Activated alumina spheres Market Introduction :

Consegic Business Intelligence analyzes that the activated alumina spheres market size is growing with a healthy CAGR of 4.1% during the forecast period (2023-2030), and the activated alumina spheres market is projected to be valued at USD 975.38 Million by 2030 from USD 708.45 Million in 2022.

Activated alumina spheres Market Definition & Overview:

The activated alumina spheres are composed of aluminum hydroxide. This product is manufactured after dehydroxylation of aluminum hydroxide by utilization of a process to make it a highly absorbent material. The prominent properties associated with these spheres include superior adsorption capacity, excellent crushing strength, low attrition loss, low bulk density, longer service life, and dust-free operation, among others. These properties of these spheres ensure selective adsorbent for the elimination of impurities such as arsenic and fluoride. As a result of the above-listed benefits, the sphere is frequently utilized in a wide range of applications such as desiccant, catalyst, bio ceramics, fluoride adsorbent, and others.

Activated Alumina Spheres Market Insights :

Key Drivers :

The booming oil and gas sector is fostering activated alumina spheres market growth

Activated alumina spheres are an ideal solution for the oil and gas sector to ensure efficient drying of air, gases, and liquids. The development of new oil & gas facilities, increasing production activities, and others are driving the oil & gas sector riseat the global level. For instance, according to the recent statistics published by the U.S. Energy Information Administration, in 2021, the annual production of crude oil at the global level was 95.69 million barrels per day, and in 2022, it was 99.85 million barrels per day. In 2022, the year-on-year rise of crude oil production at the global level was 4.34%. Hence, as per the analysis the booming oil & gas sector is boosting the demand for these alumina spheres industry to ensure efficient oil purification. This prominent factor is boosting the the activated alumina spheres market.

Advancement of water treatment applications are favoring the growth of the activated alumina spheres market

Activated alumina spheres are employed in water treatment in industrial applications, municipal water treatment facilities, and in-home use to remove contaminants from water. The sewage treatment connection rate attached to wastewater treatment plants is rising at the global level. As a result, there is a higher adoption of water treatment plants with superior cleaning efficiency. For illustration, according to the Organisation for Economic Co-operation and Development (OECD), in 2020, the sewage treatment connection rate in Austria increased to 96.04% of the Austrian population. Therefore, the increasing sewage connection rate is accelerating the demand for water treatment plants. This is fostering the demand for alumina spheres to eliminate fluoride, which, in turn, is benefiting the the activated alumina spheres market.

Key Restraints :

The availability of various substitute products for the activated alumina spheres is restraining the market growth

The availability of substitute products associated with activated alumina spheres such as activated carbon, zeolite, activated charcoal, and others restraining the market. The above-mentioned substitutes pose various superior performance features as compared with the activated alumina spheres. For instance, adsorption capacity minimizes with increasing temperatures. However, zeolites maintain their superior efficiency for drying up to 100°C and these spheres have excellent favorable adsorption characteristics below 50°C. Henceforth, the above-mentioned benefits associated with these spheres such as activated carbon, zeolite, activated charcoal, and others are restricting the adoption of alumina spheres. This, in turn, is posing a major roadblock to the rise of the activated alumina spheres market.

Future Opportunities :

The development of new food & beverage manufacturing facilities will proliferate the market growth

Activated alumina spheres are deployed in food and beverage manufacturing facilities for ensuring higher standards of water purification standards. The increasing development of new food manufacturing facilities at the global level is attributed to factors such as increasing investments in new manufacturing plants, government subsidies, and others. For instance, in November 2022, Hershey, a United States-based manufacturer of snacks such as chocolates, cookies, cakes, and others announced the development of a new food manufacturing facility in Pennsylvania, U.S. The construction of the state-of-the-art food manufacturing facility will be completed by the end of 2024. As a result, the development of new food manufacturing facilities is projected to drive the demand for alumina spheres since it is utilized as an ingredient in food and beverage water treatment, this, in turn, will provide lucrative activated alumina spheres market opportunities over the forecast period.

Activated alumina spheres Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 975.38 Million |

| CAGR (2023-2030) | 4.1% |

| Based on the Application | Catalyst, Desiccant, Fluoride Adsorbent, Bio Ceramics, and Others |

| Based on the End-use Industry | Oil and Gas, Water Treatment, Chemical, Food & Beverage, and Others |

| Based on the Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | ВАЅF ЅЕ, DYNAMIC ADSORBENTS, INC., Sorbead India, Huber Corporation, Sumitomo Chemical Co., Ltd., Axens, Patalia Chem Industries., ACURO ORGANICS LIMITED, AGC CHEMICALS PVT. LTD., and Nitrotech Engineers |

Global Activated Alumina Spheres Market Segmental Analysis:

Based on the Application :

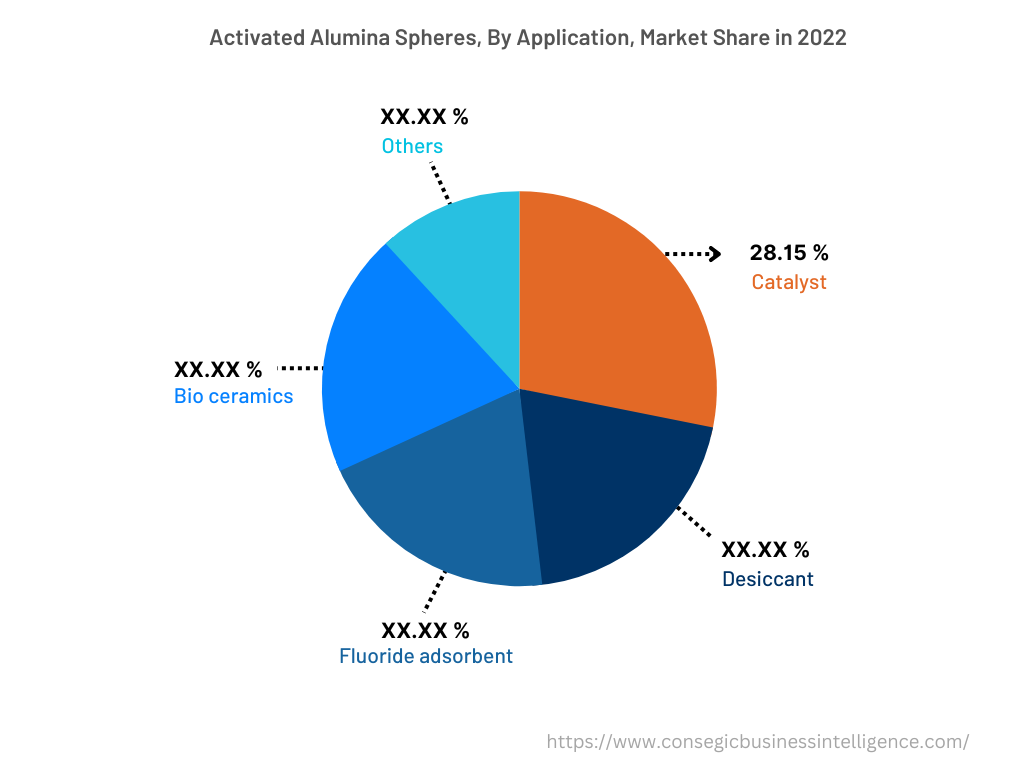

The application segment is categorized into catalyst, desiccant, fluoride adsorbent, bio ceramics, and others. In 2022, the catalyst segment accounted for the highest activated alumina spheres market share of 28.15% in the overall activated alumina spheres market and is projected to be the fastest-growing segment during the forecast period. The alumina spheres ensure efficient adsorption and a large surface area for activity in the reaction process. This makes the these spheres an ideal catalyst. They act as a buffer to manage liquid and gaseous levels to protect the natural composition of substances. The catalyst manufactured from these spheres speeds up a chemical reaction, thereby making it an ideal choice for the chemical sector. For instance, according to the recent statistics published by the European Chemical Industry Council (CEFIC), in the year 2021, the European Union region was the second largest manufacturer of chemicals at the global level valued at EURO 4,026 billion. Also, the average growth product growth rate of chemicals in the European Union region was 0.4% between 2011-2021. Therefore, the booming chemicals sector and various trends are driving the want for catalysts. This, in turn, is driving the activated alumina spheres market demand to ensure efficient synthesis of chemicals, which is boosting segment.

Based on the End-use Industry :

The end-use segment is categorized into oil and gas, water treatment, chemical, food & beverage, and others. In 2022, the oil and gas segment accounted for the highest market revenue in the activated alumina spheres market. The key technical properties associated with these spheres include excellent catalytic properties, high-temperature resistance, superior adsorbing features, and others. Thus, these alumina spheres are widely used in gaseous and liquid desiccation in the oil & gas sector. For instance, according to the recent statistics published by the U.S. Energy Information Administration, in 2021, the annual production of crude oil in OPEC countries was 31.66 million barrels per day, and in 2022, it was 34.17 million barrels per day. In 2022, the year-on-year growth of crude oil production in OPEC countries was 7.91%. Thus, the increase in the production activities associated with crude oil in OPEC countries is favoring the demand of these spheres to ensure efficient conditioning of insulated oil, which, in turn, is benefiting the market in the base year.

However, the water treatment segment is expected to be the fastest-growing segment during the forecast period. The alumina spheres are usually used for the treatment of water to remove major contaminants such as fluorides, heavy metals such as arsenic, and various other impurities from water. Natural water sources usually contain fluorides, which are harmful to human health and cause conditions such as dental and skeletal fluorosis. Through a process called adsorption, activated spheres work as an efficient adsorbent for various fluoride ions, removing them from water in a selective manner. They generally lower the fluoride level and make water portable for drinking ensuring the safety of the individual. Additionally, water sources contaminated with arsenic usually pose a serious threat to an individual's health because of its harmful effects that generally increase the risk of severe health issues such as cancer and other chronic illnesses. Based on the activated alumina spheres market analysis because of their strong affinity to arsenic ions, activated spheres are able to absorb the arsenic present in the water and lower the arsenic percentage to an acceptable level. Furthermore, these spheres are useful for treating water for a variety of municipal and industrial applications mostly because of their large surface area and adsorption capacity. Thus, as per the analysis, the demand for these spheres in the treatment of water is driven by the growing concerns about the quality of water, the development of new water treatment facilities, increasing research & development, and other trends.

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

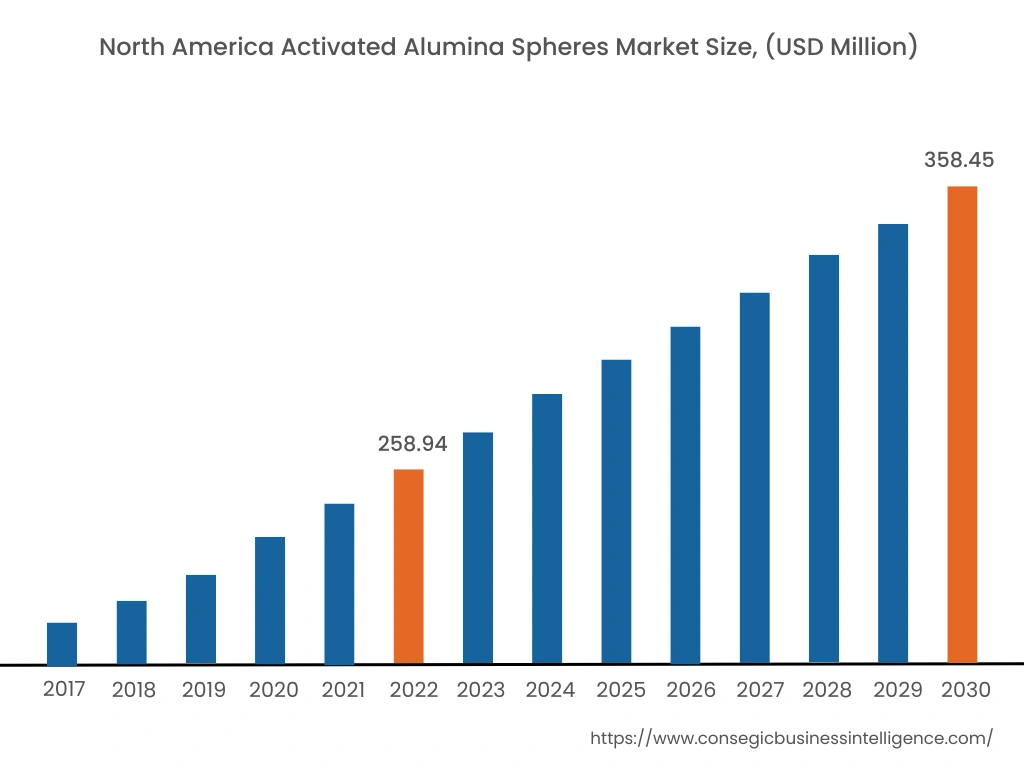

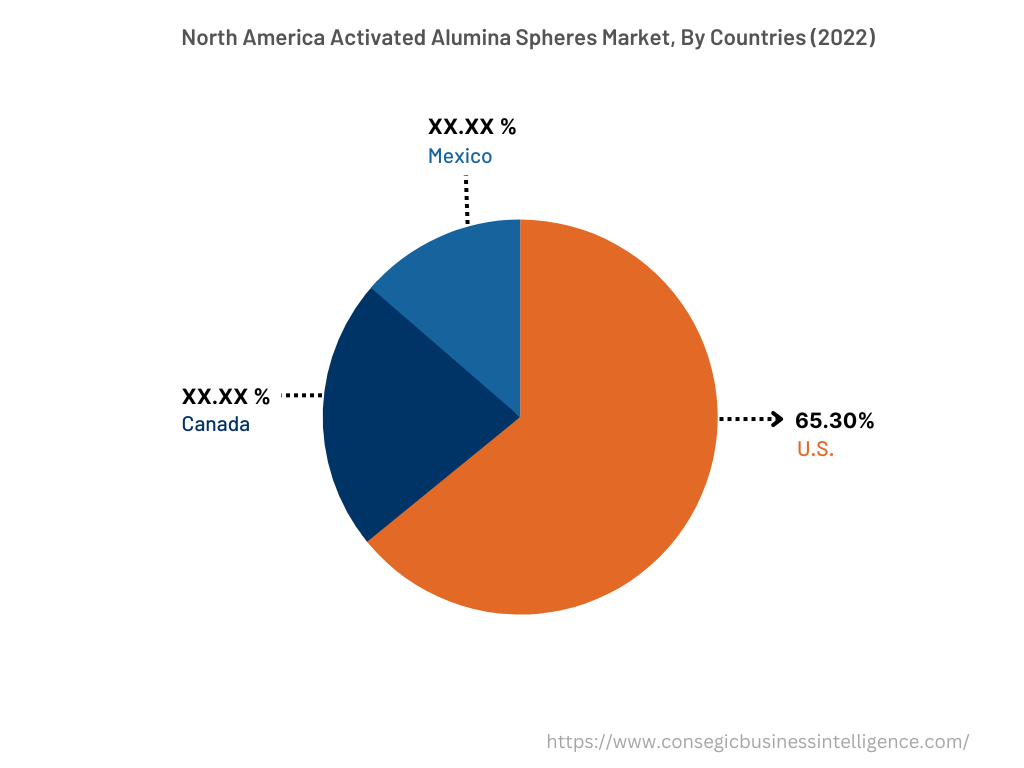

In 2022, North America accounted for the highest market revenue at 36.55% was valued at USD 258.94 million, and is expected to reach USD 358.45 million in 2030. In North America, the U.S. accounted for the highest market share of 65.30% during the base year of 2022. Advancements in sectors such as food & beverage, oil & gas, and others are propelling the market in the North American region because of various trends. For instance, Pikka Oil Field is an onshore oil and gas project in Alaska, United States. The production activities associated with the Pikka Oil Field are projected to commence by the year 2026. In addition, in June 2021, the United States Department of Agriculture (USDA) announced an investment of USD 4 billion to strengthen food production, food systems, enhanced processing of food, and others. Thus, according to the analysis, the investments will aid the market of the United States food sector in the forecast years. Therefore, the advancement of the above industries is fostering the trend for activated alumina spheres market growth.

Furthermore, Asia Pacific is expected to witness significant rise over the forecast period, growing at a CAGR of 4.9% during 2023-20230. Based on the activated alumina sphere market analysis, this is due to the increasing adoption of these spheres in various applications such as desiccant, catalyst, bioceramics, fluoride adsorbent, and others. Additionally, the rapid increase in industrialization trend and numerous investments in water treatment and air purification technologies contribute towards various opportunities for activated alumina spheres market trends over the forecast period.

Top Key Players & Market Share Insights:

The activated alumina spheres market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. Based on the analysis, the market is characterized by intense competition, with companies focusing on expanding their product offering trends and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- ВАЅF ЅЕ

- Sorbead India

- Sumitomo Chemical Co., Ltd.

- Patalia Chem Industries.

- AGC CHEMICALS PVT. LTD.

- DYNAMIC ADSORBENTS, INC.

- Schreiner Group

- Huber Corporation

- Axens

- ACURO ORGANICS LIMITED

- Nitrotech Engineers

Recent Industry Developments :

- In November 2020, Evonik, a leading chemical manufacturer at the global level acquired Porocel Group for USD 210. Porocel Group is a leading manufacturer of activated alumina products. The prime aim of the acquisition was to increase the product offering in the global activated alumina spheres business.

Key Questions Answered in the Report

What was the market size of the activated alumina spheres industry in 2022? +

In 2022, the market size of activated alumina spheres was USD 708.45 million.

What will be the potential market valuation for the activated alumina spheres industry by 2030? +

In 2030, the market size of activated alumina spheres will be expected to reach USD 975.38 million.

What are the key factors driving the growth of the activated alumina spheres market? +

The booming oil and gas industry is fostering the activated alumina sphere market growth at the global level.

What is the dominating segment in the activated alumina spheres market by application? +

In 2022, the catalyst segment accounted for the highest market share of 28.15% in the overall activated alumina spheres market.

Based on current market trends and future predictions, which geographical region is the dominating region in the activated alumina spheres market? +

North America accounted for the highest market share in the overall activated alumina spheres market.