Airless Tires Market Size:

Airless Tires Market size is estimated to reach over USD 106.68 Billion by 2032 from a value of USD 57.25 Billion in 2024 and is projected to grow by USD 60.69 Billion in 2025, growing at a CAGR of 7.3% from 2025 to 2032.

Airless Tires Market Scope & Overview:

Airless tires, also known as non-pneumatic tires or flat-free tires, refer to a type of tire that do not use pressurized air for supporting the weight and load of vehicles. The tires use flexible, non-air materials such as polyurethane spokes, foam, and others for providing support, shock absorption, as well as traction. Moreover, non-pneumatic tires several benefits including puncture-proof design, increased safety by eradicating blowouts, lower maintenance requirements, greater durability, along with longer lifespan, among others. Additionally, non-pneumatic tires are ideal option for use in commercial or industrial heavy-duty vehicles, where maintenance is difficult or costly.

Airless Tires Market Scope & Overview:

The integration of AI is considerably transforming the airless tires market. AI-powered systems help in improving every stage of the product lifecycle, ranging from initial design and material simulation to manufacturing, performance monitoring, and quality control. AI-powered systems are used for optimizing design by rapidly testing virtual prototypes, along with improving production efficiency and quality control in manufacturing.

Additionally, AI-driven systems help in optimizing manufacturing processes, in turn increasing efficiency as well as scalability for production of non-pneumatic tires. Further, AI-powered machine vision systems can also be used for inspecting manufactured airless tires for particle size and contaminants, which ensures real-time uniformity as well as high quality. Hence, the above factors are expected to positively impact the market growth in the upcoming years.

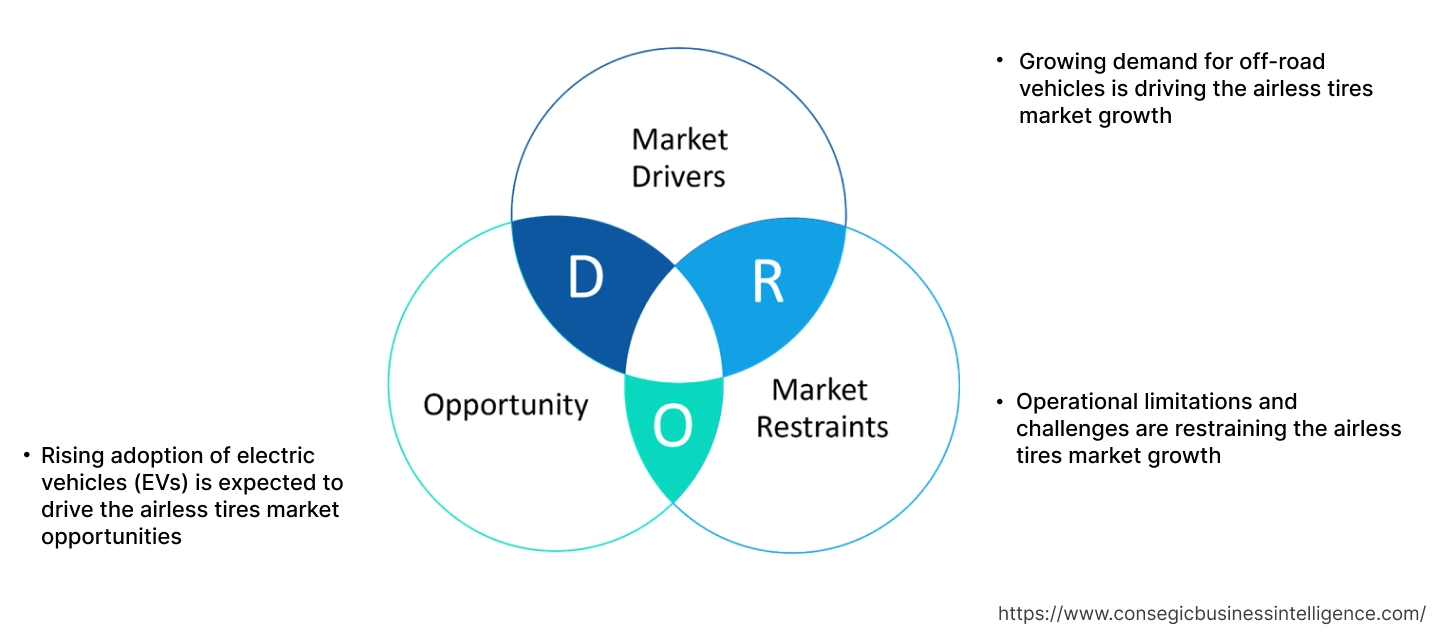

Airless Tires Market Dynamics - (DRO) :

Key Drivers:

Growing demand for off-road vehicles is driving the airless tires market growth

The increasing demand for off-road vehicles is among the primary factors driving the market. The use of airless tires in off-road vehicles provides superior durability as well as reliability in harsh terrains. Moreover, flat-free tires are composed of materials such as composite elastomers and rubber, along with having a solid, non-pneumatic structure. This design offers high resistance to heavy loads, sharp objects, as well as extreme road conditions while preventing common issues such as punctures and blowouts. The aforementioned features of non-pneumatic tires helps in reducing vehicle downtime, lowering maintenance costs, as well as increasing operational efficiency for construction, agriculture, mining, and other off-road applications. As a result, growing need for durable and maintenance-free tires in off-road vehicles is boosting the market.

- For instance, in 2024, PowerlandATV launched its Powerland Tachyon 4x4 model ATV (all-terrain vehicle). The vehicle offers a range of up to 90 km with 11 kWh battery and up to 130 km with 16.5 kWh battery on a single charge, when operated at constant speeds on level ground and under ideal conditions.

According to the analysis, the rising demand for off-road vehicles and growing need for durable tires are driving the airless tires market size.

Key Restraints :

Operational limitations and challenges are restraining the airless tires market growth

Non-pneumatic tires are usually associated with certain operational limitations and challenges, which are primary factors restricting the market growth. For instance, certain non-pneumatic tire designs are rigid, in turn contributing to a rougher ride along with reduced shock absorption, which impacts comfort, particularly at high speeds. Moreover, the solid or honeycomb design of non-pneumatic tires often traps more heat, which in turn causes thermal buildup, material degradation, as well as safety concerns, mostly during prolonged use at high speeds.

Additionally, the use of specialized materials and complex production processes results in considerably higher manufacturing costs for airless tires in comparison to traditional pneumatic tires. Therefore, the aforementioned limitations and challenges related to non-pneumatic tires are hindering the airless tires market expansion.

Future Opportunities :

Rising adoption of electric vehicles (EVs) is expected to drive the airless tires market opportunities

Factors including the prevalence of stringent automotive emission regulations, rising consumer preference for sustainable transportation, along with availability of subsidies and tax rebates are leading to significant adoption of electric vehicles (EVs). Moreover, there is an increasing potential for use of non-pneumatic tires in electric vehicles for providing increased range and efficiency through lower rolling resistance, eradicating downtime and maintenance from punctures, along with supporting heavy EV battery loads with greater durability, which in turn is providing lucrative aspects for market growth.

- For instance, according to the International Energy Agency (IEA), the overall sales of electric cars reached approximately 14 million in 2023, among which China, Europe, and United States accounted for 95% of the total sales.

Hence, as per the analysis, the rising adoption of electric vehicles is projected to increase the adoption of non-pneumatic tires in EVs, in turn boosting the airless tires market opportunities during the forecast period.

Airless Tires Market Segmental Analysis :

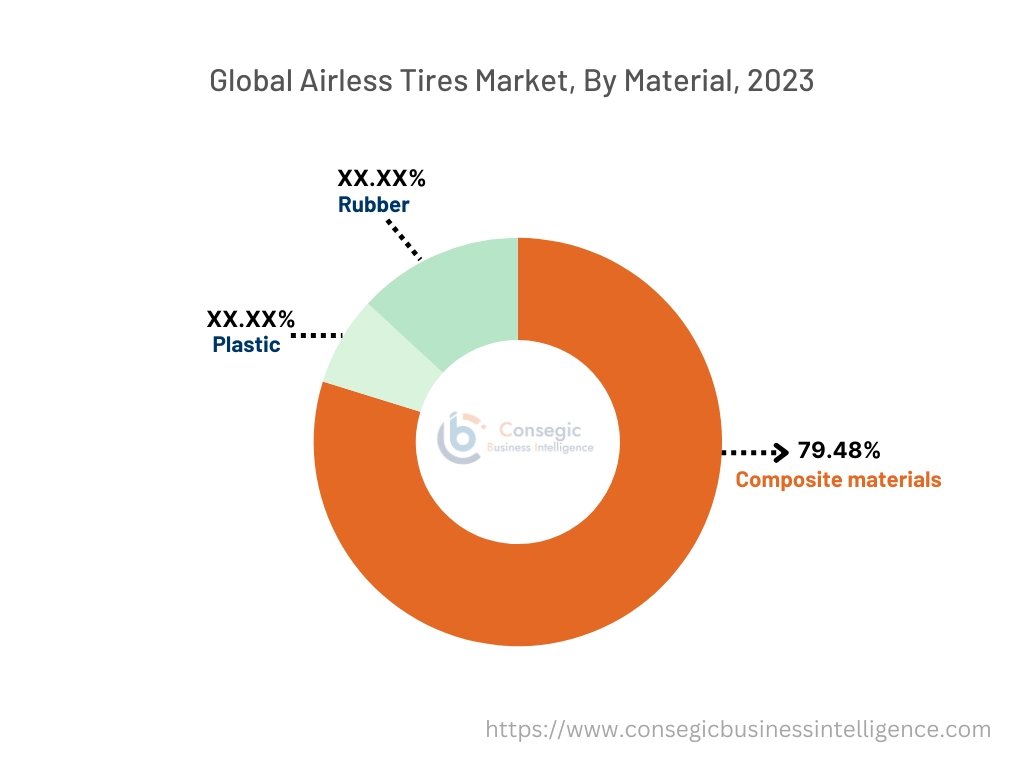

By Material:

Based on material, the market is segmented into rubber, plastic, composite materials, and others.

Trends in the material:

- Increasing trend in adoption of composite materials in non-pneumatic tires due to its several benefits, such as lightweight design, increased durability, improved performance, and others, is driving the market.

- Rising adoption of rubber material in non-pneumatic tires due to its increased durability and puncture resistance, improved shock absorption, and improved load handling is propelling the market.

The rubber segment accounted for the largest revenue share of 65.42% in the airless tires market share in 2024.

- Rubber is a major material used in flat-free tires. Rubber is mainly used in solid tread and cushioning structure of tires for offering improved load support as well as durability.

- Moreover, rubber is also used for attaining the required tire properties such as high tensile strength, increased abrasion resistance, and others, which in turn play vital role in development of puncture-proof tires.

- Additionally, the use of rubber in flat-free tires offers numerous benefits including increased durability and puncture resistance, improved shock absorption and ride comfort, along with improved load handling and traction, among others.

- According to the airless tires market analysis, the above benefits of rubber material are further driving its adoption in non-pneumatic tires, in turn boosting the airless tires market size.

The composite materials segment is anticipated to register the fastest CAGR during the forecast period.

- Composite materials such as polyurethane, fiberglass, thermoplastics, and others are significantly used in the internal structure of flat-free tires, mainly in its spoke or web design, for offering necessary stiffness, load-bearing capacity, as well as impact resistance.

- Moreover, composite materials are often combined with traditional rubber for the tread for achieving durable, lightweight, and efficient designs that offer improved performance in contrast to pneumatic tires.

- Additionally, composites materials offer a broad range of benefits including lightweight design, increased durability, improved performance, and others, which are primary determinants for increasing its adoption in flat-free tires.

- Hence, the above factors are furtherprojected to boost the market during the forecast period.

By Sales Channel:

Based on sales channel, the market is segmented into original equipment manufacturer (OEM) and aftermarket.

Trends in the sales channel:

- Factors including the availability of targeted advertising, competitive pricing, ease of use, and reliable shipping and return policies are among the key prospects driving the OEM channel segment.

- Factors including the rising automotive MRO (maintenance, repair, and operation) activities, availability of economical products in comparison to OEM products, higher accessibility to a variety of products, and higher flexibility are primary determinants for boosting the aftermarket segment.

Original equipment manufacturer (OEM) segment accounted for the largest revenue in the overall airless tires market share in 2024.

- In OEM channel, vehicle manufacturers usually collaborate with tire companies for developing flat-free tires specifically for new vehicle models, which ensures optimum compatibility with suspension and braking systems along with meeting stringent performance as well as safety standards.

- Moreover, OEM sales agreements enable a company to sell its products to another company by relabelling the products and selling them as its own. The process enables a manufacturer to quickly leverage existing marketing and sales infrastructure without the need of building their own infrastructure.

- Moreover, purchasing tires from an OEM offers various benefits including faster response time, higher product quality, competitive pricing, excellent support and warranty, faster production, and higher return on investments, among others.

- For instance, Michelin partnered with General Motors for testing the tire company’s airless wheel technology, which is expected to improve safety as well as reduce waste by eliminating the possibility of tire punctures.

- Therefore, the above factors are further driving the OEM segment growth.

The aftermarket segment is anticipated to register the fastest CAGR during the forecast period.

- The aftermarket channel involves the sale of spare parts, components, and accessories for maintaining or improving an original product.

- The aftermarket channel for flat-free tires offer opportunities for the distribution of additional goods to support and improve the usage of tires that have already been procured. Similarly, purchases are also made for upgrading or replacing the existing automobile tires after the initial purchase.

- Moreover, the aftermarket sales channel provides numerous benefits including wider reach, increased customer convenience, enhanced product visibility, and others. The above benefits of aftermarket sales channel are vital aspects for increasing the distributionof flat-free tires from aftermarket sales channels.

- Hence, the increasing availability of flat-free tires in aftermarket sales channels, attributing to its aforementioned benefits, is a key factor projected to boost the market during the forecast period.

By Vehicle Type:

Based on the vehicle type, the market is segmented into passenger cars, off-road vehicles, commercial vehicles, military vehicles, and others.

Trends in the vehicle type:

- Factors including the growing popularity of recreational activities and adventure tourism, increasing use of ATVs and UTVs in agriculture, construction, and mining, along with advancements in technology such as improved engines, suspension, and safety features are among the key trends propelling the off-road vehicle segment.

- Factors including the rising sales of heavy-duty vehicles, growing investments in commercial vehicles, and increasing need for economical modes of transportation and logistics are primary trends driving the commercial vehicles segment.

The off-road vehicles segment accounted for a significant revenue share in the market in 2024.

- Flat-free tires are used in off-road vehicles, attributing to ability to remove risk of puncture, increase durability, as well as improve traction on rough terrain. This in turn makes it ideal for utilization in heavy-duty applications involving construction, mining, agriculture, and other off-road applications.

- Moreover, flat-free tires are capable of offering increased resistance to punctures from sharp objects or rough terrain, which are very common in off-road environments.

- Flat-free tires are also strong and capable of maintaining structural integrity under severe conditions, which increases their lifespan in contrast to conventional tires.

- Further, the use of flat-free tires in off-road vehicles offers numerous benefits including improved puncture resistance, constant load support, superior traction and grip, and increased durability, among others.

- Hence, the aforementioned benefits of flat-free tires are increasing its adoption in off-road vehicles, in turndriving the market growth.

The commercial vehicles segment is anticipated to register a substantial CAGR during the forecast period.

- Commercial vehicles refer to vehicles that are licensed to be used for transportation of goods and materials along with paying passengers.

- Moreover, the use of flat-free tires in commercial vehicles offers various benefits including puncture-proof operation, increased vehicle uptime, lower maintenance requirements, and others.

- For instance, according to the International Organization of Motor Vehicle Manufacturers (OICA), the overall production of commercial vehicles across the world reached 26.41 million in 2023, depicting an increase of 12.8% as compared to 23.42 million in 2022.

- Therefore, theincreasing development of commercial vehicles is expected to propel the airless tires market trends during the forecast period.

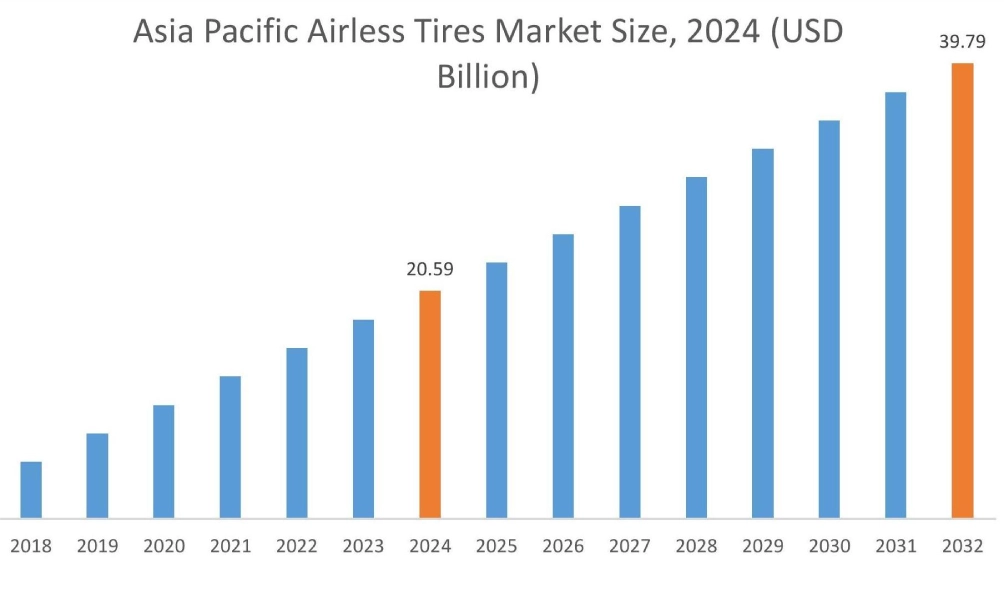

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

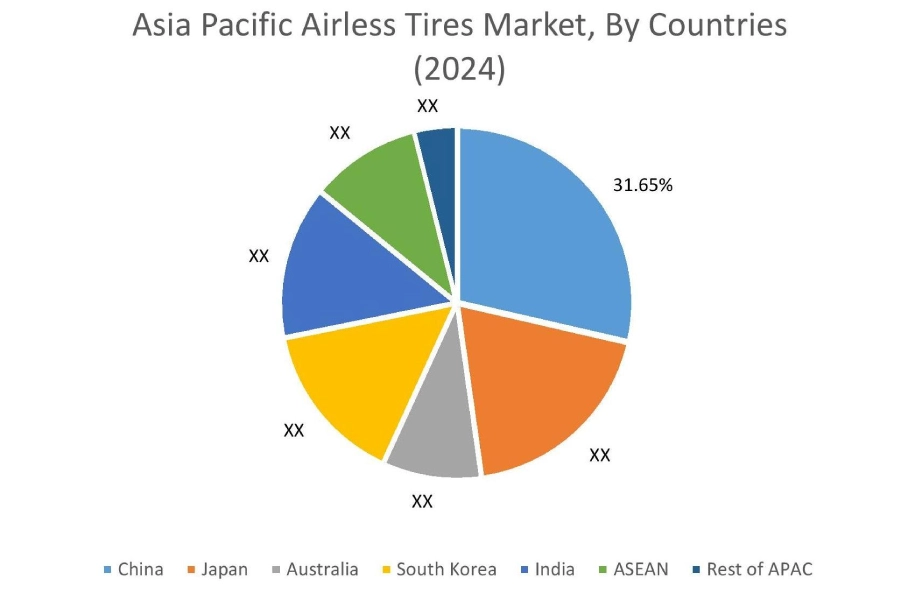

Asia Pacific region was valued at USD 20.59 Billion in 2024. Moreover, it is projected to grow by USD 21.90 Billion in 2025 and reach over USD 39.79 Billion by 2032. Out of this, China accounted for the maximum revenue share of 31.65%. As per the airless tires market analysis, the adoption of non-pneumatic tires in the Asia-Pacific region is primarily driven by increasing government investments in automotive sector, rising automobile production, and increasing adoption of electric vehicles. Similarly, increasing advancements associated with off-road vehicles are further accelerating the airless tires market expansion.

- For instance, according to the Society of Indian Automobile Manufacturers (SIAM), the total automotive production in India reached 3,10,34,174 units during FY 2024-25, representing an increase of 9% in comparison to 2,84,39,036 units during FY 2023-24. The above factors are further driving the airless tires market trendsin the Asia-Pacific region.

North America is estimated to reach over USD 30.51 Billion by 2032 from a value of USD 16.64 Billion in 2024 and is projected to grow by USD 17.61 Billion in 2025. In North America, the growth of the airless tires industry is driven by the increasing production of automobiles and rising adoption of electric vehicles (EVs) in the region. Additionally, the growing popularity of off-road vehicles and rising advancements associated with vehicle suspension systems and tires are further contributing to the airless tires market demand.

Meanwhile, according to the regional analysis, factors rising automobile production and increasing need for automobiles with improved traction, enhanced performance, and off-road capabilities are driving the airless tires market demand in Europe. Furthermore, according to the market analysis, the market demand in Latin America, Middle East, and African regions is expected to grow at a considerable rate due to factors such as such as growing automotive industry, increasing investments in electric vehicles, and increasing demand for off-road vehicles among others, among others.

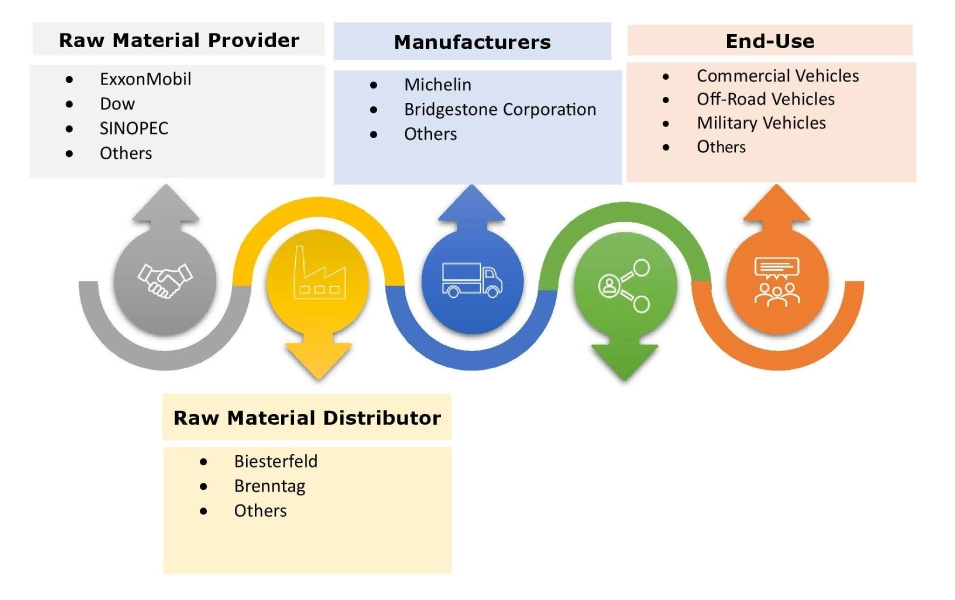

Top Key Players & Market Share Insights:

The global airless tires market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the airless tires market. Key players in the airless tires industry include-

- Michelin (France)

- Bridgestone Corporation (Japan)

- The Yokohama Rubber Co. Ltd (Japan)

- Tannus (USA)

- Ameritire Corporation (USA)

- Hankook Tire & Technology Co. Ltd (South Korea)

- General Motors (USA)

- Toyo Tire Corporation (Japan)

- Sumitomo Rubber Industries Ltd. (Japan)

- The Goodyear Tire & Rubber Company (USA)

Recent Industry Developments :

Product Launch:

- In September 2022, Hankook Tire showcased i-Flex, which is the company’s airless tire, at Hyundai Rotem’s exhibition booth. The i-Flex is an airless concept tire for use in unmanned vehicles driving on off-road terrains.

- In March 2022, Bridgestone announced the development of an airless tire concept for the passenger vehicle The company’s airless tire technology offers a distinct spoke structure that is designed for supporting the weight of a vehicle while effectively removing the need to periodically refill the tires with air.

Airless Tires Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 106.68 Billion |

| CAGR (2025-2032) | 7.3% |

| By Material |

|

| By Sales Channel |

|

| By Vehicle Type |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the airless tires market? +

The airless tires market was valued at USD 57.25 Billion in 2024 and is projected to grow to USD 106.68 Billion by 2032.

Which is the fastest-growing region in the airless tires market? +

Asia-Pacific is the region experiencing the most rapid growth in the airless tires market.

What specific segmentation details are covered in the airless tires report? +

The airless tires report includes specific segmentation details for material, sales channel, vehicle type, and region.

Who are the major players in the airless tires market? +

The key participants in the airless tires market are Michelin (France), Bridgestone Corporation (Japan), Hankook Tire & Technology Co. Ltd (South Korea), General Motors (USA), Toyo Tire Corporation (Japan), Sumitomo Rubber Industries Ltd. (Japan), The Goodyear Tire & Rubber Company (USA), The Yokohama Rubber Co. Ltd (Japan), Tannus (USA), Ameritire Corporation (USA), and others.