Data Protection as a Service (DPaaS) Market Size:

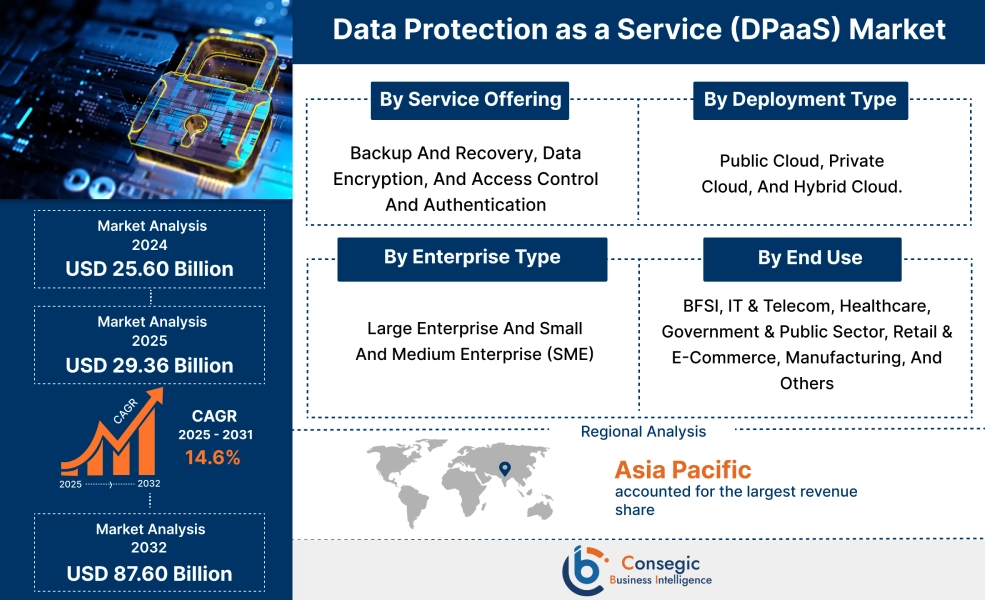

Data Protection as a Service (DPaaS) Market size is estimated to reach over USD 87.60 Billion by 2032 from a value of USD 25.60 Billion in 2024 and is projected to grow by USD 29.36 Billion in 2025, growing at a CAGR of 14.6% from 2025 to 2032.

Data Protection as a Service (DPaaS) Market Scope & Overview:

Data protection as a service (DPaaS) refers to a cloud-based service that is deployed in business enterprises for protecting their data and applications, typically through a subscription model. It includes multiple services such as backup and recovery, disaster recovery, data encryption, and access control and authentication, which aims to safeguard data against loss, corruption, and unauthorized access. Moreover, data protection as a service (DPaaS) offers several benefits including enhanced data security, improved data resilience, cost-effectiveness, enhanced scalability, and others. Additionally, DPaaS is primarily used in several industries including IT & telecom, BFSI, healthcare, government & public sector, retail & e-commerce, manufacturing, and others.

How is AI Transforming the Data Protection as a Service (DPaaS) Market?

The integration of AI is significantly influencing the DPaaS market. AI integration in DPaaS solutions helps in enhancing threat detection, automating processes, and improving overall data protection effectiveness. Moreover, AI and machine learning capabilities are being integrated into DPaaS solutions to detect threats, identify vulnerabilities, and respond to security incidents in real-time.

Additionally, the use of AI in DPaaS solutions offers a range of benefits, including automation of data protection processes, enhanced threat detection, improved operational efficiency, and others. Therefore, the above factors are expected to create lucrative prospects for market growth in upcoming years.

Data Protection as a Service (DPaaS) Market Dynamics - (DRO) :

Key Drivers:

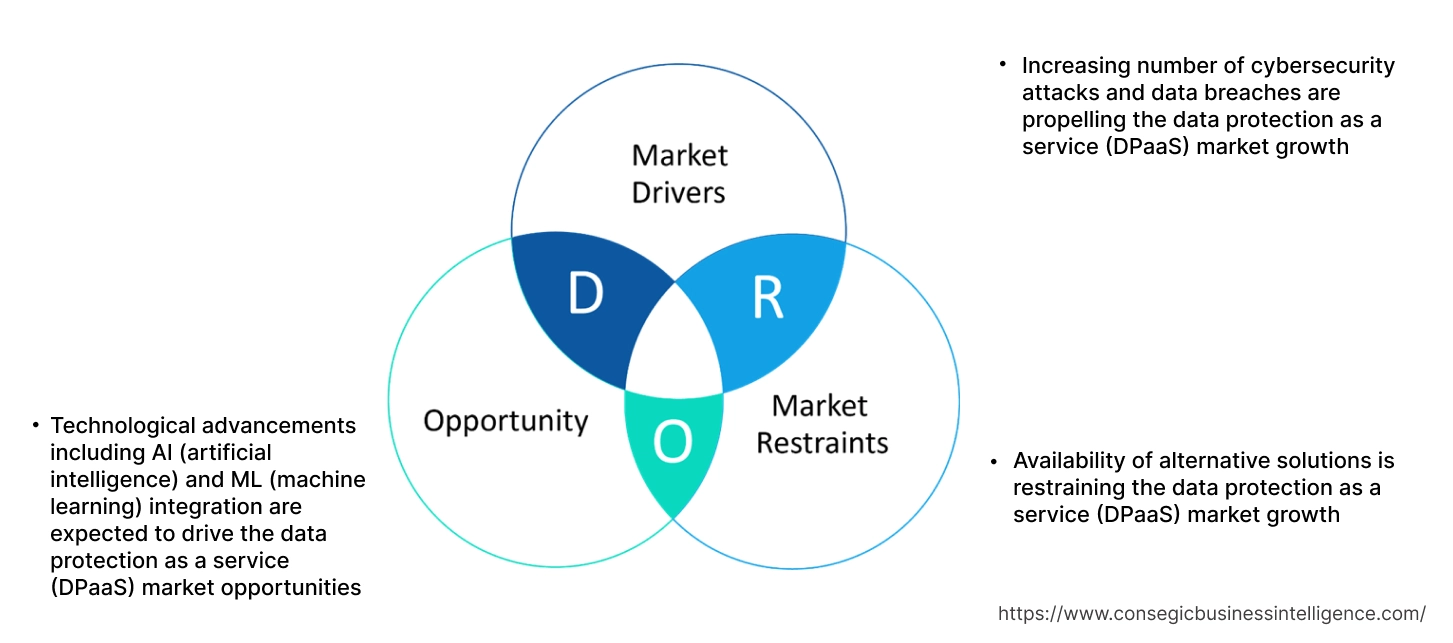

Increasing number of cybersecurity attacks and data breaches are propelling the data protection as a service (DPaaS) market growth

The current business landscape is witnessing a significant increase in volume of data breaches and cybersecurity threats from cyber criminals. Business enterprises are increasingly exposed to data loss and security breaches, where sensitive information is stolen or compromised. As a result, business enterprises are seeking reliable and cost-effective data protection solutions such as DPaaS for protecting their sensitive information. Moreover, DPaaS offers a cost-effective and scalable alternative to traditional on-premise data protection solutions, making it an ideal option for business enterprises, particularly small and medium enterprises (SMEs).

- For instance, according to the Identity Theft Resource Center (ITRC), the total number of data breaches in the United States reached 3,205 breaches in 2023, representing a substantial increase of 78% in comparison to 1,801 data breaches in 2022.

Therefore, the increasing number of data breaches and cybersecurity attacks are driving the need for advanced data protection solutions, in turn propelling the data protection as a service (DPaaS) market size.

Key Restraints:

Availability of alternative solutions is restraining the data protection as a service (DPaaS) market growth

There are multiple alternative solutions to data protection as a service (DPaaS) including traditional on-premises solutions and others. Likewise, the alternative solutions have similar benefits and applications in comparison to DPaaS, which is a primary factor limiting the market.

Additionally, an on-premise data protection solution involves maintaining all data protection infrastructure and management within the company's own facilities. On-premise data protection solution offers several benefits including higher security, greater control over hardware, and customization options. Thus, the aforementioned factors are hindering the data protection as a service (DPaaS) market expansion.

Future Opportunities :

Technological advancements including AI (artificial intelligence) and ML (machine learning) integration are expected to drive the data protection as a service (DPaaS) market opportunities

The integration of data protection solutions with AI and ML helps in improving data security and compliance management while providing a more efficient and robust approach for data protection in comparison to traditional methods. Moreover, AI integration in data protection solutions enables improved threat detection, automation of repetitive tasks, and improved data management and security, which facilitates businesses in meeting the evolving regulatory requirements and reducing risks associated with data breaches. Additionally, these technological advancements address the increasing complexity and volume of cyber threats by leveraging AI's ability to analyze vast amounts of data, identify patterns, and automate responses.

- For instance, in May 2024, Zscaler Inc. introduced its AI innovations to power the company’s comprehensive data protection platform. The AI-powered data protection platform is designed to address the growing need for a combined approach to data protection that is capable of securing all types of data in all locations while optimizing security operations.

Hence, as per the analysis, technological advancements such as AI and ML integration with data protection solutions are projected to boost the data protection as a service (DPaaS) market opportunities during the forecast period.

Data Protection as a Service (DPaaS) Market Segmental Analysis :

By Service Offering:

Based on service offering, the market is segmented into backup and recovery, data encryption, and access control and authentication.

Trends in the service offering:

- Rising adoption of DPaaS in business enterprises for automated backup of critical data and applications in a secure location is driving the market.

- Increasing deployment of DPaaS for data encryption to protect sensitive information from unauthorized access is boosting the market.

The backup and recovery segment accounted for the largest revenue in the overall market in 2024.

- Backup and recovery primarily involve automated backup of critical data and applications in a secure location.

- Moreover, business enterprises can ensure that their data is constantly protected without any manual intervention by automating backups.

- Additionally, in case of hardware failure, cyberattacks, or human error, recovery processes facilitate quick restoration of data, which minimizes downtime and ensures business continuity.

- Further, effective backup and recovery strategies play a crucial role in preventing data loss and maintaining operational efficiency.

- Thus, according to the analysis, the rising adoption of DPaaS for data backup and recovery applications is driving the market.

Data encryption segment is anticipated to register significant CAGR growth during the forecast period.

- Data encryption plays a crucial role in protecting sensitive information from unauthorized access.

- Moreover, encryption involves converting available data into a coded format that can only be deciphered by authorized users with correct decryption keys. This added layer of security is crucial for protecting against data breaches while ensuring compliance with data protection regulations.

- Additionally, DPaaS solutions are used for encrypting data both at rest and during transfer, which ensures that it remains secure throughout its lifecycle.

- For instance, Secure Agility offers DPaaS in its solution offerings, which provide data encryption services. The company’s DPaaS makes sure that the organization's data is encrypted while at rest or during transmission and it is governed by granular permissions.

- Hence, the above factors are projected to boost the market during the forecast period.

By Deployment Type:

Based on deployment type, the market is segmented into public cloud, private cloud, and hybrid cloud.

Trends in the deployment type:

- Factors including the rapid pace of digital transformation and increasing consumer preference for flexible, scalable, reliable, and cost-effective cloud platform are primary determinants for driving the public cloud segment.

- Factors including ease of integration, flexibility, higher security, and more control over sensitive assets of an organization are key aspects driving the private cloud deployment segment.

The public cloud segment accounted for a substantial revenue share in the overall data protection as a service (DPaaS) market share in 2024.

- In public cloud deployment, computing services including data protection as-a-service are typically available on-demand to enterprises over the public internet.

- Moreover, it involves utilizing cloud-based services for protecting data and applications while offering features such as backup, recovery, and disaster recovery.

- Additionally, public cloud deployment offers several benefits higher accessibility, no maintenance requirement, increased scalability, and relatively lower costs in comparison to other types of cloud deployment.

- Consequently, the above benefits related to public cloud deployment are further driving its adoption for the deployment of DPaaS, in turn propelling data protection as a service (DPaaS) market trends.

Private cloud segment is anticipated to register significant CAGR growth during the forecast period.

- In private cloud deployment, all software and hardware resources within a cloud infrastructure are dedicated and accessible to a single-user organization.

- Moreover, private cloud deployment offers a wide range of benefits including scalability, improved security and privacy, enhanced performance along with the availability of additional control and customization from dedicated resources over a computing infrastructure.

- Further, private cloud deployment enables organizations to leverage DPaaS solutions, including backup, disaster recovery, and others, within their own dedicated environment, in turn improving data privacy, regulatory compliance, and performance.

- Hence, the aforementioned factors are projected to drive the adoption of private cloud deployment, in turn boosting the market during the forecast period.

By Enterprise Type:

Based on enterprise type, the market is segmented into large enterprise and small and medium enterprise (SME).

Trends in the enterprise type:

- Increasing trend in the deployment of private cloud-based DPaaS in large enterprises, due to its increased flexibility, higher security, and more control over sensitive assets of an enterprise.

- Factors including rising investments in the development of small and medium enterprises and increasing deployment of public cloud-based DPaaS in SMEs are key trends driving the small and medium enterprise segment.

Large enterprise segment accounted for the largest revenue share in the total Data protection as a service (DPaaS) market share in 2024.

- Large enterprises primarily use DPaaS as a cost-effective and efficient approach for securing their data, applications, and infrastructure through a cloud-based model.

- It provides a broad range of services including backup, disaster recovery, and data encryption, which are managed by a service provider, allowing large enterprises to focus on core operations while ensuring data security and compliance.

- For instance, UnitedLayer offers DPaaS in its solution offerings, which is designed for both large enterprises and SMEs. It offers comprehensive data protection services including key management, advanced encryption, and access control for protecting sensitive information both at rest and during transit.

- Therefore, the increasing adoption of DPaaS in large enterprises is driving the data protection as a service (DPaaS) market trends.

Small and medium enterprise (SME) segment is anticipated to register the fastest CAGR growth during the forecast period.

- Small and medium enterprises are companies that typically maintain workforce, revenues, and assets below a certain threshold.

- Moreover, SMEs usually account for the majority of the businesses that are operating across the world.

- Additionally, DPaaS offers a cost-effective and scalable approach for SMEs to protect their data and ensure compliance with regulations.

- Further, DPaaS enables SMEs to outsource data protection functions and gain access to advanced security measures and expertise without the need for significant upfront investment or dedicated IT staff.

- For instance, according to the U.S. Chamber of Commerce, the total number of small businesses in the United States reached 33.2 million in 2022, accounting for nearly 99.9% of total businesses in the U.S.

- Thus, the rising number of small and medium enterprises is expected to boost the adoption of DPaaS, in turn driving the data protection as a service (DPaaS) market size during the forecast period.

By End Use:

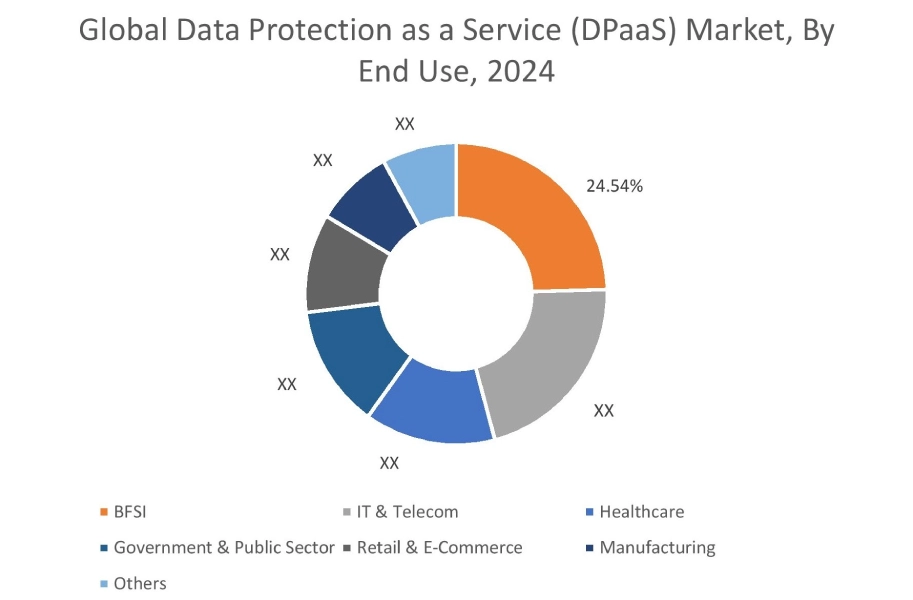

Based on end use, the market is segmented into BFSI, IT & telecom, healthcare, government & public sector, retail & e-commerce, manufacturing, and others.

Trends in the end use:

- There is a rising trend towards the utilization of DPaaS in the BFSI industry for protecting sensitive customer data, complying with regulations, and maintaining operational resilience.

- Increasing adoption of DPaaS in the IT & telecom sector for protecting critical data, user privacy, and communication confidentiality.

BFSI segment accounted for the largest revenue share of 24.54% in the overall market in 2024.

- BFSI firms typically handle huge amounts of sensitive data, which makes them major targets for cyberattacks.

- DPaaS plays a vital role in the BFSI industry for protecting sensitive customer data, complying with regulations, and maintaining operational resilience.

- Moreover, DPaaS providers offer robust security measures such as data encryption, access controls, and regular security audits, which helps BFSI firms in protecting against cyber threats and data breaches.

- For instance, according to the Federal Reserve Board, there are approximately 2,160 large commercial banks in the United States as of March 2025. These banks have combined assets of USD 300 million or more, with numerous branches in the U.S as well as other countries.

- According to the data protection as a service (DPaaS) market analysis, the growing BFSI sector is increasing the utilization of DPaaS, thereby driving the market.

The IT & telecom segment is anticipated to register the fastest CAGR growth during the forecast period.

- IT & telecom companies typically handle a large amount of user data, including personal information, call records, and internet usage among others.

- DPaaS helps IT & telecom companies protect user privacy and communication confidentiality.

- Moreover, in IT & telecom sector, DPaaS offers inclusive data protection, including backup and recovery, data encryption, and other security measures, to protect sensitive data from unauthorized access, theft, or loss.

- Additionally, DPaaS enables business enterprises to quickly recover their IT infrastructure and data in case of a disaster, in turn minimizing downtime and business disruptions.

- Hence, the rising adoption of DPaaS in IT & telecom sector is projected to drive market growth during the forecast period.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

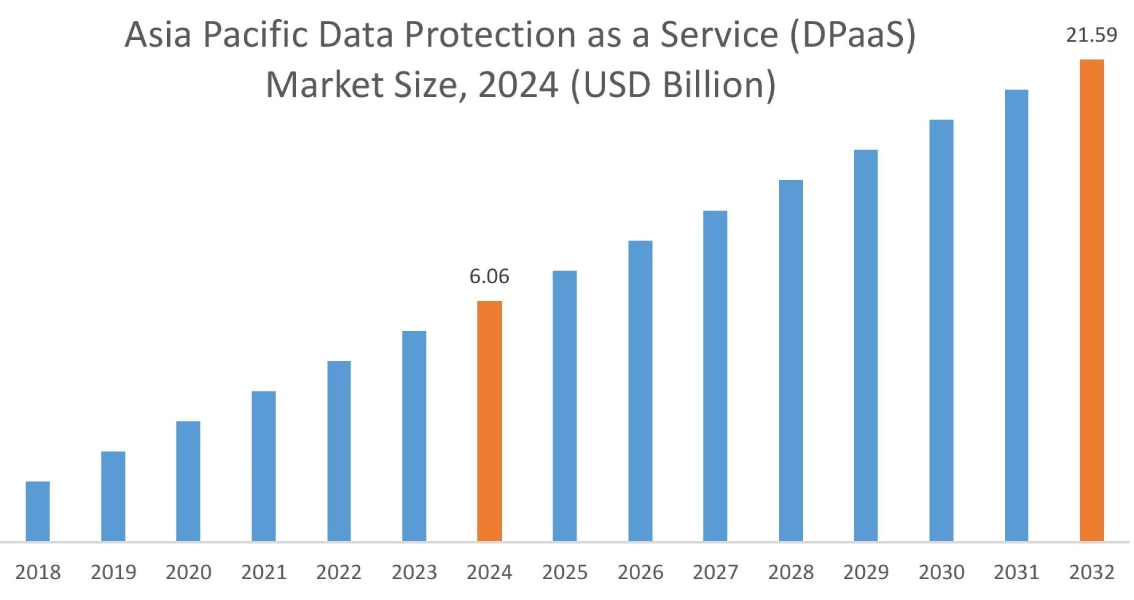

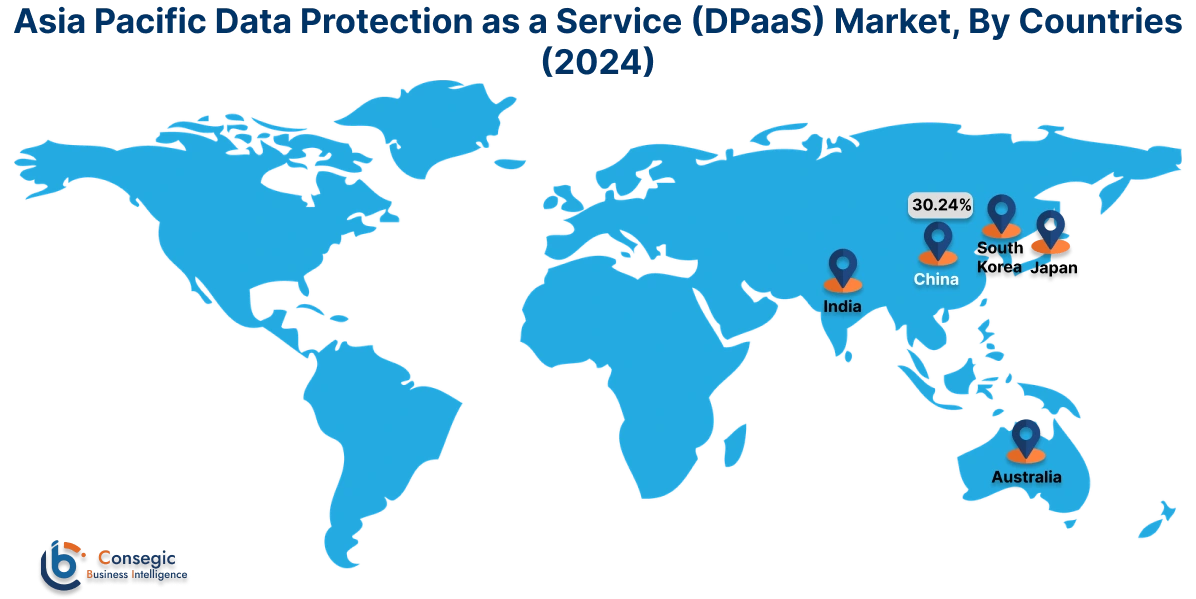

Asia Pacific region was valued at USD 6.06 Billion in 2024. Moreover, it is projected to grow by USD 6.97 Billion in 2025 and reach over USD 21.59 Billion by 2032. Out of this, China accounted for the maximum revenue share of 30.24%. As per the data protection as a service (DPaaS) market analysis, the adoption of DPaaS in the Asia-Pacific region is primarily driven by growing retail, IT & telecom, and government sectors among others. Additionally, the increasing number of data breaches in government & public sector and growing demand for reliable and cost-efficient data protection solutions are further accelerating the data protection as a service (DPaaS) market expansion in the region.

- For instance, in July 2022, Shanghai Municipal Police, a government organization based in China, witnessed a huge data breach that leaked the personal information of approximately one billion Chinese residents from the Shanghai police database stored in the cloud. The aforementioned factors are anticipated to drive market demand in the Asia-Pacific region during the forecast period.

North America is estimated to reach over USD 33.64 Billion by 2032 from a value of USD 9.84 Billion in 2024 and is projected to grow by USD 11.29 Billion in 2025. In North America, the growth of the data protection as a service (DPaaS) industry is driven by rising investments in BFSI, retail, healthcare, and other sectors. Moreover, the rising adoption of advanced data protection solutions in BFSI sector for protecting sensitive customer data, complying with regulations, and maintaining operational resilience is contributing to the data protection as a service (DPaaS) market demand in North America.

- For instance, in July 2022, Citi Bank launched its new Citi Commercial Bank in Canada, as a part of the company’s global extension plan. Citi Commercial Bank offers a broad range of institutional solutions and products to meet the evolving needs of corporates. The above factors are further driving the market in North America.

Additionally, the regional analysis depicts that the growing healthcare, IT & telecom, and retail & e-commerce sectors along with rising need for cost-efficient data protection solutions among business enterprises are driving the data protection as a service (DPaaS) market demand in Europe. Further, as per the market analysis, the market in Latin America, Middle East, and African regions is expected to grow at a substantial rate due to several factors such as increasing investments in BFSI sector, expansion of IT firms, and rising need for robust data protection solutions in government sector among others.

Top Key Players and Market Share Insights:

The global data protection as a service (DPaaS) market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the data protection as a service (DPaaS) market. Key players in the data protection as a service (DPaaS) industry include-

- IBM Corporation (U.S)

- Veritas Technologies LLC (U.S)

- Hitachi Vantara LLC (U.S)

- Plurilock Security Inc. (Canada)

- Secure Agility (Australia)

- Microsoft (U.S)

- Oracle (U.S)

- CISO Global (U.S)

- CrowdStrike Holdings Inc. (U.S)

- Quantum Corporation (U.S)

- Amazon Web Services Inc. (U.S)

- Dell Technologies (U.S)

Recent Industry Developments :

Product Launch:

- In April 2024, Dell Technologies extended its data protection portfolio of devices, software, and as-a-service offerings for assisting customers in strengthening cyber resiliency. Moreover, the Dell APEX backup services AI, which is an integrated generative AI assistant designed for data backup and recovery, will help customers in streamlining their data protection processes.

Data Protection as a Service (DPaaS) Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 87.60 Billion |

| CAGR (2025-2032) | 14.6% |

| By Service Offering |

|

| By Deployment Type |

|

| By Enterprise Type |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the data protection as a service (DPaaS) market? +

The data protection as a service (DPaaS) market was valued at USD 25.60 Billion in 2024 and is projected to grow to USD 87.60 Billion by 2032.

Which is the fastest-growing region in the data protection as a service (DPaaS) market? +

Asia-Pacific is the region experiencing the most rapid growth in the data protection as a service (DPaaS) market.

What specific segmentation details are covered in the data protection as a service (DPaaS) report? +

The data protection as a service (DPaaS) report includes specific segmentation details for service offering, deployment type, enterprise type, end use, and region.

Who are the major players in the data protection as a service (DPaaS) market? +

The key participants in the data protection as a service (DPaaS) market are IBM Corporation (U.S), Veritas Technologies LLC (U.S), CISO Global (U.S), CrowdStrike Holdings Inc. (U.S), Quantum Corporation (U.S), Amazon Web Services Inc. (U.S), Dell Technologies (U.S), Hitachi Vantara LLC (U.S), Plurilock Security Inc. (Canada), Secure Agility (Australia), Microsoft (U.S), Oracle (U.S), and others.