the patient's unique anatomical and physiological requirements. This is particularly valuable in fields such as orthopedics and reconstructive surgery, where patient-specific implants can significantly improve surgical outcomes, reduce recovery times, and lower the risk of postoperative complications. For example, 4D-printed scaffolds used in regenerative medicine can be designed to mimic the patient's tissue structure, improving the efficacy of tissue engineering therapies. These devices can respond to the body's natural healing process, gradually changing their form or releasing therapeutic agents as required. As healthcare systems increasingly shift towards precision medicine, the demand for adaptive, patient-specific medical devices is expected to grow, positioning 4D printing as a critical tool for future healthcare solutions.

4D Printing in Healthcare Market Segmental Analysis :

By Component:

Based on components, the market is segmented into equipment, programmable materials (shape-memory materials, hydrogels, others), software, and services.

The programmable materials segment accounted for the largest revenue share of the total 4D printing in healthcare market share in 2023.

- Programmable materials, particularly shape-memory materials, and hydrogels, are at the core of 4D printing technology in healthcare.

- These materials are designed to change shape, properties, or behavior over time in response to stimuli such as temperature, moisture, or light, making them highly suitable for dynamic medical applications like tissue engineering and organ regeneration.

- Shape-memory materials are gaining traction due to their ability to respond to biological environments, enabling the development of self-assembling implants and scaffolds.

- Hydrogels, known for their biocompatibility, are extensively used in regenerative medicine and controlled drug delivery systems.

- The increasing demand for innovative materials that can evolve post-implantation is driving the growth of this segment.

- Thus, the analysis of segmental trends shows that programmable materials lead the market, driven by their unique ability to respond to environmental stimuli, which enhances their application in tissue engineering and medical implants, particularly in dynamic healthcare solutions, driving the 4D printing in healthcare market demand.

The software segment is anticipated to register the fastest CAGR during the forecast period.

- Software plays a critical role in the 4D printing process, from design to simulation and testing.

- Advanced software solutions are essential for modeling complex structures, predicting material behaviors, and controlling the transformation of programmable materials over time.

- With the growing complexity of 4D printing applications, particularly in custom implants and tissue engineering, demand for sophisticated software solutions that can simulate various biological conditions is expected to grow.

- The ability to integrate software with design and manufacturing processes is making it a vital component in the rapid adoption of 4D printing technologies in healthcare.

- Thus, the market trends depict that the software segment is expected to grow rapidly as healthcare providers and manufacturers increasingly rely on advanced simulation tools to design and test the performance of 4D printed materials and devices under dynamic conditions, proliferating the 4D printing in healthcare market trends.

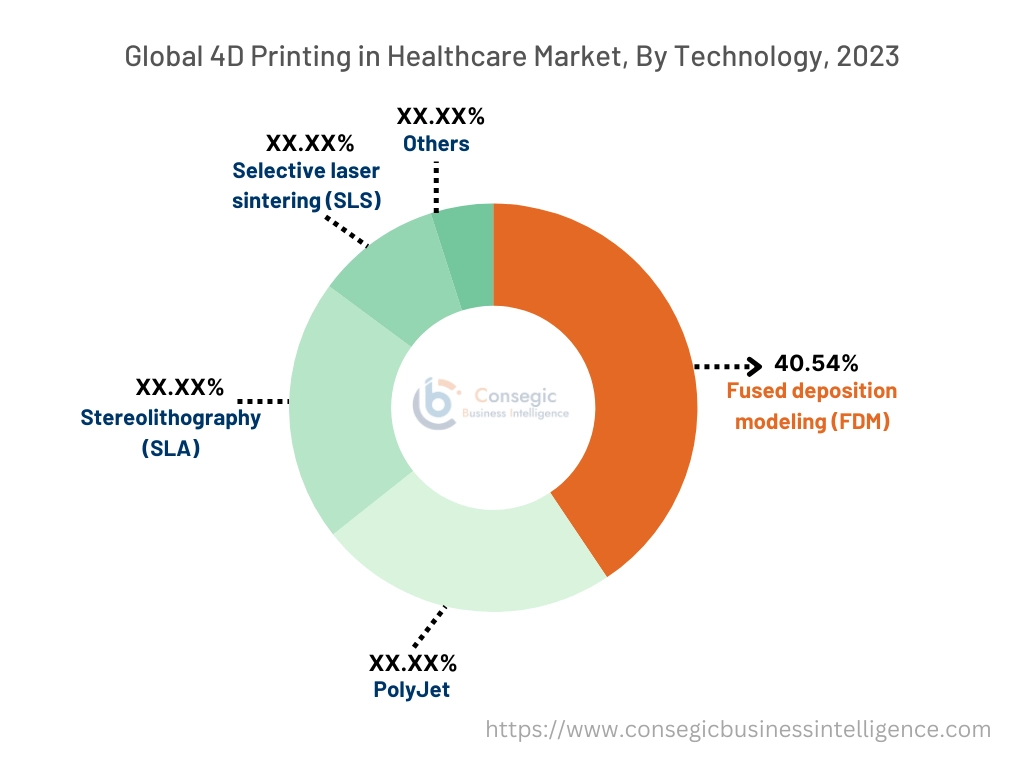

By Technology:

Based on technology, the market is segmented into fused deposition modeling (FDM), PolyJet, stereolithography (SLA), selective laser sintering (SLS), and others.

The fused deposition modeling (FDM) segment accounted for the largest revenue share of 40.54% in 2023.

- Fused deposition modeling (FDM) is one of the most widely used 3D and 4D printing technologies due to its affordability, accessibility, and ability to print with a variety of thermoplastic materials, including programmable ones.

- FDM is particularly popular in the production of custom medical devices, such as prosthetics, orthotics, and implants.

- The versatility of FDM in printing complex shapes and structures with high precision makes it a go-to technology for healthcare applications that require dynamic, patient-specific solutions.

- Its widespread use in research and clinical applications further reinforces its dominant position in the market.

- Hence, as per the segmental trends analysis, FDM leads the market, driven by its versatility, cost-effectiveness, and ability to print complex, patient-specific devices, boosting the 4D printing in healthcare market growth.

The selective laser sintering (SLS) segment is anticipated to register the fastest CAGR during the forecast period.

- Selective laser sintering (SLS) is gaining momentum in the healthcare sector due to its ability to print with a wide range of materials, including metals and polymers, and create highly durable, functional parts.

- SLS is increasingly used for producing high-performance medical devices, implants, and scaffolds with complex geometries that benefit from the use of programmable materials.

- Its capacity to build strong, precise parts without the need for support structures is driving its adoption in tissue engineering and organ regeneration applications, where material strength and precision are crucial.

- Hence, the SLS is expected to grow rapidly due to its ability to produce high-strength, precise medical devices, and implants, especially in applications that demand complex geometries and durable materials, creating the 4D printing in healthcare market opportunities.

By Application:

Based on application, the market is segmented into medical implants, tissue engineering, organ regeneration, and others.

The medical implants segment accounted for the largest revenue share of the overall 4D printing in healthcare market share in 2023.

- Medical implants are one of the primary applications of 4D printing, with the technology enabling the creation of highly personalized and adaptable implants that can respond to the patient's biological environment.

- Shape-memory materials are particularly beneficial in implantable devices, as they can adjust their shape to fit the surrounding tissue, reducing the risk of rejection and improving patient outcomes.

- The ability to create self-assembling or shape-shifting implants that adapt post-surgery is revolutionizing orthopedic, cardiovascular, and reconstructive surgeries.

- The growing demand for custom implants, coupled with the advancements in biomaterials, supports the leadership of this segment in the market.

- Thus, the segmental analysis depicts that the medical implants segment dominates the market, driven by the demand for personalized, adaptive implants that improve patient outcomes and reduce surgical complications, boosting the 4D printing in healthcare market demand.

The tissue engineering segment is anticipated to register the fastest CAGR during the forecast period.

- Tissue engineering is one of the most promising areas for 4D printing in healthcare, allowing for the creation of dynamic scaffolds that support the growth of new tissues.

- Hydrogels and other programmable materials are used to create biodegradable scaffolds that can change their structure in response to the body's environment, facilitating better tissue integration and regeneration.

- This application is particularly critical for wound healing, organ repair, and regenerative medicine, where the ability to grow functional tissues is essential.

- As research into 4D printed scaffolds continues to advance, the tissue engineering segment is expected to grow significantly.

- As per the 4D printing in healthcare market analysis, tissue engineering is set to grow rapidly, fueled by the need for dynamic scaffolds that enhance tissue regeneration and integration, positioning 4D printing as a transformative technology in regenerative medicine.

By End-User:

Based on end-users, the market is segmented into hospitals & surgical centers, dental clinics & laboratories, and others.

The hospitals & surgical centers segment accounted for the largest revenue share of the global 4D printing in healthcare market in 2023.

- Hospitals and surgical centers are the primary users of 4D printing technology, especially for applications such as surgical planning, custom implant creation, and regenerative medicine.

- The ability to produce patient-specific implants that can adapt over time, coupled with the technology's potential in complex surgeries, has made hospitals and surgical centers major adopters of 4D printing.

- The growing emphasis on personalized medicine and improved surgical outcomes is further driving the adoption of 4D printing technology in these settings.

- Hospitals and surgical centers dominate the market as the primary users of 4D printing technology, particularly in custom implant creation and regenerative medicine, driving the 4D printing in healthcare market expansion.

The dental clinics & laboratories segment is anticipated to register the fastest CAGR during the forecast period.

- Dental clinics and laboratories are increasingly adopting 4D printing technology for the production of custom dental implants, orthodontic devices, and prosthetics.

- The ability to produce highly accurate and patient-specific dental devices that adapt to the patient's oral environment is driving the adoption of 4D printing in the dental field.

- As the demand for personalized dental solutions grows and the technology becomes more accessible, dental clinics and laboratories are expected to rapidly embrace 4D printing for its precision and adaptability.

- Thus, dental clinics and laboratories are expected to grow rapidly as the demand for personalized, adaptive dental solutions increases, positioning 4D printing as a key technology in the dental industry, and boosting the 4D printing in healthcare market trends.

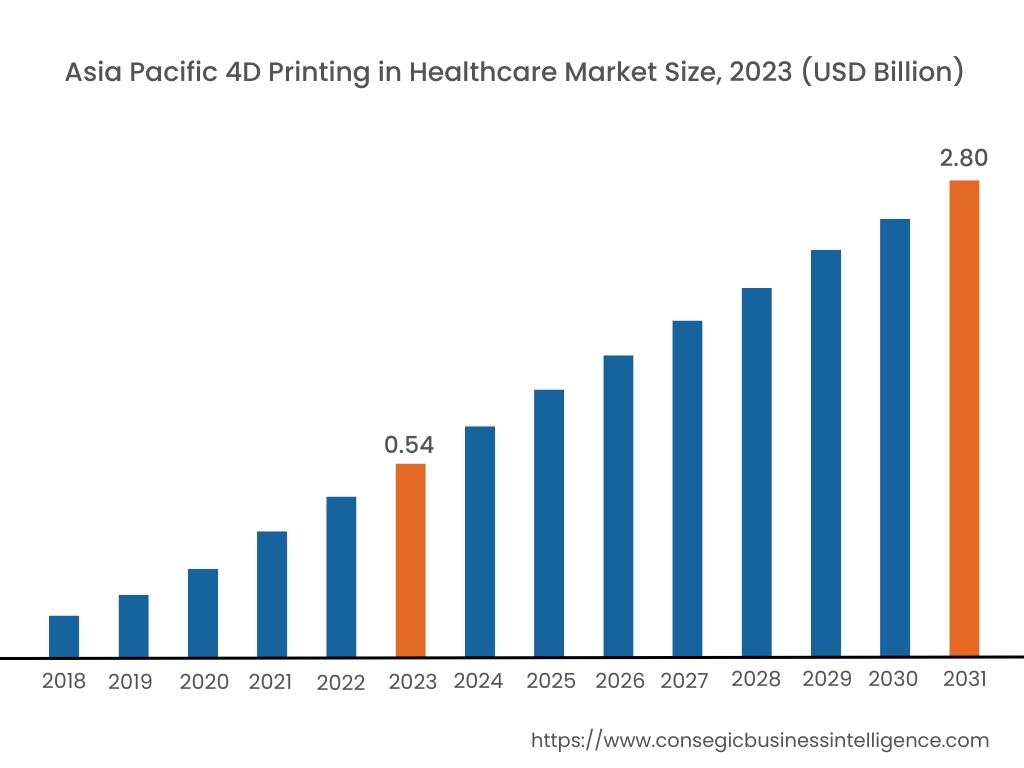

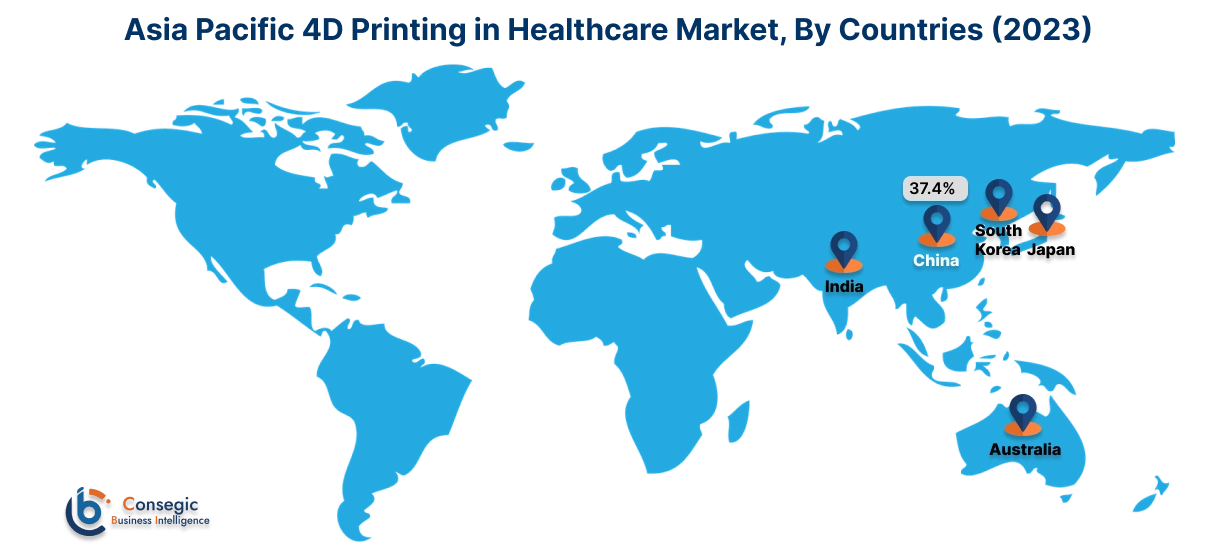

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 0.54 Billion in 2023. Moreover, it is projected to grow by USD 0.66 Billion in 2024 and reach over USD 2.80 Billion by 2031. Out of this, China accounted for 37.4% of the total market share. Asia-Pacific is the fastest-growing market, driven by increasing healthcare investments and technological advancements in countries such as China, Japan, and India. The rising prevalence of chronic diseases and the demand for personalized medical treatments are fueling the adoption of 4D printing in medical device manufacturing. Government initiatives supporting digital healthcare transformation and the expansion of healthcare infrastructure further contribute to market growth. However, challenges such as limited awareness and high costs of advanced solutions may impede 4D printing in healthcare market expansion.

North America leads the market, propelled by substantial investments in healthcare innovation and a strong presence of key industry players. The U.S. dominates due to its advanced healthcare infrastructure and early adoption of 4D printing technologies for medical applications. The demand for customized medical devices and the integration of sophisticated software for precise modeling and simulation are key growth drivers. However, high initial costs and stringent regulatory requirements may pose challenges to market expansion.

The 4D printing in healthcare market analysis shows that Europe holds a significant share of the market, with countries like Germany, the UK, and France at the forefront. The region benefits from strong research and development activities and supportive government initiatives promoting the adoption of advanced medical technologies. The focus on patient-specific medical devices and the integration of 4D printing in surgical planning and prosthetics are notable trends. Nonetheless, variations in regulatory frameworks across countries and the need for skilled professionals may hinder rapid growth.

The regional trends depict that the market in the Middle East & Africa region is gradually expanding, with growing investments in healthcare infrastructure and an increasing focus on adopting advanced medical technologies. Countries like the UAE and South Africa are witnessing a rise in the adoption of 4D printing for medical applications, particularly in orthopedics and dental care. However, limited access to advanced technologies and a shortage of skilled professionals may restrict market growth.

Latin America is an emerging market, with countries such as Brazil and Mexico showing potential growth. The region analysis shows that the increasing burden of chronic diseases and the need for cost-effective medical solutions are driving the adoption of 4D printing in the medical sector. Government initiatives aimed at improving healthcare services and the growing presence of local manufacturers adopting 4D printing technologies are contributing to market growth. However, economic instability and inadequate healthcare infrastructure in certain areas may pose challenges to market expansion.

Top Key Players & Market Share Insights:

The 4D printing in healthcare market is highly competitive with major players providing treatments to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global 4D printing in healthcare market. Key players in the 4D printing in healthcare industry include -

- 3D Systems Corporation (USA)

- Organovo Holdings, Inc. (USA)

- Stratasys Ltd. (USA & Israel)

- EnvisionTEC GmbH (Germany)

- Materialise NV (Belgium)

- Dassault Systèmes SE (France)

- Poietis (France)

- Cyfuse Biomedical K.K. (Japan)

- Medtronic plc (Ireland)

- Stryker Corporation (USA)

4D Printing in Healthcare Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 11.72 Billion |

| CAGR (2024-2031) | 21.6% |

| By Component |

|

| By Technology |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the 4D Printing in Healthcare Market? +

In 2023, the 4D Printing in Healthcare market was USD 2.45 billion.

What will be the potential market valuation for the 4D Printing in Healthcare by 2031? +

In 2031, the market size of 4D Printing in Healthcare is expected to reach USD 11.72 billion.

What are the segments covered in the 4D Printing in Healthcare market report? +

Their components, technology, applications, and end-user industries are the segments covered in this report.

Who are the major players in the 4D Printing in Healthcare market? +

3D Systems Corporation (USA), Organovo Holdings, Inc. (USA), Stratasys Ltd. (USA & Israel), EnvisionTEC GmbH (Germany), Materialise NV (Belgium), Dassault Systèmes SE (France), Poietis (France), Cyfuse Biomedical K.K. (Japan), Medtronic plc (Ireland), Stryker Corporation (USA) are the major players in the 4D Printing in Healthcare market.