Ceramic Setter Plates Market Size:

Ceramic Setter Plates Market size is estimated to reach over USD 2,235.55 Million by 2032 from a value of USD 1,621.07 Million in 2024 and is projected to grow by USD 1,658.65 Million in 2025, growing at a CAGR of 4.1% from 2025 to 2032.

Ceramic Setter Plates Market Scope & Overview:

Ceramic setter plates refer to materials that are used as supports or bases during the high-temperature processing of ceramics and other materials. Setter plates are designed for use in applications including kilns and furnaces, where they provide uniform heat distribution, stability, and resistance to thermal shock. Setter plates play a crucial role in manufacturing technical ceramics, tiles, and electronic components while ensuring dimensional accuracy and product quality. Moreover, setter plates offer a wide range of benefits including high thermal stability, increased mechanical strength, improved resistance to wear and chemical corrosion, extended service life of kiln furniture, enhanced product consistency, and reduced energy consumption in high-temperature operations among others. Additionally, they are used in several applications such as ceramics production, metallurgy, electronics manufacturing, and others, where durability and precision are essential.

Key Drivers:

Rising adoption in electronics and semiconductor manufacturing is propelling the ceramic setter plates market growth

Ceramic setter plates play a vital role in electronics and semiconductor manufacturing, where precise thermal management and stability are crucial for high-temperature processes. These setter plates offer consistent support during the sintering and firing of materials, which ensures that components such as capacitors, semiconductors, and microchips meet the stringent performance and quality standards required by modern electronics. Moreover, the benefits of ceramic-based setter plates including exceptional thermal stability and chemical resistance make them ideal for utilization in processes that involve high heat and aggressive chemical environments. Additionally, factors including the rising trend of semiconductor & electronics miniaturization and progressions in advanced electronic device manufacturing are among the key prospects driving the adoption of ceramic setter plates in semiconductor & electronics production lines.

- For instance, according to the Semiconductor Industry Association (SIA), the global sales of semiconductors were valued at USD 627.6 billion in 2024, witnessing an increase of 19.1% in comparison to USD 526.8 billion in 2023.

Hence, the growing semiconductor sector is driving the adoption of ceramic-based setter plates during semiconductor manufacturing, in turn proliferating the ceramic setter plates market size.

Key Restraints:

Operational limitations in certain high-stress environments are restraining the ceramic setter plates market

Ceramic setter plates offer superior thermal and chemical resistance, however, their performance can be compromised in high-stress applications including rapid thermal cycling, prolonged exposure to extreme conditions, or mechanical impacts. High-stress environments often lead to micro-cracking, wear, or degradation of the setter plates, which further reduces their operational lifespan and necessitates frequent replacements.

This limitation poses significant challenges for industrial sectors that require long-term durability and consistent performance under intense operational conditions, including aerospace or heavy industrial applications. Therefore, the aforementioned operational limitations associated with these setter plates are hindering the ceramic setter plates market expansion.

Future Opportunities:

Rising application in renewable energy sector is expected to drive the ceramic setter plates market opportunities

The renewable energy sector is increasingly integrating setter plates into the production of advanced ceramics that are typically used in solar panels, fuel cells, and energy storage systems among others. These plates ensure high stability and precision during the manufacturing of ceramic components that play a crucial role in clean energy technologies. The ability of setter plates to endure high temperatures and harsh conditions makes them ideal for facilitating efficient production processes in the renewable energy sector. Moreover, the ongoing developments of customized plates for specific renewable energy applications, including solar cell substrates or electrolytic cell components are expected to provide lucrative aspects for market growth.

- For instance, according to SolarPower Europe, the global installations of solar power witnessed a substantial increase of 87% in 2023 as compared to the previous year. The total installation of solar power capacity reached approximately 447 GW (gigawatt) in 2023 in comparison to 239 GW installations in 2022.

Hence, the growing renewable energy sector, specifically solar energy, is expected to boost the ceramic setter plates market opportunities during the forecast period.

Ceramic Setter Plates Market Segmental Analysis :

By Material Type:

Based on material type, the market is segmented into alumina, silicon carbide, mullite, zirconia, and others.

Trends in the material type:

- An increasing trend in the adoption of alumina plates in industrial manufacturing and sintering processes, combined with advancements in material technology, is driving the market growth.

- Rising utilization of silicon carbide setter plates in industrial applications, due to their superior thermal conductivity and high wear resistance.

The alumina segment accounted for the largest revenue share of 37.60% in the total ceramic setter plates market share in 2024.

- Alumina-based refractory setter plates offer several benefits including high mechanical strength, increased thermal stability, and improved corrosion resistance.

- These plates are primarily applied in heat treatment processes, kiln furniture, and firing ceramic components in several industries including automotive, electronics, and others.

- Moreover, alumina-based setter plates are capable of withstanding extreme temperatures and harsh environments, which makes them ideal for utilization in high-performance applications.

- Additionally, the utilization of alumina plates in industrial manufacturing and sintering processes, combined with advancements in material technology, is driving the segment development.

- According to the analysis, the aforementioned factors are further propelling the market.

The silicon carbide segment is anticipated to register the fastest CAGR growth during the forecast period.

- Silicon carbide setter plates are being increasingly used in industrial applications, attributed to their superior thermal conductivity, low thermal expansion, and high wear resistance among others.

- The above properties of silicon carbide plates make them ideal for applications involving high-temperature sintering, heat treatment, and firing processes.

- Moreover, the rising demand for lightweight and durable materials in the automotive and aerospace industries is among the primary determinants for driving the adoption of silicon carbide setter plates.

- Additionally, the rising advancements in manufacturing techniques for silicon carbide plates are projected to drive the segment.

- Therefore, the above factors are anticipated to boost the market during the forecast period.

By Application:

Based on application, the market is segmented into firing of ceramic components, heat treatment processes, sintering of powdered metals, kiln furniture, and others.

Trends in the application:

- Rising trend towards the adoption of ceramic components in semiconductors, insulators, and wear-resistant parts is driving the adoption of setter plates for the firing of ceramic components.

- Increasing adoption of setter plates during the sintering processes for powdered metals to provide improved consistency and stability during high-temperature operations.

The firing of ceramic components segment accounted for the largest revenue in the overall ceramic setter plates market share in 2024.

- Setter plates play a vital role in firing ceramic components, particularly for ensuring uniform heating and structural integrity.

- Setter plates are widely used in the production of advanced ceramics for application in electronics, aerospace, automotive, and other sectors.

- Moreover, the rising adoption of ceramic components in semiconductors, insulators, and wear-resistant parts is driving the adoption of setter plates in this application.

- In addition, the growing focus on improving the quality and efficiency of ceramic production processes is further driving the segment development.

- Consequently, the aforementioned factors are driving the ceramic setter plates market trends.

The sintering of powdered metals segment is anticipated to register the fastest CAGR growth during the forecast period.

- Setter plates play a crucial role in the sintering processes for powdered metals to provide improved consistency and stability during high-temperature operations.

- These plates are commonly used during the production of metal components for industrial machinery, aerospace, and automotive applications among others.

- Additionally, the rising adoption of sintered metals in lightweight and high-strength components, combined with rising advancements in additive manufacturing (3D printing), is driving the adoption of setter plates in this segment.

- Furthermore, the increasing advancements related to sintering technologies and materials are expected to propel segment development.

- Hence, the above factors are anticipated to boost the ceramic setter plates market growth during the forecast period.

By End-User Industry:

Based on the end-use industry, the market is segmented into electronics, automotive, aerospace, industrial manufacturing, healthcare, and others.

Trends in the end-use industry:

- Factors such as the increasing adoption of advanced electronic components in several industries, advancements in consumer electronics, and the rising trend of device miniaturization are driving the electronics segment.

- Factors including growing air travel trends, increasing commercial flight activities, and rising production of commercial and defense aircraft are primary factors propelling the growth of the aerospace segment.

Electronics segment accounted for the largest revenue share in the total market in 2024.

- The electronics sector is among the primary end-users of setter plates, driven by its growing adoption during the production of advanced ceramics and components used in semiconductors, sensors, insulators, and other electronic components.

- Moreover, setter plates play a vital role in the manufacturing of high-performance electronic components for ensuring high quality and precision during firing and sintering processes.

- Additionally, the rising adoption of electronic components in consumer devices, automotive systems, and industrial systems is driving the demand for setter plates in this segment.

- Further, the rising advancements associated with advanced ceramic materials and microelectronics are propelling the segment's development.

- For instance, according to the Brazilian Electrical and Electronics Industry Association, the electronics sector in Brazil was valued at USD 42.2 billion in 2022, representing an incline of around 8% as compared to 2021.

- According to the analysis, the above factors are driving the ceramic setter plates market size.

The aerospace segment is anticipated to register the fastest CAGR during the forecast period.

- Ceramic-based setter plates are often used in the aerospace sector to facilitate the production of lightweight and high-temperature-resistant components.

- Ceramic-based setter plates are essential in sintering processes for the development of advanced ceramics and powdered metals, which are typically used in aircraft engine components, turbine blades, and structural parts among others.

- Moreover, the rising focus on fuel efficiency, material durability, and weight reduction in aerospace applications is driving the adoption of setter plates in the aerospace segment.

- Additionally, factors including rising investments in aerospace manufacturing and increasing production of commercial and defense aircraft are expected to drive the market.

- For instance, Airbus, an aircraft manufacturer, delivered 735 commercial aircraft in 2023, witnessing an incline of 11% as compared to 2022.

- According to the market analysis, the rising aircraft production is expected to drive the market during the forecast period.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

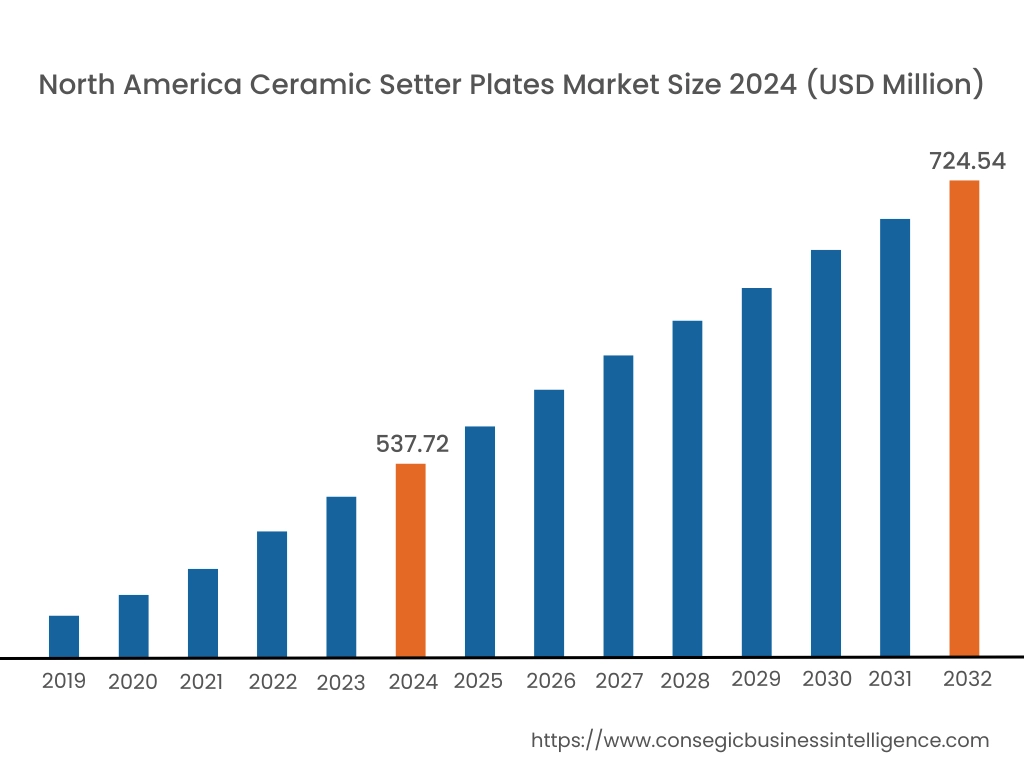

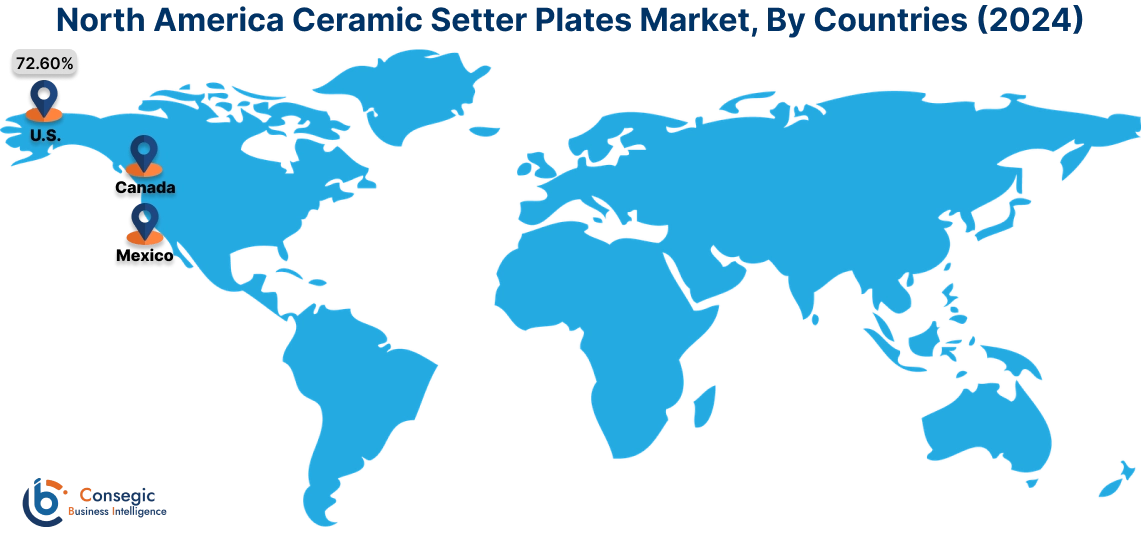

In 2024, North America was valued at USD 537.72 Million and is expected to reach USD 724.54 Million in 2032. In North America, the U.S. accounted for the highest share of 72.60% during the year 2024. In North America, the growth of the ceramic setter plates industry is driven by the rising advancements in the electronics, aerospace, and industrial manufacturing sectors among others. Similarly, the rising investments in aerospace manufacturing and increasing aircraft production are contributing to the ceramic setter plates market demand.

- For instance, Boeing, a U.S. based aerospace company, delivered approximately 136 commercial aircraft during the second quarter of 2023, representing an incline of 4.6% in comparison to the first quarter of 2023. Hence, the rising aircraft production is expected to boost the ceramic setter plates market trends in North America during the forecast period.

Asia-Pacific is expected to witness the fastest CAGR of 4.5% over the forecast period (2025-2032). As per the ceramic setter plates market analysis, the adoption of ceramic-based setter plates in the Asia-Pacific region is primarily driven by the rising utilization of setter plates in advanced ceramics production for automotive, electronics, and industrial applications. Additionally, the rising production of electronic devices is further accelerating the ceramic setter plates market expansion in the Asia-Pacific region.

- For instance, according to the India Brand Equity Foundation, the value of the consumer electronics and appliances sector in India reached up to USD 9.84 billion in 2021, and it is projected to grow at a significant rate to reach USD 21.18 billion by 2025. Hence, the aforementioned factors are further boosting the market in the Asia-Pacific region.

In addition, the regional analysis depicts that the presence of an advanced industrial base, rising investments in automotive manufacturing, increasing production of aircraft, and significant advancements in healthcare devices are driving the ceramic setter plates market demand in Europe. Furthermore, as per the ceramic setter plates market analysis, the market demand in Latin America, the Middle East, and the African region is expected to grow at a considerable rate due to factors such as rising investments in industrial manufacturing and energy sectors, and increasing demand for advanced high-performance materials in industrial sectors, among others.

Top Key Players and Market Share Insights:

The global ceramic setter plates market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the ceramic setter plates market. Key players in the ceramic setter plates industry include-

- Kerafol (Germany)

- CeramTec (Germany)

- Bailey Ceramic (USA)

- Saint-Gobain (France)

- KYOCERA Corporation (Japan)

- Applied Ceramics (USA)

- Anderman Industrial Ceramics (UK)

- IPS Ceramics (UK)

- Tuckers Pottery (USA)

- Unipretec (China)

Recent Industry Developments :

Product Launches:

- In October 2024, CeramTec GmbH, based in Marktredwitz, Germany, developed advanced Al₂O₃ (alumina) and AlN (aluminum nitride) setter plates and sintering trays designed to enhance the sintering process for Ceramic Injection Moulded (CIM) and Metal Injection Moulded (MIM) components. The advanced ceramic materials prevent reactions with metals, removing the need for release agents or protective coatings, thereby streamlining the production process and reducing contamination risks.

Ceramic Setter Plates Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 2,235.55 Million |

| CAGR (2025-2032) | 4.1% |

| By Material Type |

|

| By Application |

|

| By End-Use Industry |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

What is the projected market size for Ceramic Setter Plates by 2032? +

Ceramic Setter Plates Market size is estimated to reach over USD 2,235.55 Million by 2032 from a value of USD 1,621.07 Million in 2024 and is projected to grow by USD 1,658.65 Million in 2025, growing at a CAGR of 4.1% from 2025 to 2032.

What are the key drivers for the Ceramic Setter Plates Market? +

The increasing demand for advanced ceramics in industrial manufacturing, electronics, and automotive applications, along with rising adoption in the aerospace and healthcare sectors, are key drivers for the market.

What challenges are impacting the market growth? +

High production costs and the complexity of manufacturing processes for advanced ceramic materials pose challenges to market growth.

What opportunities are shaping the future of this market? +

The development of lightweight, high-strength ceramics for aerospace and renewable energy applications presents significant growth opportunities for market players.