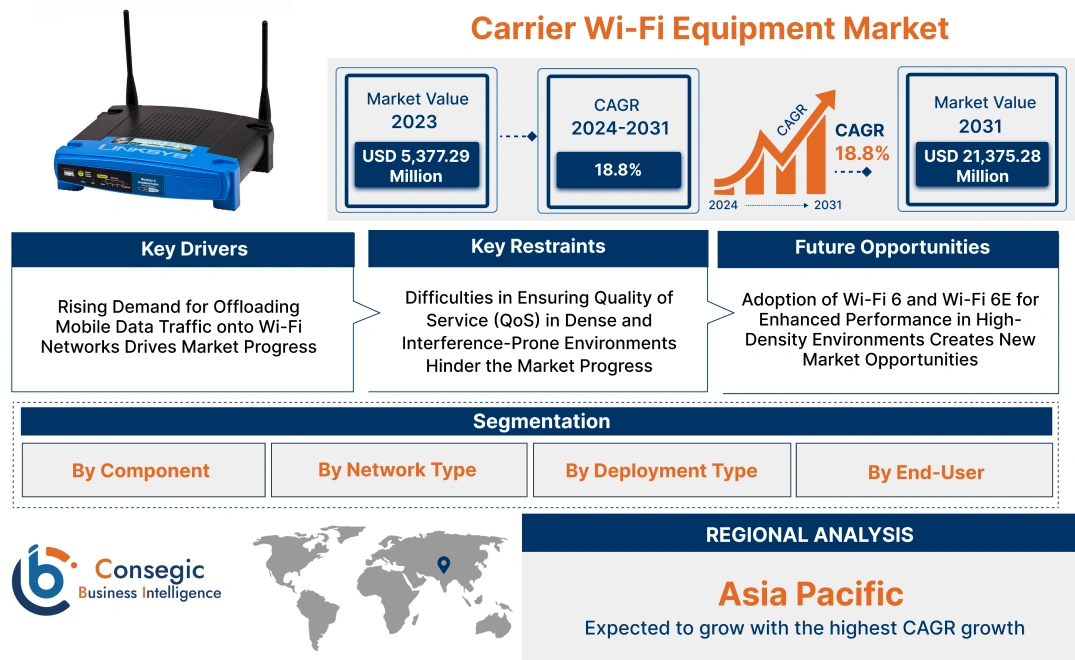

Carrier Wi-Fi Equipment Market Size:

Carrier Wi-Fi Equipment Market size is estimated to reach over USD 14.51 Billion by 2032 from a value of USD 4.52 Billion in 2024 and is projected to grow by USD 5.17 Billion in 2025, growing at a CAGR of 13.8% from 2025 to 2032.

Carrier Wi-Fi Equipment Market Scope & Overview:

Carrier Wi-Fi equipment includes a broad range of Wi-Fi access points, controllers, gateways, and other devices which are used by telecom companies for offering wireless internet access. It is mostly designed for large-scale public deployments, which in turn enables carriers to manage high-density traffic in places such as transportation hubs, cities, and other venues to complement their cellular networks while also improving connectivity for users. Moreover, carrier Wi-Fi systems offer several benefits like enhanced indoor and public space coverage, seamless roaming among Wi-Fi and cellular networks, along with improved performance and reliability for consumers as well as businesses.

How is AI Transforming the Carrier Wi-Fi Equipment Market?:

The integration of AI is considerably transforming the carrier Wi-Fi equipment market. AI incorporation helps in improving network performance, security, as well as management. Moreover, AI-driven analysis helps in facilitating several applications involving optimizing access points, automating network operations, offering predictive maintenance, along with detecting security threats in real-time.

In addition, AI is also capable of evaluating real-time data for dynamically adjusting network parameters like channel selection, power levels, and others, which in turn helps in improving coverage, capacity, and decreasing interference. Hence, the above factors are expected to positively impact the market growth in the upcoming years.

Carrier Wi-Fi Equipment Market Dynamics - (DRO):

Key Drivers:

Growing demand for high-speed connectivity is driving the carrier Wi-Fi equipment market growth

The rising demand for seamless, high-speed connectivity is among the key factors driving the market. The increasing data consumption increases due to widespread adoption of smartphones, IoT (internet of things) devices, video streaming, as well as cloud-based applications, is prompting telecom operators and service providers for offering robust and reliable internet access in high-traffic areas such as airports, shopping malls, public transport hubs, and densely populated urban environments.

Carrier Wi-Fi equipment offers an efficient solution for offloading substantial amounts of data traffic from crowded cellular networks, which in turn helps in improving overall network capacity and enhancing end-user experience. In addition, the integration of carrier Wi-Fi with existing 5G infrastructure helps in creating a unified network experience for supporting advanced applications like augmented reality, virtual reality, and others.

- For instance, in October 2023, Nokia launched its new carrier-grade portfolio of Wi-Fi 7 devices that is capable of ensuring that end-users receive the ultimate broadband experience for several applications involving streaming, online gaming, video calls, and others. The devices are capable of supporting a range of low as well as high-end devices.

Consequently, the aforementioned factors are driving the carrier Wi-Fi equipment market size.

Key Restraints :

High costs and operational limitations are restraining the carrier Wi-Fi equipment market growth

The implementation of carrier Wi-Fi equipment is often associated with high initial investment and certain operational limitations, which are among the primary factors restricting the market. The deployment of carrier-grade Wi-Fi networks mostly requires substantial investment, including the cost of advanced hardware such as access points, controllers, and others, along with additional ongoing maintenance costs. This in turn, acts as a financial barrier which may limit its widespread adoption, particularly among smaller operators or those in developing regions.

In addition to high costs, there are several operational limitations and challenges associated with carrier Wi-Fi systems such as managing network interference in crowded public spaces, ensuring seamless and secure authentication processes across different network types, and complex backhaul requirements to support high data volumes. Ensuring uniform quality of service across a vast, dynamic public area can be difficult to manage in comparison to controlled private networks. Thus, the aforementioned factors are hindering the carrier Wi-Fi equipment market expansion.

Future Opportunities :

Increasing advancements with 5G and Wi-Fi standards are expected to drive the carrier Wi-Fi equipment market opportunities

The rising advancements in wireless communication standards, specifically involving the evolution of 5G cellular technology and new Wi-Fi generations (Wi-Fi 6, 6E, and the nascent Wi-Fi 7), are creating lucrative growth prospects. This further allows service providers to offer a converged and seamless connectivity experience. Moreover, strategic integration of Wi-Fi 6 and 5G networks for facilitating efficient data offloading in densely populated areas along with ensuring robust indoor coverage in areas where cellular signals might struggle, is also expected to drive the market. Also, using carrier Wi-Fi systems as an additional layer to 5G can assist operators in maximizing their network investment, optimizing spectrum usage, as well as addressing the growing need for high-speed, universal connectivity.

- For instance, Telefonica, a Spanish multinational telecommunications company, deployed its 5G services to approximately 1,400 municipalities in Spain in 2022 and 2,400 municipalities by 2023. Additionally, Telefonica installed 700MHz 5G base stations for serving 700 towns and cities throughout Spain as of February 2022.

Hence, according to the analysis, the increasing advancements with 5G and Wi-Fi standards are projected to boost the carrier Wi-Fi equipment market opportunities during the forecast period.

Carrier Wi-Fi Equipment Market Segmental Analysis :

By Component:

Based on component, the market is segmented into hardware, software, and services.

Trends in the Component:

- Increasing trend of integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics, automated troubleshooting, self-optimizing network resources, and dynamic channel allocation is driving the market.

- There is increasing demand for Wi-Fi software to provide advanced location analytics for business intelligence, asset tracking, and targeted services in retail, hospitality, and smart city environments, which in turn propels the market growth.

Hardware segment accounted for the largest revenue share of 56.62% in the carrier Wi-Fi equipment market in 2024, and it is expected to witness a significant CAGR during the forecast period.

- There is a rapid shift toward the newest standard, Wi-Fi 7, which offers ultra-high throughput, extremely low latency, and Multi-Link Operation (MLO) essential for 8K streaming, VR/AR, and industrial IoT.

- Hardware is increasingly being designed to seamlessly integrate with 5G core networks, enabling automatic, secure roaming and supporting common core network functions.

- Additionally,focus on energy-saving hardware components is rising, driven by features like Target Wake Time in Wi-Fi 6/7, which optimizes battery life for massive IoT deployments.

- According to the carrier Wi-Fi equipment market analysis, 5G-Wi-Fi convergence, Wi-Fi 7 adoption, and energy efficiency are driving the carrier Wi-Fi equipment market size.

By Network Type:

Based on the network type, the market is segmented into 3G, 4G LTE, 5G and others.

Trends in the Network Type:

- There is an increasing trend of deployment of Wi-Fi 7 (802.11be) in 5G environments to meet the stringent latency and throughput requirements of 5G, which in turn drives the market.

- Factors, including edge compute integration and millimetre wave coverage extension are propelling the market.

4G LTE segment accounted for the largest revenue in the overall carrier Wi-Fi equipment market share in 2024, and it is anticipated to register a substantial CAGR during the forecast period.

- There is a persistent need for massive mobile data offload in dense urban and high-traffic areas, driving the adoption of 4G LTE networks, which in turn drives the market.

- There is a growing investment in Hotspot 2.0 and other authentication protocols to ensure seamless and secure handover of users between 4G LTE and carrier Wi-Fi without manual logins.

- Further, 4G LTE is increasingly being used for backhaul for smaller, distributed Wi-Fi access points, supporting last-mile connectivity in suburban and rural areas, in turn driving the market.

- Therefore, continued mobile data offload, adoption of Hotspot 2.0, and fixed wireless access backhaul are driving the carrier Wi-Fi equipment market trends.

By Application:

Based on application, the market is segmented into telecom offloading, public Wi-Fi, enterprise Wi-Fi, IoT connectivity, and others.

Trends in the Application:

- Operators are using AI/ML-driven network intelligence to predict and manage traffic surges, offloading traffic proactively before cellular congestion occurs, rather than reactively, which is driving the

- Public Wi-Fi is evolving into a core utility layer for Smart City initiatives, supporting not just citizen access but also city services, public safety, and environmental monitoring, which in turn drives the

Enterprise Wi-Fi segment accounted for the largest revenue share in the carrier Wi-Fi equipment market share in 2024.

- Enterprise Wi-Fi is being optimized to support hybrid work models, requiring robust, secure, and carrier-grade performance to handle dense client loads from employees, in turn driving the market.

- There is growing adoption of integrated solutions that allow Wi-Fi (especially Wi-Fi 7) to coexist and interoperate seamlessly with Private 5G/LTE networks, particularly in manufacturing and logistics environments, which in turn boosts the market.

- Further, there is a dominant shift toward Cloud-Managed WLAN services provided by carriers, which allows enterprises to outsource complexity and benefit from centralized, automated management, AI-driven insights, and OpEx models.

- Therefore, cloud-managed WLAN and private 5G/Wi-Fi coexistence are driving the market.

IoT connectivity segment is anticipated to register the fastest CAGR during the forecast period.

- Adoption of low-power Wi-Fi features to drastically extend the battery life of massive numbers of low-bandwidth IoT sensors, making Wi-Fi a viable choice for many battery-powered applications, which in turn drives the market.

- The extremely low latency and deterministic performance of emerging Wi-Fi 7 are making it a strong contender for time-sensitive, mission-critical industrial control and automation applications, in turn driving the market.

- Moreover,IoT devices are increasingly connected to Wi-Fi to rapidly offload data to Multi-access Edge Computing (MEC) infrastructure, enabling real-time processing and decision-making, in turn driving the market.

- Hence, low-power Wi-Fi, industrial Wi-Fi, and edge compute data offload areprojected to boost the market during the forecast period.

By End-User:

Based on the end user, the market is segmented into telecom operators and Internet Service Providers (ISPs), enterprises, government & public sector, and others.

Trends in the End User:

- Governments are investing in high-capacity Wi-Fi to ensure public safety, municipal services, and the connection of IoT infrastructure, which in turn drives the market

- Digital inclusion initiatives, educational & healthcare modernization, smart city initiatives, and others are driving the market.

Telecom Operators and Internet Service Providers (ISPs) segment accounted for the largest revenue in the market in 2024.

- Telecoms are increasingly leveraging their expertise to provide fully managed Wi-Fi services to enterprise clients, bundling connectivity, equipment, and network management into a single, high-value, recurring subscription model, which in turn drives the market.

- Moreover, there is an increasing adoption of AI and machine learning for predictive maintenance, capacity planning, and automated network optimization.

- In addition, ISPs are deploying sophisticated all-in-one gateways that combine fiber termination with high-performance Wi-Fi 6/7 mesh networking capabilities, managing the entire digital home experience for the subscriber.

- Hence, according to the analysis, converged residential gateway, AI-driven network automation, and 5G core integration aredriving the market growth.

The enterprises segment is anticipated to register a substantial CAGR during the forecast period.

- There is a significant movement toward cloud-based Wi-Fi management platforms, simplifying network operations, reducing capital expenditure (CapEx), and allowing centralized control.

- Moreover, enterprises, particularly in logistics, manufacturing, and healthcare, are deploying high-performance Wi-Fi alongside Private 5G/LTE networks to create reliable, unified wireless systems.

- Hence, focus on private wireless integration, shift to cloud-managed WLAN, and others aredriving the market growth.

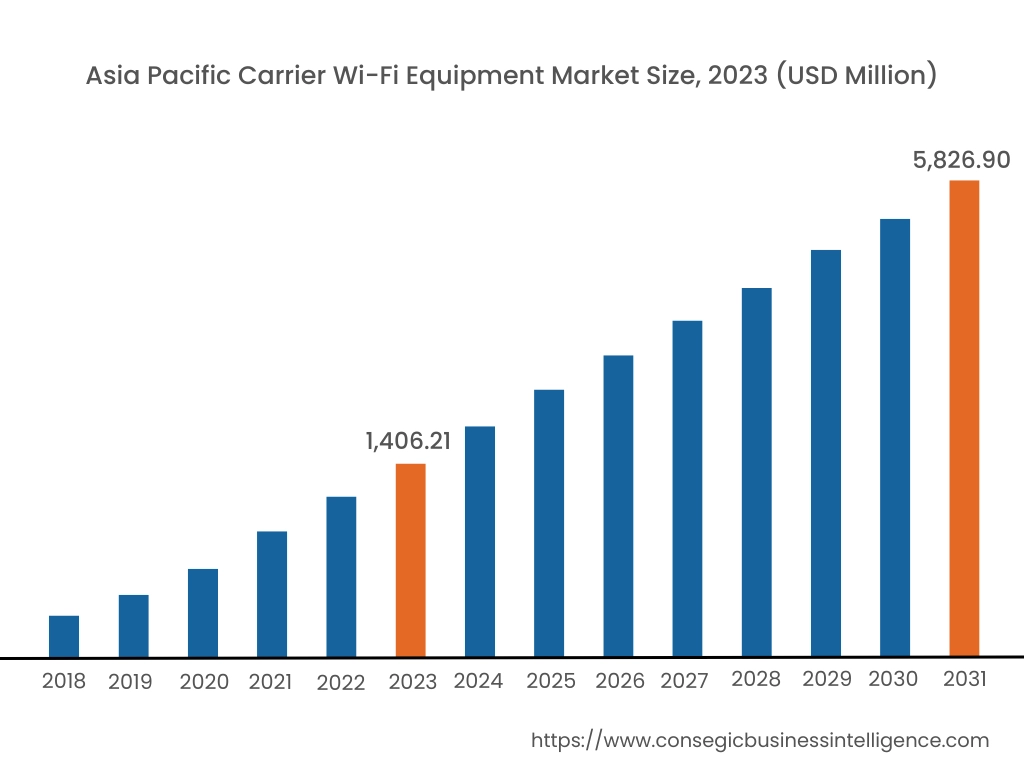

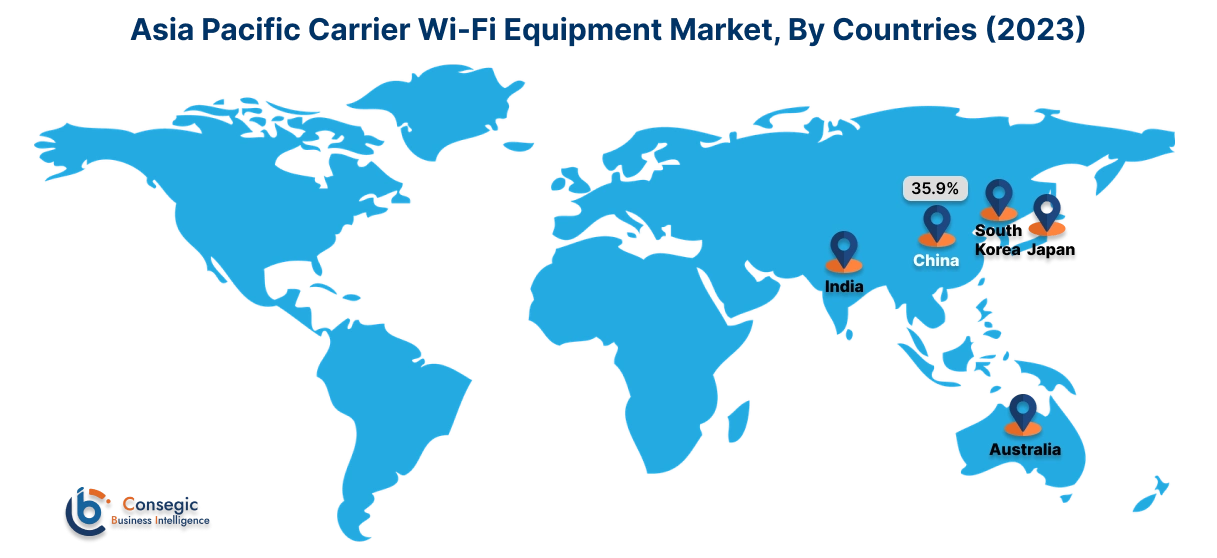

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 1.36 Billion in 2024. Moreover, it is projected to grow by USD 1.57 Billion in 2025 and reach over USD 4.47 Billion by 2032. Out of this, China accounted for the maximum revenue share of 34.59%. As per the carrier Wi-Fi equipment market analysis, the adoption of carrier Wi-Fi devices in the Asia-Pacific region is primarily driven by rapid digitalization, growing IT & telecom industry, increasing smartphone penetration, along with strong government support for smart city projects. Moreover, countries like China and India are emphasizing on cost-effective solutions and accelerating the adoption of newer standards such as Wi-Fi 6E and Wi-Fi 7, which are further driving the carrier Wi-Fi equipment market expansion.

- For instance, according to the Department of Telecommunication of India, the overall deployment of 5G base stations across India reached up to 464,990 base stations as of December 2024, depicting an increase of 10.8% from 419,845 base stations in January 2024. The above factors are expected to drive the carrier Wi-Fi equipment market trends in the Asia-Pacific regionduring the forecast period.

North America is estimated to reach over USD 5.03 Billion by 2032 from a value of USD 1.56 Billion in 2024 and is projected to grow by USD 1.79 Billion in 2025. In North America, the growth of the carrier Wi-Fi equipment industry is driven by the driven by advanced telecommunications infrastructure, high mobile data usage, and increasing implementation of Wi-Fi 6 technology in enterprises and public venues, among others. Moreover, factors such as rising digital transformation among business enterprises along with increasing need for advanced connectivity and network coverage for facilitating digitalization and IoT applications are further contributing to the carrier Wi-Fi equipment market demand in the region.

Meanwhile, according to the regional analysis, factors including significant investments in public Wi-Fi infrastructure in urban areas, government initiatives promoting digital infrastructure upgrades, and rising integration of carrier Wi-Fi with 5G networks to manage network congestion are driving the carrier Wi-Fi equipment market demand in Europe. Furthermore, according to the market analysis, the market demand in Latin America, Middle East, and African regions is expected to grow at a considerable rate due to factors such as increasing telecom infrastructure investments, growing smartphone penetration, along with government initiatives for promoting digital transformation and expanding internet access, among others.

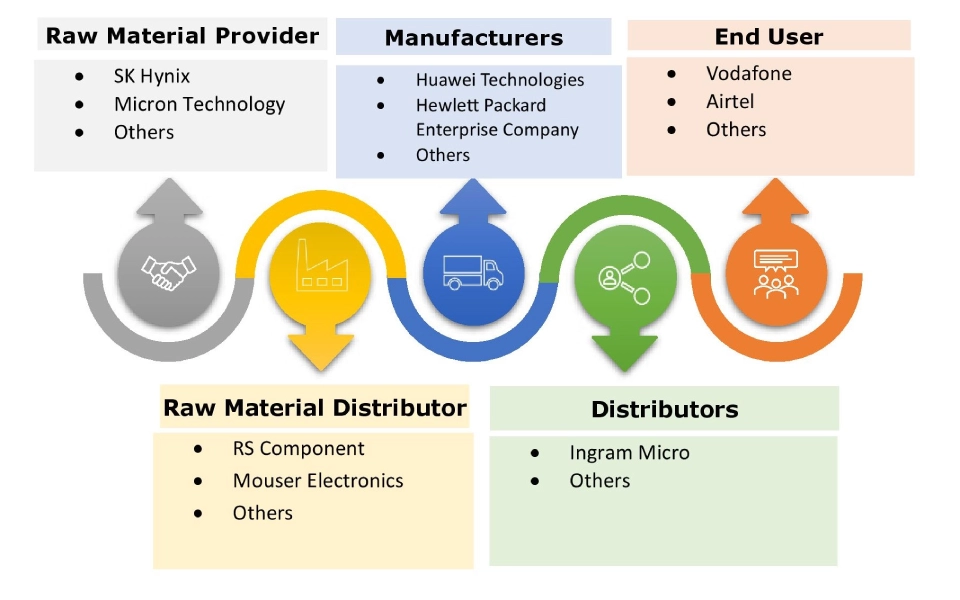

Top Key Players & Market Share Insights:

The global carrier Wi-Fi equipment market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the carrier Wi-Fi equipment market. Key players in the carrier Wi-Fi equipment industry include-

- Huawei Technologies Co., Ltd.(China)

- Hewlett Packard Enterprise Company(United States)

- Telefonaktiebolaget LM Ericsson(Sweden)

- Cisco Systems Inc. (United States)

- CommScope Holding Company Inc. (United States)

- Nokia Corporation (Finland)

- Cambium Networks (United States)

- Extreme Networks Inc. (United States)

- ADTRAN Inc. (United States)

- Ubiquiti Inc. (United States)

Recent Industry Developments :

Product Launches:

- In May 2023, CommScope launched its new HomeVantage Fiber Gateways and ONUs (Optical Network Units). The solutions offer carrier-grade enhancements for facilitating improved fiber connectivity, bringing faster and more reliable internet to homes. The products focus on delivering improved performance for service providers, supporting higher speeds and next-gen services along with ensuring efficient network operations for an improved user experience.

Carrier Wi-Fi Equipment Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 14.51 Billion |

| CAGR (2025-2032) | 13.8% |

| By Component |

|

| By Network Type |

|

| By Application |

|

| By End-user |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the carrier Wi-Fi equipment market? +

The carrier Wi-Fi equipment market was valued at USD 4.52 Billion in 2024 and is projected to grow to USD 14.51 Billion by 2032.

Which is the fastest-growing region in the carrier Wi-Fi equipment market? +

Asia-Pacific is the region experiencing the most rapid growth in the carrier Wi-Fi equipment market.

What specific segmentation details are covered in the carrier Wi-Fi equipment report? +

The carrier Wi-Fi equipment report includes specific segmentation details for component, network type, application, end user, and region.

Who are the major players in the carrier Wi-Fi equipment market? +

The key participants in the carrier Wi-Fi equipment market are Huawei Technologies Co., Ltd. (China), Hewlett Packard Enterprise Company (United States), Telefonaktiebolaget LM Ericsson (Sweden), Cisco Systems Inc. (United States), CommScope Holding Company Inc. (United States), Nokia Corporation (Finland), Cambium Networks (United States), Extreme Networks Inc. (United States), ADTRAN Inc. (United States), Ubiquiti Inc. (United States), and others.