Automotive Belt Tensioner Pulleys Market Size:

Automotive Belt Tensioner Pulleys Market size is estimated to reach over USD 5.39 Billion by 2032 from a value of USD 3.71 Billion in 2024 and is projected to grow by USD 3.82 Billion in 2025, growing at a CAGR of 5.1% from 2025 to 2032.

Automotive Belt Tensioner Pulleys Market Scope & Overview:

Automotive belt tension pulleys refer to a component of the engine that is used to correct the tension on a belt. Additionally, the pulleys are used in several vehicles, including MUVs and SUVs, to ensure proper power transfer from the engine to the car components. Further, the pulleys have experienced rising adoption due to growing awareness among end consumers about belt tensioners and the role they play in enhancing engine performance. Moreover, the increasing production of passenger and commercial vehicles around the world has driven the market.

How is AI Transforming the Automotive Belt Tensioner Pulleys Market?

AI is influencing the automotive belt tensioner pulleys market by driving smarter design, predictive maintenance, and efficiency improvements. Traditionally, these components ensure optimal tension in engine belts, but with AI integration, performance monitoring has become more precise. AI-powered systems can track vibration, wear, and alignment in real time, predicting potential failures before they occur and reducing vehicle downtime. In manufacturing, AI optimizes production processes, improving quality control and reducing defects in pulley systems. Moreover, AI supports advanced simulations to design lighter, more durable components that enhance fuel efficiency and engine reliability. As vehicles move toward electrification and intelligent systems, AI is adding greater value to the role of belt tensioner pulleys in overall automotive performance.

Automotive Belt Tensioner Pulleys Market Dynamics - (DRO) :

Key Drivers:

Growing Aftermarket is Propelling the Automotive Belt Tensioner Pulleys Market Growth

The escalating demand for replacement parts in the automotive aftermarket is a significant driver for the belt tensioner pulleys market. Further, used cars have experienced a growing adoption of belt tensioner pulleys due to the wear and tear experienced in the pulleys and the need to replace the pulleys in these cars. Moreover, there has been a rise in online platforms that provide aftermarket automotive parts due to low prices and quick shipping, which is driving the market.

- For instance, Autozone offers aftermarket belt tensioners and pulleys for various brands, including Durablast.

Hence, the growing adoption of online aftermarket sellers due to low prices and quick shipping is proliferating the automotive belt tensioner pulleys market size.

Key Restraints:

Growing Adoption of Electric Vehicles is Restraining the Automotive Belt Tensioner Pulleys Market Growth

Electric vehicles typically do not use belt tensioner pulleys to drive the vehicle like ICE vehicles. EVs rely on electric motors to turn the wheels, which eliminates the need for transmission systems, including belts, gears, and tensioners. Moreover, electric vehicle sales have experienced a growing trend due to rising environmental concerns arising from ICE cars. Additionally, several car manufacturers have started investing in technologies and R&D to develop fully electric vehicles, which can act as a restraint to the overall market. Thus, the increase in the adoption of electric vehicles poses a threat to the automotive belt tensioner pulleys market share.

Future Opportunities :

Integration of Tensioner Pulleys in Hybrid Vehicles is Expected to Drive the Automotive Belt Tensioner Pulleys Market Opportunities

Hybrid vehicles utilize a tensioner pulley system to offer better fuel efficiency by minimizing tension loss. Additionally, modern tensioners in hybrid vehicles consist of a housing, which is connected to the electric motor by a plain bearing, and a tensioner pulley is attached to this housing. Moreover, many manufacturers have started offering belt tensioners for P0 hybrid vehicle applications with a sealed design to protect the internal components of the tensioners.

- For instance, Industrias Dolz offers an auxiliary drive kit SKD25OA, which includes tensioner pulleys for a hybrid vehicle equipped with a DW10 HY Hybrid engine.

Thus, the rising technological advancements associated with hybrid vehicles and tensioner pulleys used for the hybrid engines are projected to drive the automotive belt tensioner pulleys market opportunities during the forecast period.

Automotive Belt Tensioner Pulleys Market Segmental Analysis :

By Type:

Based on type, the market is segmented into manual and automatic.

Trends in the type:

- Increasing adoption of automatic tensioner pulleys for better handling of the engine loads is driving the market.

- Rising utilization of automatic tensioner pulleys due to their ability to handle temperature variations is driving the market.

Automatic accounted for the largest revenue share in the year 2024 and is anticipated to register the fastest CAGR during the forecast period.

- Vehicle manufacturers today utilize automatic belt tensioner pulleys due to their ability to self-adjust the tension, which helps in promoting longer belt life.

- Moreover, automatic belt tensioner pulleys have started featuring a heavy-duty cast aluminium spring case to resist cracking and fatigue.

- For instance, Dayco offers automatic tensioners that come with glass-filled or steel pulleys, featuring a dust cover to protect against contaminants.

- Thus, according to the automotive belt tensioner pulleys market analysis, the rising adoption of automotive belt tensioner pulleys due to automatic handling of tension and protection against contaminants is driving the market trends.

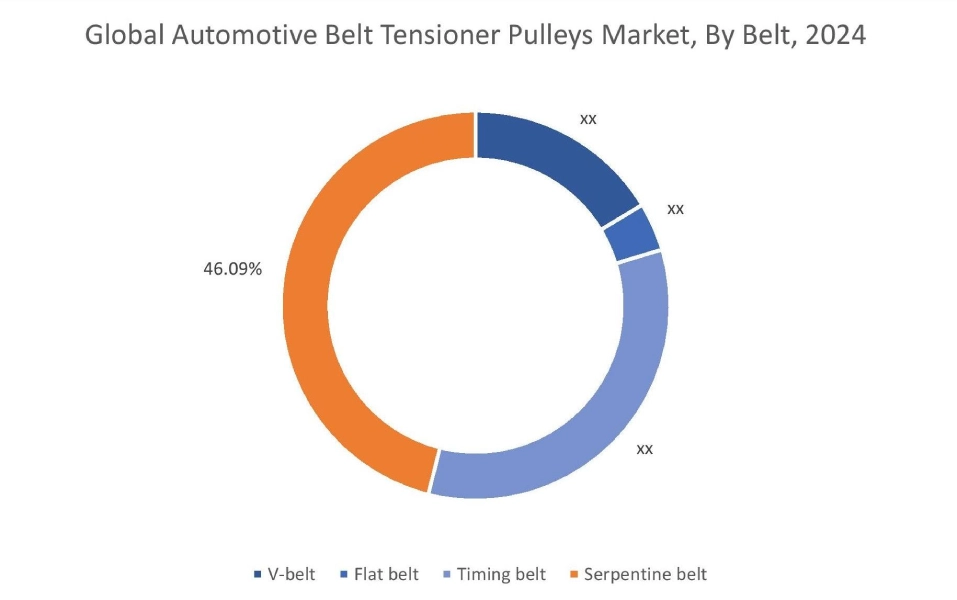

By Belt:

Based on belt, the market is segmented into v-belt, flat belt, timing belt, and serpentine belt.

Trends in the belt:

- There is a rising shift towards the use of pulleys in timing belt tensioners with two shafts, as per the automotive belt tensioner pulleys market trends.

- Increasing adoption of tensioner pulleys in serpentine belts for transferring rotational force from the engine to accessory components is driving the automotive belt tensioner pulleys market share.

Serpentine belt accounted for the largest revenue share of 46.09% in the year 2024.

- Serpentine belts are being used in vehicles to transfer power from the engine to power accessories in a vehicle that includes air conditioning compressors and water pumps.

- Moreover, the rising adoption of serpentine belts with tensioner pulleys for reduced noise and vibration within the engine compartment has driven the market.

- For instance, Dayco offers heavy-duty serpentine belt drive components, which include tensioners and pulleys for trucks and buses.

- Thus, the rising adoption of serpentine belts for powering air conditioning compressors and water pumps is driving the market.

Timing belt is anticipated to register the fastest CAGR during the forecast period.

- Timing belt tensioner pulley is a crucial component in a vehicle’s design system, specifically in the timing belt or chain assembly.

- Further, there has been a rising adoption of robust metal alloys for the tensioner pulleys for improved strength and durability, as per the automotive belt tensioner pulleys market analysis.

- Moreover, there has been an increasing use of timing belt tensioner pulleys for preventing slippage and ensuring efficient power transfer.

- For instance, SKF offers a timing belt tensioner pulley called VKM 16002 that is compatible with Renault, Nissan, and Proton vehicle models.

- Therefore, the rising adoption of timing belts due to improved strength and efficient power transfer is driving the market during the forecast period.

By Material:

Based on the material, the market is segmented into metal, plastic, and composite.

Trends in the material:

- Increasing use of steel due to its high tensile strength is driving the automotive belt tensioner pulleys market trends.

- Factors, including resistance to corrosion and fatigue, are driving the plastic segment as per the analysis.

Metal accounted for the largest revenue share in the overall market in 2024.

- Metal pulleys in vehicle engines offer proper belt tracking in vehicles due to a crowned running surface.

- Additionally, aluminum pulleys have experienced a rising adoption due to good inertia control and excellent wear characteristics.

- Moreover, manufacturers have started offering steel pulleys made from precision steel stamping.

- Therefore, the increasing use of metal pulleys due to crowned running surfaces and better inertia control is driving the automotive belt tensioner pulleys market size.

Plastic is anticipated to register the fastest CAGR during the forecast period.

- Tensioner pulleys have witnessed a growing use of plastic due to the precise dimensional tolerance for smooth operation.

- Moreover, many manufacturers have started offering plastic pulleys that feature a sealed ball bearing for protection against moisture.

- For instance, Continental offers plastic pulleys that come with glass-reinforced thermoplastic for ideal dimensional control and running surface durability.

- Thus, the rising number of plastic pulleys for dimension control and backside applications for easier installation in large pipes is driving the market during the forecast period.

By Vehicle:

Based on the vehicle, the market is segmented into passenger vehicle and commercial vehicle.

Trends in the vehicle:

- Increasing adoption of tensioner pulleys for constant belt tension and low noise levels in passenger vehicles is driving the market.

- There is a rising utilization of steel pulleys for reliable resistance to external influences under harsh load conditions in commercial vehicles.

Passenger vehicle accounted for the largest revenue share in the year 2024.

- Passenger vehicle tensioner pulleys help in ensuring proper operation of engine accessories, including power steering and alternators.

- Additionally, passenger vehicles have experienced a rising adoption of tensioners that provide a pre-determined and constant tension to help dampen the belt system vibrations.

- Moreover, manufacturers have started tensioner pulleys for high end passenger vehicles to ensure a long service life after replacement.

- For instance,Schaeffler offers a timing belt tensioner pulley under its INA brand for Land Rover cars.

- Therefore, the rising adoption of automotive belt tensioner pulleys in passenger vehicles due to the adoption of tensioners with pre-determined and constant tension has resulted in the automotive belt tensioner pulleys market expansion.

Commercial vehicle is anticipated to register the fastest CAGR during the forecast period.

- Commercial vehicles have witnessed a growing adoption of tension pulleys that provide the required operating voltage and belt guidance for the belts in commercial vehicle engines.

- Moreover, the growing demand for heavy-duty trucks has driven the adoption of belt tensioner pulleys in trucks.

- For instance, Daimler India Commercial Vehicles announced that it had achieved a 39% growth in domestic sales and a 13% increase in cumulative sales in 2023.

- Hence, the rising adoption of digital output signals due to higher measurement accuracy is driving the market.

By End User:

Based on the end user, the market is segmented into original equipment manufacturer (OEM) and aftermarket.

Trends in the end user:

- Increasing utilization of OEM tensioner pulleys due to superior quality and compatibility with the vehicle is driving the OEM segment.

- There has been a rising trend in the adoption of aftermarket belt tensioner pulleys due to their cost-effectiveness, which is driving the aftermarket segment.

Original Equipment Manufacturer (OEM) accounted for the largest revenue in the overall market in 2024.

- OEM tensioner pulleys have experienced rising adoption in sedan and hatchback cars due to the rising sales of these cars.

- Further, OEMs have started supplying tensioner pulley bearings to fix the squealing sound that occurs when the pulley bearing fails.

- Moreover, manufacturers have started offering original equipment tensioner pulleys that are designed and tested to increase the overall belt life and eliminate the need for tensioning operation during installation.

- For instance, RealMazaParts offers an OEM Tensioner Pulley KJ01-12-750 for the Mazda Millenia model, guaranteeing an exact fit and compatibility with the vehicle.

- Thus, the rising demand for original equipment manufacturer (OEM) due to higher quality and compatibility is driving the global automotive belt tensioner pulleys market.

Aftermarket is anticipated to register the fastest CAGR during the forecast period.

- Aftermarket suppliers have experienced a rising demand for tensioner pulleys for maximum performance under high mechanical and chemical loads.

- Moreover, the suppliers have started offering pulleys that dynamically adjust the belt tension and neutralize changes in the tension, including short-term changes caused by load variations and temperature.

- For instance, Bosch offers aftermarket tensioner pulleys with outer ring made of steel or plastic and single/double-row grooved for improved durability.

- Hence, the growing demand for aftermarket due to the rising adoption of tensioner pulleys that can withstand short-term and long-term load changes has resulted in the automotive belt tensioner pulleys market expansion.

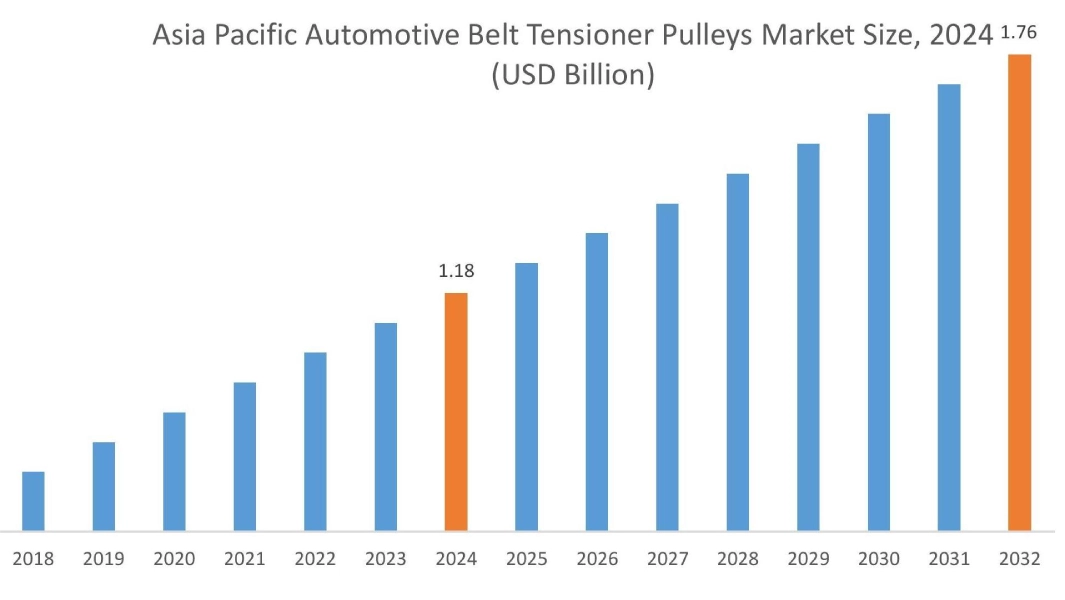

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 1.18 Billion in 2024. Moreover, it is projected to grow by USD 1.22 Billion in 2025 and reach over USD 1.76 Billion by 2032. Out of this, China accounted for the maximum revenue share of 33.4%. As per the market analysis, the adoption of tensioner pulleys in the Asia-Pacific region is primarily driven by the growth in investments for commercial vehicle production and the adoption of automotive belt tensioner pulleys supplied by aftermarket.

- For instance, in March 2025, Ashok Leyland inaugurated a new bus manufacturing plant in Andhra Pradesh. The plant spans about 75 acres and has an annual production capacity of 4,800 buses. The growing investments by manufacturers to produce buses are expected to boost the belt tensioner pulley market, as the pulleys are a key component in diesel bus engines.

North America is estimated to reach over USD 1.60 Billion by 2032 from a value of USD 1.09 Billion in 2024 and is projected to grow by USD 1.12 Billion in 2025. In North America, the growth of the automotive belt tensioner pulleys industry is driven by the growing sales of trucks. Moreover, the increasing investment in luxury vehicle part manufacturing is contributing to the automotive belt tensioner pulleys market demand.

- For instance, in January 2024, Rolls-Royce announced that it had opened a new remanufacturing and overhaul center in South Carolina. The facility aims to increase the availability of engine parts by remanufacturing 20,000 parts per year, which is expected to boost the overall market due to increased availability of remanufactured tensioners and pulleys.

Additionally, the regional analysis depicts that the growth of tensioner pulleys in hybrid vehicles with combustion engines is driving the automotive belt tensioner pulleys industry in Europe. Furthermore, as per the market analysis, the automotive belt tensioner pulleys market demand in Latin America is expected to grow at a considerable rate due to growth in investments in the production of passenger vehicles. The Middle East and African region is expected to grow at a considerable rate due to factors, including growing income levels of the population and growing urbanization, among others.

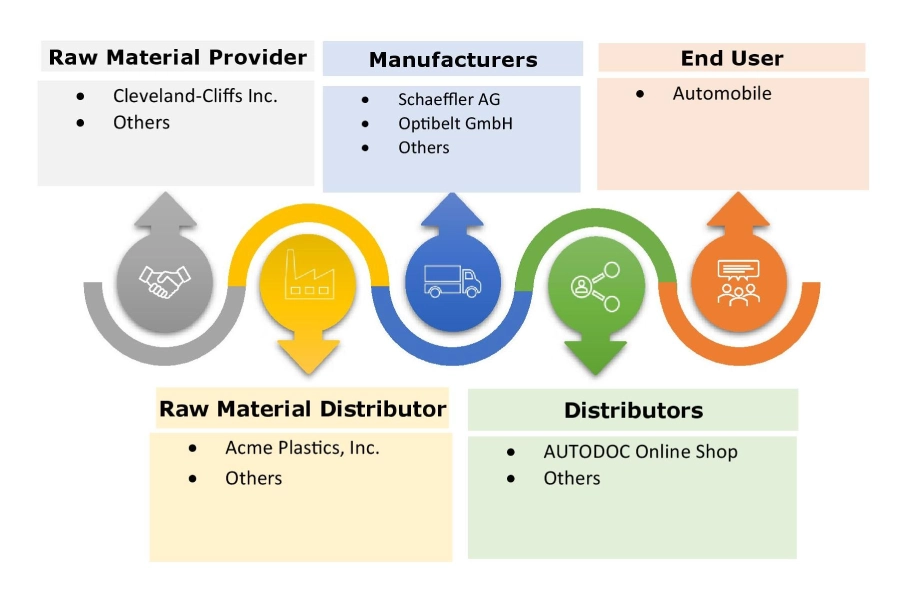

Top Key Players and Market Share Insights:

The global automotive belt tensioner pulleys market is highly competitive, with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the automotive belt tensioner pulleys market. Key players in the automotive belt tensioner pulleys industry include-

- SKF (Sweden)

- Schaeffler AG (Germany)

- Maedler (Germany)

- Dayco Incorporated (U.S.)

- NTN Corporation (Japan)

- ContiTech Deutchland Gmbh (Germany)

- Optibelt GmbH (Germany)

- Gates Corporation (U.S.)

- NSK Ltd. (Japan)

- ABA Automotive (Turkey)

Recent Industry Developments :

Acquisition

- In February 2024,Cloyes Gear and Products, a manufacturer of automotive aftermarket parts announced the acquisition of Automotive Tensioners Inc. ATI has developed a range of pulleys and tensioners for heavy-duty and off-road vehicles. The acquisition aims to deliver improved timing system solutions to modern automotive repair shops.

Market Expansion

- In October 2024, Optibelt, a leading manufacturer of automotive belts and tensioner pulleys announced the opening of a new plant facility in Mexico. Optibelt plans to invest approximately 1.5 billion pesos in the new factory by 2027, which will result in the creation of more than 600 jobs in the coming years.

Automotive Belt Tensioner Pulleys Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 5.39 Billion |

| CAGR (2025-2032) | 5.1% |

| By Type |

|

| By Belt |

|

| By Material |

|

| By Vehicle |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the automotive belt tensioner pulleys market? +

The automotive belt tensioner pulleys market is estimated to reach over USD 5.39 Billion by 2032 from a value of USD 3.71 Billion in 2024 and is projected to grow by USD 3.82 Billion in 2025, growing at a CAGR of 5.1% from 2025 to 2032.

Which is the fastest-growing region in the automotive belt tensioner pulleys market? +

Asia-Pacific region is experiencing the most rapid growth in the automotive belt tensioner pulleys market.

What specific segmentation details are covered in the automotive belt tensioner pulleys market report? +

The automotive belt tensioner pulleys market report includes specific segmentation details for type, belt, material, vehicle, end user, and region.

Who are the major players in the automotive belt tensioner pulleys market? +

The key participants in the automotive belt tensioner pulleys market are SKF (Sweden), ContiTech Deutchland Gmbh (Germany), Optibelt GmbH (Germany), Gates Corporation (U.S.), NSK Ltd. (Japan), ABA Automotive (Turkey), Schaeffler AG (Germany), Maedler (Germany), Dayco Incorporated (U.S.), NTN Corporation (Japan), and Others.

How big is the automotive belt tensioner pulleys market? +

The automotive belt tensioner pulleys market is estimated to reach over USD 5.39 Billion by 2032 from a value of USD 3.71 Billion in 2024 and is projected to grow by USD 3.82 Billion in 2025, growing at a CAGR of 5.1% from 2025 to 2032.

Which is the fastest-growing region in the automotive belt tensioner pulleys market? +

Asia-Pacific region is experiencing the most rapid growth in the automotive belt tensioner pulleys market.

What specific segmentation details are covered in the automotive belt tensioner pulleys market report? +

The automotive belt tensioner pulleys market report includes specific segmentation details for type, belt, material, vehicle, end user, and region.

Who are the major players in the automotive belt tensioner pulleys market? +

The key participants in the automotive belt tensioner pulleys market are SKF (Sweden), ContiTech Deutchland Gmbh (Germany), Optibelt GmbH (Germany), Gates Corporation (U.S.), NSK Ltd. (Japan), ABA Automotive (Turkey), Schaeffler AG (Germany), Maedler (Germany), Dayco Incorporated (U.S.), NTN Corporation (Japan), and Others.