Cobblestone Market Size:

Cobblestone Market size is estimated to reach over USD 12,134.38 Million by 2032 from a value of USD 8,097.88 Million in 2024 and is projected to grow by USD 8,376.93 Million in 2025, growing at a CAGR of 5.6% from 2025 to 2032.

Cobblestone Market Scope & Overview:

Cobblestones are naturally rounded stones, larger than pebbles but smaller than boulders, historically used for paving streets and walkways. They are often made of granite, basalt, limestone, or sandstone. These stones are generally 64-256 millimeters in size. They have a rounded, irregular shape and are often found in a variety of colors and textures, depending on the type of stone. These stones are durable and require minimal maintenance, making them a popular choice for outdoor surfaces.

How is AI Impacting the Cobblestone Market?

AI can be integrated into autonomous or semi-autonomous robots and machinery designed for laying cobblestones. These AI-powered machines could potentially utilize AI and sensors to analyze the ground, identify optimal placement patterns for cobblestones, to execute the paving process with precision and efficiency. Also, AI could be used to analyze data collected from sensors embedded in cobblestone pavements to predict potential issues like cracks or uneven settlement. This allows for preventative maintenance, reducing repair costs and extending the lifespan of the paved areas. Further, AI systems can analyze the visual characteristics of natural stone, including cobblestones, to classify and match textures, patterns, and colors. This is valuable for ensuring consistency and aesthetic appeal in projects requiring the use of multiple pieces.

Cobblestone Market Insights:

Cobblestone Market Dynamics - (DRO):

Key Drivers :

Rising utilization of cobblestone in residential sector is boosting the market

Cobblestones are used in residential areas for various purposes, including driveways, pathways, patios, and even as decorative elements. They offer a rustic, durable, and aesthetically pleasing option for outdoor spaces. Cobblestone driveways provide a traditional and durable surface for vehicles. These stones are used to create patios or other outdoor living areas, adding a rustic touch to the home. These stones are used as decorative elements in gardens or around the house, such as in retaining walls or pathways.

- For instance, according to Knight Frank India’s 'Trends in Private Equity Investment in India 2024' report, Indian real estate attracted INR 35,300 crore (USD 4.15 billion) in private equity (PE) investments in 2024, marking a 32% annual increase as compared to the previous year.

Thus, the aforementioned factors are boosting the demand for these stones, in turn driving the cobblestone market growth.

Key Restraints :

Maintenance challenges associated with cobblestone are hindering the market growth

Cobblestones, while durable and aesthetically pleasing, require regular maintenance to prevent issues like weed growth, uneven surfaces, and loose stones. Weeds and grass grow between the stones, potentially damaging the surface and joints. Over time, stones become loose or the base may settle, leading to an uneven surface. This includes tasks such as sweeping, hosing, and occasional repair of loose pavers or base. In areas with snow, these stones pose a challenge due to their uneven surface, which makes it difficult to remove snow completely and potentially leads to icy patches. Thus, the market analysis shows that the aforementioned factors are restraining the cobblestone market demand.

Future Opportunities :

Growing utilization of cobblestone in commercial sector creates new market opportunities.

Cobblestones are used in commercial applications for both flooring and landscaping, offering a durable and aesthetically pleasing option. They are commonly used in outdoor spaces like walkways, parking lots, and patios, as well as in some indoor commercial settings. They are used in parking areas to create a visually appealing and functional space. They are incorporated into commercial landscaping projects to add character and enhance the overall look of a property. In some cases, cobblestones are used as flooring in indoor commercial spaces, such as restaurants, retail stores, or office buildings.

- For instance, in June 2023, the European Union has invested USD 6.84 billion in sustainable, safe, and efficient transport infrastructure, selecting 107 transport infrastructure projects to receive over USD 6.62 billion grants from the Connecting Europe Facility (CEF).

Thus, the rising utilization of cobblestones in commercial spaces is projected to drive cobblestone market opportunities during the forecast period.

Cobblestone Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 12,134.38 Million |

| CAGR (2024-2031) | 5.6% |

| By Type | Granite, Limestone, Riverstone pebbles, Sandstone, and Others |

| By End-use | Commercial, Residential, and Infrastructure |

| By Region | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Players | Ajmera Marbles Industries, Ally Stone, UMC, ASAHI KOHMATSU CO., LTD., Asian Stones, MPGStone, Daltile., H & R Johnson, Cobble Stone Pvt. Ltd., and Granite Setts UK Ltd. |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Cobblestone Market Segmental Analysis:

By Type :

Based on type, the market is categorized into granite, limestone, river stone pebbles, sandstone, and others.

Trends in the Type:

- Rising popularity of limestone cobbles due to their natural beauty, durability, and versatile applications is boosting the cobblestone market size.

- Increasing trend in adoption of sandstone due to its ability to develop a weathered patina over time, adding character and visual appeal is boosting the cobblestone market demand.

The granite segment accounted for the largest revenue share in cobblestone market share in 2024, and it is also expected to witness the fastest CAGR over the forecast period.

- Granite cobbles are natural stone pavers cut into irregular, rounded shapes or rectangular pieces, often used for paving and landscaping due to their durability and aesthetic appeal.

- They are quarried, then processed through cutting and finishing to meet quality standards.

- Available in various sizes, colors, and textures, they are used for both traditional and modern designs.

- Granite cobbles are known for their strength and resistance to wear and tear, making them suitable for high-traffic areas.

- They are used in various applications, including paving patios, walkways, driveways, and landscaping features.

- Thus, the market analysis depicts that the aforementioned factors are driving the cobblestone market

By End-Use :

Based on end-use, the market is categorized into commercial, residential, and infrastructure.

Trends in the End-Use:

- Rising trend in adoption of cobblestone in commercial spaces including shopping malls, sidewalks, storage areas, and others is boosting the cobblestone market size.

- Increasing trend in adoption of cobblestones in residential sector as a decorative element to provide an aesthetic look is boosting the cobblestone market expansion.

The infrastructure segment accounted for the largest market share of 42.11% in the cobblestone market share in 2024.

- Cobblestones are naturally strong and resistant to wear and tear, making them durable and low-maintenance. They last for decades with minimal upkeep.

- The irregular shape of these stones allows for better water drainage compared to smooth surfaces, improving safety on roads.

- These stones are a natural material, often sourced locally, and can contribute to sustainable building practices. Their use aligns with increasing government investments in sustainable infrastructure.

- Thus, the market analysis depicts that the aforementioned factors are boosting the cobblestone market

The commercial segment is expected to register the fastest CAGR during the forecast period.

- Cobblestones are known for their strength and resistance to wear and tear, making them suitable for areas with high foot traffic and heavy loads.

- The natural texture and color variations of these stones enhance the character of any landscape, adding a timeless and charming touch.

- They enable better water drainage compared to smooth surfaces, reducing the risk of puddles and slips.

- They are used in various commercial applications, including shopping malls, driveways, sidewalks, parking spaces, and storage areas.

- Thus, the cobblestone market analysis shows that the rising adoption in commercial sector is boosting the cobblestone market

By Region :

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

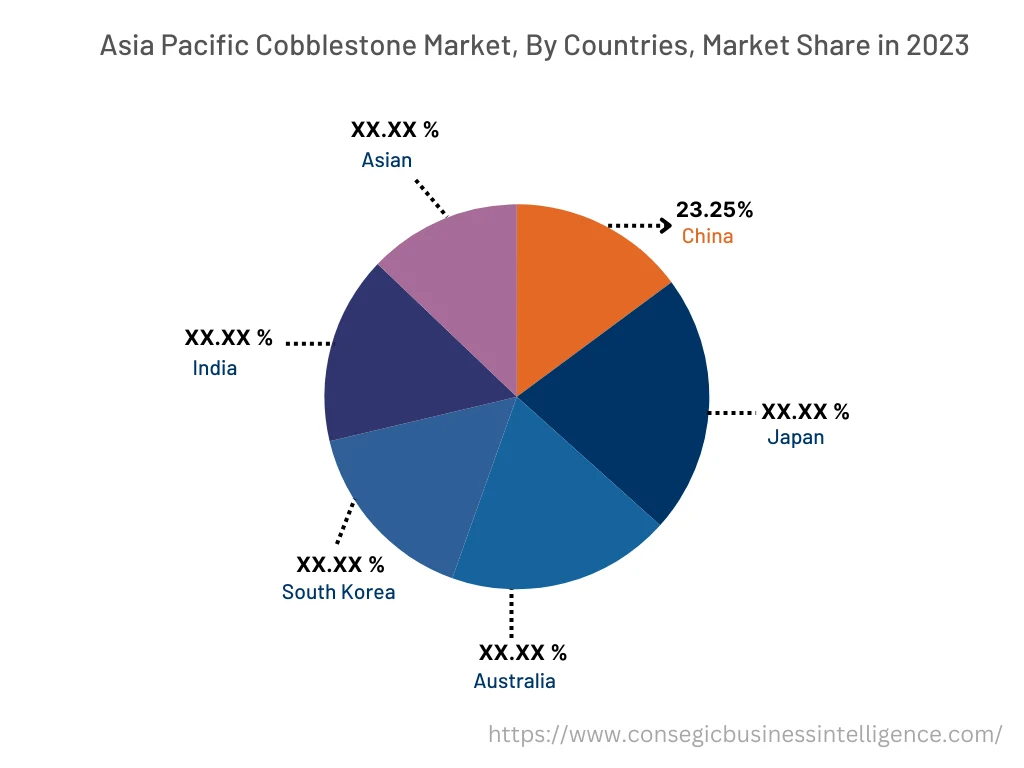

Asia Pacific region was valued at USD 2,955.86 Million in 2024. Moreover, it is projected to grow by USD 3,056.31 Million in 2025 and reach over USD 4,404.78 Million by 2032. Out of this, China accounted for the maximum revenue share of 23.25%. In the Asia-Pacific region, these stones are used for various purposes, including paving roads, pathways, and driveways, and they are also used for decorative elements in landscaping and building facades. Moreover, the region is a significant market, driven by urbanization, economic growth, and increasing demand for sustainable building materials. Thus, the cobblestone market analysis depicts that the aforementioned factors are driving the cobblestone market opportunities.

North America is estimated to reach over USD 3,170.71 Million by 2032 from a value of USD 2,126.86 Million in 2024 and is projected to grow by USD 2,199.22 Million in 2025. In North America, cobblestones are used in some historical locations and for aesthetic purposes, particularly in landscaping and construction sector, in turn driving the cobblestone market expansion in the region.

In Europe, the analysis shows that the market growth is driven due to the aesthetic appeal and historical significance of cobblestones. Many European cities maintain cobblestone streets for their historical and aesthetic value, despite the prevalence of modern paving materials, which is further driving the market demand. In Latin America, these stones are primarily used in landscaping, patios, driveways, and even as a decorative element in some areas. In the Middle East and Africa, the market growth is driven due to the rising utilization of these stones for paving, construction, and landscaping applications, among others.

Top Key Players & Market Share Insights :

The cobblestone industry is highly competitive with major players providing solutions and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global cobblestone market. Key players in the cobblestone industry include -

- Ajmera Marbles Industries (India)

- Ally Stone (China)

- H & R Johnson (India)

- Cobble Stone Pvt. Ltd. (India)

- Granite Setts UK Ltd. (UK)

- UMC (Taiwan)

- ASAHI KOHMATSU CO., LTD. (Japan)

- Asian Stones (India)

- MPGStone (India)

- Daltile (US)

Key Questions Answered in the Report

How big is the cobblestone market? +

Cobblestone Market size is estimated to reach over USD 12,134.38 Million by 2032 from a value of USD 8,097.88 Million in 2024 and is projected to grow by USD 8,376.93 Million in 2025, growing at a CAGR of 5.6% from 2025 to 2032.

What are the major segments covered in the cobblestone market report? +

The segments covered in the report are type, end-use, and region.

Which region holds the largest revenue share in 2024 in the cobblestone market? +

Asia Pacific holds the largest revenue share in the cobblestone market in 2024.

Who are the major key players in the cobblestone market? +

The major key players in the market are Ajmera Marbles Industries, Ally Stone, UMC, ASAHI KOHMATSU CO., LTD., Asian Stones, MPGStone, Daltile, H & R Johnson, Cobble Stone Pvt. Ltd., and Granite Setts UK Ltd.

Who are the major key players in the cobblestone market? +

The major key players in the market are Ajmera Marbles Industries, Ally Stone, UMC, ASAHI KOHMATSU CO., LTD., Asian Stones, MPGStone, Daltile, H & R Johnson, Cobble Stone Pvt. Ltd., and Granite Setts UK Ltd.