Alkylated Naphthalene Market Size:

Alkylated Naphthalene Market Size is estimated to reach over USD 17.49 Billion by 2032 from a value of USD 8.79 Billion in 2024 and is projected to grow by USD 9.42 Billion in 2025, growing at a CAGR of 8.0% from 2025 to 2032.

Alkylated Naphthalene Market Scope & Overview:

Alkylated naphthalene (AN) is a synthetic lubricant base oil, primarily used to enhance the performance of other lubricants. It is created by reacting naphthalene with an alkylating agent. AN offers a unique combination of properties, including high oxidative and thermal stability, good solvency, and lubricity. It is often used in applications requiring high performance and extended lubricant life.

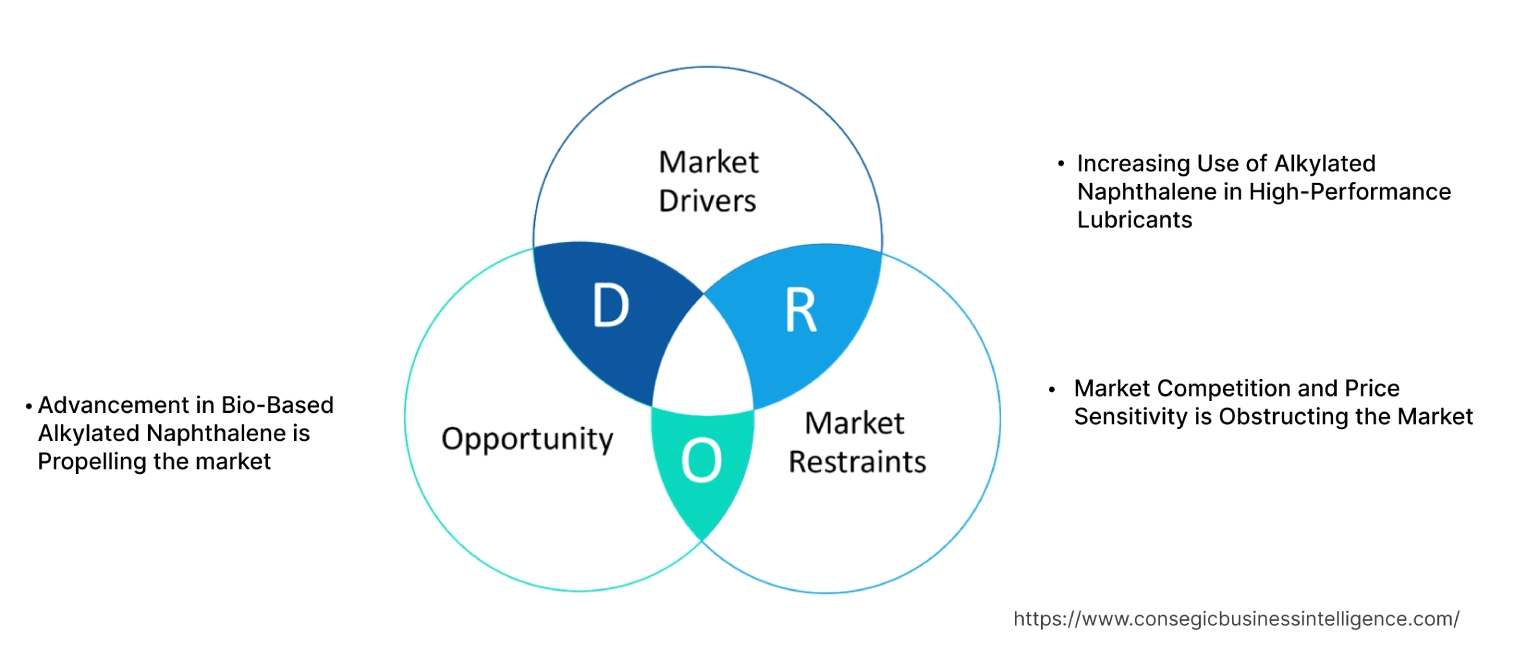

Alkylated Naphthalene Market Dynamics - (DRO) :

Key Drivers:

Rising demand for advanced lubricants is driving the alkylated naphthalene market expansion

One of the significant growth factors driving the global market is the rising need for advanced lubricants, particularly in the automotive and industrial sectors. As vehicle performance standards and industrial processes become more stringent, there is an increased need for lubricants that can withstand high temperatures and extreme pressure conditions. Alkylated naphthalene-based lubricants offer superior thermal stability and oxidation resistance, thus extending the service life of machinery components and reducing maintenance costs. Additionally, the push towards sustainability and energy efficiency is encouraging the development of lubricants that enhance fuel economy and reduce emissions, further propelling the global market.

- For instance, ExxonMobil offers Synesstic alkylated naphthalene (AN) base stocks in its product offerings, which help lubricants last longer and perform better in a wide range of operating conditions.

Thus, according to the alkylated naphthalene market analysis, the rising need for advanced lubricants is driving the alkylated naphthalene market size.

Key Restraints :

Fluctuating cost of raw materials is affecting the alkylated naphthalene market demand

One of the primary challenges includes the fluctuating cost of raw materials, which can affect production costs and pricing strategies. Additionally, the market is subject to stringent regulatory requirements, particularly concerning environmental impact and safety standards. These regulations can result in increased compliance costs and necessitate ongoing research and development to ensure products meet evolving standards. Furthermore, competition from alternative technologies and materials that offer similar performance characteristics at lower costs could also pose a threat to the market. Therefore, the aforementioned factors are further impacting the alkylated naphthalene market.

Future Opportunities :

Expanding electric vehicle (EV) market is driving the alkylated naphthalene market opportunities

One significant market opportunity lies in the expanding electric vehicle (EV) market, where the need for advanced thermal management and lubrication solutions is critical. Alkylated naphthalene, with its superior thermal stability, is well-suited to address these needs, offering manufacturers a reliable component in the development of EV technologies.

Bio-based AN is becoming increasingly attractive, particularly in the automotive sector, due to a growing emphasis on sustainable materials. Manufacturers can also gain a competitive edge by promoting bio-based AN as a cleaner and more environmentally friendly alternative. With the alkylated naphthalene market increasingly focused on incorporating sustainability into industrial processes, bio-based solutions are set to become a crucial component of advanced lubricants in the future.

- For instance, in June 2025, BEML Limited launched its first electric vehicle (EV) fleet at its Bengaluru headquarters, demonstrating its commitment to a sustainable future and supporting the Indian government's Go Green initiative. This EV rollout is a key part of BEML's larger strategy to achieve carbon neutrality and integrate sustainable practices throughout its operations. The public sector company plans to expand this green mobility program to its manufacturing facilities and regional offices nationwide. This substantial development in the automotive sector is anticipated to drive a greater need for alkylated naphthalene throughout the forecast period and boost the growth of the alkylated naphthalene market share.

According to the alkylated naphthalene market analysis, the above factors are expected to drive the alkylated naphthalene market opportunities.

Alkylated Naphthalene Market Segmental Analysis :

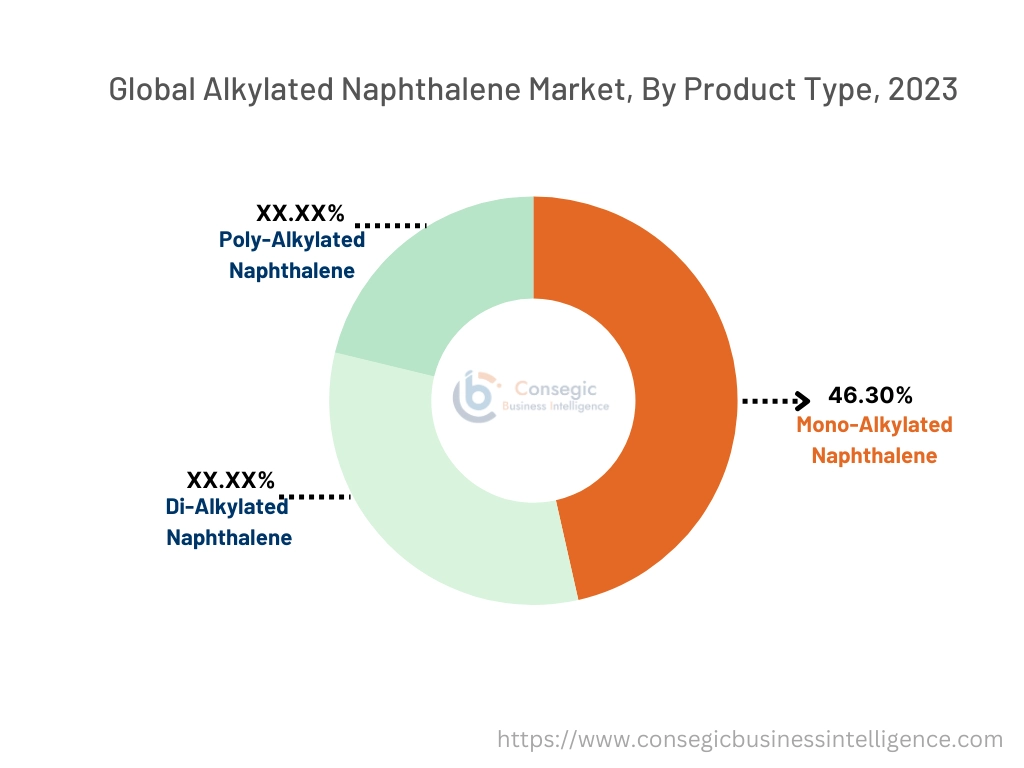

By Product Type:

Based on product type, the market is segmented into mono, di, and poly.

Trends in the product type:

- The ability to perform under higher temperatures and pressures without significant degradation is a key factor driving the adoption of AN.

- Innovations such as biodegradable formulations and enhanced recyclability are becoming increasingly important, aligning the product offerings with global environmental directives and consumer expectations for greener solutions.

- Thus, based on the above analysis, these factors are driving the alkylated naphthalene market demand.

The mono segment accounted for the largest revenue share of 48.43% in the year 2024.

- Mono AN, being the simplest form, is primarily utilized in applications where basic performance is adequate and cost considerations are necessary.

- The segment development is driven by its cost-effectiveness and growing use in standard lubrication applications, where advanced chemical properties are not required.

- Additionally, its better synthesis process makes it an attractive option for manufacturers aiming to cater to volume-driven markets.

- Thus, based on the above analysis, these factors are further driving the alkylated naphthalene market growth and trends.

The poly segment is anticipated to register the fastest CAGR during the forecast period.

- Poly-alkylated naphthalene represents the high-performance segment within this market, with its advanced molecular structure offering even greater thermal stability and compatibility with a wide range of additive technologies.

- Moreover, this type is increasingly utilized in high-end applications such as aerospace and specialized industrial processes where optimal performance is critical.

- Additionally, they are often used for developing lubricants with exceptional load-carrying capacity and prolonged shelf life, which is further driving the segment development.

- Thus, based on the above analysis, these factors are expected to drive the alkylated naphthalene market share and trends during the forecast period.

By Application:

Based on application, the market is segmented into lubricants, greases, metalworking fluids, hydraulic fluids, and others.

Trends in the application:

- The ability of AN to provide consistent performance under extreme conditions is a key factor driving its adoption in industrial fluids.

- The use of renewable feedstocks and advanced recycling methods further supports the industry's move towards more sustainable production practices, ensuring long-term viability and reduced environmental impact.

- The above factors are anticipated to further drive the alkylated naphthalene market trends during the forecast period.

The lubricants segment accounted for the largest revenue share in the year 2024, and it is expected to register the highest CAGR during the forecast period.

- The lubricant segment is one of the most significant applications, driven by the need for high-performance solutions that can withstand extreme conditions and extend the operational life of machinery.

- Alkylated naphthalene-based lubricants are particularly favored for their thermal stability, oxidation resistance, and ability to maintain performance over a wide temperature range.

- For instance, 6590 SUS alkylated naphthalene with this viscosity index is suited for mid-range applications where a moderate viscosity level is necessary. It is commonly employed in automotive and industrial lubricants, providing a balance between performance and cost.

- Thus, based on the above analysis, these factors would further supplement the alkylated naphthalene market trends.

By End-Use Industry:

Based on end use, the market is segmented into automotive, industrial machinery, aerospace, energy, and others.

Trends in the end use:

- As environmental regulations become more stringent, the marine sector’s shift towards eco-friendly and high-performance solutions is driving the market.

- The need for reliable and efficient industrial fluids that can optimize equipment performance and reduce operational costs is a major factor driving the use of alkylated naphthalene in industrial machinery.

- Thus, the above factors are driving the global market trends.

The automotive segment accounted for the largest revenue share in the year 2024.

- The automotive industry is one of the primary consumers of AN, driven by the continuous need for high-performance lubricants and fluids that enhance vehicle efficiency and longevity.

- As automotive technologies advance, particularly with the development of electric vehicles and hybrid vehicles, the need for specialized fluids that can meet rigorous performance standards is increasing.

- The expanding production of electric vehicles (EVs) and their unique lubrication needs are key drivers for market growth.

- Thus, the aforementioned factors and developments are driving the global market trends.

The aerospace segment is anticipated to register the fastest CAGR during the forecast period.

- In the aerospace industry, the demand for AN is propelled by its use in high-performance lubricants and hydraulic fluids that operate under extreme conditions.

- The ability to maintain stability and performance in high-altitude, high-temperature environments makes alkylated naphthalene a critical component in aerospace applications.

- As the aerospace sector is expected to grow steadily due to increased global travel and the development of defense sectors, the demand for these specialized fluids is expected to rise, further driving the global market.

- Thus, based on the above analysis, these developments are expected to drive the market.

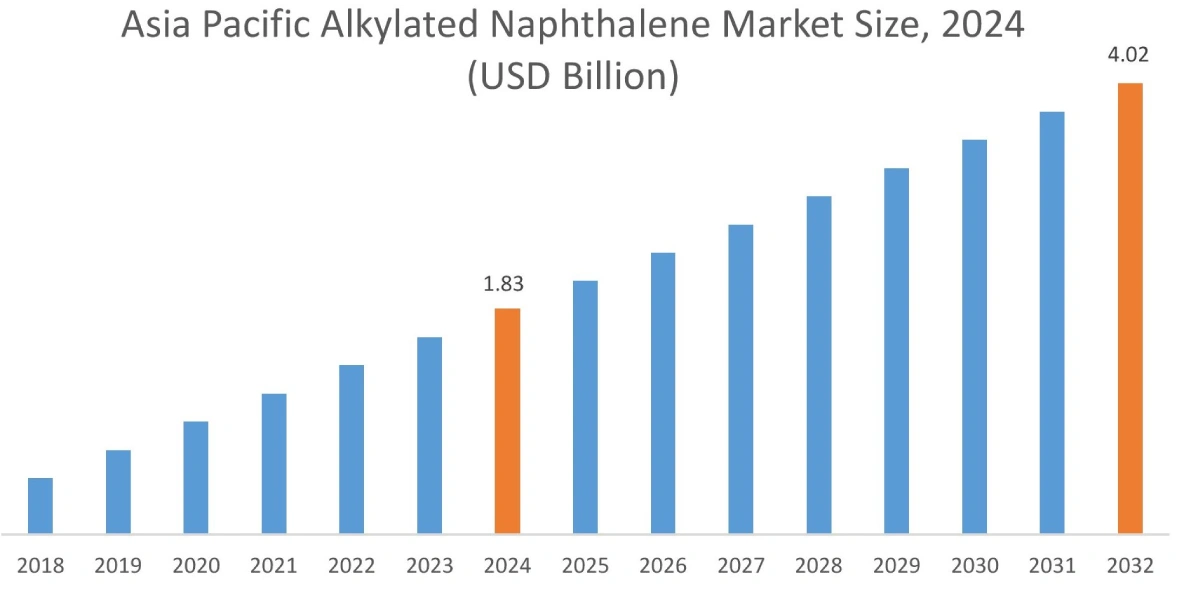

Regional Analysis:

The global market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

Asia Pacific alkylated naphthalene market expansion is estimated to reach over USD 4.02 billion by 2032 from a value of USD 1.83 billion in 2024 and is projected to grow by USD 1.97 billion in 2025. Out of this, the China market accounted for the maximum revenue split of 29.88%. The regional growth can be attributed to strong industrialization and the increasing demand for high-performance lubricants in automotive and industrial applications. Further, countries in the regions are expanding their manufacturing hubs and increasing their adoption of advanced automotive technologies. These factors would further drive the regional alkylated naphthalene market growth during the forecast period.

- For instance, in December 2024, BYD, the Chinese car manufacturer, sold 509,440 electric passenger vehicles and plug-in hybrid vehicles, which includes 207,734 EVs, bringing the total annual sales of battery-powered cars to 1.76 million. The company's overall annual sales rose by 41% as compared to the previous year.

North America market is estimated to reach over USD 7.00 billion by 2032 from a value of USD 3.55 billion in 2024 and is projected to grow by USD 3.80 billion in 2025. North America holds a significant share in the global market, due to its well-established automotive, aerospace, and industrial sectors. The United States leads this regional market, driven by the widespread adoption of alkylated naphthalene as a high-performance lubricant additive in vehicles and industrial machinery. Further, the growing need for durable lubricants, especially in demanding applications like aerospace and heavy-duty equipment, further fuels this market's development. These factors would further drive the regional market during the forecast period.

Additionally, according to the analysis, the alkylated naphthalene industry in Europe is expected to witness significant development during the forecast period. Europe’s market is characterized by stringent environmental regulations and a strong emphasis on innovation, pushing manufacturers to develop more efficient and eco-friendly products. Additionally, Latin America represents a developing market, with growth prospects emerging due to industrial expansion and increasing automotive production. Further, in the Middle East & Africa, the oil and gas sector contribute to the need for alkylated naphthalene, driven by its requirement for high-performance fluids that can withstand harsh operating conditions. Thus, the above factors are driving the regional alkylated naphthalene market size.

Top Key Players and Market Share Insights:

The global alkylated naphthalene market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the alkylated naphthalene industry include-

- ExxonMobil Corporation (U.S.)

- Chevron Phillips Chemical Company (U.S.)

- Sasol Limited (South Africa)

- Clariant AG (Switzerland)

- Evonik Industries AG (Germany)

- Lanxess AG (Germany)

- Royal Dutch Shell plc (U.K.)

- Idemitsu Kosan Co., Ltd. (Japan)

- Nippon Oil Corporation (Japan)

- BASF SE (Germany)

- TotalEnergies SE (France)

Alkylated Naphthalene Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 17.49 Billion |

| CAGR (2024-2031) | 8.0% |

| By Product Type |

|

| By Application |

|

| By End-Use Industry |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Alkylated Naphthalene Market? +

Alkylated Naphthalene market size is estimated to reach over USD 17.49 Billion by 2032 from a value of USD 8.79 Billion in 2024 and is projected to grow by USD 9.42 Billion in 2025, growing at a CAGR of 8.0% from 2025 to 2032.

Which is the fastest-growing region in the Alkylated Naphthalene Market? +

Asia-Pacific is the region experiencing the most rapid growth in the market.

What specific segmentation details are covered in the Alkylated Naphthalene report? +

The alkylated naphthalene report includes specific segmentation details for product type, application, end use, and region.

Who are the major players in the Alkylated Naphthalene Market? +

The key participants in the market are ExxonMobil Corporation (U.S.), Chevron Phillips Chemical Company (U.S.), Lanxess AG (Germany), Royal Dutch Shell plc (U.K.), Idemitsu Kosan Co., Ltd. (Japan), Nippon Oil Corporation (Japan), BASF SE (Germany), TotalEnergies SE (France), Sasol Limited (South Africa), Clariant AG (Switzerland), Evonik Industries AG (Germany), and others.