Capacity Management Market Size:

Capacity Management Market size is estimated to reach over USD 10.16 Billion by 2032 from a value of USD 1.84 Billion in 2024 and is projected to grow by USD 2.25 Billion in 2025, growing at a CAGR of 20.75% from 2025 to 2032

Capacity Management Market Scope & Overview:

The capacity management is the strategic process of planning, monitoring, and optimizing to ensure that an organization's resources are sufficient to meet current and future demands cost-effectively and efficiently. It involves tools and strategies for forecasting resource requirements, assessing performance metrics, and managing workloads across data centers, cloud environments, and IT systems to prevent performance issues. Further, the key factors driving the capacity management market growth include optimizing resource utilization, controlling costs, maintaining high performance, and scalability. Also, the service offers advantages such as improved resource allocation, better workforce management, cost savings, and enhanced customer satisfaction, which in turn is driving the capacity management market demand.

How is AI Impacting the Capacity Management Market?

AI uses machine learning to analyze historical data and identify trends to make more accurate demand forecasting for managing capacity. Also, AI has helped businesses anticipate future needs, such as staffing levels for customer service or inventory for manufacturing. Additionally, AI can automate the allocation of resources dynamically based on real-time data, which in turn has helped to prevent over-provisioning, which increases costs and ensures that resources. Further, AI helps organizations become more proactive and adaptive by allowing them to transition from passive responses to intelligent, dynamic adjustments, which builds resilience against market fluctuations and disruptions.

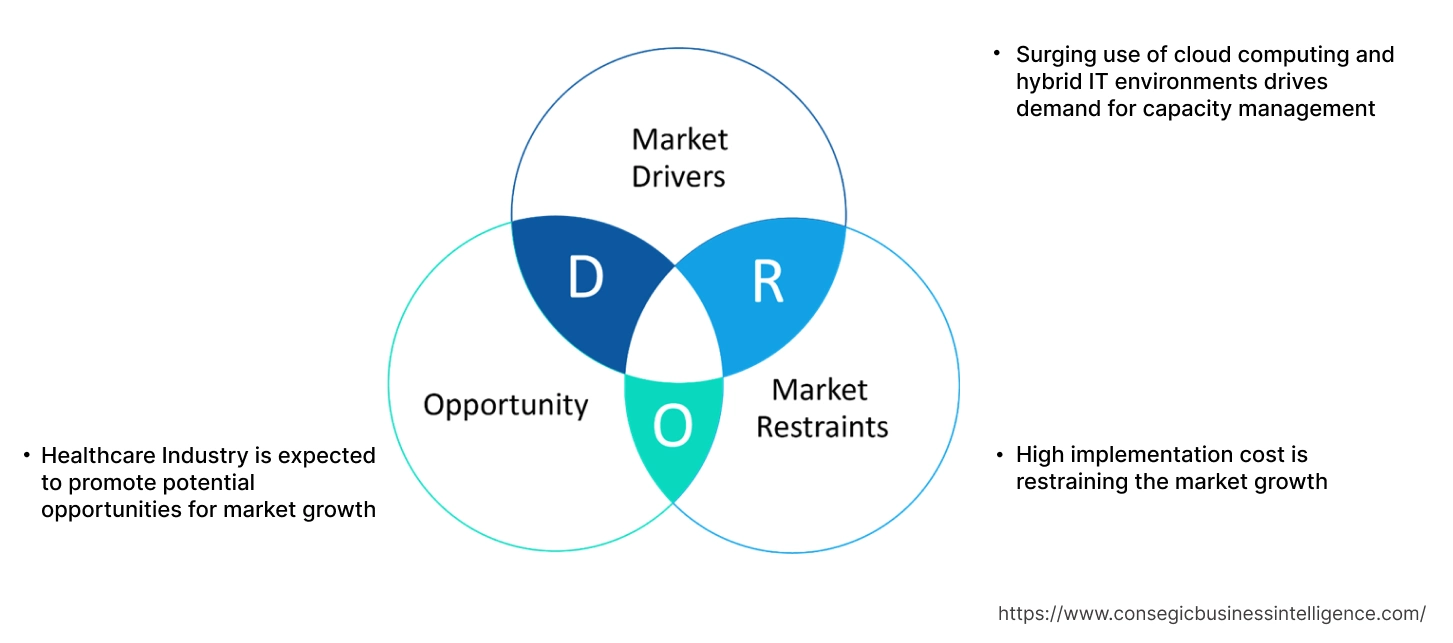

Capacity Management Market Dynamics - (DRO) :

Key Drivers:

Surging use of cloud computing and hybrid IT environments drives demand for capacity management

The increasing complexity of cloud computing and hybrid IT environments is rapidly increasing the adoption of cloud-based services, and integrating hybrid IT architectures and managing and optimizing resources across diverse environments is boosting the capacity management market demand. Moreover, traditional capacity planning tools are outdated and do not change based on user needs and application requirements. Additionally, the tool helps to prevent overspending and ensures that companies can scale up to meet sudden requirements, which in turn boosts the capacity management market growth. Further, the rapid development in industries such as e-commerce, financial services, and media streaming, among others, is fueling the market need for advanced solutions tailored to cloud and hybrid IT environments.

- For instance, in April 2025, Integrated Research launched the Capacity Management module, which enables businesses to model multiple capacity scenarios, predict future needs, anticipate and prevent performance issues, and optimize infrastructure investments for business-critical IT ecosystems.

Therefore, the increasing complexity of cloud computing and hybrid IT environments is driving the growth of the market.

Key Restraints :

High implementation cost is restraining the market growth

The upfront costs for solutions, including software, hardware, and integration, followed by maintenance, software updates, and support services, which are higher than the initial software cost, which in turn is hindering the capacity management market expansion. Additionally, organizations, specifically those lacking internal IT expertise, have to face additional costs for end-user training to ensure the efficient use of the systems. Further, the cost can vary depending on the solution's complexity and the organization's specific needs, as the adoption of advanced solutions is creating challenges for market adoption for small and medium enterprises.

Therefore, the high costs of implementation are restraining the capacity management market expansion.

Future Opportunities :

Healthcare Industry is expected to promote potential opportunities for market growth

The growing global patient population, particularly with chronic and age-related conditions, is driving the need for better management of hospital resources such as beds, staff, and equipment, which in turn is propelling the capacity management market opportunities. Additionally, the hospitals are focusing on improving productivity, reducing costs, and streamlining processes, such as patient admission, discharge, and transfers is driving the market progress. Further, the integration of AI, machine learning, and the Internet of Things (IoT) allows for real-time asset tracking, predictive analytics to forecast demand, and more efficient patient flow management.

- For instance, in August 2025, West Tennessee Healthcare expanded its partnership with Xsolis for the launch of Dragonfly Navigate, which is designed as a capacity planning solution. Additionally, the solution aims to drive efficiency, improve care coordination, and make it easier to identify and address the root causes of discharge barriers and avoidable delays.

Hence, the rising adoption of solutions in the healthcare industry is anticipated to increase the utilization, in turn promoting prospects for capacity management market opportunities during the forecast period.

Capacity Management Market Segmental Analysis :

By Component:

Based on the component, the capacity management market is segmented into software and services (consulting, integration & deployment, and support & maintenance).

Trends in the Component:

- The growing need for expert support due to the growing complexity of IT environments is driving the adoption of services, which in turn fuels the capacity management market trends.

- The rising need for dashboards and reporting tools to access and analyze capacity data is driving the need for the software segment, which in turn is boosting the capacity management market trends.

The software component accounted for the largest revenue share in the year 2024.

- The software helps in real-time monitoring, analyzing, and optimizing resource usage across IT infrastructure, including servers, networks, and storage systems.

- Additionally, the rising need for real-time monitoring with the help of advanced software with features such as automation, machine learning, and AI-driven analytics is driving the software-based capacity management market share.

- Further, the shift from traditional software to cloud-based solutions is propelling the growth of the software segment, which in turn is fueling the capacity management market size.

- Furthermore, the ability to provide comprehensive monitoring, optimization, and predictive analytics capabilities that meet the modern IT environments' requirements is driving the market growth.

- Thus, as per the capacity management market analysis, the shift from traditional software to cloud-based solutions is driving the adoption of software components.

The services component is anticipated to register the fastest CAGR during the forecast period.

- The services segment comprises of consulting, integration & deployment, and support & maintenance services.

- Also, the services segment is essential for successful implementation and operation, which in turn helps the organization assess the current capacity requirements.

- Additionally, the services segment helps to identify potential issues and develop customized strategies, which in turn is driving the capacity management market share.

- Further, the rising adoption of consulting services to optimize current capacity needs and identify potential issues is fueling the capacity management market size.

- Further, the increasing complexity of IT environments and the rising need for expert support for capacity planning and optimization are driving the need for the services segment.

- Therefore, as per the market analysis, the rising adoption of consulting services and increasing complexity of IT environments are anticipated to boost the market during the forecast period.

By Organization Size:

Based on the organization size, the market is bifurcated into small & medium enterprises (SMEs) and large enterprises.

Trends in the Organization Size:

- The trend towards the adoption of Industry 4.0 technologies such as IoT and digital twins for real-time monitoring and optimization in large enterprises is paving the way for market adoption.

- The trend towards the proliferation of e-commerce is pushing SMEs to expand their operations and capacity to meet increasing online demand is driving the need for capacity management industry.

Large Enterprises accounted for the largest revenue share in the year 2024.

- The solution helps large enterprises to achieve their goals efficiently by balancing resource availability, preventing bottlenecks, and controlling costs.

- The large enterprises comprise complex IT infrastructures, and capacity planning is essential for maintaining performance and preventing downtime.

- Additionally, large organizations invest heavily in advanced solutions to enhance their IT resources due to the increasing adoption of hybrid and multi-cloud environments.

- Further, the key factors, such as the centralized control and advanced monitoring capabilities, which are essential for the healthcare sector, in turn, are driving the adoption by large enterprises.

- For instance, in October 2024, TeleTracking Technologies launched Capacity IQ, which is a SaaS version of Capacity Management Suite for hospitals and health systems. The software aims to improve discharge efficiency, reduce bed turnover times, and minimize emergency department boarding.

- Thus, as per the capacity management market analysis, the aforementioned factors are driving the market adoption by large enterprises.

Small & Medium Enterprises is anticipated to register the fastest CAGR during the forecast period.

- The small and medium enterprises are increasingly focusing on optimizing their limited IT resources and improving operational efficiency due to the shift towards digital transformation and cloud adoption.

- Also, the flexibility, lower upfront costs, and ease of deployment offered by cloud-based solutions are driving the market adoption by SMEs.

- Further, the improved performance and reduced risk of system overloads and rising awareness about the benefits of adopting capacity planning solutions are boosting the market progress.

- Therefore, as per the market analysis, the flexibility, lower upfront costs, and ease of deployment are anticipated to boost the market adoption by SMEs during the forecast period.

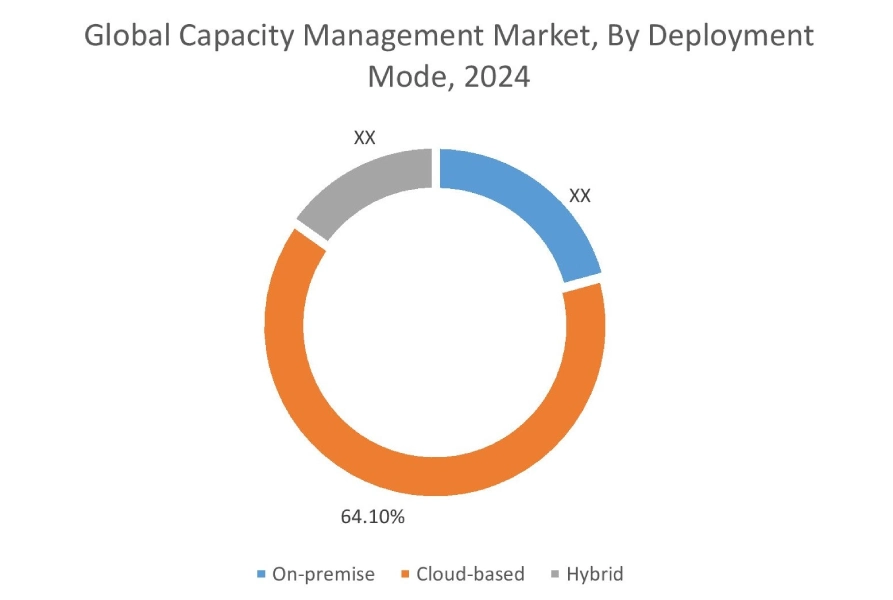

By Deployment Mode:

Based on the deployment mode, the market is segmented into on-premise, cloud-based, and hybrid.

Trends in the Deployment Mode:

- The technological advancement in cloud-native applications for capacity planning to enable more flexible and efficient deployment and management is driving the adoption of cloud-based deployment in the capacity management market.

- The increasing adoption of AI and AIOps for automation and predictive analytics is driving the need for hybrid deployment.

The cloud-based deployment accounted for the largest revenue share of 64.10% in the year 2024.

- The cloud-based deployment has the ability to offer scalability, flexibility, and ease of access, which makes it a preferable choice for many organizations.

- Also, the rising adoption of cloud computing is propelling the need for cloud-based capacity planning tools to handle workloads and provide real-time insights.

- Further, the proliferation of integrating AI and machine learning in cloud-based solutions to help organizations address capacity issues proactively is boosting the market development.

- Furthermore, the flexibility, scalability, and ability to support modern, dynamic IT environments are driving the need for cloud-based deployment in the market.

- Thus, as per the market analysis, the aforementioned factors are driving the market evolution.

The hybrid deployment is anticipated to register the fastest CAGR during the forecast period.

- The hybrid deployment is a combination of on-premise and cloud-based solutions, which in turn offers flexibility to manage both local and cloud resources effectively.

- Also, the hybrid deployment is majorly adopted by large enterprises due to their complex IT environments requiring a mix of on-premise control and cloud scalability solutions.

- Further, the key features driving the adoption of hybrid deployment include optimizing resource usage, enhancing security, and maintaining control over sensitive data.

- Furthermore, the increasing adoption of multi-cloud strategies as well as the need for integrating capacity planning across IT environments, is paving the way for market progress.

- Therefore, as per the market analysis, the aforementioned factors are anticipated to boost the market during the forecast period.

By Industry Vertical:

Based on the industry vertical, the capacity management market is segmented into IT & telecom, healthcare, BFSI, manufacturing, retail, and government & public sector.

Trends in the Industry Vertical:

- The rapid digital transformation and increasing data complexity in the BFSI sector is paving the way for market adoption in the sector.

- The trend towards the proliferation of automation and Industry 4.0 in the manufacturing sector is boosting market adoption.

IT & telecom accounted for the largest revenue share in the year 2024.

- The IT & telecom sector is majorly dependent on capacity planning solutions for optimizing resources, preventing downtime, and ensuring reliable service delivery.

- Also, the shift from LTE to 5G networks is driving the adoption of advanced capacity planning solutions, along with the increasing requirement for data-intensive applications is boosting the market progress.

- Additionally, the solution is essential for telecom providers to manage bandwidth efficiently, reducing latency, and improving customer experience.

- Further, the rising need for efficient resource optimization along with rapid extension of data centers and cloud services in the IT & telecom sector is propelling the market progress.

- Thus, the rising need for efficient resource optimization along with increasing requirements for data-intensive applications is driving the market adoption in the IT and Telecom sector.

Healthcare is anticipated to register the fastest CAGR during the forecast period.

- The healthcare sector is expected to increasingly adopt capacity planning and management solutions for enhancing patient care and supporting digital health initiatives.

- Also, the rising number of patients in hospitals is propelling hospitals and healthcare clinics to adopt capacity planning and management solutions to handle growing data volumes from electronic health records (EHRs), telemedicine, and others.

- Further, the growing focus on improving operational efficiency and reducing IT costs is paving the way for market progress.

- Furthermore, the increasing digitalization of healthcare services along with the adoption of cloud-based capacity planning solutions, is boosting the market progress.

- For instance, in April 2024, HubStar launched AI-powered space management technology, which is essentially for transforming healthcare capacity optimization and planning. Also, the AI capabilities are important to meet the increasingly challenging daily operational needs of hospitals and healthcare facilities.

- Therefore, the increasing digitalization of healthcare services is anticipated to boost the market during the forecast period.

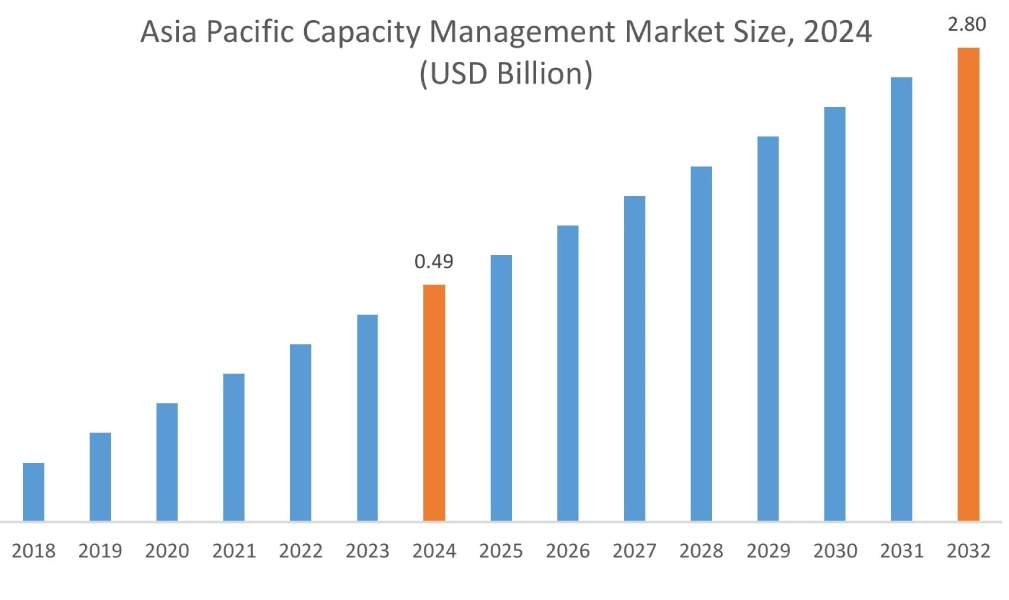

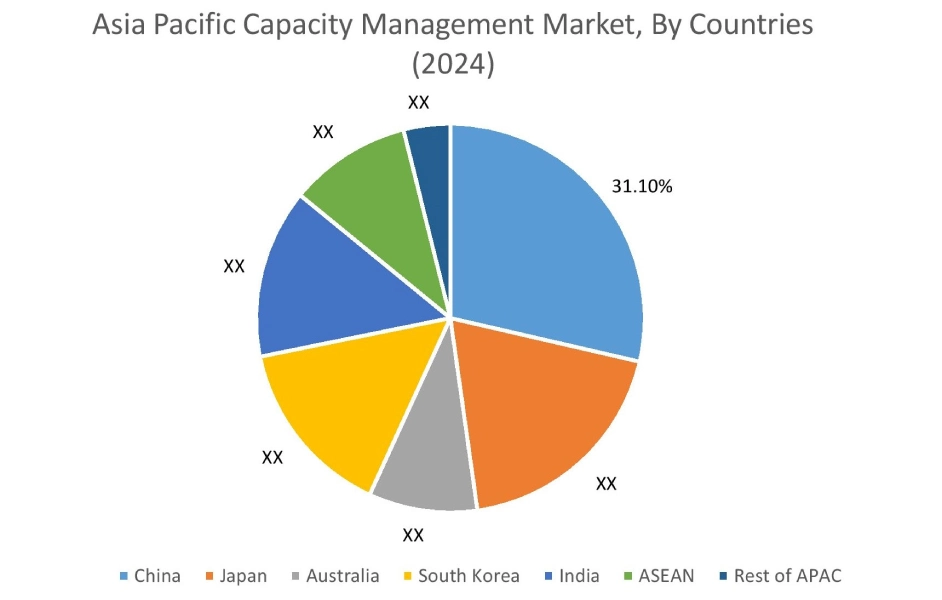

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 0.49 Billion in 2024. Moreover, it is projected to grow by USD 0.60 Billion in 2025 and reach over USD 2.80 Billion by 2032. Out of this, China accounted for the maximum revenue share of 31.10%. The market progress is mainly driven by rapid digital transformation and increased cloud computing adoption. Furthermore, factors including the growing IT investments, the expansion of cloud services, and others are projected to drive the market progress in Asia Pacific region during the forecast period.

- For instance, according to the Indian Brand Equity Foundation (IBEF), the telecom sector in India is developing rapidly from USD 37.33 billion in FY2023 to USD 43.43 billion in FY2025, which in turn is paving the way for market adoption.

North America is estimated to reach over USD 3.31 Billion by 2032 from a value of USD 0.59 Billion in 2024 and is projected to grow by USD 0.73 Billion in 2025. The North American region's growing focus on operational efficiency and cost optimization offers lucrative growth prospects for the market. Additionally, the rapid adoption of cloud and hybrid IT environments across various sectors is driving the market progress.

- For instance, in June 2025, HPE launched GreenLake Intelligence, which is an agentic AI framework for hybrid operations. Also, the AI helps to optimize workload and capacity planning.

The regional analysis depicts that the modernization of the IT environment and rapid digital transformation are driving the market in Europe. Additionally, the key factor driving the market is the increasing focus on reducing operational costs and effectively utilizing IT infrastructures, as well as growing sectors such as telecommunications and healthcare are propelling the market adoption in the Middle East and African region. Further, the technological modernization and a rising adoption of cloud computing are paving the way for the progress of the market in Latin America region.

Top Key Players & Market Share Insights:

The global capacity management market is highly competitive, with major players providing solution to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end user launches to hold a strong position in the capacity management industry. Key players in the capacity management market include-

- BMC Software(USA)

- IBM Corporation(USA)

- Hewlett Packard Enterprise(HPE) (USA)

- Broadcom Inc. (USA)

- SolarWinds Corporation (USA)

- NetApp, Inc. (USA)

- ServiceNow, Inc. (USA)

- Splunk Inc. (USA)

- LogicMonitor, Inc. (USA)

- Apptio, Inc. (USA)

Recent Industry Developments :

Funding

- In January 2025, Cinareo Solutions Inc. raised USD 1 million to address capacity planning challenges in the contact center. The company is planning to integrate AI into Cinareo's capacity management software.

Capacity Management Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 10.16 Billion |

| CAGR (2025-2032) | 20.75% |

| By Component |

|

| By Organization Size |

|

| By Deployment Mode |

|

| By Industry Vertical |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the capacity management market? +

The capacity management market size is estimated to reach over USD 10.16 Billion by 2032 from a value of USD 1.84 Billion in 2024 and is projected to grow by USD 2.25 Billion in 2025, growing at a CAGR of 20.75% from 2025 to 2032.

Which segmentation details are covered in the capacity management report? +

The capacity management report includes specific segmentation details for component, organization size, deployment mode, industry vertical, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the capacity management market, the healthcare sector is the fastest-growing segment during the forecast period due to the increasing digitalization of healthcare services.

What are the key trends in the capacity management market? +

The capacity management market is being shaped by several key trends including increasing adoption of AI and AIOps for automation and predictive analytics is driving the need for hybrid deployment, and other are the key trends driving the market.

Who are the major players in the capacity management market? +

The key participants in the capacity management market are BMC Software (USA), IBM Corporation (USA), Hewlett Packard Enterprise (HPE) (USA), Broadcom Inc. (USA), SolarWinds Corporation (USA), NetApp, Inc. (USA), ServiceNow, Inc. (USA), Splunk Inc. (USA), LogicMonitor, Inc. (USA), Apptio, Inc. (USA) and others.