Acrolein Market Size :

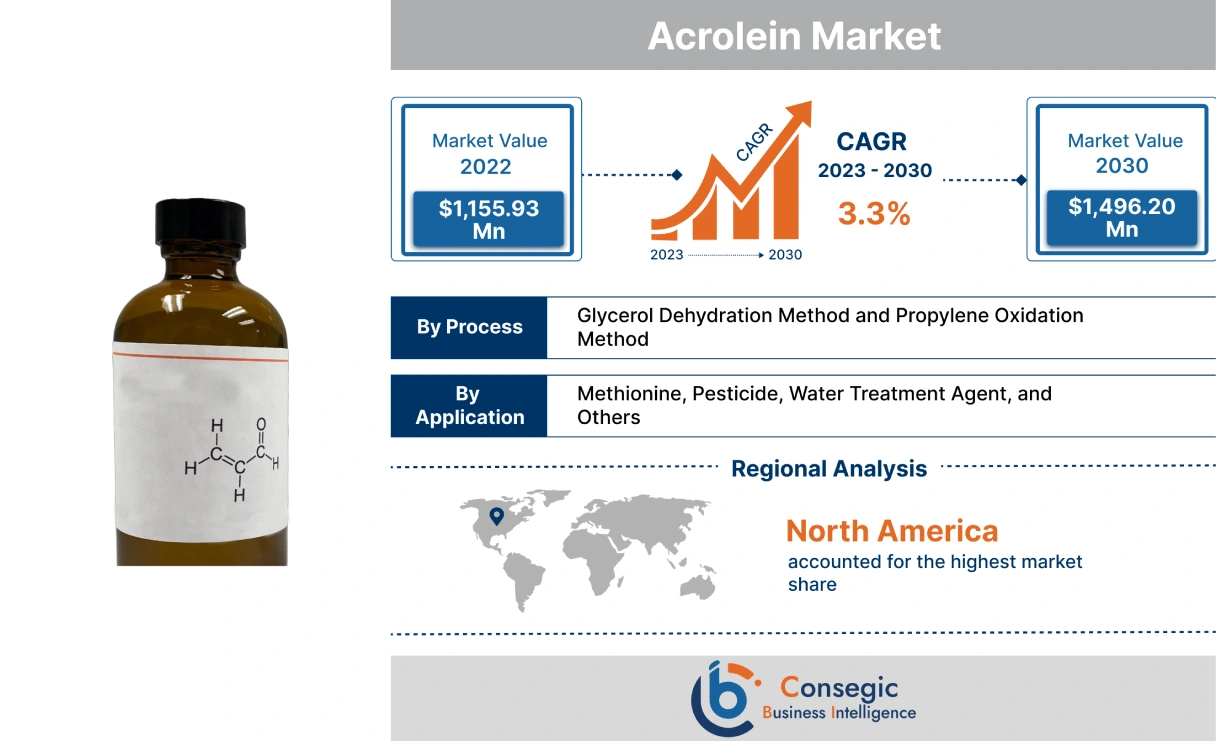

Consegic Business Intelligence analyzes that the acrolein market size is growing with a healthy CAGR of 3.3% during the forecast period (2023-2030), and the market is projected to be valued at USD 1,496.20 Million by 2030 from USD 1,155.93 Million in 2022.

Acrolein Market Scope & Overview:

Acrolein is a by-product manufactured in the combustion of organic compounds such as fossil fuels or tobacco smoke. It is manufactured from two major processes, including glycerol dehydration method and propylene oxidation method. It is a colorless liquid with a piercing, acrid smell. The key technical properties of this material include a boiling point at 53 °C, density at 0.839 g/ml, melting point at -88°C, molar mass at 56.06 g/mol, and solubility of 21.25 g/100 ml, among others. Based on the analysis, these properties ensure efficient control of sessile bacteria. Thus, this substance is an ideal solution for various applications such as methionine, pesticides, and water treatment agents, among others.

Acrolein Market Insights :

Acrolein Market Dynamics - (DRO) :

Key Drivers :

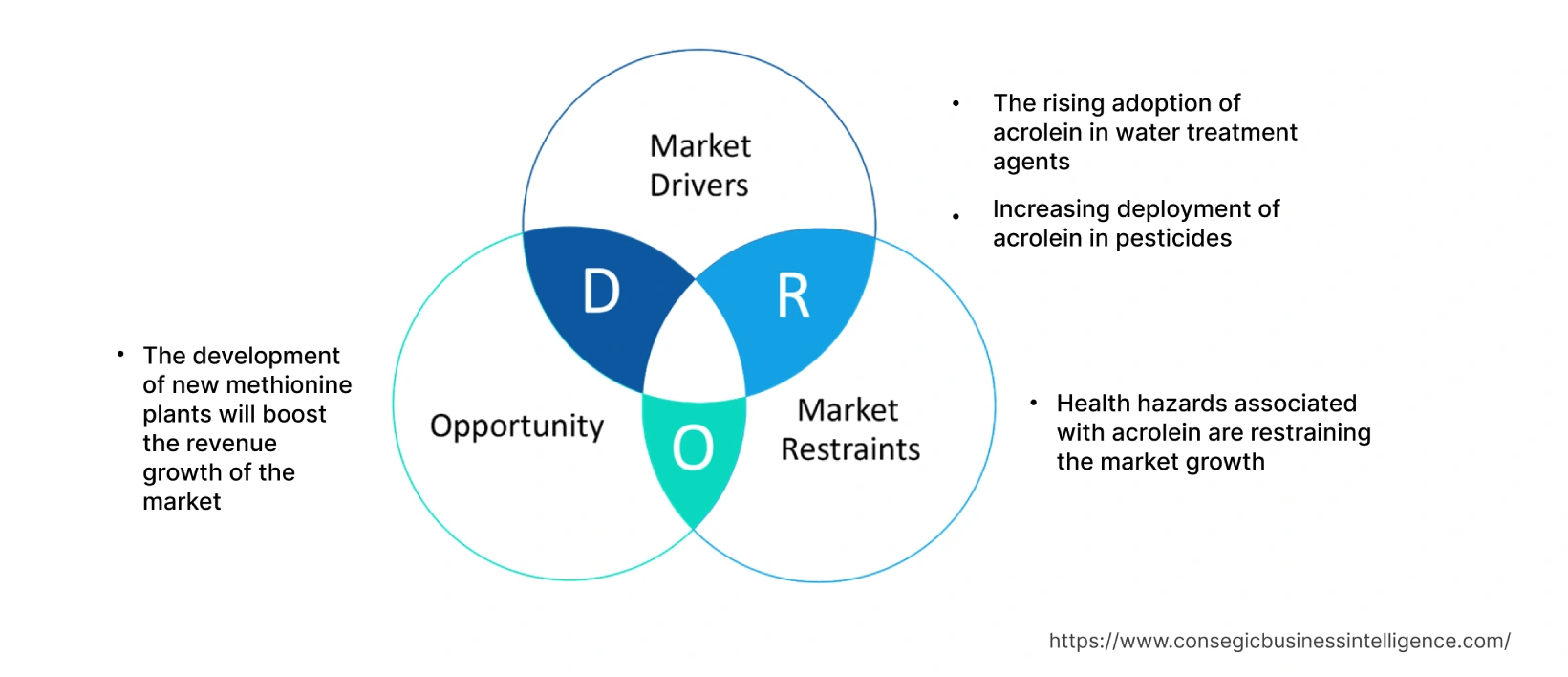

The rising adoption of acrolein in water treatment agents

This compound is utilized in the water treatment agent to efficiently control the growth of bacteria, algae, and other microorganisms. The sewage treatment connection rate attached to wastewater treatment plants is rising at the global level. As a result, there is a higher adoption of water treatment agents in wastewater treatment for superior cleaning efficiency. For illustration, according to the Organisation for Economic Co-operation and Development (OECD), in 2020, the sewage treatment connection rate in Austria increased to 96.04% of the Austrian population. Therefore, the increasing sewage connection rate is accelerating the requirement for water treatment agents. This is fostering the demand for this compoud to control plant and algae growth in irrigation canals, which, in turn, is benefiting the market growth.

Increasing deployment of acrolein in pesticides

This compound is employed in pesticides to ensure efficient protection from weeds, algae, mollusks, and bacteria. The deployment of acrolein-based pesticides results in higher yield production. As per the analysis, factors such as rising government policies for food security, increasing requirement for food crops at the global level, and others are propelling agriculture production. This is driving the demand for pesticides. For instance, according to the European Union (EU), in 2020, the agricultural sector registered growth in European countries such as Poland and Spain by 1.9% and 1.1%, respectively. Thus, the growth of the agriculture industry at the global level is fostering the demand for various pesticides. This, in turn, is amplifying the acrolein market demand to control weed, thereby favoring acrolein market.

Key Restraints :

Health hazards associated with acrolein are restraining the market growth

This compound is a highly toxic chemical that can cause a variety of health problems, including eye, nose, and throat irritation, coughing and shortness of breath, lung damage, cancer, and death. Exposure to this compound generally occurs through inhalation, ingestion, or skin contact. As per the analysis, frequent contact with this substance leads to various health hazards such as irritation to the skin, eyes, and nasal passages. For instance, according to the New Jersey Department of Health and Senior Services, this substance is considered a hazardous substance. The acute health hazards associated with this compound include irritation to the eyes, breathing problems, and others. In addition, the chronic health impact of this includes cancer and reproductive hazards. Thus, the above health hazards associated with this compound are posing a major bottleneck for the expansion of the market during the projected forecast period.

Future Opportunities :

The development of new methionine plants will boost the revenue of the market

The development of new methionine plants are factors creating lucrative opportunities in the forecast year. Acrolein is employed as a primary building block in the manufacturing process of methionine. The deployment of this compound in methionine ensures efficient synthesis. As per the analysis, the increasing awareness about food nutrition, rising requirements from the animal feed industry, and others are prompting the development of new methionine plants. For instance, in January 2023, Evonik, a leading chemical manufacturer in Germany invested EURO 25 million (USD 26.92 million) for the development of methionine intermediates plant upgradation in Germany. Henceforth, the development of new methionine plants will boost the demand for the acrolein industry as it is a key ingredient in the product. This, in turn, will create lucrative trends, and prominent acrolein market opportunities for expansion in the upcoming years.

Acrolein Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 1,496.20 Million |

| CAGR (2023-2030) | 3.3% |

| By Process | Glycerol Dehydration Method and Propylene Oxidation Method |

| By Application | Methionine, Pesticide, Water Treatment Agent, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Evonik, Arkema, Daicel, Hubei Shengling Technology, Hubei Jinghong Chemical, Puyang Shenghuade Chemical, Hubei Xinjing New Material, Oakwood Products, Inc, NSI Lab Solutions, and Thermo Fisher Scientific Inc. |

Acrolein Market Segmental Analysis :

By Process :

The process segment is categorized into glycerol dehydration method and propylene oxidation method. In 2022, the glycerol dehydration method segment accounted for the highest market share in the acrolein market. The glycerol dehydration method is a prime process utilized for the production of This compound. The glycerol is heated in combination with potassium bisulfate or conc, phosphorus pentoxide, or sulphuric acid. This results in the initiation of the dehydration process. Additionally, as per the analysis, the β-elimination reaction takes place to ensure superior quality of this compound. The adoption of biobased glycerol is increasing in this compound to reduce the reliance on natural resources. Thus, the superior quality this compound manufactured from the glycerol dehydration method is utilized in pesticides. The leading players in the pesticides market are expanding their manufacturing base for the production of pesticides. For instance, in May 2021, PI Industries based in India that manufacturers pesticides announced the expansion of its manufacturing facility in India. Hence, due to the above benefits the deployment of glycerol dehydration method in this compound to ensure cost efficiency. This prime factor is accelerating market trend.

However, the propylene oxidation method segment is projected to be the fastest-growing segment during the forecast period. Polypropylene oxidation is a two step process that includes the slow decomposition of hydroperoxide which generally creates peracides and aldehydes. The second step involves fast decomposition of peracids that involves an increase in the oxidation rate. There is a significant rise in the utilization of this method. Based on the acrolein market analysis, this is due to the increasing research and development activities for the adoption of the propylene oxidation method in this compound at the trend level, which is augmenting segment.

By Application :

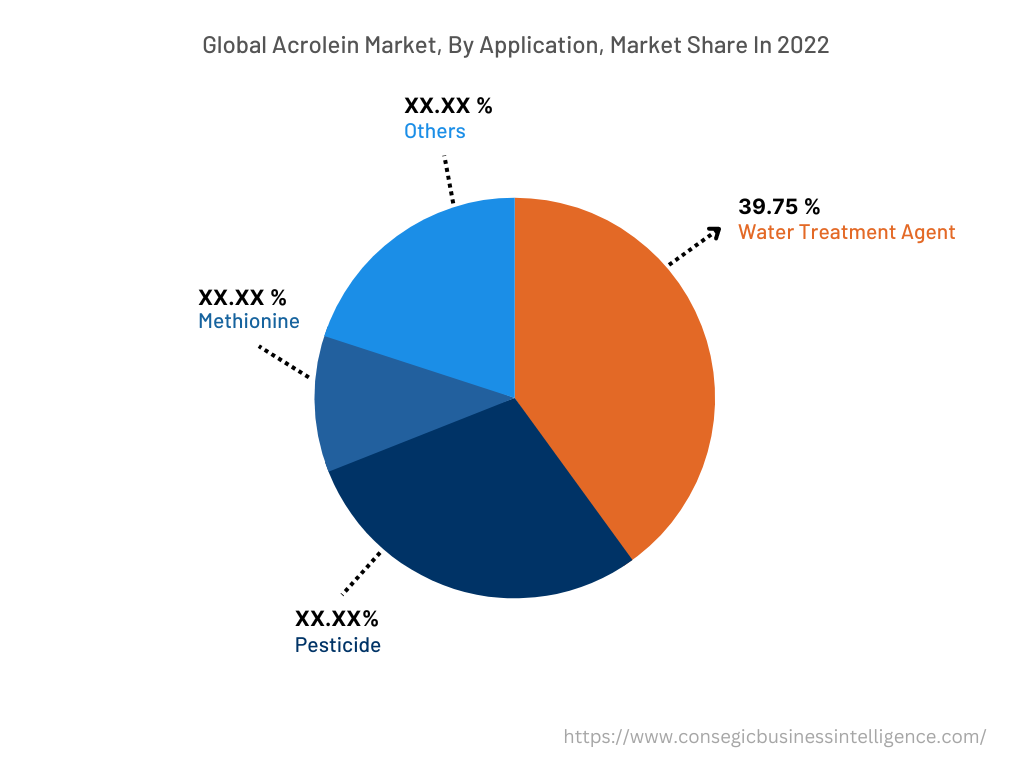

The application segment is categorized into methionine, pesticide, water treatment agent, and others. In 2022, the water treatment agent segment accounted for the highest acrolein market share of 39.75% in the overall acrolein market. This compound has superior biocide properties that frequently leads to the adoption of the substance in water treatment agent. As per the analysis, this compound is deployed in various water treatment agents such as cooling water towers, oil wells, water treatment ponds & tanks, and others. For illustration, in August 2021, Doosan Enpure and Bam Nuttall formed a joint venture to relocate Thames Water's sewage-treatment work in Guildford, the United Kingdom. The project involved the demolition of the existing facility to construct a new facility on the site. It also includes the construction of facilities to perform the four stages of water treatment. The project is scheduled to be completed in early 2026. Therefore, the development of new wastewater treatment plants is boosting the demand for water treatment agents to ensure superior cleaning properties. Thus, the adoption of his substance is increasing to eliminate harmful substances from liquids, which, in turn, is fostering market trends.

However, the pesticide segment is expected to be the fastest-growing segment during the forecast period. The compound is generally used as a pesticide to control factors such as algae, weeds, and bacteria. This expansion is attributed to factors such as increasing investment in new pesticide manufacturing facilities, increasing production activities, and others. Thus, the aforementioned factors are propelling the market trend in the upcoming years.

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

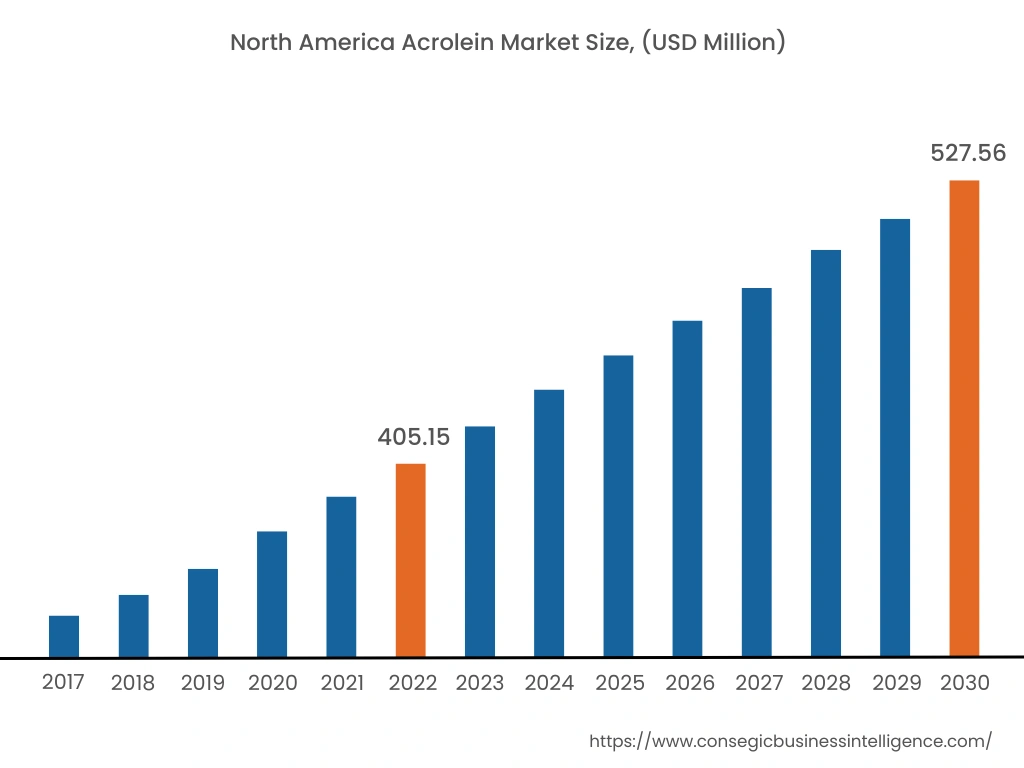

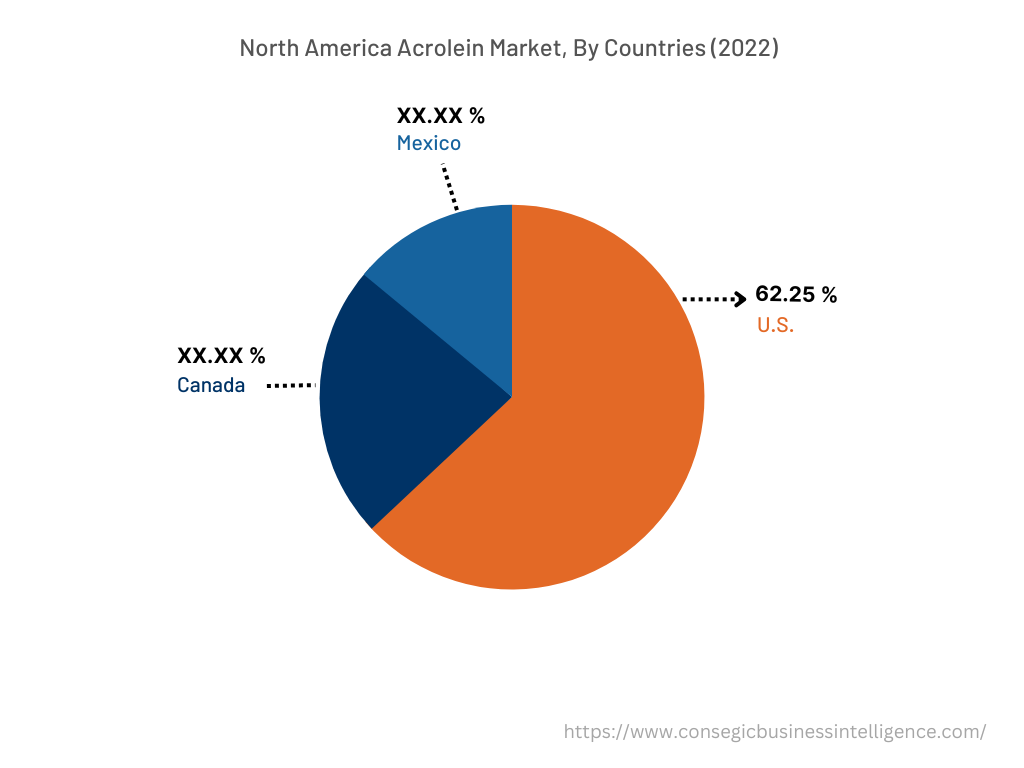

In 2022, North America accounted for the highest market share at 35.05% and was valued at USD 405.15 million, and is expected to reach USD 527.56 million in 2030. In North America, the U.S. accounted for the highest market share of 62.25% during the base year of 2022. The key trends such as the development of new wastewater treatment plants, increasing adoption of pesticides, and others are promoting the demand for products such as pesticides, water treatment agents, and others in the North American region. Thus, the rise in the utilization of this substance in various applications such as pesticides, water treatment agents, and others is accelerating the acrolein market in the North American region.

Furthermore, Asia Pacific is expected to witness significant acrolein market growth over the forecast period, growing at a CAGR of 3.9% during 2023-2030. This is due to the expansion in the deployment of products such as pesticides, water treatment agents, and others in the Asia Pacific region. For instance, according to the United States Department of Agriculture, in 2020, the Asia Pacific food crop production was about 998.8 million metric tons and in 2021 it was about 1,026.7 million metric tons, depicting an increase of about 2.8%. Furthermore, India's largest wastewater treatment plant named Okhla Waste Water Treatment Plant is projected to be operational by the end of the 3rd quarter of 2023. Thus, the aforementioned factors are propelling the acrolein market trend.

Top Key Players & Market Share Insights:

The acrolein market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the acrolein market include-

Recent Industry Developments :

- In August 2022, Spex acquired NSI Lab Solutions, a leading United States-based manufacturer. The product portfolio of NSI Lab Solutions includes acrolein, certified reference materials (CRMs), and others. The prime focus of Spex was to increase the market presence worldwide.

Key Questions Answered in the Report

What was the market size of the acrolein industry in 2022? +

In 2022, the market size of acrolein was USD 1,155.93 million.

What will be the potential market valuation for the acrolein industry by 2030? +

In 2030, the market size of acrolein will be expected to reach USD 1,496.20 million.

What are the key factors driving the growth of the acrolein market? +

The rising adoption of acrolein in water treatment agents is fostering market growth.

What is the dominating segment in the acrolein market by application? +

In 2022, the water treatment agent segment accounted for the highest market share of 39.75% in the overall acrolein market.

Based on current market trends and future predictions, which geographical region is the dominating region in the acrolein market? +

North America accounted for the highest market share in the overall acrolein market.