Laminate Flooring Market Size :

Laminate Flooring Market size is estimated to reach over USD 19,856.50 Million by 2032 from a value of USD 11,505.40 Million in 2024 and is projected to grow by USD 12,112.67 Million in 2025, growing at a CAGR of 6.4% from 2025 to 2032.

Laminate Flooring Market Scope & Overview:

Laminate flooring is a multi-layer synthetic flooring product. It is made up of several layers, including a decorative layer (often a photographic image of wood or stone) and a durable wear layer, all fused together. Laminate flooring is known for being relatively affordable, easy to install, simple to maintain and designed to mimic the look of wood or stone. It typically consists of a wear layer, a decorative layer, a core layer, and a backing layer. The wear layer provides resistance to scratches, stains, and fading, making it suitable for high-traffic areas. It is generally easy to clean and maintain, typically requiring sweeping, vacuuming, or damp mopping.

Laminate Flooring Market Insights :

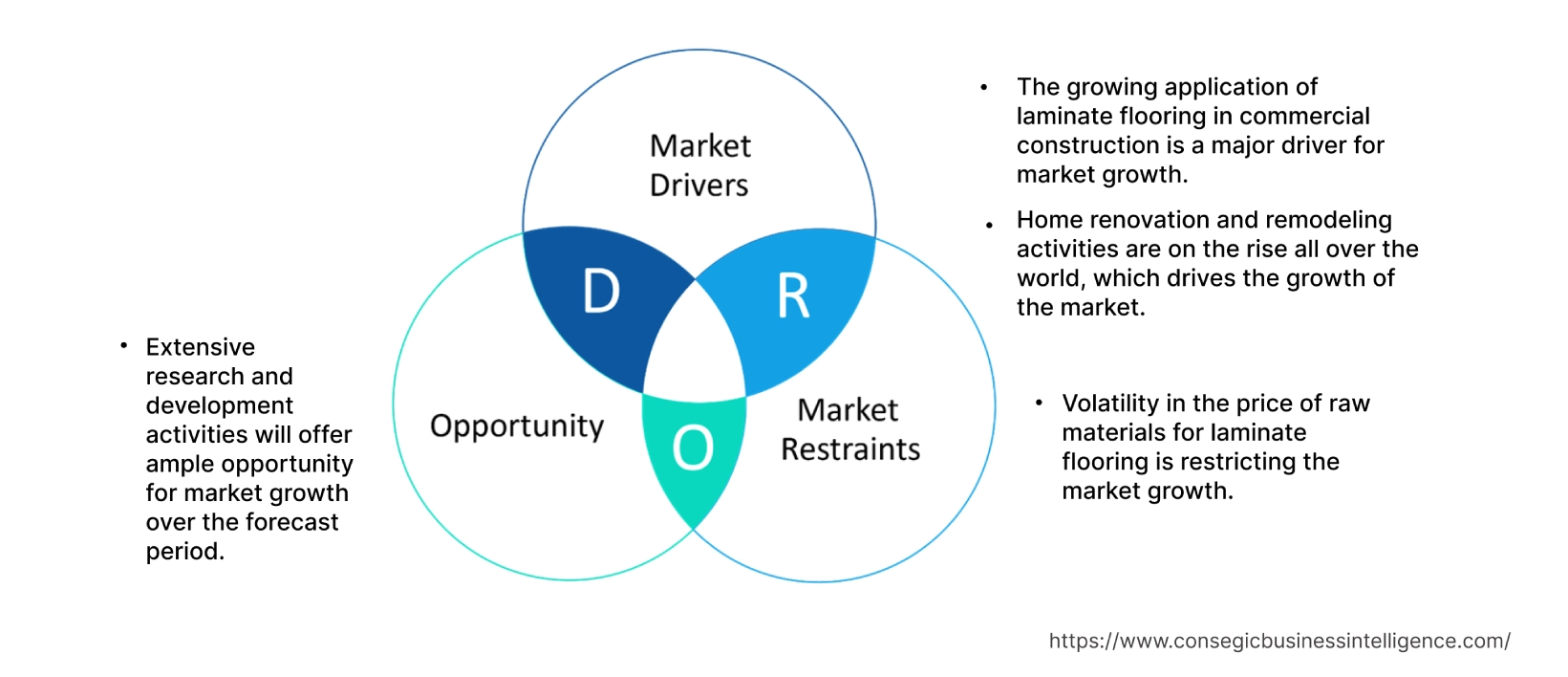

Laminate Flooring Market Dynamics - (DRO) :

Key Drivers :

Rising adoption of laminate flooring in industrial sector is boosting the market growth

Laminate flooring is increasingly used in the industrial sector due to its durability, cost-effectiveness, and ease of maintenance. Industrial settings, such as manufacturing plants and warehouses, benefit from laminate's ability to withstand heavy foot traffic, resist abrasion, and maintain its appearance under demanding conditions. Industrial environments require flooring that can handle heavy machinery, constant movement of materials, and potential impacts. Laminate flooring, particularly those designed for industrial use, provides a durable surface that resists wear and tear, scratches, and staining. Compared to other flooring options like concrete or epoxy, laminate flooring offers a more budget-friendly solution for large industrial spaces.

- For instance, Archbond Ltd. offers industrial lamination solutions. The solutions offered are hot lamination, PUR adhesive lamination, and infrared lamination.

Thus, the aforementioned factors are boosting the adoption of this flooring in turn driving the laminate flooring market growth.

Key Restraints :

Volatility in the price of raw materials is restricting the market growth

Volatility in raw material prices significantly impacts the laminate flooring industry, causing fluctuating production costs and potentially leading to price adjustments for consumers. This volatility arises from the dependence on materials like melamine, phenol, methanol, and paper, whose prices can fluctuate widely. Moreover, fluctuations in raw material prices directly affect the cost of producing laminate flooring, potentially squeezing profit margins for manufacturers. Rising raw material costs are often passed on to consumers through increased laminate flooring prices.

Thus, the market analysis shows that the aforementioned factors are restraining the laminate flooring market demand.

Future Opportunities :

Increasing innovations in laminate flooring are creating new market opportunities

New technologies like high-definition printing and embossed textures create more realistic wood and stone looks, while waterproof options and moisture-resistant cores make laminate suitable for kitchens and bathrooms. High-definition printing and embossed-in-register (EIR) technology allow laminates to closely mimic the look and feel of natural materials like wood and stone. Waterproof and water-resistant laminate options are available, making them suitable for moisture-prone areas. HPL technology and textured surfaces improve scratch and wear resistance, extending the lifespan of the flooring.

Thus, the ongoing advancements in this flooring are projected to drive laminate flooring market opportunities during the forecast period.

Laminate Flooring Market Segmental Analysis :

By Type :

Based on the type, the market is segmented into high-density fiberboard and medium-density fiberboard.

Trends in the Type:

- Rising adoption of medium-density fiberboard for cost-effectiveness, aesthetic versatility, and ease of installation is driving the laminate flooring market size.

- Increasing trend in adoption of high-density fiberboard due to its benefits including durability, stability, moisture resistance, cost-effectiveness, and easy installation.

The medium-density fiberboard segment accounted for the largest revenue share in the laminate flooring market share in 2024.

- Medium-density fiberboard (MDF) is a versatile material often used as the core for laminate flooring.

- It provides a stable and smooth base for the decorative laminate layer. This combination creates durable and aesthetically pleasing flooring options for various interior spaces.

- MDF provides a stable and even surface for the laminate layer, preventing warping and ensuring a flat floor.

- When combined with a laminate or vinyl top layer, MDF flooring becomes more durable and resistant to wear and tear.

- MDF flooring is suitable for living rooms, bedrooms, dining areas, and other spaces in homes.

- Therefore, the aforementioned factors are boosting the laminate flooring market growth.

The high-density fiberboard segment is expected to register the fastest CAGR during the forecast period.

- High-density fiberboard (HDF) is the core material used in laminate flooring, offering durability and stability.

- Laminate flooring, with its photographic layer and HDF core, is a popular option for both commercial and residential spaces due to its aesthetic appeal and resistance to wear and tear.

- Its ability to withstand medium to high foot traffic makes it suitable for offices, retail spaces, and other commercial areas.

- HDF is also used in wall panels, ceiling tiles, and furniture due to its smooth surface and ability to accept various finishes.

- Thus, the aforementioned factors are expected to boost the laminate flooring market trends during the forecast period.

By Distribution Channel :

Based on the distribution channel, the market is segmented into online and offline.

Trends in the Distribution Channel:

- Rising adoption of online stores for product purchase, as they provide a wider selection of brands, styles, and colors than brick-and-mortar stores, is boosting the laminate flooring market size.

- Increasing demand for offline stores by customers due to the ability to physically examine the flooring, receive expert advice, and potentially benefit from faster installation and local support.

The offline segment accounted for the largest revenue share in the laminate flooring market share in 2024.

- Local retailers can offer personalized recommendations based on customer needs, lifestyle, and budget, and help to select the right type of laminate and underlayment.

- Moreover, local retailers often offer faster delivery times and may even provide same-day or next-day installation services.

- Additionally, local retailers offer more flexibility in terms of custom cuts or finishes to meet specific user needs.

- Therefore, the aforementioned factors are driving the laminate flooring market demand.

The online segment is expected to register the fastest CAGR during the forecast period.

- Laminate flooring, purchased online, offers several advantages such as affordability, durability, easy installation, and a wide variety of styles to suit different tastes.

- Moreover, browsing and purchasing flooring online offers the convenience of shopping from home at any time.

- The customers are able to easily access customer reviews and ratings to get insights into the quality and performance of different laminate options.

- Further, online retailers often provide detailed product information, installation guides, and care instructions.

- Thus, the aforementioned factors are expected to boost the laminate flooring market trends during the forecast period.

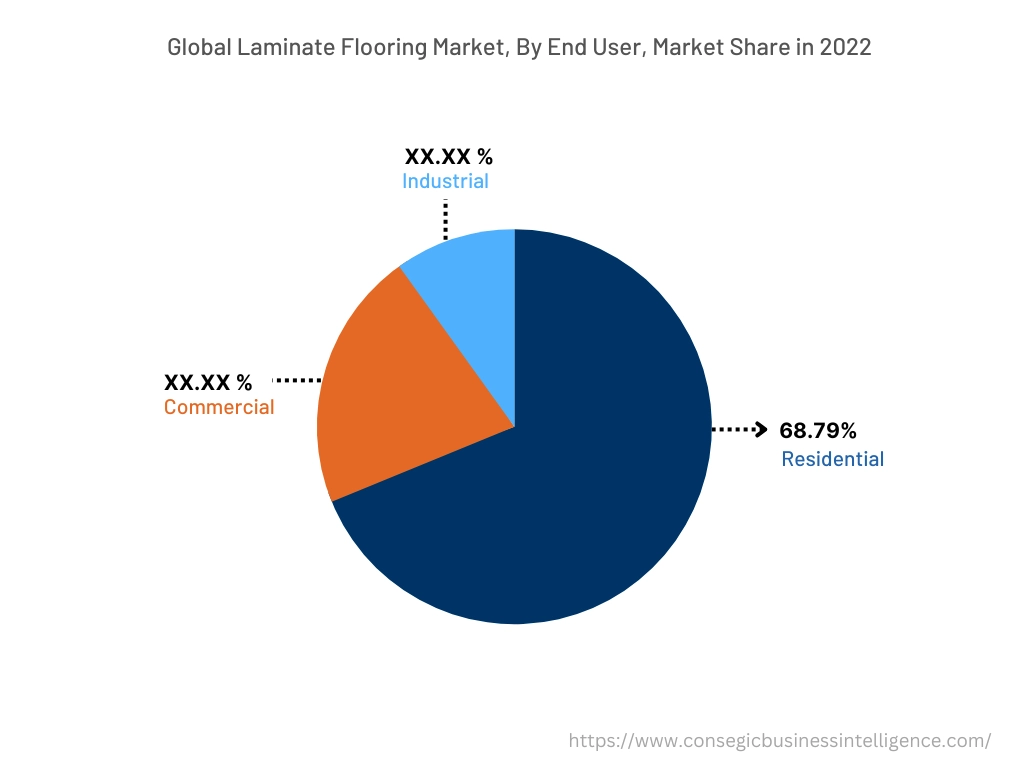

By End-User :

Based on the end use, the market is segmented into residential, commercial, and industrial.

Trends in the End Use:

- Rising adoption of laminate flooring in industrial sectors due to its durability, resistance to wear and tear, and easy maintenance.

- Increasing demand for laminate flooring in commercial spaces for a stylish look, while being resistant to scratches, stains, and heavy foot traffic.

The residential segment accounted for the largest revenue share of 56.06% in the market in 2024.

- Laminate flooring offers numerous benefits for residential spaces, including durability, easy installation, and a variety of styles.

- It is a cost-effective alternative to hardwood or tile, and its resistance to scratches, stains, and fading makes it ideal for high-traffic areas such as living rooms and hallways.

- Furthermore, laminate is relatively easy to clean and maintain, and many options feature a click-lock system for straightforward installation.

- In addition, laminate is also easy to clean and does not require special treatments or polishing, unlike some other flooring types.

- Therefore, the aforementioned factors are boosting the laminate flooring market expansion.

The commercial segment is expected to register the fastest CAGR during the forecast period.

- Commercial laminate is designed with a thicker wear layer, making it resilient to high-traffic areas and the movement of furniture.

- The wear layer also protects against scratches, dents, and stains, preserving its appearance over time.

- Moreover, it handles the daily demands of commercial spaces, including potential impacts from dropped objects.

- Many commercial laminates are available with certifications for slip resistance, fire resistance, and low VOCs (volatile organic compounds).

- Thus, the aforementioned factors are expected to boost the laminate flooring market opportunities during the forecast period.

By Region :

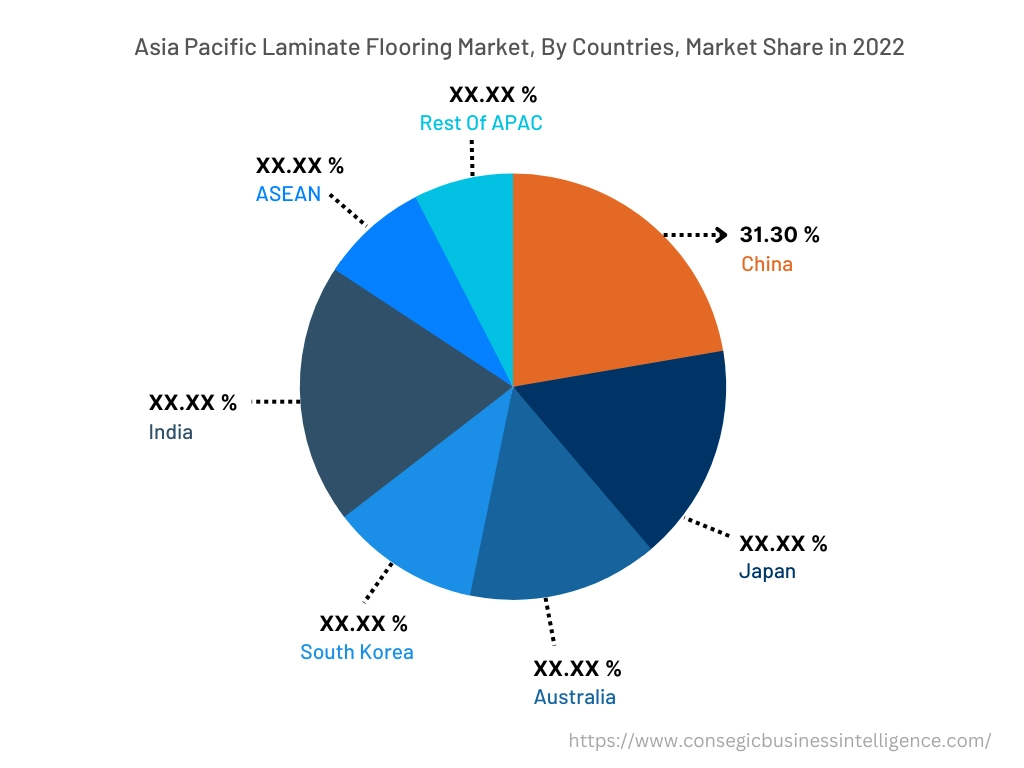

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

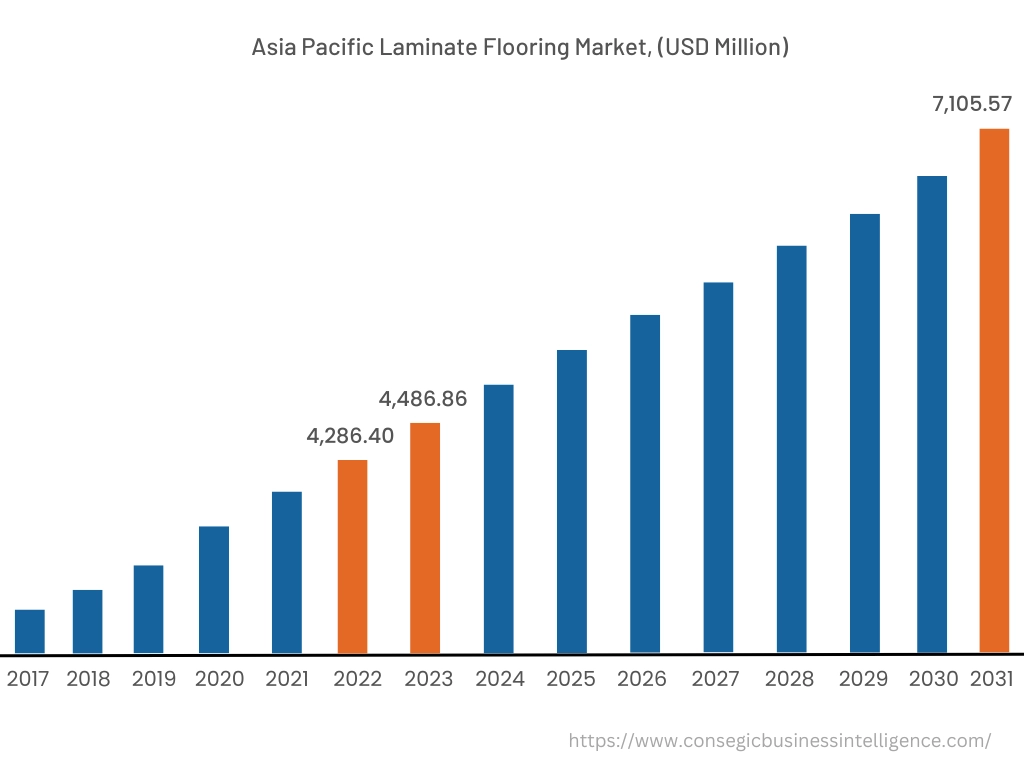

Asia Pacific region was valued at USD 4,200.43 Million in 2024. Moreover, it is projected to grow by USD 4,423.06 Million in 2025 and reach over USD 7,267.48 Million by 2032. Out of this, China accounted for the maximum revenue share of 29.80%. In the Asia-Pacific region, market growth is proliferating due to rapid urbanization, infrastructure development, and rising disposable incomes. Key countries like China and India are seeing particularly strong demand due to these trends. Sustainability concerns are also influencing the market, with an increasing focus on eco-friendly options.

- For instance, in India, Interim Budget 2024-25 allocated capital investment USD 133.86 billion for infrastructural development increased by outlay 11.1%. This shows that the rising investments in infrastructural development also drive the demand for the market in the region.

North America is estimated to reach over USD 5,301.69 Million by 2032 from a value of USD 3,050.85 Million in 2024 and is projected to grow by USD 3,213.73 Million in 2025. The laminate flooring market analysis depicts that the market growth in the region is growing due to increasing home renovations, eco-consciousness, and initiatives to improve public buildings. The market is also influenced by the DIY trend, advancements in technology, and the desire for affordable, aesthetically pleasing flooring options.

In Europe, the laminate flooring market analysis shows that the market is growing due to affordability, durability, and ease of installation of laminate floors, in combination with factors like sustainability, style, and cost influencing the market demand. In Middle East, Africa, and Latin America, the market is driven by the rising pace of urbanization, infrastructure development, and a growing demand for cost-effective and aesthetically pleasing flooring solutions in residential and commercial spaces. Thus, the aforementioned factors are boosting the laminate flooring market expansion in the region.

Top Key Players & Market Share Insights:

The laminate flooring industry is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global laminate flooring market. Key players in the laminate flooring industry include -

- Tarkett SA (France)

- Mohawk Industries Inc. (United States)

- Squarefoot (United States)

- Action TESA (India)

- BVG Industries Pvt. Ltd. (India)

- Shaw Industries Group Inc. (United States)

- AHF LLC. (United States)

- Beaulieu International Group (Belgium)

- Sika AG (Switzerland)

- Mannington Mills, Inc. (United States)

Laminate Flooring Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2031 |

| Market Size in 2031 | USD 19,856.50 Million |

| CAGR (2023-2031) | 6.4% |

| By Type |

|

| By End Use |

|

| By Distribution Channel |

|

| By Region |

|

| Key Players |

|

Key Questions Answered in the Report

How big is the laminate flooring market? +

Laminate Flooring Market size is estimated to reach over USD 19,856.50 Million by 2032 from a value of USD 11,505.40 Million in 2024 and is projected to grow by USD 12,112.67 Million in 2025, growing at a CAGR of 6.4% from 2025 to 2032.

What are the major segments covered in the laminate flooring market report? +

The segments covered in the report are type, distribution channel, end use, and region.

Which region holds the largest revenue share in 2024 in the laminate flooring market? +

Asia Pacific holds the largest revenue share in the laminate flooring market in 2024.

Who are the major key players in the laminate flooring market? +

The major key players in the market are Tarkett SA (France), Mohawk Industries Inc. (United States), Shaw Industries Group Inc. (United States), AHF, LLC. (United States), Beaulieu International Group (Belgium), Sika AG (Switzerland), Mannington Mills, Inc. (United States), Squarefoot (United States), Action TESA (India), and BVG Industries Pvt. Ltd. (India).

Based on current market trends and future predictions, which geographical region is the dominating region in the laminate flooring market? +

Asia Pacific accounted for the highest market share in the overall laminate flooring market.