Industry Controls and Factory Automation Market Size:

Industry Controls and Factory Automation Market size is estimated to reach over USD 511.70 Billion by 2031 from a value of USD 255.15 Billion in 2023 and is projected to grow by USD 277.91 Billion in 2024, growing at a CAGR of 9.1% from 2024 to 2031.

Industry Controls and Factory Automation Market Scope & Overview:

Industry controls refer to systems and methods that manage and regulate various operations within industrial settings. Industry controls typically include a broad range of technologies that ensure production processes operate smoothly, efficiently, and safely. Moreover, factory automation refers to the utilization of technologies for automating manufacturing processes. Additionally, industry controls and factory automation solutions offer several benefits such as improved automation, real-time monitoring and control, increased operational efficiency, reduced downtime, increased flexibility, scalability, enhanced safety, and others.

How is AI Transforming the Industry Controls and Factory Automation Market?

The integration of AI is significantly transforming the industry controls and factory automation market. AI-powered solutions are enhancing efficiency, precision, and control across various manufacturing processes, ranging from predictive maintenance to quality control and automated material handling.

Moreover, AI-powered equipment and autonomous mobile robots can streamline material movement within factories and warehouses, in turn improving efficiency and reducing labor costs. Additionally, AI enables smarter, faster, and more efficient manufacturing processes within factories. These advancements are leading to increased productivity, reduced costs, and improved product quality. Hence, the aforementioned factors are expected to drive the market growth in upcoming years.

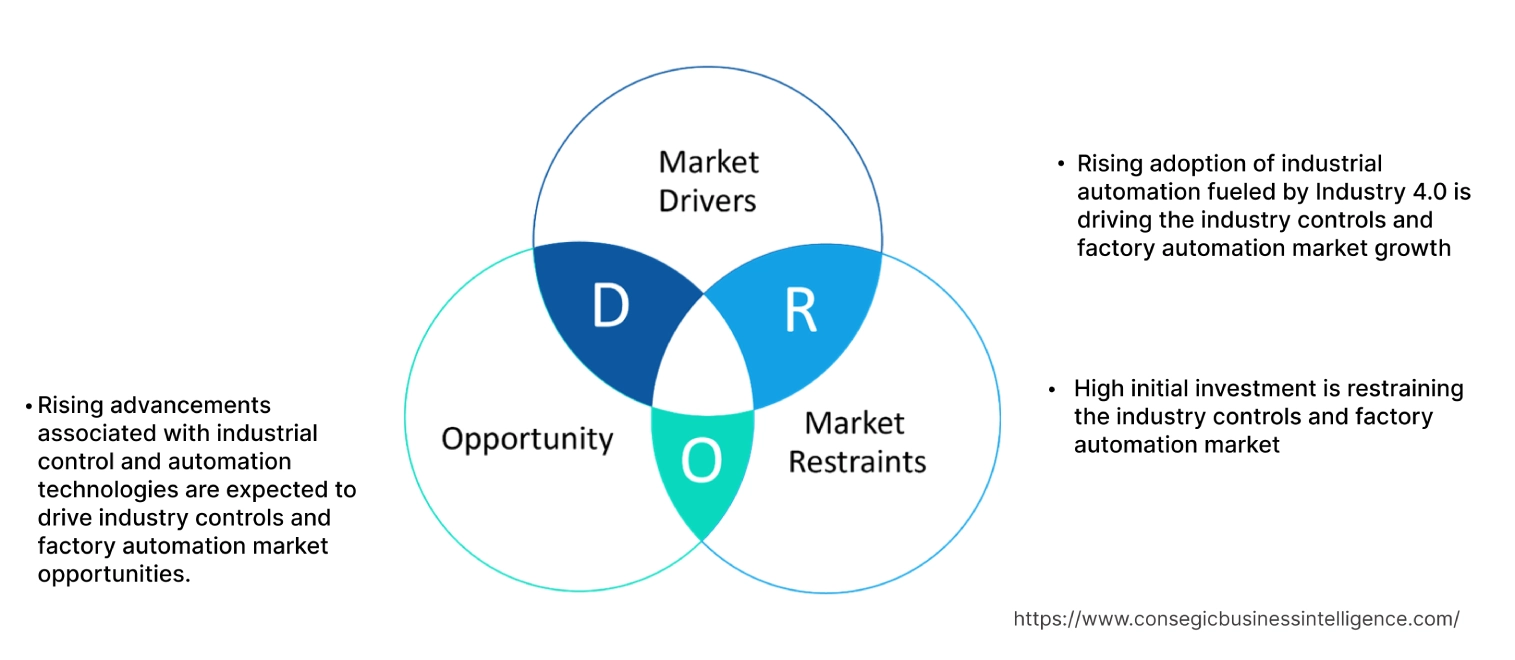

Industry Controls and Factory Automation MarketDynamics - (DRO) :

Key Drivers:

Rising adoption of industrial automation fueled by Industry 4.0 is driving the industry controls and factory automation market growth

Industry 4.0-enabled manufacturing represents automation readiness, extreme flexibility, minimal human intervention, and the highest productivity. Moreover, industry controls and factory automation solutions enable real-time monitoring and control of industrial processes and continuous production capabilities while minimizing downtime and maximizing throughput. Manufacturing companies are increasingly focused on improving operational efficiency, and industry controls and factory automation technologies help achieve this by streamlining industrial processes. Additionally, the utilization of industrial control and automated systems in factories can analyze workflows and optimize operations, helping manufacturers to become more agile and responsive to market demands.

- For instance, in July 2024, Xiaomi launched its completely automated smart factory in Beijing, China. The automated factory spans across 860,000 square feet and it is developed to manufacture approximately 10 million smartphones each year without any human intervention.

Thus, the rising adoption of industrial automation in manufacturing facilities is driving the industry controls and factory automation market size.

Key Restraints :

High initial investment is restraining the industry controls and factory automation market.

High initial investment associated with setting up industrial control and factory automation systems is among the primary factors restraining market growth. The upfront costs associated with the acquisition of industrial control systems factory automation hardware/equipment, and software, along with integrating them into existing systems can be significantly high, which may cause financial barriers, particularly for smaller businesses or businesses operating on tighter budgets.

Additionally, industrial controls and factory automation systems can be quite complex to install and integrate, which further necessitates additional expenses on training personnel or hiring specialized experts to implement and maintain the systems effectively. Hence, the high initial investment associated with setting up these systems is hindering the industry controls and factory automation market expansion.

Future Opportunities :

Rising advancements associated with industrial control and automation technologies are expected to drive industry controls and factory automation market opportunities.

Industrial control and factory automation solution providers are frequently investing in the development of new technologies including industrial control and automation hardware and software solutions to ensure its safe and effective utilization in manufacturing facilities for enhanced operational efficiency and minimal human intervention.

- For instance, in May 2023, Renishaw, a global engineering technology company, introduced its new RCS product line that is specifically designed for industrial automation. The new RCS product line aims to transform the process of commissioning and servicing industrial automation technologies. It focuses on challenges related to manual set-up, calibration, and maintenance of robots within industrial facilities.

- In February 2023, ABB introduced its updated version of ABB Ability Symphony Plus distributed control system that supports digital transformation for water and power generation industries. The solution also features a new process controller that is capable of increasing performance and enabling plant-wide digitalization, while providing a non-invasive modernization of the installed base.

Thus, as per the industry controls and factory automation market analysis, rising advancements associated with industrial control and factory automation solutions are anticipated to drive industry controls and factory automation market opportunities.

Industry Controls and Factory Automation Market Segmental Analysis :

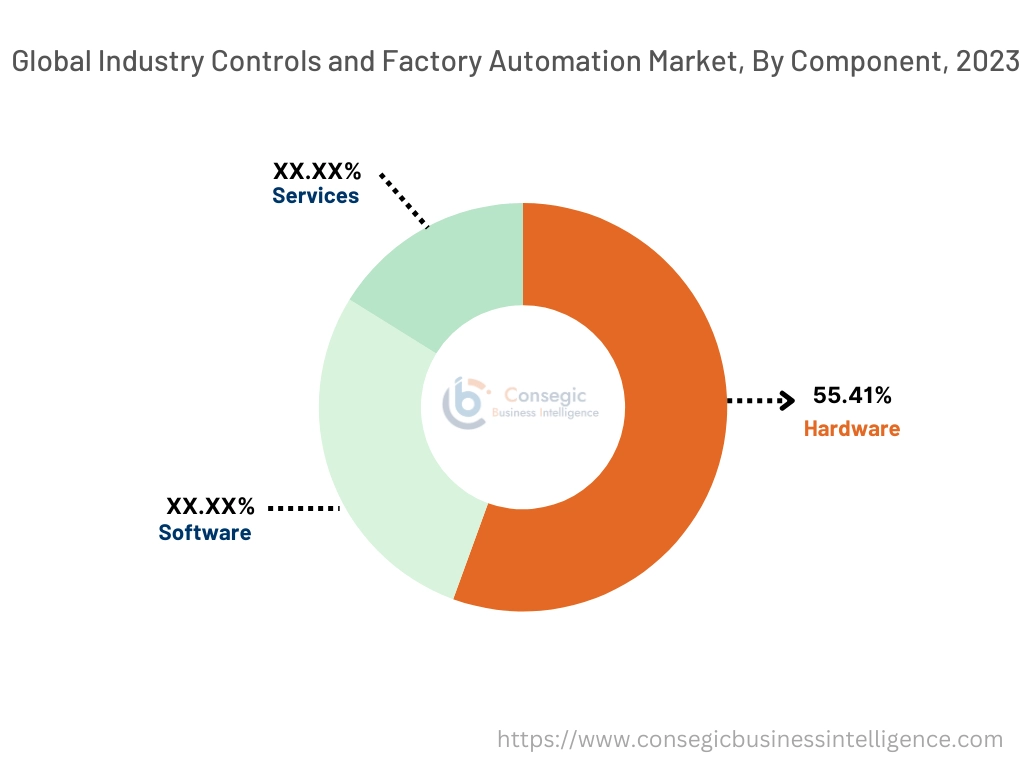

By Component:

Based on components, the market is segmented into hardware, software, and services.

Trends in the component:

- Increasing technological advancements associated with industrial control and factory automation devices such as robotics systems, sensors, actuators, controllers, and others.

- There is a rising trend towards utilization of industrial control and automation devices in industrial facilities for constant monitoring, optimization, and improved operational efficiency.

The hardware segment accounted for the largest revenue share of 55.41% of the total industry controls and factory automation market share in 2023.

- The primary hardware components used for industrial control and factory automation include controllers, industrial robots, sensors, actuators, motors, human-machine interfaces (HMIs), and others

- Industrial controllers are used to control machinery and processes automatically. Meanwhile, industrial robots are used for automating repetitive tasks in factories for increased precision and efficiency.

- Additionally, sensors are used for gathering data from the environment while actuators are utilized for performing the necessary actions based on control signals.

- Moreover, the aforementioned hardware components help in facilitating precise process control and automation within industrial facilities, in turn leading to improved efficiency, precision, and safety in industrial processes.

- For instance, in August 2024, Okuma America Corporation launched its new ORL series of robotics for facilitating automation within factories. The ORL series includes three products, which are optimized to seamlessly load and unload workpieces from both new and pre-existing Okuma machines for increasing productivity and aiding operators' efficiency.

- According to the analysis, the rising innovations associated with hardware components for facilitating improved industrial control and factory automation are driving the industry controls and factory automation market growth.

The software segment is anticipated to register the fastest CAGR growth during the forecast period.

- Industry control and factory automation software provides a centralized platform for monitoring and controlling the equipment and automation systems used within industrial facilities.

- The software has the ability to capture, organize, and analyze data to monitor industrial equipment and system performance.

- Moreover, the benefits of integrating industrial control and factory automation software include smarter maintenance and effective analysis of equipment performance within industrial facilities.

- In October 2022, Schneider Electric launched EcoStruxure Automation Expert v24, its next-generation industrial automation software. The upgraded industrial automation software is capable of supporting larger industrial plants and additional communication protocols.

- Therefore, the increasing advancements associated with industrial control and automation software are anticipated to boost the industry controls and factory automation market size during the forecast period.

By Technology:

Based on technology, the market is segmented into distributed control systems (DCS), supervisory control and data acquisition (SCADA), programmable logic controllers (PLC), programmable automation controllers (PAC), intelligent electronic devices (IED), and Others.

Trends in the technology:

- There is an increasing trend towards the adoption of programmable logic controllers within industrial facilities for real-time processing and operation while increasing operational efficiency.

- Rising adoption of distributed control systems (DCS) in industries such as oil & gas, power generation, and others.

The programmable logic controller (PLC) segment accounted for the largest revenue in the overall industry controls and factory automation market share in 2023.

- Programmable logic controllers (PLCs) are compact, robust digital computers that are specifically designed for controlling manufacturing processes or machinery. Programmable logic controllers utilize programmable software for executing various logic operations and controlling key industrial processes.

- Moreover, PLCs offer a range of benefits including real-time processing and operation, increased flexibility in accommodating different tasks and industrial processes, along increased reliability and durability while operating in harsh industrial environments.

- For instance, in February 2024, WEG launched its new PLC410 model of programmable logic controller. The newly launched PLC offers a versatile solution for industrial automation in several industries, including pharmaceuticals, pulp and paper, metallurgy, and others.

- Therefore, the rising developments associated with programmable logic controllers (PLCs) are driving the industry controls and factory automation market trends.

The distributed control system (DCS) segment is anticipated to register the fastest CAGR growth during the forecast period.

- Distributed control system (DCS) refers to a type of control system for a process or plant, where the control elements are distributed throughout the system instead of being centralized. DCS systems typically consist of multiple controllers, sensors, and actuators linked through a network.

- Moreover, a distributed control system provides numerous benefits including increased scalability, high reliability, flexibility, and real-time monitoring among others. A distributed control system can easily be expanded to accommodate additional processes, which makes it ideal for large-scale industrial installations.

- In April 2024, Valmet introduced its next-generation distributed control system (DCS), which is a completely web-based process control system that is optimized to improve efficiency, sustainability, productivity, and safety in industrial operations. The DCS represents a key milestone in process automation and offers a reliable platform for moving towards more digitalized and autonomous operations.

- Therefore, the increasing advancements associated with distributed control systems (DCS) are anticipated to boost the market growth during the forecast period.

By Application:

Based on the application, the market is segmented into manufacturing, oil & gas, automotive, chemical, energy & utilities, food & beverage, electronics & semiconductor, and others.

Trends in the application:

- Industrial facilities have witnessed a growing trend in the utilization of industrial control and factory automation systems for optimizing and streamlining industrial processes.

- The prevalence of favorable government initiatives for industrial automation is driving the growth of the manufacturing segment.

The manufacturing segment accounted for the largest revenue share of the total market share in 2023, and it is anticipated to register a significant CAGR during the forecast period.

- This dominance is attributed to the rising adoption of industrial control and automation systems in manufacturing facilities for optimizing manufacturing processes and operations with minimal human intervention.

- Additionally, the increasing development of smart factories and technological advancements in manufacturing equipment such as artificial intelligence (AI), industrial internet of things (IIoT), and others has further propelled the market expansion.

- For instance, in December 2023, Mitsubishi Electric India introduced its new smart manufacturing facility for advanced factory automation systems in the state of Maharashtra, India. The new manufacturing facility is optimized to deliver products with the highest quality and reliability while strengthening its business in India and addressing the increasing demand for advanced automation and smart manufacturing solutions.

- According to the analysis, the rising developments associated with smart factories and the adoption of automation in manufacturing facilities are driving the industry controls and factory automation market.

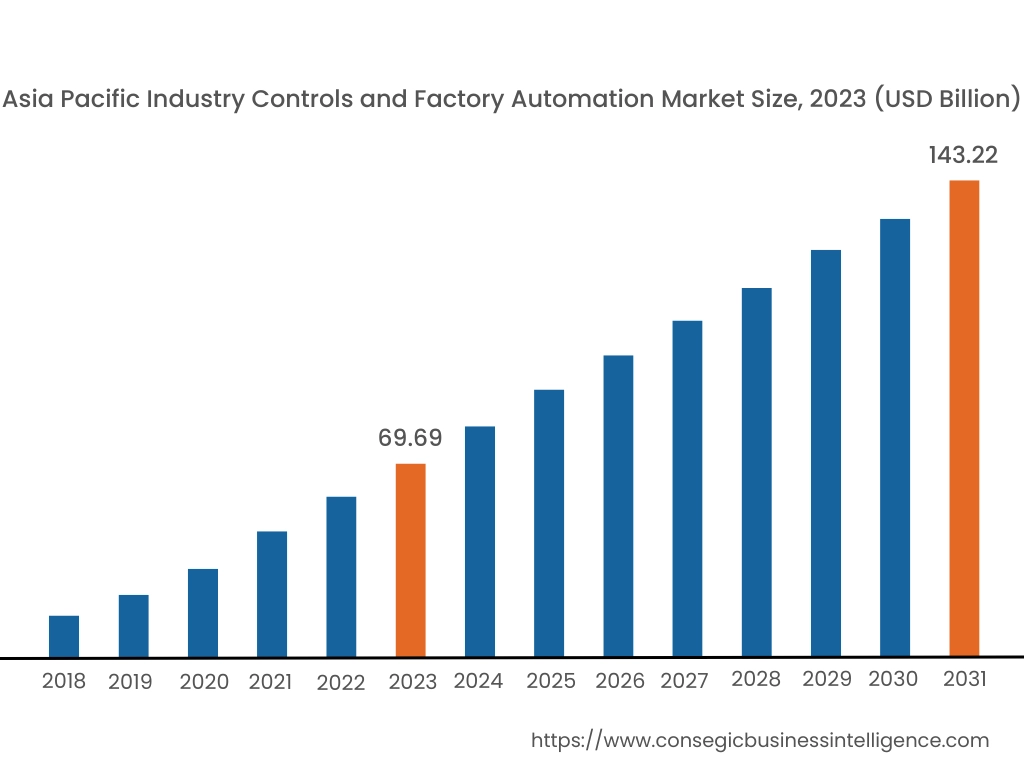

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

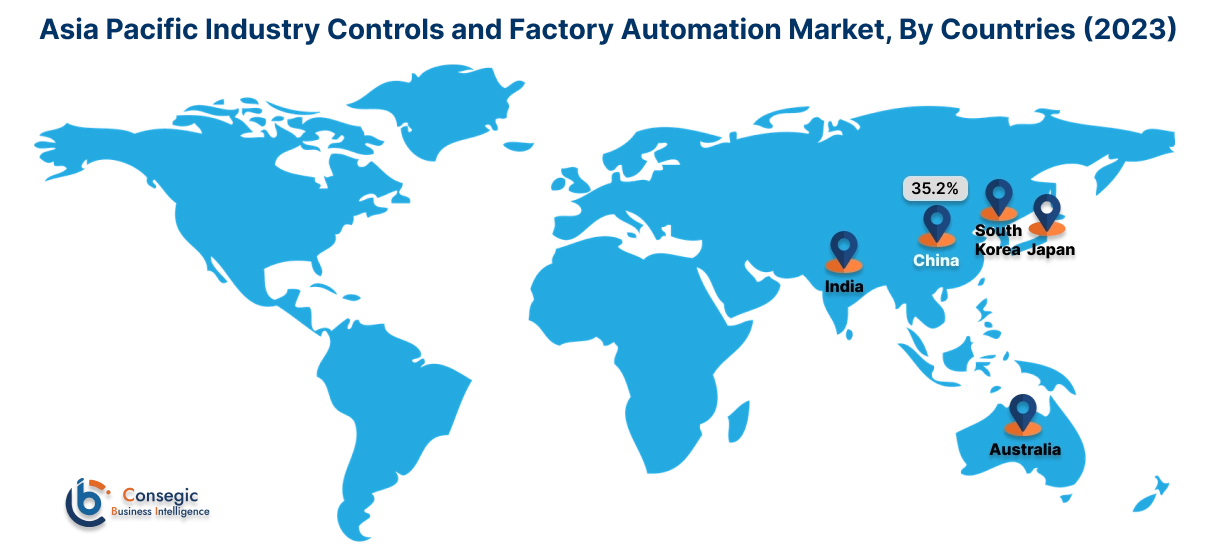

Asia Pacific region was valued at USD 69.69 Billion in 2023. Moreover, it is projected to grow by USD 76.06 Billion in 2024 and reach over USD 143.22 Billion by 2031. Out of this, China accounted for the maximum revenue share of 35.2%. As per the industry controls and factory automation market analysis, there is increasing adoption of industry controls and factory automation solutions, particularly in countries such as China, India, and Japan for improved operational efficiency. Additionally, increasing advancements associated with smart factory solutions are further accelerating the industry controls and factory automation market expansion.

- For instance, in September 2024, Panasonic Smart Factory Solutions India launched its advanced smart factory solutions and products that are integrated with technologies such as IIoT (industrial internet of things), AI (artificial intelligence), automation, and others. These innovations are optimized to integrate with manufacturing processes seamlessly, in turn driving quality, efficiency, and production capacity to exceptional levels.

North America is estimated to reach over USD 168.91 Billion by 2031 from a value of USD 84.48 Billion in 2023 and is projected to grow by USD 91.99 Billion in 2024. In North America, the growth of industry controls and factory automation industry is driven by the rising adoption of industrial automation and the increasing development of smart factories in the region. Similarly, the rising investment in the development of industrial facilities is contributing to the industry controls and factory automation market demand.

- For instance, in March 2022, Kerry Group, a food and beverage company, invested USD 137 million in the development of its new food manufacturing facility in Georgia, United States. The rising development of manufacturing facilities is increasing the integration of industrial control and factory automation systems within manufacturing facilities, thereby, driving the industry controls and factory automation market trends in North America.

The regional analysis depicts that the prevalence of favorable government measures for facilitating industrial automation and increasing the development of industrial factories is driving the industry controls and factory automation market demand in Europe. Furthermore, as per the market analysis, the market demand in Latin America, Middle East, and African regions is expected to grow at a considerable rate due to factors such as increasing investments in the development of industrial facilities and rising adoption of industrial automation solutions within industrial plants.

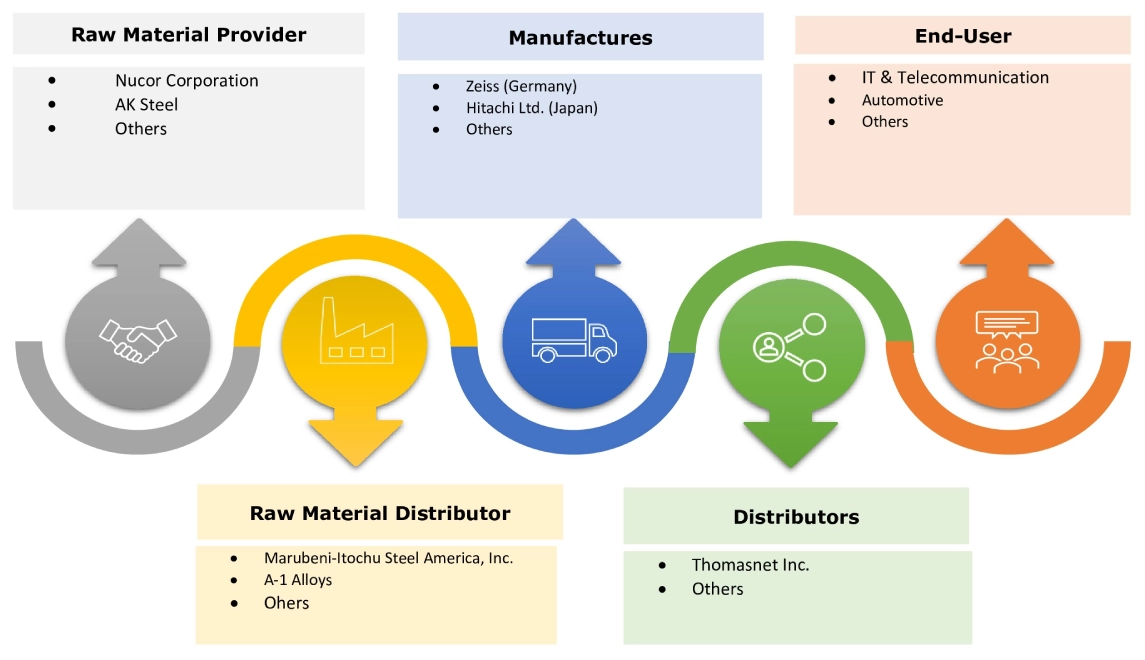

Top Key Players & Market Share Insights:

The global industry controls and factory automation market is highly competitive with major players providing services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the industry controls and factory automation market. Key players in the industry controls and factory automation industry include -

- Siemens (Germany)

- Schneider Electric (France)

- Rockwell Automation Inc. (United States)

- Emerson Electric Co. (United States)

- B&R Industrial Automation GmbH (Austria)

- ABB (Switzerland)

- Yokogawa Electric Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- Omron Corporation (United States)

- Honeywell International Inc. (United States)

Recent Industry Developments :

Product Launches:

- In April 2023, Omron Corporation announced the launch of its NX series of automation controllers that are integrated with advanced information control and safety control. The launch responds to the rising efforts towards carbon neutrality at manufacturing sites.

- In February 2023, ABB introduced its updated version of ABB Ability Symphony Plus distributed control system that supports digital transformation for water and power generation industries.

- In October 2022, Schneider Electric launched EcoStruxure Automation Expert v24, its next-generation industrial automation software. The upgraded industrial automation software is capable of supporting larger industrial plants and additional communication protocols.

Mergers & Acquisitions:

- In March 2024, Siemens announced the acquisition of the industrial drive technology business of ebm-papst. The business employs approximately 650 individuals and includes intelligent, integrated mechatronic systems along with innovative motion control systems. This acquisition aims to strengthen Siemens’ position in the field of factory automation and digitalization.

Industry Controls and Factory Automation Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 511.70 Billion |

| CAGR (2024-2031) | 9.1% |

| By Component |

|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the industry controls and factory automation market? +

The industry controls and factory automation market was valued at USD 255.15 Billion in 2023 and is projected to grow to USD 511.70 Billion by 2031.

Which is the fastest-growing region in the industry controls and factory automation market? +

Asia-Pacific is the region experiencing the most rapid growth in the industry controls and factory automation market.

What specific segmentation details are covered in the industry controls and factory automation report? +

The industry controls and factory automation report includes specific segmentation details for components, technology, applications, and regions.

Who are the major players in the industry controls and factory automation market? +

The key participants in the industry controls and factory automation market are Siemens (Germany), Schneider Electric (France), ABB (Switzerland), Yokogawa Electric Corporation (Japan), Mitsubishi Electric Corporation (Japan), Omron Corporation (United States), Honeywell International Inc. (United States), Rockwell Automation Inc. (United States), Emerson Electric Co. (United States), and B&R Industrial Automation GmbH (Austria).