Colorless Polyimide Films Market Size:

Colorless Polyimide Films Market size is estimated to reach over USD 9,281.99 Million by 2032 from a value of USD 202.55 Million in 2024 and is projected to grow by USD 323.10 Million in 2025, growing at a CAGR of 61.3% from 2025 to 2032.

Colorless Polyimide Films Market Scope & Overview:

Colorless polyimide (CPI) films refer to transparent, high-performance materials with excellent heat and chemical resistance, mechanical properties, and dielectric characteristics. These films are increasingly used in optoelectronics, specifically for flexible displays, flexible printed circuit boards, flexible solar cells, and other applications. Additionally, CPI films offer a range of benefits, including high transparency, excellent thermal stability, superior chemical resistance, increased flexibility, and durability among others.

Colorless Polyimide Films Market Dynamics - (DRO) :

Key Drivers:

Growing demand for consumer electronics is propelling the colorless polyimide films market

Colorless polyimide films play a crucial role in the consumer electronics sector, specifically in flexible and foldable displays, due to their improved transparency, flexibility, and high-temperature resistance. These films are also used in flexible printed circuit boards (PCBs) and other applications where a combination of optical clarity and mechanical strength is required. Moreover, factors including rising advancements in foldable smartphones, increasing innovations related to curved televisions, growing popularity of wearable devices, and other related factors are among the key prospects driving the adoption of CPI films in consumer electronic devices. Consequently, the above factors are driving the colorless polyimide films market expansion.

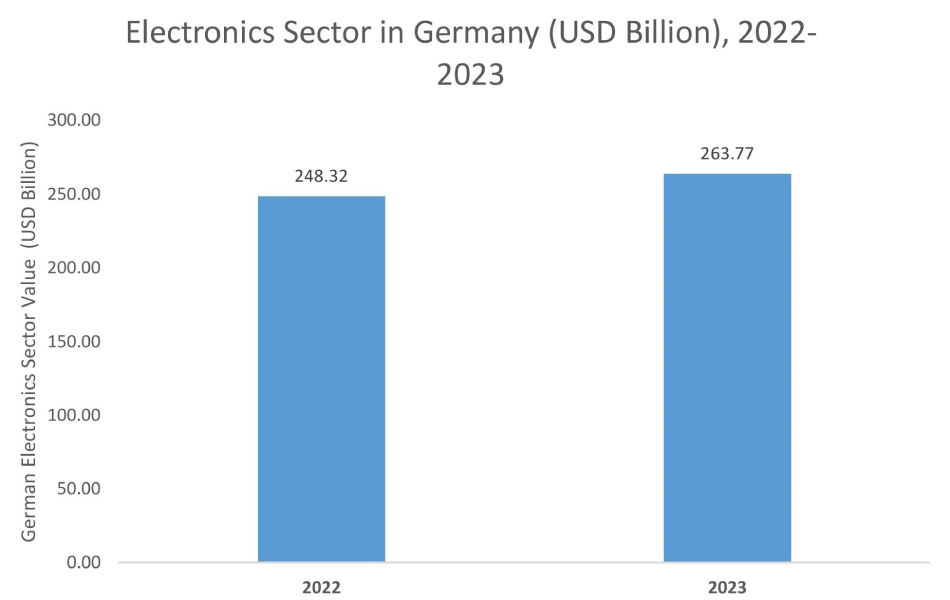

- For instance, according to the German Electrical and Electronic Manufacturer’s Association (ZVEI), the electronics production in Germany witnessed an annual growth rate of 3.7% in 2022. Additionally, the electronics sector in Germany was valued at USD 263.77 billion in 2023, witnessing an increase of 6% from USD 248.32 billion in 2022.

Thus, the growing electronics sector is driving the adoption of CPI films, particularly in flexible and foldable displays, flexible PCBs, and others, in turn proliferating the colorless polyimide films market size.

Key Restraints:

High cost of production is restraining the colorless polyimide films market

The production of colorless polyimide film is often associated with high cost, which is among the primary factors limiting the market. Moreover, the high cost of manufacturing these films is primarily attributed to the growing demand for specialized raw materials, complex manufacturing processes, and stringent quality control measures that are involved in their production.

Additionally, the above factors significantly increase the overall production expenses, making CPI films more expensive as compared to conventional polyimide films. Therefore, the high cost of production associated with CPI film is hindering the colorless polyimide films market expansion.

Future Opportunities :

Rising application in solar energy sector is expected to drive the colorless polyimide films market opportunities

Colorless polyimide films are being increasingly used in the solar energy sector, particularly in flexible solar cells and energy storage devices, due to their excellent thermal and mechanical properties, high transparency, and durability. These films can act as flexible substrates for solar cells, which helps in the development of lightweight, bendable, and more efficient solar energy solutions. Moreover, CPI films can be used as substrates for flexible solar cells, in turn offering a lightweight and bendable alternative to traditional glass-based solar panels.

- For instance, according to Invest India, India observed the highest year-on-year growth in renewable energy additions of approximately 9.83% in 2022. Moreover, the installed solar energy capacity increased significantly by 30 times in the past 9 years and reached up to 87.2 GW as of July 2024.

Thus, the rising application of CPI films in solar energy sector is expected to boost the colorless polyimide films market opportunities during the forecast period.

Colorless Polyimide Films Market Segmental Analysis :

By Thickness:

Based on thickness, the market is segmented into less than 10 µm, 10-25 µm, and more than 25 µm.

Trends in the thickness:

- Increasing trend in adoption of CPI films with a thickness ranging between 10-25 µm, due to its improved flexibility, durability, high transparency, and the ability to withstand high temperatures, among others.

- Factors including the rising trend toward device miniaturization in electronics and healthcare sectors, along with advancements in medical device manufacturing are primary determinants driving the colorless polyimide films market trends.

The 10-25 µm segment accounted for the largest revenue in the total colorless polyimide films market share in 2024.

- CPI films with a thickness ranging between 10-25 µm are commonly used in the electronics sector, particularly for applications including flexible displays and printed circuit boards, automotive, and others.

- Moreover, CPI films with a thickness ranging between 10-25 µm offer several benefits, including improved flexibility, durability, high transparency, excellent mechanical properties, and the ability to withstand high temperatures.

- Further, factors including increasing advancements in consumer electronics, including smartphones, wearable devices, and others, rising automotive production, along with increasing need for flexible displays in electronics devices and lightweight automotive displays, are among the key aspects driving the segmental growth of CPI films with a thickness ranging between 10-25 µm.

- According to the colorless polyimide films market analysis, the aforementioned factors are driving the market.

Less than 10 µm segment is anticipated to register the fastest CAGR during the forecast period.

- CPI films with thicknesses less than 10 µm are often used in advanced flexible electronics and displays, attributed to its lightweight, exceptional optical transparency, flexibility, and thermal stability among others.

- Additionally, CPI films with thicknesses less than 10 µm are ultra-thin films that provide superior performance in applications that require high performance with space constraints.

- Furthermore, factors including the rising trend toward device miniaturization in electronics and healthcare sectors, along with advancements in medical device manufacturing, are among the primary determinants for driving the segment.

- Thus, as per analysis, the above factors are anticipated to drive the market during the forecast period.

By Application:

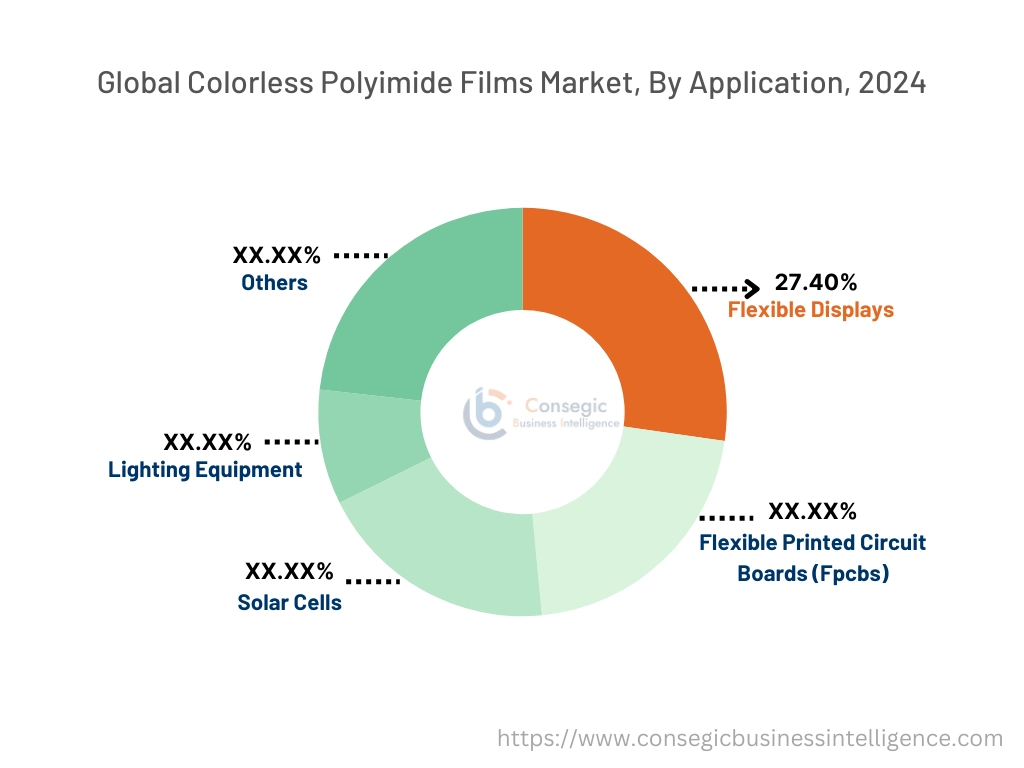

Based on application, the market is segmented into flexible displays, flexible printed circuit boards (FPCBs), solar cells, lighting equipment, and others.

Trends in the application:

- Rising adoption of CPI films in flexible displays, due to its high transparency, excellent thermal stability, mechanical flexibility, and other related properties.

- Factors including the prevalence of green energy targets, growing adoption of renewable sources for power generation, combined with government incentives and tax rebates for installation of solar panels are key prospects driving the growth of the solar cells segment.

The flexible displays segment accounted for the largest revenue share of 27.40% in the overall colorless polyimide films market share in 2024.

- CPI films play a vital role in development of flexible displays, due to their broad range of properties, such as high transparency, excellent thermal stability, mechanical flexibility, and others.

- The above properties enable CPI films to be utilized as substrates for flexible screens, foldable smartphones, and curved televisions, among other applications.

- Moreover, CPI films are designed to be optically transparent, allowing light to pass through without any significant distortion or color cast, which is vital for display clarity.

- Therefore, based on colorless polyimide films market analysis, the above benefits are driving the adoption of CPI films in flexible displays, thereby, propelling the colorless polyimide films market trends.

The solar cells segment is anticipated to register the fastest CAGR during the forecast period.

- CPI films are being increasingly used in flexible and transparent solar cells, due to their superior thermal and mechanical properties, high transparency, and flexibility.

- Moreover, the high transparency, heat resistance, and mechanical strength of CPI films make them suitable for use in substrates in flexible solar cells.

- Further, factors including the prevalence of green energy targets, growing adoption of renewable sources for power generation, combined with government incentives and tax rebates for installation of solar panels are key prospects driving the growth of the solar cells segment.

- For instance, according to SolarPower Europe, the global installations of solar power witnessed a substantial increase of 87% in 2023 as compared to the previous year. The total installation of solar power capacity reached approximately 447 GW (gigawatt) in 2023, in comparison to 239 GW installations in 2022.

- Hence, based on analysis, the aforementioned factors are anticipated to boost the colorless polyimide films market growth during the forecast period.

By End Use Industry:

Based on the end use industry, the market is segmented into electronics, aerospace, automotive, healthcare, and energy.

Trends in the End Use Industry:

- The trend towards miniaturization, as well as the rising need for lightweight and durable electronics due to a lightweight solution with excellent mechanical strength, is driving the market adoption in the electronics sector.

- The trend towards growing adoption of ADAS, autonomous driving technologies, and other electronic systems in vehicles is driving the market adoption in the automotive sector.

The electronics sector accounted for the largest revenue share in the year 2024.

- The rising adoption of films in the manufacturing of electronics devices such as smartphones, tablets, and wearable gadgets is driving the colorless polyimide films market size.

- Additionally, the development of advanced electronics such as flexible displays and multi-functional portable devices is driving the market adoption in the electronics sector.

- Further, the proliferation of foldable phones, smartwatches, and other flexible devices is driving the colorless polyimide films market demand.

- Thus, the rising demand for foldable phones, smartwatches, and other devices is driving the market adoption in the electronics sector.

The energy sector is anticipated to register the fastest CAGR during the forecast period.

- The films are utilized for development of flexible and lightweight solar modules due to high thermal stability and low expansion which in turn drives the colorless polyimide films market demand.

- Additionally, films are mainly used for the development of thin-film solar cells, driving innovation in the energy sector.

- Further, the growing focus on sustainability, as well as the rising adoption of renewable energy sources, is paving the way for market adoption in the energy sector.

- Therefore, the growing focus on sustainability is anticipated to boost the market during the forecast period.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

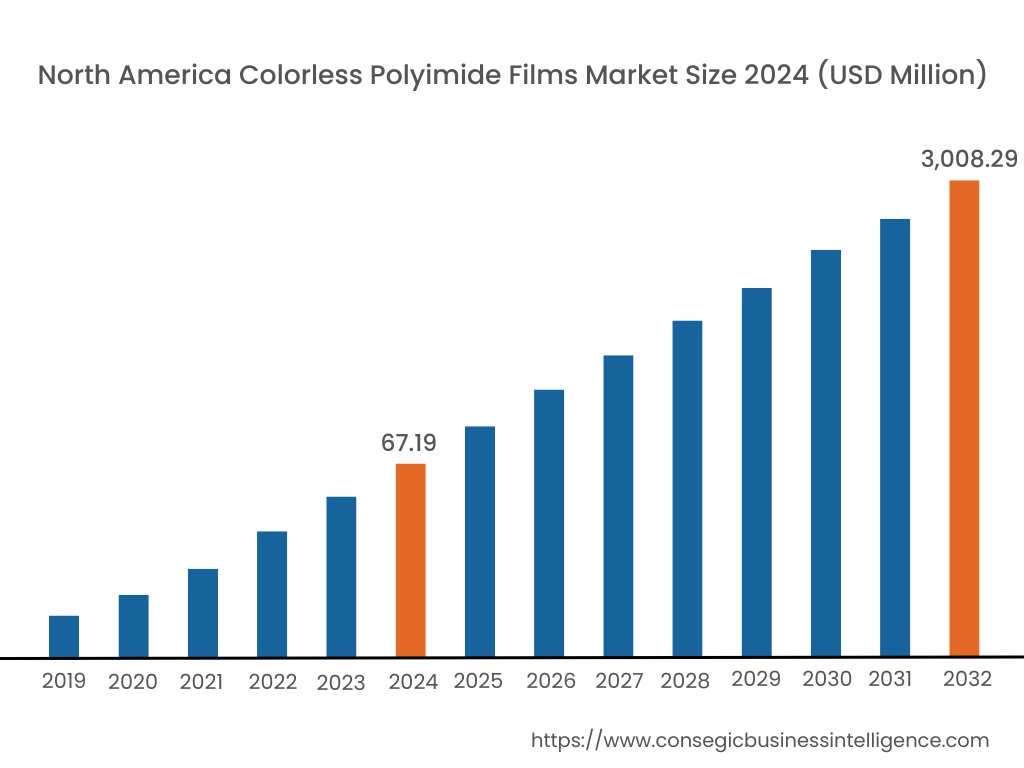

North was valued at USD 67.19 Million and is expected to reach USD 3,008.29 Million in 2032. In North America, the U.S. accounted for the highest share of 71.30% during the base year of 2024. The North American region's growing focus on lightweight and durable materials in aerospace and defense, as well as rising adoption of foldable displays, flexible circuits, and photovoltaic cells, offers lucrative growth prospects for the market. Additionally, advancements in the electronics, aerospace, and automotive industries, as well as increasing use in renewable energy applications, particularly in solar panels, driving the colorless polyimide films industry.

In Asia Pacific, the market is experiencing the fastest growth with a CAGR of 62.0% over the forecast period. China dominates the market due to rising market adoption in foldable smartphones, flexible displays, and semiconductor manufacturing. The market progress is mainly driven by rapid industrialization, urbanization, and expanding electronics and automotive sectors in China, Japan, and South Korea. Furthermore, the government support for research and development is projected to drive the market in the Asia Pacific region during the forecast period.

The regional analysis depicts that the strong automotive, aerospace, and industrial manufacturing sectors are driving the market in Europe. Also, the proliferation of electric vehicles is paving the way for market adoption in Germany, France, and the UK. The rising demand for lightweight, high-temperature-resistant components in aerospace applications is driving the market development.

Additionally, the key factor driving the market is the increasing adoption of renewable energy and industrial applications, as well as the rising utilization of films in solar panels and other energy-efficient technologies, due to sustainable energy initiatives are propelling the market adoption in the Middle East and African region.

Further, based on analysis, the expanding automotive and electronics sectors, as well as growing investments in renewable energy, are paving the way for the progress of the market in the Latin American region. Additionally, the growing adoption of medical devices and wearable electronics is paving the way for market adoption in the Latin American region.

Top Key Players and Market Share Insights:

The global colorless polyimide films market is highly competitive with major players providing films to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end user launches to hold a strong position in the colorless polyimide films industry. Key players in the colorless polyimide films industry include-

- DuPont de Nemours, Inc. (USA)

- Kaneka Corporation (Japan)

- S.T Corporation (Japan)

- NeXolve Holding Company (USA)

- Wuhan Imide New Materials Technology Co., Ltd. (China)

- Kolon Industries, Inc. (South Korea)

- Sumitomo Chemical Co., Ltd. (Japan)

- SK Innovation Co., Ltd. (South Korea)

- Toray Industries, Inc. (Japan)

- 3M Company (USA)

Colorless Polyimide Films Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 9,281.99 Million |

| CAGR (2025-2032) | 61.3% |

| By Thickness |

|

| By Application |

|

| By End Use Industry |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

What is the projected market size of the Colorless Polyimide Films Market by 2032? +

Colorless Polyimide Films Market size is estimated to reach over USD 9,281.99 Million by 2032 from a value of USD 202.55 Million in 2024 and is projected to grow by USD 323.10 Million in 2025, growing at a CAGR of 61.3% from 2025 to 2032.

What are the key drivers for the growth of the market? +

Key drivers include the rising adoption of flexible displays and electronics, advancements in electronic devices, and the increasing focus on lightweight and durable materials.

What challenges does the market face? +

The market faces challenges such as limited awareness and adoption in emerging markets and high production costs of advanced polyimide films.

Which thickness segment holds the largest market share? +

The 10-25 µm thickness segment holds the largest share due to its balance of flexibility and durability, making it ideal for flexible displays and printed circuit boards.