Aircraft Soft Goods Market Size:

Aircraft Soft Goods Market size is estimated to reach over USD 908.68 Million by 2032 from a value of USD 717.84 Million in 2024, growing at a CAGR of 3.1% from 2025 to 2032.

Aircraft Soft Goods Market Scope & Overview:

Aircraft soft goods refer to various textile and fabric-based products that are used in the interiors of an aircraft for enhancing passenger comfort, aesthetics, and functionality. It includes characteristics including lightweight, increased durability, fire resistance, and others. Moreover, airplane soft goods play a vital role in improving the overall cabin experience while adhering to strict aviation safety regulations, such as flame resistance and durability. They are primarily composed of materials such as nylon, leather, cotton, and others. They are incorporated in commercial aircraft, military aircraft, and business jets, among others.

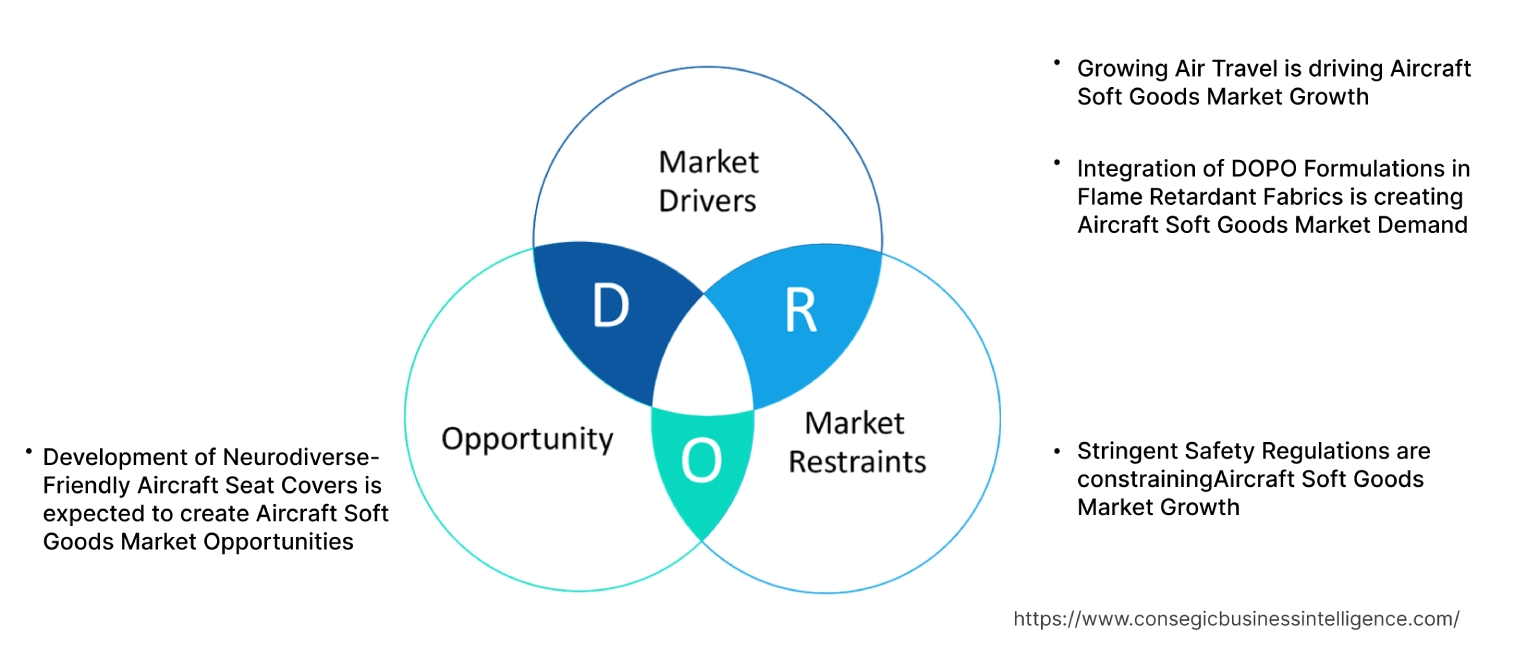

Aircraft Soft Goods Market Dynamics - (DRO) :

Key Drivers:

Rising development of commercial aircraft is propelling the aircraft soft goods market growth

Aircraft soft goods play a crucial role in the commercial aviation sector. In commercial aircraft, airplane soft goods, such as seat covers, carpets, and cabin interior textiles, are typically used for improving the overall travel experience. The integration of soft goods in commercial aircraft significantly improves cabin aesthetics and provides improved passenger comfort and convenience. As a result, the rising aircraft production is driving the adoption of soft goods.

- For instance, Airbus, a European aircraft manufacturer, delivered 735 commercial aircraft in 2023, depicting an increase of approximately 11% in comparison to 661 deliveries in 2022.

Hence, the increasing production of commercial aircraft is driving the adoption of airplane soft goods including seat covers, carpets, and cabin interior textiles within the aircraft, in turn proliferating the aircraft soft goods market size.

Key Restraints:

Prevalence of stringent regulations is restraining the aircraft soft goods market

The manufacturers of aircraft soft goods have to comply with multiple stringent standards, including ISO (International Organization for Standardization) Standard - ISO 9001, FAR 25.853/ FAR 25.856 regulation, and others, which are among the primary factors constraining the market growth.

For instance, the ISO 9001 standard specifies particular requirements for a quality management system. Aircraft soft goods manufacturers must comply with the ISO standard for demonstrating the ability to consistently provide products and services that meet regulatory and consumer requirements.

Additionally, the Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA) have established a series of tests and standards that materials must fulfil before they can be used in aircraft interiors. FAR 25.853 is an FAA regulation that specifies the flammability requirements for materials utilized in passenger compartments of transport category airplanes. Meanwhile, FAR 25.856 regulation applies to the flammability of aircraft interior materials when exposed to post-crash fire conditions. Therefore, the prevalence of the aforementioned regulations and standards associated with airplane soft goods is hindering the aircraft soft goods market expansion.

Future Opportunities :

Rising air travel activities are expected to drive the aircraft soft goods market opportunities

The global air travel industry continues to grow as airlines are expanding their fleets, owing to an increase in commercial flight activities. Moreover, global air travel is also driven by rising urbanization, an expanding middle-class population, and increasing disposable incomes. Further, increased convenience, less time for travel, and advancements in the aviation sector are increasing air travel activities. As more passenger flights are increasing, commercial airlines are investing heavily in soft goods such as seat covers, carpets, curtains, and others for improving aesthetic appeal and comfort, which is further providing lucrative aspects for market growth.

- For instance, according to the International Air Transport Association (IATA), the global air passenger traffic gained significant momentum and increased by 36.9% in 2023 as compared to 2022. Additionally, according to the IATA, European airlines’ full-year traffic increased by 22% in 2023 in comparison to 2022.

Hence, the rising air travel activities are expected to boost the aircraft soft goods market opportunities during the forecast period.

Aircraft Soft Goods Market Segmental Analysis :

By Product Type:

Based on product type, the market is segmented into seat covers, carpets, cushions, and others.

Trends in the product type:

- Increasing trend in adoption of high-quality seat covers in commercial aircraft to improve aesthetic appeal and comfort.

- The utilization of eco-friendly carpets in aircraft is increasing, thereby promoting sustainability and reducing carbon footprints.

The seat covers segment accounted for the largest revenue in the total aircraft soft goods market share in 2024.

- In airplane soft goods sector, seat covers are considered to be one of the most crucial products, which play a vital role in improving passenger comfort and contributing to the overall aesthetic appeal of the cabin.

- Aircraft seat covers are primarily composed a several materials, including synthetic leather, wool/nylon blends, and others, which are designed to meet stringent safety and durability standards that are specific to the aviation sector.

- Moreover, the rising preference for premium passenger experiences, particularly in business and first-class cabins, has significantly contributed to the proliferation of the seat covers segment.

- Further, the increasing airline focus on upgrading and refurbishing cabin interiors is driving the adoption of seat covers, offering both functionality and aesthetic appeal.

- According to the analysis, the aforementioned factors are driving the market.

The carpets segment is anticipated to register the fastest CAGR growth during the forecast period.

- In airplane soft goods, carpets play a vital role in improving cabin aesthetics and passenger comfort.

- These are manufactured using materials, including wool, nylon, and others, and they are designed to meet stringent aviation safety standards associated with flame resistance and durability.

- Moreover, several airlines are also investing in eco-friendly carpets that are mostly composed of recycled nylon with less crude oil and energy production, which is expected to provide lucrative aspects for segment development.

- For instance, in December 2023, Sri Lankan Airlines introduced eco-friendly carpet for its aircraft. The eco-friendly carpets are lightweight and manufactured from regenerated nylon. The introduction of eco-friendly carpets will help SriLankan Airlines in its journey toward a reduced carbon footprint.

- Thus, increasing innovations related to carpets for use in aircraft are anticipated to drive the market during the forecast period.

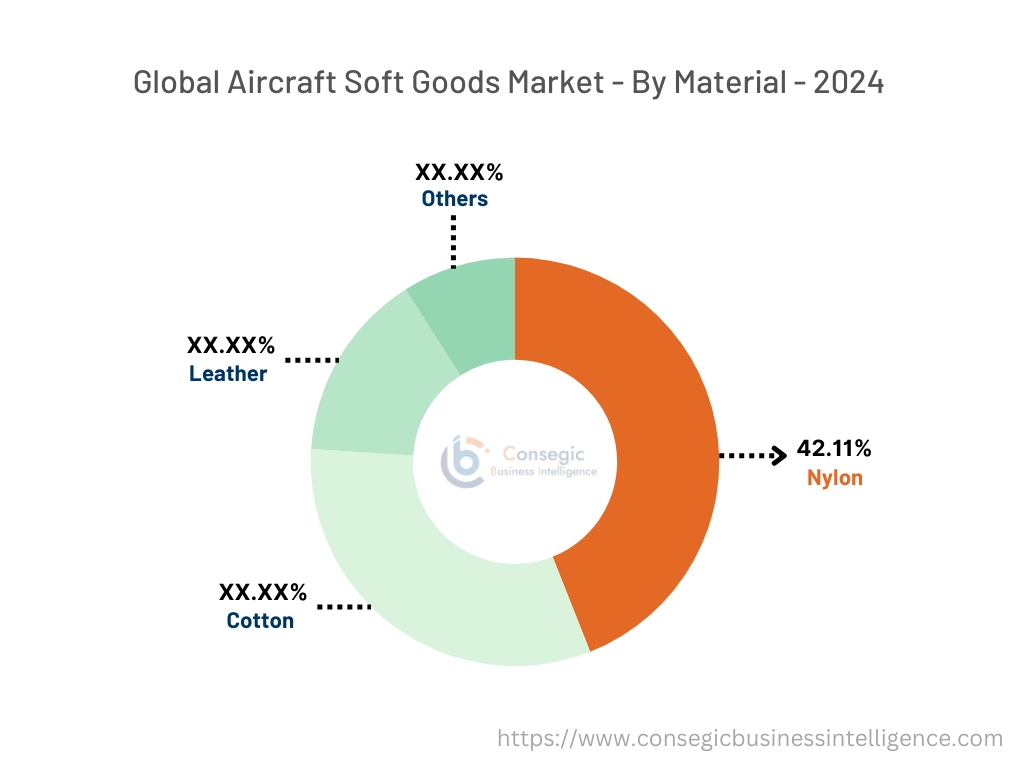

By Material:

Based on material, the market is segmented into nylon, cotton, leather, and others.

Trends in the material:

- Rising trend towards adoption of nylon material in airplane soft goods, due to improved durability and flame-retardant properties.

- Increasing integration of leather material in airplane soft goods, due to its fire resistance, longer lifespan, and ease of maintenance.

Nylon segment accounted for the largest revenue share of 42.11% in the overall aircraft soft goods market share in 2024.

- In airplane soft goods, nylon material is primarily used due to its several benefits, including improved durability, light weight, and superior resistance to wear and tear.

- The improved versatility of nylon material enables it to be used in various soft goods, including woven fabrics for seat covers, nylon yarn for carpets, and others.

- Moreover, nylon is mainly used in aircraft seat covers and carpets, as it fulfils the stringent fire safety standards required in aviation.

- Additionally, nylon’s abrasion resistance makes it ideal for utilization in aircraft, ensuring longevity and maintaining a clean appearance over time.

- Therefore, increasing adoption of nylon material in airplane soft goods is driving the aircraft soft goods market trends.

Leather segment is anticipated to register the fastest CAGR growth during the forecast period.

- Leather material is being increasingly incorporated into airplane soft goods due to its luxurious appeal and increased durability.

- Leather is primarily utilized in premium cabins, including business and first-class sections, for providing a high-end, premium aesthetic and improving passenger comfort.

- Moreover, airline companies are integrating recycled leather to maintain the balance between sustainability and comfort.

- For instance, in April 2025, LATAM Airlines commenced operations of its three aircraft, featuring renovated cabins for both economy and premium business suites. Further, the cabin seats are furnished with up to 70% recycled leather material, which decreases water usage in production by 87% in comparison to regular leather.

- Hence, the increasing advancements related to the use of leather in aircraft cabin interiors are anticipated to boost the aircraft soft goods market growth during the forecast period.

By Aircraft type:

Based on the aircraft type, the market is segmented into commercial aircraft, military aircraft, business jets, and others.

Trends in the aircraft type:

- Factors including the growing air travel trend, increasing commercial flight activities, and rising production of commercial aircraft are the primary factors propelling the commercial air travel segment.

- Rising incorporation of soft goods in business jets, driven by a growing preference for luxury and customized interiors.

Commercial aircraft segment accounted for the largest revenue share in the total market in 2024.

- This dominance is attributed to the rising adoption of soft goods such as seat covers, carpets, and cabin interior textiles in commercial aircraft for improving the overall travel experience.

- Moreover, the integration of soft goods in commercial aircraft improves cabin aesthetics, along with enhancing passenger comfort and convenience.

- Additionally, several airline companies are investing in aircraft cabin upgrades for their commercial aircraft fleet with high-quality soft goods such as seats, carpets, and others, in turn driving the segment development.

- For instance, in September 2024, Air India commenced its USD 400 million refurbishment program, which includes upgrading 67 aircraft in its commercial fleet. This program involved upgrading the aircraft with new seats, curtains, carpets, and upholstery.

- According to the analysis, the above factors are driving the aircraft soft goods market size.

The business jets segment is anticipated to register the fastest CAGR during the forecast period.

- Business jets are increasingly using soft goods, primarily driven by the growing preference for luxury and customized interiors in business jets.

- Moreover, business jet owners and companies that are investing in private aviation often prioritize comfort and exclusivity, which facilitates the demand for premium soft goods such as high-end upholstery, luxurious leather set covers, and customized carpets, among others.

- Additionally, soft goods designed for business jets are typically made from materials such as premium leather, wood blends, and high-performance fabrics that offer durability, comfort, and improved aesthetics.

- According to the market analysis, the increasing development of business jets is expected to drive the demand for airplane soft goods, in turn propelling the market during the forecast period.

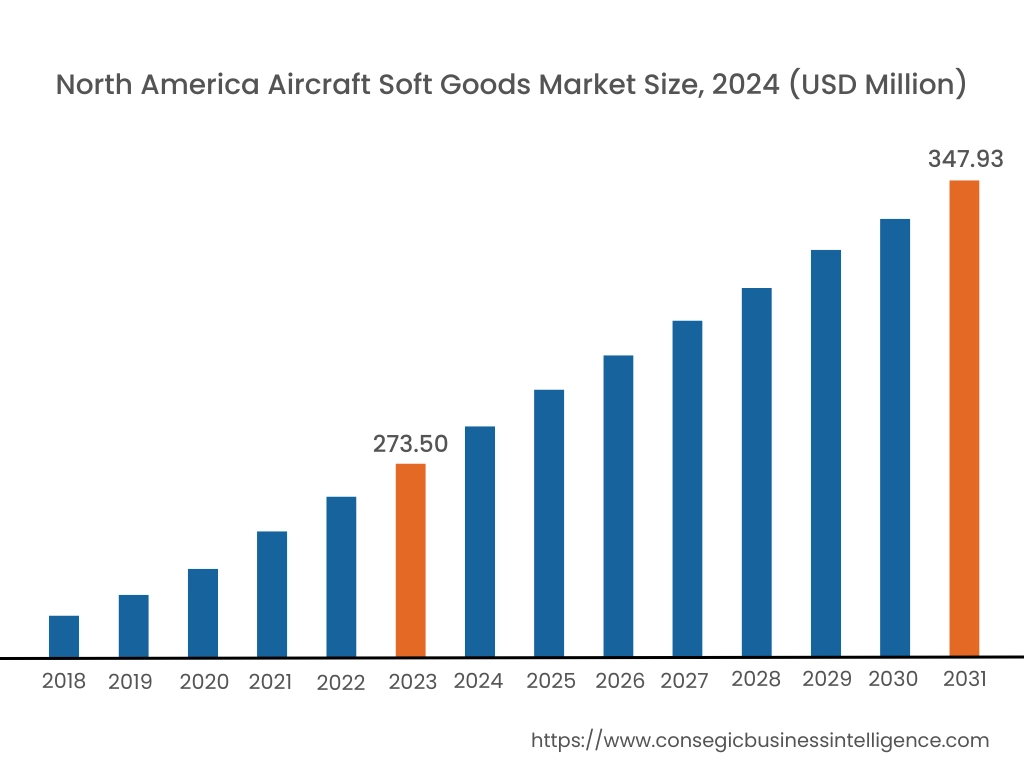

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2024, North America accounted for the highest market share at 38.10% and was valued at USD 273.50 Million, and it is expected to reach USD 347.93 Million in 2032. In North America, the United States accounted for the highest market share of 73.89% during the year 2024. In North America, the growth of aircraft soft goods industry is driven by the growing commercial aviation and defense sectors. Factors including the rising number of air travelers and growing preference for luxury travel are driving the need for high-quality aircraft interiors. Similarly, the rising development of commercial aircraft is contributing to the aircraft soft goods market demand.

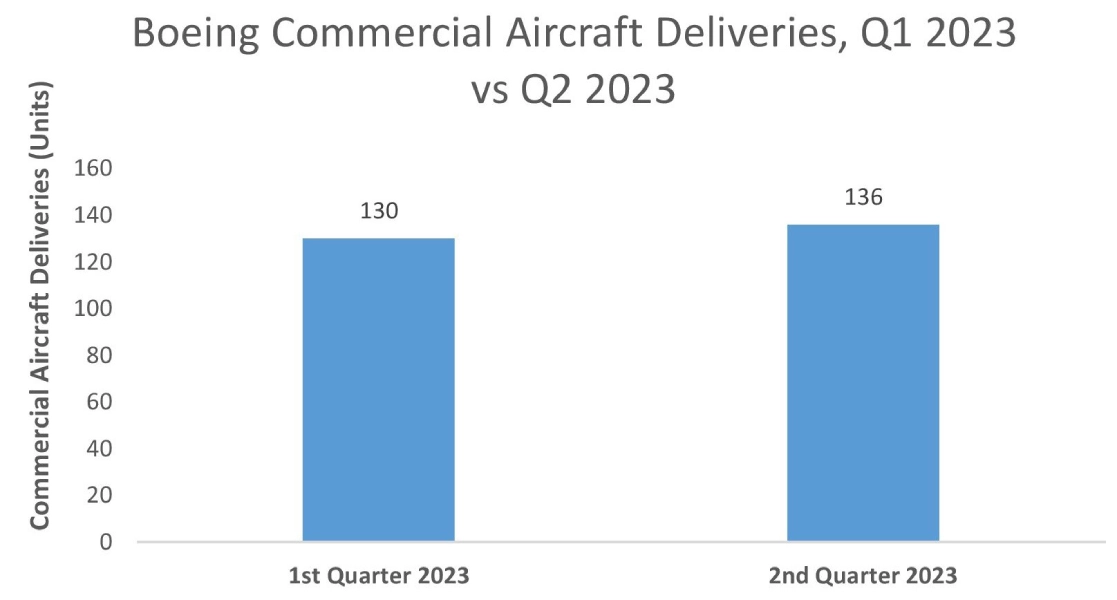

- For instance, Boeing, a U.S.-based aerospace company, delivered approximately 136 commercial aircraft in the second quarter of 2023, witnessing an increase of 4.6% as compared to 130 commercial aircraft deliveries in the first quarter of 2023. The increasing commercial aircraft deliveries are expected to boost the aircraft soft goods market trends in North America during the forecast period.

Asia-Pacific is expected to witness the fastest CAGR of 3.7% over the forecast period (2025-2032). As per the aircraft soft goods market analysis, the adoption of airplane soft goods in the Asia-Pacific region is primarily driven by the increasing production from aerospace & defense sector and rising investments in private business jets, among others. Airlines in the Asia-Pacific region are focusing on enhancing passenger experience, which is further driving the need for soft goods, including cushions, carpets, seat covers, and others. Further, the business jet market is also growing significantly in this region, driven by the increase in high-net-worth individuals and corporate executives seeking private air travel. Thus, the above factors are accelerating the aircraft soft goods market expansion in the Asia-Pacific region.

In addition, the regional analysis depicts that rising production of commercial aircraft, increasing air travel activities, and growing focus on sustainable cabin interiors are driving the aircraft soft goods market demand in Europe. Furthermore, as per the aircraft soft goods market analysis, the market demand in Latin America, Middle East, and African regions is expected to grow at a considerable rate due to factors such as the growing aerospace & defense industry, large-scale commercial fleet expansions, and increasing investments in aircraft production, among others.

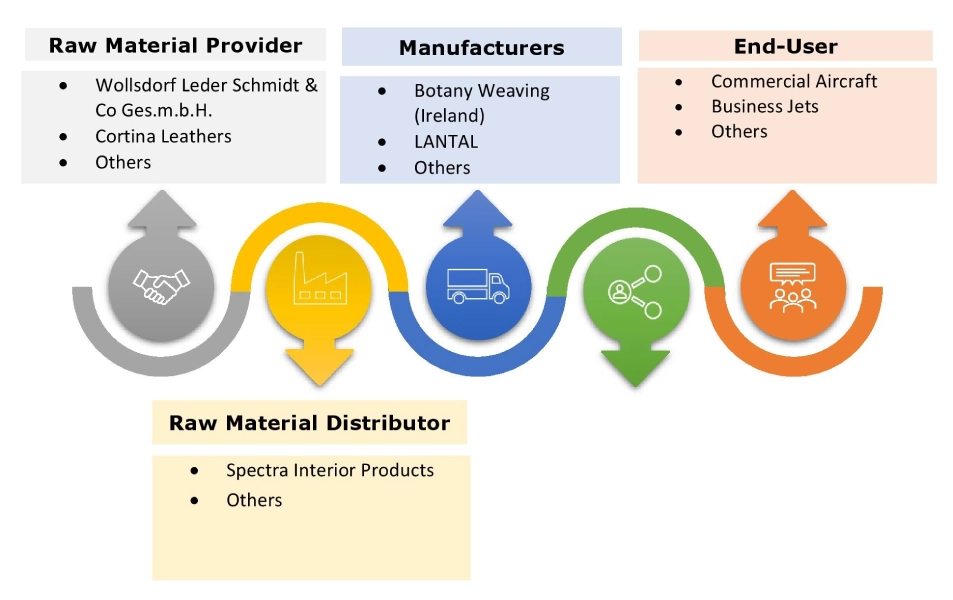

Top Key Players and Market Share Insights:

The global aircraft soft goods market is highly competitive, with major players providing services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the aircraft soft goods market. Key players in the aircraft soft goods industry include-

- Botany Weaving (Ireland)

- LANTAL (Switzerland)

- Hong Kong Aircraft Engineering Company Limited. (China)

- Spectra Interior Products (United States)

- Aerofoam Industries, LLC (United States)

- INTECH AEROSPACE (United States)

- RAMM AEROSPACE (United States)

- Tapis Corporation (United States)

- ANKER Gebr. Schoeller GmbH + Co. KG (Germany)

- Mohawk Group (United States)

Recent Industry Developments:

Product Launches:

- In May 2024, Gen Phoenix introduced its first completely recyclable aircraft seat covers composed of circular material. The company’s patent-pending technology enables airlines’ old seat covers to be completely recycled and repurposed at the end of their lives through its innovative process.

Partnerships and Collaborations:

- In 2023, PriestmanGoode collaborated with Lantel, with the aim of developing new sustainable carpets for the aviation sector. This collaboration will explore Lantel’s DEEP DYEING CARPET technology for producing a new set of carpet designs to facilitate the growing demand for durable and lightweight materials in the aviation sector.

Aircraft Soft Goods Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 908.68 Million |

| CAGR (2025-2032) | 3.1% |

| By Product Type |

|

| By Material |

|

| By Aircraft Type |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Aircraft soft goods market? +

In 2024, the Aircraft soft goods market is USD 717.84 Million.

Which is the fastest-growing region in the Aircraft soft goods market? +

Asia-Pacific is the fastest-growing region in the Aircraft soft goods market.

What specific segmentation details are covered in the Aircraft soft goods market? +

Product type, material, and aircraft type are covered in the Aircraft soft goods market.

Who are the major players in the Aircraft soft goods market? +

Botany Weaving (Ireland), RAMM AEROSPACE (United States), and Tapis Corporation (United States) are some of the major players in the market.