Aerospace Floor Panels Market Size :

Aerospace Floor Panels Market size is estimated to reach over USD 128.25 Million by 2030 from a value of USD 84.85 Million in 2022, growing at a CAGR of 5.6% from 2023 to 2030.

Aerospace Floor Panels Market Scope & Overview:

Aerospace floor panels also known as floorboards are attached to the aircraft's floor beams to facilitate easy movement for the crew and passengers and also provide attachment points for certain furnishings and other components. The floor panels of aircraft are manufactured using lightweight materials namely aluminum and have a sandwich structure. The core material, particularly a honeycomb structure is sandwiched between two outer layers to act as a supporting structure. Additionally, the floor panels are highly durable to withstand wear and tear, inflexible, and in some cases, versatile to allow a variety of cabin configurations.

Aerospace Floor Panels Market Insights :

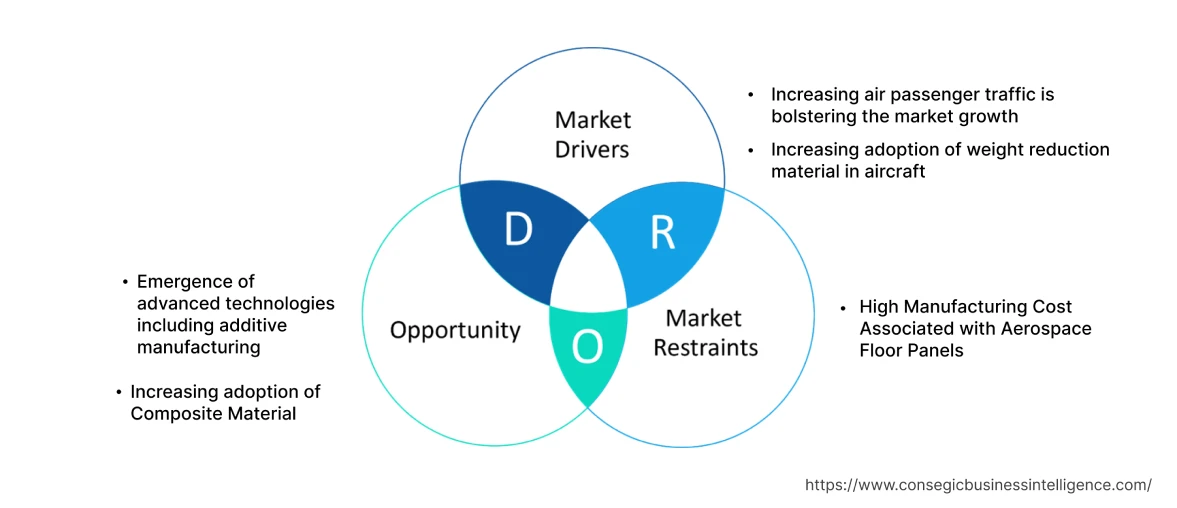

Aerospace Floor Panels Market Dynamics - (DRO) :

Key Drivers :

Increasing air passenger traffic is bolstering the market growth.

Increasing air passenger traffic is bolstering the market growth.

The advancements in technology at airports including the emergence of automation and robotics, advanced data analytics, and the Internet of Things (IoT) are increasing the number of flyers leading to air passenger traffic. In order to meet the growing demand for air passenger trafficking, airlines are investing in renewing the old aircraft floors and upgrading the floors with new materials namely aluminum and Nomex honeycomb. The ability of the advanced materials to offer high durability in view of the increasing air passenger traffic serves as the key factor in driving the market.

- For instance, in January 2021, according to the Ministry of Communication and Transport, Mexico City International Airport (AICM) was the busiest airport in Mexico, reporting 23,951 operations. Additionally, the airports of Cancún (CUN) and Guadalajara (GDL) also have 13,745 and 11,960 operations respectively in the same month.

Consequently, the market trends analysis shows that the surge in the number of flyers serves as a key factor responsible for propelling the aerospace floor panels market growth.

Increasing adoption of weight reduction material in aircraft

Weight reduction is another key factor for the market. Lightweight materials have a direct impact on the profitability of airlines with a significant increase in fuel efficiency. Consequently, floor panels made up of lightweight materials are being increasingly consumed in the aerospace industry to facilitate weight reduction. In addition, lightweight materials have low flammability to ensure passenger safety in case of fire outbreaks and other emergencies.

- For instance, in February 2021, ThermHex launched a new honeycomb core lightweight sandwich panel to provide better surface quality. The material helps in weight reduction along with offering sustainability and cost savings.

Thus, the market trends analysis shows that the aforementioned factors are driving the aerospace floor panels market growth.

Key Restraints :

High Manufacturing Cost Associated with Aerospace Floor Panels

The cost of manufacturing aerospace floor panels is expensive and acts as a major restraint hampering the market. Carbon fiber-reinforced epoxy skins are used in the manufacturing process that is expensive to produce. Additionally, the core material used to manufacture floor panels is aluminum which has limited strength compared to other metals including stainless steel. Low strength makes aluminum unsuitable for certain components that require strength or stiffness. In conclusion, analysis of market trends depicts that the low strength and high manufacturing cost of aerospace floor panels act as major restraints impeding the aerospace floor panels market demand.

Future Opportunities :

Emergence of advanced technologies including additive manufacturing

Additive manufacturing, also known as 3D printing is a technology that creates three-dimensional objects by building layer by layer from a digital model. Additive manufacturing allows for the customization of products to meet the specific needs of each business or industry. Additionally, advanced technology reduces production costs by eliminating the need for expensive tooling and molds. Moreover, additive manufacturing also allows companies to create prototypes and final products much faster than traditional manufacturing. In conclusion, the ability of additive manufacturing to offer customization, lower production costs, and fast product delivery is expected to create potential aerospace floor panels market opportunities.

Increasing adoption of Composite Material

The increasing adoption of composite materials including carbon fiber and fiberglass is predicted to create future opportunities for the market. The advanced material offers several advantages over the traditional materials including high strength-to-weight ratio, lightweight, corrosion resistance, and durability. Consequently, with the increasing demand for lightweight materials in aircraft to improve the performance and durability of floor panels, the demand for advanced composite materials is also expected to increase in the upcoming years.

Aerospace Floor Panels Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 (USD Billion) | USD 128.25 Million |

| CAGR (2023-2030) | 5.6% |

| By Core Material | Aluminum Honeycomb, Nomex Honeycomb, and Others |

| By Operation | Military Aircraft, Commercial Aircraft, Business Jets, Narrow Body Aircraft, Wide Body Aircraft, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Diehl Stiftung & Co. KG, Advanced Custom Manufacturing, AIM ALTITUDE, Avcorp Industries, EFW, ENCORE GROUP, EURO COMPOSITES, Satair, Rockwell Collins (UTC), The Gill Corporation |

Aerospace Floor Panels Market Segmental Analysis :

By Core Material :

The core material segment is divided into aluminum honeycomb, nomex honeycomb, and others.

Nomex honeycomb accounted for the largest market share in 2022 of the total aerospace floor panels market share owing to the high durability and rigidity offered by the material. Additionally, Nomex is manufactured by DuPont and falls under the category of meta-aramid fibers. Furthermore, Nomex honeycomb has excellent chemical and thermal resistance thus, helps in safeguarding the passenger's interest in case of emergency or fire outbreak. Moreover, the material is compatible with most adhesives, corrosion-resistant, self-extinguishing, thermally insulating, has excellent dielectric properties, and has good thermal stability. In conclusion, the segmental trends analysis shows that the aforementioned factors are responsible for driving the aerospace floor panels market trends.

Aluminum honeycomb is projected to witness the fastest CAGR in the aerospace floor panels market during the forecast period. The growth is attributed to the ability of aluminum honeycomb to offer superior stiffness and strength is driving the market. In addition, the material also offers improved performance in both wet and dry conditions along with delivering high strength-to-weight properties at a relatively low cost. Moreover, aluminum panels are available in various sizes and thicknesses and are also corrosion-resistant further accelerating the market.

- For instance, in June 2022, Alstone launched Alstone Alcomb, an aluminum honeycomb that provides high strength and rigidity. In addition, the material is lightweight, sound resistant, and 100% recyclable thus, is suitable for the construction of aerospace floor panels.

Consequently, analysis of segmental trends depicts that the ability of aluminum honeycomb to offer improved performance, durability, versatility, and non-corrosive properties are the key factors expected to drive the aerospace floor panels market expansion.

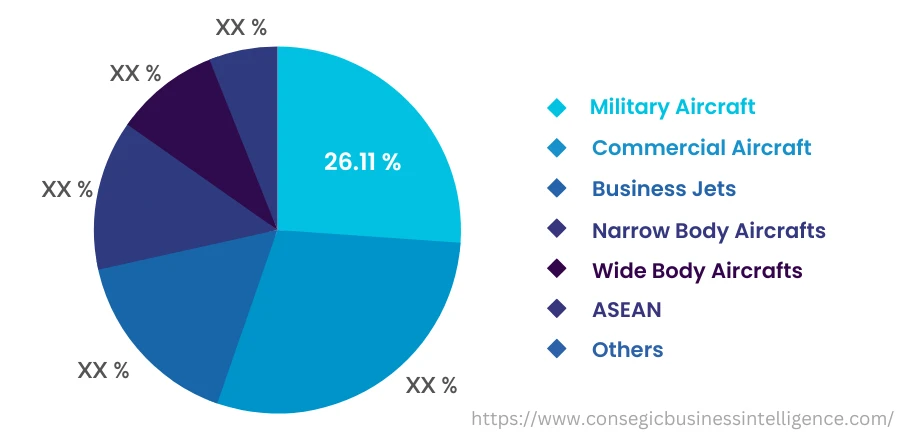

By Operation :

The operation segment is classified into military aircraft, commercial aircraft, business jets, narrow-body aircraft, wide-body aircraft, and others.

Commercial aircraft accounted for the largest market share in 2022 of the overall aerospace floor panels market share as commercial aircraft are the largest consumer of aerospace floor panels. Additionally, the growth is attributed to increased longevity, superior durability, weight reduction, and high strength of floor panels that are extensively used in commercial aircraft. Moreover, the panels also eliminate the need for more frequent floorboard replacements in the cabin and the cargo bay in commercial planes, further propelling the market. In addition, the key companies are also investing heavily in launching advanced technologies for integrating improved floor panels in commercial planes.

- For instance, in March 2021, GKN AEROSPACE introduced advanced next-generation technologies to develop composite materials for aerospace floor panels. The introduction of thermally and electrically conductive polymer composite materials enables efficient manufacturing processes of commercial aircraft across the entire UK.

Consequently, the segmental trends analysis shows that the aforementioned reasons contribute significantly to driving aerospace floor panels market expansion.

Military aircraft are projected to witness the fastest CAGR of 26.11% as floor panels are made from advanced composite materials that are much lighter in weight in comparison to traditional materials. The lightweight materials increase fuel efficiency and allow aircraft to carry more payload driving the market. Additionally, the panels offer high durability and are resistant to wear and tear, important in military aircraft that are subjected to harsh environmental conditions. Moreover, many floor panels help to reduce noise levels in the aircraft, essential in military applications where noise compromises stealth or communication. In conclusion, aerospace floor panels offer a range of benefits including reduced weight, increased durability, and noise reduction. The aforementioned benefits are ideal for the use of floor panels in military aircraft thereby, contributing significantly to bolstering the aerospace floor panels market trends.

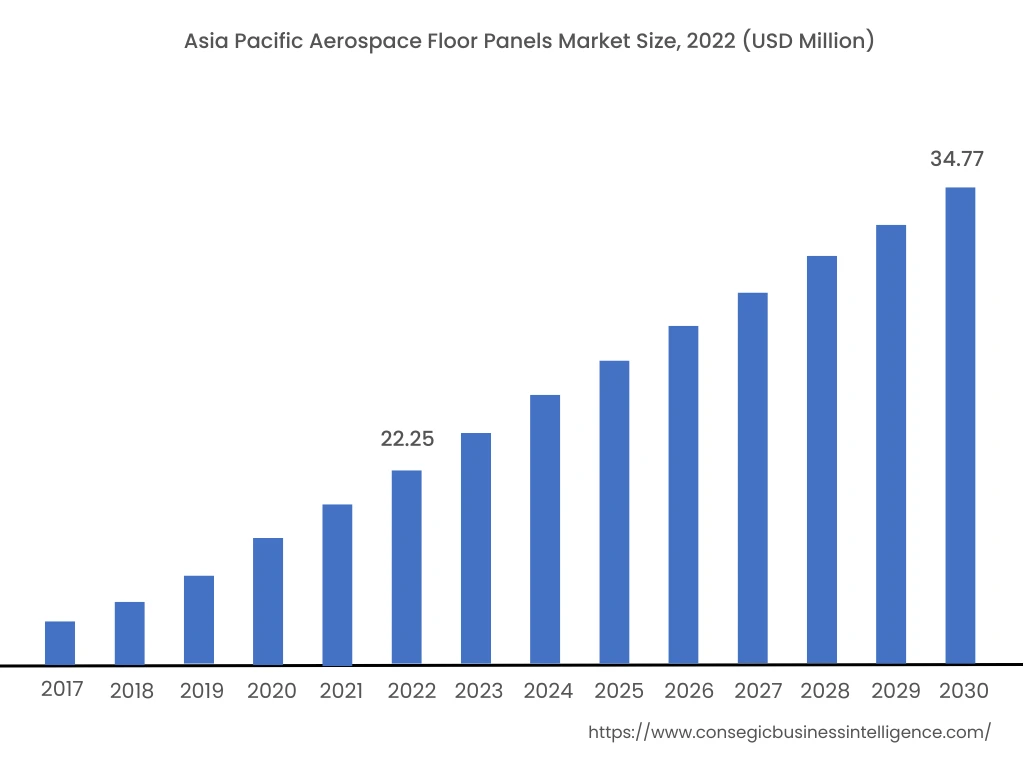

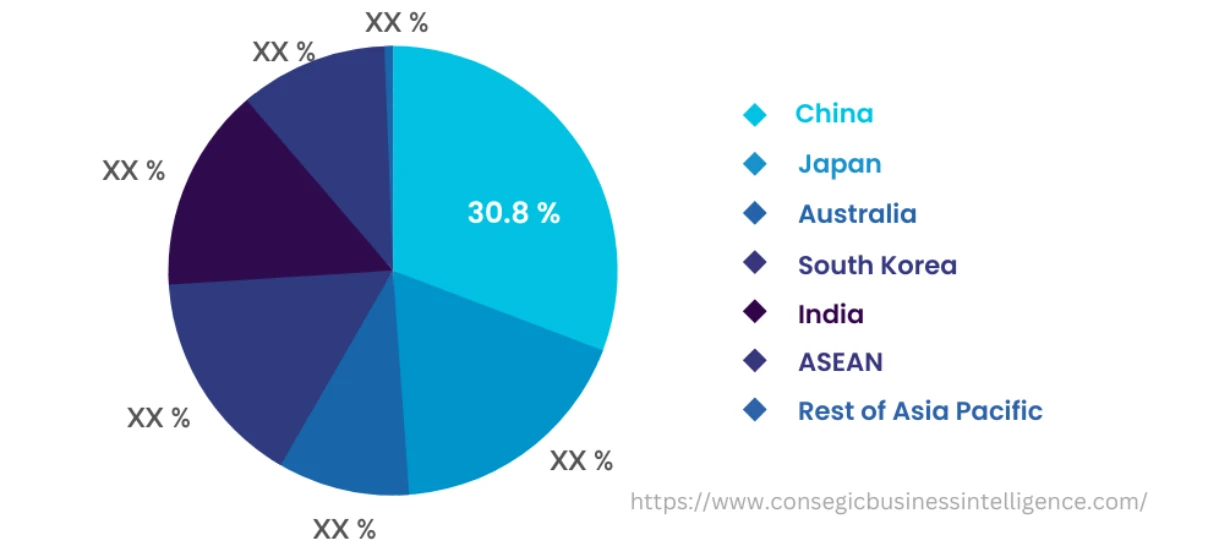

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

North America accounted for the largest revenue share in the year 2022 valued at USD 28.66 Million and is projected to grow at a CAGR of 5.6% during the forecast period. The growth is attributed to the early adoption of advanced technologies, materials, and manufacturing processes to produce high-quality and durable floor panels. Additionally, the region has a strong supply chain and infrastructure, including a robust network of suppliers and logistic providers that help to streamline the production and delivery of floor panels. Moreover, the presence of key players namely Boeing Company Lockheed Martin, and Northrop Grumman Corporation also contributes to driving the market in the region.

Asia Pacific is expected to register the fastest CAGR of 6.0% during the forecast period in the aerospace floor panels market. The region accounted for USD 22.25 Million market share in 2022. In addition, in the region, China accounted for the maximum revenue share of 30.8% in the year 2022. As for the aerospace floor panels market analysis, the growth in the region is attributed to the easy availability of raw materials in countries including India, China, and South Korea offering convenience to manufacturers to source raw materials needed for production. Moreover, the expansion of the aerospace industry is also contributing to market growth by raising the demand for advanced and durable floor panels.

- For instance, in October 2020, HONYLITE announced that the company had successfully exported Stainless Steel Honeycomb to the United States of America.

Furthermore, the key players in Asia Pacific countries are applying strategic decisions to expand themselves in the international market.

Top Key Players & Market Share Insights:

The competitive landscape of the global aerospace floor panels market has been analyzed in the report, along with the detailed profiles of the major players operating in the industry. Further, the surge in Research and Development (R&D), product innovation, various business strategies, and application launches have accelerated the growth of the aerospace floor panels market. Key players in the aerospace floor panels industry include -

- Diehl Stiftung & Co. KG

- Advanced Custom Manufacturing

- Avcorp Industries

- EFW

- ENCORE GROUP

- EURO COMPOSITES

- AIM ALTITUDE

- Satair

- Rockwell Collins (UTC)

- The Gill Corporation

Recent Industry Developments :

- In July 2022, Lilium selected Diehl Aviation to design the cabin floor for its eVTOL Aircraft using the latest LED technology and lightweight composite materials, such as foam granulates for air outlets.

- In March 2022, Satair launched the first semi-finished floor panel solution with cost-reducing benefits and improved quality. The new solution offers product durability, and high stock flexibility, and also eases the operational administration and handling.

Key Questions Answered in the Report

What are Aerospace Floor Panels? +

Aerospace Floor Panels are designed to withstand high compression loads in numerous aircraft including commercial planes, and military planes, among others. The floor panels of aircraft are manufactured using lightweight materials namely aluminum that offers high durability and strength.

What specific segmentation details are covered in the aerospace floor panel market report, and how is the dominating segment impacting the market growth? +

The report consists of segments including Core Material and Operation. Each segment has a key dominating sub-segment being driven by industry trends and market dynamics. For instance, the operation segment has witnessed commercial aircraft as the dominating segment in the year 2022, driven by factors such as superior durability, weight reduction, and high strength of floor panels.

What specific segmentation details are covered in the aerospace floor panel market report, and how is the fastest segment anticipated to impact the market growth? +

The report consists of segments including Core Material and Operation. Each segment is projected to have the fastest-growing sub-segment driven by industry trends and drivers. For instance, in Core Material, the aluminum honeycomb sub-segment is anticipated to witness the fastest CAGR growth during the forecast period. The material offers improved performance in both wet and dry conditions along with delivering high strength-to-weight properties at a relatively low cost.

Which region is anticipated to witness the highest CAGR during the forecast period, 2023-2030? +

Asia Pacific is anticipated to witness the fastest CAGR during the forecast period due to the easy availability of raw materials and the expansion of the aerospace industry.