Interactive Video Wall Market Size:

Interactive Video Wall Market size is estimated to reach over USD 40,354.12 Million by 2031 from a value of USD 19,035.63 Million in 2023 and is projected to grow by USD 20,571.04 Million in 2024, growing at a CAGR of 9.8% from 2024 to 2031.

Interactive Video Wall Market Scope & Overview:

An interactive video wall is a large display made up of multiple screens or panels tiled together contiguously or overlapped to form one large screen. These video walls incorporate touch capabilities, gesture recognition, and advanced content management systems to enable users to engage directly with the displayed content. Additionally, these video walls are widely used in various sectors, including retail, education, corporate environments, and public spaces for advertising, interactive presentations, collaborative workspaces, and live update information. The aforementioned factors are major determinants for increasing the adoption of interactive video walls.

Interactive Video Wall Market Insights:

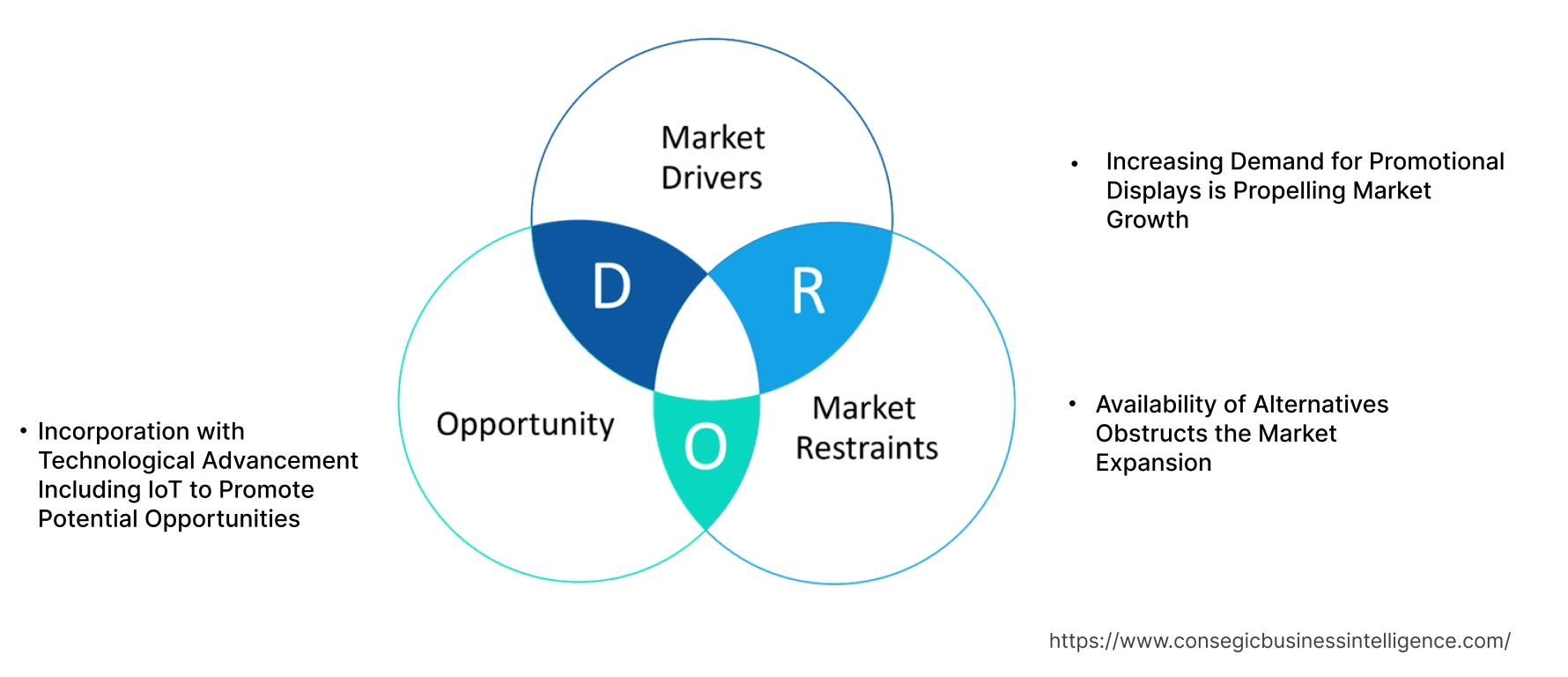

Interactive Video Wall Market Dynamics - (DRO) :

Key Drivers:

Increasing Demand for Promotional Displays is Propelling Market Growth

Businesses across various sectors are increasingly adopting these video walls to captivate and engage audiences effectively to promote products, services, and others. These advanced display systems are being utilized in public spaces including buses, broadcast stations, airports, shops, and others, to create dynamic and visually appealing promotional content that attracts potential customers and enhances brand visibility. Additionally, these provide functions for operating content, controlling monitors to display products, and improving CMS (Content Management System).

- According to the analysis of LG Electronics, Video walls can be useful for businesses to convey information or advertise in several locations including control rooms, meeting rooms, broadcast stations, airports, and shops. The number of instances where huge video walls are set up as iconic features to attract an audience is on the rise.

Hence, demand for promotional displays and improved Content Management Systems collectively boost the market.

Key Restraints :

Availability of Alternatives Obstructs the Market Expansion

Alternatives to video walls include large format screens, projection mapping, touchscreen monitors, interactive kiosks, and modular display systems, providing businesses with diverse options better suited for specific applications. These alternatives allow organizations to choose solutions that meet display and interactive needs without the complexity associated with these video wall installations. Additionally, technological advancements in these alternatives offer versatile solutions for companies to deploy content across multiple locations and provide unique visual experiences for events and exhibitions.

- In March 2023, ViewSonic Corp introduced a range of Direct View LED displays, offering ProAV installers and dealers more options for large-screen messaging that makes a strong impression. This display option offers the same features as a large video wall but without the expenses or limitations of a fixed setup.

Hence, this growing competition from alternative solutions is reducing the demand for the market.

Future Opportunities :

Incorporation with Technological Advancement Including IoT to Promote Potential Opportunities

The convergence of these video walls with IoT (Internet of Things) technology is driving significant expansion and innovation. By utilizing the capabilities of connected devices and data analysis, companies can develop extremely captivating and interactive experiences. IoT integration allows for collecting real-time data to support personalized content, predictive maintenance, and energy optimization. This mutual relationship creates fresh chances in industries such as retail, healthcare, and smart cities, allowing companies to provide outstanding customer experiences and achieve a competitive advantage using data-driven insights.

Moreover, the incorporation of IoT into interactive video walls is at an early stage and has a promising outlook for growth in the future. With these advancements in sensor capabilities and data analysis, video walls will progress into intelligent systems providing tailored and contextually suitable experiences. The coming together of technologies will spur creativity, open up fresh market possibilities, and transform how we engage with digital screens.

Hence, rising innovation in sensor technology integrated with IoT is expected to boost interactive video wall market growth.

Interactive Video Wall Market Segmental Analysis :

By Display:

Based on the display, the market is segmented into LCD, LED, OLED, and Others.

Trends in the display:

- Quantum dot technology is increasingly being adopted to enhance color accuracy and brightness in LCD and LED displays, providing a wider and better image quality.

The LED segment accounted for the largest revenue share in 2023.

- LED (light-emitting diodes) display is a flat panel display that uses an array of LEDs as pixels for a video display.

- Factors include high brightness, color accuracy, durability, versatility, and high refresh rates, and are well suited for large-scale video walls and outdoor billboards.

- In May 2022, Barco launched the TruePix LED video wall, providing a seamless display, enhanced color accuracy under all lighting conditions, Purpose-built robustness, and ergonomics for 24/7 smooth and efficient operation.

- Thus, the aforementioned factors of LED display including high resolution and refresh rates are driving the proliferation of the interactive video wall market trend.

The OLED segment is anticipated to register the fastest CAGR growth during the forecast period.

- OLED acronym for Organic Light-Emitting Diode, a technology that uses LEDs in which the light is produced by organic molecules.

- These enable emissive displays which means that each pixel is controlled individually and emits its own light.

- Determining features include superior color quality, high-contrast ratios, fast motion, rapid response times, wide viewing angles, and flexible and thin design.

- For instance, LG Electronics's OLED video wall provides high resolution, brightness, and superior color quality.

- Therefore, trends in OLED display continue to evolve with better features comparatively including energy efficiency, which is anticipated to accelerate interactive video wall market demand.

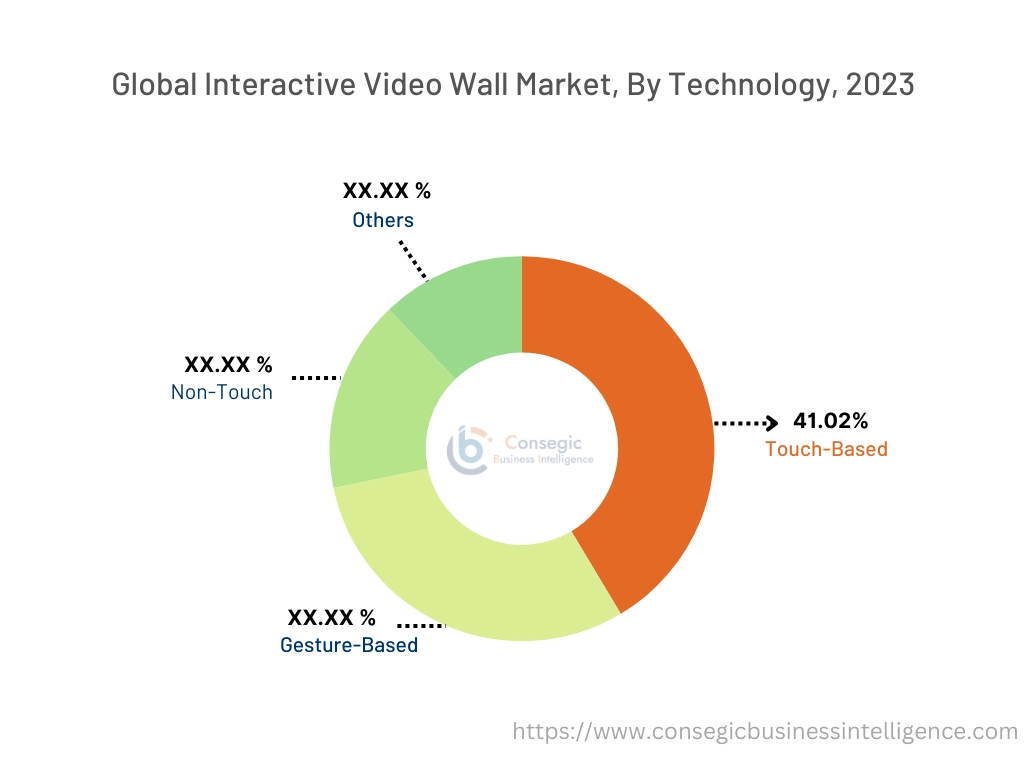

By Technology:

Based on technology, the market is segmented into Touch-based, Gesture-based, Non-touch, and Others.

Trends in the technology:

- Advances in touch technology are providing higher sensitivity and accuracy, enabling more precise interactions and a smoother user experience.

- The integration of 3D gesture recognition technologies is allowing users to interact with video walls through spatial movements, expanding the range of possible gestures and interactions.

The touch-based segment accounted for the largest revenue share of 41.02% in the year 2023.

- Touch-based video walls offer a high level of interactivity, allowing users to directly engage with the content, which is particularly appealing in educational, professional, and retail settings.

- Continuous advancements in touch technology, including improved calibration and support for stylus and glove interactions, have made touch-based video walls more reliable and efficient.

- In Feb 2021, Planar unveiled the Planar UltraRes X Series, which offers 4K resolution with precise touch interactivity, ideal for collaborative spaces, and educational and professional environments. These displays support 24/7 operation, providing robust performance with a sleek, modern design.

- Thus, as per the interactive video wall market analysis touch-based segment enables interactive and collaborative spaces across various industries and is driving the proliferation of the global interactive video wall market share.

The Gesture-based segment is anticipated to register the fastest CAGR growth during the forecast period

- Gesture-based enables touchless interactivity driven by the need for hygienic and intuitive user interactions.

- These walls are versatile and can be used in a wide range of applications, including interactive advertising, digital signage, control rooms, and educational settings.

- Rapid advancements in gesture recognition technology are continually improving accuracy, speed, and responsiveness, paving the way for more sophisticated and versatile applications.

- Consequently, the combination of intuitive design, health benefits, accessibility, and technological progress positions gesture-based video walls as a compelling and dominant force in the future of display technology, boosting the interactive video wall market opportunity.

By Application :

Based on application the market is segmented into BFSI, Retail, Transportation, Commercial buildings, Government, Entertainment, Education, Healthcare, and Others.

Trends in the application:

- Interactive video walls are increasingly being used for live monitoring and security, enabling comprehensive surveillance and incident management through integrated feeds and analytics.

- Governments are utilizing video walls for displaying public information, emergency response, and real-time data visualization in control centers, enhancing communication and decision-making.

The commercial building segment accounted for the largest revenue share in the year 2023.

- The commercial sector includes offices, retail stores, hotels, shopping malls, and others.

- Increasing need for interactive promotional displays across commercial buildings enables maximum reach of consumers.

- In January 2021, Samsung Electronics, RGB Spectrum, and SYNNEX Corporation joined forces to offer a high-resolution interactive video wall display, providing a powerful tool for visual communication. The packaged options are tailored for digital signage, corporate lobbies, control rooms, and operations centers, drawing on vast expertise in the commercial industry.

- Thus, the trend in the display of video walls in commercial buildings allows to reach out and attract potential customers, boosting the global interactive video wall market expansion.

The healthcare segment is anticipated to register the fastest CAGR growth during the forecast period.

- Healthcare facilitates the increasing adoption of advanced technologies to improve patient care and operational efficiency.

- Video walls are being integrated for various applications including medical imaging, real-time patient data monitoring, telemedicine, and interactive patient education.

- In April 2023, Matrox Video unveiled the Matrox LUMA series of graphic cards with Intel Arc GPUs. The LUMA series targets high-reliability and embedded PC applications within the medical, digital signage, control room, video wall, and industrial sectors. It provides advanced graphics for healthcare applications, enabling multiple high-quality displays from a single board.

- Consequently, according to analysis, the trend is anticipated to continue as healthcare providers seek innovative ways to enhance patient care, in return proliferating the interactive video wall market opportunities.

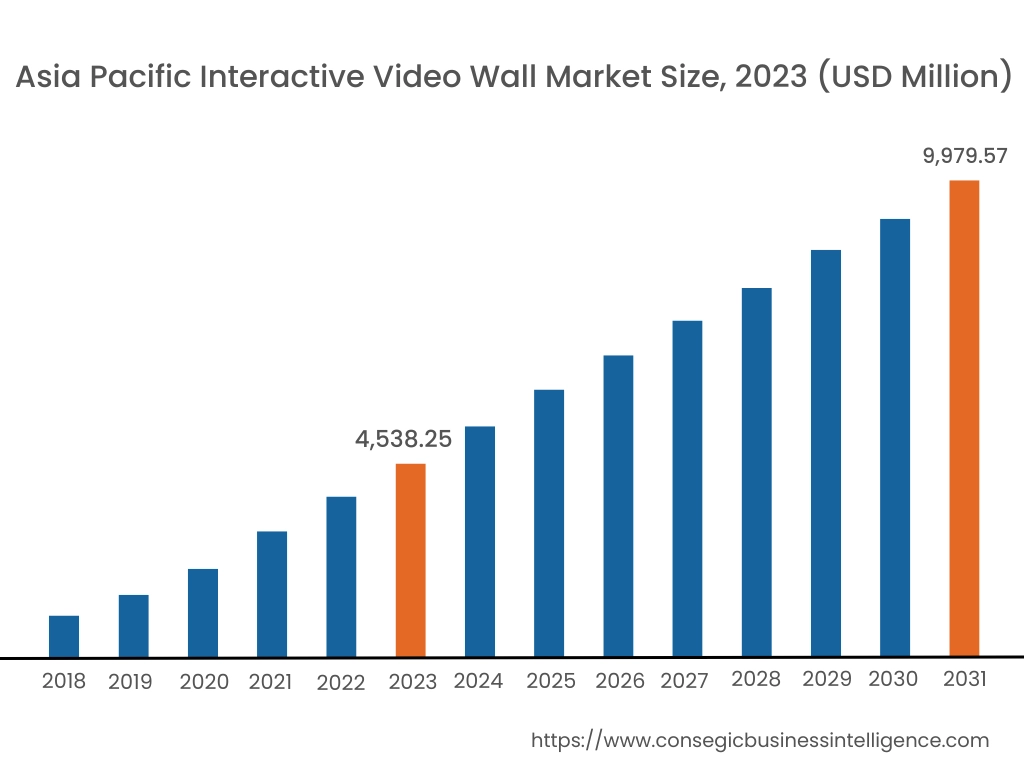

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

North America is estimated to reach over USD 13,292.65 Million by 2031 from a value of USD 6,268.59 Million in 2023 and is projected to grow by USD 6,774.37 Million in 2024. Continuous advancements in display technology and increasing demand for interactive and immersive advertising solutions are expected to fuel the interactive video wall market growth.

Asia-Pacific region was valued at USD 4,538.25 Million in 2023. Out of this, China accounted for the maximum revenue share of 31.6%.

Asia-Pacific is poised to become a dominant player in the market, driven by rapid urbanization, increasing disposable income, and a growing emphasis on digital signage. The region has witnessed substantial growth in the retail, hospitality, and transportation sectors, fueling the demand for interactive displays.

In the Middle East and Africa, there is a growing trend towards the use of display systems driving the interactive video wall market. Companies in this area are utilizing the screens for retail marketing, entertainment locations, and business functions. The oil-rich economies in the region and their investments in infrastructure development have opened up possibilities for advanced display solutions. Nevertheless, the market is still in its early stages compared to North America and Asia-Pacific. In countries like the UAE and Saudi Arabia, there is an increasing interest in interactive technology, despite obstacles like economic volatility and infrastructure limitations.

Latin America offers a developing interactive video wall market, with Brazil and Mexico at the forefront. The significant population in the area and growing urbanization offer chances for expansion. Though smaller than other regions, there is an increasing desire for digital signage and interactive displays in retail, hospitality, and corporate industries. Nevertheless, economic instability and infrastructure obstacles can impede interactive video wall market expansion.

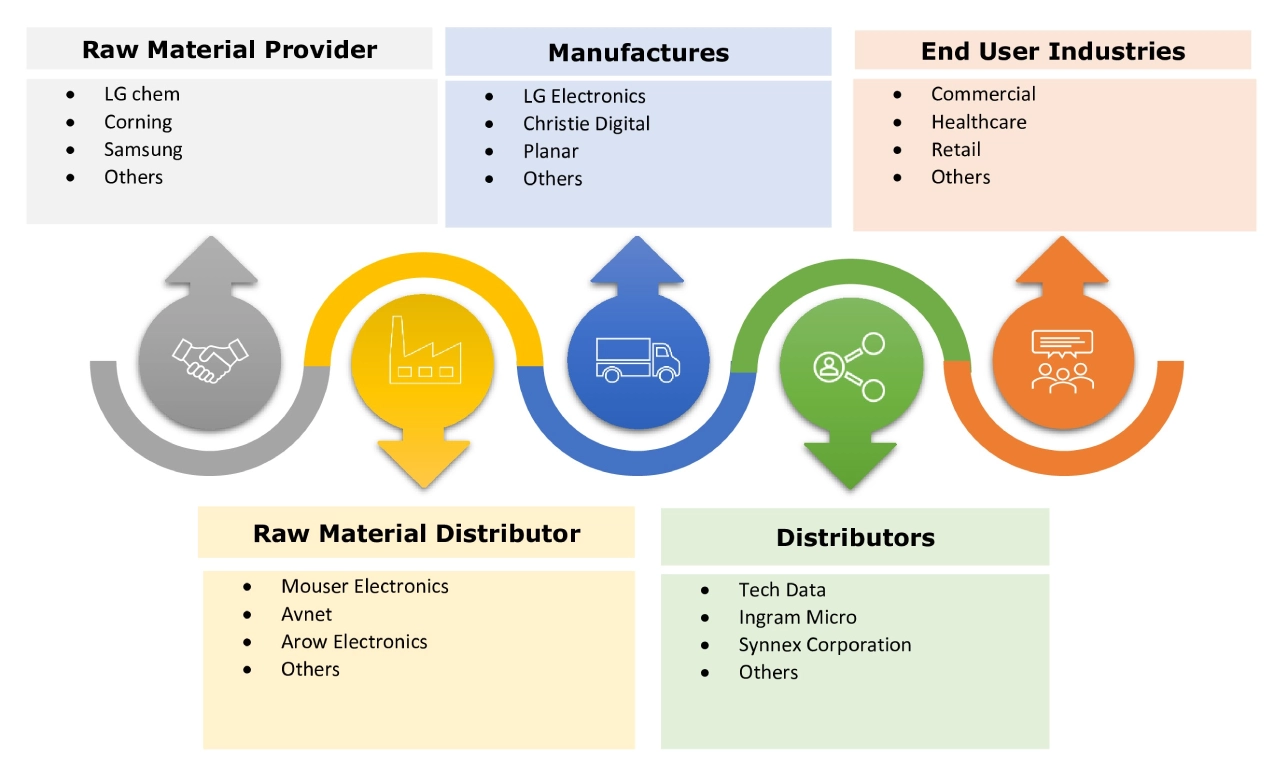

Top Key Players & Market Share Insights:

The interactive video wall market is highly competitive with major players providing advanced display systems to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the interactive video wall market. Key players in the interactive video wall industry include-

- LG Electronics (Japan)

- Samsung Electronics (South Korea)

- NEC Corporation (Japan)

- Delta Electronics, Inc (Taiwan)

- Barco (Belgium)

- Sony Corporation (Japan)

- Philips N.V (Netherlands)

- Planar (US)

- Panasonic (Japan)

- Christie Digital Systems (US)

- Mitsubishi Corporation (Japan)

- Formetco (US)

Recent Industry Developments :

Product launches

- In June 2023, Planar introduced Planar DirectLight Pro Series, an LED video wall platform at InfoComm2023, designed to be easily customized for various video wall dimensions and resolutions using two cabinet dimensions and a 5G video architecture.

- In May 2024, ATEN released the Video Wall Processor Series, which aims to streamline the analysis of intricate data in settings like transportation hubs, security operations, and control rooms, promoting improved decision-making and teamwork in various industries.

Business Expansion

- In June 2024, Barco will grow its TruePix LED video wall options, with a focus on ergonomics and sustainability. The TP-I family is an advanced indoor LED video wall solution that establishes a higher level of visual quality by integrating intelligent design, energy efficiency, and ergonomics. This additional introduction enhances Barco's current TruePix lineup and can be used in control rooms and various other markets like simulation, home entertainment, corporate lobbies, and more.

Interactive Video Wall Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 40,354.12 Million |

| CAGR (2024-2031) | 9.8% |

| By Display |

|

| By Technology |

|

| By Installation |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Interactive video wall Market? +

Interactive Video Wall Market size is estimated to reach over USD 40,354.12 Million by 2031 from a value of USD 19,035.63 Million in 2023 and is projected to grow by USD 20,571.04 Million in 2024, growing at a CAGR of 9.8% from 2024 to 2031.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2023-2031? +

Asia-Pacific is anticipated to register the fastest CAGR growth during the forecast period. Driven by rapid urbanization, increasing disposable income, and a growing emphasis on digital signage. The region has witnessed substantial growth in the retail, hospitality, and transportation sectors, fueling the demand for interactive displays.

Who are the major players in the Interactive video wall Market? +

Key players in interactive video wall LG Electronics (Japan), Samsung Electronics (South Korea), NEC Corporation (Japan), Delta Electronics, Inc (Taiwan), Barco (Belgium), Panasonic (Japan), Christie Digital Systems (US), Mitsubishi Corporation (Japan), Planar (US), Formetco (US), Sony Corporation (Japan) and Philips N.V (Netherlands).

What is the key market trend? +

The integration of 3D gesture recognition technologies is allowing users to interact with video walls through spatial movements, expanding the range of possible gestures and interactions.